Professional Documents

Culture Documents

11 07 2014 001

Uploaded by

Ina PawarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

11 07 2014 001

Uploaded by

Ina PawarCopyright:

Available Formats

Shankar.Raghuraman@timesgroup.

com

F

inance minister Arun Jaitley started his

maiden Budget speech noting that the

people of India have decisively voted for

a change and that the poll verdict was a sign

of their exasperation with the status quo.

That appeared to be a signal that he would ar-

ticulate a radically new vision. But he then

spent the next two hours and a bit one of the

longest Budget speeches ever presenting a

Budget that was in its larger vision almost in-

distinguishable from the offerings of the UPA

over the past 10 years.

The Budget also showed quite clearly that

the Modi government prefers a something-

for-everyone kind of approach, at least for

the moment, with crucial state elections com-

ing up, and will not be in a hurry to com-

pletely distance itself from the welfarist

stance of the UPA regime.

It will, however, try and signal a shift,

even where UPA schemes are continued. For

instance, while the job creation scheme MN-

REGA is to stay, work under it will now be

targeted at asset creation in rural areas.

One clear policy indicator was in the area

of foreign direct investment. FDI up to 49%

will be allowed in defence manufacturing

and insurance, subject to approval by the

Foreign Investment Promotion Board (FIPB),

and with full Indian management and con-

trol. FDI entry into construction was also

eased with the floor on built-up area for

projects that can qualify for foreign invest-

ment being lowered.

Another palpable sign of regime change

was in the nomenclature of various govern-

ment schemes the Gandhi-Nehru tags have

given way to Hindu nationalists Deendayal

Upadhyaya, Syama Prasad Mookerjee and

Madan Mohan Malaviya.

The attempt to glorify these Hindu nation-

alists, seen together with the announcement

of a package for Kashmiri Pandits, boost to

religious tourism and the rail link to Char

Dham announced earlier in the railway

budget, indicates an effort to enlarge the

BJPs Hindu constituency.

5 injured in Pune explosion

A low-intensity blast set off by a bomb on a

bike parked in front of a police station near

Dagdusheth temple in Pune left five injured

on Thursday. Police suspect IMs hand | P 19

Zohra Sehgal, 102, the

grand old diva of Indias

performing arts, died in New

Delhi on Thursday. Her career

spanned over 70 years | P 19

Hands and ngers of forgers should be

chopped off, says Tamil Nadu HC judge | P 19

Iraqi militants seize 40kg uranium, Baghdad

fears it may be used to make WMDs | P 22

Heavy workload has reduced SC to a court

of appeal, says CJI, seeks solution | P 19

Bhuvneshwar (58), Shami (51*) take India

to 457; England 43/1 at stumps on Day 2 | P 26

BEYOND THE BUDGET

MOVIE REVIEWS TURN TO P 18

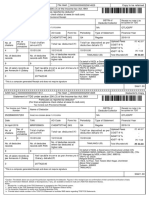

FOR TAXPAYERS

SMOOTH | I-T

exemption limit up

from 2L to 2.5L,

top bracket saves

5,665 in tax

Exemption

limit for those

aged above 60

but below 80 also

increased from 2.5 lakh to 3 lakh

Deduction limit under Section 80C up

from 1L to 1.5L, resulting in a maximum

possible tax saving of 16,995 a year

Deduction limit on interest for home loan

increased from 1.5L to 2L, resulting in

maximum tax saving of 16,995

ROUGH | 3% education cess to continue

10% surcharge continues for individuals

with income over 1 crore

FOR CONSUMERS

SMOOTH | Free

baggage allowance

increased from

35,000 to 45,000

Customs duty on

inputs for durables

like PCs, TVs and

LED lights reduced

Excise duty on

footwear priced at 500- 1,000 halved to 6%

ROUGH| Cut & polished diamonds, coloured

gemstones to attract 2% customs duty

Radio taxis brought under service tax net

Excise duty on cigarettes, cigars, cheroots

and cigarillos increased by 11%-72%; excise

duty on pan masala raised from 12% to 16%

Prices of zzy drinks, avoured water,

juices & energy drinks to increase by 5%

FOR BUSINESSMEN

SMOOTH | Realty

investment trusts,

infrastructure

investment trusts

to get pass-through

status for tax

purposes to avoid

double tax

Sunset clause

for power units extended till March 2017

ROUGH| Retrospective amendment on

indirect transfer of shares retained,

high-level panel to look at any fresh cases

TEAMTOI

F

or those who were expecting a tough, non-

populist Budget, the surprise couldnt

have been more pleasant. In one shot,

finance minister Arun Jaitley raised the

income tax exemption limit by Rs 50,000

for all taxpayers below 80 years of age,

allowed an extra Rs 50,000 for tax-saving

investments like provident fund and insurance and

for good measure gave you a tax write-off on an extra

Rs 50,000 for interest payments on home loans. Pre-

Budget speculation was that he would do one or two

of the above; he did a hat-trick. Taken together, the

annual tax savings from these three changes

could go up to nearly Rs 39,000 for those in the

top income bracket. Even for those in the 10% tax

slab, the savings are a not-insignificant Rs 15,665.

Heres how you can maximize your gains:

The basic exemption limit is to be increased from

Rs 2 lakh to Rs 2.5 lakh and for senior citizens from

Rs 2.5 lakh to Rs 3 lakh. The existing education cess

of 3% and the surcharge of 10% for annual incomes

of Rs 1 crore or more continue. The change in the

exemption limit means

that irrespective of

whether you are in the

10%, 20% or 30% income

tax slab, you save Rs

5,150 in taxes. If your

income is a crore or

more, you save Rs 5,665.

Theres a catch, though.

For those aged 80 or

more, the change in the

exemption limit is irrelevant, since they are anyway

eligible for a limit of Rs 5 lakh.

The maximum deduction under Section 80C,

which covers investment options like provident fund,

public provident fund (PPF), insurance policies and

equity-linked savings schemes, is to increase from

Rs 1 lakh to Rs 1.5 lakh. Since this means you can

deduct an extra Rs 50,000 from your taxable income,

the tax savings could go as high as Rs 16,995 depend-

ing on which tax slab you are in. Even at the lowest

tax slab, this change will save you Rs 5,150 a year.

The icing on the cake is that all of the Rs 1.5 lakh

can be invested in PPF, which has been giving tax-free

returns of about 8.5-9%. Thats equivalent to a return

of over 12% from an instrument whose returns are

taxed like fixed deposits, the other option much fa-

voured by risk-averse middle-class investors.

The maximum deduction for payment of interest

on home loans for self-occupied property is to go up

from Rs 1.5 lakh to Rs 2 lakh. As in the case of Sec 80C,

this will allow you to knock off Rs 50,000 from your

taxable income and hence result in cutting your tax

liability by anywhere between Rs 5,150 and Rs 16,995.

A couple of caveats need to be kept in mind. First,

you must acquire or construct the property for which

the loan has been taken within three years from the

end of the financial year in which it was taken. Sec-

ond, this provision really helps only in the early

years of the repayment of home loans, since that is

when the interest component tends to be high.

While it would seem that you will have to start

paying tax the moment your income crosses Rs 2.5

lakh, in fact, it is theoretically possible to pay zero

tax right up to an income of Rs 9.30 lakh. A very

senior citizen (defined as someone above 80 years)

doesnt pay any tax till Rs 5 lakh. If he or she were

to take a home loan (that may seem improbable but

can be done against collateral) for say Rs 90 lakh,

there would be a tax saving on interest payment of

up to Rs 2 lakh. Throw in the Rs 1.5 lakh exemption

limit under Sec 80C, deduction of Rs 20,000 on med-

ical insurance premium, and another Rs 60,000 on

specified medical expenses and you get a neat tax-free

sum thats over four times the apparent exemption

limit. For those aged between 60 and 80, the corre-

sponding figure would be Rs 7.10 lakh and for those

aged below 60, it would be Rs 6.40 lakh (as the medi-

cal expenses limit is lower at Rs 40,000). Admittedly,

some of these examples may seem a little stretched

but they do serve to illustrate how misleading the

official exemption limit is.

INSIDE THE BUDGET

What does this Budget mean for you and

your family? What were the political pressures

that shaped it? And how will it impact your

finances as well as the nations fortunes?

This special edition analyses the impact and

implications of the Budget from every

possible angle | Pages 2-17, 21

View From The Top: Kumar Birla, Deepak

Parekh, Sunil Mittal, Saumitra Chaudhuri

FM MAKES MONEY

FOR YOU

PM Modi and FM Jaitley have their work

cut out as they chip away at slow growth,

unemployment and price rise in their bid

to chisel the economy into shape. What

they have tried to do is lift the mood of

their strong middle-class constituency by

leaving them with a bigger share of the

rupee through a slew of tax breaks

T

he Ganga has always been far more than

just a river. Worshipped as a mother

goddess, it commands unique reverence in the

Indian psyche. Sadly, its alarming pollution has

also come to symbolize a hopeless failure of

governance. Little wonder that PMand Varanasi

MP Narendra Modi has made an evocative pledge

to clean it up and nance minister Arun Jaitley

has allocated over 2,000 crore for the purpose

in the Budget. As India waits to see if Modi can

deliver on his promise, TOI presents River Sutra, a

photo series on the ebb and owof life along the

banks of the Ganga | Pages 2-13

RIVER SUTRA

I

ts been 10 years since an NDA government

was last in ofce. TOI takes stock of howIndia

and the world have changed, dus saal baad a

theme that also runs through almost all the

panels on the special Budget pages | Page 15

DUS SAAL BAAD

Imaging: Chanchal Kumar Mazumder

www. ti mesofi ndi a. com

SPECIAL

EDITION

TRIPLE TREAT | Tax exemptions on income, investments

like PPF and insurance, and home loans up 50,000 each

BOOST FOR EDUCATION, HEALTH | 5 IITs, 5 IIMs, 4 AIIMS,

12 govt medical colleges, 2 agriculture univs to be set up

GAMBLING ON GROWTH| Targets low deficit of 3% of GDP

in 2 yrs, betting on revival despite poor rains & global risks

NEW TAX MIX | Service tax collections to overtake

customs/excise; levy extended to radio cab, AC bus rides

OLD & NEW | NRI fund, 2,000 cr to clean up Ganga; plans

for metros in 2mn-plus cities, 7,000 cr to build smart cities

FOREIGN FUNDS WELCOME | FDI cap for insurance, defence

raised to 49%; area, capital norms for construction eased

500 crore for IITs, IIMs, P 21

UNiON

BUDGET

2014

FOR INVESTORS

SMOOTH |

Annual limit for

PPF investment up

from 1L to 1.5L

Deduction for

investment in New

Pension Scheme

available to all pvt

sector employees

Minimum pension limit under employees

pension scheme set at 1,000 per month

ROUGH| Lock-in for long-term capital gains

tax on sale of listed non-equity MFs raised

to 3 years, tax rate up from 10% to 20%

MONEYFESTOI

Take a joint home loan, get a break on your kids school fees...

TOIs guide to max your tax savings, because every rupee saved

is a rupee earned. SPECIAL 3-PAGE PANORAMAFROMPAGE4

TOI.COM OPINION POLL

RATING THE BUDGET

82%

FOR ME

GOOD

BAD

18%

FOR INDIA

84%

16%

GOOD

BAD

Portuguese crisis

fears hit sensex

but investor wealth

up 89.3 lakh cr as

non-index stocks

rise. FIIs and FIs

both net buyers

SENSEX

-72

SMOOTH ROUGH

&

Long On Words,

But Short On

Radical Reform

Cheers Taxpayers

By Putting More

Cash In Pockets

*With 3% of tax liability added as

education cess and 10% surcharge

on incomes of Rs 1cr or more

Income Tax Rate

Up to 2.5 lakh NIL

2.5-5 lakh 10.30%

5-10 lakh 20.60%

10 lakh-1cr 30.90%

1cr & above 33.99%

A BRIEF CASE FOR BUDGET TRAVELLERS

Jaitley gives

himself a break

S

omething unprecedented

happened at around

11.45am: Jaitley took a four-

minute break mid-speech due

to back trouble. The FM is

learnt to have been putting in

18-hour days, often ignoring

calls by his wife asking him

to get some rest. When he re-

sumed speaking, he did so

seated. But that didnt stop

him from almost breaking the

record for longest Budget

speechheld by another NDA

FM, Jaswant Singh, who

clocked 2 hours, 13 minutes

in 2003. Excluding the break,

Jaitley spoke for 2 hours, 10

minutes. This is one record

he may not mind missing!

Sin tax on gutka,

cigs, soft drinks

W

hat you might save in

taxes, you will blow up

in smoke if you havent yet

kicked the butt. For, the FM

has proposed a hefty hike in

excise duty for cigarettes, ci-

gars, pan masala and gutka.

Jaitley has hiked tax on eve-

ry tobacco product from

11% to 72% on cigarettes,

cheroots and cigarillos, 12%

to 16% on pan masala, 60%

to 70% on gutka and chew-

ing tobacco, 50% to 55% on

unmanufactured tobacco.

Concern for health also led

him to hike excise duty on

soft drinks by 5%. Doctors

will be happy, but it wont go

down well with kids. P 8

A

run Jaitley spoke over 16,000 words in his

speech, in which the word I figured 204

times, shows an analysis of his speech using

online tool WriteWords. Every 81st word Jaitley

used was an I. But the FM with the highest I-

Q was P Chidambaram whos first, second,

third, fourth and fifth in the list of FMs fond of

the first person singular. According to an anal-

ysis of 67 previous Budgets (not including in-

terim ones), Chidambaram used I with the

highest frequency in 2013-14 once every 55

words. This frequency was lower in Chidam-

barams earlier stints as FM, but not by a wide

margin. In 2005, 2007 and 2008, he used I once

every 59 words. His 1997 speech was more

modest, but by only one word. Jaitley actually

comes a distant 19th in this list of 67 speeches.

The rather self-effacing Manmohan Singh

used I only once every 87 words in his land-

mark 1991 Budget. But the least I-inclined of all

FMs was Jawaharlal Nehru he used I only

once every 276 words.

B

ollywoods Rs 100-crore club is often criti-

cized for turning script into formula and film

into circus. Arun Jaitley joined the club on

Thursday, not once but many times over after

he announced a long list of schemes pegged at

the round figure. Madrasa uplift? Rs 100 crore.

Tribal welfare? Rs 100 crore. Ghat development?

You guessed it, Rs 100 crore. In all, there were

28 plans tied up to that amount. Social media

had a ball. In comparison, Jaitley provided

Rs 200 crore for a mammoth statue of Sardar

Patel, which attracted robust flak. P 13

New FM scores 204 but lags behind PC in I-Q

100cr each for 28 schemes, 200cr for statue

BENNETT, COLEMAN & CO. LTD. | ESTABLISHED 1838 | TIMESOFINDIA.COM | EPAPER.TIMESOFINDIA.COM MUMBAI | FRIDAY, JULY 11, 2014 | PAGES 46 *

PRICE `6.00 ALONG WITH MUMBAI MIRROR OR `9.00 ALONG WITH THE ECONOMIC TIMES OR `7.00 ALONG WITH MAHARASHTRA TIMES * PLUS 16 PAGES BOMBAY TIMES

You might also like

- What It Means For: - You As An InvestorDocument1 pageWhat It Means For: - You As An InvestorIna PawarNo ratings yet

- SEBIDocument17 pagesSEBIIna PawarNo ratings yet

- Budget 2014 FeaturesDocument21 pagesBudget 2014 FeaturesOutlookMagazineNo ratings yet

- Budget 2014 FeaturesDocument21 pagesBudget 2014 FeaturesOutlookMagazineNo ratings yet

- U.S. Subprime Mortgage CrisisDocument15 pagesU.S. Subprime Mortgage CrisisIna PawarNo ratings yet

- 15 Toughest Interview Questions and Answers!: 1. Why Do You Want To Work in This Industry?Document8 pages15 Toughest Interview Questions and Answers!: 1. Why Do You Want To Work in This Industry?johnlemNo ratings yet

- Cathay Pacific Value Chain AnalysisDocument16 pagesCathay Pacific Value Chain AnalysisIna PawarNo ratings yet

- Tax Lift Goes Down, You're Up One Floor: Take A Home Loan, Take Home MoreDocument1 pageTax Lift Goes Down, You're Up One Floor: Take A Home Loan, Take Home MoreIna PawarNo ratings yet

- MCGM AdvtDocument3 pagesMCGM AdvtIna PawarNo ratings yet

- DerivativesDocument120 pagesDerivativesMansi Raut PatilNo ratings yet

- Types of LC - Scotia BankDocument20 pagesTypes of LC - Scotia BankgmsangeethNo ratings yet

- BVK If Ppt-Bop Gold STD Int Liq SDR Mms.. 13Document58 pagesBVK If Ppt-Bop Gold STD Int Liq SDR Mms.. 13Ina PawarNo ratings yet

- Strategiccostmanagement 091225010512 Phpapp01Document22 pagesStrategiccostmanagement 091225010512 Phpapp01Rahul KadamNo ratings yet

- Interview QuestionsDocument4 pagesInterview QuestionsRashid ChaudhryNo ratings yet

- Nse Wealth Management Module-BasicsDocument116 pagesNse Wealth Management Module-BasicsSethu Raman K R83% (29)

- Bank ManagementDocument112 pagesBank Managementsat237No ratings yet

- Personal Effectiveness - KamalDocument47 pagesPersonal Effectiveness - KamalIna PawarNo ratings yet

- Reliance Capital financial services leadership targetDocument11 pagesReliance Capital financial services leadership targetIna PawarNo ratings yet

- Kevin Martis Reliance SecuritiesDocument13 pagesKevin Martis Reliance SecuritiesIna PawarNo ratings yet

- Tally LedgersDocument2 pagesTally Ledgersnagendra tiwari82% (79)

- Presentation 2Document19 pagesPresentation 2Ina PawarNo ratings yet

- My PPT (Sip)Document16 pagesMy PPT (Sip)Ina PawarNo ratings yet

- Form ITR-1Document3 pagesForm ITR-1Rajeev PuthuparambilNo ratings yet

- Expert tax planning tips for salaried employeesDocument60 pagesExpert tax planning tips for salaried employeessinghalsachin2003No ratings yet

- 79564Document42 pages79564Ina PawarNo ratings yet

- 3 G TechnologyDocument11 pages3 G TechnologyIna PawarNo ratings yet

- Tax Planning: Taurus Capital AdvisorsDocument13 pagesTax Planning: Taurus Capital AdvisorsIna PawarNo ratings yet

- OM Quality MGNT - BasicsDocument40 pagesOM Quality MGNT - BasicsIna PawarNo ratings yet

- Bill of MaterialsDocument25 pagesBill of MaterialsIna Pawar100% (1)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Income Tax Plannig in India With Respectred To Individual AssesseeDocument79 pagesIncome Tax Plannig in India With Respectred To Individual AssesseeSAJIDA SHAIKHNo ratings yet

- 01 Jose J. Ferrer JR V City Mayor Herbert Bautista Et Al GR 210551 June 30 2015Document4 pages01 Jose J. Ferrer JR V City Mayor Herbert Bautista Et Al GR 210551 June 30 2015Nojoma PangandamanNo ratings yet

- 10000000879Document299 pages10000000879Chapter 11 DocketsNo ratings yet

- 252289600057294Document1 page252289600057294Pricila MercyNo ratings yet

- Case Digests On Tax Remedies and JurisdictionsDocument36 pagesCase Digests On Tax Remedies and JurisdictionsNurul-Izza A. Sangcopan100% (2)

- Manning Elliott Newsletter - March 2013Document8 pagesManning Elliott Newsletter - March 2013Juan CañaSNo ratings yet

- Income Tax History - Check Your Income Tax - GOV - UK - Check Your Income Tax - GOV - UKDocument5 pagesIncome Tax History - Check Your Income Tax - GOV - UK - Check Your Income Tax - GOV - UKChris CritchNo ratings yet

- Doh Et Al Corruption AME 2003Document15 pagesDoh Et Al Corruption AME 2003Violeta MijatovicNo ratings yet

- Tio v. Videogram Regulatory Board, G.R. No. 75697, June 18, 1987, 151 SCRA 208Document2 pagesTio v. Videogram Regulatory Board, G.R. No. 75697, June 18, 1987, 151 SCRA 208DenneNo ratings yet

- Vikrant Tyres Plant History and MilestonesDocument51 pagesVikrant Tyres Plant History and MilestonesUdayveerSinghNo ratings yet

- 8559 Finalresponsetoprebidqueriesftp114720.04.2016 PDFDocument90 pages8559 Finalresponsetoprebidqueriesftp114720.04.2016 PDFAbhijeet SahuNo ratings yet

- PARLEDocument16 pagesPARLESaurabh SinghNo ratings yet

- Videocon Financial AnalysisDocument9 pagesVideocon Financial AnalysisDiv KabraNo ratings yet

- HR Professional with Education and CertificationsDocument1 pageHR Professional with Education and CertificationsdestaputrantoNo ratings yet

- Panchshil Domestic Bill-JuneDocument60 pagesPanchshil Domestic Bill-JuneUJJWALNo ratings yet

- Syllabus - M.Com - Bhadrak Autonomous CollegeDocument28 pagesSyllabus - M.Com - Bhadrak Autonomous CollegeRamesh Chandra DasNo ratings yet

- Billing Address: Tax InvoiceDocument1 pageBilling Address: Tax InvoiceManojkumar DNo ratings yet

- MGFP One PagerDocument2 pagesMGFP One PagerHumanearthNo ratings yet

- 1801 Estate Tax Return FormDocument2 pages1801 Estate Tax Return FormMay DinagaNo ratings yet

- Basic Concepts of Income Tax ExplainedDocument47 pagesBasic Concepts of Income Tax Explainedleela naga janaki rajitha attiliNo ratings yet

- Essay Chp7Document8 pagesEssay Chp7barrettm82a1No ratings yet

- FILE SE VC Tech T-10 2023-24 Version 1 1684570086666Document64 pagesFILE SE VC Tech T-10 2023-24 Version 1 1684570086666Deelip ZopeNo ratings yet

- Revised Irr of Mining Act of 1995Document6 pagesRevised Irr of Mining Act of 1995agfajardoNo ratings yet

- THE HISTORY OF MONEY PART 1Document25 pagesTHE HISTORY OF MONEY PART 1skhicksNo ratings yet

- 2 Contract To Sell TemplateDocument3 pages2 Contract To Sell TemplateSamuel Kwon100% (1)

- Financial Model of New RestaurantDocument42 pagesFinancial Model of New RestaurantPrabhdeep Dadyal0% (1)

- RavaDocument1 pageRavaPhilip ChomeNo ratings yet

- Barbara and Barrie Seid Foundation 363342443 2011 08e875b6searchableDocument22 pagesBarbara and Barrie Seid Foundation 363342443 2011 08e875b6searchablecmf8926No ratings yet

- F6mwi QPDocument15 pagesF6mwi QPangaNo ratings yet

- Exercise 4-20Document6 pagesExercise 4-20烈仙雪0% (1)