Professional Documents

Culture Documents

Batteries

Uploaded by

Tushar RastogiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Batteries

Uploaded by

Tushar RastogiCopyright:

Available Formats

BATTERIES

Introduction

The Indian battery industry, comprising automobile, sealed maintenance free (SMF), tubular and lead

acid batteries, has been growing at an annual rate of 25 per cent for the last 4 years. The growth is

mainly in the automobile division but, significantly, also in the industrial sectors powered by usage in

telecom, railways, power and other industrial applications. Currently the value of market is over Rs

100 billion and automotive market makes up for 65% of the total. Growth in lead acid batteries is

expected to continue in the future, since heavy growth is expected in the telecom sector and the

governments focus on infrastructure development. In addition, with demand coming from

manufacturing facilities, banking, insurance and finance companies, followed by IT/ITeS sector and to

hedge against power failures, the demand for batteries are only going to surge heaviliy.

Automotive Battery Segment

A phenomenal change was brought by liberalization for the automobile industry. A number of

international players footed themselves in Indian markets. Their demand for world-class batteries

for pushed Indian battery manufacturers to tie up with international players or buy technology, so as

to upgrade their offerings to meet the high standards expected.

With consolidation and growth being the maxim of most auto players today, we are seeing increased

participation and partnership of battery manufacturers with auto players in creating battery

solutions for new vehicle introductions.

The automotive segment contributes in excess of 55 percent of the total turnover of the Indian lead

acid battery market. Demand for auto batteries can be further divided into the OE (original

equipment) market and the aftermarket segments.

This is a difficult division to service as each player has different specifications for which the battery

has to undertake major modification. Additionally, margins for battery manufacturers are usually

thin in this segment due to the bargaining power of the auto majors. However, inherent advantages

such as a steady source of production and revenue, and strong brand recall during battery

replacement make this an attractive segment for battery manufacturers.

The past couple of years have been bumpy in the automotive sector. While there has been a drop in

HCV and LCV (Heavy and Light commercial vehicles) segment sales, there has been an increase in

sales in the passenger car and two-wheeler segments. This has helped soften the blow.

The replacement market has a sizeable small player component - as this was traditionally in the

realm of the small scale sector. These players have hence been able to offer new/reconditioned

unbranded or lesser known branded batteries at very attractive rates. The replacement market is

where the margins are, and hence battery majors are now paying a lot of attention to this segment.

With the introduction of sealed long-life batteries by these players in the OE and replacement

market segments, there could be a drop in battery sales in the replacement market for relatively

new vehicles. However, this market is still substantial, considering that the discerning Indian vehicle

owner is today more quality and brand conscious and hence willing to pay more to be free from

battery problems.

The market leader in this automotive battery segment is Exide Industries Limited. The other players

include Tudor India and Amco Batteries. Amara Raja batteries, a relatively new player in the auto

battery segment, has made very impressive inroads into the market.

Industrial Battery Segment

The industrial market is a steadier, growing market comparatively. Batteries here are used as a

rugged high-drain stationary standby power source. These can be used for moving power and

stationary applications. Moving power application batteries are used in trains, forklifts, submarines,

etc. The demand is substantially higher and major applications are UPS systems, telecommunication

networks, power plants, etc.

The demand for industrial batteries is only bound to increase as India continues to develop the

service sector that includes call centers, data centers, banking networks and other communication

systems.

The industrial battery market has a few established players as capital investment in technology and

the manufacture of these batteries is considerably high, compared to investment in the automotive

battery industry. The per-unit realization is also substantially higher than that of automotive

batteries, but the frequency of purchase is less. This also acts as a barrier for players in the

unorganized sector to enter this market. Amara Raja Batteries is a strong player in the industrial

battery segment.

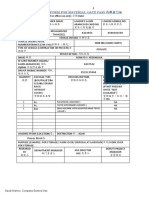

Drivers & Challenges can be summarised as below:

Drivers Challenges

Growing Automotive Industry Polluting and toxic nature of lead

Increasing demand of power backup Threat from other types of batteries

Booming renewable energy sector Volatility in lead prices

Recycling efficiency Large unorganized segment

Lucrative Replacement Market

Marketing

The interest level shown by any car owner to a battery revolves around only when the car fails to

start. Amaron therefore realized the need to make the consumer think about automotive batteries,

because thinking before a purchase will definitely lead to a comparison among the brands available.

Amaron thus went ahead with its media campaign that created a storm in the advertising industry

and made people look to this relatively new player in the battery industry. Its campaigns are majorly

focussed towards educating the consumer. ) For the first time a battery manufacturer had created

an ad campaign which was in the same league as mega ad spenders like Coca Cola, Times of India,

and others and won the Creative Advertiser of the Year, which was a shot in the arm for the entire

automotive battery industry.

This was followed by Exide when they were a major sponsor in the country for a major cricket

tournament.

DISTRIBUTION

Off late a lot of focus has been given to visibility and network creation. Aggressive efforts have been

made to reach out to nook and corner of the country and points where batteries are consumed and

sold. Strategic tie ups with major automobile manufactures and franchise holders helped in creating

access to there outlets.

Flashy names of outlets like "Pitstops" and "Terminals" helped in building better brand recall and

awareness among the end users.

All these strategies have helped consumers to make intelligent comparisons which has led to the

erosion in the market share of the unorganized sector and cheaper imports. This move towards

branding a low interest product, will go a long way in setting some standards for the industry,

increasing the entry barriers and making quality products available at affordable prices.

INDUSTRY LEADER - EXIDE INDUSTRY- FEATURES

Naming of the brand is derived from the words Oxidation and Excellent Oxide ---> Exide.

Products under Exide brand are Conventional Lead Acid Battery, VRLA battery, Nickel Cadmium

Battery, Tubular & Tele tubular Battery and High End Submarine Batteries.

Strategic Brand Positioning

Positioning multiple brands across the entire price spectrum with established brand equity.

'EXIDE', the brand name embodies the values of excellence, commitment, dependability and

service, which has shaped its character and leadership with a continuing responsibility.

Pricing strategy has resulted in a high recall brand proposition.

As a Market Leader since inception, has redefining the market periodically.

Joined hands with UNICEF to support them in their Child Environment Projects.

Road to Success

Battery Technology from Ex Parent Company CESCO.

Enjoying a monopoly in Indian market up to 80s.

In several African Countries good batteries, irrespective of brand are known as Exide!

Technical collaboration with Shin Kobe group for new technology in Automotive Batteries.

Technical collaboration with Furukawa group for new technology in Industrial Batteries.

Strategies adopted

Entering in the Non-Conventional energy sources, where it integrate and design solar and

wind power solution.

Manufacturing the widest range of storage batteries in the world from 2.5 Ah to 20400 Ah

capacity.

Offers a battery for every type of vehicle on Indian roads.

Exide - Invatubular batteries for Inverter, Tele tubular for Telecom sector.

Tied up with Tata to supply batteries for TATA - Nano.

Acquisition of two lead smelter company.

Introduction of Batmobile, Exidereachout - emergency service for automotive

consumers for battery problems.

Project Kissan and Highway - free advice to farmers about servicing and maintenance.

INDUSTRY LEADER AMARA RAJA BATTERIES FEATURES

Competitive Advantages for ARBL: Advanced technology and the wide distribution network are the

two major competitive advantages that have helped ARBL tackle competition and make in-roads in

an industry that was solely dominated by Exide. Further, now that the company has established itself

as a well-known brand, it itself acts as a sustainable moat and creates a vicious circle for the

company to outgrow competition.

Amara has followed really innovative branding strategies. The company associated itself with a

rugged sport and roped in racer Karthikeyan for endorsing. The company promotes go-karting as a

leisure sport and supports go-kart competitions. Its distribution outlets are called Pit Stops, a racing

term. They all have a standardised design, which franchisees have to strictly conform to. The Pit Stop

reflect the brand's racing theme and its colours. Today, the brand has 100 franchisees across the

country and about 7,250 retailers. It targets retailers of almost every kind ranging from plain old

battery dealers, or dealers in lubricants, auto spare parts, service stations, accessories shops, etc.

There also are other things that they did at the product stage itself to be different. They had put in

fancy wends and charge indicator on the battery. Next was the brand name itself and the colours. Ad

agency O&M and research agency TNS Mode researched a brand name and came up with Amaron

an amalgam of the Hindi word, Amar, (immortal) and `on' in English. The font that was adopted was

green and bold which enhanced the rugged image of the brand.

LOOKING AHEAD

Due to increased domestic competition, strong investment will be required in product R&D, brand

building, competitive pricing, and a very effective distribution network. This will eventually require

companies to focus on exports and tackle neighbouring growth markets even if players have to

manage in lower returns. Ultimately international tie-ups and acquisitions will have to be

capitalised.

By investing in R&D, these players would be able to offer niche products that propel them ahead of

the low-price fiercely competitive segment. On the industrial front, battery manufacturers would

have to constantly upgrade their offerings for the telecommunication and IT industry, taking into

consideration the requirement to expand power storage and discharge capacities, while reducing

storage space occupied at installations and charge time.

On the automotive front, domestic demand from the automotive sector is bound to rise. Batteries

of Panasonic, Japan and Varta, Germany are being imported and marketed in India. Existing

battery majors would have to work closely with automobile manufacturers to retain their market

shares in the OE segment, considering increased competition in this segment.

Innovative attempts in the domestic battery replacement market to de-commoditize batteries

would earn them rich dividends. Supplies to niches such as the electric vehicle segment could also

offer interesting opportunities.

Given their track record so far, it seems certain that the major players in the Indian lead acid

battery market will continue to power their way ahead by tapping the tremendous potential of this

market.

BIBLIOGRAPHY

1. The Indian Lead Acid Battery Market - a Look at Whats in Store Frost and Sullivan Report

2. Amara Raja Batteries Stock Recommendation report by Katalyst Wealth

3. Indian battery market review ElecronicsB2B.com report

You might also like

- Industry ProfileDocument63 pagesIndustry Profilesaravana saravanaNo ratings yet

- Battery Projects, Automobile Batteries-29079Document30 pagesBattery Projects, Automobile Batteries-29079ayaanNo ratings yet

- Mysore District ProfileDocument16 pagesMysore District ProfilenarayankoppalNo ratings yet

- Management Accountant Dec 2018Document124 pagesManagement Accountant Dec 2018ABC 123No ratings yet

- Type of Industries in SipcotDocument9 pagesType of Industries in Sipcotbalaji0% (1)

- IRB Infrastructure Developers LTDDocument18 pagesIRB Infrastructure Developers LTDSwati SinhaNo ratings yet

- Indian Agrochemical Industry Report Highlights Role in Second Green RevolutionDocument64 pagesIndian Agrochemical Industry Report Highlights Role in Second Green RevolutionshaaaaNo ratings yet

- NEERI N N RaoDocument25 pagesNEERI N N Raorahul_sexyNo ratings yet

- STP-BestPractices Presentation Ballari CC 2019Document10 pagesSTP-BestPractices Presentation Ballari CC 2019Corporation Health Officer BccNo ratings yet

- A Project Report On Operation Management AT: Submitted To: Submittted byDocument75 pagesA Project Report On Operation Management AT: Submitted To: Submittted bykarthickNo ratings yet

- Toolkit for Improving MSWM Services in India through PPPsDocument122 pagesToolkit for Improving MSWM Services in India through PPPshardiksanjayshah100% (2)

- Skyline Millars LimitedDocument9 pagesSkyline Millars Limitedjitendra singhNo ratings yet

- FICCI-Accenture - Circular Economy Report - OptVer PDFDocument70 pagesFICCI-Accenture - Circular Economy Report - OptVer PDFDebanu MahapatraNo ratings yet

- Tamil Nadu 2023 Vision Infrastructure PlanDocument68 pagesTamil Nadu 2023 Vision Infrastructure PlanRajanbabu100% (1)

- Oct 2016Document124 pagesOct 2016AK PuriNo ratings yet

- Gujarat's Automotive Hub at Sanand Industrial EstateDocument10 pagesGujarat's Automotive Hub at Sanand Industrial EstateMuhammad Mushahid Bin VahidaliNo ratings yet

- A Handbook On Supply Chain Management For HIV AIDS Medical CommoditiesDocument69 pagesA Handbook On Supply Chain Management For HIV AIDS Medical Commoditiesamirq4No ratings yet

- RFP For O&M of Engineering College On PPPDocument66 pagesRFP For O&M of Engineering College On PPPShashi ShankarNo ratings yet

- Kurukshetra English FINAL JAN 2017Document52 pagesKurukshetra English FINAL JAN 2017Sowjanya AvulaNo ratings yet

- GIDC Sanand Industrial EstateDocument11 pagesGIDC Sanand Industrial EstateRaj100% (1)

- Surat Solar City Master Plan PDFDocument117 pagesSurat Solar City Master Plan PDFvparthibban37No ratings yet

- Hinduism Today Oct Nov Dec 2011Document51 pagesHinduism Today Oct Nov Dec 2011nrajentranNo ratings yet

- Sustainable & Inclusive Rural GrowthDocument56 pagesSustainable & Inclusive Rural GrowthShailendra YadavNo ratings yet

- List of Operational SEZsDocument8 pagesList of Operational SEZsArup BanerjeeNo ratings yet

- Current Affairs Q - A PDF - March 2018 by AffairsCloud - New PDFDocument234 pagesCurrent Affairs Q - A PDF - March 2018 by AffairsCloud - New PDFAyush JhaNo ratings yet

- Sipcot Ranipet PDFDocument18 pagesSipcot Ranipet PDFAmit YadavNo ratings yet

- Agrochemical AdarshDocument7 pagesAgrochemical AdarshadarshNo ratings yet

- Importance of Good SDDocument34 pagesImportance of Good SDITDP IndiaNo ratings yet

- Presentation On Farm Mechanization Before Parliamentary Consultative Committee (Jan-2013)Document30 pagesPresentation On Farm Mechanization Before Parliamentary Consultative Committee (Jan-2013)Thandava_YNo ratings yet

- Chitrika 10 Yr Perspective PlanDocument46 pagesChitrika 10 Yr Perspective PlanmanasmacNo ratings yet

- Indore RFPVol1 PDFDocument129 pagesIndore RFPVol1 PDFCorporation Health Officer BccNo ratings yet

- Sez JaipurDocument71 pagesSez JaipurSUVADIP BHOWMIKNo ratings yet

- Manufacturing of Biofertilizers and BiopesticidesDocument24 pagesManufacturing of Biofertilizers and Biopesticidesvikaspatidar78_27504No ratings yet

- List of SEZDocument29 pagesList of SEZSandeep KohliNo ratings yet

- State Govt Products - TBUDocument29 pagesState Govt Products - TBUsrinivasa annamayyaNo ratings yet

- Groceries and Food Retail in IndiaDocument9 pagesGroceries and Food Retail in Indiaabhi2799100% (1)

- IBEF Auto Components 261112Document37 pagesIBEF Auto Components 261112asingh0001No ratings yet

- Investor Presentation (Company Update)Document32 pagesInvestor Presentation (Company Update)Shyam SunderNo ratings yet

- Avanti FeedsDocument10 pagesAvanti FeedsSunny SrivastavaNo ratings yet

- VRL LogisticsDocument10 pagesVRL LogisticsGopalPatelNo ratings yet

- Multi-Modal Logistics Park (MMLP) Governance in IndiaDocument24 pagesMulti-Modal Logistics Park (MMLP) Governance in IndiaPMA Vepery100% (1)

- Management Accountant FEBRUARY-2019Document124 pagesManagement Accountant FEBRUARY-2019ABC 123No ratings yet

- FDI Investors in India Top10 CountriesDocument11 pagesFDI Investors in India Top10 CountriesJhunjhunwalas Digital Finance & Business Info LibraryNo ratings yet

- Venkatagiri APIIC PDFDocument83 pagesVenkatagiri APIIC PDFMadan Mohan ReddyNo ratings yet

- Special Economic Zones: Role of MIDCDocument28 pagesSpecial Economic Zones: Role of MIDCinfooncoNo ratings yet

- Apiic Ongole IpDocument1 pageApiic Ongole IpAPSFC VijayawadaNo ratings yet

- Pipeline OutlooDocument60 pagesPipeline OutlooNikhil GaurNo ratings yet

- Kurukshetra June 2020 EnglishDocument52 pagesKurukshetra June 2020 EnglishKaliraj KKrNo ratings yet

- An Electric Utility Perspective On Building A Hydrogen Infrastructure For Sustainable Electric PowerDocument5 pagesAn Electric Utility Perspective On Building A Hydrogen Infrastructure For Sustainable Electric PowerAdriana Almeida de SouzaNo ratings yet

- Agri Input RetailingDocument6 pagesAgri Input RetailingNagarjun KushwahaNo ratings yet

- Automotive Industry in IndiaDocument25 pagesAutomotive Industry in IndiaDeepti GuptaNo ratings yet

- Udupi Dist - FinalDocument19 pagesUdupi Dist - FinalcyberabadNo ratings yet

- Chemicals Sector - FICCIDocument48 pagesChemicals Sector - FICCIP VinayakamNo ratings yet

- Kerala vISION 2025Document57 pagesKerala vISION 2025newvedvyasNo ratings yet

- Financial Analysis of Indian Oil Corporation Limited: January 2020Document16 pagesFinancial Analysis of Indian Oil Corporation Limited: January 2020Narasimha AlandkarNo ratings yet

- LC Leaderboard - April - Card SystemDocument25 pagesLC Leaderboard - April - Card SystemSai SandeepNo ratings yet

- Exide BatteriesDocument5 pagesExide BatteriesAmol KhadkeNo ratings yet

- A Project Report On Exide BatteryDocument72 pagesA Project Report On Exide BatterySourav Roy75% (4)

- A Project Report On Exide BatteryDocument73 pagesA Project Report On Exide BatterySourav RoyNo ratings yet

- Strategic Brand Management: Automobile IndustryDocument5 pagesStrategic Brand Management: Automobile Industryhanishgurnani 2k20umba12No ratings yet

- What Are New Marketing Avenues For Real Estate DevelopersDocument5 pagesWhat Are New Marketing Avenues For Real Estate DevelopersTushar RastogiNo ratings yet

- Driving Business Strategy Through BSC in Large OrganizationsDocument20 pagesDriving Business Strategy Through BSC in Large OrganizationsTushar RastogiNo ratings yet

- Balance Score CardDocument16 pagesBalance Score CardTaslim AliNo ratings yet

- Conflict Management & ResolutionDocument6 pagesConflict Management & ResolutionTushar RastogiNo ratings yet

- SQC 2013 - Exercise Booklet PDFDocument13 pagesSQC 2013 - Exercise Booklet PDFTushar RastogiNo ratings yet

- A Reverse-Innovation PlaybookDocument13 pagesA Reverse-Innovation PlaybookTushar RastogiNo ratings yet

- National:: India-Australia First Bilateral Naval Exercise in 2015Document3 pagesNational:: India-Australia First Bilateral Naval Exercise in 2015Tushar RastogiNo ratings yet

- SNAP 2005 QuestionsDocument14 pagesSNAP 2005 QuestionsTushar RastogiNo ratings yet

- Saudi Arabia to sell more crude to India in JulyDocument3 pagesSaudi Arabia to sell more crude to India in JulyShridhar SrinivasanNo ratings yet

- 01 April 2013Document3 pages01 April 2013Tushar RastogiNo ratings yet

- SNAP 2004 QuestionsDocument21 pagesSNAP 2004 QuestionsAmlandeep NandiNo ratings yet

- CAT 2005 SolutionsDocument13 pagesCAT 2005 SolutionsTushar RastogiNo ratings yet

- Budgetary Arithmetic Fiscal Imprudence and Macroeconomic ImplicationsDocument5 pagesBudgetary Arithmetic Fiscal Imprudence and Macroeconomic ImplicationsTushar RastogiNo ratings yet

- MBA Counselling PPT V3.1Document61 pagesMBA Counselling PPT V3.1Tushar Rastogi100% (1)

- CAT 2006 SolutionsDocument11 pagesCAT 2006 SolutionsTushar RastogiNo ratings yet

- Business Plan for a Small Premium WineryDocument49 pagesBusiness Plan for a Small Premium WineryTushar RastogiNo ratings yet

- CYCLIC Group AppnDocument42 pagesCYCLIC Group AppnTushar RastogiNo ratings yet

- How RSA Works With ExamplesDocument10 pagesHow RSA Works With ExamplesTushar RastogiNo ratings yet

- Motor Vehicles Act 1988Document233 pagesMotor Vehicles Act 1988sriram_iyer_8No ratings yet

- Session 19 Capital StructureDocument43 pagesSession 19 Capital StructureTushar RastogiNo ratings yet

- 12th Five Year Plan - Infra InvestmentDocument22 pages12th Five Year Plan - Infra InvestmentdevaljNo ratings yet

- Carrom RulesDocument13 pagesCarrom RulesTushar RastogiNo ratings yet

- Asian Economies JGBA October2014Document2 pagesAsian Economies JGBA October2014Tushar RastogiNo ratings yet

- Rahul Gandhi's Problem - Why He Can Afford To Be A Loser - FirstpostDocument17 pagesRahul Gandhi's Problem - Why He Can Afford To Be A Loser - FirstpostTushar RastogiNo ratings yet

- A Real Choice in 2014 - The Indian ExpressDocument5 pagesA Real Choice in 2014 - The Indian ExpressTushar RastogiNo ratings yet

- Agri Trade in 2012Document14 pagesAgri Trade in 2012Tushar RastogiNo ratings yet

- Invest in Restaurants. It's Big Money - RediffDocument6 pagesInvest in Restaurants. It's Big Money - Redifftr071092No ratings yet

- Homosexuality Is Criminal Offence, Supreme Court Rules - The Times of IndiaDocument9 pagesHomosexuality Is Criminal Offence, Supreme Court Rules - The Times of IndiaTushar RastogiNo ratings yet

- World Agriculture - Towards 2015 - 2030Document14 pagesWorld Agriculture - Towards 2015 - 2030tr071092No ratings yet

- SC Accuses Sahara Group of Manipulating Courts - The New Indian ExpressDocument3 pagesSC Accuses Sahara Group of Manipulating Courts - The New Indian ExpressTushar RastogiNo ratings yet

- Implementing Cisco UCS Solutions Sample ChapterDocument44 pagesImplementing Cisco UCS Solutions Sample ChapterPackt PublishingNo ratings yet

- P Nagar, Near Ordnance Factory: 0t, R111 KOTA / S T. / CAIDocument2 pagesP Nagar, Near Ordnance Factory: 0t, R111 KOTA / S T. / CAISupradeep GoudNo ratings yet

- Engine Control System: SectionDocument948 pagesEngine Control System: Sectionenrique revecoNo ratings yet

- Fork Lift Truck Training BizHouse - UkDocument3 pagesFork Lift Truck Training BizHouse - UkAlex BekeNo ratings yet

- TWI Control of Welding DistortionDocument12 pagesTWI Control of Welding DistortionClaudia Mms100% (2)

- Beam Analysis BS5950Document229 pagesBeam Analysis BS5950cataiceNo ratings yet

- Vocational Training ProgramDocument6 pagesVocational Training ProgramolabodeogunNo ratings yet

- Design Installation and Operation of Onshore N Offshore PipelinesDocument3 pagesDesign Installation and Operation of Onshore N Offshore Pipelineseke23No ratings yet

- Magnet Field v300 Help Manual en PDFDocument474 pagesMagnet Field v300 Help Manual en PDFSami Abdelgadir MohammedNo ratings yet

- BS 1881 Part 5 1970Document14 pagesBS 1881 Part 5 1970juzarmatinNo ratings yet

- 6.1 Item Code and ReplenishDocument10 pages6.1 Item Code and ReplenishMohamed AnwarNo ratings yet

- Racing Drones Market Key Players, Size, Trends, Opportunities and Growth AnalysisDocument2 pagesRacing Drones Market Key Players, Size, Trends, Opportunities and Growth Analysissurendra choudharyNo ratings yet

- Unitech Metro - SAFE WORK METHOD STATEMENT - CARPENTRYDocument3 pagesUnitech Metro - SAFE WORK METHOD STATEMENT - CARPENTRY'David Tee100% (2)

- CDD Brochure Hospitality 2019 PDFDocument27 pagesCDD Brochure Hospitality 2019 PDFAna BalevaNo ratings yet

- Good Year Case AnalysisDocument2 pagesGood Year Case AnalysisCharit BhattNo ratings yet

- IrvingCC Packet 2011-01-13Document466 pagesIrvingCC Packet 2011-01-13Irving BlogNo ratings yet

- 2018 t3 Mn405 Assignment 1 Mel Syd v1.3Document7 pages2018 t3 Mn405 Assignment 1 Mel Syd v1.3Sarah EvanNo ratings yet

- PV Testing White Paper Harnessing The PotentialDocument20 pagesPV Testing White Paper Harnessing The PotentialphilipnartNo ratings yet

- Study of HR Verticals at Electrosteel SteelsDocument64 pagesStudy of HR Verticals at Electrosteel SteelsAtikna DasNo ratings yet

- Manual Instrucciones Power-One Forza 48-25600 PDFDocument112 pagesManual Instrucciones Power-One Forza 48-25600 PDFPaul Rasmussen100% (1)

- Industrial Profile of Bhavnagar DistrictDocument19 pagesIndustrial Profile of Bhavnagar Districtsiddharth singhNo ratings yet

- PFMEA Import FormatDocument1 pagePFMEA Import FormatMani Rathinam RajamaniNo ratings yet

- Best Seminar Topics For Tech AspirantsDocument8 pagesBest Seminar Topics For Tech Aspirantsramshe singhNo ratings yet

- 2017 05MayMEDocument108 pages2017 05MayMEJanejiraLertpornprasithNo ratings yet

- 200-1013-06-003 RFQ Full Package and High Pressure Coil Design CalculationDocument15 pages200-1013-06-003 RFQ Full Package and High Pressure Coil Design CalculationBilel MahjoubNo ratings yet

- Compressible Flow Presentation Compressible - Flow - Presentation - Chapter7Jane - Chapter7JaneDocument11 pagesCompressible Flow Presentation Compressible - Flow - Presentation - Chapter7Jane - Chapter7JaneAbbas MohajerNo ratings yet

- Approval Form For Material Gate Pass 内部出门证: COD Muhammed Thanzeel 8424503 0580281560Document1 pageApproval Form For Material Gate Pass 内部出门证: COD Muhammed Thanzeel 8424503 0580281560Muhammed ThanzeelNo ratings yet

- Sage015061 PDFDocument13 pagesSage015061 PDFaliNo ratings yet

- Tec PecDocument23 pagesTec PecALI BEN AMORNo ratings yet

- SDLC (Software Development Life Cycle) : by SapnaDocument20 pagesSDLC (Software Development Life Cycle) : by SapnaZerihun Alemayehu100% (1)