Professional Documents

Culture Documents

Assignment TOTAL Company

Uploaded by

Lao Sophorn0%(1)0% found this document useful (1 vote)

239 views11 pagesNational University of Management A case study on Strategic management TOTAL Company. National university of management, london. Case study focuses on Company history, products and services, customers, Strategic goal, vision, mission and values.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentNational University of Management A case study on Strategic management TOTAL Company. National university of management, london. Case study focuses on Company history, products and services, customers, Strategic goal, vision, mission and values.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0%(1)0% found this document useful (1 vote)

239 views11 pagesAssignment TOTAL Company

Uploaded by

Lao SophornNational University of Management A case study on Strategic management TOTAL Company. National university of management, london. Case study focuses on Company history, products and services, customers, Strategic goal, vision, mission and values.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 11

National University of Management

A case Study on Strategic Management

TOTAL Company

Group members:

1. Ky Sophan

2. Khun Linna

3. Pheng Chheanghong

4. Vong Rada

5. Lao Sophorn

6. Ouk Chandaravuth

7. Touch Chamrong

8. Sim Pheak

9. So Sokfai

July 2014

A case Study on Strategic Management

TOTAL Company

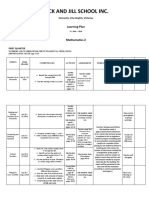

Table of Contents

I. General Overview of the Company ................................................................... 3

Company history ............................................................................................ 3

Major products and services ............................................................................ 3

Customers ..................................................................................................... 3

Strategic goal, vision, mission and values .......................................................... 3

Current corporate and business strategy ........................................................... 4

Major facing problems..................................................................................... 4

II. Environmental Analysis ................................................................................. 4

1) External Environment ................................................................................. 4

2) Internal Environment .................................................................................. 5

3) Construction of Matrixes: ............................................................................ 5

3.1. External Factors Evaluation Matrix (EFE Matrix) ........................................ 5

3.2. Internal Factor Evaluation Matrix (IFE Matrix) ........................................... 6

3.3. Internal and External Matrix (IE Matrix) ................................................... 6

3.4. Strategic Position Action Evaluation Matrix (SPACE Matrix) ......................... 7

3.5. SWOT Matrix ........................................................................................ 8

III. Conclusion and Recommendation ................................................................ 9

Conclusion ..................................................................................................... 9

Recommendation ......................................................................................... 10

Reference .................................................................................................... 10

Appendix ..................................................................................................... 10

TOTAL Company

A case Study on Strategic Analysis

I. General Overview of the Company

Company history

TOTAL S.A., a French socit anonyme (limited company) incorporated on March 28,

1924, together with its subsidiaries and affiliates, is the fifth largest publicly-traded

integrated international oil and gas company in the world

1

.

With operations in more than 130 countries, TOTAL has activities in every sector of

the oil industry: including in the upstream (oil and gas exploration, development and

production, liquefied natural gas) and downstream (refining, petrochemicals, specialty

chemicals, the trading and shipping of crude oil and petroleum products, marketing).

In addition, TOTAL operates in the power generation and renewable energy sectors

and has equity stakes in coal mines.

Major products and services

Oil and gas (Petrol, fluid, natural gas)

Specialty chemicals (Rubber)

Renewable energies (Solar, biomass)

Trading and Transportation

Marketing and Service Stations

2

Customers

Manufacturing

Transportation

Aircrafts

Consumers

Strategic goal, vision, mission and values

Vision:

Total's strategic vision, which combines performance and responsibility in an

integrated business model, coincides with rising energy demand and new

environmental challenges.

Mission:

To responsibly enable as many people as possible to access energy on a continent where demand

is constantly growing by focusing on three basic cornerstones:

Ethics

Safety

Corporate social responsibility (CSR)

1

Registration document 2013, Total S.A

2

http://www.total.com/en/energies-expertise/oil-gas

Current corporate and business strategy

TOTALs activities lie at the heart of the two biggest challenges facing the world now and in future:

energy supply and environmental protection. The Groups responsibility as an energy producer is

to provide optimum management of these twin imperatives.

TOTALs strategy, the implementation of which is based on a model for sustainable growth

combining the acceptability of operations with a profitable investment program, aims at:

- expanding hydrocarbon exploration and production activities and strengthening its

worldwide position as one of the global leaders in the natural gas and LNG markets;

- progressively expanding energy solutions and developing new energies to complement oil

and gas;

- adapting its refining and petrochemical base to market changes, focusing on a small

number of large, competitive platforms and maximizing the advantages of integration;

- developing its petroleum product marketing business, in particular in Africa, Asia and the

Middle East, while maintaining the competitiveness of its operations in mature areas; and

- pursuing research and development to develop clean sources of energy, contributing to

the moderation of the demand for energy, and participating in the effort against climate

change.

Major facing problems

Totals Controversies are as the following:

TOTAL met some challenges in operating in some countries such as Malta, Myanmar,

Italia, Iraq, Iran. Those challenges are bribe commission from bidding and tenders,

secure contract,

II. Environmental Analysis

1) External Environment

List of opportunities:

- Increasing fuel/oil price

- Increasing natural gas market

- More oil well discoveries

- Expand export market

- Increasing mobility of labor, capital and technology

- Demand shifts for renewable energy

List of threats:

- Government regulations

- High Competition

- Hybrid cars replacing petrol and diesel cars

- Depletion of natural energy resources.

- Disruption in gas supply

- OPEC restrictions.

2) Internal Environment

List of strengths:

- Strong corporate governance

- Strong corporate culture and management

- Strong on human resource, multi-cultural nations, there are 99,000 employees

in over 130 countries (include 31% of women)

3

- Strong corporate branding and marketing

- Financial strengths: Revenues EUR189,5 Billion; Net debt to Equity Ratio: 0.23

(2011), 0.22 (2012), 0.23 (2013); ROE: 19% (2011), 18%(2012), 15%

(2013)

4

- Standard of operation and environment: ISO14001

5

- Operation and marketing in more than 130 counties with 15,551 service

stations

6

- 5

th

ranked international oil company

- Research and development investment $7.1 Billions

- Involve more in corporate social responsibility

7

List of weaknesses:

- Sale decreased 5.23% in 2013, ROE decreased at 16.67% in 2013

8

- Total number of sites operated by the Group decreased from 867 to 858

9

3) Construction of Matrixes:

3.1. External Factors Evaluation Matrix (EFE Matrix)

Key External Factors Weight Rating

Weighted

score

Opportunities

Increasing fuel/oil price 0.05 2 0.10

Increasing natural gas market 0.10 3 0.30

More oil well discoveries 0.05 2 0.10

Expand export market 0.10 3 0.30

Increasing mobility of labor, capital and technology 0.06 3 0.18

Demand shifts for renewable energy 0.05 1 0.05

Threats

Government regulations 0.10 3 0.30

High Competition 0.20 3 0.60

Hybrid cars replacing petrol and diesel cars 0.05 1 0.05

Depletion of natural energy resources 0.10 3 0.30

Disruption in gas supply 0.04 3 0.12

3

Total at a Glance 2013, TOTAL

4

http://csr-analysts.total.com/key-indicators/economic

5

http://csr-analysts.total.com/key-indicators/environmental

6

Total at a Glance 2013

7

CSR Report 2013, Total company

8

http://csr-analysts.total.com/key-indicators/economic

9

http://csr-analysts.total.com/key-indicators/environmental

OPEC restrictions 0.10 3 0.30

Total Score 1.00 2.70

3.2. Internal Factor Evaluation Matrix (IFE Matrix)

Key Internal Factors Weight Rating

Weighted

score

Strengths

Strong corporate governance 0.08 4 0.32

Strong corporate culture and management 0.08 4 0.32

Strong on human resource, multi-cultural nations, there

are 99,000 employees in over 130 countries (include

31% of women)

0.09 4 0.36

Strong corporate branding and marketing 0.09 4 0.36

Financial strengths: Revenues EUR189,5 Billion; Net debt

to Equity Ratio: 0.23 (2011), 0.22 (2012), 0.23 (2013);

ROE: 19% (2011), 18%(2012), 15% (2013)

0.10 4 0.40

Standard of operation and environment: ISO14001 0.09 3 0.27

Operation and marketing in more than 130 counties with

15,551 service stations

0.10 3 0.30

5th ranked international oil company 0.10 3 0.30

Research and development investment $7.1 Billions 0.10 3 0.30

Involve more in corporate social responsibility 0.05 3 0.15

-

Weaknesses

Sale decreased 5.23% in 2013, ROE decreased at

16.67% in 2013

0.08 3 0.24

Total number of sites operated by the Group decreased

from 867 to 858

0.04 3 0.12

Total Score 1.00 3.44

3.3. Internal and External Matrix (IE Matrix)

EFE = 2.70 IFE = 3.44

E

F

E

3

2

1

IFE

4 3 2 1

I

II III

IV

V VI

VII

VIII IX

3.4. Strategic Position Action Evaluation Matrix (SPACE Matrix)

Strategic Position Rating

Financial strength (FA) +

Financial strengths:

Revenues: 189,542 (2013), 200,061 (2012), 184,693 (2011)

6

Decreased in ROE by 22% in 2013 4

Decreased in ROA by 21% in 2013 4

Earnings per share decreased by 21% in 2013. 3

Total assets growth rate: 1% (2013), 5% (2012) 5

Liquidity:

Current ratio: 1.37 (2013), 1.38 (2012), 1.36 (2011)

Quick ratio: 0.33 (2013), 0.32 (2012), 0.30 (2011)

Debt to equity: 1.32( 2013), 1.36 (2012), 1.40 (2011)

4

Decreased in growth rate by (0.05) in 2013 4

Average scores 4.28

Environmental Stability (ES) -

Productions disruptions due to political crisis -2

Low bargaining power -1

Technological change from fuel to renewable energy -3

Barriers to entry -1

Competitive pressure -2

Product demand -1

The fluctuation of oil price affects business environment -3

The economic environment is unstable especially in under developing

countries.

-3

Natural disasters -3

Average scores -2.11

Competitive Advantage (CA) -

Market share among the largest marketers in Western Europe, No. 1

marketer in Africa

10

-1

Product quality -2

Product life cycle -1

Customer loyalty, more than 3 million customers stop by TOTALs retail

outlets every day.

11

-1

Technological advantage High tech for industry -1

Control over supply chain and distribution operation over 130 countries

worldwide.

-1

Average scores -1.17

Industry Strength (IS) +

Low threat of substitutes 6

Growth potential 5

Profit potential 5

Financial stability 5

Technological know-how 4

Resource utilization 4

Capital intensify 5

Ease of entry into market 6

10

Registration document 2013, TOTAL S.A

11

Total at a Glance 2013, Total S.A

Average scores 5.00

X axis: CA + IS = -1.17 + 5.00 = 3.83

Y axis: FA + ES = 4.28 2.11 = 2.17

3.5. SWOT Matrix

S

S1. Strong corporate governance

S2. Strong corporate culture and

management

S3. Strong on human resource, multi-

cultural nations, there are 99,000

employees in over 130 countries

(include 31% of women)

S4. Strong corporate branding and

marketing

S5. Financial strengths: Revenues

EUR189,5 Billion; Net debt to Equity

Ratio: 0.23 (2011), 0.22 (2012), 0.23

(2013); ROE: 19% (2011),

18%(2012), 15% (2013)

S6. Standard of operation and

environment: ISO14001

W

W1. Total number

of sites operated

by the Group

decreased from

867 to 858

W2. Sale

decreased 5.23%

in 2013, ROE

decreased at

16.67% in 2013

FA

Conservative +6 Aggressive

+5

+4

+3

+2

CA +1 IS

-6 -5 -4 -3 -2 -1 +1 +2 +3 +4 +5 +6

-2

-3

-4

-5

Defensive -6 Competitive

ES

S7. Operation and marketing in more

than 130 counties with 15,551 service

stations

S8. 5th ranked international oil

company

S9. Research and development

investment $7.1 Billions

S10. Involve more in corporate social

responsibility

Opportunities

O1. Increasing fuel/oil

price

02. Increasing natural

gas market.

03. Increasing mobility

of labor, capital and

technology.

0.4 More oil well

discoveries

0.5 Expand export

market

0.6 Demand shifts for

renewable energy

SO

S01. Expand Market distribution

Channels to other target countries.

S02. Increase renewable energies

to global market. (Solar or Bio).

S03. Increase chemical plant

worldwide.

WO

W01.

Developing

new strategies

for sale and

Marketing.

T

T1. OPEC restrictions

T2. Disruption in gas supply

T3. Depletion of natural

energy resources

T4. Hybrid cars replacing

petrol and diesel cars

T5. High Competition

Government regulations

ST

ST1. Research and develop new

technology for Hybrid car ,

ST2. Promote alternative energy

WT

WT1. Develop

strategic

alliance with

stakeholders

(Government

and OPEC.

III. Conclusion and Recommendation

Conclusion

Recommendation

Reference

2013 Activity Report, Total Corporate Foundation

Appendix

Chapter Responsible Closing Date

I. General Overview of the company

Company history

Major products and services

Customers

Strategic goal, vision, mission and values

Current corporate and business strategy

Major facing problems

Khun Linna

Seam Pheak

30 Jun 2014

II. Environmental Analysis

1) External Environment

Economic Environment

Political and Legal Environment

Social and Cultural Environment

Technological Environment

Ecological Environment

Government Agencies

Labor Supply

Creditors

Vong Rada

Chheang Hong

30 Jun 2014

2) Internal Environment

Corporate Culture

Human Resource Management

Marketing

Management

Accounting/Finance

Research and Development

Operation/Production

Management Information System

Ky Sophan

Chandaravuth

30 Jun 2014

3) Construction of:

- External Factors Evaluation Matrix (EFE

Matrix)

- Internal Factor Evaluation Matrix (IFE

Matrix)

Lao Sophorn

Sok Fai

30 Jun 2014

- Internal and External Matrix (IE Matrix)

- Strategic Position Action Evaluation

Matrix (SPACE Matrix)

- SWOT Matrix

III. Conclusion and Recommendation

Conclusion

Recommendation

Reference

Appendix

Ky Sophan

10 July 2014

You might also like

- Performance Strategy and Environmental Analysis of The Royal Dutch Shell PDFDocument13 pagesPerformance Strategy and Environmental Analysis of The Royal Dutch Shell PDFISHAN KAR EPGDF 2017-190% (3)

- Understanding the Oil Industry Dynamics Using Porter's Five Forces FrameworkDocument11 pagesUnderstanding the Oil Industry Dynamics Using Porter's Five Forces FrameworkamareshgautamNo ratings yet

- Marketing Activity and Marketing of Petroleum ProductsDocument6 pagesMarketing Activity and Marketing of Petroleum ProductsMurtaza ShaikhNo ratings yet

- Market PositionDocument4 pagesMarket PositionmahmudaNo ratings yet

- CaltexDocument1 pageCaltexHabiba MukhtarNo ratings yet

- Strategy Management in Construction Management - ThesisDocument4 pagesStrategy Management in Construction Management - ThesisShreedharNo ratings yet

- 03 Krispy KremeDocument14 pages03 Krispy Kreme84112213No ratings yet

- M&ADocument15 pagesM&AHrusikesh DasNo ratings yet

- Shell Ems - EditedDocument14 pagesShell Ems - EditedGeovanie LauraNo ratings yet

- Shell Comprofile MapDocument4 pagesShell Comprofile MapEasy WriteNo ratings yet

- Alaska For Upload - Free EssayDocument23 pagesAlaska For Upload - Free Essaysophie_irishNo ratings yet

- Shell Marketing MixDocument4 pagesShell Marketing MixSalman MannanNo ratings yet

- Royal Dutch Shell Valuation As of December 3, 2018Document35 pagesRoyal Dutch Shell Valuation As of December 3, 2018KevinNo ratings yet

- Derla, Jennifer JaneDocument127 pagesDerla, Jennifer JaneDecrypxion (Josh)No ratings yet

- Oil 6.porter Value ChainDocument6 pagesOil 6.porter Value Chaintousah2010100% (1)

- Marketing Plan Audit and BarriersDocument7 pagesMarketing Plan Audit and BarriersMuhammad FaisalNo ratings yet

- Analysis Report For Petroleum IndustryDocument41 pagesAnalysis Report For Petroleum IndustryMohsin AliNo ratings yet

- Accounting 101 Chapter 1Document39 pagesAccounting 101 Chapter 1Md. Riyad Mahmud 183-15-11991No ratings yet

- Global Top 10 Energy CompaniesDocument191 pagesGlobal Top 10 Energy CompaniesDing LiuNo ratings yet

- Petron Corp Financial AnalysisDocument2 pagesPetron Corp Financial AnalysisNeil NaduaNo ratings yet

- BPDocument41 pagesBPjadesso1981100% (2)

- Porter's Five Forces Analysis of Competition in the Real Estate Industry for Ayala Land, IncDocument15 pagesPorter's Five Forces Analysis of Competition in the Real Estate Industry for Ayala Land, IncNadine YbascoNo ratings yet

- Swot Analysis Motor OilDocument9 pagesSwot Analysis Motor OilEirini TougliNo ratings yet

- Wilfred Corrigan's global financing strategy for LSI Logic CorpDocument2 pagesWilfred Corrigan's global financing strategy for LSI Logic Corpvikas joshiNo ratings yet

- FINMAN - Exercises - 4th and 5th Requirements - PimentelDocument10 pagesFINMAN - Exercises - 4th and 5th Requirements - PimentelOjuola EmmanuelNo ratings yet

- Exxon Mobil Research PaperDocument16 pagesExxon Mobil Research Paperbmcginnis83No ratings yet

- Internationalization of ExxonmobilDocument4 pagesInternationalization of ExxonmobilJuan FernandoNo ratings yet

- Financial Analysis: Pilipinas Shell Petroleum Corporation Petron CorporationDocument11 pagesFinancial Analysis: Pilipinas Shell Petroleum Corporation Petron CorporationJamaica RamosNo ratings yet

- Executive SummaryDocument2 pagesExecutive SummaryOm PrakashNo ratings yet

- Dell Strategic ManagementDocument38 pagesDell Strategic ManagementRoben Joseph89% (9)

- BCG Matrix of Nestle ScribdDocument2 pagesBCG Matrix of Nestle ScribdsreeyaNo ratings yet

- Markman Individual Paper FinalDocument14 pagesMarkman Individual Paper Finalreizch100% (1)

- Motors Liquidation Company - Strategic Analysis Review: Company Snapshot Company OverviewDocument5 pagesMotors Liquidation Company - Strategic Analysis Review: Company Snapshot Company OverviewAmanda ZhaoNo ratings yet

- Financial Management of Phoenix Petroleum Philippines Inc. BodyDocument29 pagesFinancial Management of Phoenix Petroleum Philippines Inc. BodyAl Therese R. CedeñoNo ratings yet

- Top 100 Oil and Gas Operators PDFDocument6 pagesTop 100 Oil and Gas Operators PDFNur Syaffiqa Mohamad RuzlanNo ratings yet

- Case 17 Casper & GambiniDocument18 pagesCase 17 Casper & GambiniKad SaadNo ratings yet

- British PetroleumDocument3 pagesBritish PetroleumAbdullah IshfaqNo ratings yet

- A Comparison of Shell and BP's Corporate Social Responsibility EngagementsDocument11 pagesA Comparison of Shell and BP's Corporate Social Responsibility EngagementsOgweno OgwenoNo ratings yet

- Kane County Food Hub (Feasibility Report)Document35 pagesKane County Food Hub (Feasibility Report)Dulvan Devnaka Senaratne100% (2)

- Eunice Espiritu and Charlotte Gayle Jaro: Presented byDocument16 pagesEunice Espiritu and Charlotte Gayle Jaro: Presented byCelline Junsay100% (1)

- Mercedes-Benz SWOT Analysis in UAE 2014-2018Document7 pagesMercedes-Benz SWOT Analysis in UAE 2014-2018ramanpreet kaurNo ratings yet

- MKTG Analysis - Diversification StrategyDocument29 pagesMKTG Analysis - Diversification StrategyWan Muhammad Abdul HakimNo ratings yet

- Mission Statements of NikeDocument12 pagesMission Statements of Nikemkam212No ratings yet

- Lana Beciragic - Case IVDocument2 pagesLana Beciragic - Case IVBila Bla100% (1)

- Porter's Diamond Model ExplainedDocument13 pagesPorter's Diamond Model ExplainedKAPIL MBA 2021-23 (Delhi)No ratings yet

- Marketing PlanDocument7 pagesMarketing PlanKris Elaine FiguracionNo ratings yet

- Sinopec Case Study AnalysisDocument23 pagesSinopec Case Study AnalysisAlok Jain100% (1)

- Case study on American Home Products Corporation capital structureDocument2 pagesCase study on American Home Products Corporation capital structureDanny CastilloNo ratings yet

- Assessment Point - The Reflective EssayDocument15 pagesAssessment Point - The Reflective EssayRue Spargo ChikwakwataNo ratings yet

- Derivatives Learning ResourcesDocument13 pagesDerivatives Learning ResourcesPrasadNo ratings yet

- Global FinanceDocument49 pagesGlobal FinanceAnisha JhawarNo ratings yet

- CaltexDocument15 pagesCaltexRussel AlingigNo ratings yet

- Company AnalysisDocument20 pagesCompany AnalysisRamazan BarbariNo ratings yet

- Getting To Conflict-Free - Assessing Corporate Action On Conflict MineralsDocument19 pagesGetting To Conflict-Free - Assessing Corporate Action On Conflict MineralsICTdocsNo ratings yet

- OD Term Paper - Group-6Document23 pagesOD Term Paper - Group-6tepanie fababeirNo ratings yet

- Financial Analysis Report Fauji Fertilizer Bin Qasim LTDDocument15 pagesFinancial Analysis Report Fauji Fertilizer Bin Qasim LTDwaqarshk91No ratings yet

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- Chapter 1 Critical Thin...Document7 pagesChapter 1 Critical Thin...sameh06No ratings yet

- Family Preparedness PlanDocument6 pagesFamily Preparedness PlanSabrinaelyza UyNo ratings yet

- Event ReportDocument2 pagesEvent Reportakshitdaharwal997No ratings yet

- 2022 - J - Chir - Nastase Managementul Neoplaziilor Pancreatice PapilareDocument8 pages2022 - J - Chir - Nastase Managementul Neoplaziilor Pancreatice PapilarecorinaNo ratings yet

- Asian Games African Games: Beach VolleyballDocument5 pagesAsian Games African Games: Beach VolleyballJessan Ybañez JoreNo ratings yet

- Fire Pump System Test ReportDocument12 pagesFire Pump System Test Reportcoolsummer1112143100% (2)

- Homer BiographyDocument3 pagesHomer BiographyKennethPosadasNo ratings yet

- 26 05 29 Hangers and Supports For Electrical SystemsDocument8 pages26 05 29 Hangers and Supports For Electrical SystemskaichosanNo ratings yet

- Chime Primary School Brochure TemplateDocument1 pageChime Primary School Brochure TemplateNita HanifahNo ratings yet

- JA Ip42 Creating Maintenance PlansDocument8 pagesJA Ip42 Creating Maintenance PlansvikasbumcaNo ratings yet

- Vernacular Architecture: Bhunga Houses, GujaratDocument12 pagesVernacular Architecture: Bhunga Houses, GujaratArjun GuptaNo ratings yet

- Prperman 2016 14 3 (Spec. 14Document8 pagesPrperman 2016 14 3 (Spec. 14celia rifaNo ratings yet

- Flight Instructor Patter Ex17Document1 pageFlight Instructor Patter Ex17s ramanNo ratings yet

- Sr. No. Name Nationality Profession Book Discovery Speciality 1 2 3 4 5 6 Unit 6Document3 pagesSr. No. Name Nationality Profession Book Discovery Speciality 1 2 3 4 5 6 Unit 6Dashrath KarkiNo ratings yet

- Sample ResumeDocument3 pagesSample Resumeapi-380209683% (6)

- Amity Online Exam OdlDocument14 pagesAmity Online Exam OdlAbdullah Holif0% (1)

- Nelson Sanchez GE Module October 2020Document92 pagesNelson Sanchez GE Module October 2020Nneg Gray0% (1)

- Color TheoryDocument28 pagesColor TheoryEka HaryantoNo ratings yet

- Pengkondisian Kesiapan Belajar Untuk Pencapaian Hasil Belajar Dengan Gerakan Senam OtakDocument9 pagesPengkondisian Kesiapan Belajar Untuk Pencapaian Hasil Belajar Dengan Gerakan Senam OtakSaadah HasbyNo ratings yet

- Generate Ideas with TechniquesDocument19 pagesGenerate Ideas with TechniquesketulNo ratings yet

- Chick Lit: It's not a Gum, it's a Literary TrendDocument2 pagesChick Lit: It's not a Gum, it's a Literary TrendspringzmeNo ratings yet

- Metal Oxides Semiconductor CeramicsDocument14 pagesMetal Oxides Semiconductor Ceramicsumarasad1100% (1)

- (The Heritage Library of African Peoples) Tiyambe Zeleza - Akamba-The Rosen Publishing Group (1995)Document72 pages(The Heritage Library of African Peoples) Tiyambe Zeleza - Akamba-The Rosen Publishing Group (1995)BlackFlix Legendas em PortuguêsNo ratings yet

- Hmdu - EnglishDocument20 pagesHmdu - EnglishAbdulaziz SeikoNo ratings yet

- Solwezi General Mental Health TeamDocument35 pagesSolwezi General Mental Health TeamHumphreyNo ratings yet

- 4MB0 02R Que 20160609 PDFDocument32 pages4MB0 02R Que 20160609 PDFakashNo ratings yet

- Math 2 Curriculum GuideDocument19 pagesMath 2 Curriculum GuideMichelle Villanueva Jalando-onNo ratings yet

- Cognitive Clusters in SpecificDocument11 pagesCognitive Clusters in SpecificKarel GuevaraNo ratings yet

- Digital Burner Controller: Tbc2800 SeriesDocument4 pagesDigital Burner Controller: Tbc2800 SeriesSUDIP MONDALNo ratings yet

- 3 - 6consctructing Probability Distributions CG A - 4 - 6 Lesson 2Document24 pages3 - 6consctructing Probability Distributions CG A - 4 - 6 Lesson 2CHARLYN JOY SUMALINOGNo ratings yet