Professional Documents

Culture Documents

Trading Options at Expirations

Uploaded by

amostdqOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Trading Options at Expirations

Uploaded by

amostdqCopyright:

Available Formats

Trading Options at Expirations Jeff Augen

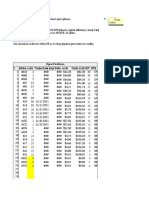

Chapter 1 - Expiration Pricing Dynamics Implied Volatility Collapse Strike rice Effects Time Decay Ratio Trades 2:1/3:1 put/call bear/bull spread - cover premium requires a view on where price will be instead of just normal 1:1 spread Chapter 2 Working with Statistical Models Selecting Candidates Collect and analyse minute data for volume stocks eg. Strike crosses, price to strike, ratio Pinning effects Long straddles early in day for expiring stock options earnings calendar week most priced in so long straddle may be expensive Strike price effects and implied volatility collapse dominate Evening before expiration Thursday Larger ratios exaggerates effects of weak trade structures and benefits strong ones Chapter 3 Day Trading Strategies Expiration Thursday Most of option value decay that occurs during these two sessions is related to implied volatility collapse rather than time decay Opening and closing prices do not tell full story. Many instances, underlying stock exhibits transient price swings that are large enough to force conservative investors out of their trades behaviour underscores importance of aggressive stopping out of profitable positions that begin to lose money. Net delta also an important characteristic of an trade Simultaneously profiting from stock movement and volatility decay eg. Bull call - long 1 itm call and short 2-3 itm call at further srike

You might also like

- Ds Iron Condor StrategiaDocument43 pagesDs Iron Condor StrategiaFernando ColomerNo ratings yet

- Gamma Trade OptionsDocument40 pagesGamma Trade Optionssnowbash50% (2)

- Iron Condor PrimerDocument45 pagesIron Condor PrimerAndree W. KurniawanNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- IronCondors CBOEDocument11 pagesIronCondors CBOEPablo OrellanaNo ratings yet

- TheTradingEmpress - 052313 Charles CottleDocument35 pagesTheTradingEmpress - 052313 Charles CottleR@gmail100% (2)

- Using Options To Buy Stocks - Build Wealth With Little Risk and No CapitalDocument534 pagesUsing Options To Buy Stocks - Build Wealth With Little Risk and No CapitalpetefaderNo ratings yet

- High Probability Option Trading Covered Calls and Credit SpreadDocument69 pagesHigh Probability Option Trading Covered Calls and Credit Spreadjeorba56100% (3)

- Equity Collar StrategyDocument3 pagesEquity Collar StrategypkkothariNo ratings yet

- Sheridan Top 5 Mistakes When Creating Monthly Income Feb10Document32 pagesSheridan Top 5 Mistakes When Creating Monthly Income Feb10ericotavaresNo ratings yet

- Bullshi T Free Guide To Option Volatility by Gavin McMasterDocument84 pagesBullshi T Free Guide To Option Volatility by Gavin McMasterFaisal Koroth100% (1)

- Understanding Options TradingDocument44 pagesUnderstanding Options Tradingjohnsm2010No ratings yet

- SMB - Options - Tribe - 8!20!2013 (Jeff Augen - Short Butterfly)Document8 pagesSMB - Options - Tribe - 8!20!2013 (Jeff Augen - Short Butterfly)Peter Guardian100% (4)

- EtjefDocument92 pagesEtjefMiteshNo ratings yet

- Cottle BWBDocument68 pagesCottle BWBam13469679No ratings yet

- Art of Making 10% PMDocument27 pagesArt of Making 10% PMDavid AngNo ratings yet

- Options Trade Evaluation Case StudyDocument7 pagesOptions Trade Evaluation Case Studyrbgainous2199No ratings yet

- Selling Naked Puts For Profit and Avoiding AssignmentDocument7 pagesSelling Naked Puts For Profit and Avoiding AssignmentRed Dot SecurityNo ratings yet

- What Are Some Basic Points Which We Must Know Before Go For Options TradingDocument7 pagesWhat Are Some Basic Points Which We Must Know Before Go For Options TradingAnonymous w6TIxI0G8lNo ratings yet

- Double Calendar Spreads, How Can We Use Them?Document6 pagesDouble Calendar Spreads, How Can We Use Them?John Klein120% (2)

- Proffesional Option TraderDocument15 pagesProffesional Option TraderNehang PandyaNo ratings yet

- Presentation The Vega Trap Dan Passarelli PDFDocument45 pagesPresentation The Vega Trap Dan Passarelli PDFabiel_guerraNo ratings yet

- Jeff Augen - Trading Options at Expiration-Strategies and Models For Winning The EndgameDocument6 pagesJeff Augen - Trading Options at Expiration-Strategies and Models For Winning The EndgameBe SauNo ratings yet

- A Rhino Update (Aug '23)Document27 pagesA Rhino Update (Aug '23)manhphuho88No ratings yet

- Option Special Report PDFDocument22 pagesOption Special Report PDFbastian_wolf100% (1)

- Option SellingDocument5 pagesOption SellingSathishNo ratings yet

- Commodity Research Bureau Delta Options Trading CourseDocument0 pagesCommodity Research Bureau Delta Options Trading Coursejohnsm2010100% (1)

- Amy Meissner Is Known AsDocument5 pagesAmy Meissner Is Known Asslait73100% (1)

- Pencil In Profits With A Calendar SpreadDocument13 pagesPencil In Profits With A Calendar SpreadRaju Roy100% (1)

- Profitable Options Strategies for Any MarketDocument43 pagesProfitable Options Strategies for Any Marketwilliam380No ratings yet

- Option Strategies: 1. Long Call Profit: Loss: Break-EvenDocument7 pagesOption Strategies: 1. Long Call Profit: Loss: Break-EvenZoya SyedNo ratings yet

- Ryan Road Trip Trade PresentationDocument32 pagesRyan Road Trip Trade PresentationHernan DiazNo ratings yet

- Advanced Option TraderDocument1 pageAdvanced Option TradergauravroongtaNo ratings yet

- What About Options?: A Prelude to Profitable Options TradingFrom EverandWhat About Options?: A Prelude to Profitable Options TradingRating: 3 out of 5 stars3/5 (1)

- Economy - March 2014 ReportDocument6 pagesEconomy - March 2014 ReportamostdqNo ratings yet

- In Search of Crisis Alpha:: A Short Guide To Investing in Managed FuturesDocument8 pagesIn Search of Crisis Alpha:: A Short Guide To Investing in Managed FuturesclaytonNo ratings yet

- The Complete Options Trader: A Strategic Reference for Derivatives ProfitsFrom EverandThe Complete Options Trader: A Strategic Reference for Derivatives ProfitsNo ratings yet

- Option Profit AcceleratorDocument129 pagesOption Profit AcceleratorlordNo ratings yet

- Bear Call SpreadDocument41 pagesBear Call SpreadMadhav PotaganiNo ratings yet

- Advanced Strategies For Options Trading Success With James BittmanDocument56 pagesAdvanced Strategies For Options Trading Success With James Bittmanggs_123No ratings yet

- Understanding LEAPS: Using the Most Effective Options Strategies for Maximum AdvantageFrom EverandUnderstanding LEAPS: Using the Most Effective Options Strategies for Maximum AdvantageRating: 3 out of 5 stars3/5 (1)

- Bond Futures OpenGammaDocument9 pagesBond Futures OpenGammamshchetkNo ratings yet

- Iron FlyDocument1 pageIron FlyMohammed Asif Ali RizvanNo ratings yet

- Options for the Stock Investor: How to Use Options to Enhance and Protect ReturnsFrom EverandOptions for the Stock Investor: How to Use Options to Enhance and Protect ReturnsRating: 4 out of 5 stars4/5 (2)

- Options IQDocument128 pagesOptions IQAnil SoodNo ratings yet

- Balancing Risk and Reward: Ed PadonDocument6 pagesBalancing Risk and Reward: Ed Padonapi-19771937No ratings yet

- TOS - UnbalancedbutterfliesDocument9 pagesTOS - UnbalancedbutterfliesthiendNo ratings yet

- Constructing A Delta-Neutral StrategyDocument7 pagesConstructing A Delta-Neutral StrategyIndranilNo ratings yet

- Income Methods Summary for Options TradingDocument2 pagesIncome Methods Summary for Options Tradingkvel2005No ratings yet

- Options Based Risk MGMT SummaryDocument8 pagesOptions Based Risk MGMT SummarynsquantNo ratings yet

- Trinity System - Theta Engine (Formerly 45+ DTE)Document404 pagesTrinity System - Theta Engine (Formerly 45+ DTE)trungNo ratings yet

- Options GreeksDocument12 pagesOptions GreeksAnupriya NagpalNo ratings yet

- 9 Option Strategies CH 11Document35 pages9 Option Strategies CH 11RLG631No ratings yet

- Using LEAPS in A Covered Call WriteDocument4 pagesUsing LEAPS in A Covered Call WriteJonhmark AniñonNo ratings yet

- Derivatives (Futures and Options) MBA ProjectDocument48 pagesDerivatives (Futures and Options) MBA ProjectRuchi TiwariNo ratings yet

- Navigation Search Option Vertical Spreads Bull Put Spread Bear Call SpreadDocument7 pagesNavigation Search Option Vertical Spreads Bull Put Spread Bear Call Spreadksk461No ratings yet

- Stocks: Fundamental Analysis: Sample Investing PlanDocument5 pagesStocks: Fundamental Analysis: Sample Investing PlanNakibNo ratings yet

- Calendar Spreads - Varsity by ZerodhaDocument6 pagesCalendar Spreads - Varsity by ZerodhaKeval ShahNo ratings yet

- Ira Strategies 010615 Iwm Big LizardDocument7 pagesIra Strategies 010615 Iwm Big Lizardrbgainous2199No ratings yet

- NewDocument5 pagesNewChen CenNo ratings yet

- Daily Strategy Note: The Joy of Put SellingDocument5 pagesDaily Strategy Note: The Joy of Put Sellingchris mbaNo ratings yet

- Make Your Family Rich: Why to Replace Retirement Planning with Succession PlanningFrom EverandMake Your Family Rich: Why to Replace Retirement Planning with Succession PlanningNo ratings yet

- TM Legacy Plus Aug2014Document2 pagesTM Legacy Plus Aug2014amostdqNo ratings yet

- 1conservative 2015Document204 pages1conservative 2015amostdqNo ratings yet

- SGX MSCI Malaysia Factsheet (Eng) - Nov 2014 - D3Document2 pagesSGX MSCI Malaysia Factsheet (Eng) - Nov 2014 - D3amostdqNo ratings yet

- Options Strategies and Pricing AnalysisDocument2 pagesOptions Strategies and Pricing AnalysisamostdqNo ratings yet

- 17 Under 15 Dollars in SingaporeDocument7 pages17 Under 15 Dollars in SingaporeamostdqNo ratings yet

- A4 Term Life Affinity (LUV)Document3 pagesA4 Term Life Affinity (LUV)amostdqNo ratings yet

- De Mystifying The Pe 2012Document14 pagesDe Mystifying The Pe 2012amostdqNo ratings yet

- Day Trading OptionsDocument1 pageDay Trading Optionsamostdq0% (1)

- Grad Electrical Engineer PDDocument4 pagesGrad Electrical Engineer PDamostdqNo ratings yet

- BA - HVAC-R Controls Technology EngineerDocument1 pageBA - HVAC-R Controls Technology EngineeramostdqNo ratings yet

- 20 Best Income Stocks For 2014Document10 pages20 Best Income Stocks For 2014amostdqNo ratings yet

- Cation Anion TestsDocument2 pagesCation Anion TestsZainBaloch100% (4)