Professional Documents

Culture Documents

Chapter Four Data and Empirical Results 4.1 Unit Root Test

Uploaded by

Alere John Adebola0 ratings0% found this document useful (0 votes)

31 views4 pagesproject

Original Title

Chapter Four

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentproject

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

31 views4 pagesChapter Four Data and Empirical Results 4.1 Unit Root Test

Uploaded by

Alere John Adebolaproject

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

CHAPTER FOUR

DATA AND EMPIRICAL RESULTS

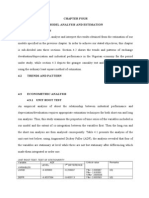

4.1 Unit Root Test

This involves testing for the stationarity of the individual variables using both the

Augmented Dickey Fuller (ADF) and Phillips Perron (PP) tests to find the

existence of unit root in each of the time series. The results of both the ADF and

PP tests are reported in Tables 4.1(Levels) and 4.2 (First Difference).

All the variables were not found stationary in levels. This can be seen by

comparing the observed values (in absolute terms) of both the ADF and PP test

statistics with the critical values (also in absolute terms) of the test statistics at

the 1%, 5% and 10% level of significance. Result from table 4.1 provides strong

evidence of non stationarity. Therefore, the null hypothesis is accepted and it is

sufficient to conclude that there is a presence of unit root in the variables at

levels.

As a result of the above result, all the variables were differenced once and both

the ADF and PP test were conducted on them a shown in table 4.2. The

coefficients compared with the critical values (1%, 5% and 10%) reveals that all

the variables were stationary at first difference and on the basis of this, the null

hypothesis of non-stationary is rejected and it is safe to conclude that the

variables are stationary. This implies that the variables are integrated of order

one, i.e. 1(1).

4.2 Cointegration test result and Analysis

The result of the cointegration condition (that is the existence of a long term

linear relation) is presented in Table 4.3 (Trace Statistics) and 4.4 (Maximum

Eigenvalue) using methodology proposed by Johansen and Juselius (1990):

In the Cointegration tables, both trace statistic and maximum Eigenvalue statistic

indicated no cointegration at the 5 percent level of significance, suggesting that

there is no cointegrating (or long run) relationship between Growth and Inflation.

Since the null hypothesis was accepted, there is no need to further subject the

variables to error correction test which has lead us to examine the causality

between growth and inflation.

4.3 Granger Causality Test Analysis

Causality does not necessarily suggest exogeneity in the sense that the result

gotten may not explain whether the relationship is positive or negative. However,

growth and inflation, as widely suggested by many economist scholars in the

literature reviewed are known to relate inversely, in other words, the economy

does not grow well in the midst of high inflation. In any case the following result

shown in the tables below reveals the direction of causality between growth and

inflation at lag two (2) and lag four (4).

Following the result in table 4.5, the null hypothesis that LCPI does not Granger

Cause LGDP is rejected and it is safe to conclude that Uni-directional causality run

from Inflation to GDP at lag two (2).

In the result shown in table 4.6, the null hypothesis that LCPI does not Granger

cause GDP is also rejected, further confirming a unidirectional causality from

Inflation to GDP at lag 4.

Appendix

Table 4.1 ADF and PP Stationarity test at Levels

Variables ADF (Intercept) ADF (Intercept

& Trend)

PP (Intercept) PP (Intercept &

Trend)

LGDP 0.401(-3.632)* -1.383(-4.243)* 0.353(-3.632)* -1.531(-4.243)*

LCPI -0.072(-3.639)* -2.593(-4.252)* 2.292(-3.632)* 1.920(-4.243)*

Note: Significance at 1% level. Figures within parenthesis indicate critical values.

Mackinnon (1991) criticalvalue for rejection of hypothesis of unit root applied.

Source: Authors Estimation using Eviews 6.0.

4.2 ADF and PP Stationarity test at First Difference

Variables ADF (Intercept) ADF (Intercept

& Trend)

PP (Intercept) PP (Intercept &

Trend)

LGDP -4.984(-3.639)* -4.965(-4.252)* -4.984(-3.639)* -4.971(-4.252)*

LCPI -3.229(-2.951)** -3.192(-3.548)** -3.018(-2.951)** -2.994(-4.252)*

Note: * and ** denotes Significance at 1% & 5% level, respectively. Figures within

parenthesis indicate critical values. Mackinnon (1991) critical value for rejection

of hypothesis of unit root applied.

Source: Authors Estimation using Eviews 6.0.

Table 4.3 Unrestricted Cointegration Rank Test (Trace)

Hypothesized

No. of CE(s)

Eigenvalue Trace

Statistic

0.05 Critical

Value

Prob.**

None 0.190841 7.203769 15.49471 0.5541

At most 1 0.000116 0.003935 3.841466 0.9487

Trace test indicates no cointegration at the 0.05 level

* denotes rejection of the hypothesis at the 0.05 level

**MacKinnon-Haug-Michelis (1999) p-values

Table 4.4 Unrestricted Cointegration Rank Test (Maximum Eigenvalue)

Hypothesized Max-Eigen 0.05

No. of CE(s) Eigenvalue Statistic Critical Value Prob.**

None 0.190841 7.199833 14.26460 0.4658

At most 1 0.000116 0.003935 3.841466 0.9487

Max-eigenvalue test indicates no cointegration at the 0.05 level

* denotes rejection of the hypothesis at the 0.05 level

**MacKinnon-Haug-Michelis (1999) p-values

Table 4.5 Pairwise Granger Causality Tests (lag 2)

Null Hypothesis: Obs F-Statistic Probability

LCPI does not Granger Cause LGDP 34 2.08237 0.14288

LGDP does not Granger Cause LCPI 0.86471 0.43175

Table 4.6 Pairwise Granger Causality Tests (lag 4)

Null Hypothesis: Obs F-Statistic Probability

LCPI does not Granger Cause LGDP 32 2.30776 0.08862

LGDP does not Granger Cause LCPI 0.30337 0.87269

You might also like

- Psy7620 U10a1 Chi SquareDocument15 pagesPsy7620 U10a1 Chi Squarearhodes777No ratings yet

- DOE Primer: Understanding Design of Experiments ConceptsDocument6 pagesDOE Primer: Understanding Design of Experiments ConceptsPujitha GarapatiNo ratings yet

- Imeko WC 2012 TC21 O10Document5 pagesImeko WC 2012 TC21 O10mcastillogzNo ratings yet

- Summary of Chapter 4Document3 pagesSummary of Chapter 4ThomasNo ratings yet

- 4th ChapterDocument32 pages4th ChapterAzwad AbizetNo ratings yet

- 05 Schmitt96UsesAbusesAlpha PDFDocument4 pages05 Schmitt96UsesAbusesAlpha PDFajnnixNo ratings yet

- Interpretation of Eviews RegressionDocument6 pagesInterpretation of Eviews RegressionRabia Nawaz100% (1)

- EVIEWS Tutorial: Co Integration and Error Correction ModalDocument14 pagesEVIEWS Tutorial: Co Integration and Error Correction ModalSamia NasreenNo ratings yet

- Gia Work 2Document11 pagesGia Work 2Fred MsumaliNo ratings yet

- Warrens2016 Article AComparisonOfReliabilityCoeffi PDFDocument14 pagesWarrens2016 Article AComparisonOfReliabilityCoeffi PDFLanaBecNo ratings yet

- Warrens2016 Article AComparisonOfReliabilityCoeffi PDFDocument14 pagesWarrens2016 Article AComparisonOfReliabilityCoeffi PDFLanaBecNo ratings yet

- Testing The Volatility and Leverage Feedback Hypotheses Using GARCH (1,1) and VAR ModelsDocument22 pagesTesting The Volatility and Leverage Feedback Hypotheses Using GARCH (1,1) and VAR ModelsFisher BlackNo ratings yet

- Unit 16 Analysis of Quantitative Data: Inferential Statistics Based On Nqn-Pametric TestsDocument16 pagesUnit 16 Analysis of Quantitative Data: Inferential Statistics Based On Nqn-Pametric Testsromesh10008No ratings yet

- Relationship between Inflation and Unemployment: A Time Series AnalysisDocument29 pagesRelationship between Inflation and Unemployment: A Time Series Analysisnits0007No ratings yet

- Pesaran M. H., Shin Y., Smith R. J. (2001)Document38 pagesPesaran M. H., Shin Y., Smith R. J. (2001)Michele DalenaNo ratings yet

- IA Analysis SampleDocument5 pagesIA Analysis Sample2741993153No ratings yet

- Pesaran Bounds Test TableDocument38 pagesPesaran Bounds Test TableNuur Ahmed100% (5)

- G Power Test 2Document12 pagesG Power Test 2quierolibrosyaNo ratings yet

- Chapter ADocument46 pagesChapter AKamijo YoitsuNo ratings yet

- Post Hoc Power: A Concept Whose Time Has Come: Anthony J. OnwuegbuzieDocument31 pagesPost Hoc Power: A Concept Whose Time Has Come: Anthony J. OnwuegbuzieKellixNo ratings yet

- The Research and Analysis of Factors Affecting Critical Flicker FrequencyDocument8 pagesThe Research and Analysis of Factors Affecting Critical Flicker FrequencymelissastgoNo ratings yet

- Optimize Attribute Responses Using Design of Experiments: Example ExperimentDocument6 pagesOptimize Attribute Responses Using Design of Experiments: Example Experimentangel_garcia6877No ratings yet

- Chapter Four Data Presentation, Analysis and InterpretationDocument11 pagesChapter Four Data Presentation, Analysis and InterpretationsirconceptNo ratings yet

- Complete Issue May 2010Document92 pagesComplete Issue May 2010Ivan LessiaNo ratings yet

- Amino MUDocument158 pagesAmino MUBin HadithonNo ratings yet

- ToxstatDocument9 pagesToxstatBárbara Assis CantarelaNo ratings yet

- Personality Factors in The Eysenck Personality Questionnaire (Barrett & Kline, 1980)Document17 pagesPersonality Factors in The Eysenck Personality Questionnaire (Barrett & Kline, 1980)Mal FaladoNo ratings yet

- A Case Study of TanzaniaDocument15 pagesA Case Study of TanzaniaVladGrigoreNo ratings yet

- Data and MethodologyDocument5 pagesData and MethodologyAdnan RashidNo ratings yet

- Combined AnalysisDocument7 pagesCombined AnalysisKuthubudeen T MNo ratings yet

- Roohullah - Monetory ResearchDocument9 pagesRoohullah - Monetory ResearchŔòóh ÚĺĺáhNo ratings yet

- Topic 9. Factorial Experiments (ST&D Chapter 15) : 1 2 I I I IDocument19 pagesTopic 9. Factorial Experiments (ST&D Chapter 15) : 1 2 I I I ImaleticjNo ratings yet

- Newsom Psy 521 Post Hoc TestsDocument4 pagesNewsom Psy 521 Post Hoc Testsinayati fitriyahNo ratings yet

- L5 - MeanSeparationDocument16 pagesL5 - MeanSeparationTeflon SlimNo ratings yet

- Data Analysis TechniquesDocument16 pagesData Analysis TechniquesAltaf KhanNo ratings yet

- Export Growth and Output GrowthDocument11 pagesExport Growth and Output GrowthMOHD NOR HIDAYAT MELBINNo ratings yet

- Handout Stat Week 9 Chi SquareDocument4 pagesHandout Stat Week 9 Chi SquareIsa IrawanNo ratings yet

- Manufacturing CSR and Institutional Ownership Impact on Company ValueDocument11 pagesManufacturing CSR and Institutional Ownership Impact on Company ValueHafizhHermawanNo ratings yet

- Experimental Design - TQMDocument70 pagesExperimental Design - TQMRishi Balan0% (1)

- Analysis and FindingsDocument26 pagesAnalysis and FindingsAfzaal AliNo ratings yet

- Contingency Tables: Example: The Following Table Shows Results of HIV Testing. What Is The Probability ThatDocument2 pagesContingency Tables: Example: The Following Table Shows Results of HIV Testing. What Is The Probability ThatMasudul ICNo ratings yet

- 513FA-Dougoud FBUCVCDocument14 pages513FA-Dougoud FBUCVCmitchelllingNo ratings yet

- B. Path Analysis ResultDocument5 pagesB. Path Analysis ResultA-LubisNo ratings yet

- Tuto 3 AnsDocument2 pagesTuto 3 AnsopenemailaddNo ratings yet

- S U R J S S: Indh Niversity Esearch Ournal (Cience Eries)Document6 pagesS U R J S S: Indh Niversity Esearch Ournal (Cience Eries)leostarz05No ratings yet

- FactorDocument40 pagesFactoraraksunNo ratings yet

- Pakistan Institute of Development Economics Assignment Analyzes ARCH Family Models for Allied Bank Limited Price HistoryDocument7 pagesPakistan Institute of Development Economics Assignment Analyzes ARCH Family Models for Allied Bank Limited Price HistoryHafiz Saddique MalikNo ratings yet

- Gordon 1997Document6 pagesGordon 1997Md. Sohanur RahmanNo ratings yet

- Chapter 9. Multiple Comparisons and Trends Among Treatment MeansDocument21 pagesChapter 9. Multiple Comparisons and Trends Among Treatment MeanskassuNo ratings yet

- Med Mediation AnalysisDocument3 pagesMed Mediation AnalysisHazel LoNo ratings yet

- Quantile Regression: Estimation and SimulationFrom EverandQuantile Regression: Estimation and SimulationRating: 3.5 out of 5 stars3.5/5 (1)

- Tests With More Than Two Independent Samples - The Kruskal-Wallis TestDocument7 pagesTests With More Than Two Independent Samples - The Kruskal-Wallis TestIL MareNo ratings yet

- Linear Regression For Air Pollution Data: U T S ADocument14 pagesLinear Regression For Air Pollution Data: U T S AEncikFiiNo ratings yet

- Spearman & Mann WhitneyDocument7 pagesSpearman & Mann WhitneyMilka RahmanNo ratings yet

- Dizzle 4Document8 pagesDizzle 4ezioliseNo ratings yet

- Chapter Four Model Analysis and Estimation 4.1Document8 pagesChapter Four Model Analysis and Estimation 4.1Oladipupo Mayowa PaulNo ratings yet

- 10 1 1 534 5826 PDFDocument17 pages10 1 1 534 5826 PDFDella Kartika CorieNo ratings yet

- Comparison of Probability Based Design and Eurocode 7 in Slope Stability AnalysisDocument8 pagesComparison of Probability Based Design and Eurocode 7 in Slope Stability AnalysisLaidon ZekajNo ratings yet

- EXPRESS STATISTICS "Hassle Free" ® For Public Administrators, Educators, Students, and Research PractitionersFrom EverandEXPRESS STATISTICS "Hassle Free" ® For Public Administrators, Educators, Students, and Research PractitionersNo ratings yet

- Abstrac Ajulo On HospitalityDocument1 pageAbstrac Ajulo On HospitalityAlere John AdebolaNo ratings yet

- Chapter One Komo DegreDocument82 pagesChapter One Komo DegreAlere John AdebolaNo ratings yet

- Echo Green Form and InstDocument15 pagesEcho Green Form and InstAlere John AdebolaNo ratings yet

- ALAKARADocument8 pagesALAKARAAlere John AdebolaNo ratings yet

- 1st SeptemberDocument5 pages1st SeptemberAlere John AdebolaNo ratings yet

- 30 Mar 201 CBNproved Accounts FinalDocument62 pages30 Mar 201 CBNproved Accounts FinalAlere John AdebolaNo ratings yet

- 30 Mar 201 CBNproved Accounts FinalDocument62 pages30 Mar 201 CBNproved Accounts FinalAlere John AdebolaNo ratings yet

- Paying Taxes 2011Document104 pagesPaying Taxes 2011Alere John AdebolaNo ratings yet

- Evaluating The Impact of Training On Staff RetentionDocument13 pagesEvaluating The Impact of Training On Staff RetentionAlere John AdebolaNo ratings yet

- 409Document21 pages409Alere John AdebolaNo ratings yet

- HousingDocument21 pagesHousingAlere John AdebolaNo ratings yet

- Exam Blueprint: ConciseDocument5 pagesExam Blueprint: ConciseGlc PekanbaruNo ratings yet

- School uniforms vs casual clothes debateDocument2 pagesSchool uniforms vs casual clothes debatePham HienNo ratings yet

- Global TobaccoDocument35 pagesGlobal TobaccoTimothée Muller ScientexNo ratings yet

- European Patent Office (Epo) As Designated (Or Elected) OfficeDocument40 pagesEuropean Patent Office (Epo) As Designated (Or Elected) Officejasont_75No ratings yet

- CP IIDocument540 pagesCP IIMichael Tache VictorinoNo ratings yet

- Organisational StructureDocument18 pagesOrganisational StructureAmmy D Extrovert70% (10)

- HCM Signalized Intersection Capacity Analysis SummaryDocument1 pageHCM Signalized Intersection Capacity Analysis SummaryEduardo Talla NegreirosNo ratings yet

- Cadbury Schweppes: Capturing Confectionery (A)Document5 pagesCadbury Schweppes: Capturing Confectionery (A)Rubak Bhattacharyya100% (2)

- DibujoDocument29 pagesDibujoJ0hker100% (1)

- ACCA - Financial Management (FM) - Course Exam 1 Questions - 2019 PDFDocument6 pagesACCA - Financial Management (FM) - Course Exam 1 Questions - 2019 PDFADELINE LIONIVIA100% (1)

- Smirnoff Word FinalDocument10 pagesSmirnoff Word Finalapi-304871269No ratings yet

- AT&T/McCaw Merger Valuation and Negotiation StrategyDocument9 pagesAT&T/McCaw Merger Valuation and Negotiation StrategySong LiNo ratings yet

- Cost Exercises - Corrections To BookDocument3 pagesCost Exercises - Corrections To Bookchamie143No ratings yet

- Unit 4 Planning and Running A Hospitality EventDocument13 pagesUnit 4 Planning and Running A Hospitality Eventtelfordunited2No ratings yet

- Chapter 2 Demand and Supply AnalysisDocument44 pagesChapter 2 Demand and Supply AnalysisNur AtikahNo ratings yet

- CHAPTER - 5 - Exercise & ProblemsDocument6 pagesCHAPTER - 5 - Exercise & ProblemsFahad Mushtaq20% (5)

- Category Strategy Development WorksheetsDocument18 pagesCategory Strategy Development WorksheetsSainsuren SamdanrenchinNo ratings yet

- Lincoln Electric Venturing Abroad CaseDocument2 pagesLincoln Electric Venturing Abroad Caseyuxuanyx100% (1)

- Synthesis On Capital BudgetingDocument2 pagesSynthesis On Capital BudgetingRu MartinNo ratings yet

- Excel Professional Services, Inc.: Discussion QuestionsDocument5 pagesExcel Professional Services, Inc.: Discussion QuestionsSadAccountantNo ratings yet

- Shopping for shoes across the seaDocument4 pagesShopping for shoes across the seacecaisamNo ratings yet

- Bangladesh RMG Industry Faces Major Political, Worker, and Safety IssuesDocument2 pagesBangladesh RMG Industry Faces Major Political, Worker, and Safety IssuesMahbub EmonNo ratings yet

- List of Cases in Persons and Family RelationsDocument4 pagesList of Cases in Persons and Family RelationsSheena RimaNo ratings yet

- Adams CorporationDocument2 pagesAdams Corporationrocamorro67% (6)

- Unit 18: Calculating Food Costs, Selling Prices and Making A ProfitDocument4 pagesUnit 18: Calculating Food Costs, Selling Prices and Making A Profitkarupukamal100% (2)

- Books of 2021Document67 pagesBooks of 2021Joey De CelioNo ratings yet

- Audit PlanningDocument6 pagesAudit PlanningFrancis Martin90% (10)

- Econ 301 MT 1 NotesDocument24 pagesEcon 301 MT 1 NotesNicolle YhapNo ratings yet

- BD234 PDFDocument4 pagesBD234 PDFCalin LuchianNo ratings yet

- Solapur hotel guide with room ratesDocument3 pagesSolapur hotel guide with room ratesSreekanth G RaoNo ratings yet