Professional Documents

Culture Documents

New Century Colorado Project Fleet Management Start Report

Uploaded by

Daud JavedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Century Colorado Project Fleet Management Start Report

Uploaded by

Daud JavedCopyright:

Available Formats

New Century Colorado Project

Fleet Management

Start Report

This study examines the opportunity for cost savings resulting from more efficient use

and disposal of the State of Colorados fleet, managed by the General Support

Services Fleet Management (SFM !rogram" The study revie#ed only those

vehicles #hich are managed by SFM and are under three$%uarter ton si&e (light

truc's and sedans" SFM managed (,)** vehicles during fiscal year +,,-$,,"

Summary of Savings

The summary of savings for fiscal year .///$/+ is0

1reas of 2pportunity Cost Savings

3ehicle disposal 4 +,)+5,///

3ehicle utili&ation +,6-(,///

3ehicle preparation time +,+*5,///

Total Savings 4*,(*+,///

2f these total savings, an estimated 4+", million #ill be from the General Fund"

Summary of Changes

+" VEHICLE SALES

The State should retain the net proceeds from the disposal of vehicles in SFM to

reduce the monthly fixed costs, rather than returning the proceeds to the leasing state

agencies"

." VEHICLE UTILIZATION

The State currently has +,//( nonexempt, lo# annual mileage vehicles"

7ecommendations include0

a" 7educing the SFM managed fleet si&e by selling (+- vehicles, classified as

nonexempt #ith lo# annual mileage averaging 6,55/ miles per year"

b" Moving other nonexempt and lo# annual mileage vehicles into local area motor

pools to increase vehicle use and to reduce the number of individually assigned or

similar vehicles" SFM, in cooperation #ith the 8e# Century Colorado pro9ect,

should investigate the development of local motor pools to effectively reduce the

remaining number of nonexempt, lo# annual mileage vehicles in the fleet"

5" VEHICLE PREPARATION TIME

The State should restructure Colorado State !atrols police pac'age vehicle order

process to reduce excess inventory and to provide for multiple deliveries throughout

the fiscal year"

Fleet Management

Start Report, continued

*" IMPLEMENTATION PLAN

8e# Century Colorado #ill continue to investigate fleet management processes" 1

detailed implementation plan #ill be developed to assist departments in ta'ing

advantage of these recommendations"

Summary of Assumptions

:ey definitions used in this study follo#"

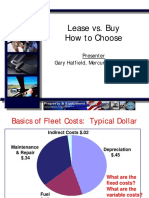

+" There are t#o types of costs associated #ith State Fleet Management (SFM0

a" Fixed costs, #hich represent the follo#ing0

i. Financing Costs of Veic!es

1ll ne# vehicles in the fleet are financed from t#o to seven years #ith

a third party" SFM pays principal and interest on a monthly basis to

the third party" The department using a specific vehicle is charged the

vehicles financing costs of principal and interest"

ii. Manage"ent Fee

The costs of operating SFM or SFMs overhead are charged to all SFM

users through the management fee"

b" Va#ia$!e costs, #hich represent the follo#ing0

i. F%e! Cost Pe# Mi!e

The average cost of fuel as allocated to all vehicles

ii. Maintenance Cost Pe# Mi!e

This is specific to each vehicle based on actual #or' performed to

maintain the vehicle

iii. Ins%#ance

The average cost of insurance as allocated to all vehicles, #hich

e%uates to 4/"//- per mile

;ased on intervie#s #ith SFM and vehicle record revie#s, the average fixed cost for

the entire fleet #as 4/"+, per mile for fiscal year +,,-$,," The average variable cost

for fiscal year +,,, #as 4 /"++ per mile" The variable cost fluctuates from year to

year primarily due to the fluctuation of fuel prices" Fuel prices have risen, since the

fiscal year +,,-$,,, 4/"++ per mile variable calculated cost"

." 1ll vehicles in the state fleet are o#ned by SFM and leased to individual state

agencies"

5" A&e#age net t#ansfe# 'e# &eic!e is the portion of the sales proceeds, #hich SFM

sends to the state agencies leasing the vehicles" For cars purchased after +,,*, SFM

sells vehicles at auction and uses the net auction proceeds to pay off the vehicles

financing agreement" For cars purchased prior to +,,*, SFM retains a portion of the

proceeds e%ual to +( percent of the original value" The remaining proceeds are then

transferred to the state agencies leasing the vehicles"

.

Fleet Management

Start Report, continued

*" Uti!i(ation refers to annual average mileage of a vehicle" SFM considers lo# annual

mileage to be less than +.,)// miles per year, determined by dividing the total

mileage of 6),)// (set in state statute .*$5/$++/* C"7"S" by six years, the typical

replacement life of a vehicle" SFM<s average current motor pool mileage is +,,.//

per vehicle, per year"

(" Exe"'t and nonexe"'t refers to SFM vehicle designations" =xempt vehicles have a

special purpose such as maintenance or public safety, 9ustifying a lo#er annual

mileage use and the associated higher cost per mile" This determination is

reevaluated each year based on the previous years actual use"

)" This study #as based on SFM data as of >une 5/, +,,,"

VEHICLE SALES

?hen vehicle mileage is over +//,///, or #hen other criteria are met, centrally$located

State vehicles are typically sold at %uarterly auctions conducted by State Surplus, a

division of Correctional @ndustries" The leasing state agency can sell remotely$located

vehicles directly to local agencies, or at auction"

1fter the sale, SFM uses the net auction proceeds to pay off the vehicle financing

agreement for cars purchased after +,,*" SFM retains proceeds e%ual to +( percent of the

original value for cars purchased prior to +,,*" The remaining sales proceeds are then

transferred to the leasing state agency" These net proceeds are called the average net

transfer per vehicle" The state agency usually transfers the net proceeds into a cash

revenue account, #hich re%uires spending authority" 1 revie# of all of these transfers for

the last fiscal year confirmed that these funds #ere placed into cash accounts"

Supporting Data:

The average net transfer per vehicle is 4.,/(*, based on the most recent three fiscal years

of %uarterly auctions as detailed in the follo#ing table"

5

Fleet Management

Start Report, continued

Net Proceeds from Sae of !eet Vehices

!isca

"ear

#ota Proceed

#r

an

sfe

rs

Num$er of

Veh

ice

s

So

d

Average Net #ransfer

Per Vehice

+,,- 4 ((5,((- 5+, 4 +,65(

+,,, )*+,.5* .(- .,*-(

./// *6+,5)- .5* .,/+*

#hree%year average:

4 +,))),+)/ -++ & '()*+

Note: The source #as accounting documents for internal transfers

provided by General Support Services"

Issue Description:

;y returning the fleet net sales proceeds to the various state agencies, the costs of

managing the fleet program are overstated"

Soution Description:

SFM should retain the fleet sales proceeds and reduce the management fee charged to the

agencies" SFM plans to sell and replace 6-( vehicles in fiscal year .///$/+" @f SFM

retains the average sales proceeds from those 6-( vehicles, historically transferred to

state agencies, this #ould result in savings of approximately 4+,)+5,/// (represented by

6-( planned disposals at the average net transfer of 4.,/(*" The SFM management fee

for fiscal year +,,,$// is 45/ per vehicle per month" ;y retaining the disposal proceeds,

#e estimate SFM could reduce the management fee charged to agencies by an estimated

-/ percent" These savings represent a reallocation of retained funds, #hich drives a net

reduction in appropriations"

Further, it is recommended that SFM provide an annual report to all state agencies, listing

the cost components of the management fee including a detailed brea'do#n of all

personal services, operating expenses and overheads, and the proceeds from vehicle sales"

VEHICLE ,#ILI-A#I.N

*

Fleet Management

Start Report, continued

State Fleet Management uses a custom$built fleet management system, called Colorado

1utomotive 7eporting System (C17S, #hich trac's vehicle use as #ell as performs

other critical functions" SFM uses a fixed mileage of +.,)// miles per year as the limit

for determining lo# annual mileage.

Supporting Data:

2f the (,)** vehicles in the state fleet during fiscal year +,,-$,,, .,(-( or *("- percent

fell belo# the +.,)// annual mileage criteria" This is consistent #ith the 2ffice of the

State 1uditors +,,( audit report #hich states *- percent of the fleet fell belo# the annual

mileage criteria and recommended increased monitoring of the criteria"

2f these lo# annual mileage vehicles, +,(/+ are designated by SFM as exempt" =xempt

vehicles are those #ith special purpose use such as maintenance, security patrol or la#

enforcement" SFM, #ith input from the Motor 3ehicle 1dvisory Council, #hich includes

vehicle coordinators from each state agency, determines the exempt status of vehicles"

The remaining +,/-* lo# annual mileage, nonexempt vehicles are being used as

individually assigned for office or on$call duties, shared assigned duties, seasonal usage,

special programs (such as grants and departmental motor pools"

1fter deducting vehicles that have been sold, or are pending sale, there are +,//( vehicles

in the States fleet inventory #hich are the focus of this analysis" These vehicles are

designated as nonexempt and lo# annual mileage, #ith an average of only 6,55/ miles

per year"

SFMs database (C17S #as examined to identify pro9ected costs for these +,//(

vehicles" 1 ma9or factor in this analysis is the !ersonal 3ehicle 7eimbursement (!37 of

4/".- per mile that #ould be paid if a state vehicle #ere not available for employees" 2f

the +,//( vehicles, (+- #ere identified #ith total costs (fixed and variable greater than

the !37"

Issue Description:

The cost of the state fleet is effectively increased through the o#nership of vehicles #ith

operating costs above the current !37 rate"

Soution Description:

The follo#ing table summari&es the states fleet inventory and the related

issuesAsolutions"

(

Fleet Management

Start Report, continued

Summary of !eet ,tii/ation

Current ,sage

Num$er of

Vehices

0ecom%

mendation

Estimated

Savings

1de%uately utili&ed 5,/(, 8A1

Bo# annual mileage and exempt +,(/+ 8A1

Bo# annual mileage and nonexempt

3ehicles pending sale 6, 8A1

3ehicles #ith costs greater than the

!37 (+-

8os" +

and .

4 6.+,///

+,/)*,///

3ehicles #ith costs less than !37 *-6 8A1 CCCCCCCC

Total (,)** 4 +,6-(,///

Note: Source of number and current usage of vehicles #as SFM, specifically the

C17S database as of >une 5/, +,,,"

The follo#ing recommendations should be implemented to reduce the costs associated

#ith lo# annual mileage and nonexempt vehicles"

+" 7educe the total state fleet si&e by eliminating the (+- vehicles identified as lo#

annual mileage, nonexempt vehicles #ith costs greater than the !37" Some of these

(+- vehicles are ne#er vehicles, therefore, an agency could choose to sell an alternate

vehicle #ith high mileage" 1s a result, the cost savings for this reduction in fleet si&e

are based on the average fixed cost for the entire fleet, #hich is 4/"+, per mile" SFM

is in the process of revie#ing all nonexempt vehicles #ith lo# annual mileage, as

#ell as some exempt, lo# annual mileage vehicles in an effort to identify vehicles

that could be eliminated"

The annual mileage incurred on these vehicles #ill be transferred to the local motor

pool vehicles discussed under 8o" 5 belo#, #hich have only the variable costs of

4/"++ per mile" Thus, this recommendation should result in fixed cost savings of

approximately 46.+,/// ((+- vehicles #ith total annual mileage of approximately

5,6,6,/// at 4/"+, per mile"

." =liminate these (+- vehicles or suitable replacements from the fleet inventory"

Disposition of (+- vehicles at the historical average net transfer of 4.,/(* should

result in revenue of approximately 4+,/)*,///"

5" 7etain the balance of lo# annual mileage vehicles and place a portion of them in

local motor pools" These vehicles have variable operating costs e%ual to the standard

average variable cost of state fleet vehicles averaging 4/"++ per mile" Further, these

vehicles can accommodate the annual mileage associated #ith the +,//( lo# annual

mileage vehicles to be reduced from the fleet" This #ould re%uire an average of

+,,.// miles per year for the remaining vehicles"

)

Fleet Management

Start Report, continued

C17S appears to effectively maintain state fleet vehicle utili&ation dataE ho#ever, it

currently does not have functionality to help manage motor pools, a component of the

above recommendation"

VEHICLE P0EPA0A#I.N #I1E

1n analysis of C17S data revealed that a significant number of Colorado State !atrol

(CS! vehicles remain in storage an average of +. months before they brought into

service" This number has been as high as +.* in >uly +,,, and is presently ++) (based on

a physical inventory performed in December +,,," This time lag is the result of the

follo#ing t#o factors0

+" 1uto manufacturers historically produced police pac'age vehicles only once a year"

This practice mandated that State Fleet Management ma'e an annual purchase of the

CS! police pac'age vehicles for delivery in the last %uarter of the fiscal year"

Contacts #ith both General Motors and Ford confirmed that the manufacturers no#

produce police pac'age vehicles throughout the model year #ith the exception of

approximately ) to - #ee's in >une and >uly during model change" The ordering

process can be modified to fit both the manufacturers and the States needs"

." !atrol cars re%uire extensive modification once they are received from SFM" 1ll

units re%uire additional #iring and fuse pac'ages to accommodate radios, ruggedi&ed

laptops, sirens and light bars" !ush$bumpers, cages and gun rac's must also be

added" 1s a result, CS! reported that only ) to - patrol cars could typically be ready

in a #ee', #ith their current staff"

The one$time delivery of patrol cars results in unused cars for the ma9ority of the year"

The State is currently paying finance costs of over 4)// per month per vehicle" For fiscal

year .///$/+, SFM estimates finance costs to be 46*( per month"

Supporting Data:

1 revie# of the CS! fleet in C17S revealed a total of *5- police pac'age vehicles

currently on the road, 6/ of #hich have reached the -/,/// mile replacement benchmar'

as of >une 5/, +,,," @n addition, another 6, vehicles are expected to reach -/,/// miles

by >une 5/, .///" They plan to buy +*, and +/. patrol vehicles in March ./// and

.//+, respectively" They #ill finance these vehicles over a three$year period #ith an

estimated ) percent interest rate" ;ased on intervie#s #ith CS!, an assumption #as made

for the purpose of this study that at any point in time, a minimum of ( percent of the total

patrol fleet, or ./ vehicles, are available for emergency replacement of patrol vehicles"

Issue Description:

6

Fleet Management

Start Report, continued

The current annual procurement and delivery system of patrol cars significantly increases

fleet program costs by forcing the State to pay financing costs prior to the vehicles being

placed into operations"

Soution Description:

To eliminate unnecessary financing costs, the police pac'age vehicle procurement

process should be changed to ta'e advantage of the recent changes in the auto

manufacturing industry" SFM should re%uire multiple deliveries throughout the fiscal

year that coincide #ith the needs of CS!" @t is recommended that !urchasing, SFM and

CS! #or' #ith both General Motors and Ford to develop a delivery plan that meets the

needs of the State" This plan may re%uire ordering vehicles over a model year change"

Funding for these vehicles also should be changed to meet the ne# delivery schedule"

;ased on a physical count of vehicles, CS! currently has ++) vehicles on the CS! lot, in

process or a#aiting preparation for service" ;ased on intervie#s #ith CS!, this inventory

of patrol vehicles #ill be in service no later than February ./// (#hich appears to be

possible under their normal preparation schedule" These ++) vehicles #ill more than

replace the 6/ vehicles currently identified at the -/,/// mile benchmar'"

Conse%uently, a revised vehicle delivery schedule #ould ma'e the first delivery of +/

vehicles per month occurring in 1ugust .///" This schedule accommodates GM and

Ford<s model change during >une and >ulyE ho#ever, SFM and !urchasing need to

negotiate the exact timing" 1ny resulting variation is not anticipated to have significant

impact on the proposed savings"

The delivery change #ould result in savings of 4**+,/// and 4+,+*5,/// for fiscal years

./// and .//+, respectively" There #ould be ongoing annual savings of no less than

4+,///,///"

For purchases in fiscal year .//. and all subse%uent years, the State could purchase

patrol pac'age vehicles on an incremental basis, as the cars are needed (approximately +/

per month" This practice #ill avoid future monthly financing charges that are

unnecessary" C17S can provide data to effectively manage and pro9ect timing of future

patrol car purchases"

@n addition, the %uestion of #hether State !atrol vehicles should be included in the state

fleet #ill be considered during the development of an implementation plan for the above

recommendations"

-

Fleet Management

Start Report, continued

8==D T2 1TT1CF TF= F@818C@8G T1;B= T2 SG!!27T TF= S13@8GS C@T=D

1;23=

,

You might also like

- Toll Road Financial Model v1-0Document52 pagesToll Road Financial Model v1-0siby13172100% (3)

- HR BrandingDocument6 pagesHR Brandinggswalia818342No ratings yet

- Vehicle Lifecycle Costs Analysis: Sponsored byDocument32 pagesVehicle Lifecycle Costs Analysis: Sponsored byJairo Iván SánchezNo ratings yet

- Police Electric Vehicle Pilot Program Outcome Report 2020 - Final - 11.17.20Document20 pagesPolice Electric Vehicle Pilot Program Outcome Report 2020 - Final - 11.17.20Fred Lamert100% (3)

- Estimation of Costs of Heavy Vehicle Use Per Vehicle-Kilometre in CanadaDocument71 pagesEstimation of Costs of Heavy Vehicle Use Per Vehicle-Kilometre in Canada07103091No ratings yet

- Equipco FleetMgtDocument25 pagesEquipco FleetMgtrajadas777No ratings yet

- Insurance Car Claim Project Data VisualisationDocument12 pagesInsurance Car Claim Project Data VisualisationPurva Soni50% (2)

- Fundamentals of SellingDocument180 pagesFundamentals of SellingMohammed Said MohammedNo ratings yet

- Amigo V TevesDocument2 pagesAmigo V TevesRaya Alvarez TestonNo ratings yet

- Vehicle Replacement and Kilometre Operating Costs Tool Users GuideDocument9 pagesVehicle Replacement and Kilometre Operating Costs Tool Users GuideWelly Pradipta bin Maryulis0% (1)

- Financial Modeling Case StudyDocument4 pagesFinancial Modeling Case StudykshitijNo ratings yet

- Writing A Business LetterDocument28 pagesWriting A Business LetterReina100% (1)

- FSC For Retail Banking Point of ViewDocument2 pagesFSC For Retail Banking Point of Viewtranhieu5959No ratings yet

- SHIELD Configuration Document SummaryDocument11 pagesSHIELD Configuration Document SummaryUtkarsh DhamechaNo ratings yet

- IIFL Car Lease Policy: 1. Objective of The PolicyDocument5 pagesIIFL Car Lease Policy: 1. Objective of The PolicyNanda BabaniNo ratings yet

- Bpi V Sanchez Et AlDocument4 pagesBpi V Sanchez Et AlJohn Benedict TigsonNo ratings yet

- Redwood City - Public Works Memo - Police Patrol Vehicle - Fleet Replacement Cycle Analysis 010515Document4 pagesRedwood City - Public Works Memo - Police Patrol Vehicle - Fleet Replacement Cycle Analysis 010515api-281755212No ratings yet

- SPD Take Home CarsDocument6 pagesSPD Take Home CarsTim KnaussNo ratings yet

- Topic 7 Road freight transport costingDocument12 pagesTopic 7 Road freight transport costingYoung BunnyNo ratings yet

- Vehicle Vehicle Vehicle Vehicle Management Management Management Management System System System SystemDocument7 pagesVehicle Vehicle Vehicle Vehicle Management Management Management Management System System System SystemSyed Ishteaque AhmedNo ratings yet

- Rajendra Ladda DVT Car Insurance Tableau ProjectDocument8 pagesRajendra Ladda DVT Car Insurance Tableau ProjectRajendra LaddaNo ratings yet

- 2014 - Predicting The Price of Used Cars Using Machine Learning Techniques PDFDocument12 pages2014 - Predicting The Price of Used Cars Using Machine Learning Techniques PDFSameerchand PudaruthNo ratings yet

- Lease vs. Buy How To Choose: Presenter Gary Hatfield, Mercury AssociatesDocument28 pagesLease vs. Buy How To Choose: Presenter Gary Hatfield, Mercury AssociatesMuhammad Zahid FaridNo ratings yet

- City of Chattanooga Fuel Key AuditDocument11 pagesCity of Chattanooga Fuel Key AuditDan LehrNo ratings yet

- Essential Fleet Metrics You Should Be Watching and WhyDocument6 pagesEssential Fleet Metrics You Should Be Watching and WhyAdarsh PoojaryNo ratings yet

- Accounting For Employee Use of Company VehiclesDocument12 pagesAccounting For Employee Use of Company VehiclesMike KarlinsNo ratings yet

- Revision Progress Test 1 - Investment AppraisalDocument5 pagesRevision Progress Test 1 - Investment Appraisalsamuel_dwumfourNo ratings yet

- Attachment 1Document12 pagesAttachment 1gualnegusNo ratings yet

- Transparency Market ResearchDocument11 pagesTransparency Market Researchapi-259683748No ratings yet

- Police Electric Vehicle PilotDocument20 pagesPolice Electric Vehicle PilotSimon AlvarezNo ratings yet

- C4C Report v4Document13 pagesC4C Report v4Mohd Nor Azman HassanNo ratings yet

- Mustang Vin Check PDFDocument8 pagesMustang Vin Check PDFAnonymous PuD6rdbNo ratings yet

- Chapter 12 Activity - Total Cost of OwnershipDocument4 pagesChapter 12 Activity - Total Cost of OwnershipAbdul MueedNo ratings yet

- 2016 Car Running CostsDocument17 pages2016 Car Running CostsTomato GreenNo ratings yet

- Cafe StdsDocument21 pagesCafe StdsRinu Sathyan100% (1)

- Fleet Management FrameworkDocument8 pagesFleet Management FrameworkYehualashet BelaynehNo ratings yet

- System Selection and Definition: Cc14 Milestone 1Document5 pagesSystem Selection and Definition: Cc14 Milestone 1Christian DemavivasNo ratings yet

- Transport CostingDocument3 pagesTransport CostingSubodh Mayekar80% (5)

- Buying Your First Car Mind MapDocument5 pagesBuying Your First Car Mind MapSamIamNo ratings yet

- Long Term Ferry Funding Study Status Update: Washington State Transportation CommissionDocument21 pagesLong Term Ferry Funding Study Status Update: Washington State Transportation CommissionDan TurnerNo ratings yet

- DATA VISUALISATION TABLEAU_Meenakarthika_17.3.24Document6 pagesDATA VISUALISATION TABLEAU_Meenakarthika_17.3.24meena13121993No ratings yet

- CARFAX Vehicle History Report On 1HGFA16508L118285Document13 pagesCARFAX Vehicle History Report On 1HGFA16508L118285cemayhanNo ratings yet

- Updated 2014 Fuel Economy Guide for Choosing Efficient VehiclesDocument44 pagesUpdated 2014 Fuel Economy Guide for Choosing Efficient VehicleschandshineNo ratings yet

- 2014 NRMCA Fleet Survey ReportDocument23 pages2014 NRMCA Fleet Survey Reportdcoronado0487No ratings yet

- Industrial Simulation CaseDocument1 pageIndustrial Simulation Casearry90No ratings yet

- Instructions For Vehicle Preventive Maintenance Schedule FormDocument2 pagesInstructions For Vehicle Preventive Maintenance Schedule Formikperha jomafuvweNo ratings yet

- CHAPTER 1 Introduction For Project On STFCDocument10 pagesCHAPTER 1 Introduction For Project On STFCmahammed saheedNo ratings yet

- World Bank Road Use Costs Study Results: June 9, 2006Document12 pagesWorld Bank Road Use Costs Study Results: June 9, 2006Rabindranath Hendy TagoreNo ratings yet

- Price Calculator: Vehicle InformationDocument5 pagesPrice Calculator: Vehicle InformationSterling GreeneNo ratings yet

- 2012fleetsurveyfinalrepot PDFDocument28 pages2012fleetsurveyfinalrepot PDFAlexNo ratings yet

- California Caltrans 2012-13 Transportation Financing PackageDocument30 pagesCalifornia Caltrans 2012-13 Transportation Financing Packagewmartin46No ratings yet

- Tonbridge Parking Services Annual ReportDocument12 pagesTonbridge Parking Services Annual ReportparkingeconomicsNo ratings yet

- 1.0 Glossary:: Saudi Arabian Oil Company (Saudi Aramco) General Instruction ManualDocument6 pages1.0 Glossary:: Saudi Arabian Oil Company (Saudi Aramco) General Instruction Manualmalika_00No ratings yet

- Financial Benefits of Converting A Fleet To Run On CNGDocument7 pagesFinancial Benefits of Converting A Fleet To Run On CNGapi-234260238No ratings yet

- Service Costing 1Document4 pagesService Costing 1Sayali KamtekarNo ratings yet

- Fleet ManagementDocument5 pagesFleet ManagementRitwik PradhanNo ratings yet

- CyRide Vehicle Maintenance PlanDocument21 pagesCyRide Vehicle Maintenance PlanNakkolopNo ratings yet

- Revenue ManagementDocument5 pagesRevenue Managementabdulazeez111No ratings yet

- Maxiella Rose M. Berdos Financial Analysis and Reporting Bsba FM 2-4 Final RequirementDocument11 pagesMaxiella Rose M. Berdos Financial Analysis and Reporting Bsba FM 2-4 Final RequirementJohn Daniel BerdosNo ratings yet

- Vehicle-Request-FormDocument3 pagesVehicle-Request-Formchiriceaviorel87No ratings yet

- Management Control Systems Finance Department Automobile IndustryDocument4 pagesManagement Control Systems Finance Department Automobile IndustryAbhishek9102No ratings yet

- 04 Feg2013Document44 pages04 Feg2013api-309082881No ratings yet

- Coursework2016 17Document6 pagesCoursework2016 17Brian DeanNo ratings yet

- Aircraft Rental & Leasing Revenues World Summary: Market Values & Financials by CountryFrom EverandAircraft Rental & Leasing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Taxi & Limousine Service Revenues World Summary: Market Values & Financials by CountryFrom EverandTaxi & Limousine Service Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Motor Vehicle Towing Revenues World Summary: Market Values & Financials by CountryFrom EverandMotor Vehicle Towing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Truck Rental Revenues World Summary: Market Values & Financials by CountryFrom EverandTruck Rental Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Paper StudyDocument2 pagesPaper StudyDaud JavedNo ratings yet

- 95-843 Service Oriented Architecture: Cloud Computing and SOADocument22 pages95-843 Service Oriented Architecture: Cloud Computing and SOANitin UbhayakarNo ratings yet

- WA1 SolsDocument467 pagesWA1 SolsDaud JavedNo ratings yet

- 0291040702Document12 pages0291040702Daud JavedNo ratings yet

- Service Computing: Foundations, Design and Implementation: Dr. Yuhong Yan Dr. Daniel Lemire Jan, 2008Document11 pagesService Computing: Foundations, Design and Implementation: Dr. Yuhong Yan Dr. Daniel Lemire Jan, 2008Daud JavedNo ratings yet

- MPDFDocument5 pagesMPDFDaud JavedNo ratings yet

- Assignment 1 RemarksDocument2 pagesAssignment 1 RemarksDaud JavedNo ratings yet

- Lec 9+10 Divide and Conqure Quick Sort AlgorithmDocument9 pagesLec 9+10 Divide and Conqure Quick Sort AlgorithmDaud JavedNo ratings yet

- How programming language characteristics affect readability, writability, reliability and costDocument28 pagesHow programming language characteristics affect readability, writability, reliability and costDaud Javed0% (1)

- Human Res. Management - M. Com - IDocument151 pagesHuman Res. Management - M. Com - IShailesh Mehta100% (2)

- Language CategoriesDocument15 pagesLanguage CategoriesDaud Javed50% (2)

- Csharp InterfacesDocument2 pagesCsharp InterfacesDaud JavedNo ratings yet

- MBA Summer Training InsightsDocument102 pagesMBA Summer Training InsightsMansi Bhatt100% (1)

- Key Marketing Issues of New Venture Prepared By:: Divyesh GandhiDocument24 pagesKey Marketing Issues of New Venture Prepared By:: Divyesh GandhimaazNo ratings yet

- Strategic Marketing ManagementDocument45 pagesStrategic Marketing ManagementMohamed NajeemNo ratings yet

- Multiple ChoiceDocument14 pagesMultiple Choiceايهاب غزالة100% (2)

- Merch Operations-Adjusting QandADocument5 pagesMerch Operations-Adjusting QandAFaker MejiaNo ratings yet

- Livestock Marketing: Price Discovery Pricing Methods Marketing Decisions Supply and DemandDocument86 pagesLivestock Marketing: Price Discovery Pricing Methods Marketing Decisions Supply and DemandNirmal KambojNo ratings yet

- Honduras EnvironmentDocument4 pagesHonduras EnvironmentInoue JpNo ratings yet

- Consumer Behavior High InvolvementDocument25 pagesConsumer Behavior High InvolvementSrijan SrivastavaNo ratings yet

- Kslu Question PaperDocument4 pagesKslu Question Paperanand121988No ratings yet

- MIS For Marketing ManagementDocument44 pagesMIS For Marketing ManagementRida ZahidNo ratings yet

- Rajasthan's Secondary Board's Free Laptop Distribution SchemeDocument68 pagesRajasthan's Secondary Board's Free Laptop Distribution Schemeneeraj meenaNo ratings yet

- Principles of Mathematical Economics Applied To A Physical-Stores Retail BusinessDocument24 pagesPrinciples of Mathematical Economics Applied To A Physical-Stores Retail BusinessSoumojit KumarNo ratings yet

- Retail Invoice for Moto G 3rd Gen MobileDocument1 pageRetail Invoice for Moto G 3rd Gen MobileEr Ravi Kant MishraNo ratings yet

- Forbidden PDFDocument105 pagesForbidden PDFAshish GadnayakNo ratings yet

- EMGT 6010 Learning Reflection 9Document2 pagesEMGT 6010 Learning Reflection 9seanmks106No ratings yet

- September 8, Maple Ridge-Pitt Meadows NewsDocument25 pagesSeptember 8, Maple Ridge-Pitt Meadows NewsmapleridgenewsNo ratings yet

- Strengths, Weaknesses, Opportunities and Threats AnalysisDocument13 pagesStrengths, Weaknesses, Opportunities and Threats Analysisanuraag1710No ratings yet

- CavinKare Founder's Success StoryDocument4 pagesCavinKare Founder's Success StoryTEJAL100% (1)

- Sales Distribution Management CourseDocument47 pagesSales Distribution Management CourseAvinash JollyNo ratings yet

- Management Accounting Key ConceptsDocument7 pagesManagement Accounting Key ConceptsNageshwar singhNo ratings yet

- Sale of Goods Act (9.6.2022) DiscussionDocument19 pagesSale of Goods Act (9.6.2022) DiscussionDrEi Shwesin HtunNo ratings yet

- Chapter 9 - Marketing Management: Dr. C. M. ChangDocument66 pagesChapter 9 - Marketing Management: Dr. C. M. ChangbawardiaNo ratings yet

- 1414+FAR EASTERN UNIVERSITY AUDITING PROBLEMS PRELIM EXAMDocument16 pages1414+FAR EASTERN UNIVERSITY AUDITING PROBLEMS PRELIM EXAMShaina Kaye De GuzmanNo ratings yet