Professional Documents

Culture Documents

FORM 16 TITLE

Uploaded by

PunitBeriOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FORM 16 TITLE

Uploaded by

PunitBeriCopyright:

Available Formats

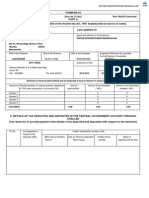

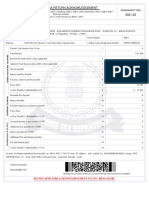

FORM NO.

16

[See rule 31(1)(a)]

Certificate under Section 203 of the Income-tax Act, 1961 for tax deducted at source on salary

Name and address of the Employer

COGNIZANT TECHNOLOGY SOLUTIONS INDIA PRIVATE

LIMITED

5/535, OKKIYAM, OLD MAHABALIPURAM ROAD,

THORAIPAKKAM, CHENNAI - 600097

Tamilnadu

+(91)44-43675000

TaxTeam-India@cognizant.com

Name and address of the Employee

PUNIT BERIWAL

127/1, ANNAPURNA ASHRAM, MASJID BARI STREET, KOLKATA

- 700006 West Bengal

PAN of the Deductor

AAACD3312M

TAN of the Deductor

CHEC02509D

PAN of the Employee

ASKPB1934C

Assessment Year

2014-15

CIT (TDS)

The Commissioner of Income Tax (TDS)

7th Floor, New Block, Aayakar Bhawan, 121 , M.G. Road,

Chennai - 600034

Period with the Employer

To

31-Mar-2014

From

01-Apr-2013

Summary of amount paid/credited and tax deducted at source thereon in respect of the employee

Quarter(s)

Receipt Numbers of original

quarterly statements of TDS

under sub-section (3) of

Section 200

Amount of tax deducted

(Rs.)

Amount of tax deposited / remitted

(Rs.) Amount paid/credited

Q2 IPOXCEUC 441.00 441.00 58372.00

Q4 QQPHNODA 1796.00 1796.00 57703.00

Total (Rs.) 2237.00 2237.00 116075.00

Sl. No.

Tax Deposited in respect of the

deductee

(Rs.)

Book Identification Number (BIN)

Receipt Numbers of Form

No. 24G

DDO serial number in Form no.

24G

Date of transfer voucher

(dd/mm/yyyy)

Status of matching

with Form no. 24G

Total (Rs.)

Sl. No.

Tax Deposited in respect of the

deductee

(Rs.)

Challan Identification Number (CIN)

BSR Code of the Bank

Branch

Date on which Tax deposited

(dd/mm/yyyy)

Challan Serial Number Status of matching with

OLTAS*

1 440.00 0004329 06-09-2013 26200 F

2 1.00 0004329 07-10-2013 77566 F

3 1796.00 0004329 30-04-2014 24845 F

Total (Rs.) 2237.00

PART A

Certificate No. RZWYDIH Last updated on 21-May-2014

Employee Reference No.

provided by the Employer

(If available)

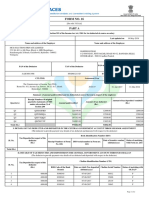

I. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH BOOK ADJUSTMENT

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

II. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Page 1 of 2

1

Certificate Number: RZWYDIH TAN of Employer: CHEC02509D PAN of Employee: ASKPB1934C Assessment Year: 2014-15

I, VINJAMOOR GOPALAN ARAVINDANAYAGI, son / daughter of GOPALAN VINJAMOOR working in the capacity of SENIOR DIRECTOR FINANCE (designation) do

hereby certify that a sum of Rs.2237.00 [Rs. Two Thousand Two Hundred and Thirty Seven Only (in words)] has been deducted and a sum of Rs.2237.00 [Rs. Two

Thousand Two Hundred and Thirty Seven Only] has been deposited to the credit of the Central Government. I further certify that the information given above is true,

complete and correct and is based on the books of account, documents, TDS statements, TDS deposited and other available records.

Verification

Place

Date (Signature of person responsible for deduction of Tax)

Chennai

21-May-2014

SENIOR DIRECTOR FINANCE Designation: Full Name:VINJAMOOR GOPALAN ARAVINDANAYAGI

Notes:

1. Part B (Annexure) of the certificate in Form No.16 shall be issued by the employer.

2. If an assessee is employed under one employer during the year, Part 'A' of the certificate in Form No.16 issued for the quarter ending on 31st March of the financial year shall contain the details

of tax deducted and deposited for all the quarters of the financial year.

3. If an assessee is employed under more than one employer during the year, each of the employers shall issue Part A of the certificate in Form No.16 pertaining to the period for which such

assessee was employed with each of the employers. Part B (Annexure) of the certificate in Form No. 16 may be issued by each of the employers or the last employer at the option of the assessee.

4. To update PAN details in Income Tax Department database, apply for 'PAN change request' through NSDL or UTITSL.

Legend used in Form 16

* Status of matching with OLTAS

Legend Description Definition

U Unmatched

Deductors have not deposited taxes or have furnished incorrect particulars of tax payment. Final credit will be reflected only when payment

details in bank match with details of deposit in TDS / TCS statement

P Provisional

Provisional tax credit is effected only for TDS / TCS Statements filed by Government deductors."P" status will be changed to Final (F) on

verification of payment details submitted by Pay and Accounts Officer (PAO)

O Overbooked

Payment details of TDS / TCS deposited in bank by deductor have matched with details mentioned in the TDS / TCS statement but the

amount is over claimed in the statement. Final (F) credit will be reflected only when deductor reduces claimed amount in the statement or

makes new payment for excess amount claimed in the statement

F Final

In case of non-government deductors, payment details of TDS / TCS deposited in bank by deductor have matched with the payment details

mentioned in the TDS / TCS statement filed by the deductors. In case of government deductors, details of TDS / TCS booked in Government

account have been verified by Pay & Accounts Officer (PAO)

Page 2 of 2

2

Digitally Signed By ARAVINDANAYAGI V G

(Personal)

Date : 22-May-2014

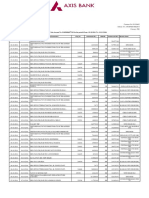

EmpID : 308043 PAN :ASKPB1934C Emp.Name : Punit Beriwal

PART B

Details of Salary paid and any other income and tax deducted

Rs. Rs. Rs.

1. Gross Salary

(a) Salary as per provisions contained in sec.17(1)

(b) Value of perquisites u/s 17(2) (as per Form No. 12BA,

wherever applicable)

(c) Profits in lieu of salary under section 17(3) (as per Form

No. 12BA, wherever applicable)

(d) Total

-

2. Less: Allowance to the extent exempt u/s 10

Allowance Rs.

(a) HRA exemption u/s (10 (13A))

(b) Conveyance Exemption

(c) LTA Exemption

3. Balance (1 - 2)

4. Deductions :

(a) Entertainment allowance

(b) Tax on employment

5. Aggregate of 4(a) and (b)

6. Income chargeable under the head 'Salaries'(3 - 5)

7. Add: Any other income reported by the employee

Income Rs.

-

345,879

345,879

57,675

9,600

-

57,675

9,600

-

-

1,720

278,604

1,720

276,884

(a) Loss on housing property - -

8. Gross total income (6 + 7) 276,884

1

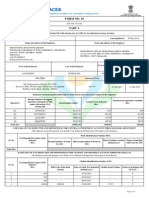

EmpID : 308043 PAN :ASKPB1934C Emp.Name : Punit Beriwal

9. Deductions under Chapter VIA

Rs. Rs. Rs.

(A) Sections 80C, 80CCC and 80CCD

(a) Sections 80C Gross Amount Deductible Amount

Provident Fund 13,842 i)

Life Insurance Premium Paid 9,663 ii)

Total of 80C 23,505 23,505

(b) Sections 80CCC 0

(c) Sections 80CCD - -

(B) Other Sections (e.g. 80E, 80G, 80TTA etc.) under Chapter VIA Gross Amount Qualifying Amount Deductible Amount

Mediclaim Premium (Section 80D) 11,659 i)

11,659

10. Aggregate of deductible amount under Chapter VIA

11. Total Income (8-10) (Rounded off to nearest ten)

12. Tax on total income

14. Education cess @ 3% (on tax computed at S.No. 12)

15. Tax Payable (12+13+14) (Rounded off to nearest ten)

16. Less: Relief under section 89/90 (attach details)

17. Tax payable (15 - 16)

35,164

241,720

2,172

65

2,240

Verification

I VINJAMOOR GOPALAN ARAVINDANAYAGI , son/daughter of Gopalan Vinjamoor working in the capacity of SENIOR

DIRECTOR - FINANCE (designation) do hereby certify that the information given above is true, complete and correct and is based

on the books of account,documents,TDS statements, and other available records.

13. Surcharge -

0

2,240

Place

Date

Designation

Signature of person responsible for deduction of tax

Full Name :

Chennai

SENIOR DIRECTOR - FINANCE VINJAMOOR GOPALAN ARAVINDANAYAGI

19-May-2014

2

EmpID : 308043 PAN :ASKPB1934C Emp.Name : Punit Beriwal

Details of Form 16

EmpID : 308043 Emp Name : Punit Beriwal

Salary as per provisions contained in section 17(1)

Particulars Amount(Rs)

Annual Incentive

Basic

Conveyance Allowance

House Rent Allowance

Medical Reimbursement-payout

Mobile Reimbursement-payout

Special Allowance

Thank you Bonus

30,000

115,350

9,600

68,220

1,250

267

115,192

6,000

Value of perquisites u/s. 17(2)

Particulars Amount(Rs)

Total 345,879

Total -

Overseas Income

Particulars Amount(Rs)

Total -

Place :

Date :

Chennai Full Name : VINJAMOOR GOPALAN ARAVINDANAYAGI

Designation : SENIOR DIRECTOR - FINANCE 19-May-2014

3

You might also like

- Form 16 by Tcs PDFDocument5 pagesForm 16 by Tcs PDFAnonymous utPqL6jA3i25% (4)

- Form 16 PDFDocument5 pagesForm 16 PDFJoshua Hicks100% (1)

- Form 16Document2 pagesForm 16SIVA100% (1)

- Form 16Document4 pagesForm 16Aruna Kadge JhaNo ratings yet

- Form 16-Part A - 2020-2021Document2 pagesForm 16-Part A - 2020-2021Ravi S. Sharma100% (2)

- Form 16 FYbilDocument8 pagesForm 16 FYbilBilalNo ratings yet

- Form 16 PDFDocument3 pagesForm 16 PDFkk_mishaNo ratings yet

- FORM 16 TAX DEDUCTION CERTIFICATEDocument5 pagesFORM 16 TAX DEDUCTION CERTIFICATEJagdeep SinghNo ratings yet

- Form 16 1Document2 pagesForm 16 1Vijay JiíväNo ratings yet

- Accenture Form 16Document7 pagesAccenture Form 16Srikrishna PadmannagariNo ratings yet

- FORM16Document11 pagesFORM16ganeshPVRMNo ratings yet

- Form 16Document6 pagesForm 16CSKNo ratings yet

- Pay Slip ModelDocument1 pagePay Slip ModelAryan ShashiNo ratings yet

- Basha Form 16Document6 pagesBasha Form 16BakiarajNo ratings yet

- Form No. 16: Part ADocument5 pagesForm No. 16: Part AHarish KumarNo ratings yet

- Form 16 20-21 PartaDocument2 pagesForm 16 20-21 PartaTEMPORARY TEMPNo ratings yet

- Geeta - Form 16 A 2022-23Document2 pagesGeeta - Form 16 A 2022-23Sourabh PunshiNo ratings yet

- Wipro Form 16 Details for Aniruddh TiwariDocument6 pagesWipro Form 16 Details for Aniruddh Tiwaribharath50% (2)

- Form No. 16: Part ADocument10 pagesForm No. 16: Part ARAJASHEKAR KYAROLLANo ratings yet

- Sibu Salary Statement Wipro LimitedDocument3 pagesSibu Salary Statement Wipro Limited5 ROINo ratings yet

- Form 26ASDocument3 pagesForm 26ASHarshil MehtaNo ratings yet

- PaySlip-EXC0857 (KARAN PRADIPRAO MAHALLE) - AUG - 2020Document1 pagePaySlip-EXC0857 (KARAN PRADIPRAO MAHALLE) - AUG - 2020Karan Mahalle PatilNo ratings yet

- FORM 16 DETAILSDocument2 pagesFORM 16 DETAILSKushal MalhotraNo ratings yet

- PAYSLIP Cognizant Mar 2018Document1 pagePAYSLIP Cognizant Mar 2018Ajay Chowdary Ajay Chowdary20% (5)

- Form16 - Vinoth Subramaniyan PDFDocument6 pagesForm16 - Vinoth Subramaniyan PDFi netsty BROWSING & TICKETSNo ratings yet

- Form 16 TDS Certificate SummaryDocument2 pagesForm 16 TDS Certificate SummaryPravin HireNo ratings yet

- Form 16 Part - BDocument3 pagesForm 16 Part - BdivanshuNo ratings yet

- Form 16 651746Document4 pagesForm 16 651746Arslan1112No ratings yet

- Income Tax Worksheet For The Financial Year APR-2018 To MAR-2019Document1 pageIncome Tax Worksheet For The Financial Year APR-2018 To MAR-2019svecraoNo ratings yet

- Itr VDocument1 pageItr VcachandhiranNo ratings yet

- Form 16Document2 pagesForm 16sowjanya0% (1)

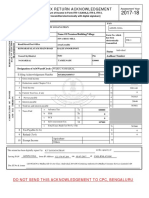

- Indian income tax return acknowledgementDocument1 pageIndian income tax return acknowledgementRajneesh Khichar : MathematicsNo ratings yet

- Tata Consultancy Services PayslipDocument2 pagesTata Consultancy Services PayslipRahimaNo ratings yet

- Form 16 TDS CertificateDocument10 pagesForm 16 TDS CertificateLogeshwaranNo ratings yet

- BSNL Salary Slip 1Document1 pageBSNL Salary Slip 1empirecot50% (2)

- Form 16Document2 pagesForm 16robin0903No ratings yet

- Aug PDFDocument1 pageAug PDFDhirendraNo ratings yet

- Form 16 FY 18-19 PART - ADocument2 pagesForm 16 FY 18-19 PART - Asai venkataNo ratings yet

- AGICL AXIS Bank Statement MO OCT 16 PDFDocument6 pagesAGICL AXIS Bank Statement MO OCT 16 PDFSagar AsatiNo ratings yet

- Salary SlipDocument1 pageSalary SlipJames Jones100% (1)

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageAKASH KUMARNo ratings yet

- Payslip MAY 2019 PDFDocument1 pagePayslip MAY 2019 PDFKushal Malhotra100% (1)

- Sahrudaya Health Care Private LimitedDocument1 pageSahrudaya Health Care Private LimitedBabu MallelaNo ratings yet

- Form 16 CertificateDocument3 pagesForm 16 CertificateGanesh LohakareNo ratings yet

- Formats for Company Payslips and LettersDocument1 pageFormats for Company Payslips and LettersArchana Dalvi BhandareNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMahesh JadhavNo ratings yet

- Payslip details for Mr. Abhilash EDocument1 pagePayslip details for Mr. Abhilash Eabhilash eNo ratings yet

- Payslip 1Document1 pagePayslip 1Tamoghna DeyNo ratings yet

- Payslip SummaryDocument2 pagesPayslip SummaryVyas Keshini100% (1)

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountAnkur murarkaNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountTinisharmaNo ratings yet

- 126687Document2 pages126687DiptiNo ratings yet

- January PayslipDocument1 pageJanuary PayslipPothnak SukrithNo ratings yet

- Shashank Kantheti Hyd 12 13Document5 pagesShashank Kantheti Hyd 12 13kshashankNo ratings yet

- 14374752Document2 pages14374752Anshul MehtaNo ratings yet

- Ahrpv0731f 2013-14Document2 pagesAhrpv0731f 2013-14Shiva KumarNo ratings yet

- Samsung India Electronics Pvt. LTD.: Signature Not VerifiedDocument7 pagesSamsung India Electronics Pvt. LTD.: Signature Not VerifiedGajendra Singh RaghavNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- PerpetuityDocument1 pagePerpetuityPunitBeriNo ratings yet

- EggDocument1 pageEggPunitBeriNo ratings yet

- Domestic StudentsDocument2 pagesDomestic StudentsPunitBeriNo ratings yet

- Domestic StudentsDocument2 pagesDomestic StudentsPunitBeriNo ratings yet

- LithiDocument1 pageLithiPunitBeriNo ratings yet

- Presentation 1Document1 pagePresentation 1PunitBeriNo ratings yet

- Sad moments in lifeDocument1 pageSad moments in lifePunitBeriNo ratings yet

- Oligopolu Market StructureDocument1 pageOligopolu Market StructurePunitBeriNo ratings yet

- Slide SCM PPT 2Document3 pagesSlide SCM PPT 2PunitBeriNo ratings yet

- 17Document27 pages17PunitBeriNo ratings yet

- Indian Pharma Ndustryie: in Its Ninw Fkbjkew Phas'Document1 pageIndian Pharma Ndustryie: in Its Ninw Fkbjkew Phas'PunitBeriNo ratings yet

- Apple ExportDocument1 pageApple ExportPunitBeriNo ratings yet

- Presentation 1Document1 pagePresentation 1PunitBeriNo ratings yet

- Export from India goodsDocument1 pageExport from India goodsPunitBeriNo ratings yet

- TeaDocument1 pageTeaPunitBeriNo ratings yet

- BananaDocument1 pageBananaPunitBeriNo ratings yet

- Apple export introDocument1 pageApple export introPunitBeriNo ratings yet

- Mangoes ExportDocument1 pageMangoes ExportPunitBeriNo ratings yet

- Mangoes ExportDocument1 pageMangoes ExportPunitBeriNo ratings yet

- Mangoes ExportDocument1 pageMangoes ExportPunitBeriNo ratings yet

- PapayaDocument1 pagePapayaPunitBeriNo ratings yet

- StatsDocument1 pageStatsPunitBeriNo ratings yet

- Ato GattDocument5 pagesAto GattPunitBeriNo ratings yet

- Bullwhip EffectDocument14 pagesBullwhip EffectPunitBeri100% (2)

- Constituent of Symbiosis International (Deemed University) : Accredited by NAAC With A' GradeDocument46 pagesConstituent of Symbiosis International (Deemed University) : Accredited by NAAC With A' GradePunitBeri100% (1)

- Mahesh 5 SemDocument56 pagesMahesh 5 SemManjunath HagedalNo ratings yet

- DB 45 PDFDocument120 pagesDB 45 PDFzaheeruddin_mohdNo ratings yet

- A Project Report On Direct TaxDocument53 pagesA Project Report On Direct Taxrani26oct84% (44)

- Cost of Capital Components Debt Preferred Common Equity WaccDocument55 pagesCost of Capital Components Debt Preferred Common Equity Waccfaisal_stylishNo ratings yet

- Deploy Jakabare Sub CableDocument2 pagesDeploy Jakabare Sub CableSandi PutraNo ratings yet

- SEC BS File 3Document137 pagesSEC BS File 3the kingfishNo ratings yet

- Suryavanshi 5141400310Document52 pagesSuryavanshi 5141400310HitechSoft HitsoftNo ratings yet

- Indiafirst Smartsaveplan Onepager 19122013Document2 pagesIndiafirst Smartsaveplan Onepager 19122013N-1397-10 KANISHKA Y HARDASANINo ratings yet

- ACCA F3 - FA Support Material by FBTDocument102 pagesACCA F3 - FA Support Material by FBTMuhammad Idrees100% (2)

- 222 Executive Borad Meeting of NHADocument52 pages222 Executive Borad Meeting of NHAHamid NaveedNo ratings yet

- IAS 37 ProvisionsDocument9 pagesIAS 37 ProvisionsfurqanNo ratings yet

- Template Investment AgreementDocument27 pagesTemplate Investment AgreementAnonymous Azxx3Kp9No ratings yet

- SanDisk Corporation Equity Valuation AnalysisDocument6 pagesSanDisk Corporation Equity Valuation AnalysisBrant HammerNo ratings yet

- MOMENTRIX Script OnBoardingDocument9 pagesMOMENTRIX Script OnBoardingKelli J Smith ConsultingNo ratings yet

- Nike Case Analysis PDFDocument9 pagesNike Case Analysis PDFSrishti PandeyNo ratings yet

- Welcome to Pass4Sure Mock TestDocument28 pagesWelcome to Pass4Sure Mock TestManan SharmaNo ratings yet

- Prospectus Axway English Version FinalDocument187 pagesProspectus Axway English Version FinalhpatnerNo ratings yet

- 09 FAR CompletionDocument53 pages09 FAR CompletionChristopher Diaz BronNo ratings yet

- Cfa2 QuestionsDocument28 pagesCfa2 QuestionsGabriel AmerNo ratings yet

- Pfizer, Inc: Company ValuationDocument15 pagesPfizer, Inc: Company ValuationPriyanka Jayanth DubeNo ratings yet

- Ethics Predetermined Overhead Rate and Capacity Pat MirandaDocument3 pagesEthics Predetermined Overhead Rate and Capacity Pat MirandaMargaret CabreraNo ratings yet

- What is General Insurance in 40 CharactersDocument249 pagesWhat is General Insurance in 40 CharactersSandhya TambeNo ratings yet

- Princeton Financial Math PDFDocument46 pagesPrinceton Financial Math PDF6doitNo ratings yet

- Econ 102 S 05 X 2Document9 pagesEcon 102 S 05 X 2hyung_jipmNo ratings yet

- Difference Between BCG and GE Matrices (With Comparison Chart) - Key DifferencesDocument12 pagesDifference Between BCG and GE Matrices (With Comparison Chart) - Key DifferencesNaman Bajaj100% (1)

- Converged Systems Sales PlaybookDocument12 pagesConverged Systems Sales PlaybookPeter Stone100% (3)

- INSURANCE MARKET STATSDocument31 pagesINSURANCE MARKET STATSKristi DuranNo ratings yet

- PgcilDocument3 pagesPgcilKaran BajpaiNo ratings yet

- Ar2018 PDFDocument102 pagesAr2018 PDFNurul JannahNo ratings yet

- An Introduction To Money: MacroeconomicsDocument3 pagesAn Introduction To Money: Macroeconomicsameen17aNo ratings yet