Professional Documents

Culture Documents

VML Financial Reports

Uploaded by

Amrinder Setia0 ratings0% found this document useful (0 votes)

51 views13 pagesVML Financial

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentVML Financial

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

51 views13 pagesVML Financial Reports

Uploaded by

Amrinder SetiaVML Financial

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 13

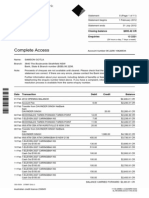

VML INTERNATIONAL PTY LTD

ABN 28 159 789 509

Financial Statements

For the Year ended 30 June 2013

- 1 -

VML INTERNATIONAL PTY LTD

ABN 28 159 789 509

Trading, Profit and Loss Statement

For the Year ended 30 June 2013

2013 2012

$ $

Income

Sales 1,496,969 -

Other Income 5,050 -

Mis Income 7,783 -

1,509,802 -

Less Cost of Goods Sold

Cost of Sales 927,915 -

7-11 Charges 324,362 -

1,252,277 -

1,252,277 -

Gross Profit from Trading 257,525 -

Expenditure

Management Fee 19,500 -

Bank Charges 2,225 -

General Expenses 1,645 -

Insurance 2,338 -

Interest Paid

- Interest Paid 202 -

- Interest Paid 86061 13,165 -

- Interest Paid 27555 19,444 -

Km Charges 3,700 -

Office Purchase 302 -

Inventory Expenses 4,126 -

Annual Leave 6,400 -

Petty Cash Expenditure 2,105 -

Postage 885 -

Repairs & Maintenance 71 -

Salaries 110,542 -

Security Costs 125 -

Supply 7-11 21,436 -

Subscriptions 240 -

Superannuation 8,765 -

Telephone 846 -

218,062 -

Profit before Income Tax 39,463 -

Income Tax Expense (11,839) -

Profit after Income Tax 27,624 -

The accompanying notes form part of these financial statements.

- 2 -

VML INTERNATIONAL PTY LTD

ABN 28 159 789 509

Income Statement

For the Year ended 30 June 2013

Note 2013 2012

$ $

Revenue 2 1,509,802 -

Expenses excluding Finance Costs 3 1,437,528 -

Finance Costs 4 32,811 -

Profit before Income Tax 5 39,463 -

Income Tax Expense (11,839) -

Profit Attributable to Members of the Company 27,624 -

The accompanying notes form part of these financial statements.

- 3 -

VML INTERNATIONAL PTY LTD

ABN 28 159 789 509

Balance Sheet

As at 30 June 2013

2013 2012

$ $

Equity

Paid Up Capital

Ordinary Shares 100 -

Unappropriated Profit 27,624 -

Total Capital and Reserves 27,724 -

Represented by:

Current Assets

ANZ 65021 20,244 -

Cash on hand 1,320 -

Trade Debtors 21,332 -

Loans - Deposit 1,000 -

Prepaid Borrowing Expenses 7,979 -

Stock on Hand 68,750 -

120,625 -

Non-Current Assets

Business Cost 674,740 -

674,740 -

674,740 -

Total Assets 795,365 -

Current Liabilities

PAYG Payable 3,931 -

Loans - 86061 300,305 -

Loans - 27555 403,399 -

Loans - Director 36,269 -

Provision for Annual Leave 6,400 -

Current Tax Liability 11,839 -

Provision for GST 5,498 -

767,641 -

Total Liabilities 767,641 -

Net Assets 27,724 -

The accompanying notes form part of these financial statements.

- 4 -

VML INTERNATIONAL PTY LTD

ABN 28 159 789 509

Notes to the Financial Statements

For the Year ended 30 June 2013

1. STATEMENT OF SIGNIFICANT ACCOUNTING POLICIES

The directors have prepared the financial statements on the basis that the company is a

non-reporting entity because there are no users dependent on general purpose financial statements.

The financial statements are therefore special purpose financial statements that have been prepared

in order to meet the needs of members.

The financial statements have been prepared in accordance with the significant accounting policies

disclosed below, which the directors have determined are appropriate to meet the needs of

members. Such accounting policies are consistent with the previous period unless stated otherwise.

The financial statements have been prepared on an accruals basis and are based on historical costs

unless stated otherwise in the notes. The accounting policies that have been adopted in the

preparation of the statements are as follows:

(a) Cash and Cash Equivalents

Cash and cash equivalents include cash on hand, deposits held at call with banks, other

short-term highly liquid investments with original maturities of three months or less, and

bank overdrafts. Bank overdrafts are shown within borrowings in current liabilities on the

balance sheet.

(b) Provisions

Provisions are recognised when the company has a legal or constructive obligation, as a result

of past events, for which it is probable that an outflow of economic benefits will result

and that outflow can be reliably measured.

Provisions are measured using the best estimate of the amounts required to settle the

obligation at the end of the reporting period.

(c) Employee Benefits

Provision is made for the companys liability for employee benefits arising from services

rendered by employees to the end of the reporting period. Employee benefits have been

measured at the amounts expected to be paid when the liability is settled, plus related

on-costs.

(d) Property, Plant and Equipment

All property, plant and equipment excluding freehold land and buildings, are initially

measured at cost and are depreciated over their useful lives to the company.

The depreciation method and useful life used for items of property, plant and equipment

(excluding freehold land) reflects the pattern in which their future economic benefits are

expected to be consumed by the company. Depreciation commences from the time the asset

is available for its intended use. Leasehold improvements are depreciated over the shorter of

either the unexpired period of the lease or the estimated useful lives of the improvements.

The accompanying notes form part of these financial statements.

- 5 -

VML INTERNATIONAL PTY LTD

ABN 28 159 789 509

Notes to the Financial Statements

For the Year ended 30 June 2013

Freehold land and buildings are shown at their fair value (being the amount for which an

asset could be exchanged between knowledgeable willing parties in an arm's length

transaction), based on periodic, but at least triennial, valuations by directors, less subsequent

depreciation.

The carrying amount of plant and equipment is reviewed annually by directors to ensure it is

not in excess of the recoverable amount. The recoverable amount is assessed on the basis of

the expected net cash flows that will be received from the assets employment and

subsequent disposal. The expected net cash flows have not been discounted in determining

recoverable amounts.

(e) Income Tax

The income tax expense (income) for the year comprises current income tax expense

(income). The company does not apply deferred tax.

Current income tax expense charged to the profit or loss is the tax payable on taxable

income calculated using applicable income tax rates enacted, or substantially enacted,

as at the end of the reporting period. Current tax liabilities (assets) are therefore

measured at the amounts expected to be paid to (recovered from) the relevant taxation

authority.

(f) Trade and Other Receivables

Trade receivables are recognised initially at the transaction price (i.e. cost) and are

subsequently measured at cost less provision for impairment. Receivables expected to be

collected within 12 months of the end of the reporting period are classified as current assets.

All other receivables are classified as non-current assets.

At the end of each reporting period, the carrying amount of trade and other receivables are

reviewed to determine whether there is any objective evidence that the amounts are not

recoverable. If so, an impairment loss is recognised immediately in income statement.

(g) Inventories

Inventories are measured at the lower of cost and net realisable value. Costs are assigned on

a first-in first-out basis and include direct materials, direct labour and an appropriate

proportion of variable and fixed overhead expenses.

(h) Revenue and Other Income

All revenue is stated net of the amount of goods and services tax (GST).

(i) Trade and Other Payables

Trade and other payables represent the liabilities at the end of the reporting period for goods

and services received by the company that remain unpaid.

Trade payables are recognised at their transaction price. Trade payables are obligations on

the basis of normal credit terms.

The accompanying notes form part of these financial statements.

- 6 -

VML INTERNATIONAL PTY LTD

ABN 28 159 789 509

Notes to the Financial Statements

For the Year ended 30 June 2013

(j) Goods and Services Tax (GST)

Revenues, expenses and assets are recognised net of the amount of GST, except where the

amount of GST incurred is not recoverable from the Australian Taxation Office (ATO).

In these circumstances, the GST is recognised as part of the cost of acquisition of the

asset or as part of an item of the expense.

Receivables and payables in the balance sheet are shown inclusive of GST. The net

amount of GST recoverable from, or payable to, the ATO is included with other

receivables or payables in the balance sheet.

The accompanying notes form part of these financial statements.

- 7 -

VML INTERNATIONAL PTY LTD

ABN 28 159 789 509

Notes to the Financial Statements

For the Year ended 30 June 2013

2013 2012

$ $

2. Revenue

Sales Revenue

Sale of Goods 1,509,802 -

1,509,802 -

1,509,802 -

3. Expenses

Raw Materials, Purchases and Consumables Used 1,252,277 -

Employee Benefits Expense 119,307 -

Bank Charges 2,225 -

Insurance 2,338 -

Postage 885 -

Repairs & Maintenance 71 -

Telephone 846 -

Other Expenses 59,579 -

1,437,528 -

4. Finance Costs

Interest Paid

- Interest Paid 202 -

- Interest Paid 86061 13,165 -

- Interest Paid 27555 19,444 -

32,811 -

Finance Costs Capitalised

Finance costs that have been capitalised

during the period which will be amortised

Over Future Periods 7,979 -

5. Profit for the Year

Profit before income tax expense from continuing

operations includes the following specific expenses:

Charging as Expense

Cost of Goods Sold 1,252,277 -

Finance Costs 32,811 -

The accompanying notes form part of these financial statements.

- 8 -

VML INTERNATIONAL PTY LTD

ABN 28 159 789 509

Notes to the Financial Statements

For the Year ended 30 June 2013

2013 2012

$ $

6. Cash and Cash Equivalents

ANZ 65021 20,244 -

Cash on hand 1,320 -

21,564 -

7. Trade and Other Receivables

Current

Trade Debtors 21,332 -

Loans - Deposit 1,000 -

22,332 -

Total Trade and Other Receivables 22,332 -

8. Inventories

Current

Stock on Hand 68,750 -

68,750 -

Total Inventories 68,750 -

9. Tax Assets and Liabilities

Current

Liabilities

Current Tax Liability 11,839 -

11,839 -

Net Tax Liabilities 11,839 -

10. Property, Plant and Equipment

Land and Buildings

Business Cost

Business Cost 674,740 -

674,740 -

The accompanying notes form part of these financial statements.

- 9 -

VML INTERNATIONAL PTY LTD

ABN 28 159 789 509

Notes to the Financial Statements

For the Year ended 30 June 2013

2013 2012

$ $

11. Trade and Other Payables

Current

PAYG Payable 3,931 -

Provision for GST 5,498 -

9,429 -

Total Trade and Other Payables 9,429 -

12. Financial Liabilities

Current

Loans - 86061 300,305 -

Loans - 27555 403,399 -

Loans - Director 36,269 -

739,973 -

Total Financial Liabilities 739,973 -

13. Provisions

Current

Provision for Annual Leave 6,400 -

Total Provisions 6,400 -

14. Contributed Equity

Issued Capital

Ordinary Shares 100 -

100 -

The accompanying notes form part of these financial statements.

- 10 -

VML INTERNATIONAL PTY LTD

ABN 28 159 789 509

Notes to the Financial Statements

For the Year ended 30 June 2013

2013 2012

$ $

15. Retained Earnings

Retained Earnings at the Beginning of the Financial

Year

-

-

Add

Net profit attributable to members of the company 39,463 -

Less

Income Tax Expense 11,839 -

Retained Earnings at the End of the Financial Year 27,624 -

The accompanying notes form part of these financial statements.

- 11 -

VML INTERNATIONAL PTY LTD

ABN 28 159 789 509

Directors Declaration

for the Year Ended 30 June 2013

The directors have determined that the company is not a reporting entity and that this special purpose

financial report should be prepared in accordance with the accounting policies outlined in Note 1 to the

financial statements.

The directors of the company declare that:

1. the financial statements and notes, as set out in the financial statements, present fairly

the companys financial position as at 30 June 2013 and its performance for the year

ended on that date in accordance with the accounting policies described in Note 1

to the financial statements; and

2. in the directors opinion there are reasonable grounds to believe that the company will

be able to pay its debts as and when they become due and payable.

This declaration is made in accordance with a resolution of the Board of Directors.

___________________

Director Bing GAO

___________________

Director Rui JIA

Dated this................day of.................................... 2013

- 12 -

VML INTERNATIONAL PTY LTD

ABN 28 159 789 509

Annual Report

for the Year Ended 30 June 2013

Contents Page

Trading, Profit & Loss Statement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

Income Statement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Balance Sheet . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Notes to the Accounts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Directors' Declaration . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

You might also like

- 189 VisaDocument44 pages189 VisaAmrinder SetiaNo ratings yet

- Exercise 4Document3 pagesExercise 4Amrinder SetiaNo ratings yet

- Exercise 2Document3 pagesExercise 2Amrinder SetiaNo ratings yet

- Narrative ExampleDocument9 pagesNarrative ExampleAmrinder SetiaNo ratings yet

- Indian Passport Application FormDocument6 pagesIndian Passport Application FormNazumuddin ShaikhNo ratings yet

- Advanced Electrical Machines and Drives: Lab1: Speed Torque Characteristics of DC MotorsDocument1 pageAdvanced Electrical Machines and Drives: Lab1: Speed Torque Characteristics of DC MotorsAmrinder SetiaNo ratings yet

- Fuel ConsumptionDocument8 pagesFuel ConsumptionAmrinder SetiaNo ratings yet

- Exercise 3Document4 pagesExercise 3Amrinder SetiaNo ratings yet

- Exercise 1Document3 pagesExercise 1Amrinder SetiaNo ratings yet

- Master Project Report STANDocument47 pagesMaster Project Report STANAmrinder SetiaNo ratings yet

- Business Plan WA 2014Document12 pagesBusiness Plan WA 2014Amrinder SetiaNo ratings yet

- Roster Costing FormDocument1 pageRoster Costing FormAmrinder SetiaNo ratings yet

- Series DC Motor Torque-Speed CharacteristicsDocument6 pagesSeries DC Motor Torque-Speed CharacteristicsAmrinder SetiaNo ratings yet

- VMLDocument2 pagesVMLAmrinder SetiaNo ratings yet

- Fuel ConsumptionDocument8 pagesFuel ConsumptionAmrinder SetiaNo ratings yet

- Monday Tuesday Wednesday Thursday Friday Saturday Sunday: This Information On This Document Is Current and CorrectDocument2 pagesMonday Tuesday Wednesday Thursday Friday Saturday Sunday: This Information On This Document Is Current and CorrectAmrinder SetiaNo ratings yet

- Wage Rate WA Non FuelDocument5 pagesWage Rate WA Non FuelAmrinder SetiaNo ratings yet

- Statement of Average Earnings National 2013Document3 pagesStatement of Average Earnings National 2013Amrinder SetiaNo ratings yet

- Budget Forecast MDocument2 pagesBudget Forecast MAmrinder SetiaNo ratings yet

- Form 1424Document6 pagesForm 1424Amrinder SetiaNo ratings yet

- Authority Form: Section A: I'M Applying ToDocument2 pagesAuthority Form: Section A: I'M Applying ToAmrinder SetiaNo ratings yet

- Wage Rate WA FuelDocument5 pagesWage Rate WA FuelAmrinder SetiaNo ratings yet

- Statement 31072012Document11 pagesStatement 31072012Amrinder Setia100% (1)

- Business Plan WA 2014Document12 pagesBusiness Plan WA 2014Amrinder SetiaNo ratings yet

- Books 9Document50 pagesBooks 9Amrinder SetiaNo ratings yet

- Credit Limit Increase Application: D D / M M / Y YDocument2 pagesCredit Limit Increase Application: D D / M M / Y YAmrinder SetiaNo ratings yet

- Sam StatementDocument11 pagesSam StatementAmrinder Setia100% (1)

- Ielts Task 2 6 Sample EssaysDocument7 pagesIelts Task 2 6 Sample EssaysSungjin ParkNo ratings yet

- Authority Form: Section A: I'M Applying ToDocument2 pagesAuthority Form: Section A: I'M Applying ToAmrinder SetiaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Kogas Ar 2020Document11 pagesKogas Ar 2020Vinaya NaralasettyNo ratings yet

- AMZN ReportDocument19 pagesAMZN ReportTanya GhumanNo ratings yet

- Adobe Scan 03-May-2021Document22 pagesAdobe Scan 03-May-2021Mohit RanaNo ratings yet

- Employee RemunerationDocument55 pagesEmployee Remunerationsshreyas100% (2)

- AbbreviationsDocument4 pagesAbbreviationsGlennMontoyaNo ratings yet

- Penalties Under Income Tax Act: SL No Section No and Description PenaltyDocument9 pagesPenalties Under Income Tax Act: SL No Section No and Description PenaltyShainaNo ratings yet

- Trial Balance ReportDocument19 pagesTrial Balance ReportJeremy LunsodNo ratings yet

- Adv Business Calculations L3 Singapore) Past Paper Series 4 2010Document6 pagesAdv Business Calculations L3 Singapore) Past Paper Series 4 2010Richard Chan100% (1)

- Labor Costing MCQS: Home Financial Accounting Cost & Management Accounting Q & A Short Questions McqsDocument5 pagesLabor Costing MCQS: Home Financial Accounting Cost & Management Accounting Q & A Short Questions McqsRaja Ghufran ArifNo ratings yet

- GE1451 NotesDocument18 pagesGE1451 NotessathishNo ratings yet

- Case Background: Case - TSE International CompanyDocument9 pagesCase Background: Case - TSE International CompanyAvinash AgrawalNo ratings yet

- Pricing Policies And Decisions SummaryDocument10 pagesPricing Policies And Decisions SummaryayushdixitNo ratings yet

- Corporate Finance Project Report ON: Oil and Natural Gas Corporation LTD (Ongc)Document13 pagesCorporate Finance Project Report ON: Oil and Natural Gas Corporation LTD (Ongc)Sachin PanwarNo ratings yet

- Ce F5 002Document28 pagesCe F5 002សារុន កែវវរលក្ខណ៍No ratings yet

- North Carolina Individual Income Tax Instructions: EfileDocument24 pagesNorth Carolina Individual Income Tax Instructions: EfileQunariNo ratings yet

- Q 1Document4 pagesQ 1vanNo ratings yet

- Advance Auditing TechniquesDocument29 pagesAdvance Auditing TechniquesFaizan Ch75% (8)

- Cambridge Ordinary LevelDocument20 pagesCambridge Ordinary LevelMarlene BandaNo ratings yet

- 9706 s11 QP 21-22-23Document40 pages9706 s11 QP 21-22-23zahid_mahmood3811No ratings yet

- Critical Analysis of The Present Budget of Bangladesh and Its Sectors' Impacts"Document18 pagesCritical Analysis of The Present Budget of Bangladesh and Its Sectors' Impacts"rayhan555No ratings yet

- HDFC Bank Limited: "Melioration in Asset Quality Marginal Compression in NIM Initiating Coverage With HOLD"Document18 pagesHDFC Bank Limited: "Melioration in Asset Quality Marginal Compression in NIM Initiating Coverage With HOLD"janu_ballav9913No ratings yet

- PGBPDocument61 pagesPGBPJyoti Kalotra0% (1)

- The Subsidies - An Instrument of Trade Policy. Case Study: The Boeing-Airbus "War"Document14 pagesThe Subsidies - An Instrument of Trade Policy. Case Study: The Boeing-Airbus "War"Tezâswi SthâNo ratings yet

- Marriott ValuationDocument16 pagesMarriott ValuationOladipupo Mayowa PaulNo ratings yet

- Topic 1 Introduction To Financial Environment and Financial ManagementDocument69 pagesTopic 1 Introduction To Financial Environment and Financial ManagementNajwa Alyaa binti Abd WakilNo ratings yet

- Payments in Lieu of TaxesDocument52 pagesPayments in Lieu of TaxesLincoln Institute of Land PolicyNo ratings yet

- Cellcyte Genetics Corp.: Visibility Visibility I RDocument16 pagesCellcyte Genetics Corp.: Visibility Visibility I RMattNo ratings yet

- Bridge The Gaps Broschure FinalDocument36 pagesBridge The Gaps Broschure FinalVicente PerezNo ratings yet

- Ims Ship Management PVT - LTD: (Vikas Anton Sajan Roustabout Sagar Bhushan CETDocument2 pagesIms Ship Management PVT - LTD: (Vikas Anton Sajan Roustabout Sagar Bhushan CETlucasNo ratings yet

- IAS 20 - Accounting For Government Grants and Disclosure of Government Assistance (Detailed Review)Document8 pagesIAS 20 - Accounting For Government Grants and Disclosure of Government Assistance (Detailed Review)Nico Rivera CallangNo ratings yet