Professional Documents

Culture Documents

Prob 3-30 - Advanced Accounting Hoyle

Uploaded by

ssmith0128Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prob 3-30 - Advanced Accounting Hoyle

Uploaded by

ssmith0128Copyright:

Available Formats

30. c.

(continued)

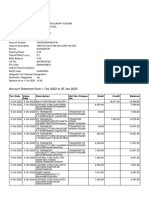

GIANT COMPANY AND SMALL COMPANY

Consolidation Worksheet

For Year Ending December 31, 2015

Consolidation Entries Consolidated

Accounts Giant Small Debit Credit Totals

Revenues............................................................. (1,175,000) (360,000) (1,535,000)

Cost of goods sold.............................................. 550,000 90,000 640,000

Depreciation expense......................................... 172,000 130,000(E) 5,000 307,000

Equity income of Small....................................... (135,000) -0- (I) 135,000 -0-

Net income..................................................... (588,000) (140,000) (588,000

Retained earnings 1/1......................................... (1,417,000) (620,000)(S) 620,000 (1,417,000)

Net income (above)............................................. (588,000) (140,000) (588,000)

Dividends declared............................................. 310,000 110,000 (D) 110,000 310,000

Retained earnings 12/31............................... (1,695,000) (650,000) (1,695,000

Current assets..................................................... 398,000 318,000 (P) 10,000 706,000

Investment in Small............................................. 995,000 -0- (D) 110,000 (S) 790,000 -0-

(A) 180,000

(I) 135,000

Land .................................................................. 440,000 165,000(A) 90,000 695,000

Buildings (net)..................................................... 304,000 419,000 723,000

Equipment (net)................................................... 648,000 286,000(A) 30,000 (E) 5,000 959,000

Goodwill............................................................... -0- -0- (A) 60,000 60,000

Total assets.................................................... 2,785,000 1,188,000 3,143,000

Liabilities.............................................................. (840,000) (368,000)(P) 10,000 (1,198,000)

Common stock.................................................... (250,000) (170,000)(S)170,000 (250,000)

Retained earnings (above).................................. (1,695,000) (650,000)

(1,695,000)

Total liabilities and equity............................. (2,785,000) (1,188,000)1,230,000 1,230,000 (3,143,000

You might also like

- ITFA Solution June 2018 ExamDocument7 pagesITFA Solution June 2018 ExamF A Saffat RahmanNo ratings yet

- Questions On Chapter FourDocument2 pagesQuestions On Chapter Fourbrook butaNo ratings yet

- The Following Information For The Year Ending December 31 2015Document1 pageThe Following Information For The Year Ending December 31 2015Muhammad ShahidNo ratings yet

- The Following Data Presented in Alphabetical Order Are Taken From 68954 PDFDocument1 pageThe Following Data Presented in Alphabetical Order Are Taken From 68954 PDFAnbu jaromiaNo ratings yet

- CH 10 - End of Chapter Exercises SolutionsDocument57 pagesCH 10 - End of Chapter Exercises SolutionssaraNo ratings yet

- Final Exam AnswerDocument5 pagesFinal Exam AnswerPham Ngoc AnhNo ratings yet

- Tugas Kelompok Ke-3 Week 8: Flexible BudgetDocument4 pagesTugas Kelompok Ke-3 Week 8: Flexible BudgetArkan HafidzNo ratings yet

- Solutions - CH 5Document4 pagesSolutions - CH 5Khánh AnNo ratings yet

- 111Document7 pages111haerudinsaniNo ratings yet

- The Following Data Were Taken From The Records of SkateDocument1 pageThe Following Data Were Taken From The Records of SkateM Bilal SaleemNo ratings yet

- Tugas Kelompok Ke-3 Week 8: Flexible BudgetDocument4 pagesTugas Kelompok Ke-3 Week 8: Flexible BudgetNadilla NurNo ratings yet

- SOAL LATIHAN INTER 1 - Chapter 4Document14 pagesSOAL LATIHAN INTER 1 - Chapter 4Florencia May67% (3)

- Extra Applications - Lecture Week 2Document5 pagesExtra Applications - Lecture Week 2Muhammad HusseinNo ratings yet

- Cash Flow 1Document3 pagesCash Flow 1Percy JacksonNo ratings yet

- Sales Revenue ($250 X 6 Mos.) ......................................................................................................... $1,500Document4 pagesSales Revenue ($250 X 6 Mos.) ......................................................................................................... $1,500Iman naufalNo ratings yet

- Bryant Ritchie Trisnodjojo - 041911333021 - AKM 3 Week 10Document4 pagesBryant Ritchie Trisnodjojo - 041911333021 - AKM 3 Week 10Goji iiiNo ratings yet

- CH 4 In-Class Exercise SOLUTIONSDocument7 pagesCH 4 In-Class Exercise SOLUTIONSAbdullah alhamaadNo ratings yet

- gr12 Chapter 5 SolutionsDocument14 pagesgr12 Chapter 5 SolutionsMrinmoy SahaNo ratings yet

- Jawaban Laporan Arus Kas Dan Laba Rugi KomprehensifDocument4 pagesJawaban Laporan Arus Kas Dan Laba Rugi KomprehensifAksit RistiyaningsihNo ratings yet

- Calculation of net income from shareholders' equity changeDocument4 pagesCalculation of net income from shareholders' equity changePrerna AroraNo ratings yet

- Chapter 5Document4 pagesChapter 5Ngô Hoàng Bích KhaNo ratings yet

- Laporan Perubahan Arus Kas (Indirect)Document2 pagesLaporan Perubahan Arus Kas (Indirect)Amelia SembiringNo ratings yet

- ACCT336 Chapter23 SolutionsDocument7 pagesACCT336 Chapter23 SolutionskareemrawwadNo ratings yet

- Solutions Manual Advanced Accounting 12th Edition by Hoyle Schaefer DoupnikDocument30 pagesSolutions Manual Advanced Accounting 12th Edition by Hoyle Schaefer DoupnikThu NguyenNo ratings yet

- More Cash Flow ExercisesDocument4 pagesMore Cash Flow ExercisesLorenzodeLunaNo ratings yet

- The Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineDocument1 pageThe Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineAmit PandeyNo ratings yet

- 0 - AE 17 ProblemsDocument3 pages0 - AE 17 ProblemsMajoy BantocNo ratings yet

- Chapter 9 SolutionsDocument6 pagesChapter 9 SolutionsmackkshellNo ratings yet

- Model Solution: Solution To The Question No. 1 (B) Required (I)Document4 pagesModel Solution: Solution To The Question No. 1 (B) Required (I)HossainNo ratings yet

- Akm3 Week-10Document5 pagesAkm3 Week-10pizzaanutriaNo ratings yet

- Acct 3101 Chapter 05Document13 pagesAcct 3101 Chapter 05Arief RachmanNo ratings yet

- The Following Data Were Taken From The Records of Surf SDocument1 pageThe Following Data Were Taken From The Records of Surf SM Bilal SaleemNo ratings yet

- Consolidated-Financial-Statements-80%-Owned-SubsidiaryDocument10 pagesConsolidated-Financial-Statements-80%-Owned-SubsidiaryBetty SantiagoNo ratings yet

- Solutions To Exercises Exercise 18-1-15Document50 pagesSolutions To Exercises Exercise 18-1-15Aiziel OrenseNo ratings yet

- Mannie Company worksheet data adjustmentsDocument17 pagesMannie Company worksheet data adjustmentsVy Pham Nguyen KhanhNo ratings yet

- Financial Management, MBA511, Section: 01 Chapter 3: ProblemsDocument2 pagesFinancial Management, MBA511, Section: 01 Chapter 3: ProblemsShakilNo ratings yet

- Chapter 9 Solutions - Inclass ExercisesDocument5 pagesChapter 9 Solutions - Inclass ExercisesSummerNo ratings yet

- FIN 220, Ch3, Selected Problems 2Document3 pagesFIN 220, Ch3, Selected Problems 23ooobd1234No ratings yet

- Jawaban AKM2Document10 pagesJawaban AKM2Jeaxell RieskyNo ratings yet

- Cash FlowsDocument6 pagesCash FlowsZaheer AhmadNo ratings yet

- Assignment No 1Document15 pagesAssignment No 1M Naveed SultanNo ratings yet

- Module III. Business Combination - Subsequent To Date of AcquisitionDocument5 pagesModule III. Business Combination - Subsequent To Date of AcquisitionAldrin Zolina0% (4)

- Chapter 8 Solutions - Inclass ExercisesDocument8 pagesChapter 8 Solutions - Inclass ExercisesSummerNo ratings yet

- Financial Analysis 4Document10 pagesFinancial Analysis 4Alaitz GNo ratings yet

- Buscom 8Document11 pagesBuscom 8dmangiginNo ratings yet

- Chapter 5 Assigned Question SOLUTIONS PDFDocument28 pagesChapter 5 Assigned Question SOLUTIONS PDFKeyur PatelNo ratings yet

- 03 Course Notes On Statement of Cash Flows-2 PDFDocument4 pages03 Course Notes On Statement of Cash Flows-2 PDFMaxin TanNo ratings yet

- Dickinson Company 2014 Income StatementDocument2 pagesDickinson Company 2014 Income StatementSp MagdalenaNo ratings yet

- Key Chapter 4Document12 pagesKey Chapter 4JinAe NaNo ratings yet

- Description Income Statement Adjustments Statement of Cash FlowsDocument2 pagesDescription Income Statement Adjustments Statement of Cash FlowsFhem Leighn SimetraNo ratings yet

- Contoh Dan Soal Cash FlowDocument9 pagesContoh Dan Soal Cash FlowAltaf HauzanNo ratings yet

- Jawaban Webster CompanyDocument4 pagesJawaban Webster CompanyHans WakhidaNo ratings yet

- Solutions To Problems: 13/e, Solutions Manual (For Instructor Use Only)Document5 pagesSolutions To Problems: 13/e, Solutions Manual (For Instructor Use Only)Adam IngberNo ratings yet

- Exhibit 7.1: Financial Statement AnalysisDocument2 pagesExhibit 7.1: Financial Statement AnalysisYean SoramyNo ratings yet

- Financial Statements of Sole Traders: 2020 NOV P21 Q1 DDocument9 pagesFinancial Statements of Sole Traders: 2020 NOV P21 Q1 DNavid BackupNo ratings yet

- 6th Edition Module 2 Selected Homework AnswersDocument5 pages6th Edition Module 2 Selected Homework AnswersjoshNo ratings yet

- AIK CH 7 Part 2Document11 pagesAIK CH 7 Part 2rizky unsNo ratings yet

- Buscom 7Document9 pagesBuscom 7dmangiginNo ratings yet

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisFrom EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNo ratings yet

- Institutional Investment in Infrastructure in Emerging Markets and Developing EconomiesFrom EverandInstitutional Investment in Infrastructure in Emerging Markets and Developing EconomiesNo ratings yet

- 9418 - Financial Statements TranslationDocument3 pages9418 - Financial Statements Translationjsmozol3434qcNo ratings yet

- Chapter Two Theory of Consumer Behavior and DemandDocument66 pagesChapter Two Theory of Consumer Behavior and DemandAlazer Tesfaye Ersasu TesfayeNo ratings yet

- The Corporate Social Responsibility (CSR) TrendDocument15 pagesThe Corporate Social Responsibility (CSR) TrendNancy VõNo ratings yet

- Impact of Covid-19 On E-Commerce 1700Document12 pagesImpact of Covid-19 On E-Commerce 1700Nadia RiazNo ratings yet

- Supplementary Agreement FormatDocument5 pagesSupplementary Agreement FormatRijul RanaNo ratings yet

- Presentation On FedexDocument16 pagesPresentation On FedexAnshulNo ratings yet

- Indian Bank ChallanDocument1 pageIndian Bank Challanranga1231No ratings yet

- TITLE: "Determinants For Profitability of E-Commerce Operations of Companies in The Communication Sector in Nairobi County, Kenya"Document6 pagesTITLE: "Determinants For Profitability of E-Commerce Operations of Companies in The Communication Sector in Nairobi County, Kenya"Freda Mae Pomilban LumayyongNo ratings yet

- LIC Housing Finance LTD: This Is A Computer Generated Statement Hence Does Not Require SignatureDocument1 pageLIC Housing Finance LTD: This Is A Computer Generated Statement Hence Does Not Require SignatureGSAINTSSANo ratings yet

- Marriott's Project Chariot Offers Shareholders ValueDocument7 pagesMarriott's Project Chariot Offers Shareholders Valuesurya rajanNo ratings yet

- View your monthly fiber statementDocument2 pagesView your monthly fiber statementghanshyam sidhdhapuraNo ratings yet

- Sub-Topic 1: The Best Cheap Car Insurance Companies in Twin Falls IDDocument5 pagesSub-Topic 1: The Best Cheap Car Insurance Companies in Twin Falls IDKIPKEMOI KOECHNo ratings yet

- StatmentDocument9 pagesStatmentManju ManjunathNo ratings yet

- Tugas P18-5 - AKLDocument4 pagesTugas P18-5 - AKLNovie AriyantiNo ratings yet

- A Session 23Document18 pagesA Session 23Sơn CaoNo ratings yet

- CA Certificate For VisaDocument4 pagesCA Certificate For VisaVamshi Krishna Reddy Pathi0% (1)

- Bank account statement of Mr. Devendra Kumar KunjamDocument14 pagesBank account statement of Mr. Devendra Kumar KunjamDevendra KunjamNo ratings yet

- Case 6c-Kok Weng and Ming (Part 1)Document2 pagesCase 6c-Kok Weng and Ming (Part 1)SHIERY MAE FALCONITINNo ratings yet

- Amazon ClothingBillDocument2 pagesAmazon ClothingBillSantosh KumarNo ratings yet

- PROBLEM SET 5 Part 2.: SwapsDocument8 pagesPROBLEM SET 5 Part 2.: SwapsSumit GuptaNo ratings yet

- MSME Customer - Sales DocumentationDocument14 pagesMSME Customer - Sales DocumentationkathirNo ratings yet

- AP Macroeconomics Assignment: Apply Concepts of AD/AS: SlopingDocument7 pagesAP Macroeconomics Assignment: Apply Concepts of AD/AS: SlopingSixPennyUnicornNo ratings yet

- Tax Grant ThorntonDocument40 pagesTax Grant ThorntonMAYANK AGGARWALNo ratings yet

- 8 - Managing Nondeposit Liabilities and Borrowed FundsDocument22 pages8 - Managing Nondeposit Liabilities and Borrowed FundsTiến ĐứcNo ratings yet

- Big Data at GAP - Group 6 - Section ADocument9 pagesBig Data at GAP - Group 6 - Section AARKO MUKHERJEE100% (1)

- Pdo SR 2018 - EaDocument174 pagesPdo SR 2018 - Eajoenediath9345100% (1)

- Cpa ReviewDocument1 pageCpa ReviewLeonel KingNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruKokila Sham100% (1)

- Keventer AbhiDocument28 pagesKeventer AbhiVLOGGER CHACHANo ratings yet

- CP Financial Statement 2015Document245 pagesCP Financial Statement 2015Andrea GatchalianNo ratings yet