Professional Documents

Culture Documents

Equity Compensation - Looking Beyond Legality

Uploaded by

abhishek1234560 ratings0% found this document useful (0 votes)

10 views3 pagesmanagement

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentmanagement

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views3 pagesEquity Compensation - Looking Beyond Legality

Uploaded by

abhishek123456management

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

Focus Areas Managing and Rewarding Performance

Equity Compensation - Looking Beyond Legality

Jan 15th 2011

By Harshu Ghate

ESOPs can emerge as vital compensation tool to attract and retain talent if design of the program is

aligned to companys need and the plan is communicated well to employees

Equity based compensation, popularly known in India as ESOPs, gets talked about quite often in the

Board meetings, management huddles and also sometimes in HR conferences. Most of the times, these

discussions hover around the legal aspects, the tax impact and off late also the accounting charge.

Invariably, all the interactions that one hears on this subject include everything but the compensation

angle of ESOPs. This instrument is still perceived as a legal and financial instrument, which is very

complicated to understand given its own jargon and terminology. Unfortunately, many HR professionals

also have the same view. This instrument needs to be looked at as a potent compensation tool to attract

and retain talent.

For ESOPs to be sold to employees as a part of compensation, it is critical that the entire Plan is

designed, communicated and administered like any other component of compensation. It is very

common to see the HR function getting involved in ESOPs only till the Plan is designed and rolled out to

employees. The baton then is usually handed over to either Finance or Legal team. There is very little

effort invested in communication and administration of the Plan. Interestingly, the success or otherwise

of an ESOP plan is largely dependent on how well the Plan is understood by the employees

(communication) and whether the process for them to encash their value is streamlined and hassle free

(administration). If at the time of granting of Options, employees are only told about the enormous

value of what they are getting but later they encounter difficulties in realizing their gains, the entire HR

exercise of implementing ESOPs would actually boomerang, as it does in many cases.

Customized design

Even while designing a Plan, the tendency is to follow a publicized success story, without factoring in the

specific needs of a sector or the company. Some companies follow the industry leader often ignoring

that it is much larger and well established as compared to you. It would greatly benefit if you were to

design an option which is specific to your needs and profile of the employees you plan to cover. Many

are not aware that it is possible (and perfectly legal) to design different option structures for employees

of different levels. For instance, one can have options for senior management at the market price with

performance based vesting, whereas for the middle and junior management they could be at discount

with time based vesting. ESOPs structured with performance based vesting are essentially another form

of variable pay whereas with time based vesting they are essentially deferred pay.

Effective communication

The companies usually go overboard while communicating the attractiveness of ESOPs. While ESOPs do

provide a significant upside potential, there are situations and periods when ESOPs may not look that

attractive. Even though usually such periods (falling stock markets for instance or a bad business year)

are a passing phase, it is important for the employees to know about them. The tendency of the

employees to perceive ESOPs as a pendulum (swinging with the stock markets) needs to be rectified by

emphasizing the long term nature of the instrument. Many of us would have experienced that the same

options which were underwater not more than a year and half ago are now worth a fortune. Given a

normal option life of five to six years, this was a small period of aberration. The heartburn that the

employees felt during those days could have been avoided if the long term element of this

compensation was adequately communicated.

Communication is an on-going exercise. As a part of the HR function, one would have enough

opportunities and occasions to interact with employees. It could be Town halls, one on ones, open

house forums, et al. ESOPs, their valuations, information on business performance, recent changes in

regulations and their impact, et al, should form part of the agenda at such events. Such communication

is all the more critical when the going is not good and option values are sliding down. Unlisted

companies have a different challenge of communicating the value and appreciation when there are no

market quotes. Involvement of HR is extremely critical during the entire Plan period.

While talking about communication, an important side issue that is worth a discussion is whether ESOPs

are only about compensation. Do we grant ESOPs just to reward employees? One of the top three stated

objectives of ESOPs is to encourage employee ownership. Does this objective go beyond compensation?

When we say employee ownership, we are talking about employees as owners. It means that

employees have to think like owners would in a given business or economic situation. They have to take

similar risks like an owner would and take a bad year or a failed business decision in a stride and move

on with optimism and positive frame of mind. This is easier said than done. A well thought of and

structured communication program is essential to bring about this change in the employees mindset

and cultivate their behavior.

Last mile process hiccups

Coming back, if ESOPs are to be accepted as a potent compensation tool by the employees, it is crucial

to streamline the process for them to encash their value. At the end of the day, it is the cash in hand

that the employees will be checking. If the process to get the cash is fraught with delays and market

uncertainties, it will drive the employees away. The challenges here are different for listed and unlisted

companies. In case of listed companies, the challenge is not about the visibility of the value but about its

realization. Most of us believe that if the companys shares are quoted, the realization of the gains is not

a big issue. However, thats not true thanks to some of the regulations and procedures. Let us take the

following example:

Every listed company is required to list the ESOP shares separately as and when they are allotted. The

shares so allotted to employees can be traded in the market only after listing. The employee needs to be

communicated about the date of listing so that he can trade. So we are talking about four relevant dates

date of exercise, date of allotment, date of listing and finally the date on which he/she can trade (after

listing is communicated to him/her). In the example given above, the time lag between the date of

exercise and date of receipt of cash is close to one month. One irritant here is the shere time lag but the

other and more important one is the market risk, which the employee takes during this period. Given

the price movements in this example, the employee hoped to pocket Rs. 3,50,000 post tax when he

chose to exercise. In reality though, he is out of pocket by Rs. 50,000 by the time he could sell the

shares. After all the hard work that one does in communicating and educating the employee and

generating the enthusiasm, it would be very frustrating if the employee were to shell out cash instead of

earning a bounty. Very often, HR teams express helplessness citing the legal process and time lags.

Usually the buck is passed to the Finance or Legal teams who handle the allotment and listing process.

Both the bottlenecks, time lag and market uncertainty, can be addressed completely if the company

were to follow the practices followed globally, namely cashless exercise and same day sale. Use of

technology to facilitate on-line exercises and payments, email alerts and pop ups will help in reducing

time lags. It is also important to allot ESOP shares more frequently than the usual monthly or quarterly

schedules.

Trust route can be very effectively used to ensure availability of listed shares on the day when

employees exercise. It is possible to bring down this time lag to less than three days. This will lead to

minimal market risk.

In case of unlisted companies, the challenge is visibility of the share price. But the bigger challenge is

how to provide liquidity to the employees. It is important to spell out the alternative options the

company would explore to ensure liquidity of the shares. Some of the common choices used are buying

by the investors or promoters. Rarely, buy back commitment from the company is provided. In case of

broad based coverage of employees, a regulated internal market place should also be explored.

As the process owner, HR is the key stakeholder in making ESOPs successful. If ESOPs are to be accepted

enthusiastically by the employees as the sought-after compensation, it will have to be ensured that the

entire experience of owning an ESOP is as enjoyable and rewarding as the cash it generates. HR

managers should ensure that ESOPs are not looked as a legal instrument with complexities but a user-

friendly and attractive component of compensation.

Harshu Ghate is Co-Founder & Managing Director, ESOP Direct

0 Comment

You might also like

- 1.class 7 Geography Worksheet OneDocument11 pages1.class 7 Geography Worksheet Oneabhishek123456No ratings yet

- Law and Social ChangeDocument8 pagesLaw and Social Changeabhishek123456No ratings yet

- 2.class 7 Physics Worksheet TwoDocument3 pages2.class 7 Physics Worksheet Twoabhishek123456No ratings yet

- The New Management Challenge Leading Different GenerationsDocument2 pagesThe New Management Challenge Leading Different Generationsabhishek123456No ratings yet

- The Power of AttractionDocument5 pagesThe Power of Attractionabhishek123456No ratings yet

- Mr Collins' proposal rejectedDocument5 pagesMr Collins' proposal rejectedabhishek123456No ratings yet

- Vegetable Garden CalendarDocument7 pagesVegetable Garden Calendarabhishek123456No ratings yet

- The People Productivity PuzzleDocument3 pagesThe People Productivity Puzzleabhishek123456No ratings yet

- The Future of Talent ManagementDocument7 pagesThe Future of Talent Managementabhishek123456No ratings yet

- The Industry ViewDemand-Supply MismatchDocument2 pagesThe Industry ViewDemand-Supply Mismatchabhishek123456No ratings yet

- The Mortal's Guide To Surviving M&AsDocument3 pagesThe Mortal's Guide To Surviving M&Asabhishek123456No ratings yet

- The Greatness ChallengeDocument2 pagesThe Greatness Challengeabhishek123456No ratings yet

- The Management & Leadership ConundrumDocument3 pagesThe Management & Leadership Conundrumabhishek123456No ratings yet

- The New ROI Return On IntangiblesDocument4 pagesThe New ROI Return On Intangiblesabhishek123456No ratings yet

- The Future of Ecological LeadershipDocument2 pagesThe Future of Ecological Leadershipabhishek123456No ratings yet

- The Challenge of Disciplined ManagementDocument5 pagesThe Challenge of Disciplined Managementabhishek123456No ratings yet

- Structured Assessments Will Deliver ROIDocument3 pagesStructured Assessments Will Deliver ROIabhishek123456No ratings yet

- Strategy and Execution - Essential Skills For A Modern LeaderDocument4 pagesStrategy and Execution - Essential Skills For A Modern Leaderabhishek123456No ratings yet

- Tata Teleservices The Values NetworkDocument1 pageTata Teleservices The Values Networkabhishek123456No ratings yet

- Talent Strategy No More A Supplementary TaskDocument2 pagesTalent Strategy No More A Supplementary Taskabhishek123456No ratings yet

- Small Is BeautifulDocument2 pagesSmall Is Beautifulabhishek123456No ratings yet

- Talent Management Is Key To Building A Performance CultureDocument2 pagesTalent Management Is Key To Building A Performance Cultureabhishek123456No ratings yet

- Talent AdvocacyDocument4 pagesTalent Advocacyabhishek123456No ratings yet

- TelecomDocument1 pageTelecomabhishek123456No ratings yet

- Talent Strategy No More A Supplementary TaskDocument2 pagesTalent Strategy No More A Supplementary Taskabhishek123456No ratings yet

- Sunil Bharti Mittal - The Game ChangerDocument3 pagesSunil Bharti Mittal - The Game Changerabhishek123456No ratings yet

- Stable Leadership Is Very ImportantDocument2 pagesStable Leadership Is Very Importantabhishek123456No ratings yet

- Smarter HR Deploying Technology To Deliver ResultsDocument3 pagesSmarter HR Deploying Technology To Deliver Resultsabhishek123456No ratings yet

- Talent & Organization Challenges in M&a An Indian PerspectiveDocument6 pagesTalent & Organization Challenges in M&a An Indian Perspectiveabhishek123456No ratings yet

- Strategy and Execution - Essential Skills For A Modern LeaderDocument4 pagesStrategy and Execution - Essential Skills For A Modern Leaderabhishek123456No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Calculating present value of lease payments and journal entriesDocument8 pagesCalculating present value of lease payments and journal entriesraihan aqilNo ratings yet

- PB1.3 CH1 Using NumbersDocument22 pagesPB1.3 CH1 Using NumbersGadgetGlitchKillNo ratings yet

- Course List - Minor From Other Kulliyyahs-CentresDocument5 pagesCourse List - Minor From Other Kulliyyahs-CentresAzrin SaediNo ratings yet

- Lesson 6 - Price LevelDocument17 pagesLesson 6 - Price LevelMuktesh SinghNo ratings yet

- (2013 Pattern) PDFDocument77 pages(2013 Pattern) PDFamNo ratings yet

- Group Assignment AccountingDocument3 pagesGroup Assignment Accountingkow kai lynnNo ratings yet

- Barber Shop Business PlanDocument25 pagesBarber Shop Business PlanStephen FrancisNo ratings yet

- Reclassification AdjustmentsDocument3 pagesReclassification AdjustmentsRanilo HeyanganNo ratings yet

- Principles of Corporate PersonalityDocument27 pagesPrinciples of Corporate PersonalityLusajo Mwakibinga100% (1)

- Ministry of Finance and Financiel Services Joint Communiqué On Mauritius LeaksDocument4 pagesMinistry of Finance and Financiel Services Joint Communiqué On Mauritius LeaksION NewsNo ratings yet

- 20 Cube El (Final)Document20 pages20 Cube El (Final)ankitNo ratings yet

- Irctcs E Ticketing Service Electronic Reservation Slip (Personal User)Document2 pagesIrctcs E Ticketing Service Electronic Reservation Slip (Personal User)descrocNo ratings yet

- Letters of Credit-1Document42 pagesLetters of Credit-1Glace OngcoyNo ratings yet

- Beauty SalonDocument6 pagesBeauty SalonsharatchandNo ratings yet

- Credit Rating Changes and Stock Market Reaction: The Impact of Investor SentimentDocument30 pagesCredit Rating Changes and Stock Market Reaction: The Impact of Investor SentimenttavaxoNo ratings yet

- 2020-08-31 - Best Practices For Electrifying Rural Health Facilities - FinalDocument54 pages2020-08-31 - Best Practices For Electrifying Rural Health Facilities - FinalAdedimeji FredNo ratings yet

- Sensitivity Analysis: 1. Revenue Sensitivity: Major Inputs To The Revenue Estimation AreDocument3 pagesSensitivity Analysis: 1. Revenue Sensitivity: Major Inputs To The Revenue Estimation AreVn RaghuveerNo ratings yet

- Solution Manual For International Accounting and Multinational Enterprises 6th Edition by Lee H Radebaugh Sidney J Gray Ervin L BlackDocument5 pagesSolution Manual For International Accounting and Multinational Enterprises 6th Edition by Lee H Radebaugh Sidney J Gray Ervin L BlackMarjorie Rosales100% (39)

- Chapter 4 Consolidated Financial Statements Piecemeal AcquisitionDocument11 pagesChapter 4 Consolidated Financial Statements Piecemeal AcquisitionKE XIN NGNo ratings yet

- PD 1517Document8 pagesPD 1517Enp Gus AgostoNo ratings yet

- Partnership - Admission of Partner - DPP 03 (Of Lecture 05) - (Kautilya)Document9 pagesPartnership - Admission of Partner - DPP 03 (Of Lecture 05) - (Kautilya)DevanshuNo ratings yet

- Beda Notes - Credit TransactionsDocument18 pagesBeda Notes - Credit TransactionsMaan ElagoNo ratings yet

- 63 Useful Exam Formulas for ACCA Paper F9Document4 pages63 Useful Exam Formulas for ACCA Paper F9Muhammad Imran UmerNo ratings yet

- Open Banking Api Service FactsheetDocument2 pagesOpen Banking Api Service FactsheetswiftcenterNo ratings yet

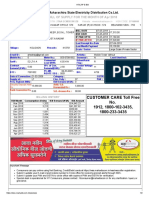

- LT bill details for mobile towerDocument2 pagesLT bill details for mobile towerAMolNo ratings yet

- Analytical Tools - End Term - Tri 3 Set 1Document9 pagesAnalytical Tools - End Term - Tri 3 Set 1wikiSoln blogNo ratings yet

- Applied Economics PPT 3Document9 pagesApplied Economics PPT 3Angel AquinoNo ratings yet

- Alveo Trading API - Apiary FundDocument2 pagesAlveo Trading API - Apiary Fundfuturegm2400No ratings yet

- Edristi Current Affairs Jan 2017 V2Document161 pagesEdristi Current Affairs Jan 2017 V2dassreerenjiniNo ratings yet

- Truth in Lending Act (Ayn Ruth Notes)Document3 pagesTruth in Lending Act (Ayn Ruth Notes)Ayn Ruth Zambrano TolentinoNo ratings yet