Professional Documents

Culture Documents

Testimony - Terry Dorman

Uploaded by

Philip Tortora0 ratings0% found this document useful (0 votes)

333 views16 pagesTestimony by Terry Dorman, a principal at Dorman & Fawcett, the firm that has been advising Burlington on the operations of BT since 2010

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTestimony by Terry Dorman, a principal at Dorman & Fawcett, the firm that has been advising Burlington on the operations of BT since 2010

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

333 views16 pagesTestimony - Terry Dorman

Uploaded by

Philip TortoraTestimony by Terry Dorman, a principal at Dorman & Fawcett, the firm that has been advising Burlington on the operations of BT since 2010

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 16

STATE OF VERMONT

PUBLIC SERVICE BOARD

Petition of City of Burlington d/b/a Burlington

Telecom, for a certificate of public good to

operate a cable television system in the City of

Burlington, Vermont

)

)

)

)

Docket No. 7044

PREFILED TESTIMONY

OF TERRY DORMAN

ON BEHALF OF THE CITY OF BURLINGTON

March 28, 2014

Mr. Terry Dorman is a principal of Dorman & Fawcett, the firm serving as advisor to the

City of Burlington and manager of the Citys Burlington Telecom system. His testimony

discusses the solicitation of proposals for the financing of Burlington Telecom, the terms of the

proposal from the bridge financing lessor, the steps to implement and close on the financing, and

that such financing is reasonable in light Burlington Telecoms financial history and the related

legal proceedings. In addition, Mr. Dorman will discuss the potential for a return to the City for

its prior expenditures upon the intended sale of the Burlington Telecom system.

TABLE OF CONTENTS

1. Introduction And Background ............................................................................................. 1

2. The Citibank Settlement ....................................................................................................... 4

3. The Bridge Lease Financing ................................................................................................. 8

4. Planned Sale of Burlington Telecom .................................................................................. 11

EXHIBITS

Exhibit Petitioner TD-1 Commitment Letter from Raymond C. Pecor, III

STATE OF VERMONT

PUBLIC SERVICE BOARD

Petition of City of Burlington d/b/a Burlington

Telecom, for a certificate of public good to

operate a cable television system in the City of

Burlington, Vermont

)

)

)

)

Docket No. 7044

PREFILED TESTIMONY

OF TERRY DORMAN

ON BEHALF OF THE CITY OF BURLINGTON

1. Introduction And Background 1

Q1. Please state your name and occupation. 2

A1. My name is Terry Dorman. I am the principal of Dorman & Fawcett (D&F). D&F is a 3

consulting, financial advisory, and turnaround firm located in Quechee, Vermont. Over 4

the past 27 years, D&F has represented private and public companies in the construction, 5

entertainment, hospitality, food products, printing, communications, manufacturing and 6

technology industries. All members of D&Fs senior team have been founders or key 7

executives at growth companies and all have extensive experience in crisis management. 8

Prior to founding D&F in 1987, I was the co-founder and President of a venture capital 9

backed technology company. In addition to our work assisting the City of Burlington, we 10

have worked on other telecom engagements, including Shared Technologies, a public 11

company that was ultimately acquired by Intermedia in 1997. Our scope included a 12

comprehensive operational and financial restructuring involving a secondary public 13

offering followed by a merger with Fairchild Telecommunications. We have also 14

represented bondholders in a failed municipal cable system in the midwest. 15

16

Q2. Please explain how D&F became involved with Burlington Telecom. 17

Docket No. 7044

Prefiled Testimony of Terry Dorman

March 28, 2014

Page 2 of 14

A2. In 2009, the Burlington City Council created the Blue Ribbon Committee (BRC), 1

comprised of City Councilors and business leaders to identify all viable options to 2

address Burlington Telecoms (BT) financial situation. The committee was 3

specifically charged with assessing all available options for the financial structure of BT 4

including but not limited to: a. Piper Jaffrey financing offer, b. other possible financing 5

options, c. joint venture of equity sale, d. outright sale of BT, and e. other options 6

recommended by consultants. The Resolution Creating the Blue Ribbon Committee is 7

attached as an exhibit to Mr. Barracloughs testimony. 8

9

In its 2010 report, the BRC recommended that the City retain an expert financial advisor 10

to stabilize BTs finances and develop short and long-term strategies for bringing about a 11

suitable strategic and financial partner for BT. Following that recommendation, the City 12

engaged D&F as its financial advisor in March 2010. In September 2010, D&Fs role 13

expanded to include an operational aspect as General Manager overseeing the day-to-day 14

management of BT. Since that time, Stephen Barraclough, senior D&F executive, has 15

acted as interim General Manager of BT. 16

17

Q3. Please provide a description of your work in connection with BT. 18

Q3. Since March 2010, I have served as the financial advisor to the City on matters 19

concerning BT. In that capacity, I work closely with the Burlington Telecom Advisory 20

Board (BTAB), the Mayor, and other City officials on a regular basis. One of my 21

principal objectives over the past four years has been to identify and secure a financial 22

Docket No. 7044

Prefiled Testimony of Terry Dorman

March 28, 2014

Page 3 of 14

partner for BT. The scope of my work has included key participation in the weekly BT 1

status and restructuring meetings, regular review of BTs operating plan as it relates to 2

obtaining new financial partners or financing, leading restructuring discussions with 3

Citibank, support and participation in the Citibank lawsuit, discussions with Moodys 4

about the impact of BT on Burlingtons bond rating, participation in City Council 5

meetings involving BT, and seeking financial partners and possible buyers of the 6

enterprise, 7

8

Q4. What is the purpose of your testimony? 9

A4. My testimony describes the steps D&F undertook to seek financing for BT in order to 10

settle the Citibank litigation and to take the actions needed to effectuate the settlement 11

(Citibank Settlement or Settlement). The Citibank Settlement provides that the City 12

will obtain financing from a special purpose municipal lender to finance at least $6 13

million of the $9,031,085 payment due from the City to Citibank under the settlement. 14

15

I will also discuss the proposed terms of the proposed bridge lease financing between the 16

City and Raymond C. Pecor, III (Lessor or Pecor) (the Bridge Lease Financing or 17

Lease) and the steps needed to implement that financing. I will also offer my 18

understanding as to why the terms and conditions of the Lease are reasonable in light of 19

the current market situation, BTs unique status as a municipal telecommunication system 20

operating under a Certificate of Public Good (CPG), and the pending Citibank 21

litigation (the Citibank Action). 22

Docket No. 7044

Prefiled Testimony of Terry Dorman

March 28, 2014

Page 4 of 14

1

2. The Citibank Settlement 2

Q5. Are there deadlines or milestones required to effectuate the Citibank Settlement that this 3

Board should be made aware of? 4

A5. Yes. The Citibank Settlement, Section 3, speaks to the stay of the federal court 5

proceedings in the Citibank Action. The parties must report back to the court in July, 6

2014, and the agreement contemplates that BT will seek interim financing and PSB 7

approval during this period. Pursuant to Sections 4.5 and 5.5 of the Citibank Settlement, 8

the City must obtain Board approval of the Settlement and the Bridge Lease Financing. 9

Under Section 7, the financing must then close not less than five business days after 10

PSB approval becomes final (the Closing). Under section 5.5, the City is also required 11

to request that the Board provide expedited treatment of the Petition. 12

13

Q6. What were the Citys options for sources to fund the bridge financing necessary to 14

implement the Citibank Settlement? 15

A6. D&F, on behalf of the City, solicited proposals for financing, and over the past week, the 16

City obtained commitment letters from two lenders willing to provide the $6 million in 17

cash financing to the City under a sale-leaseback arrangement. On Monday, March 24, 18

2014, the Burlington City Council convened a special meeting to consider both financing 19

proposals. On March 26, 2014, the City Council reconvened the special meeting and 20

approved the terms of the Bridge Lease Financing with Pecor. 21

22

Docket No. 7044

Prefiled Testimony of Terry Dorman

March 28, 2014

Page 5 of 14

I should note that the City received other proposals, both written and verbal, for bridge 1

financing that did not result in commitment letters. The terms of these other transactions 2

were less favorable than the terms the City received from the two funding sources who 3

provided commitment letters. For example, other than the proposals that resulted in 4

commitment letters, the next best proposal contemplated a 12% interest rate and a 5

maximum of 20% excess cash proceeds to the City upon a sale of the system. 6

7

Efforts to obtain the bridge financing were constrained by the pending Citibank Action 8

and certain limitations in the City Charter on financing options. For these reasons, most 9

customary financing options were not available to the City. Moreover, conventional 10

municipal financing would have required changes in state law and/or voter approval as 11

well as a significant extension of time from Citibank. The financing that was available is 12

a non-recourse financing to the City. This risk to the lender was the basis for the 13

structural terms for the extension of credit. 14

15

Q7. What are the basic terms of the Citibank Settlement? 16

A7. The Citibank Settlement requires a $10.5 million settlement payment to Citibank. 17

$1,468,915 of the $10.5 million has been paid by McNeil, Leddy & Sheahan, 18

Burlingtons co-defendant in the Citibank Action, and/or its insurance carrier. 19

Burlingtons $9,031,085 share of the settlement payment consists of (i) a minimum 20

amount of $6 million at the closing of the Bridge Lease Financing; (ii) $1.3 million which 21

may be in the form of a participation by Burlington in the bridge financing (bringing the 22

Docket No. 7044

Prefiled Testimony of Terry Dorman

March 28, 2014

Page 6 of 14

total financing to $7.3 million); (iii) $260,235.07 currently held by Citibanks counsel; 1

(iv) approximately $720,850 currently held in escrow by the court in the Citibank Action 2

to be released at Closing; (v) insurance proceeds of $500,000 to be released at Closing; 3

and (vi) commencing as of the date of the Citibank Settlement, ongoing monthly 4

payments of the greater of a) the amount set forth in the March 27, 2012 Joint Stipulation 5

and Order (i.e., 60% of BT net cash flow) or b) $50,000 per month from BT net revenues 6

up $250,000.

1

7

8

At the closing of the bridge financing and payment of the balance of the settlement 9

payment, the Citibank Action will be dismissed with prejudice and Citibank and 10

Burlington are to exchange mutual general releases. 11

12

The Citibank Settlement also contemplates an eventual sale of the system to a private 13

entity. At the time of the sale, Burlington will share 50% of Burlingtons share of the net 14

proceeds of the sale with Citibank. Upon payment or conveyance by Burlington of that 15

50% share to Citibank, all of Burlingtons obligations to Citibank shall be deemed 16

complete and final. 17

18

Q8. Please explain item (vi), above the monthly payments to Citibank. 19

A8. These represent payment for BTs ongoing use of the Citibank leased equipment, title to 20

which is held by Citibank. These payments to Citibank will terminate at the Closing of 21

1

In addition to the settlement payment, Burlington will continue to make monthly payments to Citibank in the

amount of 60% of BT net cash flow after payment of the $250,000 in (vi) until the Closing.

Docket No. 7044

Prefiled Testimony of Terry Dorman

March 28, 2014

Page 7 of 14

the financing, which is, under Section 7 of the Settlement, required to occur not less than 1

five (5) business days after the Public Service Boards approval of the Petition. 2

3

Q9. Please explain BTs potential $1.3 million participation in the Bridge Lease Financing. 4

A9. The Citibank Settlement provides that Burlington may participate up to $1.3 million in 5

the financing to increase the financing amount to $7.3 million. To the extent Burlington 6

does not participate in the financing, it will pay Citibank $1.3 million at the Closing. 7

8

In my discussions with potential special situation lenders/bridge financers prior to the 9

Citibank Settlement, I had been told by lenders that they would not increase the bridge 10

financing above $6 million. These lenders would allow Burlington to purchase a last- 11

out participation in the bridge facility. This structure is often utilized to allow a junior 12

creditor to obtain the benefit of a senior lenders position or collateral. 13

14

It has not yet been determined whether the $1.3 million will be in the form of a 15

participation or whether it will be a direct payment from Burlington. I will supplement 16

my testimony once that decision is made. 17

18

Q10. Does the Citibank Settlement give Citibank the right to approve the terms of the Bridge 19

Lease Financing or the planned sale of BT? 20

A10. No. Citibank also does not have the ability under the settlement to direct the sale of BT. 21

22

Docket No. 7044

Prefiled Testimony of Terry Dorman

March 28, 2014

Page 8 of 14

3. The Bridge Lease Financing 1

Q11. What is the basic structure of the Bridge Lease Financing? 2

A11. The Bridge Lease Financing is a sale-leaseback transaction for a term of five (5) years 3

whereby all components of the BT system (other than the land and building located at 4

200 Church Street) will be sold and conveyed by the City and Citibank to a special 5

purpose entity (SPE) formed and owned by Raymond C. Pecor, III. The SPE/Pecor 6

will simultaneously advance the City $6 million for funding the Citibank Settlement and 7

lease the BT system back to the City. 8

9

The SPE will obtain financing from Merchants Bank that will involve conveyance of a 10

security interest in certain BT assets owned by the SPE/Pecor under the Bridge Lease 11

Financing. BT will continue to operate BT during the 5 year term of the Bridge Lease 12

Financing. During that time, it is expected that D&F will continue to provide services as 13

general manager and financial advisor of BT, unless otherwise agreed by Lessor and the 14

City. 15

16

The principal terms are as follows: 17

Burlington and Citibank, both of which have interests in the BT equipment, will 18

convey the system assets to Pecor at the Closing. Included in the system assets 19

will be billing records, inventory, accounts receivable and contract rights, to the 20

extent assignable. 21

Docket No. 7044

Prefiled Testimony of Terry Dorman

March 28, 2014

Page 9 of 14

A special purpose entity will be established and Raymond C. Pecor, III as the 1

managing member, will provide a $6 million bridge loan to the City, which, with 2

other funds described in A7, will be used to make the $9,031,085 settlement 3

payment to Citibank at the Closing. 4

Pecor will obtain financing for the funding of the $6 million bridge transaction 5

from Merchants Bank (the bank financing). 6

The interest rate will be 7% per year. 7

The Lease will have a maximum five (5) year term, with equal monthly Lease 8

payments (principal and interest) of $46,544.33, based upon a twenty-year 9

amortization. Lease payments during each year of the term will be subject to 10

annual appropriation by the City, and Lease payments will be due and payable 11

monthly on or before the 15

th

day of each month. Lease payments shall be made 12

solely from BT revenues, the Lease obligations shall not constitute an 13

indebtedness of the City, and the City will not be required to use any general fund 14

monies or tax revenues to make any such payments. 15

The City will continue to manage and operate BT. 16

At the time of Closing, two BT accounts will be established at Merchants Bank. 17

The first account is a lock box and trust account (the Trust Account). All 18

revenues from the Citys operations of BT during the 5 year lease will be directly 19

deposited in the Trust Account. The second account is a segregated BT operating 20

account (the Operating Account). At the time of Closing, $500,000 from BTs 21

prior operations will be deposited in the Operating Account. 22

Docket No. 7044

Prefiled Testimony of Terry Dorman

March 28, 2014

Page 10 of 14

Each month, the City will submit BTs prior period income statement to the 1

Lessor who will direct Merchants Bank to transfer the operating expenses, 2

including capital expenditures in the ordinary course, to the Operating Account. 3

All operating expenses will be paid directly from the Operating Account. As 4

discussed in Mr. Rustens testimony, this is a change from the current way in 5

which the City pays BTs operating expenses. 6

As a fundamental term in the Bridge Lease Financing, Burlington has agreed to 7

sell BT during the four years following the closing of the Citibank settlement. It 8

is our current view that BT will require at least 30 months of further operations to 9

optimally position the enterprise for sale. 10

11

Q12. What are the Pecor Lease requirements concerning the eventual sale of the BT system? 12

A12. As discussed above, Burlington has four years from the commencement of the Bridge 13

Lease Financing to direct a sale of BT to a purchaser of the Citys choosing, subject to 14

Pecors consent. In the event the City has not entered into an agreement for the sale of 15

BT within that time, Pecor has the right to direct a sale of BT. The bridge financing 16

envisions that the parties will cooperate in conducting any such sale of the system and, if 17

applicable, the sale or lease of 200 Church Street. 18

19

Q13. What would happen if the City chose to not appropriate funds to make the Lease 20

payment? 21

Docket No. 7044

Prefiled Testimony of Terry Dorman

March 28, 2014

Page 11 of 14

A13. Under the terms of the Lease, failure to make an annual appropriation will be considered 1

an event of default. Upon any event of default, Pecor has the right to (a) terminate the 2

Lease; (b) use and operate BT; (c) purchase 200 Church Street for $100; (d) direct a sale 3

of BT; and (d) upon sale, retain all Net Sale Proceeds, except for 10% payable to D&F. 4

5

Q14. Will BT need to use Burlington funds to make the monthly payments under the 6

financing? 7

A14. No. The terms of the financing are such that monthly payments are to be made solely 8

from BT revenues. The financial projections prepared by Mr. Barraclough, 9

CONFIDENTIAL Exhibit Petitioner SB-5, establish that BT will be in a position to meet 10

its payment obligations and maintain a positive cash flow position. 11

12

4. Planned Sale of Burlington Telecom 13

Q15. Please explain the term in the Citibank settlement that contemplates a future sale of BT. 14

A15. The settlement agreement is based on the assumption that the financing from Pecor is a 15

bridge to an arms-length sale of BT to a private entity. 16

17

Q16. What are the terms of the sale Burlington is required to pursue under the settlement and 18

lease financing? 19

A16. The terms of a future sale to a third party are not yet defined. The financing entered into 20

here provides Burlington an opportunity to find the best entity that will allow BT to 21

operate in the future, although under different ownership. There are, however, some 22

Docket No. 7044

Prefiled Testimony of Terry Dorman

March 28, 2014

Page 12 of 14

provisions in the financing agreement that pertain to the future sale. In particular, if 1

Burlington sells the system within the three years from the commencement of the lease 2

term, Burlington will receive 50% of the net proceeds. If Burlington takes longer to sell 3

the system, Burlington receives a smaller percentage of the net sale proceeds. 4

5

Q17. What percentage of Burlingtons net sale proceeds is Burlington required to pay to 6

Citibank? 7

A17. Burlington must pay Citibank 50% of its share of the net sale proceeds. 8

9

Q18. How is net sale proceeds defined by the financing? 10

A18. The net proceeds include all amounts held in the Trust Account and in any BT operating, 11

capital, reserve or other deposit accounts, plus the gross proceeds of a sale, less (i) any 12

remaining unpaid balance of the financing principal amount; (ii) accrued and unpaid 13

interest; (iii) accrued and unpaid fees of D&F (together with an interest at the rate of 7% 14

per annum); (iv) any transfer taxes; (v) any expenses reasonably incurred by Pecor or the 15

City in connection with the sale; and (vi) the $500,000 closing working capital deposit 16

(which will be returned to the City of Burlington before the excess proceeds calculation). 17

18

Q19. Can you explain the $500,000 closing working capital deposit? 19

A19. The terms of the bridge financing require a segregated BT operating account (defined 20

above as the Operating Account) to be funded at Closing with prior BT retained 21

earnings in order to pay operating expenses that are due in the days and weeks following 22

Docket No. 7044

Prefiled Testimony of Terry Dorman

March 28, 2014

Page 13 of 14

the Closing, but before the next months receipts are collected. This requirement was 1

essential to obtaining a bridge financing and was a condition of both commitment letters, 2

as well as other terms and conditions offered by other financing sources. 3

4

Q20. If BT is sold before the end of the five-year term of the lease, how is the remaining 5

unpaid principal balance accounted for in the net proceeds? 6

A20. As discussed above, the lease contemplates that Burlingtons share from the sale of BT 7

(net proceeds) will be less any remaining unpaid balance of the financing lease principal 8

amount. 9

10

Q21. What is the expected recovery to the City on a sale of the BT System? 11

A21. That is difficult to estimate. It is the goal of Burlington to find the right entity to acquire 12

the system, to continue to provide service to the City and its residents, to continue 13

partnering with US Ignite as an economic development tool, and to provide an 14

opportunity of a return of Burlingtons investment in BT upon a sale. The Lessor too has 15

a strong economic interest in realizing the highest value of BT. Upon closing of the 16

financing, D&F will continue to work to increase the value of BT as a going concern, by 17

increasing revenue growth, and to increase subscriber counts. To the extent that BT is 18

sold at a level above the outstanding amount of the financing and related expenses, 19

Burlington will share in that. 20

21

Q22. What would be the expected recovery to the City if the CPG were revoked? 22

Docket No. 7044

Prefiled Testimony of Terry Dorman

March 28, 2014

Page 14 of 14

A22. First, there would be no settlement with Citibank, and the risk of litigation liability would 1

remain. But, second, in my estimation, a sale of assets that is not part of a going concern 2

would be significantly less than for an operating enterprise. If the Certificate of Public 3

Good were revoked such that subscribers were then forced to move to other service 4

providers, the ability to sell the assets would be difficult and the sales proceeds likely to 5

be significantly less than a sale of a going concern. 6

You might also like

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- The Independent Filmmaker's Law and Business Guide: Financing, Shooting, and Distributing Independent Films and SeriesFrom EverandThe Independent Filmmaker's Law and Business Guide: Financing, Shooting, and Distributing Independent Films and SeriesNo ratings yet

- San Bernardino Recovery Plan For Plan of AdjustmentDocument79 pagesSan Bernardino Recovery Plan For Plan of AdjustmentSan Gabriel ValleyNo ratings yet

- Accounting Concepts and ConventionsDocument22 pagesAccounting Concepts and ConventionsMishal SiddiqueNo ratings yet

- Demolition Procurement Process ReportDocument36 pagesDemolition Procurement Process ReportClickon DetroitNo ratings yet

- Roy Brady's AffidavitDocument295 pagesRoy Brady's AffidavitPeterborough ExaminerNo ratings yet

- Financial AccountingDocument135 pagesFinancial AccountingAkshita Jain100% (1)

- MAMBA Vs LARADocument2 pagesMAMBA Vs LARATherese MamaoagNo ratings yet

- Morrow Park Transfer AgreementDocument11 pagesMorrow Park Transfer Agreementnewsroom7857No ratings yet

- !P7 Audit and Assurance Summary - 1 - 20 PagesDocument20 pages!P7 Audit and Assurance Summary - 1 - 20 Pagesckomaromi776No ratings yet

- Audit Report On Financial StatementsDocument37 pagesAudit Report On Financial StatementsPeter BanjaoNo ratings yet

- Management AccountingDocument159 pagesManagement AccountingAl Mahmun100% (1)

- Pas 1 - Presentation of Financial StatementsDocument30 pagesPas 1 - Presentation of Financial StatementsLee Anne Gallema Camarao100% (3)

- Tatad v. Garcia DigestDocument2 pagesTatad v. Garcia DigestBinkee VillaramaNo ratings yet

- Trash RFP MemoDocument8 pagesTrash RFP MemoAnthony WarrenNo ratings yet

- City Council Agenda For 8-15-16Document60 pagesCity Council Agenda For 8-15-16NicoleNo ratings yet

- 07-02-12 Moran Open Letter - FinalDocument3 pages07-02-12 Moran Open Letter - FinalTom BrownNo ratings yet

- Bloomington, Ind. Memo 11.23.22 - Options For Convention Center ExpansionDocument11 pagesBloomington, Ind. Memo 11.23.22 - Options For Convention Center ExpansionHolden AbshierNo ratings yet

- City Council Special Meeting Packet 11-15-12 OCR DocumentDocument144 pagesCity Council Special Meeting Packet 11-15-12 OCR DocumentL. A. PatersonNo ratings yet

- Citibank Sues Over Burlington Telecom AssetsDocument38 pagesCitibank Sues Over Burlington Telecom AssetsBurlington FreePressNo ratings yet

- DOA Board Meeting February 17, 2009 MinutesDocument16 pagesDOA Board Meeting February 17, 2009 MinutesOaklandCBDsNo ratings yet

- CAO Report Responsible Banking OrdinanceDocument41 pagesCAO Report Responsible Banking OrdinanceBill RosendahlNo ratings yet

- Affidavit PopescuDocument7 pagesAffidavit PopescuTorVikNo ratings yet

- Special City Council Meeting - September 9, 2020Document38 pagesSpecial City Council Meeting - September 9, 2020The Talk of TitusvilleNo ratings yet

- Subsidizing The Low Road - Economic Development of BaltimoreDocument67 pagesSubsidizing The Low Road - Economic Development of BaltimoreVinay AchutuniNo ratings yet

- Wilmington City Council: Proposed Installment Financing Contract Amendment For Up To 30 Million DollarsDocument9 pagesWilmington City Council: Proposed Installment Financing Contract Amendment For Up To 30 Million DollarsJamie BouletNo ratings yet

- Minutes Final 2 24 2020Document4 pagesMinutes Final 2 24 2020cravenangel864No ratings yet

- Key Legal Points February 20, 2013: HE ITY TtorneyDocument2 pagesKey Legal Points February 20, 2013: HE ITY Ttorneyapi-143385479No ratings yet

- How Might The City Come Up With $17 Million More For The Streetcar?Document2 pagesHow Might The City Come Up With $17 Million More For The Streetcar?janeprendergastNo ratings yet

- Mayor Weinberger Accountability ReportDocument9 pagesMayor Weinberger Accountability ReportJoel Banner BairdNo ratings yet

- Delray Beach WM Contract Extension Analysis. FinalDocument9 pagesDelray Beach WM Contract Extension Analysis. FinalMy-Acts Of-SeditionNo ratings yet

- 20-17 Analysis of The Initial Recommendations Concerning The Electric and Gas Franchise AgreementsDocument8 pages20-17 Analysis of The Initial Recommendations Concerning The Electric and Gas Franchise AgreementsRob NikolewskiNo ratings yet

- CAO Allan Seabrooke Report On City Annexation of Cavan Monaghan Township LandDocument23 pagesCAO Allan Seabrooke Report On City Annexation of Cavan Monaghan Township LandPeterborough Examiner100% (1)

- Via Email: Hol UCDocument5 pagesVia Email: Hol UCChapter 11 DocketsNo ratings yet

- 1) Aug 30 Cover Letter To Mayor Rob Ford and Members of Council - PackageDocument109 pages1) Aug 30 Cover Letter To Mayor Rob Ford and Members of Council - PackageIsaiah WaltersNo ratings yet

- New Moran Nov. 15 ReportDocument51 pagesNew Moran Nov. 15 ReportvtburbNo ratings yet

- CAO 2017 02 - March 6 Facilitation MOE FINAL PDFDocument8 pagesCAO 2017 02 - March 6 Facilitation MOE FINAL PDFPeterborough ExaminerNo ratings yet

- CM Grosso Opening Statement - Sports Wagering ContractDocument2 pagesCM Grosso Opening Statement - Sports Wagering ContractTeam_GrossoNo ratings yet

- Seelbach-Bigham FC Stadium EmailDocument2 pagesSeelbach-Bigham FC Stadium EmailWCPO 9 NewsNo ratings yet

- BNI Case Study AnalysisDocument11 pagesBNI Case Study AnalysisJowjie TVNo ratings yet

- Negotiable Instruments Case Digest: Allied Banking Corp. V. Lim Sio Wan (2008)Document19 pagesNegotiable Instruments Case Digest: Allied Banking Corp. V. Lim Sio Wan (2008)Trina RiveraNo ratings yet

- Respondent's Factum 2Document28 pagesRespondent's Factum 2TorontoistNo ratings yet

- 2014-12-18 Old Oak Strategy Board MeetingDocument5 pages2014-12-18 Old Oak Strategy Board MeetingscribdstorageNo ratings yet

- OCG's Letter To PM Golding On UDC Asset Divestment To BashcoDocument5 pagesOCG's Letter To PM Golding On UDC Asset Divestment To BashcoOG.NRNo ratings yet

- Village (At Avon) Litigation Settlement Financial Questions and AnswersDocument18 pagesVillage (At Avon) Litigation Settlement Financial Questions and AnswersvaildailyNo ratings yet

- CMS ReportDocument4 pagesCMS ReportRecordTrac - City of OaklandNo ratings yet

- Wilmington - North Riverfront Marina and Hotel Park Riverwalk Swap Land DealDocument51 pagesWilmington - North Riverfront Marina and Hotel Park Riverwalk Swap Land DealMichael D KaneNo ratings yet

- William T. Whiting V Citimortgage IncDocument35 pagesWilliam T. Whiting V Citimortgage IncForeclosure FraudNo ratings yet

- Code of Ethics PresentationDocument25 pagesCode of Ethics PresentationApril ToweryNo ratings yet

- Draft Burlington Town Center Development Agreement Public ProcessDocument4 pagesDraft Burlington Town Center Development Agreement Public ProcessvtburbNo ratings yet

- Plainview Grocery Store CID and TIF in Wichita, KansasDocument15 pagesPlainview Grocery Store CID and TIF in Wichita, KansasBob WeeksNo ratings yet

- 1 CFN.#8 7u : United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument5 pages1 CFN.#8 7u : United States Bankruptcy Court Eastern District of Michigan Southern DivisionWDET 101.9 FMNo ratings yet

- Seabrooke Report On PDIDocument19 pagesSeabrooke Report On PDIPeterborough ExaminerNo ratings yet

- Proposed Settlement Term SheetDocument8 pagesProposed Settlement Term SheetMelissa RatliffNo ratings yet

- Solicitor-General's Advice On Peter DuttonDocument27 pagesSolicitor-General's Advice On Peter DuttonLatika M BourkeNo ratings yet

- Helen Burstyn's Opening Remarks On The Auditor General's ReportDocument5 pagesHelen Burstyn's Opening Remarks On The Auditor General's ReportToronto StarNo ratings yet

- Allied Banking Vs Lim Sio WanDocument7 pagesAllied Banking Vs Lim Sio WanshambiruarNo ratings yet

- PL150274 Request For Review of Decision March 2018Document8 pagesPL150274 Request For Review of Decision March 2018JBNo ratings yet

- LMU Board Meeting February 17, 2009 MinutesDocument10 pagesLMU Board Meeting February 17, 2009 MinutesOaklandCBDsNo ratings yet

- Response To Auditor's Draft Report On Earmarks (122309)Document12 pagesResponse To Auditor's Draft Report On Earmarks (122309)Susie CambriaNo ratings yet

- Lawyers in Ontario CanadaDocument5 pagesLawyers in Ontario Canadathomas lapriseNo ratings yet

- Morrison Police Sergeant Job DescriptionDocument44 pagesMorrison Police Sergeant Job DescriptionsaukvalleynewsNo ratings yet

- Citizen’s Guide to P3 Projects: A Legal Primer for Public-Private PartnershipsFrom EverandCitizen’s Guide to P3 Projects: A Legal Primer for Public-Private PartnershipsNo ratings yet

- Financial Public RelationsFrom EverandFinancial Public RelationsPat BowmanNo ratings yet

- Woolf: Inflation-Adjusted Spending Per Vermont PupilDocument1 pageWoolf: Inflation-Adjusted Spending Per Vermont PupilPhilip TortoraNo ratings yet

- Woolf: Vermont Earned Income Tax CreditDocument1 pageWoolf: Vermont Earned Income Tax CreditPhilip TortoraNo ratings yet

- Woolf: Vermont Family Characteristics by CountyDocument1 pageWoolf: Vermont Family Characteristics by CountyPhilip TortoraNo ratings yet

- Woolf: Vermont Labor Force and JobsDocument1 pageWoolf: Vermont Labor Force and JobsPhilip TortoraNo ratings yet

- Quinnipiac Presidential PollDocument9 pagesQuinnipiac Presidential PollPhilip TortoraNo ratings yet

- Woolf: Number of Vermont Married CouplesDocument1 pageWoolf: Number of Vermont Married CouplesPhilip TortoraNo ratings yet

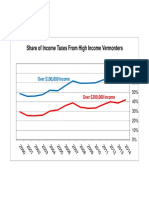

- Woolf: Share of Income Taxes From High Income VermontersDocument1 pageWoolf: Share of Income Taxes From High Income VermontersPhilip TortoraNo ratings yet

- Woolf: Vermont Median Family Income Jan 2016Document1 pageWoolf: Vermont Median Family Income Jan 2016Philip TortoraNo ratings yet

- Woolf: Keurig Green Mountain Stock PriceDocument1 pageWoolf: Keurig Green Mountain Stock PricePhilip TortoraNo ratings yet

- Woolf: Initial Claims For Unemployment InsuranceDocument1 pageWoolf: Initial Claims For Unemployment InsurancePhilip TortoraNo ratings yet

- Bernie Sanders Medical ReportDocument1 pageBernie Sanders Medical ReportPhilip TortoraNo ratings yet

- PDF: Northfield Fatal Fire Search Warrant ApplicationDocument10 pagesPDF: Northfield Fatal Fire Search Warrant ApplicationPhilip TortoraNo ratings yet

- Woolf: Vermont PopulationDocument1 pageWoolf: Vermont PopulationPhilip TortoraNo ratings yet

- Woolf: Vermont Gasoline and Fuel Oil PricesDocument1 pageWoolf: Vermont Gasoline and Fuel Oil PricesPhilip TortoraNo ratings yet

- Woolf: Vermont Skier DaysDocument1 pageWoolf: Vermont Skier DaysPhilip TortoraNo ratings yet

- November 2012 Vaughan Real Estate Market UpdateDocument5 pagesNovember 2012 Vaughan Real Estate Market Updateinfo7761No ratings yet

- Woolf: Vermont Labor Force & JobsDocument1 pageWoolf: Vermont Labor Force & JobsPhilip TortoraNo ratings yet

- Affidavit: United States vs. Mark McLoudDocument9 pagesAffidavit: United States vs. Mark McLoudPhilip TortoraNo ratings yet

- Art Woolf: Vermont Construction EmploymentDocument1 pageArt Woolf: Vermont Construction EmploymentPhilip TortoraNo ratings yet

- The Danforth PewterersDocument1 pageThe Danforth PewterersPhilip TortoraNo ratings yet

- Woolf: Vermont Media Income by Household TypeDocument1 pageWoolf: Vermont Media Income by Household TypePhilip TortoraNo ratings yet

- PDF: Court Papers Filed in Evi Quaid CaseDocument23 pagesPDF: Court Papers Filed in Evi Quaid CasePhilip TortoraNo ratings yet

- Art Woolf: State and Local Taxes As A Share of Personal IncomeDocument1 pageArt Woolf: State and Local Taxes As A Share of Personal IncomePhilip TortoraNo ratings yet

- Art Woolf: FY12 Vermont Government SpendingDocument1 pageArt Woolf: FY12 Vermont Government SpendingPhilip TortoraNo ratings yet

- Art Woolf: Percentage of Students Achieving A Score of Proficient or AdvancedDocument1 pageArt Woolf: Percentage of Students Achieving A Score of Proficient or AdvancedPhilip TortoraNo ratings yet

- Art Woolf: Vermont Percent of Under 65 Population Without Health InsuranceDocument1 pageArt Woolf: Vermont Percent of Under 65 Population Without Health InsurancePhilip TortoraNo ratings yet

- Art Woolf: Vermont Payroll EmploymentDocument1 pageArt Woolf: Vermont Payroll EmploymentPhilip TortoraNo ratings yet

- Art Woolf: Vermont Employment Change Since RecessionDocument1 pageArt Woolf: Vermont Employment Change Since RecessionPhilip TortoraNo ratings yet

- PDF: Court Papers Filed in Randy Quaid CaseDocument18 pagesPDF: Court Papers Filed in Randy Quaid CasePhilip TortoraNo ratings yet

- Vermont State Police AMBER Alert ReviewDocument5 pagesVermont State Police AMBER Alert ReviewPhilip TortoraNo ratings yet

- Group 2 - Jollibee Foods Corporation 2019 Financial ReportDocument15 pagesGroup 2 - Jollibee Foods Corporation 2019 Financial ReportVenziel Pedrosa0% (1)

- Auditing Standard ASA 570: Going ConcernDocument32 pagesAuditing Standard ASA 570: Going Concernbrian_dinh_5No ratings yet

- 1 Session OneDocument6 pages1 Session OneHardik ShahNo ratings yet

- 8 BPI Family Savings Bank V ST Michael Medical Center, GR 205469, March 25, 2015Document2 pages8 BPI Family Savings Bank V ST Michael Medical Center, GR 205469, March 25, 2015Nea TanNo ratings yet

- APE Company Audit Plan for Tetanus BankDocument18 pagesAPE Company Audit Plan for Tetanus BankPia De LaraNo ratings yet

- BSP RelationshipDocument30 pagesBSP RelationshipErica BueNo ratings yet

- Anglais 3 6 01 01Document6 pagesAnglais 3 6 01 01lb. zinouNo ratings yet

- ACCT 444 (All Weeks 1-5 Quizzes and Homework Assignments) Full CourseDocument32 pagesACCT 444 (All Weeks 1-5 Quizzes and Homework Assignments) Full CourseMarlaPringle0% (1)

- JG Summit Annual - FS 2019 PDFDocument210 pagesJG Summit Annual - FS 2019 PDFZo ThelfNo ratings yet

- Ias-10: Events After The Reporting Period: ScopeDocument3 pagesIas-10: Events After The Reporting Period: ScopennwritiNo ratings yet

- Fauji Cement PDFDocument96 pagesFauji Cement PDFtahirNo ratings yet

- CFAS ReviewerDocument33 pagesCFAS Reviewerjanine toledoNo ratings yet

- Revised Audit ReportDocument2 pagesRevised Audit ReportJheza Mae PitogoNo ratings yet

- Philippine Interpretations Committee (Pic) Questions and Answers (Q&As)Document3 pagesPhilippine Interpretations Committee (Pic) Questions and Answers (Q&As)Mary Joy SumapidNo ratings yet

- 1Document5 pages1Steve JacobNo ratings yet

- Chapter 1 - Accounting As A Form of Communication (Notes)Document7 pagesChapter 1 - Accounting As A Form of Communication (Notes)Hareem Zoya WarsiNo ratings yet

- Celebrity Fashion Annual Report 2010Document56 pagesCelebrity Fashion Annual Report 2010Abhishek RajNo ratings yet

- Session 2 SolutionsDocument11 pagesSession 2 SolutionsAaron ChandlerNo ratings yet

- 1 IntroductionDocument13 pages1 IntroductiontsololeseoNo ratings yet

- Chapter 1-Bài TậpDocument8 pagesChapter 1-Bài Tậplinhnk234111eNo ratings yet

- Auditing Theory Audit Report Key Audit ConceptsDocument13 pagesAuditing Theory Audit Report Key Audit ConceptsMay RamosNo ratings yet

- TOPIC 3 2021 B RevisedDocument40 pagesTOPIC 3 2021 B Revisedkitderoger_391648570No ratings yet

- Central Services Administration Financial Statements 2021 2020 PDFDocument35 pagesCentral Services Administration Financial Statements 2021 2020 PDFKarenNo ratings yet

- Interview Questions for Government AuditorDocument20 pagesInterview Questions for Government AuditornadeemNo ratings yet