Professional Documents

Culture Documents

Frasers Commercial Trust: Charted Territory

Uploaded by

ventria0 ratings0% found this document useful (0 votes)

7 views2 pagesFraser Commercial Trust

Original Title

FCT

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFraser Commercial Trust

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pagesFrasers Commercial Trust: Charted Territory

Uploaded by

ventriaFraser Commercial Trust

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Please refer to important disclosures at the back of this document.

MCI (P) 008/06/2013

Frasers Commercial

Trust

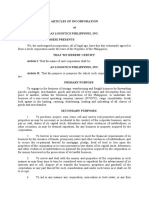

Closing Price: Last Market Volume: 52 Week Range:

$1.32 4.0m shares $1.17 - $1.59

Bullish break suggests further recovery

Key resistance conquered. Frasers Commercial Trust

could see more upside ahead after initiating a strong bullish

break above its $1.30 key resistance on heavy trading

volume yesterday.

Indicator turning bullish. The MACD has just initiated a

sharp bullish crossover as well; this suggests that the

upside momentum is accelerating.

Target price at $1.43. The counter could climb higher

towards the next key resistance at $1.43 (support-turned-

resistance) in the weeks ahead.

Stop loss level at $1.27. Meanwhile, we advocate a stop-

loss exit around $1.27, which is slightly below the newly

established resistance-turned-support of $1.30.

Note: We currently have a fundamental BUY rating on

Frasers Commercial Trust with $1.45 fair value.

Technical Analysis | Singapore

22 May 2014

CHARTED TERRITORY

Philip Teo, Chief Technical Analyst

+65 6531 9807

philipteo@ocbc-research.com

Source: Bloomberg

OCBC Investment Research

Technical Analysis

Important disclosures

SHAREHOLDING DECLARATION:

The analyst/analysts who wrote this report holds/hold NIL shares in the above security.

DISCLAIMER FOR RESEARCH REPORT

This report is solely for information and general circulation only and may not be published, circulated, reproduced or distri buted in whole or in part to any other person without our written

consent. This report should not be construed as an offer or solicitation for the subscription, purchase or sale of the securities mentioned herein. Whilst we have taken all reasonable care to

ensure that the information contained in this publication is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness, and you should not act on it

without first independently verifying its contents. Any opinion or estimate contained in this report is subject to change without notice. We have not given any consideration to and we have not

made any investigation of the investment objectives, financial situation or particular needs of the recipient or any class of persons, and accordingly, no warranty whatsoever is given and no

liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of the recipient or any class of persons acting on such information or opini on or estimate. You may

wish to seek advice from a financial adviser regarding the suitability of the securities mentioned herein, taking into consideration your investment objectives, financial situation or particular

needs, before making a commitment to invest in the securities. OCBC Investment Research Pte Ltd, OCBC Securities Pte Ltd and their respective connected and associated corporations

together with their respective directors and officers may have or take positions in the securities mentioned in this report and may also perform or seek to perform broking and other

investment or securities related services for the corporations whose securities are mentioned in this report as well as other parties generally.

Privileged / confidential information may be contained in this document. If you are not the addressee indicated in this document (or responsible for delivery of this message to such person),

you may not copy or deliver this message to anyone. Opinions, conclusions and other information in this document that do not relate to the official business of OCBC Investment Research

Pte Ltd, OCBC Securities Pte Ltd and their respective connected and associated corporations shall not be understood as neither given nor endorsed.

RATINGS AND RECOMMENDATIONS:

- OCBC Investment Researchs (OIR) technical comments and recommendations are short-term and trading oriented.

- OIRs fundamental views and ratings (Buy, Hold, Sell) are medium-term calls within a 12-month investment horizon.

- As a guide, OIRs BUY rating indicates a total return in excess of 10% based on the current price; a HOLD rating indicates total returns within +10% and -5%; a SELL rating indicates total

returns less than -5%.

Co.Reg.no.: 198301152E

Carmen Lee

Head of Research

For OCBC Investment Research Pte Ltd

Published by OCBC Investment Research Pte Ltd

You might also like

- Stock Market Investing for Beginners: Investing Tactics, Tools, Lessons, and Proven Strategies to Make Money by Investing & Trading Like Pro in the Stock Market for BeginnersFrom EverandStock Market Investing for Beginners: Investing Tactics, Tools, Lessons, and Proven Strategies to Make Money by Investing & Trading Like Pro in the Stock Market for BeginnersNo ratings yet

- Charted Territory - CDL HTrust - 101206Document2 pagesCharted Territory - CDL HTrust - 101206rementNo ratings yet

- Technical Stock PickDocument3 pagesTechnical Stock PickGauriGanNo ratings yet

- NIFTY trading note highlights consolidation rangeDocument2 pagesNIFTY trading note highlights consolidation rangeSnp PandeyNo ratings yet

- LAOPALA Technical Pick Target 368, 400 3 MonthsDocument3 pagesLAOPALA Technical Pick Target 368, 400 3 MonthsViswanathan SundaresanNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail ResearchumaganNo ratings yet

- Stock To Watch:: Nifty ChartDocument2 pagesStock To Watch:: Nifty ChartSrinivas KaraNo ratings yet

- Technical Stock Idea: Private Client GroupDocument2 pagesTechnical Stock Idea: Private Client GroupumaganNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail ResearchumaganNo ratings yet

- Sign Up For Our Financial Insights NewsletterDocument2 pagesSign Up For Our Financial Insights NewsletterAnonymous 1QrlZi8No ratings yet

- Technical stock picks for JM Financial and Simplex InfraDocument4 pagesTechnical stock picks for JM Financial and Simplex InfraumaganNo ratings yet

- Stock To Watch:: Nifty ChartDocument3 pagesStock To Watch:: Nifty ChartbidyuttezuNo ratings yet

- Retail Research: Technical Stock IdeaDocument2 pagesRetail Research: Technical Stock IdeaumaganNo ratings yet

- Technical Stock Idea: Private Client GroupDocument2 pagesTechnical Stock Idea: Private Client GroupumaganNo ratings yet

- Momentum Pick - CHALETDocument3 pagesMomentum Pick - CHALETSourav PalNo ratings yet

- Weekly Momentum Stock Pick: Rs.555 Rs.617 Rs.480/445 1-2 MonthsDocument2 pagesWeekly Momentum Stock Pick: Rs.555 Rs.617 Rs.480/445 1-2 MonthsGauriGanNo ratings yet

- Technical Stock Idea: Retail ResearchDocument3 pagesTechnical Stock Idea: Retail ResearchumaganNo ratings yet

- Equities: Nifty & DJIA - at Crucial Support LevelsDocument4 pagesEquities: Nifty & DJIA - at Crucial Support LevelsSubodh GuptaNo ratings yet

- Technical Stock Idea: Retail ResearchDocument2 pagesTechnical Stock Idea: Retail ResearchumaganNo ratings yet

- Technical analysis of Hind. Petro suggests sell opportunityDocument3 pagesTechnical analysis of Hind. Petro suggests sell opportunityGauriGanNo ratings yet

- Gold Research ReportDocument3 pagesGold Research ReportshobhaNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail ResearchDinesh ChoudharyNo ratings yet

- Long Term Wave Count in IOCDocument4 pagesLong Term Wave Count in IOCanon_483049492No ratings yet

- India Nippon Electricals trading pickDocument2 pagesIndia Nippon Electricals trading pickumaganNo ratings yet

- Gujarat Gas Technical Pick Targets 655-690Document2 pagesGujarat Gas Technical Pick Targets 655-690Viswanathan SundaresanNo ratings yet

- Retail Research: Indian Currency MarketDocument3 pagesRetail Research: Indian Currency MarketGauriGanNo ratings yet

- Banking & IT Sector WatchDocument4 pagesBanking & IT Sector WatchAnonymous y3hYf50mTNo ratings yet

- Technical Stock Idea: Buy Indigo between 890-915Document2 pagesTechnical Stock Idea: Buy Indigo between 890-915umaganNo ratings yet

- Long Term Technical Stock Pick - Buy PC JEWELLER - 131218Document4 pagesLong Term Technical Stock Pick - Buy PC JEWELLER - 131218VINOD KUMARNo ratings yet

- Technical Stock Idea: Retail ResearchDocument3 pagesTechnical Stock Idea: Retail ResearchAnonymous y3hYf50mTNo ratings yet

- Stock To Watch:: Nifty ChartDocument2 pagesStock To Watch:: Nifty ChartSoundara Moorthy GunasekaranNo ratings yet

- Technical Stock Idea: Retail ResearchDocument2 pagesTechnical Stock Idea: Retail ResearchumaganNo ratings yet

- Diwali Technical Stock Pick: Retail ResearchDocument2 pagesDiwali Technical Stock Pick: Retail ResearchumaganNo ratings yet

- Stock To Watch:: Nifty ChartDocument3 pagesStock To Watch:: Nifty ChartbbaalluuNo ratings yet

- Zztreasury Research - Daily - Global and Asia FX - April 29 2013Document2 pagesZztreasury Research - Daily - Global and Asia FX - April 29 2013r3iherNo ratings yet

- Stock Sentiment IndicatorDocument14 pagesStock Sentiment IndicatorNihit VarshneyNo ratings yet

- Tata Motors technical buy signalDocument2 pagesTata Motors technical buy signalAnonymous y3hYf50mTNo ratings yet

- ICICIBANK technical analysis sell signal below Rs. 267Document2 pagesICICIBANK technical analysis sell signal below Rs. 267GauriGanNo ratings yet

- Technical Stock Pick - BHARATFIN CMP Rs.815 Buy 750-815 Target 905/995Document2 pagesTechnical Stock Pick - BHARATFIN CMP Rs.815 Buy 750-815 Target 905/995umaganNo ratings yet

- NMDC (NSE Cash) : Daily ChartDocument2 pagesNMDC (NSE Cash) : Daily ChartTirthajit SinhaNo ratings yet

- Lunch - : DailyDocument1 pageLunch - : DailyhdfcblgoaNo ratings yet

- Technical Stock Idea: Private Client GroupDocument2 pagesTechnical Stock Idea: Private Client GroupumaganNo ratings yet

- Jammu & Kashmir Bank Technical Stock IdeaDocument2 pagesJammu & Kashmir Bank Technical Stock IdeaumaganNo ratings yet

- Nifty: Technical OutlookDocument2 pagesNifty: Technical OutlookAmit kumarNo ratings yet

- Derivatives Report 5th December 2011Document3 pagesDerivatives Report 5th December 2011Angel BrokingNo ratings yet

- Nifty Technical Analysis and Market RoundupDocument3 pagesNifty Technical Analysis and Market RoundupKavitha RavikumarNo ratings yet

- Stock To Watch:: Nifty ChartDocument3 pagesStock To Watch:: Nifty ChartKavitha RavikumarNo ratings yet

- Technical Stock Idea: Private Client GroupDocument2 pagesTechnical Stock Idea: Private Client GroupumaganNo ratings yet

- Retail Research: Indian Currency MarketDocument3 pagesRetail Research: Indian Currency MarketumaganNo ratings yet

- MTF (BSPL) Stock Pick - TATASTEEL - 17102023Document3 pagesMTF (BSPL) Stock Pick - TATASTEEL - 17102023riddhi SalviNo ratings yet

- Near term trading pick KANSAI NEROLACDocument2 pagesNear term trading pick KANSAI NEROLACkhaniyalalNo ratings yet

- Daily Technical Snapshot: September 03, 2015Document3 pagesDaily Technical Snapshot: September 03, 2015GauriGanNo ratings yet

- HSL PCG "Currency Daily": 14 September, 2016Document5 pagesHSL PCG "Currency Daily": 14 September, 2016shobhaNo ratings yet

- Osk Report Technical Analyzer FBM Klci 20141202 RHB Retail Research IFPW1230980397547d11003035bDocument3 pagesOsk Report Technical Analyzer FBM Klci 20141202 RHB Retail Research IFPW1230980397547d11003035bandrew_yeap_2No ratings yet

- Daily Technical Snapshot: August 25, 2015Document3 pagesDaily Technical Snapshot: August 25, 2015GauriGanNo ratings yet

- Weekly Chart: Technical PicksDocument2 pagesWeekly Chart: Technical PicksGauriGanNo ratings yet

- Retail Research: Technical Stock IdeaDocument2 pagesRetail Research: Technical Stock IdeaumaganNo ratings yet

- Diwali Technical Stock PicksDocument2 pagesDiwali Technical Stock PicksumaganNo ratings yet

- DaburIndia ICICI 130412Document2 pagesDaburIndia ICICI 130412Vipul BhatiaNo ratings yet

- Small Caps: Singapore Small-Cap ConferenceDocument12 pagesSmall Caps: Singapore Small-Cap ConferenceventriaNo ratings yet

- Trading StocksDocument8 pagesTrading StocksventriaNo ratings yet

- Artificial Intelligence Global Ex UsDocument28 pagesArtificial Intelligence Global Ex UsventriaNo ratings yet

- OCBC CSEGlobal11052016Document6 pagesOCBC CSEGlobal11052016ventriaNo ratings yet

- HK Bullish PointsDocument7 pagesHK Bullish PointsventriaNo ratings yet

- Hang Seng Index FuturesDocument3 pagesHang Seng Index FuturesventriaNo ratings yet

- Kim HengDocument4 pagesKim HengventriaNo ratings yet

- CIMB EzraHoldings10072015Document11 pagesCIMB EzraHoldings10072015ventriaNo ratings yet

- Memtech International Not Rated: A Visit To China FactoriesDocument12 pagesMemtech International Not Rated: A Visit To China FactoriesventriaNo ratings yet

- Fund Flow ReportDocument9 pagesFund Flow ReportventriaNo ratings yet

- Insas BerhadDocument3 pagesInsas BerhadventriaNo ratings yet

- Economic Update - Malaysia Inflation Rate April 2014Document3 pagesEconomic Update - Malaysia Inflation Rate April 2014ventriaNo ratings yet

- SPH Reit - Hold: Upholding Its StrengthDocument5 pagesSPH Reit - Hold: Upholding Its StrengthventriaNo ratings yet

- TA FUTURES SDN BHD Daily Commentary - 26 May 2014Document2 pagesTA FUTURES SDN BHD Daily Commentary - 26 May 2014ventriaNo ratings yet

- Market Analysis - 25 May 2014Document1 pageMarket Analysis - 25 May 2014ventriaNo ratings yet

- Trading StocksDocument8 pagesTrading StocksventriaNo ratings yet

- 21 May Technical FocusDocument1 page21 May Technical FocusventriaNo ratings yet

- Economic Update - Malaysia 1q14 BopDocument5 pagesEconomic Update - Malaysia 1q14 BopventriaNo ratings yet

- 21 May Technical FocusDocument1 page21 May Technical FocusventriaNo ratings yet

- 23 May 14 CPO FuturesDocument1 page23 May 14 CPO FuturesventriaNo ratings yet

- SGX MSCI Singapore Index FuturesDocument3 pagesSGX MSCI Singapore Index FuturesventriaNo ratings yet

- 23 May 14 Market OpnionDocument1 page23 May 14 Market OpnionventriaNo ratings yet

- Daily Market Commentary: FBMKLCI Futures: Technical AnalysisDocument1 pageDaily Market Commentary: FBMKLCI Futures: Technical AnalysisventriaNo ratings yet

- 26 May 14 Daily Commentary CPO FuturesDocument1 page26 May 14 Daily Commentary CPO FuturesventriaNo ratings yet

- WilmarDocument3 pagesWilmarventriaNo ratings yet

- RHB Trading IdeasDocument8 pagesRHB Trading IdeasventriaNo ratings yet

- Starhill Global REIT Ending 1Q14 On High NoteDocument6 pagesStarhill Global REIT Ending 1Q14 On High NoteventriaNo ratings yet

- Singapore Container Firm Goodpack Research ReportDocument3 pagesSingapore Container Firm Goodpack Research ReportventriaNo ratings yet

- FINAL Speed Merchant ArticleDocument2 pagesFINAL Speed Merchant ArticleZerohedgeNo ratings yet

- C11 Principles and Practice of InsuranceDocument9 pagesC11 Principles and Practice of InsuranceAnonymous y3E7ia100% (2)

- Death ClaimDocument29 pagesDeath Claimparikshit purohitNo ratings yet

- Chapter 4 Assignment Recording TransactionsDocument6 pagesChapter 4 Assignment Recording TransactionsjepsyutNo ratings yet

- FDPP FormsDocument12 pagesFDPP FormsMay Joy Janapon Torquido-KunsoNo ratings yet

- Subramanian Cibil ReportDocument13 pagesSubramanian Cibil ReportManish KumarNo ratings yet

- Sakthi Fianance Project ReportDocument61 pagesSakthi Fianance Project ReportraveenkumarNo ratings yet

- Default Profile Customer Level Account - FusionDocument1 pageDefault Profile Customer Level Account - FusionhuyhnNo ratings yet

- Denim Jeans Stitching UnitDocument25 pagesDenim Jeans Stitching UnitSaad NaseemNo ratings yet

- Audit EvidenceDocument23 pagesAudit EvidenceAmna MirzaNo ratings yet

- ICICI ProjectDocument55 pagesICICI ProjectRamana GNo ratings yet

- Itr-3 Coi - F.Y 2021-22 - Ayush BhosleDocument6 pagesItr-3 Coi - F.Y 2021-22 - Ayush Bhosledarshil thakkerNo ratings yet

- AAIB Mutual Fund (Shield) : Fact Sheet June 2014Document2 pagesAAIB Mutual Fund (Shield) : Fact Sheet June 2014api-237717884No ratings yet

- Articles of IncorporationDocument4 pagesArticles of IncorporationRuel FernandezNo ratings yet

- IFC Promotes Private Sector Growth in Developing NationsDocument7 pagesIFC Promotes Private Sector Growth in Developing NationsJawad Ali RaiNo ratings yet

- New Income Tax Law 2018.1 NewDocument87 pagesNew Income Tax Law 2018.1 NewDamascene100% (1)

- The Nairobi Stock Exchange (NSE) Sectors ReconfiguredDocument5 pagesThe Nairobi Stock Exchange (NSE) Sectors ReconfiguredPatrick Kiragu Mwangi BA, BSc., MA, ACSINo ratings yet

- Power Notes: BudgetingDocument46 pagesPower Notes: BudgetingfrostyangelNo ratings yet

- Sap Central Finance in Sap S4hanaDocument5 pagesSap Central Finance in Sap S4hanaHoNo ratings yet

- Educational Institution Tax Exemption CaseDocument1 pageEducational Institution Tax Exemption Casenil qawNo ratings yet

- Activities FXDocument5 pagesActivities FXWaqar KhalidNo ratings yet

- BIF Capital StructureDocument13 pagesBIF Capital Structuresagar_funkNo ratings yet

- Practie-Test-For-Econ-121-Final-Exam 1Document1 pagePractie-Test-For-Econ-121-Final-Exam 1mehdi karamiNo ratings yet

- PROFILE FINTECH MENARA JAMSOSTEK - ContohDocument18 pagesPROFILE FINTECH MENARA JAMSOSTEK - ContohRioz GonzalezNo ratings yet

- The Asian Financial Crisis of 1997 1998 Revisited Causes Recovery and The Path Going ForwardDocument10 pagesThe Asian Financial Crisis of 1997 1998 Revisited Causes Recovery and The Path Going Forwardgreenam 14No ratings yet

- Term Plan 65yeras PDFDocument5 pagesTerm Plan 65yeras PDFRohit KhareNo ratings yet

- Consolidated CSOFP of Jasin Bhd GroupDocument4 pagesConsolidated CSOFP of Jasin Bhd GroupNoor ShukirrahNo ratings yet

- Equifax Credit Report - A New Credit Score in IndiaDocument4 pagesEquifax Credit Report - A New Credit Score in IndiaVyas Maharshi GarigipatiNo ratings yet

- LLP Notes As Per DU SyllabusDocument39 pagesLLP Notes As Per DU SyllabusAryan GuptaNo ratings yet

- FCO Swiss Procedure SampleDocument2 pagesFCO Swiss Procedure SamplePeter Huffman70% (10)