Professional Documents

Culture Documents

Archives: Worldcom'S Collapse: The Overview Worldcom Files For Bankruptcy Largest U.S. Case

Uploaded by

sweetjar220 ratings0% found this document useful (0 votes)

25 views3 pagesx

Original Title

Wwwww

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentx

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

25 views3 pagesArchives: Worldcom'S Collapse: The Overview Worldcom Files For Bankruptcy Largest U.S. Case

Uploaded by

sweetjar22x

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

5/9/2014 WORLDCOM' S COLLAPSE: THE OVERVIEW; WORLDCOM FILES FOR BANKRUPTCY; LARGEST U.S.

CASE - New York Times

http://www.nytimes.com/2002/07/22/us/worldcom-s-collapse-the-overview-worldcom-files-for-bankruptcy-largest-us-case.html 1/3

Search All NYTimes.com

WORLDCOM'S COLLAPSE: THE OVERVIEW; WORLDCOM FILES FOR

BANKRUPTCY; LARGEST U.S. CASE

By SIMON ROMERO and RIVA D. ATLAS

Publ i shed: Jul y 22, 2002

WorldCom, plagued by the rapid erosion of its profits and an accounting scandal that created

billions in illusory earnings, last night submitted the largest bankruptcy filing in United States

history.

The bankruptcy is expected to shake an already wobbling telecommunications industry, but is

unlikely to have an immediate impact on customers, including the 20 million users of its MCI

long-distance service.

The WorldCom filing listed more than $107 billion in assets, far surpassing those of Enron,

which filed for bankruptcy last December. The WorldCom filing had been anticipated since the

company disclosed in late June that it had improperly accounted for more than $3.8 billion of

expenses.

Few experts or officials expect WorldCom's service to deteriorate noticeably, at least in the near

term. ''I want to assure the public that we do not believe this bankruptcy filing will lead to an

immediate disruption of service to consumers,'' Michael K. Powell, chairman of the Federal

Communciations Commission, said last night.

But industry consultants said they could not imagine how the belt-tightening expected in

bankruptcy would improve service that is already, in some respects, sloppy. [Page A12.]

WorldCom's collapse has already reverberated through jittery financial markets, and is likely to

be felt in the wider economy, with banks, suppliers and other telephone companies devising

strategies to contain their exposure.

WorldCom, built through rapid acquisitions, accumulated $41 billion in debts. Founded in 1983

as LDDS Communications, it became the nation's second-largest long-distance company and

the largest handler of Internet data.

Company executives said they intended to remain in business, and have been promised new

financing from banks to do so. ''We are going to aggressively go forward and restructure our

operations,'' John W. Sidgmore, WorldCom's chief executive, said in an interview last night. ''I

think ultimately we will emerge as a stronger company.''

While WorldCom has already cut its work force significantly, Mr. Sidgmore said last night that

he did not expect further layoffs for the time being. He said he would remain WorldCom's chief

but would be joined by a chief restructuring officer brought in by creditors.

Some creditors, however, have questioned whether Mr. Sidgmore, who has served on

WorldCom's board for years, should remain in charge. Mr. Sidgmore took over as chief

executive in late April after the board ousted Bernard J. Ebbers, one of the company's founders.

Shareholders, who owned what was once one of the world's most valuable companies, worth

more than $100 billion at its peak, are expected to be virtually wiped out. With the bankruptcy

filing, control passes instead to the banks and bondholders who financed WorldCom's growth.

Besides its own overambitious strategies and flawed accounting, WorldCom also fell victim to a

glut of telecommunications capacity.

Cheap and plentiful financing allowed companies rapidly to build transcontinental and

transoceanic fiber optic networks in the 1990's. The additional capacity resulted in lower prices

for WorldCom's services, which include basic phone service and the transmission of Internet

Archives

HOME PAGE TODAY'S PAPER VIDEO MOST POPULAR

Log In Register Now Help SUBSCRIBE NOW

5/9/2014 WORLDCOM' S COLLAPSE: THE OVERVIEW; WORLDCOM FILES FOR BANKRUPTCY; LARGEST U.S. CASE - New York Times

http://www.nytimes.com/2002/07/22/us/worldcom-s-collapse-the-overview-worldcom-files-for-bankruptcy-largest-us-case.html 2/3

data for large companies.

Mr. Sidgmore said last night that he was opposed to breaking up WorldCom and selling its

pieces, aside from an effort already under way to part with peripheral units like businesses in

Latin America and some other operations. This approach would rule out selling UUNet, a large

Internet backbone operation, or MCI.

But once the company reorganizes, and investors gain a better understanding of its twisted

finances, WorldCom could become an attractive acquisition target, analysts say.

WorldCom's crisis deepened last month when it disclosed that Scott D. Sullivan, the chief

financial officer, had devised a strategy that improperly accounted for $3.85 billion of expenses.

Mr. Sullivan was fired by the board and David F. Myers, the financial controller, resigned.

The Securities and Exchange Commission has charged WorldCom with fraud and the Justice

Department has begun a criminal investigation of its business practices.

In an attempt to regain its credibility, WorldCom's board elected two new members to replace

Mr. Sullivan and Mr. Ebbers: Nicholas deB. Katzenbach, a private attorney who was attorney

general in the Johnson administration; and Dennis R. Beresford, a former head of the Financial

Accounting Standards Board and a professor of accounting at the Terry College of Business at

the University of Georgia.

The two were also appointed to a special committee to oversee the internal investigation being

led by William R. McLucas, the former chief of the enforcement division of the S.E.C.

WorldCom filed for bankruptcy shortly before 9 last night in Federal District Court in

Manhattan.

Its international operations, which include companies in Brazil and Mexico, were not included.

The filing will relieve WorldCom of about $2 billion of interest payments in the coming year.

Lower debt costs could allow WorldCom to compete on a stronger footing with its rivals,

involving a potential price-cutting strategy that has analysts concerned about the wider strength

of the telecommunications industry.

''WorldCom probably won't get any new big contracts from its current customers, but it

probably won't lose any either, because of the difficulty and complexity involved in switching

carriers,'' said Glen Macdonald, a vice president with Adventis, a consulting firm in Boston.

WorldCom, based in Clinton, Miss., scrambled in recent days to secure new financing from its

banks after its cash dwindled to less than $300 million from more than $2 billion in May.

WorldCom said last night that it had received commitments for up to $2 billion in additional

bank financing. Such new loans to companies in bankruptcy receive top priority in repayment.

WorldCom must now deal with holders of $28 billion in bonds as well as 27 banks that loaned

the company $2.65 billion last May.

But in contrast with other companies that have recently filed for bankruptcy, including Enron,

WorldCom has many more tangible assets, generating actual revenues, lawyers said --

improving the odds that the company could emerge from bankruptcy as a going concern.

The creditors first in line to be repaid will be the three institutions -- Citigroup, J. P. Morgan and

General Electric Capital -- that have pledged to arrange a loan of up to $2 billion, known as

debtor in possession financing, to WorldCom. The lenders were comfortable pledging the funds

in part because of the company's stream of customer payments, such as phone bills, one

executive close to the company said last week. Citigroup is leading the new financing in part to

protect what it is already owed by WorldCom.

WorldCom's bankruptcy filing, like Enron's last December, came on a Sunday. Companies often

prefer to file over the weekend, because the status of any business transactions in process at the

time of a filing would be open to question in court.

WorldCom's lenders and its bondholders were taking steps, even before the bankruptcy filing, to

protect their claims. Just over a week ago, the banks that participated in the earlier $2.65 billion

loan tried, unsuccessfully, to get a court order limiting WorldCom's access to the loan. The banks

ultimately reached a settlement with WorldCom that placed few restrictions on the company's

5/9/2014 WORLDCOM' S COLLAPSE: THE OVERVIEW; WORLDCOM FILES FOR BANKRUPTCY; LARGEST U.S. CASE - New York Times

http://www.nytimes.com/2002/07/22/us/worldcom-s-collapse-the-overview-worldcom-files-for-bankruptcy-largest-us-case.html 3/3

Home Times Topics Member Center

Copyright 2013 The New York Times Company Privacy Policy Help Contact Us Work f or Us Site Map Index by Keyword

ability to use the cash.

Chart: ''Top U.S. Bankruptcies'' More than half of the 10 biggest bankruptcies since 1980 have

occurred in the last 18 months. Below, estimated prebankruptcy assets. WorldCom Year: '02 In

billions: $107 Enron Year: '01 In billions: 63 Texaco Year: '87 In billions: 36 Financial Corp. of

America Year: '88 In billions: 34 Global Crossing Year: '02 In billions: 25 Pacific Gas and

Electric Year: '01 In billions: 22 MCorp Year: '89 In billions: 20 Kmart Year: '02 In billions: 17

NTL Year: '02 In billions: 17 (Source: BankruptcyData.Com)(pg. A1) Graph: ''A Brash

Company's Rise and Fall'' Founded in 1983 as LDDS Communications to provide discount long-

distance telephone service in the wake of the breakup of AT&T, WorldCom grew through

acquisitions into one of the country's largest telecommunications companies. Ultimately, the

growth proved unsustainable and the company's collapse accelerated with the disclosure that it

had misreported billions of dollars in expenses. August 1989 LDDS, once privately held,

completes the acquisition of Advantage Companies, a public company. LDDS becomes publicly

traded. Aug. 26, 1996 Called WorldCom, and already the fourth-largest long-distance phone

company because of an earlier merger, it agrees to buy MFS Communications for $12 billion in

stock, becoming the only integrated local and long-distance company. Oct. 1, 1997 WorldCom

makes a $37 billion stock offer for MCI, ultimately wresting it away from British

Telecommunications, which had previously agreed to buy MCI. Oct. 4, 1999 WorldCom offers

$129 billion in stock for Sprint. June 27, 2000 The Justice Department blocks the WorldCom-

Sprint deal on antitrust grounds. April 2, 2002 WorldCom says it will lay off 10 percent of its

workforce. Three weeks later, the company reduces revenue projections for the year. April 30,

2002 Bernard J. Ebbers, a WorldCom founder, is forced out as chief. executive. May 9, 2002

WorldCom's debt is downgraded to below investment grade. June 25, 2002 WorldCom discloses

that $3.8 billion in expenses were improperly booked as capital investments. Scott D. Sullivan, its

chief financial officer, is fired. Graph shows WorldCom's weekly closing stock price since 1989.

(Source: Bloomberg Financial Markets)(pg. A12) Chart: ''Banks vs. WorldCom'' Select banks'

share of WorldCom's bank loan, as of May 16, 2002. BANK: Deutsche Bank AMOUNT:

$240,250,000 BANK: ABN Amro Bank AMOUNT: 202,750,000 BANK: Citibank AMOUNT:

154,880,000 BANK: Fleet AMOUNT: 150,000,000 BANK: Bank One AMOUNT: 100,000,000

BANK: Mellon Bank AMOUNT: 100,000,000 BANK: Wells Fargo Bank AMOUNT:

100,000,000 BANK: J.P. Morgan Chase AMOUNT: 6,000,000 (Source: July 12, 2002, court

filings)(pg. A12)

You might also like

- Worldcom'S Collapse: The Overview Worldcom Files For Bankruptcy Largest U.S. CaseDocument4 pagesWorldcom'S Collapse: The Overview Worldcom Files For Bankruptcy Largest U.S. CaseBrizza Angela HerbeseNo ratings yet

- B& S WorldcomDocument15 pagesB& S WorldcomManikanta Varma SaripellaNo ratings yet

- Worldcom Says It Hid Expenses, Inflating Cash Flow $3.8 BillionDocument4 pagesWorldcom Says It Hid Expenses, Inflating Cash Flow $3.8 Billionsientami_tanNo ratings yet

- Corporate Affairs The Worldcom CollapseDocument2 pagesCorporate Affairs The Worldcom CollapseKhalil JebranNo ratings yet

- WorldCom SummaryDocument4 pagesWorldCom Summaryburka123100% (1)

- Worldcom MakalahDocument17 pagesWorldcom MakalahIcha50% (2)

- Crs Report For Congress: Worldcom: The Accounting ScandalDocument6 pagesCrs Report For Congress: Worldcom: The Accounting ScandalMarc Eric RedondoNo ratings yet

- Worldcom Inc.: Management CaseDocument14 pagesWorldcom Inc.: Management CaseHenry StewartNo ratings yet

- Worldcom TimelineDocument10 pagesWorldcom TimelineGigiNo ratings yet

- An Assignment On WorldComDocument8 pagesAn Assignment On WorldComArefeen ArmanNo ratings yet

- Business Analysis and ValuationDocument5 pagesBusiness Analysis and Valuationarno6antonio6spinaNo ratings yet

- I. Background of The StudyDocument13 pagesI. Background of The StudyalyssaNo ratings yet

- Anugrah Joy - 2018003 - Corp Governance - Final DraftDocument10 pagesAnugrah Joy - 2018003 - Corp Governance - Final DraftAnugrah JoyNo ratings yet

- Dividend-Paying Stock: Lehman BrothersDocument3 pagesDividend-Paying Stock: Lehman BrothersVangie BandoyNo ratings yet

- Traduccion Del EnsayoDocument22 pagesTraduccion Del EnsayoAngela Andrade GNo ratings yet

- Cityam 2012-12-19 PDFDocument31 pagesCityam 2012-12-19 PDFCity A.M.No ratings yet

- Case Study WorldComDocument4 pagesCase Study WorldComMuhammad ZubairNo ratings yet

- WorldcomDocument18 pagesWorldcomLakshmeesh RamMohan Maddala100% (1)

- WorldCom Scam: Financial Analysis and ImpactDocument15 pagesWorldCom Scam: Financial Analysis and ImpactVishal ZavariNo ratings yet

- The DotDocument5 pagesThe DotChristov AnastasiadisNo ratings yet

- Legal Aspects of M&A: Citigroup and Glass-SteagallDocument11 pagesLegal Aspects of M&A: Citigroup and Glass-SteagallfahadisawahooNo ratings yet

- The Y2K Problem PDFDocument6 pagesThe Y2K Problem PDFFernanda GallegosNo ratings yet

- New EU Data Breach Measure Could Impact American Companies: MonarchDocument1 pageNew EU Data Breach Measure Could Impact American Companies: MonarchPrice LangNo ratings yet

- LDDS later known as MCI and WorldComDocument5 pagesLDDS later known as MCI and WorldComBhanu VashishtaNo ratings yet

- Case StudyDocument2 pagesCase StudySindhu TalrejaNo ratings yet

- WorldCom Fraud and Inherent RisksDocument4 pagesWorldCom Fraud and Inherent RisksCryptic LollNo ratings yet

- WorldCom Case Study Update 2006Document5 pagesWorldCom Case Study Update 2006Chong YanNo ratings yet

- WorldcomDocument9 pagesWorldcomGhazanfarNo ratings yet

- The Fall of Jack GrubmanDocument6 pagesThe Fall of Jack Grubmanprateeka_17No ratings yet

- MicroStrategy Chairman Accused of Fraud by S.E.C. - The New York TimesDocument2 pagesMicroStrategy Chairman Accused of Fraud by S.E.C. - The New York TimesUgur AlkanNo ratings yet

- JCOM Final c21Document21 pagesJCOM Final c21Anonymous Ht0MIJNo ratings yet

- Fraud and Abuse May19Document3 pagesFraud and Abuse May19EANNA15No ratings yet

- Case Study: Worldcom: Worldcom Took The Telecom Industry by Storm When It Began A Frenzy ofDocument2 pagesCase Study: Worldcom: Worldcom Took The Telecom Industry by Storm When It Began A Frenzy ofBrizza Angela HerbeseNo ratings yet

- Broadbandits: Inside the $750 Billion Telecom HeistFrom EverandBroadbandits: Inside the $750 Billion Telecom HeistRating: 2.5 out of 5 stars2.5/5 (4)

- WorldcomDocument12 pagesWorldcomapi-308703671No ratings yet

- Two Audit Failures: Satyam and WorldCom ScandalsDocument19 pagesTwo Audit Failures: Satyam and WorldCom ScandalsMahiUddinNo ratings yet

- Ass 1 Issues in FM Sep - Dec 2022Document40 pagesAss 1 Issues in FM Sep - Dec 2022Mark KinotiNo ratings yet

- Dot Com BubbleDocument7 pagesDot Com BubbleaugustkingNo ratings yet

- WorldCom Accounting ScandalSummaryDocument6 pagesWorldCom Accounting ScandalSummarysamuel debebeNo ratings yet

- Dodd-Frank Act Explained: What It Does and CriticismsDocument3 pagesDodd-Frank Act Explained: What It Does and CriticismsFarwa Muhammad SaleemNo ratings yet

- A Giant Bonfire of Taxpayers' Money' - Fraud and The UK Pandemic Loan Scheme - Financial TimesDocument13 pagesA Giant Bonfire of Taxpayers' Money' - Fraud and The UK Pandemic Loan Scheme - Financial TimespaulicalejerNo ratings yet

- Assignment - 5: International Finance and Forex ManagementDocument8 pagesAssignment - 5: International Finance and Forex ManagementAnika VarkeyNo ratings yet

- Cityam 2012-06-29Document39 pagesCityam 2012-06-29City A.M.No ratings yet

- Case Study On WorldComDocument8 pagesCase Study On WorldComsateybanik100% (4)

- Worldcom Scandal SummaryDocument1 pageWorldcom Scandal SummaryChampy100% (1)

- Shriram Insight: The Subprime CrisisDocument6 pagesShriram Insight: The Subprime CrisisNeeraj KumarNo ratings yet

- WorldCom Accounting Fraud Scandal ExposedDocument6 pagesWorldCom Accounting Fraud Scandal Exposedrachel mae urmatanNo ratings yet

- GovernDocument2 pagesGovernLilac heartNo ratings yet

- FinTech Rising: Navigating the maze of US & EU regulationsFrom EverandFinTech Rising: Navigating the maze of US & EU regulationsRating: 5 out of 5 stars5/5 (1)

- Bailout: What Is A 'Bailout'?Document2 pagesBailout: What Is A 'Bailout'?ibrahimNo ratings yet

- Casi Di Studio Aggiuntivi Industrial Organization and StrategyDocument19 pagesCasi Di Studio Aggiuntivi Industrial Organization and Strategyfabry95No ratings yet

- WorldCom Case Study: Fraud at Telecom GiantDocument2 pagesWorldCom Case Study: Fraud at Telecom GiantNia ニア MulyaningsihNo ratings yet

- Dotcom Bubble: Causes: Rapid Technological AdvancementDocument3 pagesDotcom Bubble: Causes: Rapid Technological AdvancementHarsh ShahNo ratings yet

- History: Corporate FoundingDocument4 pagesHistory: Corporate FoundingBrizza Angela HerbeseNo ratings yet

- Current Business Affairs: Assignment-1Document17 pagesCurrent Business Affairs: Assignment-1Salman JanNo ratings yet

- 01-02-2013 Term Sheet - Wednesday, January 2318Document5 pages01-02-2013 Term Sheet - Wednesday, January 2318Sri ReddyNo ratings yet

- Detroit Do OverDocument24 pagesDetroit Do OverRichard WoodNo ratings yet

- Today'S Headlines Wednesday, October 2, 2013Document2 pagesToday'S Headlines Wednesday, October 2, 2013Swearingen USNo ratings yet

- Biggest Corporate Lawsuit Settlements in HistoryDocument16 pagesBiggest Corporate Lawsuit Settlements in HistoryVisNo ratings yet

- Measuring The Impact of Microfinance in Hyderabad, IndiaDocument3 pagesMeasuring The Impact of Microfinance in Hyderabad, Indiasweetjar22No ratings yet

- Two Are Promoted As Enron Seeks Executive Stability - New York TimesDocument2 pagesTwo Are Promoted As Enron Seeks Executive Stability - New York Timessweetjar22No ratings yet

- SparkchartsDocument9 pagesSparkchartssweetjar22No ratings yet

- Course OfferingsT3!11!12Document447 pagesCourse OfferingsT3!11!12sweetjar22No ratings yet

- Case Study 2Document5 pagesCase Study 2sweetjar22No ratings yet

- Louw 1Document13 pagesLouw 1Kristin PateNo ratings yet

- Order FormDocument5 pagesOrder Formsweetjar22No ratings yet

- Chapter 1Document4 pagesChapter 1sweetjar22No ratings yet

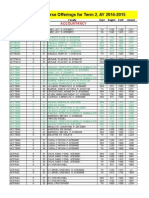

- RVR-COB Course Offerings Term 2Document19 pagesRVR-COB Course Offerings Term 2sweetjar22No ratings yet

- Elements of Poetry 1qDocument9 pagesElements of Poetry 1qsweetjar22No ratings yet

- Management Advisory ServicesDocument7 pagesManagement Advisory ServicesMarc Al Francis Jacob40% (5)

- USG Shirt DimensionsDocument1 pageUSG Shirt Dimensionssweetjar22No ratings yet

- How to Structure Legal Analysis Using IRACDocument3 pagesHow to Structure Legal Analysis Using IRACRC1214No ratings yet

- Donor's Tax ReturnDocument4 pagesDonor's Tax ReturnJerome MoradaNo ratings yet

- USG Shirt DimensionsDocument1 pageUSG Shirt Dimensionssweetjar22No ratings yet

- How to Structure Legal Analysis Using IRACDocument3 pagesHow to Structure Legal Analysis Using IRACRC1214No ratings yet

- SparkchartsDocument9 pagesSparkchartssweetjar22No ratings yet

- Elements of Poetry 1qDocument9 pagesElements of Poetry 1qsweetjar22No ratings yet

- RFPDocument9 pagesRFPSanjayThakkarNo ratings yet

- ACCT 3326 Tax II Cengage CH 2 199ADocument6 pagesACCT 3326 Tax II Cengage CH 2 199Abarlie3824No ratings yet

- Philippine Christian University Dasmariñas CampusDocument14 pagesPhilippine Christian University Dasmariñas CampusKrystalove JjungNo ratings yet

- HW On Receivables B PDFDocument12 pagesHW On Receivables B PDFJessica Mikah Lim AgbayaniNo ratings yet

- (SMM) - HP Talk - Dr. Ediansyah, MARS, MM - 3 Pilihan Strategis RS Bersaing, Berjejaring, Atau Keluar (14012021)Document15 pages(SMM) - HP Talk - Dr. Ediansyah, MARS, MM - 3 Pilihan Strategis RS Bersaing, Berjejaring, Atau Keluar (14012021)Dedi WahyudiNo ratings yet

- 10 Best Practices For Implementing New GLDocument51 pages10 Best Practices For Implementing New GLraghu100% (3)

- CS - EXE - Income Tax - Notes - Combined PDFDocument437 pagesCS - EXE - Income Tax - Notes - Combined PDFRam Iyer100% (1)

- Dividend Discount ModelDocument48 pagesDividend Discount ModelRajes DubeyNo ratings yet

- A Brief Introduction To Business IncubationDocument9 pagesA Brief Introduction To Business IncubationThiagarajan VenugopalNo ratings yet

- Insurance Law Course OutlineDocument4 pagesInsurance Law Course OutlineHannah Alvarado BandolaNo ratings yet

- 1.+FGV MCACapital Final BrasilDocument149 pages1.+FGV MCACapital Final BrasilBruno LimaNo ratings yet

- Du Pont Capital Structure Case Maximizes Firm ValueDocument4 pagesDu Pont Capital Structure Case Maximizes Firm Valueabhishekhrc0% (1)

- Comparison of Selected Equity Capital and Mutual Fund Schemes in Respect Their RiskDocument7 pagesComparison of Selected Equity Capital and Mutual Fund Schemes in Respect Their RiskSuman V RaichurNo ratings yet

- Kingsbridge Armory Request For Proposals 2011 FF 1 11 12Document54 pagesKingsbridge Armory Request For Proposals 2011 FF 1 11 12xoneill7715No ratings yet

- Introduction to Banking Industry and Credit AppraisalDocument47 pagesIntroduction to Banking Industry and Credit AppraisalJasmine KaurNo ratings yet

- Chapter 3 - Investment Appraisal - DCFDocument37 pagesChapter 3 - Investment Appraisal - DCFInga ȚîgaiNo ratings yet

- Acct Statement - XX9031 - 19032024Document9 pagesAcct Statement - XX9031 - 19032024khadnan.1234No ratings yet

- Peer Analysis of Major Players in Cement Industry: ACC, Ambuja, Dalmia, Shree, UltratechDocument6 pagesPeer Analysis of Major Players in Cement Industry: ACC, Ambuja, Dalmia, Shree, Ultratechsai chandraNo ratings yet

- CORPORATIONS, ACQUISITIONS, MERGERS AND CONSOLIDATIONSDocument3 pagesCORPORATIONS, ACQUISITIONS, MERGERS AND CONSOLIDATIONSLaurice Claire C. PeñamanteNo ratings yet

- Credit and Credit Administration LatestDocument297 pagesCredit and Credit Administration LatestPravin GhimireNo ratings yet

- 794-10102017-Project Vijay-Vijaypath Role Manual PDFDocument53 pages794-10102017-Project Vijay-Vijaypath Role Manual PDFdhananjayNo ratings yet

- Mechanics of Currency Dealing and Exchange Rate QuotationsDocument6 pagesMechanics of Currency Dealing and Exchange Rate Quotationsvijayadarshini vNo ratings yet

- CFA Level II: DerivativesDocument48 pagesCFA Level II: DerivativesCrayonNo ratings yet

- Life Contingencies Study Note For CAS Exam SDocument14 pagesLife Contingencies Study Note For CAS Exam SJaswanth ChinnuNo ratings yet

- MCO 7120 AssignmentDocument3 pagesMCO 7120 AssignmentAnusree SasidharanNo ratings yet

- Contemporary Financial ManagementDocument33 pagesContemporary Financial ManagementHayat TarrarNo ratings yet

- May-6 - Louise Peralta - 11 - FairnessDocument5 pagesMay-6 - Louise Peralta - 11 - FairnessLouise Joseph Peralta0% (1)

- Financial MGMT McqsDocument64 pagesFinancial MGMT McqsSonuNo ratings yet

- Internship Report Comparison Derivatives Equity MarketsDocument2 pagesInternship Report Comparison Derivatives Equity MarketsSupriya TholeteNo ratings yet

- Logical Reasoning 2Document2 pagesLogical Reasoning 2luigimanzanaresNo ratings yet