Professional Documents

Culture Documents

An Alternative Corporate Governance System: Aswath Damodaran! 47!

Uploaded by

Nikhil GandhiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

An Alternative Corporate Governance System: Aswath Damodaran! 47!

Uploaded by

Nikhil GandhiCopyright:

Available Formats

Aswath Damodaran 47

An Alternative Corporate Governance System

! Germany and Japan developed a different mechanism for corporate

governance, based upon corporate cross holdings.

In Germany, the banks form the core of this system.

In Japan, it is the keiretsus

Other Asian countries have modeled their system after Japan, with family

companies forming the core of the new corporate families

! At their best, the most efcient rms in the group work at bringing the less

efcient rms up to par. They provide a corporate welfare system that makes

for a more stable corporate structure

! At their worst, the least efcient and poorly run rms in the group pull down

the most efcient and best run rms down. The nature of the cross holdings

makes its very difcult for outsiders (including investors in these rms) to

gure out how well or badly the group is doing.

Aswath Damodaran 48

Choose a Different Objective Function

! Firms can always focus on a different objective function. Examples would

include

maximizing earnings

maximizing revenues

maximizing rm size

maximizing market share

maximizing EVA

! The key thing to remember is that these are intermediate objective functions.

To the degree that they are correlated with the long term health and value of the

company, they work well.

To the degree that they do not, the rm can end up with a disaster

Aswath Damodaran 49

Maximize Stock Price, subject to ..

! The strength of the stock price maximization objective function is its internal

self correction mechanism. Excesses on any of the linkages lead, if

unregulated, to counter actions which reduce or eliminate these excesses

! In the context of our discussion,

managers taking advantage of stockholders has led to a much more active market

for corporate control.

stockholders taking advantage of bondholders has led to bondholders protecting

themselves at the time of the issue.

rms revealing incorrect or delayed information to markets has led to markets

becoming more skeptical and punitive

rms creating social costs has led to more regulations, as well as investor and

customer backlashes.

Aswath Damodaran 50

The Stockholder Backlash

! Institutional investors such as Calpers and the Lens Funds have become much

more active in monitoring companies that they invest in and demanding

changes in the way in which business is done

! Individuals like Carl Icahn specialize in taking large positions in companies

which they feel need to change their ways (Blockbuster, Time Warner and

Motorola) and push for change

! At annual meetings, stockholders have taken to expressing their displeasure

with incumbent management by voting against their compensation contracts or

their board of directors

Aswath Damodaran 51

The Hostile Acquisition Threat

! The typical target rm in a hostile takeover has

a return on equity almost 5% lower than its peer group

had a stock that has signicantly under performed the peer group over the previous

2 years

has managers who hold little or no stock in the rm

! In other words, the best defense against a hostile takeover is to run your rm

well and earn good returns for your stockholders

! Conversely, when you do not allow hostile takeovers, this is the rm that you

are most likely protecting (and not a well run or well managed rm)

Aswath Damodaran 52

In response, boards are becoming more independent

! Boards have become smaller over time. The median size of a board of directors has

decreased from 16 to 20 in the 1970s to between 9 and 11 in 1998. The smaller boards

are less unwieldy and more effective than the larger boards.

! There are fewer insiders on the board. In contrast to the 6 or more insiders that many

boards had in the 1970s, only two directors in most boards in 1998 were insiders.

! Directors are increasingly compensated with stock and options in the company, instead

of cash. In 1973, only 4% of directors received compensation in the form of stock or

options, whereas 78% did so in 1998.

! More directors are identied and selected by a nominating committee rather than being

chosen by the CEO of the rm. In 1998, 75% of boards had nominating committees; the

comparable statistic in 1973 was 2%.

Aswath Damodaran 53

Eisners concession: Disneys Board in 2003

Board Members Occupation

Reveta Bowers Head of school for the Center for Early Education,

John Bryson CEO and Chairman of Con Edison

Roy Disney Head of Disney Animation

Michael Eisner CEO of Disney

Judith Estrin CEO of Packet Design (an internet company)

Stanley Gold CEO of Shamrock Holdings

Robert Iger Chief Operating Officer, Disney

Monica Lozano Chief Operation Officer, La Opinion (Spanish newspaper)

George Mitchell Chairman of law firm (Verner, Liipfert, et al.)

Thomas S. Murphy Ex-CEO, Capital Cities ABC

Leo ODonovan Professor of Theology, Georgetown University

Sidney Poitier Actor, Writer and Director

Robert A.M. Stern Senior Partner of Robert A.M. Stern Architects of New York

Andrea L. Van de Kamp Chairman of Sotheby's West Coast

Raymond L. Watson Chairman of Irvine Company (a real estate corporation)

Gary L. Wilson Chairman of the board, Northwest Airlines.

Aswath Damodaran 54

Changes in corporate governance at Disney

! Required at least two executive sessions of the board, without the CEO or

other members of management present, each year.

! Created the position of non-management presiding director, and appointed

Senator George Mitchell to lead those executive sessions and assist in setting

the work agenda of the board.

! Adopted a new and more rigorous denition of director independence.

! Required that a substantial majority of the board be comprised of directors

meeting the new independence standards.

! Provided for a reduction in committee size and the rotation of committee and

chairmanship assignments among independent directors.

! Added new provisions for management succession planning and evaluations of

both management and board performance

! Provided for enhanced continuing education and training for board members.

Aswath Damodaran 55

Eisners exit and a new age dawns? Disneys board in

2008

Aswath Damodaran 56

What about legislation?

! Every corporate scandal creates impetus for a legislative response. The

scandals at Enron and WorldCom laid the groundwork for Sarbanes-Oxley.

! You cannot legislate good corporate governance.

The costs of meeting legal requirements exceed the benets

Laws always have unintended consequences

In general, laws tend to be blunderbusses that penalize good companies more than

they punish the bad companies.

Aswath Damodaran 57

Is there a payoff to better corporate governance?

! In the most comprehensive study of the effect of corporate governance on value, a

governance index was created for each of 1500 rms based upon 24 distinct corporate

governance provisions.

Buying stocks that had the strongest investor protections while simultaneously selling shares

with the weakest protections generated an annual excess return of 8.5%.

Every one point increase in the index towards fewer investor protections decreased market

value by 8.9% in 1999

Firms that scored high in investor protections also had higher prots, higher sales growth and

made fewer acquisitions.

! The link between the composition of the board of directors and rm value is weak.

Smaller boards do tend to be more effective.

! On a purely anecdotal basis, a common theme at problem companies is an ineffective

board that fails to ask tough questions of an imperial CEO.

Aswath Damodaran 58

The Bondholders Defense Against Stockholder Excesses

! More restrictive covenants on investment, nancing and dividend policy have

been incorporated into both private lending agreements and into bond issues,

to prevent future Nabiscos.

! New types of bonds have been created to explicitly protect bondholders

against sudden increases in leverage or other actions that increase lender risk

substantially. Two examples of such bonds

Puttable Bonds, where the bondholder can put the bond back to the rm and get

face value, if the rm takes actions that hurt bondholders

Ratings Sensitive Notes, where the interest rate on the notes adjusts to that

appropriate for the rating of the rm

! More hybrid bonds (with an equity component, usually in the form of a

conversion option or warrant) have been used. This allows bondholders to

become equity investors, if they feel it is in their best interests to do so.

Aswath Damodaran 59

The Financial Market Response

! While analysts are more likely still to issue buy rather than sell

recommendations, the payoff to uncovering negative news about a rm is

large enough that such news is eagerly sought and quickly revealed (at least to

a limited group of investors).

! As investor access to information improves, it is becoming much more

difcult for rms to control when and how information gets out to markets.

! As option trading has become more common, it has become much easier to

trade on bad news. In the process, it is revealed to the rest of the market.

! When rms mislead markets, the punishment is not only quick but it is savage.

Aswath Damodaran 60

The Societal Response

! If rms consistently out societal norms and create large social costs, the

governmental response (especially in a democracy) is for laws and regulations

to be passed against such behavior.

! For rms catering to a more socially conscious clientele, the failure to meet

societal norms (even if it is legal) can lead to loss of business and value.

! Finally, investors may choose not to invest in stocks of rms that they view as

socially irresponsible.

Aswath Damodaran 61

The Counter Reaction

STOCKHOLDERS

Managers of poorly

run rms are put

on notice.

1. More activist

investors

2. Hostile takeovers

BONDHOLDERS

Protect themselves

1. Covenants

2. New Types

FINANCIAL MARKETS

SOCIETY Managers

Firms are

punished

for misleading

markets

Investors and

analysts become

more skeptical

Corporate Good Citizen Constraints

1. More laws

2. Investor/Customer Backlash

Aswath Damodaran 62

So what do you think?

! At this point in time, the following statement best describes where I stand in

terms of the right objective function for decision making in a business

a) Maximize stock price, with no constraints

b) Maximize stock price, with constraints on being a good social citizen.

c) Maximize stockholder wealth, with good citizen constraints, and hope/pray that the

market catches up with you.

d) Maximize prots or protability

e) Maximize earnings growth

f) Maximize market share

g) Maximize revenues

h) Maximize social good

i) None of the above

Aswath Damodaran 63

The Modied Objective Function

! For publicly traded rms in reasonably efcient markets, where bondholders

(lenders) are protected:

Maximize Stock Price: This will also maximize rm value

! For publicly traded rms in inefcient markets, where bondholders are

protected:

Maximize stockholder wealth: This will also maximize rm value, but might not

maximize the stock price

! For publicly traded rms in inefcient markets, where bondholders are not

fully protected

Maximize rm value, though stockholder wealth and stock prices may not be

maximized at the same point.

! For private rms, maximize stockholder wealth (if lenders are protected) or

rm value (if they are not)

Aswath Damodaran 64

The Investment Principle: Risk and Return

Models

You cannot swing upon a rope that is attached only to your

own belt.

Aswath Damodaran 65

First Principles

Aswath Damodaran 66

The notion of a benchmark

! Since nancial resources are nite, there is a hurdle that projects have to cross

before being deemed acceptable.

! This hurdle will be higher for riskier projects than for safer projects.

! A simple representation of the hurdle rate is as follows:

Hurdle rate = Riskless Rate + Risk Premium

! The two basic questions that every risk and return model in nance tries to

answer are:

How do you measure risk?

How do you translate this risk measure into a risk premium?

Aswath Damodaran 67

What is Risk?

! Risk, in traditional terms, is viewed as a negative. Websters dictionary, for

instance, denes risk as exposing to danger or hazard. The Chinese symbols

for risk, reproduced below, give a much better description of risk

! The rst symbol is the symbol for danger, while the second is the symbol

for opportunity, making risk a mix of danger and opportunity. You cannot

have one, without the other.

Aswath Damodaran 68

A good risk and return model should

1. It should come up with a measure of risk that applies to all assets and not be

asset-specic.

2. It should clearly delineate what types of risk are rewarded and what are not, and

provide a rationale for the delineation.

3. It should come up with standardized risk measures, i.e., an investor presented

with a risk measure for an individual asset should be able to draw conclusions

about whether the asset is above-average or below-average risk.

4. It should translate the measure of risk into a rate of return that the investor

should demand as compensation for bearing the risk.

5. It should work well not only at explaining past returns, but also in predicting

future expected returns.

Aswath Damodaran 69

The Capital Asset Pricing Model

! Uses variance of actual returns around an expected return as a measure of risk.

! Species that a portion of variance can be diversied away, and that is only

the non-diversiable portion that is rewarded.

! Measures the non-diversiable risk with beta, which is standardized around

one.

! Translates beta into expected return -

Expected Return = Riskfree rate + Beta * Risk Premium

! Works as well as the next best alternative in most cases.

You might also like

- Applied Corporate Finance: Aswath DamodaranDocument258 pagesApplied Corporate Finance: Aswath DamodaranMus MualimNo ratings yet

- FINANCEDocument258 pagesFINANCESamir KochaiNo ratings yet

- So This Is What Can Go Wrong... : ManagersDocument32 pagesSo This Is What Can Go Wrong... : ManagersAnkit VermaNo ratings yet

- COrporate Finance OutlineDocument130 pagesCOrporate Finance Outlinepun33tNo ratings yet

- So, What Next? When The Cat Is Idle, The Mice Will Play ...Document28 pagesSo, What Next? When The Cat Is Idle, The Mice Will Play ...Nikhil GandhiNo ratings yet

- Corporate Finance Instructor's ManualDocument541 pagesCorporate Finance Instructor's ManualJohn MathiasNo ratings yet

- Stakeholder Approach: Social Responsibility and the Importance of Stakeholder OrientationDocument41 pagesStakeholder Approach: Social Responsibility and the Importance of Stakeholder OrientationAhijit RavichandarNo ratings yet

- Chapter 19 Lecture NotesDocument33 pagesChapter 19 Lecture Notesstacysha13No ratings yet

- The Scope of Corporate Finance: Answers To Concept Review QuestionsDocument4 pagesThe Scope of Corporate Finance: Answers To Concept Review QuestionsHuu DuyNo ratings yet

- International Corporate Governance: Reading: Chapter 1 (Pages 3-21)Document33 pagesInternational Corporate Governance: Reading: Chapter 1 (Pages 3-21)Shakeel ChughtaiNo ratings yet

- Theory, Practice - CG SummaryDocument31 pagesTheory, Practice - CG SummaryMark K. EapenNo ratings yet

- The Dividend Puzzle Around the WorldDocument33 pagesThe Dividend Puzzle Around the WorldAnugrah DilaNo ratings yet

- A Test of Your Social Consciousness: Put Your Money Where You Mouth IsDocument35 pagesA Test of Your Social Consciousness: Put Your Money Where You Mouth IsReza HaryoNo ratings yet

- The Objective of Corporate Finance and Corporate Governance: Ch.2 and CFA Reading (Available in My Office)Document33 pagesThe Objective of Corporate Finance and Corporate Governance: Ch.2 and CFA Reading (Available in My Office)ANSHU_KHESENo ratings yet

- Corporate Governance Issues Around the World (CG IssuesDocument30 pagesCorporate Governance Issues Around the World (CG IssuesMary Shine Magno MartinNo ratings yet

- Maximizing Stockholder Wealth in Corporate FinanceDocument59 pagesMaximizing Stockholder Wealth in Corporate FinanceMargaretta LiangNo ratings yet

- Integrating Ethics into Corporate Culture and PracticesDocument21 pagesIntegrating Ethics into Corporate Culture and PracticesMa. Noelenn TaboyNo ratings yet

- Horizon Kinetics Study of Owner OperatorsDocument18 pagesHorizon Kinetics Study of Owner OperatorsCanadianValueNo ratings yet

- The Objectives in Corporate FinanceDocument33 pagesThe Objectives in Corporate FinanceShelly Jain67% (3)

- Financial Management: Charak RayDocument36 pagesFinancial Management: Charak RayCHARAK RAYNo ratings yet

- Corporate GovernanceDocument31 pagesCorporate GovernanceSnigdha SinghNo ratings yet

- The Theory & Practice of Corporate GovernanceDocument34 pagesThe Theory & Practice of Corporate GovernanceMuhammad ZubairNo ratings yet

- Intro To Corp GovDocument84 pagesIntro To Corp Govarun achariNo ratings yet

- Put Your Money Where Your Mouth Is: Discussing Corporate Social ResponsibilityDocument17 pagesPut Your Money Where Your Mouth Is: Discussing Corporate Social ResponsibilityNancy QuispeNo ratings yet

- Unit2 - BPSM Corporate GovernanceDocument50 pagesUnit2 - BPSM Corporate GovernanceKunal GuptaNo ratings yet

- Bus and Soc Presentation NotesDocument17 pagesBus and Soc Presentation NoteschloedevecseriNo ratings yet

- Finance KeyDocument37 pagesFinance KeyTrần Lan AnhNo ratings yet

- Ba323 - Exam 1 Study GuideDocument1 pageBa323 - Exam 1 Study Guideemily kleitschNo ratings yet

- The Objective in Corporate Finance: Stern School of BusinessDocument54 pagesThe Objective in Corporate Finance: Stern School of BusinessKhattak MusafirNo ratings yet

- Corporate Governance Systems in IndiaDocument18 pagesCorporate Governance Systems in IndiaVincent ClementNo ratings yet

- Introduction to Corporate Governance RisksDocument13 pagesIntroduction to Corporate Governance RisksJonathan KakombohiNo ratings yet

- Becg Corporate Governance:: Notes Complied by Dr. Dhimen Jani Mba, CBS, Pgdibo, PHD MBA Sem. 1Document32 pagesBecg Corporate Governance:: Notes Complied by Dr. Dhimen Jani Mba, CBS, Pgdibo, PHD MBA Sem. 112Twinkal ModiNo ratings yet

- Investment ManagementDocument11 pagesInvestment ManagementkopanoNo ratings yet

- Chapter 7Document45 pagesChapter 7tientran.31211021669No ratings yet

- Financial Management: Chapter 1 The CorporationDocument38 pagesFinancial Management: Chapter 1 The CorporationTaVuKieuNhiNo ratings yet

- Corporate Governance in Japan For PresentationDocument23 pagesCorporate Governance in Japan For Presentationrk_dharmani5305100% (1)

- Investment ManagementDocument15 pagesInvestment ManagementAleksandar PejanovicNo ratings yet

- Summary of Corporate Fraud ArticleDocument3 pagesSummary of Corporate Fraud ArticleKabeer QureshiNo ratings yet

- In Search of Excellence! Are Good Companies Good Investments?Document28 pagesIn Search of Excellence! Are Good Companies Good Investments?Kamalakar ReddyNo ratings yet

- Investment Management Is The Professional Management of VariousDocument9 pagesInvestment Management Is The Professional Management of VariousshanrajuNo ratings yet

- Corporate Governance PresentationDocument146 pagesCorporate Governance PresentationCompliance CRG100% (1)

- CorporategovernanceDocument28 pagesCorporategovernanceRushi VyasNo ratings yet

- Chapter Four OutlineDocument22 pagesChapter Four OutlineNazish MeharNo ratings yet

- AfM 7 - Corporate GovernanceDocument21 pagesAfM 7 - Corporate GovernancejaymursalieNo ratings yet

- Corporate Governance in India Evolution ChallengesDocument6 pagesCorporate Governance in India Evolution ChallengesHitesh ShahNo ratings yet

- Module 1-Financial ManagementDocument4 pagesModule 1-Financial ManagementXienaNo ratings yet

- Chapter 13 - Stockholder Rights and Corporate GovernanceDocument19 pagesChapter 13 - Stockholder Rights and Corporate Governanceapi-328716222No ratings yet

- Group 4Document28 pagesGroup 4Kriti SinghNo ratings yet

- Corporate Governance in India)Document32 pagesCorporate Governance in India)Arnab SardarNo ratings yet

- Solution Manual For Corporate Finance 12th Edition Stephen Ross Randolph Westerfield Jeffrey Jaffe Bradford Jordan 3Document37 pagesSolution Manual For Corporate Finance 12th Edition Stephen Ross Randolph Westerfield Jeffrey Jaffe Bradford Jordan 3athanormimictsf1l100% (12)

- PPTs On Chapters 5-8 of CGDocument42 pagesPPTs On Chapters 5-8 of CGnikhilsharma5No ratings yet

- Chapter 4 NotesDocument7 pagesChapter 4 NotesMax PossekNo ratings yet

- Maximizing Firm Value and Shareholder Wealth in Corporate FinanceDocument59 pagesMaximizing Firm Value and Shareholder Wealth in Corporate FinanceSania AliNo ratings yet

- Introduction To Managerial FinanceDocument4 pagesIntroduction To Managerial FinanceAkpknuako1No ratings yet

- Corporate Governance Issues and RemediesDocument29 pagesCorporate Governance Issues and RemediesHarPearl Lie100% (3)

- Fianacial MarketsDocument53 pagesFianacial MarketsMostafa ElgendyNo ratings yet

- Getting Bigger by Growing Smaller (Review and Analysis of Shulman's Book)From EverandGetting Bigger by Growing Smaller (Review and Analysis of Shulman's Book)No ratings yet

- Private Equity: Transforming Public Stock to Create ValueFrom EverandPrivate Equity: Transforming Public Stock to Create ValueNo ratings yet

- Managing for the Long Run (Review and Analysis of Miller and Le-Breton-Miller's Book)From EverandManaging for the Long Run (Review and Analysis of Miller and Le-Breton-Miller's Book)No ratings yet

- Governance, Risk Management, and Compliance: It Can't Happen to Us--Avoiding Corporate Disaster While Driving SuccessFrom EverandGovernance, Risk Management, and Compliance: It Can't Happen to Us--Avoiding Corporate Disaster While Driving SuccessRating: 4 out of 5 stars4/5 (1)

- 5 2 199-211Document13 pages5 2 199-211Nikhil GandhiNo ratings yet

- Afs PDFDocument86 pagesAfs PDFms.AhmedNo ratings yet

- Session 13Document28 pagesSession 13Nikhil GandhiNo ratings yet

- 437 Handout 7Document60 pages437 Handout 7Nikhil GandhiNo ratings yet

- Spreadsheet Modelling For Solving Combinatorial Problems: The Vendor Selection ProblemDocument13 pagesSpreadsheet Modelling For Solving Combinatorial Problems: The Vendor Selection ProblemNikhil GandhiNo ratings yet

- Spreadsheet Modelling For Solving Combinatorial Problems: The Vendor Selection ProblemDocument13 pagesSpreadsheet Modelling For Solving Combinatorial Problems: The Vendor Selection ProblemNikhil GandhiNo ratings yet

- 01 Kros Ch01Document28 pages01 Kros Ch01Nikhil Gandhi0% (1)

- Session 7Document20 pagesSession 7Nikhil GandhiNo ratings yet

- Session 9Document17 pagesSession 9Nikhil GandhiNo ratings yet

- Session 11Document23 pagesSession 11Nikhil GandhiNo ratings yet

- Session 8Document23 pagesSession 8Nikhil GandhiNo ratings yet

- Session 6Document28 pagesSession 6Nikhil GandhiNo ratings yet

- Other Assumptions: Each YearDocument22 pagesOther Assumptions: Each YearNikhil GandhiNo ratings yet

- Session 10Document10 pagesSession 10Nikhil GandhiNo ratings yet

- Session 5Document17 pagesSession 5Nikhil GandhiNo ratings yet

- A Primer On Spreadsheet AnalyticsDocument12 pagesA Primer On Spreadsheet Analyticsmasarriam1986No ratings yet

- The Cost of Capital: OutlineDocument10 pagesThe Cost of Capital: OutlineNikhil GandhiNo ratings yet

- Session 2Document18 pagesSession 2Nikhil GandhiNo ratings yet

- Finance Notes From DamodharamDocument2 pagesFinance Notes From DamodharamNikhil GandhiNo ratings yet

- Session 17Document17 pagesSession 17Nikhil GandhiNo ratings yet

- Finance Notes From DamodharamDocument2 pagesFinance Notes From DamodharamNikhil GandhiNo ratings yet

- Other Assumptions: Each YearDocument22 pagesOther Assumptions: Each YearNikhil GandhiNo ratings yet

- Hurdlerate ChapterDocument109 pagesHurdlerate ChapterNikhil GandhiNo ratings yet

- Session 14Document39 pagesSession 14Nikhil GandhiNo ratings yet

- Finance Solved CasesDocument79 pagesFinance Solved Cases07413201980% (5)

- MultiplesDocument13 pagesMultiplesNikhil GandhiNo ratings yet

- What Is Free Cash Flow and How Do I Calculate It?: A Summary Provided by Pamela Peterson Drake, James Madison UniversityDocument8 pagesWhat Is Free Cash Flow and How Do I Calculate It?: A Summary Provided by Pamela Peterson Drake, James Madison UniversityNikhil GandhiNo ratings yet

- Oromia Insurance Monthly Bordereau ReportDocument1 pageOromia Insurance Monthly Bordereau Reportlight of moonNo ratings yet

- Arabic Training Courses Catalogue 2018Document16 pagesArabic Training Courses Catalogue 2018السماني احمدNo ratings yet

- SBR 2019 Revision Kit PDFDocument513 pagesSBR 2019 Revision Kit PDFAftab ShaniNo ratings yet

- Sustainability and Responsibilty Report 2015 Final Issue 1Document44 pagesSustainability and Responsibilty Report 2015 Final Issue 1DiaszNo ratings yet

- Uk Listing RegimeDocument7 pagesUk Listing RegimeNicholas EeNo ratings yet

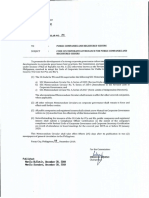

- SEC MC No. 24, Series of 2019 PDFDocument39 pagesSEC MC No. 24, Series of 2019 PDFJoanness BatimanaNo ratings yet

- Pantaloons Retail: India's Premium Lifestyle Apparel CompanyDocument36 pagesPantaloons Retail: India's Premium Lifestyle Apparel CompanyPragnya NandaNo ratings yet

- Syllabus - Investment Banking Harvard Fall 2014 Posting1Document8 pagesSyllabus - Investment Banking Harvard Fall 2014 Posting1Aman MachraNo ratings yet

- Business Administration Project Topics and MaterialsDocument47 pagesBusiness Administration Project Topics and MaterialsProject Championz100% (1)

- Annual Report 2014Document80 pagesAnnual Report 2014khongaybytNo ratings yet

- Danaharta Annual Report 2000Document136 pagesDanaharta Annual Report 2000az1972100% (2)

- A Corporate Governance Assessment of Ukraine's State-Owned Aviation SectorDocument79 pagesA Corporate Governance Assessment of Ukraine's State-Owned Aviation SectorOECD Global RelationsNo ratings yet

- AcademicCalendar 2018Document149 pagesAcademicCalendar 2018Khandaker Amir EntezamNo ratings yet

- Sebi-Code of Corporate Governance PDFDocument21 pagesSebi-Code of Corporate Governance PDFDimple NathNo ratings yet

- Tata Motors - Corporate Governance PolicyDocument6 pagesTata Motors - Corporate Governance PolicyAnthony D'souza100% (1)

- Basel Norms - Presentation TranscriptDocument5 pagesBasel Norms - Presentation TranscriptTanya SharmaNo ratings yet

- MJ Hudson Fund Guide 1Document55 pagesMJ Hudson Fund Guide 1sukitraderNo ratings yet

- Bip 2154-2008Document50 pagesBip 2154-2008ali rabieeNo ratings yet

- Corporate Governance Failures in Bangladesh - A Study of Hall Mark and Basic BankDocument16 pagesCorporate Governance Failures in Bangladesh - A Study of Hall Mark and Basic BankMd Miraj AhmedNo ratings yet

- Chapter 8Document6 pagesChapter 8syopiNo ratings yet

- Australian Financial Reporting Manual June 2014Document192 pagesAustralian Financial Reporting Manual June 2014pnrahmanNo ratings yet

- 2020 Ifs InsuranceDocument262 pages2020 Ifs InsuranceSensi CTPrima100% (1)

- Annual Report-2017 PDFDocument223 pagesAnnual Report-2017 PDFTHIND TAXLAWNo ratings yet

- Tiffany Case Exchange Rate Risk ManagementDocument1 pageTiffany Case Exchange Rate Risk Managementsaurabhkalra4uNo ratings yet

- AA MJ23 Examiner's Report - FinalDocument25 pagesAA MJ23 Examiner's Report - FinalSoykat HossainNo ratings yet

- The Effect of Tax Planning, Profitability and Company Growth On Firm Value With CorporateGovernance Quality As A Moderating Variable Study in Manufacturing Companies Listed On CSE 2017-2021Document8 pagesThe Effect of Tax Planning, Profitability and Company Growth On Firm Value With CorporateGovernance Quality As A Moderating Variable Study in Manufacturing Companies Listed On CSE 2017-2021International Journal of Innovative Science and Research TechnologyNo ratings yet

- Marvel in WritingDocument22 pagesMarvel in WritingIing Suratman NatakusumahNo ratings yet

- Reflection On Corporate Governance and The Role of The Internal Auditor PDFDocument66 pagesReflection On Corporate Governance and The Role of The Internal Auditor PDFVerenizeIrisVCNo ratings yet

- International Harmonization of Financial ReportingDocument38 pagesInternational Harmonization of Financial ReportingCoffee JellyNo ratings yet

- CDO StructureDocument2 pagesCDO StructuretvlodekNo ratings yet