Professional Documents

Culture Documents

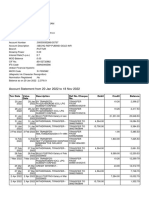

2014 Itr2 PR3 01

Uploaded by

88arjOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2014 Itr2 PR3 01

Uploaded by

88arjCopyright:

Available Formats

Click on the sheets below Schedules for filing Income Tax Return

Select

applicable

sheets below by

choosing Y/N

and Click on

Apply

1 PART A - GENERAL Personal Info., Filing Status Y

2 PARTB - TI - TTI - SAL PartB-TI,PartB-TTI,Verification,Schedule S Y

3 HOUSE_PROPERTY Schedule HP Y

4 CG Schedule CG, Schedule OS Y

5 OS Schedule CG, Schedule OS Y

6 CYLA-BFLA Schedule CYLA, Schedule BFLA Y

7 CFL ScheduleCFL Y

8 VIA Schedule VIA Y

9 SPI - SI Schedule SPI, Schedule SI Y

10 EI Schedule EI Y

11 IT Schedule AIR, Schedule IT Y

12 FSI Schedule AIR, Schedule FSI Y

12 TR_FA Schedule TR, Schedule FA Y

13 TDS Schedule TDS1,Schedule TDS2 Y

14 SCH5A Schedule 5A Y

Select sheets to

print and click

apply

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

ScheduleName Appli

cable

YN

GENERAL PartA_Gen1 Y

PART_B PartB-TI Y

PART_B PartB-TTI Y

HOUSE_PROPERTY ScheduleHP Y

CG ScheduleCG Y

OS ScheduleOS Y

CYLA BFLA ScheduleCYLA Y

CYLA BFLA ScheduleBFLA Y

CFL ScheduleCFL Y

VIA ScheduleVIA Y

SPI - SI ScheduleSPI Y

SPI - SI ScheduleSI Y

EI ScheduleEI Y

IT ScheduleIT Y

FSI ScheduleFSI Y

TR ScheduleTR Y

FA ScheduleFA Y

TDS ScheduleTDS1 Y

TDS ScheduleTDS2 Y

SCH5A Schedule5A Y

Description

Click on applicable links to navigate to the respective sheet / schedule.

Click on any of the links on this page to navigate to the respective schedules.

Computation of total income

Computation of tax liability on total income

Details of Income from House Property

Capital Gains

Income from other sources

Details of Income after set-off of current years losses

Details of Income after Set off of Brought Forward Losses of earlier years

Details of Losses to be carried forward to future Years

Deductions under Chapter VI-A

Income chargeable to Income tax at special rates IB [Please see instruction Number-9(iii) for section code and

rate of tax]

Income chargeable to Income tax at special rates IB [Please see instruction Number-9(iii) for section code and

rate of tax]

Details of Exempt Income (Income not to be included in Total Income)

Details of Advance Tax and Self Assessment Tax Payments of Income-tax

Details of Income accruing or arising outside India

Schedule TR Details of Tax Relief claimed under Section 90 or Section 90A or Section 91.

Schedule FA Details of foreign assets

Details of Tax Deducted at Source on Income [As per Form 16 A issued by Deductor(s)]

Details of Tax Collected at Source [As per Form 27D issued by the Collector(s)]

Information regarding apportionment of income between spouses governed by Portuguese Civil Code

a

(Select)

(Select) Whether original or revised

return?

(Select) If filed, in response to a notice u/s

139(9)/142(1)/148/153A/153C enter date

of such notice, or u/s 92CD enter date of

advance pricing agreement

00/00/0000

State

Landline Phone

number

(Residence /

Office)

Country

ITR-2

Email Address-2

Town/City/District

Mobile No 1 (Std code)

Name of Premises / Building / Village

Assessment Year

Flat / Door / Block No

First Name

Income Tax Ward/Circle

(Please see Rule 12 of the Income Tax-Rules,1962)

Middle Name

Sex

2 0 1 4 - 1 5

(Also see attached Instructions)

(Select)

F

I

L

I

N

G

S

T

A

T

U

S

Road / Street / Post Office

Name of the representative

DD/MM/Y

Employer

Category

(Select)

(Refer

Instruction 7 )

F

O

R

M

P

E

R

S

O

N

A

L

I

N

F

O

R

M

A

T

I

O

N

Mobile No 2

(Select)

Email Address-1 (self)

Dateof

[For Individuals and HUFs not having Income from Business or Profession]

PAN

Status (I-Individual,H-HUF)

If revised, defective, Modified then Enter

Receipt No

Pin Code

Last Name

Area / Locality

Return filed under section

(Select)

(Select)

Are you governed by Portuguese Civil Code as per

section 5A?

(Select)

b

INDIAN INCOME TAX RETURN

Whether this return is being filed by a representative assessee? If yes, please furnish

following information

c Permanent Account Number (PAN) of the representative

Address of the representative

Notice No (Where the original return

filed was defective and a notice is issued

to the assessee to file a fresh return Sec

139(9)

Date

(DD/MM/YYYY

Residential

Status

1

2

3

a

i 3ai 0

ii 3aii 0

iii 3aiii 0

iv 3a 0

b i 3bi 0

ii 3bi 0

b 3b 0

c

4

a 4a 0

b 4b 0

c 4c 0

d

5

6

7

8

9

10

11

12

13

14

15

16

Computation of tax liability on total income

1

a 1a 0

b 1b 0

Part B - TI

Computation of total income . PLEASE NOTE THAT CALCULATED FI ELDS (I N WHI TE) ARE PI CKED UP FROM OTHER

SCHEDULES AND ARE NOT TO BE ENTERED. For ex : The income figures below will get filled up when the Schedules linked

to the I ncome are filled.

Long-term (20%) (7vi of Table E of Sch CG)

Short term

Income from house property (C of Schedule-HP) (Enter nil if loss)

C

O

M

P

U

T

A

T

I

O

N

O

F

T

A

X

L

I

A

B

I

L

I

T

Y

Short-term (Applicable Rate) 7(iv) of Table E of Schedule CG)

Total capital gains (3a + 3b) (enter nil if loss)

Short-term (15%) 7(ii) of Table E of Schedule CG)

Balance after set off current year losses (5-6) (also total of column 4 of Schedule CYLA +4b)

Part B - TTI

Tax at special rates (total of (ii) of Schedule-SI)

Tax payable on total income

from the activity of owning and maintaining race horses (3c of Schedule

OS)(enter nil if loss)

Salaries (7 of Schedule S)

Income from other sources

Short-term (30%) 7(iii) of Table E of Schedule CG)

Income chargeable to tax at special rate (1fiii of Schedule OS)

Long-term (10%) (7v of Table E of Sch CG)

Long-term (3bi + 3bii)

from sources other than from owning race horses and income chargeable to

tax at special rate (1i of Schedule OS) (enter nil if loss)

Net agricultural income/ any other income for rate purpose (4 of Schedule EI)

Brought forward losses set off against 7 (2x of Schedule BFLA)

Gross Total income (7-8)(also 3xi of Schedule BFLA +4b )

Losses of current year to be carried forward (total of xi of Schedule CFL)

Total (1 + 2 + 3 c+ 4d)

Aggregate income (12-13+14) [applicable if (12-13) exceeds maximum amount not chargeable to tax]

Deductions under Chapter VI-A [r of Schedule VIA and limited to (9-10)]

Losses of current year set off against 5 (total of 2x and 3x of Schedule CYLA)

T

O

T

A

L

I

N

C

O

M

E

Total short-term (3ai + 3aii + 3aiii)

Capital gains

Tax at normal rates on 15 of Part B-TI

Total income (9 - 11)

Income chargeable to tax at special rate under section 111A, 112 etc. included in 9

Income which is included in 12 and chargeable to tax at special rates (total of (i) of schedule SI)

Total (4a + 4b + 4c) (enter nil if loss)

c 1c 0

d

2

3

4

5

6

7

a 7a 0

b 7b 0

c 7c 0

d

8

9

a 9a 0

b 9b 0

c 9c 0

d

10

11

a 11a 0

b 11b 0

c 11c 0

d

12

13

14

16 Type of Account (Select)

17

14

Counter Signature of

TRP

Tax payable (1d-2)

C

O

M

P

U

T

A

T

I

O

N

O

F

T

A

X

L

I

A

B

I

L

I

T

Y

For default in furnishing the return (section 234A)

Rebate under section 87A (applicable for resident and if 12 of Part B-TI does not exceed 5 lakh)

Net tax liability (6 7d) Enter 0 if negative

Total (a + b + c)

Section 91 (3 of Schedule TR)

Aggregate liability (8 + 9d)

Education Cess, including secondary and higher education cess, on (3 + 4)

Rebate on agricultural income [applicable if (12-13) of Part B-TI exceeds

maximum amount not chargeable to tax]

Gross tax liability (3+ 4+5)

R

E

F

U

N

D

Surcharge on 3 (applicable if 12 of Part B-TI exceeds 1 crore)

15 IFSC Code

Do you have,-

(i) any asset (including financial interest in any entity) located outside India or

(ii) signing authority in any account located outside India?

[applicable only in case of a resident] [Ensure Schedule FA is filled up if the answer is Yes ]

Advance Tax (from Schedule-IT)

Taxes Paid

Total Interest Payable (a+b+c)

Refund (If 11d is greater than 10)

TDS (total of column 5 of Schedule-TDS1 and column 8 of Schedule-TDS2

AND Schedule TDS3)

Identification No. of

TRP

Self Assessment Tax (from Schedule-IT)

Total Taxes Paid (a+b+c)

Place

VERIFICATION

Amount payable (Enter if 10 is greater than 11d, else enter 0)

T

A

X

E

S

P

A

I

D

son/ daughter of

Interest payable

Section 90/90A (2 of Schedule TR)

For default in payment of advance tax (section 234B)

For deferment of advance tax (section 234C)

Section 89

Tax Payable on Total Income (1a + 1b-1c)

Tax relief

Name of TRP

If the return has been prepared by a Tax Return Preparer (TRP) give further details below:

PAN

(Date)

solemnly declare that to the best of my knowledge and belief, the information given in the return and the schedules thereto is is correct and complete and that

the amount of total income/ fringe benefits and other particulars shown therein are truly stated and are in accordance with the the provisions of the Income-

tax Act, 1961, in respect of income and fringe benefits chargeable to Income-tax for the previous year relevant to the assessment year 2014-2015

I,

Enter your bank account number (the number should be 9 digits or more as per CBS system of the bank )

14

Schedule S Details of Income from Salary (Fields marked in RED should not be left Blank)

Name of Employer PAN of Employer (optional)

Address of employer Town/City

State (Select)

1 Salary (Excl all exempt/ non-exempt allowances, perquisites ,profit in lieu of sal as they are shown separately below)

2 Allowances exempt under section 10 (Not to be included in 7 below)

i Travel concession/assistance received [(sec. 10(5)] 2i 0

ii Tax paid by employer on non-monetary perquisite [(sec. 10(10CC)] 2ii 0

iii Allowance to meet expenditure incurred on house rent [(sec. 10(13A)] 2iii 0

iv Other allowances 2iv 0

3 Allowances not exempt (refer Form 16 from employer)

4 Value of perquisites (refer Form 16 from employer)

5 Profits in lieu of salary (refer Form 16 from employer)

6 Deduction u/s 16 (Entertainment allowance by Government and tax on employment)

7 Income chargeable under the Head Salaries (1 + 3 + 4 + 5 - 6)

Total

If TRP is entitled for any reimbursement from the Government, amount

thereof

1 0

2 0

3c 0

4d 0

5 0

6 0

7 0

8 0

9 0

10 0

11 0

12 0

13 0

14 0

15 0

16 0

Computation of total income . PLEASE NOTE THAT CALCULATED FI ELDS (I N WHI TE) ARE PI CKED UP FROM OTHER

SCHEDULES AND ARE NOT TO BE ENTERED. For ex : The income figures below will get filled up when the Schedules linked

to the I ncome are filled.

1d 0

2 0

3 0

4 0

5 0

6 0

7d 0

8 0

9d 0

10 0

11d 0

12 0

13 0

14

(Select)

16

(Select)

VERIFICATION

If the return has been prepared by a Tax Return Preparer (TRP) give further details below:

solemnly declare that to the best of my knowledge and belief, the information given in the return and the schedules thereto is is correct and complete and that

the amount of total income/ fringe benefits and other particulars shown therein are truly stated and are in accordance with the the provisions of the Income-

tax Act, 1961, in respect of income and fringe benefits chargeable to Income-tax for the previous year relevant to the assessment year 2014-2015

Pin code

1 0

3 0

4 0

5 0

6 0

7 0

0

ADDRESS OF

PROPERTY (NOTE :

DO NOT LEAVE

ADDRESS BLANK )

Town/ City

Is the property co-owned? (SELECT)

S.No NAME OF CO-OWNER (TO ADD MORE COOWNERS,

PLEASE CLICK ON "ADD COOWNERS" BUTTON AT THE BOTTOM

1

2

3

4

5

IS THE PROPERTY

LET OUT ? ( Y - YES, N-

NO)

Name of Tenant

(SELECT)

a Annual letable value or rent received or receivable (higher of the two, if let out for whole of the year, lower of the two if let out for part of the year)

b The amount of rent which cannot be realized

c Tax paid to local authorities

d Total (b + c)

e Annual value (a d) (nil, if self -occupied etc. as per section 23(2)of the Act)

f Annual value of the property owned (own percentage share x e)

g 30% of f

h Interest payable on borrowed capital

i Total (g + h)

j Income from house property (f i)

ADDRESS OF

PROPERTY (NOTE :

DO NOT LEAVE

ADDRESS BLANK )

Town/ City

Is the property co-owned? (SELECT)

S.No NAME OF CO-OWNER (TO ADD MORE COOWNERS,

PLEASE CLICK ON "ADD COOWNERS" BUTTON AT THE BOTTOM

1

2

3

4

5

IS THE PROPERTY

LET OUT ? ( Y - YES, N- Name of Tenant

(SELECT)

a Annual letable value or rent received or receivable (higher of the two, if let out for whole of the year, lower of the two if let out for part of the year)

b The amount of rent which cannot be realized

SCH HP Details of Income from House Property (Fields marked in RED must not be left Blank)

c Tax paid to local authorities

d Total (b + c)

e Annual value (a d) (nil, if self -occupied etc. as per section 23(2)of the Act)

f Annual value of the property owned (own percentage share x e)

g 30% of f

h Interest payable on borrowed capital

i Total (g + h)

j Income from house property (f i)

ADDRESS OF

PROPERTY (NOTE :

DO NOT LEAVE

ADDRESS BLANK )

Town/ City

Is the property co-owned? (SELECT)

S.No NAME OF CO-OWNER (TO ADD MORE COOWNERS,

PLEASE CLICK ON "ADD COOWNERS" BUTTON AT THE BOTTOM

1

2

3

4

5

IS THE PROPERTY

LET OUT ? ( Y - YES, N- Name of Tenant

(SELECT)

a Annual letable value or rent received or receivable (higher of the two, if let out for whole of the year, lower of the two if let out for part of the year)

b The amount of rent which cannot be realized

c Tax paid to local authorities

d Total (b + c)

e Annual value (a d) (nil, if self -occupied etc. as per section 23(2)of the Act)

f Income from house property 1 chargeable in own hands (own percentage share x i)

g 30% of f

h Interest payable on borrowed capital

i Total (g + h)

j Income from house property (f i)

Income under the head Income from house property

A Rent of earlier years realized under section 25A/AA

B Arrears of rent received during the year under section 25B after deducting 30%

C Total (A + B + Total of (j) for all properties above)

State PIN Code

(SELECT)

Your percentage of

share in the

property.

100

PAN of Co-owner

Percentage Share

in Property

PAN of Tenant

(optional)

Annual letable value or rent received or receivable (higher of the two, if let out for whole of the year, lower of the two if let out for part of the year) a 0

0

0

0

e 0

f 0

0

Cannot exceed

1.5 lacs if not let

out

0

i 0

j 0

State PIN Code

(SELECT)

Your percentage of

share in the

property.

100

PAN of Co-owner Percentage Share

in Property

PAN of Tenant

(optional)

Annual letable value or rent received or receivable (higher of the two, if let out for whole of the year, lower of the two if let out for part of the year) a 0

0

Details of Income from House Property (Fields marked in RED must not be left Blank)

0

0

e 0

f 0

0

Cannot exceed

1.5 lacs if not let

out

0

i 0

j 0

State PIN Code

(SELECT)

Your percentage of

share in the

property.

100

PAN of Co-owner Percentage Share

in Property

PAN of Tenant

(optional)

Annual letable value or rent received or receivable (higher of the two, if let out for whole of the year, lower of the two if let out for part of the year) a 0

0

0

0

e 0

f 0

0

Cannot exceed

1.5 lacs if not let

out

0

i 0

j 0

A

B

C 0

Capital Gains

C

A

P

I

T

A

L

G

A

I

N

S

A Short-term Capital Gains (STCG) (Items 3 & 4 are not applicable for residents)

i

ii

iii

Deductions under section 48

i

ii

iii

iv Total (bi + bii + biii)

c Balance (aiii biv)

d Deduction under section 54B(Specify details in item Dbelow)

e Short-term Capital Gains on Immovable property (1c - 1d)

ia Full value of consideration

i Cost of acquisition without indexation

ii Cost of Improvement without indexation

iii Expenditure wholly and exclusively in connection with transfer

iv Total ( i + ii + iii)

ic Balance (2a 2biv)

id

ie Short-term capital gain on equity share or equity oriented MF (STT paid) u/s 111A [for others] (2c +2d)

iia Full value of consideration

i Cost of acquisition without indexation

ii Cost of Improvement without indexation

iii Expenditure wholly and exclusively in connection with transfer

iv Total ( i + ii + iii)

iic Balance (2a 2biv)

iid

iie

a Full value of consideration

Deductions under section 48

i Cost of acquisition without indexation

ii Cost of Improvement without indexation

iii Expenditure wholly and exclusively in connection with transfer

iv Total (i + ii + iii)

c Balance (3a biv)

d

e STCG on assets other than at A1 or A2 or A3 or A4 above (5c + 5d)

6. Amount deemed to be short term capital gains under sections 54B

7. Total Short-term Capital Gain (A1e+ A2e+ A3a+ A3b+ A4e+ A5e+A6)

5. From sale of assets other than at A1 or A2 or A3 or A4 above

In case of asset (security/unit)loss to be disallowed u/s 94(7) or 94(8)- for example if asset

bought/acquired within 3 months prior to record date and dividend/income/bonus units are received,

then loss arising out of sale of such asset to be under (Enter positive value only)

Expenditure wholly and exclusively in connection with transfer

(i) From sale of equity share or unit of equity oriented Mutual Fund (MF) on which STT is paid u/s 111A [for others]

ib Deductions under section 48

Loss to be disallowed u/s 94(7) or 94(8)- for example if asset bought/acquired within 3 months prior

to record date and dividend/income/bonus units are received, then loss arising out of sale of such

asset to be ignored (Enter positive value only)

Short-term capital gain on equity share or equity oriented MF (STT paid) u/s 115AD(1)(b)(ii) [for

Foreign Institutional Investors] (2iic +2iid)

Schedule CG

1. From sale of land or building or both

a Full value of consideration received/receivable

Value of property as per stamp valuation authority

Full value of consideration adopted as per section 50C for the purpose of Capital Gains (ai or aii)

b

Cost of acquisition without indexation

Cost of Improvement without indexation

(ii) From sale of equity share or unit of equity oriented Mutual Fund (MF) on which STT is paid u/s 115AD(1)(b)(ii) [for Foreign

Institutional Investors]

iib Deductions under section 48

Loss to be disallowed u/s 94(7) or 94(8)- for example if asset bought/acquired within 3 months prior

2.

b

B Long-term capital gain (LTCG) (Items 4, 5 & 6 are not applicable for residents)

From sale of land or building or both

i Full value of consideration received/receivable

ii Value of property as per stamp valuation authority

iii

Deductions under section 48

i Cost of acquisition with indexation

ii Cost of Improvement with indexation

iii Expenditure wholly and exclusively in connection with transfer

iv Total (bi + bii + biii)

c Balance (aiii biv)

di Deduction under section 54 (Specify details in item D below)

dii Deduction under section 54B (Specify details in item D below)

diii Deduction under section 54EC (Specify details in item D below)

div Deduction under section 54F (Specify details in item D below)

dv Deduction under section 54GB (Specify details in item D below)

d Total Deduction under section 54/54B/54EC/54F/54GB (Specify details in item D below)

e Long-term Capital Gains on Immovable property (1c - 1d)

From sale of bonds or debenture (other than capital indexed bonds issued by Government)

a Full value of consideration

Deductions under section 48

i Cost of acquisition without indexation

ii Cost of improvement without indexation

iii Expenditure wholly and exclusively in connection with transfer

iv Total (bi + bii +biii)

c Balance (2a biv)

di Deduction under sections 54EC (Specify details in item D below)

dii Deduction under sections 54F(Specify details in item D below)

d Deduction under sections 54EC/54F(Specify details in item D below)

e LTCG on bonds or debenture (2c 2d)

ia Full value of consideration

Deductions under section 48

i Cost of acquisition without indexation

ii Cost of improvement without indexation

iii Expenditure wholly and exclusively in connection with transfer

iv Total (bi + bii +biii)

ic Balance (3a biv)

di Deduction under sections 54EC(Specify details in item D below)

dii Deduction under sections 54F(Specify details in item D below)

id Deduction under sections 54EC/54F(Specify details in item D below)

ie Long-term Capital Gains on assets at B3 above (3c 3d)

a Full value of consideration

Deductions under section 48

i Cost of acquisition without indexation

ii Cost of improvement without indexation

iii Expenditure wholly and exclusively in connection with transfer

iv Total (bi + bii +biii)

c Balance (3a biv)

di Deduction under sections 54EC(Specify details in item D below)

dii Deduction under sections 54F(Specify details in item D below)

d Deduction under sections 54EC/54F(Specify details in item D below)

From sale of GDR of an Indian company referred in sec. 115ACA

b

L

o

n

g

-

t

e

r

m

C

a

p

i

t

a

l

G

a

i

n

s

a

Full value of consideration adopted as per section 50C for the purpose of Capital Gains

(ai or aii)

b

2

b

3. From sale of listed securities or units or zero coupon bonds where proviso under section 112(1) is applicable

(taxable @ 10% without indexation benefit)

ib

1.

e Long-term Capital Gains on assets at B3 above (3c 3d)

7 From sale of assets where B1 to B6 above are not applicable

a Full value of consideration

b Deductions under section 48

i Cost of acquisition with indexation

ii Cost of improvement with indexation

iii Expenditure wholly and exclusively in connection with transfer

iv Total (bi + bii +biii)

c Balance (7a biv)

di Deduction under sections 54EC (Specify details in item D below)

dii Deduction under sections 54F (Specify details in item D below)

d Deduction under sections 54EC/54F (Specify details in item D below)

e Long-term Capital Gains on assets at B7 above (7c-7d)

i Amount deemed to be LTCG under sections 54

ii Amount deemed to be LTCG under sections 54B

iii Amount deemed to be LTCG under sections 54EC

iv Amount deemed to be LTCG under sections 54F

v Amount deemed to be LTCG under sections 54GB

vi Amount deemed to be LTCG under sections 115F

Total Amount deemed to be LTCG under sections 54/54B/54EC/54F/54GB/115F

9

C

D Information about deduction claimed

1 In case of deduction u/s 54/54B/54EC/54F/54GB/115F give following details

Section Amount of

Deduction

Cost of

New Asset

Date of its

acquisition/

construc-

tion

Amount

deposited

in Capital

Gains

Accounts

Scheme

before due

date

1 (Select) 0 0 00/00/0000 0

2 (Select) 0 0 00/00/0000 0

3 (Select) 0 0 00/00/0000 0

4 (Select) 0 0 00/00/0000 0

5 (Select) 0 0 00/00/0000 0

6 (Select) 0 0 00/00/0000 0

c Total deduction claimed 1c 0

2 In case of deduction u/s 54GB, furnish PAN of the company

Set-off of current year capital losses with current year capital gains

15% 30%

applicable

rate

20%

1 2 3 4 5 6

Long term capital loss set off

10%

Total long term capital gain [B1e +B2e+B3e + B4d +B4e + B5e +B6c+ B6f+ B7e+ B8] (In case of loss take the figure to 5xi of

schedule CFL)

Income chargeable under the head CAPITAL GAINS (A7 + B9) (take B9 as nil, if loss)(If C is negative, take the figure to 4xi of

schedule CFL and if it is positive, take the figure to respective row in item E)

L

o

n

g

-

t

e

r

m

C

a

p

i

t

a

l

G

a

i

n

s

E

SI.

Type of Capital Gain

Gain of current

year (Fill this

column only if

computed

figure is

positive)

Short term capital loss set off

8

i

0 0 0 0 0

ii 15% 0 0 0

iii 30% 0 0 0

iv

applicable

rate

0 0 0

v 10% 0 0 0 0 0

vi 20% 0 0 0 0 0

vii

0 0 0 0 0

viii 0 0 0 0 0

Information about accrual/receipt of capital gain

Type of Capital gain / Date

1

2

3

4

5

Please include the income of the specified persons referred to in Schedule SPI while computing the income under this head NOTE

Long- term capital gains taxable at the rate of 10%

Enter value from item 3vi of schedule BFLA, if any.

0 0

Long- term capital gains taxable at the rate of 20%

Enter value from item 3vii of schedule BFLA, if any.

0 0

Short-term capital gains taxable at the rate of 30%

Enter value from item 3iv of schedule BFLA, if any.

0 0

Short-term capital gains taxable at applicable rates

Enter value from item 3v of schedule BFLA, if any.

0 0

Loss remaining after set off

F

Upto 15/9

(i)

16/9 to 15/12

(ii)

Short-term capital gains taxable at the rate of 15%

Enter value from item 3iii of schedule BFLA, if any.

0 0

Short

term

capital

gain

Total loss set off

(ii + iii + iv + v + vi)

Loss to be set off

(Fill this row if

figure computed is

negative)

------

Long

term

E

ai 0

aii 0

aiii

0

bi 0

bii 0

biii 0

biv 0

1c 0

1d 0

A1e 0

2ia 0

bi 0

bii 0

biii 0

ibiv 0

2ic 0

2id

0

Short-term capital gain on equity share or equity oriented MF (STT paid) u/s 111A [for others] (2c +2d) A2ie 0

2iia 0

bi 0

bii 0

biii 0

iibiv 0

2iic 0

2iid 0

A2iie

0

5a 0

bi 0

bii 0

biii 0

biv 0

5c 0

5d 0

A5e 0

A6 0

A7 0

From sale of assets other than at A1 or A2 or A3 or A4 above

(i) From sale of equity share or unit of equity oriented Mutual Fund (MF) on which STT is paid u/s 111A [for others]

Deductions under section 48

From sale of land or building or both

(ii) From sale of equity share or unit of equity oriented Mutual Fund (MF) on which STT is paid u/s 115AD(1)(b)(ii) [for Foreign

Institutional Investors]

Deductions under section 48

ai 0

aii 0

aiii 0

bi 0

bii 0

biii 0

biv 0

1c 0

di 0

dii 0

diii 0

div 0

dv 0

1d 0

B1e 0

2a 0

bi 0

bii 0

biii 0

biv 0

2c 0

di 0

dii 0

2d 0

B2e 0

3ia 0

bi 0

bii 0

biii 0

ibiv 0

3ic 0

di 0

dii 0

3id 0

Bi3e 0

3iia 0

bi 0

bii 0

biii 0

iibiv 0

3iic 0

di 0

dii 0

3iid 0

From sale of GDR of an Indian company referred in sec. 115ACA

From sale of listed securities or units or zero coupon bonds where proviso under section 112(1) is applicable

(taxable @ 10% without indexation benefit)

B3iie 0

7a 0

bi 0

bii 0

biii 0

biv 0

7c 0

di 0

dii 0

7d 0

B7e 0

i 0

ii 0

iii 0

iv 0

v 0

vi 0

B8 0

B9

0

C

0

Current years capital

gains remaining after

set off

(7= 1-2-3-4-5-6)

7

Total long term capital gain [B1e +B2e+B3e + B4d +B4e + B5e +B6c+ B6f+ B7e+ B8] (In case of loss take the figure to 5xi of

schedule CFL)

Income chargeable under the head CAPITAL GAINS (A7 + B9) (take B9 as nil, if loss)(If C is negative, take the figure to 4xi of

schedule CFL and if it is positive, take the figure to respective row in item E)

0

0

0

0

0

16/3 to 31/3

(iv)

0

0

0

0

0

Please include the income of the specified persons referred to in Schedule SPI while computing the income under this head

0 0

0 0

0 0

0 0

16/9 to 15/12

(ii)

16/12 to 15/3

(iii)

0 0

Sc hOS

O

T

H

E

R

S

O

U

R

C

E

S

1

a 1a 0

b 1b 0

c 1c 0

d

Income

(2)

1 5BB-Winnings from lotteries, crossword puzzles etc. 1 0

2 2 0

3 3 0

4 0

5 0

6 0

7 0

1d 0

e 1e 0

f

i 1fi 0

ii 1fii 0

iii Income included in 1e chargeable to tax at special rate (1fi +1fii) 1fiii 0

g Gross amount chargeable to tax at normal applicable rates (1e-1fiii) 1g 0

h

i hi 0

ii Depreciation hii 0

iii hiii 0

i 1i 0

2 2 0

Total

Source

(i)

Income from other sources (other than from owning race horses) (1fiii + 1i) (enter1i as nil, if negative)

Total (1a + 1b + 1c + 1d)

Deductions under section 57:-

Expenses / Deductions

Total

Income from other sources (other than from owning race horses and amount chargeable to tax at special rate) (1g hiii) (If negative take the figure to 3i of schedule CYLA)

Income included in 1e chargeable to tax at special rate (Chapter XII/XIIA) (to be taken to

schedule SI)

Winnings from lotteries, crossword puzzles, races, games, gambling, betting etc (u/s 115BB)

Any other income under chapter XII/XII-A

Income

Income other than from owning race horse(s):-

Dividends, Gross

Interest, Gross

Rental income from machinery, plants, buildings, etc., Gross

Others, Gross (excluding income from owning race horses) (Fill up the Source and the Income

Below). Note: For source other than the available Section Codes in Sl no 3 dropdown and Sl no1,

Pl enter description in Sl no 2 below. Note: Do not enter amount without selecting Section

Code/Filling Description. 1st coumn is mandatory.

3

a 3a 0

b 3b 0

c 3c 0

4

4 0

NOTE Please include the income of the specified persons referred to in Schedule SPI while computing the income under this head

Income under the head Income from other sources (2 + 3c) (take 3c as nil if negative)

Income from the activity of owning and maintaining race horses

Receipts

Deductions under section 57 in relation to (3)

Balance (3a 3b) if negative, take figure to 6xi of Sch CFL

Details of Income after set-off of current years losses

Sl.No

Head/ Source of

Income

Income of current

year (Fill this

column only if

income is

positive)

House property

loss of the current

year set off

Other sources

loss (other

than loss from

race

horses) of the

current

year set off

Current years

Income

remaining

after set off

Loss to be set off 0 0

1 2 3 4=1-2-3

i Salaries 0 0 0 0

ii House property 0 0 0

iii

Short-term capital gain

taxable @ 15% 0 0 0 0

iv

Short-term capital gain

taxable @ 30% 0 0 0 0

v

Short-term capital gain

taxable @ applicable

rates 0 0 0 0

vi

Long term capital gain

taxable @ 10% 0 0 0 0

vii

Long term capital gain

taxable @ 20%

0 0 0 0

viii

Other sources

(excluding profit from

owning race horses

and amount

chargeable to special

0 0 0 0

ix

Profit from owning

and maintaining race

horses

0 0 0 0

x Total loss set-off 0 0

xi 0 0

Income after set

off, if

any, of current

years

losses as per 4 of

Schedule CYLA)

Brought forward

loss

set off

Current years

income remaining

after set off

1 2 3

i Salaries 0 0

ii House property 0 0 0

iii

Short-term capital gain

taxable @ 15% 0 0 0

iv

Short-term capital gain

taxable @ 30% 0 0 0

B

R

O

U

G

H

T

F

O

R

W

A

R

D

L

O

S

S

A

D

J

U

S

T

M

E

N

T

Sl.

No.

Head/ Source of

Income

Schedule BFLA

Schedule CYLA

C

U

R

R

E

N

T

Y

E

A

R

L

O

S

S

A

D

J

U

S

T

M

E

N

T

Loss remaining after set-off out of 2 & 3

Details of Income after Set off Brought Forward

Losses of earlier years

v

Short-term capital gain

taxable @ applicable

rates 0 0 0

vi

Long term capital gain

taxable @ 10% 0 0 0

vii

Long term capital gain

taxable @ 20% 0 0 0

viii

Other sources

(excluding profit from

owning race horses

and amount

chargeable to special

rate of tax)

0 0 0

ix

Profit from owning

and maintaining race

horses 0 0 0

x 0

xi

0

Note : Short Term Capital Loss Brought Forward will be adjusted against

STCG and LTCG in the sequence of STCG Other than 111A,

LTCG Non Proviso, STCG u/s 111A, LTCG Proviso to the extent of loss

brought forward available for set off

Please click on "Compute Set off" button on top to allow the utility to auto fill

the Adjustment of Current Year and Brought Forward Loss in yellow fields .

B

R

O

U

G

H

T

F

O

R

W

A

R

D

L

O

S

S

A

D

J

U

S

T

M

E

N

T

Total of brought forward loss set off

Current years income remaining after set off Total (i3 + ii3

+ iii3 + iv3 + v3+vi3)

Sl.

No.

Assessmen

t Year

Date of

Filing

(DD/MM/

YYYY)

House

property loss

Short-term

capital loss

Long-term

Capital loss

Other sources

loss (other

than loss from

race horses)

Other

sources loss

(from owning

race horses)

i 2006-07

ii 2007-08

iii 2008-09

iv 2009-10

v 2010-11

vi 2011-12

vii 2012-13

viii 2013-14

ix

Total of

earlier

year losses

0 0 0 0

x

Adjustmen

t of above

losses in

ScheduleB

FLA

0 0 0 0

xi 0 0 0 0

xii 0 0 0 0

C

A

R

R

Y

F

O

R

W

A

R

D

O

F

L

O

S

S

Schedule CFL Details of Losses to be carried forward to future Years

2014-15 (Current

year losses)

Total loss Carried

Forward to future

Schedule 80G Details of donations entitled for deduction under section 80G

A

Name of

donee

Address City or

Town or

District

State Code PinCode PAN of

Donee

1 (Select)

2 (Select)

3 (Select)

4 (Select)

B Donations entitled for 50% deduction without qualifying limit

Name of

donee

Address City or

Town or

District

State Code PinCode PAN of

Donee

1 (Select)

2 (Select)

3 (Select)

4 (Select)

C Donations entitled for 100% deduction subject to qualifying limit

Name of

donee

Address City Or

Town Or

District

State Code PinCode PAN of

Donee

1 (Select)

2 (Select)

3 (Select)

4 (Select)

Total 80GB :

Total 80GA

Total 80GC :

Donations entitled for 100% deduction without qualifying

limit. (Please see the NOTE given below) (Note : If no

entry is made in Donee Name, then other columns will not

be considered for that row)

D Donations entitled for 50% deduction subject to qualifying limit

Name of

donee

Address City Or

Town Or

District

State Code PinCode PAN of

Donee

1 (Select)

2 (Select)

3 (Select)

4 (Select)

E Donations (A + B + C + D)

NOTE : (IN CASE OF DONEE FUNDS SETUP BY GOVERNMENT AS DESCRIBED IN SECTION 80G(2),

PLEASE USE PAN AS "GGGGG0000G")

Total 80GD

Amount of

donation

Eligible Amount of

Donation

0

0

0

0

0 0

Amount of

donation

Eligible Amount of

Donation

0

0

0

0

0 0

Amount of

donation

Eligible Amount of

Donation

0

0

0

0

0 0

Amount of

donation

Eligible Amount of

Donation

0

0

0

0

0 0

0 0

NOTE : (IN CASE OF DONEE FUNDS SETUP BY GOVERNMENT AS DESCRIBED IN SECTION 80G(2),

Deductions under Chapter VI-A System Calculated

a a 0 0

b b 0 0

c(i) c(ii) 0 0

c(ii) c(i) 0 0

d d 0 0

e e 0 0

f f 0 0

g g 0 0

h h 0 0

i 80EE i 0 0

j j 0 0

k k 0

l l 0 0

m m 0 0

n n 0 0

o o 0 0

p p 0 0

q q 0 0

r r 0 0

80C

Total deductions (total of a to r)

Schedule VI-A

80GGA

T

O

T

A

L

D

E

D

U

C

T

I

O

N

S

80DD

80CCD(1) (assessees contribution)

80DDB

80U

80QQB

80GG

80GGC

80RRB

80TTA

80CCC

80CCD(2) (employers contribution)

80D

80G (Eligible Amount)

80E

80CCG

Income of specified persons(spouse, minor child etc) includable in income of the assessee

(income of the minor child, in excess of Rs. 1,500 per child, to be included)

Sl No Name of person PAN of person (optional) Relationship Nature of Income Amount (Rs)

1

2

3

0

Schedule SI

SPECI

AL

RATE Sl

No

Section

code (Serial nos

other than Sl no

1,2 are autofilled)

Special rate

(%)

Income

i

Taxable Income

after adjusting for

Min Chargeable to

Tax

System calculated

tax thereon

1 1 0 0 0

2 DTAA 1 0 0 0

3 1A 15 0 0 0

4 5AD1biip 15 0 0 0

5 21 20 0 0 0

6 22 10 0 0 0

7 21ciii 10 0 0 0

8 5A1ai 20 0 0 0

9 5A1aii 20 0 0 0

10 5A1aiia 5 0 0 0

11 5A1aiiaa 5 0 0 0

12 5A1aiiab 5 0 0 0

13 5A1aiii 20 0 0 0

14 FA 50 0 0 0

15 5A1bA 25 0 0 0

16 5A1bB 25 0 0 0

17 5AC1ab 10 0 0 0

18 5AC1c 10 0 0 0

19 5ACA1a 10 0 0 0

20 5ACA1b 10 0 0 0

21 5AD1i 20 0 0 0

22 5AD1iP 5 0 0 0

23 5ADii 30 0 0 0

24 5ADiii 10 0 0 0

25 5BB 30 0 0 0

26 5BBA 20 0 0 0

27 5BBC 30 0 0 0

28 5BBE 30 0 0 0

29 5Ea 20 0 0 0

30 5Eacg 20 0 0 0

SI 5Eb 10 0 0 0

Tax at Spl Rate 0

Income chargeable to Income tax at special rates IB [Please see instruction

Number-9 for section code and rate of tax]

Please clilck on Recalculate initially, and also subsequently if Gender, Date of Birth ,

Residential Status or Assessee Status (Indl / HUF etc) is changed (Note "Recalculate button is

provided in Sheet PART B - TI - TTI)

Schedule SPI

Please Click on

Compute Tax

button in Part B TI

to re calculate Tax

at Normal Rate

and Tax at Special

Rate

Details of Exempt Income (Income not to be included in Total Income)

1 1

2 2

3 3 0

4 4

5 5 0

6 6 0 Total (1+2+3+4+5)

Schedule EI

E

X

E

M

P

T

I

N

C

O

M

E

Interest income

Dividend income

Long-term capital gains on which Securities Transaction Tax is paid

Net Agricultural income (other than income to be excluded under rule 7A, 7B or 8 of

I.T. Rules)

Others, (including exempt income of minor child)

TA

X

PA

YM

EN

TS

Sl

No

BSR Code

Date of Credit into

Govt Account

(DD/MM/YYYY)

Serial Number

of Challan

Amount (Rs)

1

2

If no entry is

made in this

column, then

columns (3) to

(5) will not be

considered for

that row

3 4 5

1

2

3

4

5

6

NOTE Enter totals of Advance and Self Assessment tax in Sl No. 11a & 11c of PartB-TTI

Schedule ITDetails of Advance Tax and Self Assessment Tax Payments

FSI Details of Income accruing or arising outside India

1 Details of Income included in Total Income in Part-B-TI above

Sr

No

Income

(included in

PART B-TI)

(ia)

Tax paid

outside India

(ib)

Tax payable

on such

income under

normal

provisions in

India

(ic)

Tax relief

available in

India

(id=lower of

ib and ic)

1 (Select) 0 0 0 0

2 (Select) 0 0 0 0

3 (Select) 0

4 (Select) 0

Country Code

(Note : If no

entry is made in

this column,

then other

columns will not

be considered

for that row)

Taxpayer

Identification

number

Note : Please refer to the instructions for filling out this schedule

Salary

Relevant article

of DTAA if relief

claimed u/s 90 or

90A

(ie)

Income

(included in

PART B-TI)

(iia)

Tax paid

outside India

(iib)

Tax payable

on such

income under

normal

provisions in

India

(iic)

Tax relief

available in

India

(iid=lower of

iib and iic)

Relevant

article of

DTAA if

relief claimed

u/s 90 or 90A

(iie)

Tax

paya

ble

unde

r

norm

al

provi

sions

in

India

(iic)

Income

(included in

PART B-TI)

(iiia)

0 0 0

0 0 0 0

0

0

Note : Please refer to the instructions for filling out this schedule

Salary House Property

Busi

ness

Capital Gains

Tax paid

outside India

(iiib)

Tax payable

on such

income under

normal

provisions in

India

(iiic)

Tax relief available

in India

(iiid=lower of iiib

and iiic)

Relevant

article of

DTAA if

relief claimed

u/s 90 or 90A

(iiie)

Income

(included in

PART B-TI)

(iva)

Tax paid

outside India

(ivb)

Tax payable

on such

income under

normal

provisions in

India

(ivc)

0 0 0 0

0 0

0

0

Other Sources

Note : Please refer to the instructions for filling out this schedule

Capital Gains

Tax relief

available in

India

ivde=lower of

ivb and ivc)

Relevant article of

DTAA if relief

claimed u/s 90 or

90A

(ive)

Income

(included in

PART B-TI)

(iva)

Tax paid

outside India

(ivb)

Tax payable

on such

income under

normal

provisions in

India

(ivc)

Tax relief

available in

India

ivde=lower of

ivb and ivc)

0 0 0 0 0

0 0 0 0 0

0 0 0 0 0

0 0 0 0 0

Other Sources Total Countrywise

Note : Please refer to the instructions for filling out this schedule

(Note : If no entry is made in the Country Code column, then other columns will not be considered for that row)

TR Schedule TR Details of Tax Relief claimed under Section 90 or Section 90A or Section 91.

1

Country Code Tax Identification number

(b)

Total taxes paid

outside India

((ib+iib+iiib+ivb) of

Sch FSI) (c)

2

3

4

a Amount of tax refunded b) Assessment year in which tax relief allowed in India

FA Schedule FA Details of foreign assets

NOTE : This Schedule is not Applicable for NRI \(Non Resident Indians) as per Reseidential Status

A Details of Foreign Bank Accounts

Sr No Country Code Name of the Bank Address of the Bank

1 (Select)

2 (Select)

3 (Select)

4 (Select)

Total:

B Details of Financial Interest in any Entity

Sr No Country Code Nature of entity Name of the Entity

1 (Select)

2 (Select)

3 (Select)

4 (Select)

Total:

C Details of immovable property

Sr No Country Code Address of the Property Total Investment (at

cost) (in rupees)

Total Tax relief available in respect of country where DTAA is applicable (section 90/90A) (Part of total of 1(d))

Total Tax relief available in respect of country where DTAA is not applicable (section 91) (Part of total of 1(d))

Whether any tax paid outside India, on which tax relief was allowed in India, has been refunded/credited by the foreign tax

authority during the year? If yes, provide the details below

1 (Select)

2 (Select)

3 (Select)

4 (Select)

Total: 0

D Details of any other Asset in the nature of Investment

Sr No Country Code Nature of Asset Total Investment (at

cost) (in rupees)

1 (Select)

2 (Select)

3 (Select)

4 (Select)

Total: 0

E Details of account(s) in which you have signing authority and which has not been included in A to D above.

Sr No Name of the Institution

in which the account is

held

(Note : If no entry is

made in this column,

then other columns will

not be considered for

that row)

Address of the Institution Name of the Account

Holder

1

2

3

`1 4

Total:

F Details of trusts, created under the laws of a country outside India, in which you are a trustee

Sr No Country Code Name of the trust Address of the trust

1 (Select)

2 (Select)

3 (Select)

4 (Select)

(Note : If no entry is made in the Country Code column, then other columns will not be considered for that row)

Total tax relief available

((id+iid+iiid+ivd) of

Schedule FSI

(d)

Section under which

relief claimed

(90, 90A or 91)

(e)

0

0

(Select)

b) Assessment year in which tax relief allowed in India

NOTE : This Schedule is not Applicable for NRI \(Non Resident Indians) as per Reseidential Status

Name mentioned in the

account

Account Number Peak Balance during the

year (in Rupees)

0

Address of the Entity Total Investment (at

cost) (in rupees)

0

Total Tax relief available in respect of country where DTAA is applicable (section 90/90A) (Part of total of 1(d))

Total Tax relief available in respect of country where DTAA is not applicable (section 91) (Part of total of 1(d))

Whether any tax paid outside India, on which tax relief was allowed in India, has been refunded/credited by the foreign tax

authority during the year? If yes, provide the details below

Details of account(s) in which you have signing authority and which has not been included in A to D above.

Account Number Peak

Balance/Investment /

during the year (in

rupees)

0

Details of trusts, created under the laws of a country outside India, in which you are a trustee

Name of Other trustees Address of Other

trustees

Name of Settlor Address of Settlor

Name of Beneficiaries Address of

Beneficiaries

Schedule TDS1

Sl

No

Tax Deduction Account

Number (TAN) of the

Deductor

Name of Deductor

Income chargeable

under Salaries

Total tax

deducted

1

2

If no entry is made in this

column, then columns (3)

to (5) will not be

considered for that row

3 4 5

1

2

3

Schedule TDS2

Sl

No

Tax Deduction Account

Number (TAN) of the

Deductor

Name of Deductor

Unique TDS

Certificate Number

Unclaimed TDS brought forward (b/f)

TDS of the current

fin. Year

1

2

If no entry is made in this

column, then columns (3)

to (7) will not be

considered for that row

3 4

Financial Year in which

TDS is deducted

5

Amount b/f

6

7

Details of Tax Deducted at Source from SALARY

[As per FORM 16 issued by Employer(s)]

Details of Tax Deducted at Source on Income

[As per FORM 16 A issued by Deductor(s)]

1 0 0

2 0 0

3 0 0

Information regarding apportionment of income between spouses governed by Portuguese Civil Code

Name of the Spouse

PAN of the Spouse

Heads

of

Income

Income

received under

the head

(i)

Amount

apportioned

in the hands

of the spouse

(ii)

Amount of

TDS deducted

on income at

(ii)

1 House Property 1 0 0 0

2 Business or profession 2 0

3 Capital Gains 3 0 0 0

4 Other Sources 4 0 0 0

5 Total (1+2+3+4) 5 0 0 0

Schedule 5A

Information regarding apportionment of income between spouses governed by Portuguese Civil Code

TDS apportioned in the

hands of spouse

0

0

0

0

You might also like

- Project Documents OrderDocument2 pagesProject Documents Order88arjNo ratings yet

- Dividend PolicyDocument9 pagesDividend Policy88arjNo ratings yet

- What Is A Zero-Coupon Treasury Bond: Guarantees The SecurityDocument7 pagesWhat Is A Zero-Coupon Treasury Bond: Guarantees The Security88arjNo ratings yet

- Atm FaqDocument3 pagesAtm Faq88arjNo ratings yet

- Higher Algebra - Hall & KnightDocument593 pagesHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Compact for Responsive Responsible LeadershipDocument1 pageCompact for Responsive Responsible LeadershipMiguel AugustoNo ratings yet

- How To Keep ScoreDocument2 pagesHow To Keep ScoreJoyasLoniNo ratings yet

- Spouses Francisco Sierra, Et Al Vs PAIC Savings and Mortgage Bank Inc, G.R. No. 197857Document7 pagesSpouses Francisco Sierra, Et Al Vs PAIC Savings and Mortgage Bank Inc, G.R. No. 197857Janskie Mejes Bendero LeabrisNo ratings yet

- Bank StatementDocument4 pagesBank Statementvenkatarammana99No ratings yet

- February 5, 2015 Courier SentinelDocument20 pagesFebruary 5, 2015 Courier SentinelcwmediaNo ratings yet

- Hailey College of Bankng and Finance Punjab University LahoreDocument33 pagesHailey College of Bankng and Finance Punjab University LahoreAqil GhaffarNo ratings yet

- Tradicionalismo Católicos EstadounidenseDocument18 pagesTradicionalismo Católicos EstadounidenseHaniel BarazarteNo ratings yet

- Theories of Intellectual Property Rights in Relation With WIPODocument6 pagesTheories of Intellectual Property Rights in Relation With WIPOSiddharth soniNo ratings yet

- The Poor in Spirit - SBCDocument9 pagesThe Poor in Spirit - SBCCharles Daniel Da SilvaNo ratings yet

- United States v. Tyrone Roberson, 991 F.2d 627, 10th Cir. (1993)Document2 pagesUnited States v. Tyrone Roberson, 991 F.2d 627, 10th Cir. (1993)Scribd Government DocsNo ratings yet

- Ashok LeylandDocument76 pagesAshok LeylandvikasatmarsNo ratings yet

- SOP User Guide - Check Customer IDDocument30 pagesSOP User Guide - Check Customer IDDella GbedemahNo ratings yet

- Reflection KinemryDocument2 pagesReflection Kinemrytaehyung trashNo ratings yet

- SREI Infrastructure Finance Limited NCD detailsDocument1 pageSREI Infrastructure Finance Limited NCD detailsKV SinglaNo ratings yet

- Annex B - Negotiated Offer To Purchase FormDocument1 pageAnnex B - Negotiated Offer To Purchase FormcandiceNo ratings yet

- Leasehold CovenantsDocument10 pagesLeasehold CovenantsLecture WizzNo ratings yet

- TABANGDocument81 pagesTABANGGuilbert CimeneNo ratings yet

- Salary Slip (00091018 October, 2019)Document1 pageSalary Slip (00091018 October, 2019)Alam AfridiNo ratings yet

- Evi2 Ing9 LDDocument3 pagesEvi2 Ing9 LDCristian MolinaNo ratings yet

- Essay On CareersDocument9 pagesEssay On Careerslmfbcmaeg100% (2)

- Fin2bsat Quiz1 InvProperty Fund PpeDocument5 pagesFin2bsat Quiz1 InvProperty Fund PpeMarvin San JuanNo ratings yet

- State Secrecy and Child Deaths in The U.S.Document101 pagesState Secrecy and Child Deaths in The U.S.Beverly TranNo ratings yet

- Scotland The Making and Unmaking of The Nation C. ... - (6 The Western Gàidhealtachd)Document17 pagesScotland The Making and Unmaking of The Nation C. ... - (6 The Western Gàidhealtachd)Annie HunterNo ratings yet

- Case DigestDocument9 pagesCase Digestdonna panlilioNo ratings yet

- Short Speech On The Problems Faced by TeenagersDocument2 pagesShort Speech On The Problems Faced by TeenagersPemmasaniSrinivasNo ratings yet

- Political Instability: A Case Study of PakistanDocument13 pagesPolitical Instability: A Case Study of PakistanimranNo ratings yet

- Writ of Praecipi, Tax Levi, 1096, & 1099C To Internal RevenueDocument4 pagesWrit of Praecipi, Tax Levi, 1096, & 1099C To Internal RevenueEarl Julian Lloyd ElNo ratings yet

- Oakwell AR09Document111 pagesOakwell AR09GopuNo ratings yet

- The Smart Guide To The MPTDocument108 pagesThe Smart Guide To The MPTlarisaserzo100% (2)

- 2019 - Volume 5 PDFDocument68 pages2019 - Volume 5 PDFmsuddin76No ratings yet