Professional Documents

Culture Documents

Chapter 2

Uploaded by

Fariha AhmadCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 2

Uploaded by

Fariha AhmadCopyright:

Available Formats

Chapter 2: The External Environment

Chapter 2 The External Environment: Opportunities, Threats, Industry Competition, and Competitor Analysis

KNOWLEDGE OBJECTIVES 1. 2. 3. 4. !. $. %. Explain the importance of analyzing and understanding the firms external environment. Define and describe the general environment and the industry environment. Discuss the four activities of the external environmental analysis process. ame and describe the general environments six segments. "dentify the five competitive forces and explain ho# they determine an industrys profit potential. Define strategic groups and describe their influence on the firm. Describe #hat firms need to &no# about their competitors and different methods 'including ethical standards( used to collect intelligence about them.

CHAPTER OUTLINE Opening Case Environmental )ressures on *al+,art -.E /E E0123 " D45-063 1 D 78,)E-"-80 E 9"08 ,E -5 E:-E0 12 E 9"08 ,E -12 1 1265"5 5canning ,onitoring ;orecasting 1ssessing 5E/,E -5 8; -.E /E E012 E 9"08 ,E -he Demographic 5egment -he Economic 5egment -he )olitical<2egal 5egment -he 5ociocultural 5egment -he -echnological 5egment -he /lobal 5egment Strategic Focus Does /oogle .ave the ,ar&et )o#er to "gnore External )ressures= " D45-06 E 9"08 ,E - 1 1265"5 -hreat of e# Entrants >argaining )o#er of 5uppliers >argaining )o#er of >uyers -hreat of 5ubstitute )roducts "ntensity of 0ivalry among 7ompetitors " -E0)0E-" / " D45-06 1 1265E5 5-01-E/"7 /084)5 Strategic Focus ">, 7losely *atches "ts 7ompetitors to 5tay at the -op of "ts /ame 78,)E-"-80 1 1265"5 E-."712 78 5"DE01-"8 5 54,,106 0E9"E* ?4E5-"8 5 E:)E0"E -"12 E:E07"5E5 8-E5

2+1

Chapter 2: The External Environment LECTURE NOTES Chapter Introduction: This chapter can be introduced with a general statement regarding the importance of understanding what is happening outside of the firm itself and how what is happening can affect the firms ability to achieve strategic competitiveness and earn aboveaverage returns. This importance is illustrated by the Opening Case, which discusses the impact events in the external environment can have on a firms performance, despite efforts to adjust to industry dynamics.

OPENING CASE Environmental Pre !re on Wal"#art 5ince the mid+1@$As3 5am *alton has been nurturing his vision of #hat discount retailing should be. .is dream is no# a mega+giant of approximately $!AA discount stores and clubs employing 1.@ million associates in 1! countries. "n addition to a phenomenal gro#th rate3 *al+,art #as designated the most admired retailer in 2AA$ by Fortune magazine. >ut all is not happy in >entonville3 1r&ansas. *al+,art has hit a speed bump in its gro#th pattern driven by its cost leadership strategy. 7ompared to some of *al+,arts formidable competition3 it has experienced the smallest percentage in ne# store sales. "n ovember 2AA$3 existing store sales gro#th actually netted negative gro#th. 5o #hy has a company that has experienced phenomenal gro#th and cited for outstanding performance recently found itself struggling to regain its proud gro#th posture= *all 5treet analysts feel that *al+,arts gro#th strategy is relying too heavily on opening ne# stores to offset sagging same+store sales. 5o #hy are same+store sales sagging= -he ans#er lies #ith legal and political troubles3 public relation problems3 and labor issues. -he public3 including *al+,art customers3 has been Bturned+offC by open criticism leveled at *al+,art. -hus3 an anti+*al+,art movement has manifested itself #ith legal obstacles barring construction of ne# *al+,art stores in specific areas. -he company has become notorious for lo# pay and poor benefits. Environmentalists have challenged *al+,art to become more Bgreen.C Everything mentioned above is part of the external environment in which the discount retail industry operates. People have perceptions of how they want suppliers to loo within this environment. !al"art has fallen short of buyers expectations, and is now having to deal with the conse#uences. $ompanies need to understand that %customer expectations& are an element of the external environment. People act and react to their perceptions and it appears that !al-"art is reali'ing just how powerful perceptual influences within the environment can be. !al-"art is being reactive through efforts to control the damage resulting from perceptions that it is not being as good a corporate citi'en as potential and former customers desire.

Explain the importance of analyzing and understanding the firms external environment.

Teaching Note: (iven that the external environment will continue to change)and that change may be unpredictable in terms of timing and strength)a firms management is challenged to be aware of, understand the implications of, and identify patterns represented in these changes by ta ing actions to improve the firms competitive position, improve operational efficiency, and to be effective global competitors.

2+2

Chapter 2: The External Environment External environmental factorsDli&e the #ar in "raE3 variations in the strength of national economies3 and ne# technologiesDaffects firm gro#th and profitability in the 4.5. and beyond. Environmental conditions in the current global economy differ from those previously faced by firmsF -echnological advances reEuire more timely and effective competitive actions and responses. 0apid sociological changes abroad affect labor practices and product demand of diverse consumers. /overnmental policies and la#s affect #here and ho# firms may choose to compete. 4nderstanding the external environment helps to build the firms base of &no#ledge and information #hich can '1( help to build ne# capabilities3 '2( buffer the firm from environmental impacts3 and '3( build bridges to influential sta&eholders. Teaching Note: This section introduces definitions, Figure 2.1 *which deals with the general environment+, and the competitor,industry environment. -ecause of the chapter layout, it is best to delay a detailed presentation,discussion of the general environment until after discussing the external environmental analysis process because the characteristics of the general environment are presented in more detail later in the chapter.

Define and describe the general environment and the industry environment.

Teaching Note: The firms understanding of the external environment is matched with nowledge about its internal environment *discussed in $hapter .+ to form its vision, to develop its mission, and to ta e strategic actions that result in strategic competitiveness and above-average returns. This is an important point to ma e. THE GENERAL& INDUSTR'& AND CO#PETITOR ENVIRON#ENTS

FIGURE 2.1 T(e E)ternal Environment Figure 2.1 illustrates the three components of a firms external environment and the elements or factors that are part of each component. -hey areF $* the general environment Demographic Economic %* the industry environment -hreat of e# Entrants "ntensity of 0ivalry +* the competitor environment 'Note: -hese components of the external environment and their elements or factors and ho# they are related to each and to firm performance #ill be discussed in detail in later sections of the chapter.( )o#er of >uyers )roduct 5ubstitutes )o#er of 5uppliers )olitical<2egal -echnological 5ociocultural /lobal

2+3

Chapter 2: The External Environment

-he general environment is composed of elements in the broader society that can indirectly influence an industry and the firms #ithin the industry. >ut firms cannot directly control the general environments segments and elements.

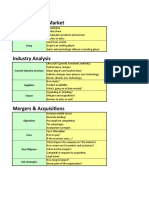

TABLE 2.1 T(e General Environment, Se-ment an. Element Table 2.1 lists elements that characterize each of the six segments of the general environmentF demographic3 economic3 political<legal3 sociocultural3 technological3 and global. Each of these segments #ill be discussed in more detail later in this chapter3 follo#ing a discussion of the external environmental analysis process.

-he industry environment is the constellation of factorsDthreat of ne# entrants3 suppliers3 buyers3 product substitutes3 and the intensity of rivalry among competitorsDthat directly influence a firm and its competitive decisions and responses. om!etitor analysis represents the firms understanding of its current competitors. -his understanding #ill complement information and insights derived from investigating the general and industry environments. -he follo#ing are important distinctions to ma&e regarding different external analysesF 1nalysis of the general environment focuses on the future. "ndustry analysis focuses on factors and conditions influencing firm profitability #ithin its industry. 7ompetitor analysis focuses on predicting the dynamics of rivals actions3 responses3 and intentions. )erformance improves #hen the firm integrates the insights provided by analyses of the general environment3 the industry environment3 and the competitor environment. Teaching Note/ 0t should be noted that, while firms cannot directly control the elements of the general environment, they can influence)and will be influenced by)factors in their industry and competitor environments. -he strategic challenge is to develop an understanding of the implications of these elements and factors for a firms competitive position. )rocesses and frame#or&s for the analysis of the external environment are provided in this chapter. Teaching Note: (lobal implications should be)and are)integrated into the discussion of the general environment while global issues related to a firms industry environment are integrated throughout the text. 1tudents will find that $hapter 2 covers this topic in detail.

Discuss the four activities of the external environmental analysis process.

E/TERNAL ENVIRON#ENTAL ANAL'SIS

2+4

Chapter 2: The External Environment "n addition to increasing a firms a#areness and understanding of an increasingly turbulent3 complex3 and global general environment3 external environmental analysis also is necessary to enable the firms managers to interpret information to identify opportunities and threats. "!!ortunities represent conditions in the general environment that may help a company achieve strategic competitiveness by presenting it #ith possibilities3 #hile t#reats are conditions that may hinder or constrain a companys efforts to achieve strategic competitiveness. "nformation used to analyze the general environment can come from multiple sourcesF publications3 observation3 attendance at trade sho#s3 or conversations #ith customers3 suppliers3 and employees of public+ sector organizations. 1nd this information can be formally gathered by individuals occupying traditional Bboundary spanningC roles 'such as a position in sales3 purchasing3 or public relations( or by assigning information+gathering responsibility to a special group or team. Teaching Note: 3ccording to a recent comment by an industry analyst from a national firm, the 0nternet is becoming an increasingly valuable source of data and information for analy'ing the general environment. 1howing students how to do this in class or via an assignment can be a very helpful exercise. 8ne strategy that firms can use to enhance their a#areness of conditions in the external environment is to establish an analysis process involving scanning3 monitoring3 forecasting3 and assessing 'see -able 2.2(. TABLE 2.2 Com0onent o1 t(e E)ternal Environmental Anal2 i Table 2.2 identifies the four components of the external environmental analysisF scanning3 monitoring3 forecasting3 and assessing.

S3annin$%anning entails the study of all segments in the general environment. ;irms use the scanning process to either detect early #arning signals regarding potential changes or to detect changes that are already under#ay. "n most cases3 information and data being collected or observed are ambiguous3 incomplete3 and appear to be unconnected. 5canning is most important in highly volatile environments3 and the scanning system should fit the organizational context 'e.g.3 scanning systems designed for volatile environments are not suitable for firms competing in a stable environment(. Teaching Note: 1canning may signal a future change in the needs and lifestyles of baby boomers as they approach retirement age. This may not only provide opportunities for financial institutions as they prepare for an increase in the number of retirees, but also may provide opportunities for pac agers and mar eters of retirement communities and other products specifically targeted to this segment. -he "nternet provides significant opportunities to obtain information. ;or example3 1mazon.com records significant information about individuals visiting its #ebsite3 particularly if a purchase is made. 1mazon then #elcomes the individual by name #hen s<he visits the #ebsite again. "t even sends messages to the individual about specials and ne# products similar to that purchased in previous visits. 1dditionally3 many #ebsites and advertisers on the "nternet obtain information surreptitiously from those #ho visit their sites via the use of Bcoo&iesC.

2+!

Chapter 2: The External Environment

#onitorin&onitoring represents a process #hereby analysts observe environmental changes 'over time( to see if3 in fact3 an important trend begins to emerge. -he critical issue in monitoring is that analysts be able to detect meaning from the data and information collected during the scanning process. '0emind students that this data is generally ambiguous3 incomplete and unconnected.( ;or example3 in the 4nited 5tates3 middle class 1frican 1mericans are gro#ing in number and #ealth and are pursuing investment options3 an opportunity in the economic segment that companies in the financial planning sector could monitor. Effective monitoring reEuires the firm to identify important sta&eholders. >ecause the importance of different sta&eholders can vary over a firms life cycle3 careful attention must be given to the firms needs and its sta&eholder groups over time. 5canning and monitoring can also provide information about successfully commercializing ne# technologies. 4ore3a tin-he next step is for analysts to ta&e the information and data gathered during the scanning and monitoring phases and attempt to proGect for#ard. Fore%asting represents the process #here analysts develop feasible proGections of #hat might happenDand ho# Euic&lyDas a result of the changes and trends detected through scanning and monitoring. >ecause of uncertainty3 forecasting events and outcomes accurately is a challenging tas&. A e in1ssessing represents the step in the external analysis process #here all of the other steps come together. -he obGective of assessing is to determine the timing and significance of the effects of changes and trends in the environment on the strategic management of a firm. /etting the strategy right #ill depend on the accuracy of the assessment. Teaching Note: 0t is good to alert students to the fact that a major challenge for managers and firms engaging in the process of external analysis is to recogni'e biases and assumptions that may affect the analysis process. This is important, because these may limit the accuracy of forecasts and assessments. 4or example, managers may choose to disregard certain information, thus missing critical indicators of future environmental changes. 5r, past experiences may prejudice the ways that opportunities or threats are perceived)if they are perceived at all. 5ne solution might be to solicit multiple inputs so a single source is not able to manipulate the information and to see fre#uent feedbac regarding the accuracy or usefulness of forecasts and assessments.

ame and describe the general environments six segments.

SEG#ENTS O4 THE GENERAL ENVIRON#ENT 1s outlined in Table 2.13 the general environment consists of six segmentsF demographic3 economic3 political<legal3 sociocultural3 global3 and technological. -he challenge is to scan3 monitor3 forecast3 and assess all six segments of the general environment3 focusing the primary effort on those elements in each segment of the general environment that have the greatest potential impact on the firm.

2+$

Chapter 2: The External Environment

Teaching Note: 0n the twenty-first century competitive landscape, analysts are cautioned against confining their analysis to domestic mar ets alone. 3ny analysis of the general environment and its segments should recogni'e global elements that may have an impact on the firm. External analysis efforts should focus on segments most important to the firms strategic competitiveness to identify environmental changes3 trends3 opportunities3 and threats that can be matched #ith the firms core competencies so that it can achieve strategic competitiveness and earn above+average returns. T(e Demo-ra0(i3 Se-ment -he demographic segment is concerned #ith a populations size3 age structure3 geographic distribution3 ethnic mix3 and distribution of income. Teaching Note: !hile each of the elements of this segment are discussed below, you might note that the challenge for analysts *and managers+ is to determine what the changes that have been identified in the demographic characteristics or elements of a population imply for the future strategic competitiveness of the firm. 'o!ulation $i(e *hile population size itself may be important to firms that reEuire a Bcritical massC of potential customers3 changes in the specific ma&e+up of a populations size may have even more critical implications. 8ne of the most important changes in a populations size is changes in a nations birth rate and<or family size3 as #ell as demographic changes in the population of developed versus developing countries. Age $tru%ture 7hanges in a nations birth rate or life expectancy can have important implications for firms. 1re people living longer= *hat is the life expectancy of infants= -hese #ill impact the health care system 'and firms serving that segment( and the development of products and services targeted to an older 'or younger( population. Geogra!#i% )istri*ution )opulation shiftsDas have occurred in the 4.5.Dfrom one region of a nation to another or from metropolitan to non+metropolitan areas may have an impact on a firms strategic competitiveness. "ssues that should be considered includeF -he attractiveness of a firms location may be influenced by governmental support3 and a shrin&ing population may imply a shrin&ing tax base and a lesser availability of official financial support. ;irms may have to consider relocation if tax demands reEuire it. 1dvances in communications technology #ill have a profound effect on geographic distribution and the #or&force. Et#ni% &i+ -his reflects the changes in the ethnic ma&e+up of a population and has implications both for a firms potential customers and for the #or&force. "ssues that should be addressed includeF

2+%

Chapter 2: The External Environment

*ill ne# products and services be demanded or can existing ones be modified= .o# #ill changes in the ethnicity of a population affect the composition of the #or&force= 1re managers prepared to manage a more culturally diverse #or&force= .o# can the firm position itself to ta&e advantage of increased #or&force heterogeneity=

In%ome )istri*ution 7hanges in income distribution are important because changes in the levels of individual and group purchasing po#er and discretionary income often result in changes in spending 'consumption( and savings patterns. -rac&ing3 forecasting3 and assessing changes in income patterns may identify ne# opportunities for firms. T(e E3onomi3 Se-ment -he e%onomi% segment of the general environment refers to the nature and direction of the economy in #hich a firm competes or may compete. 1nalysts must scan3 monitor3 forecast3 and assess a number of &ey economic indicators or elements3 including levels and trends of inflation rates and interest rates trade deficits and surpluses budget deficits and surpluses personal savings rates business savings rates gross domestic product

for both domestic and &ey international mar&ets. "n addition3 the implications of changes and trends in the economic segment may affect the political<legal segment both domestically and in other global mar&ets. -his may be of critical importance as nations eliminate or reduce trade barriers and integrate their economies. T(e Politi3al6Le-al Se-ment -he !oliti%al,legal segment is the arena in #hich organizations and interest groups compete for attention3 resources3 and a voice in overseeing the body of la#s and regulations guiding the interactions among nations. "n other #ords3 this segment is concerned #ith ho# interest groups and organizations attempt to influence representatives of governments 'and governmental agencies( and ho# they3 in turn3 are influenced by them. >ecause of the influence that this segment can have on the nature of competition as #ell as on the overall profitability of industries and individual firms3 analysts must assess changes and trends in administration philosophies regardingF 1nti+trust regulations and enforcement -ax la#s "ndustry deregulation 2abor training la#s 7ommitments to education ;ree trade versus protectionism Teaching Note: 0t would be good to comment *using examples from the text or examples that may be even more current+ on strategies followed by firms as they attempt to manage or influence the political,legal segment.

2+H

Chapter 2: The External Environment 6ow can firms in the electric utility industry manage the costs of deregulation, including write-offs of inefficient plants7 !ho will pay these costs7 $onsumers7 (overnmental units7 1toc holders7 -ondholders7 6ow can individual firms and industries manage the effects of free trade which will lower entry barriers for new, lower-cost competitors7 6ow might firms position themselves to ta e advantage of emerging, free-mar et economies7 !hat is li ely to be the competitive impact of loosening governmental controls in the entertainment industry7 0n the telecommunications industry7 !hat strategies can firms use to manage or influence deregulation to their advantage7 T(e So3io3!lt!ral Se-ment -he o3io3!lt!ral e-ment is concerned #ith different societies social attitudes and cultural values. -his segment is important because the attitudes and values of society influence and thus are reflected in changes in a societys economic3 demographic3 political<legal3 and technological segments. 1nalysts are especially cautioned to pay attention to sociocultural changes and effects that they may have onF *or&force compositionDand the implications for managingDresulting from an increase in the number of #omen3 and increased ethnic and cultural diversity 7hanges in attitudes about the gro#ing number of contingency #or&ers 5hifts in population to#ard suburban life3 and resulting transportation issues 5hifts in #or& and career preferences3 including a trend to #or& from home made possible by technology advances T(e Te3(nolo-i3al Se-ment 1s noted in many of the other segments of the general environmentDand as discussed in 7hapter 1 as a &ey driver of the ne# competitive landscapeDtechnological changes can have broad effects on society. -he te%#nologi%al segment includes institutions and activities involved #ith creating ne# &no#ledge and translating that &no#ledge into ne# outputs3 products3 processes3 and materials. ;irms should pay careful attention to the technological segment3 since early adopters can gain mar&et share and above average returns. "mportant technology+related issues that might affect a broad variety of firms includeF "ncreasing plant automation "nternet technologies and their application to commerce and data gathering 4ses of #ireless technology T(e Glo7al Se-ment 1s discussed in 7hapter 13 the 21st+century competitive landscape reEuires that firms also must analyze global factors. 1mong the global factors that should be assessed areF -he potential impact of significant international events such as peace in the ,iddle East or the recent entry of 7hina into the *-8 -he identification of both important emerging global mar&ets and global mar&ets that are changing -he trend to#ard increasing global outsourcing -he differences bet#een cultural and institutional attributes of individual global mar&ets 'the focus in Iorea on inhwa3 or harmony3 based on respect for hierarchical relationships and obedience to authorityJ the focus in 7hina on guanxi3 or personal relationshipsJ the focus in Kapan on wa3 or group harmony<social cohesion(

2+@

Chapter 2: The External Environment /lobal mar&et expansion opportunities -he opportunities to learn from doing business in other countries Expanding access to the resources firms need for success 'e.g.3 capital(

STRATEGIC 4OCUS Doe Goo-le Have t(e #ar8et Po9er to I-nore E)ternal Pre !re : /oogle has become a BgenericC li&e Ileenex3 :erox3 and Kell+8. "nternet users of all ages B/oogleC regardless of the search engine used. 7urrently3 /oogle is the most #idely used "nternet search engine. .o#ever3 has its strategy of Bsearch #ith contentC been the catalyst to return /oogle to the real #orld= 9iacom has filed a L1 billion copyright infringement la#suit against /oogle and 6ou-ube3 a subsidiary of /oogle. "n addition to 9iacom3 a number of other firms3 including ,icrosoft3 have filed copyright infringement la#suits. /oogles image has been tarnished. -he investment community no longer considers /oogle to be a hot company. 1s a result3 /oogles stoc& price has fallen. /oogle no# has rivals3 and it is getting attention from the government. There is strong similarity between (oogles above plight and that of !al-"art referenced earlier in this chapter. -oth firms have been challenged with pressure from their respective political and legal environments. (oogles competitors will reali'e the benefits of alleged copyright snafus, as (oogles advertiser customer-base begins to jump ship. 0nvestor interests reflect the same concerns as those of advertisers. -oth cases reflect that elements of the environment can change rather #uic ly and conse#uently change a firms perceived competitive advantage.

"dentify the five competitive forces and explain ho# they determine an industrys profit potential.

INDUSTR' ENVIRON#ENT ANAL'SIS 1n industry is a group of firms producing products that are close substitutes for each other. 1s they compete for mar&et share3 the strategies implemented by these companies influence each other and include a broad mix of competitive strategies as each company pursues strategic competitiveness and above+average returns. "t should be noted that3 unli&e the general environment #hich has an indirect effect on strategic competitiveness and firm profitability3 the effect of the industry environment is more direct. "ndustryDand individual firmD profitability and the intensity of competition in an industry are a function of five competitive forces as presented in Figure 2.2. Figure Note: 1tudents should refer to Figure 2.2 as it provides a framewor that can be used to analy'e competition in an industry. 3 broader discussion of the five competitive forces and other factors follows Figure 2.2. FIGURE 2.2 T(e 4ive 4or3e #o.el o1 Com0etition -he ;ive ;orces ,odel of 7ompetition indicates that these forces interact to determine the intensity or strength of competition3 #hich ultimately determines the profitability of the industry. -hreat of e# Entrants -hreat of 5ubstitute )roducts >argaining )o#er of >uyers '7ustomers( >argaining )o#er of 5uppliers

2+1A

Chapter 2: The External Environment 0ivalry 1mong 7ompeting ;irms in an industry

1ssessing the relative strength of the five competitive forces is important to a firms ability to achieve strategic competitiveness and earn above+average returns. 9ie#ed differently3 competition should be seen as groupings of alternative #ays that customers can obtain desired results. -hus3 any analysis of an industry must expand beyond the traditional practice of concentrating on direct competitors to include potential competitors. ;or exampleF 5uppliers can become competitors by integrating for#ard. >uyers or customers can become competitors by integrating bac&#ard. ;irms that are not competitors today could produce products that serve as substitutes for existing products offered by firms in an industry3 transforming themselves into competitors. T#reat o- Ne. Entrants e# entrants to an industry are important because3 #ith ne# competitors3 the intensity of competitive rivalry in an industry generally increases. -his is because ne# competitors may bring substantial resources into the industry and may be interested in capturing a significant mar&et share. "f a ne# competitor brings additional capacity to the industry #hen product demand is not increasing3 prices that can be charged to consumers generally #ill fall. 8ne result may be a decline in sales and lo#er returns for many firms in the industry. Teaching Note: To help students grasp the potential impact of new entrants on an industry, it is helpful to illustrate this effect by referring to a number of examples that may be familiar to them, such as/ the transformation of the steel industry when mini-mills *such as 8ucor and -irmingham 1teel+ entered the industry in competition with integrated domestic producers such as 9.1. 1teel and -ethlehem 1teel the impact of the increase in the number of cell phone providers on the cost of having a cell phone *and the long-range, potential impact on the cost of local telephone service+ the increase in the number of 0nternet access providers and the effects of increased competition on such firms as $ompu1erve and 3merica 5nline -he seriousness or extent of the threat of ne# entrants is affected by t#o factorsF barriers to entry and expected reactions fromDor the potential for retaliation byDincumbent firms in the industry. Barriers to Entry >arriers to entering an industry are present #hen entry is difficult or #hen it is too costly and places potential entrants at a competitive disadvantage 'relative to firms already competing in the industry(. -here are seven factors that represent potentially significant entry barriers that can emerge as an industry evolves or might be explicitly BerectedC by current participants in the industry to protect profitability by deterring ne# competitors from entry. E3onomie o1 S3ale refers to the relationship bet#een Euantity produced and unit costF 1s the Euantity of a product produced during a given time period increases3 the cost of manufacturing each unit declines.

2+11

Chapter 2: The External Environment Economies of scale can serve as an entry barrier #hen existing firms in the industry have achieved these scale economies and a potential ne# entrant is only able to enter the industry on a small scale 'and produce at a higher cost per unit(. Economies of scale can be overcome as a potential entry barrier by firms that produce multiple customized products or that enter an industry on a large+enough scale. e# manufacturing technology facilitated by advanced information systems has allo#ed the development of Bmass customizationC in an increasing number of industries3 and online ordering has enhanced the ability of customers to obtain customized products 'often referred to as Bmar&ets of one.C( Pro.!3t Di11erentiation, 7ustomers may perceive that products offered by existing firms in the industry are uniEue as a result of service offered3 effective advertising campaigns3 or being first to offer a product of service to the mar&et. "f customers perceive a product or service as uniEue3 they generally are loyal to that brand. -hus3 ne# entrants may be reEuired to spend a great deal of money over a long period of time to overcome customer loyalty to existing products. *hile ne# entrants may be able to overcome perceived uniEueness and brand loyalty3 the cost of such strategies generally #ill be highF offering lo#er prices3 adding additional features3 or allocating significant funds to a maGor advertising and promotion campaign. "n the short run3 ne# entrants that try to overcome uniEueness and brand loyalty may suffer lo#er profits or may be forced to operate at a loss. Ca0ital Re<!irement , ;irms choosing to enter any industry must commit resources for facilities3 to purchase inventory3 to pay salaries and benefits3 etc. *hile entry may seem attractive 'because there are no apparent barriers to entry(3 a potential ne# entrant may not have sufficient capital to enter the industry. S9it3(in- Co t , T#ese are the one+time costs customers #ill incur #hen buying from a different supplier. -hese can include such explicit costs as retraining of employees or retooling of eEuipment as #ell as the psychological cost of changing relationships. "ncumbent firms in the industry generally try to establish s#itching costs to offset ne# entrants that try to #in customers #ith substantially lo#er prices or an improved 'or3 to some extent3 different( product. A33e to Di tri7!tion C(annel , 1s existing firms in an industry generally have developed effective channels for distributing products3 these same channels may not be available to ne# firms entering an industry. -hus3 access 'or lac& thereof( may serve as an effective barrier to entry. -his may be particularly true for consumer nondurable goods 'e.g.3 because of the limited amount of shelf space available in retail stores( and in international mar&ets. "n the case of some durable goods or industrial products3 to overcome the barrier3 ne# entrants must again incur costs in excess of those paid by existing firms3 either through lo#er prices or price brea&s3 costly promotion campaigns3 or advertising allo#ances. e# entrants may have to incur significant costs to establish a proprietary distribution channel. 1s in the case of product differentiation or uniEueness barriers3 ne# entrants may suffer lo#er profits or operate at a loss as they battle to gain access to distribution channels. Co t Di a.vanta-e In.e0en.ent o1 S3ale, Existing firms in an industry often are able to achieve cost advantages that cannot be costlessl duplicated by ne# entrants 'i.e.3 other than those related to economies of scale and access to distribution channels(. -hese can include proprietary process 'or product( technology3 more favorable access to or control of ra# materials3 the best locations3 or favorable government subsidies. )otential entrants must find #ays to overcome these disadvantages to be able to effectively compete in the industry. -his may mean successfully adapting technologies from other industries and<or non+competing

2+12

Chapter 2: The External Environment products for use in the target industry3 developing ne# sources of ra# materials3 ma&ing product 'or service( enhancements to overcome location+related disadvantages3 or selling at a lo#er price to attract customers. Government Poli32, /overnments 'at all levels( are able to control entry into an industry through licensing and permit reEuirements. ;or example3 at the firm level3 entry into the ban&ing industry is regulated at both the federal and state levels3 #hile liEuor sales are regulated at the state and local levels. "n some cases3 state and<or federal licensing reEuirements limit entry into the personal services industry 'securities sales and la#(3 #hile in others only state reEuirements may limit entry 'barbers and beauticians(. Teaching Note: 1tudents should be reminded of the monopolistic nature *on a mar et-bymar et basis+ of the public utility industry, including local telephone service, water, electric power, and cable television. The %regulated monopolies& will provide helpful illustrations to ma e sense of this section. E+!e%ted Retaliation Even if a firm concludes that it can successfully overcome all of the entry barriers3 it still must ta&e into account or anticipate reactions that might be expected from existing firms. 5trong retaliation is li&ely #hen existing firms have a heavy investment in fixed assets 'especially #hen there are fe# alternative uses for those assets( or #hen industry gro#th is slo# or declining. 0etaliation could ta&e the form of announcements of anticipated future investments to increase capacity3 ne# product plans3 price+ cutting or a study to assess the impact of lo#er prices 'this might imply price+cutting as a BpromisedC entry barrier+creation strategy by existing firms(. 5mall entrepreneurial firms can avoid retaliation by identifying and serving neglected mar&et segments. ;or example3 .onda first entered the 4.5. mar&et by concentrating on small+engine motorcycles3 a mar&et that firms such as .arley+Davidson ignored. 1fter consolidating its position3 .onda #ent on the offensive by introducing larger motorcycles and competing in the broader mar&et. Teaching Note: To illustrate competitive retaliation, consider the example of the potential for increased competition in the :;-hour news mar et that had at one time been monopoli'ed by $88 *$able 8ews 8etwor +. The --$ is establishing a global news networ . 8-$ formed an alliance with "icrosoft to implement its :;-hour news networ , "18-$, including a parallel site on the !orld !ide !eb. $apital $ities,3-$ launched a :;-hour news service, using 3-$ 8ews anchors and correspondents. Bar-ainin- Po9er o1 S!00lier -he bargaining po#er of suppliers depends on suppliers economic bargaining po#er relative to firms competing in the industry. 5uppliers are po#erful #hen firm profitability is reduced by suppliers actions. 5uppliers can exert their po#er by raising prices or by restricting the Euantity and<or Euality of goods available for sale. 5uppliers are po#erful relative to firms competing in the industry #henF the supplier segment of the industry is dominated by a fe# large companies and is more concentrated than the industry to #hich it sells

2+13

Chapter 2: The External Environment

satisfactory substitute products are not available to industry firms industry firms are not a significant customer group for the supplier group suppliers goods are critical to buyers mar&etplace success effectiveness of suppliers products has created high s#itching costs for buyers suppliers represent a credible threat to integrate for#ard into the buyers industry3 especially #hen suppliers have substantial resources and provide highly differentiated products

"n the airline industry3 suppliers bargaining po#er is changing. -here are fe# suppliers3 but demand for the maGor aircraft is also lo#. >oeing and 1irbus compete strongly for most orders of maGor aircraft. .o#ever3 7hina recently announced plans to enter the mar&et by building large commercial aircraft3 significant in a country #hich is proGected to purchase thousands. Bar-ainin- Po9er o1 B!2er *hile firms see& to maximize their return on invested capital3 buyers are interested in purchasing products at the lo#est possible price 'the price at #hich sellers #ill earn the lo#est acceptable return(. -o reduce cost or maximize value3 customers bargain for higher Euality or greater levels of service at the lo#est possible price by encouraging competition among firms in the industry. >uyer groups are po#erful relative to firms competing in the industry #henF buyers are important to sellers because they purchase a large portion of the supply industrys total sales products purchased from a supply industry represent a significant portion of the sellers annual revenues buyers are able to s#itch to another suppliers product at little3 if any3 cost suppliers products are undifferentiated and standardized3 and the buyers represent a real threat to integrate bac&#ards into the suppliers industry using resources or expertise

1rmed #ith greater amounts of information about the manufacturers costs and the po#er of the "nternet as a shopping and distribution alternative3 consumers appear to be increasing their bargaining po#er in many industries. 8ne reason for this shift is that individual buyers incur virtually zero s#itching costs #hen they decide to purchase from one manufacturer rather than another or from one dealer as opposed to a second or third one. T(reat o1 S!7 tit!te Pro.!3t 1ll firms must recognize that they compete against firms producing su*stitute !rodu%ts3 those products that are capable of satisfying similar customer needs but come from outside the industry and thus have different characteristics. "n effect3 prices charged for substitute products represent the upper limit on the prices that suppliers can charge for their products. -he threat of substitute products is greatest #henF buyers or customers face fe#3 if any s#itching costs prices of the substitute products are lo#er Euality and performance capabilities of substitutes are eEual to<greater than those of the industrys products ;irms can offset the attractiveness of substitute products by differentiating their products in #ays that are perceived by customers as relevant. 9iable strategies might include price3 product Euality3 product features3 location3 or service level.

2+14

Chapter 2: The External Environment

E+am!les o- Traditional and $u*stitute 'rodu%ts/ and T#eir Usage Traditional !rodu%t 8vernight delivery 5ugar /lass 7offee )aper bags $u*stitute !rodu%t ;ax machines<e+mail utra5#eet )lastic -ea )lastic bags Usage Document delivery 5#eetener 7ontainers >everages ;lexible pac&aging

Inten it2 o1 Rivalr2 amon- Com0etitor -he intensity of rivalry in an industry depends upon the extent to #hich firms in an industry compete #ith one another to achieve strategic competitiveness and earn above+average returns because success is measured relative to other firms in the industry. 7ompetition can be based on price3 Euality3 or innovation. >ecause of the interrelated nature of firms actions3 action ta&en by one firm generally #ill result in retaliation by competitors 'also &no#n as competitive response(. "n addition to actions and reactions that result as firms attempt to offset the other competitive forces in the industryDthreat of ne# entry3 po#er of suppliers and buyers3 and threat of substitute productsDthe intensity of competitive rivalry is also a function of a number of other factors.

Numerous or E0ually Balan%ed om!etitors "ndustries #ith a high number of firms can be characterized by intense rivalry #hen firms feel that they can ma&e competitive moves that #ill go unnoticed by other firms in the industry. .o#ever3 other firms #ill generally notice these moves and offer countermoves of their o#n in response. )atterns of freEuent actions and reactions often result in intense rivalry3 such as in local restaurant3 retailing3 or dry+cleaning industries. 0ivalry also #ill be intense in an industry that has only a fe# firms of eEuivalent resources and po#er. -he firms resource bases enable each to ta&e freEuent action to improve their competitive positions #hich3 in turn3 produces a reaction or countermove by competitors. >attles for mar&et share in the fast food industry bet#een ,cDonalds and >urger IingJ in the automobile industry bet#een such firms as /eneral ,otors3 ;ord3 and -oyotaJ and in athletic shoes bet#een i&e and 0eebo& are examples of intense rivalry bet#een relatively eEuivalent competitors. 8f course3 >oeing versus 1irbus is an especially useful example. $lo. Industry Gro.t# *hen a mar&et is gro#ing at a level #here there seem to be Benough customers for everyone3C competition generally centers around effective use of resources so that a firm can effectively serve a larger3 gro#ing customer base. >ecause of sufficient gro#th in the mar&et3 firms do not concentrate on ta&ing customers a#ay from other firms. -he intensity of competition often results in a reduction in industry profitability as observed in the fast food industry #ith the battle for a slo#er gro#ing traditional3 4.5. customer base bet#een ,cDonalds3 >urger Iing3 and *endys. -he intensity of competition can be illustrated by the various competitive strategies follo#ed by firms in the fast food industryF rapid and continuous introduction of ne# products and ne# pac&aging schemes the introduction of innovative+pricing strategies

2+1!

Chapter 2: The External Environment product and<or service differentiation 1ig# Fi+ed osts or 1ig# $torage osts *hen an industry is characterized by high fixed costs relative to total costs3 firms produce in Euantities that are sufficient to use a large percentage3 if not all of their production capacity so that fixed costs can be spread over the maximum volume of output. *hile this may lo#er per unit costs3 it also can result in excess supply if mar&et gro#th is not sufficient to absorb the excess inventory. -he intensity of competitive rivalry increases as firms use price reductions3 rebates3 and other discounts or special terms to reduce inventory as observed in the automobile industry from the 1@HAs to the present. .igh storage costs3 especially those related to perishable or time+sensitive products 'such as fruits and vegetables( also can result in high levels of competitive intensity as such products rapidly lose their value if not sold #ithin a given time period. )ricing strategies often are used to sell such products. La%2 o- )i--erentiation or Lo. $.it%#ing osts )roducts that are not characterized by brand loyalty or perceived uniEueness are generally vie#ed by buyers as commodities. ;or such products3 industry rivalry is more intense and competition is based primarily on price3 service3 and other features of interest to consumers. 5#itching costs can be used to decrease the li&elihood that customers #ill s#itch to competitors products. )roducts for #hich customers incur no or fe# s#itching costs are subGect to intense price+ and service+based competition3 similar to undifferentiated products. 1ig# $trategi% $ta2es -he intensity of competitive rivalry increases #hen success in an industry is important to a large number of firms 'such as the domestic airline industry follo#ing deregulation(. ;or example3 the success of a diversified firm may be important to its effectiveness in other industries3 especially #hen the firm is in interdependent or related industries. /eographic sta&es may also be high. -he importance of geographic sta&es can be illustrated by the intense rivalry in the 4.5. automobile industry as Kapanese manufacturers recognized the strategic importance of a 4.5. mar&etplace presence and 4.5. manufacturers responded. 1ig# E+it Barriers E+it *arriersDcreated by economic3 strategic3 and emotional factors that cause companies to remain in an industry3 even though the profitability of doing so is in EuestionDalso can increase the intensity of competition in an industry. -he higher the barriers to exit3 the greater the probability that competitive actions and reactions #ill include price cuts and extensive promotions. 5ome sources of exit barriers includeF investments in speciali!ed assets3 or assets #hose value is lin&ed to use in a particular industry or location3 #ith little or no value as salvage or in other uses "ixed costs o" exit3 such as labor agreements or a reEuirement to repay federal3 state or local aid pac&ages strategic relationships3 interdependencies #ithin the organization 'e.g.3 shared facilities3 mar&et access( emotional barriers3 such as loyalty to employees or fear for ones o#n career government and#or social restrictions based on concern for Gob losses or the economic impact of exit

2+1$

Chapter 2: The External Environment

Teaching Note: The firm that was formerly (reyhound $orporation has been transformed over the years into what is today a very different loo ing <ial $orporation. 5f course, the firm was at one time so well nown for its bus lines that we now use the term %greyhound bus& as a generic term referring to a general design of bus. <ial $orp. sold the bus lines to a <allas, Texas concern a number of years ago, but in fact the firm held on to the transportation unit through a number of years of poor performance, long after the unit lost its fit with the <ial portfolio. !hy did the firm do this7 1ome would say it was because the firm had an emotional attachment to the business that got it all started. Teaching Note/ 5ne way to get students to recogni'e the industry forces Porter presents is to allow them to learn about a given industry and report on these forces as they see them and assess their strength. 4or example, one adopter of the text shows students the first segment of a P-1 video series by <aniel =ergin called %The Pri'e.& This one-hour video profiles the formation of the oil industry and its rapid transformation in the early days. 1tudents are as ed to identify as many illustrations of %Porters 4ive 4orces in action& as they watch the video *e.g., profits were much greater early in the first part of the industrys first decade than in the last years of that period because barriers to entry were low and the rapid influx of new entrants expanded supply and depressed prices+. 3s an incentive for diligent observation, the student who identifies the greatest number of legitimate illustrations is rewarded with bonus points. INTERPRETING INDUSTR' ANAL'SES Effective industry analyses are products of careful study and interpretation of data from multiple sources. >ecause of globalization3 international mar&ets and rivalry must be included in the firms analysesJ in fact3 research sho#s international variables may have more impact on strategic competitiveness than domestic ones3 in some cases. ;ollo#ing study of the five industry forces3 the firm has the insights reEuired to determine an industrys attractiveness in terms of the potential to earn adeEuate or superior returns on its invested capital. "n general3 the stronger the competitive forces3 the lo#er the profit potential for an industrys firms. 1n unattractive industry has lo# entry barriers3 suppliers and buyers #ith strong bargaining positions3 strong competitive threats from product substitutes3 and intense rivalry among competitors3 #hich ma&e it difficult for firms to achieve strategic competitiveness and earn above+average returns. 1n attractive industry has the mirror image of these features and offers little potential for favorable performance. Teaching Note: 3 good example of the need to understand the global structure of the industry and the implications for competitive strategy is illustrated by the intensity of global competition for mar et share between >imberly-$lar and Procter ? (amble *P?(+. The former attempts to compete more effectively with P?( in Europe, as well as in emerging mar ets, while maintaining its dominant 9.1. position. 7haracteristics of attractive and unattractive industries are summarized belo#. Industry #ara%teristi% -hreat of e# Entry >argaining )o#er of 5uppliers >argaining )o#er of >uyers -hreat of 5ubstitute )roducts "ntensity of 7ompetitive 0ivalry Attra%tive 2o# 2o# 2o# 2o# 2o# Unattra%tive .igh .igh .igh .igh .igh

2+1%

Chapter 2: The External Environment

Teaching Note/ 0t may be helpful to explain that the relationship between the strength of industry forces and prices,profits in the industry is an inverse one. !hen the forces are strong, prices,profits in the industry tend to be low, whereas wea forces usually lead to higher prices,profits. The mental image is one of a playground %teeter-totter& or balance scale.

Define strategic groups and describe their influence on the firm.

STRATEGIC GROUPS 1s implied by the previous discussion3 not all firms in an industry may adopt the same strategies in their Euest for strategic competitiveness and above+average returns. .o#ever3 many firms in an industry may follo# similar strategies. -hese firms are generally classified as strategi% grou!s3 or groups of firms in an industry follo#ing the same or similar strategies along the same strategic dimensions. ,embership in a particular strategic group is determined by the essential characteristics of a firms strategy3 #hich may include the extent of technological leadership degree of product Euality pricing policies choice of distribution channels degree and type of customer service Teaching Note: 0t may be helpful to assign students *or students teams+ the tas of developing a strategic group map of an industry with which they are familiar *e.g., fast food, automobile manufacturing, computers, or the financial services industry+. Teaching Note: "any strategy experts believe that the strategic group concept provides a useful tool for analy'ing an industry from firm-specific perspectives in order to learn how to compete successfully. 6owever, some critics indicate that there is no convincing evidence that *@+ strategic groups exist or *:+ that firm performance is dependent upon membership in a particular group. 5thers contend that little additional understanding can be gained from industry analysis by loo ing at strategic groups, but recent research provides some evidence to support the usefulness of this analysis. -he strategic group concept can be useful in analyzing the competitive structure of an industry and can serve as a frame#or& for assessing competition3 positioning alternatives3 and potential profitability of firms in an industry. .igh mobility barriers3 high rivalry3 and lo# resources among the firms #ithin an industry #ill limit the formation of strategic groups. .o#ever3 research suggests that once formed3 strategic group membership remains relatively stable over time3 ma&ing analysis easier and more useful. 4se of the strategic group concept reEuires that analysts be a#are of several implicationsF 1 firms maGor or primary competitors are those in its strategic group3 thus competitive rivalry #ithin the strategic group is expected to be more intense than rivalry #ith other firms in the industry. -he relative strengths of the five competitive forces #ill differ among groups3 thus firms in different groups may adopt different competitive strategies. -he closer the strategic groups on the relevant dimensions3 the greater the li&elihood of their rivalry.

2+1H

Chapter 2: The External Environment

>

Describe #hat firms need to &no# about their competitors and different methods 'including ethical standards( used to collect intelligence about them.

STRATEGIC 4OCUS IB# Clo el2 Wat3(e It Com0etitor to Sta2 at t(e To0 o1 It Game .eres an excellent example of effective competitive intelligence. 6oull realize that there are no cloa& and dagger tactics involved3 nor is there anything clandestine about competitive information gathering. ">, has effectively monitored and analyzed mar&eting strategies that its &ey competitors are applying in the mar&et place. ">, not only manufactures and sells mainframes3 servers3 storage systems3 and peripherals but also has the largest computer service operation in the #orld. 5ervice accounts for over !A percent of ">,s total revenue. ">, has established a competitive analysis team for the sole purpose of monitoring and analyzing its competitors. -he output from this group allo#s ">, to adGust strategies and business plans to effectively compete #ith competitors such as 5un ,icrosystems and .e#lett+)ac&ard. Examples of meaningful information generated by this team include learning that 5uns direct sales team focuses on the top 1!AA accounts in its customer base and that the remaining installed base is served by 5uns business partners. 1nother significant finding that affects ">, mar&eting strategy is that 5un also concentrates on hard#are sales rather than selling solutions. -he ">, team also determined that .) operates in a similar fashion as an eEuipment supplier relying on its hard#are customers to see& support from third parties such as 7isco3 1ccenture3 ED53 and .) retailers. Existing competitors often try to develop barriers to entry to protect their commercial interests, but sometimes the rivalry comes from outside the established set of players. 3s seen in this Strategic Focus, cable firms are entering the phone service business, and local firms such as 1-$ $ommunications are ta ing measures to prevent customer loss,turnover. !hat can be done to protect the firm from outside attac s7 <ifferentiating a product along dimensions that customers value *such as price, #uality, service after the sale, and location+ reduces a substitutes attractiveness. Aocal phone server companies have lost significant subscriber base to cable companies offering phone services. 1imilarly, cable companies have lost TB subscriber base to satellite TB operators. Each company has been using a bundling approach to increase switching costs to forestall these substitutions. -ut it could be argued that the focus should be on creating value for the customer, rather than simply bloc ing them from accessing greater value from some other option.

CO#PETITOR ANAL'SIS 7ompetitor analysis represents a necessary adGunct to performing an industry analysis. 1n industry analysis provides information regarding potential sources of competition 'including the possible strategic actions and reactions and effects on profitability for all firms competing in an industry(. .o#ever3 a structured competitor analysis enables the firm to focus its attention on those firms #ith #hich it #ill directl compete3 and is especially important #hen a firm faces a fe# po#erful competitors. 7ompetitor analysis is interested ultimately in developing a profile on ho# competitors might be expected to respond to a firms strategic moves. -he process involves developing ans#ers to a series of Euestions aboutF the firms and its competitors future obGectives current strategy assumptions

2+1@

Chapter 2: The External Environment capabilities Teaching Note: To help students understand the usefulness of competitor analysis, have them develop a profile of another university or college, assume the role of a Pepsi product manager and develop a competitive profile of $oca-$ola, or ta e the perspective of 0ntel and describe 3"<s competitive characteristics. 3 specific case that contains the bul of the re#uired information also could be used to perform an in-class competitor analysis. 1nother significant component are the 3om0lementor of a firms products and strategy. -hese are the net#or&s of companies that sell goods and services compatible #ith the firms o#n product or service. ETHICAL CONSIDERATIONS 1 maGor concern of many managers is the methods that are used to gather data on competitors3 a process generally referred to as %om!etitor intelligen%e. -he illustration of ,icrosofts struggle to understand /oogle is especially helpful in explaining this concept. "t is a great managerial challenge to ensure that all data and information related to competitors is gathered both legally and ethically. -his is important because many employees may feel pressure to rely on techniEues that are Euestionable from an ethical perspective to gather information that may be valuable to their firm3 especially if they perceive value to their o#n careers from successfully obtaining such information. "t seems obvious that information that '1( is either publicly available 'annual reports3 regulatory filings3 brochures3 advertising and promotional materials( or '2( is obtained by attending trade sho#s and conventions can be used #ithout ethical or legal implications. .o#ever3 information obtained illegally 'as a result of activities such as theft3 blac&mail3 or eavesdropping( cannotDor3 at least3 should notDbe used since its use is unethical as #ell as illegal. Teaching Note: 0t might be useful and insightful to re#uire students to develop *and bring to class+ their own lists of #uestionable intelligence-gathering techni#ues or formulate an argument as to the circumstances *if any+ under which these techni#ues might be considered ethical. This could ma e for a lively discussion of the issue.

? ANSWERS TO REVIEW @UESTIONS

$* W(2 i it im0ortant 1or a 1irm to t!.2 an. !n.er tan. t(e e)ternal environment: A00* +5"+;B

-he external environment influences the firms strategic options as #ell as the decisions made in light of them. -he firms understanding of the external environment is especially useful #hen it is matched #ith &no#ledge about its internal environment. ,atching the conditions of the t#o environments is the foundation the firm needs to form its vision3 mission3 and to ta&e strategic actions in the pursuit of strategic competitiveness and above+average returns. -he importance of understanding the external environment is further underscored by the fact that the environmental conditions facing firms in the global economy of the 21st century differ from those firms faced previously. ;or example3 technological changes and the explosion in information gathering and processing capabilities demand more timely and effective competitive actions and responses. -he rapid sociological changes occurring in many countries affect labor practices and the nature of products demanded by increasingly diverse consumers. /overnmental policies and la#s affect #here and ho# firms choose to compete. 7ompetitive advantage goes to those firms #ho &no# their external environment and plan their strategies so they are relevant to these conditions.

2+2A

Chapter 2: The External Environment %* W(at are t(e .i11eren3e 7et9een t(e -eneral environment an. t(e in.! tr2 environment: W(2 are t(e e .i11eren3e im0ortant: A00* +;"+=B -he general environment represents those elements in the broader society that can influence all 'or most( industries and the firms that compete in those industriesJ it represents elements or segments that firms cannot directly control. -he general environment is composed of the follo#ing segmentsF demographic3 economic3 political<legal3 sociocultural3 technological3 and global segments. -he industry environment is the constellation of factors that directly influences a firm and its competitive actions and responses. ;irms are influenced by these factors and should attempt to establish a position in the industry that enables the firm to favorably influence the factors or to successfully defend against the factors influence. -hese factors areF threat of ne# entrants3 bargaining po#er of suppliers3 bargaining po#er of buyers3 threat from substitute products3 and intensity of rivalry among competitors. +* W(at i t(e e)ternal environmental anal2 i 0ro3e : W(at .oe t(e 1irm 9ant to learn 9(en ! int(i 0ro3e : A0* +>"+CB -he environmental analysis process represents an organized attempt by the firm to better understand turbulent3 complex3 and global environments. -his is achieved by scanning 'studying all segments of the general environment to identify existing or potential changes(3 monitoring 'observing the pattern of changes over time in an attempt to detect meaning or identify trends(3 "orecasting 'developing feasible proGections of #hat might happen3 and ho# Euic&ly3 as a result of changes and trends identified from scanning and monitoring activities( and assessing 'determining the timing and significance of environmental changes and trends on the strategic management of the firm(. 5tated differently3 this analysis should examine and process external data on a continuous basis. 1n important obGective of the environmental analysis process is to identify potential threats 'conditions that may hinder the firms efforts to achieve strategic competitiveness( and opportunities 'that may assist or help the firm in its efforts to achieve strategic competitiveness(. 5* W(at are t(e i) e-ment o1 t(e -eneral environment: E)0lain t(e .i11eren3e amon- t(em* A00* 5D" 5>B -he demographic segment is concerned #ith characteristics of the population or society that ma&es up the general environment. 7haracteristics of interest are size3 age3 structure3 geographic distribution3 ethnic mix3 and income distribution. -he economic segment refers to the nature and direction of the economy in #hich a firm competes or may compete in the future. "mportant characteristics include inflation and interest rates3 trade deficits 'or surpluses(3 budget deficits 'or surpluses(3 individual and business savings and investment rates3 and gross domestic product. -he political#legal segment is the arena in #hich organizations and interest groups compete for attention3 resources3 and a voice in overseeing the body of la#s and regulations guiding interactions bet#een nations. "n other #ords3 this segment is concerned #ith ho# firms and other organizations attempt to influence government and ho# governmental entities in turn influence them. -he sociocultural segment is concerned #ith the social attitudes and cultural values of different societies. -he technological segment is made up of the institutions and activities involved #ith creating ne# &no#ledge and translating that &no#ledge into ne# outputs3 products3 processes3 or materials. -he global segment includes relevant ne# global mar&ets and existing ones that are changing3 important international political events3 and critical cultural and institutional characteristics of relevant global mar&ets. -his segment recognizes that firms no# compete in a competitive landscape #here both competitors and customers are global3 due in part to the rapid diffusion of both information and technology. 7ompetitors #ill no longer be domesticJ they can originate from industrialized3 ne#ly industrialized3 or emerging countries.

2+21

Chapter 2: The External Environment 7ustomer demands and expectations have changedJ they are based on an ever+increasing a#areness of global products and services. ;* Ho9 .o t(e 1ive 1or3e o1 3om0etition in an in.! tr2 a11e3t it 0ro1it 0otential: E)0lain* A00* 5E";;B

1n industrys competitive intensity and profit potential can be determined by the relative strengths of five competitive forces. -his model of industry competition recognizes that suppliers can influence industry profitability by raising prices or reducing the Euality of goods sold if industry participants are unable to recover cost increases through pricing structures. >uyers can influence the profit potential of an industry if the buyer group is able to successfully bargain for higher Euality3 greater levels of service3 and lo#er prices. 5ubstitute products influence an industrys profit potential by placing an upper limit on prices that can be charged. e# entrants to an industry influence industry profitability because they bring additional production capacity to the industry. 4nless product demand is increasing3 additional capacity holds do#n 'or reduces( buyers costs3 reducing profitability for all firms in the industry. -he intensity of rivalry among competitors reflects competitor actions and responses as firms initiate moves to improve their competitive position or #hen they act in retaliation for competitive pressures brought about by the strategic actions of rival firms. /enerally3 the greater the intensity of competitive rivalry3 the lo#er the overall profitability of an industry. =* W(at i a trate-i3 -ro!0: O1 9(at val!e i 8no9le.-e o1 t(e 1irmF t(at 1irmF trate-2: A00* ;;";=B trate-i3 -ro!0 in 1orm!latin-

1 strategic group is a group of firms #ithin an industry that generally follo# the same 'or a similar( strategy3 competing along the same strategic dimensions 'such as product Euality3 pricing policy3 distribution channels3 or level of customer service(. -he strategic group concept is valuable to a firms strategic decision ma&ers because a firms primary competitors are those #ithin its strategic group 'all group members are selling similar products to a similar group of customers(3 the strengths of the five competitive forces varies across strategic groups3 and strategic groups that are similar 'in terms of strategies follo#ed and competitive dimensions emphasized( increases the possibility of increased competitive rivalry bet#een the groups. -he notion of strategic groups can be useful for analyzing an industrys competitive structure. 5uch analyses can be helpful in diagnosing competition3 positioning3 and the profitability of firms #ithin an industry. 5trategic group analysis sho#s #hich companies are competing similarly in terms of ho# they use similar strategic dimensions. 1t the same time3 research has found that strategic groups differ in performance3 suggesting their importance. 5trategic group membership also remains relatively stable over time3 ma&ing analysis easier and more useful. 5trategic groups have several implications. ;irst3 because firms #ithin a group offer similar products to the same customers3 the competitive rivalry among them can be intense. -he more intense the rivalry3 the greater the threat to each firms profitability. 5econd3 the strengths of the five industry forces 'the threats posed by ne# entrants3 the po#er of suppliers3 the po#er of buyers3 product substitutes3 and the intensity of rivalry among competitors( differ across strategic groups. -hird3 the closer the strategic groups are in terms of their strategies3 the greater is the li&elihood of rivalry bet#een the groups. "n the end3 having a thorough understanding of primary competitors helps a firm formulate and implement an appropriate strategy. >* W(at i t(e im0ortan3e o1 3olle3tin- an. inter0retin- .ata an. in1ormation a7o!t 3om0etitor : W(at 0ra3ti3e (o!l. a 1irm ! e to -at(er 3om0etitive intelli-en3e an. 9(2: A00* ;E"=DB 7ompetitor analysis can help the firm to understand and better anticipate competitors future obGectives3 current strategies3 assumptions3 and capabilities. -he firm should gather intelligence about its competitors as #ell as about public policies in countries across the #orld3 #hich can serve as an early #arning of threats and opportunities emerging from the global public policy environment that may affect the achievement of the companys strategy. -hrough effective competitive and public policy intelligence3 the firm gains the insights needed to create a competitive advantage and to increase the Euality of the strategic decisions it ma&es #hen deciding ho# to compete against its rivals.

2+22

Chapter 2: The External Environment

;irms #ant to &no# ho# competitor intelligence is gathered to determine #hether the practices employed are legal and3 further3 to assess #hether these methods are ethical3 given the firms culture and the image it desires as a corporate citizen. -he line bet#een legal and ethical practices can be difficult to ascertain3 especially #hen it comes to electronic transmissions. 8ften it is difficult for a firm to &no# ho# to gather intelligence and ho# to prevent competitors from gathering competitive intelligence that may threaten its o#n competitive advantage. 8penly discussing intelligence+gathering techniEues that the firm employs goes a long #ay to#ard assuring that people understand the firms convictions about #hat is ethical and acceptable for use and #hat is not ethical and is unacceptable for use #hen gathering competitor intelligence. -he firm can frame these practices in terms of respect for the principles of common morality and the right of competitors not to reveal information about their products3 operations3 and strategic intentions. Despite its importance3 evidence suggests that a relatively small percentage of firms use formal processes to study competitors. >eyond this3 some firms fail to analyze a competitors future obGectives #hen trying to understand its current strategy3 assumptions3 and capabilities3 but it is important to study the present and the future #hen examining competitors. ;ailure to do so may lead to incomplete or distorted insights about competitors.

? E/PERIENTIAL E/ERCISES

E)er3i e $, Airline Com0etitor Anal2 i -he "nternational 1ir -ransport 1ssociation '"1-1( reports statistics on the number of passengers carried each year by maGor airlines. )assenger data for 2AA$ is reported for the top ten fliers in three categoriesF Domestic flights "nternational flights 7ombined traffic3 domestic and international flights -he table belo# lists both passenger data and ran&ings for each category. 0ntCl Dan ing . F ; @E 0ntCl Passengers .E,;@F :@,::2 :G,;G2 @HHHF <omestic Dan ing H : <omestic Passengers ;I,.:2 F2,HEF $ombined Dan ing F 2 @ $ombined Passengers ;G,;@@ ;G,::H GG,2.I

3irline 3ir 4rance 3ll 8ippon 3irlines 3merican 3irlines -ritish 3irways $athay Pacific $hina 1outhern 3irlines $ontinental 3irlines <elta 3irlines Easyjet Emirates Japan 3irlines 0ntCl >A" Aufthansa

F G . H G I : :@,G@F @H,F;2 2 ::,.:: .2,:.H

;I,:;G .I,2I: H.,;;H

@E .

;2,I@: F.,I2;

.F,@I;

G H

;2,G@@ I@,:@.

2+23

Chapter 2: The External Environment

8orthwest 3irlines Dyanair 1ingapore 3irlines 1outhwest 3irlines 9nited 3irlines 91 3irways

I @ 2 ;E,I.: @2,E:: @ ; @E

;I,F;.

II,G:I

GH,:FF I2,2E@ .:,EG;

: ;

GH,:FF HG,:HI

;or this exercise3 you #ill develop competitor profiles of selected air carriers. Part One *or&ing in groups of five to seven people3 each team member selects one airline from the table. -he pool of selected airlines should contain a roughly even balance of three regionsF orth 1merica3 Europe<,iddle East3 and 1sia. 4sing outside resources3 ans#er the follo#ing EuestionsF *hat drives this competitor 'i.e.3 #hat are their obGectives(= *hat is their current strategy= *hat does this competitor believe about their industry= *hat are their strengths and #ea&nesses= *hen researching your companies3 you should use multiple resources. -he companys *ebsite is a good starting point. )ublic firms headEuartered in the 4.5. #ill also have annual reports and 1A+I reports filed #ith the 5ecurities and Exchange 7ommission. Part T9o 1s a group3 summarize the results of each competitor profile into a single table. -hen3 discuss the follo#ing topicsF *hich airlines in your group had the most similar strategies= -he most different= *ould you consider any of the firms you studied to be in the same strategic group M i.e.3 a group of firms that follo# similar strategies along similar dimensions= 7reate a composite five forces model based on the firms you revie#ed. .o# might these elements of industry structure 'e.g.3 substitutes3 or bargaining po#er of buyers( differ from the perspective of individual airlines= .o# #ell do the strategies of these airlines fit #ith their industry and general environments= *hich airlines do you expect to advance in passenger ran&ings3 and #hich #ill lose ground=

2+24

Chapter 2: The External Environment E)er3i e %, T(e Ora3le at Del0(i "n ancient /reece3 people traveled to the temple at Delphi #hen they had important Euestions about the future. 1 priestess3 #ho #as ostensibly a direct connection to the god 1pollo3 #ould ans#er these Euestions in the form of a riddle. -oday3 executives are still faced #ith significant challenges in predicting the future3 albeit #ith very different processes. ,any strategies rely in part on Eualitative forecasts and untested assumptions3 simply because hard data may not exist3 or because the data may be of poor Euality. 5uch problems are particularly common in ne# product segments 'e.g.3 early stages of the "nternet(3 or in emerging economies 'e.g.3 #hen *estern firms first started selling in 7hina(. *hen ma&ing a subGective forecast3 it is often helpful to rely on multiple opinions and perspectives. .o#ever3 group discussions can often be s&e#ed if some participants are more vocal than others3 or if group members differ by status. -he Delphi ,ethod provides a process for helping a group to reach consensus #hile minimizing individual biases. -he decision process starts #ith the selection of a Euestion3 or set of Euestions. 1 facilitator is designated to manage the process3 and a group of experts is selected to provide input. -he facilitator polls each expert3 and creates a summary of the responses. -he summary is then sent bac& to the expert pool3 and each person is given the opportunity to revise their estimates. -his process repeats until the summary scores have stabilized. Part One 5elect one group member to serve as facilitator. -he facilitators role is to select an issue currently in the ne#s that has implications for a specific industry. 8nce a topic has been selected3 the facilitator should prepare a couple of survey Euestions that can be numerically ran&ed by the expert panel 'i.e.3 the rest of the team(. ;or example3 assume that the topic #as an upcoming election3 and ho# the results of that election might affect the attractiveness of an industry. "f there #ere three candidates3 the sample Euestions might loo& li&e thisF *hat is your assessment of the li&elihood of 7andidate 5mith being elected= *hat is your assessment of the li&elihood of 7andidate Kones being elected= *hat is your assessment of the li&elihood of 7andidate Doe being elected= '5cale 1 N extremely unli&ely 3 N moderately li&ely ! N extremely li&ely( "f 7andidate 5mith is elected3 #hat is the li&ely effect on industry gro#th and profitability= "f 7andidate Kones is elected3 #hat is the li&ely effect on industry gro#th and profitability= "f 7andidate Doe is elected3 #hat is the li&ely effect on industry gro#th and profitability= '5cale 1 N #orsened substantially 3 N unchanged ! N improved substantially( Part T9o -he facilitator should administer the survey to each group member. )repare a summary that includes the average score and range for each item. 0epeat the survey3 using the same Euestions t#o more times follo#ing this process. Part T(ree 1s a group3 discuss the follo#ing EuestionsF .o# much did the feedbac& of composite scores affect your assessment= "n your opinion3 #ere the final scores an improvement over the initial scores= *hy or #hy not= .o# might a Delphi process lead to lo# Euality results= *hat steps could you ta&e to help ensure a more accurate forecast=

2+2!

Chapter 2: The External Environment

>onus EuestionF .o# is the logic of the Delphi forecast similar to that of the boo& $isdom o" Crowds3 by Kames 5uro#iec&i=

INSTRUCTORGS NOTES 4OR E/PERIENTIAL E/ERCISES