Professional Documents

Culture Documents

Daily Market Watch - 26 01 2015 PDF

Uploaded by

Randora LkOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Market Watch - 26 01 2015 PDF

Uploaded by

Randora LkCopyright:

Available Formats

DAILY MARKET WATCH

First Capital Research

January 26, 2015

MARKET INDICES

S&P SL20

ASPI

7,400

4,140

7,350

4,120

MARKET PERFORMANCE

Today

ASPI

S&P SL20

7,316.08

4,096.74

7,276.63

4,078.89

0.54%

0.44%

338.21

987.36

-65.75%

16.16

32.18

-49.78%

Turnover (LKR 'Mn)

Previous

Change (%)

4,100

Volume ('Mn)

4,080

Market Cap. (LKR 'Bn)

3,099.88

3,099.51

0.01%

7,250

4,060

Market Cap. (USD 'Bn)

23.48

23.51

-0.10%

7,200

4,040

219

217

0.92%

Foreign Purchases (LKR 'Mn)

Foreign Sales (LKR 'Mn)

67.88

25.83

103.83

622.18

-34.62%

-95.85%

Net Foreign Inflow (LKR 'Mn)

42.06

-518.34

108.11%

7,300

ASPI

S&P SL20

MARKET TURNOVER & VOLUME

Domestic - 86%,

Foreign - 14%

Turnover ('Mn)

Volume

1,400

1,200

1,000

800

600

400

200

0

60

MTD Net Foreign Flow (LKR 'Mn)

-737.37

YTD Net Foreign Flow (LKR 'Mn)

-737.37

50

40

30

20

10

0

Turnover

Volume

NET FOREIGN FLOW

MARKET COMMENTARY

Market continued to perform dull during the day; however ASPI gained 39

points to close at 7,316. Positive contributions by JKH, NEST and CARS

supported the uptick in the bourse while outweighing the negative

contributions by DIST, DIAL and PLC. Both market turnover and volumes

dropped while foreign participation remained at 14%, recording a mere

net foreign inflow of LKR 42mn. Market did not witness any crossings

during the day.

ESTIMATED LARGEST FOREIGN FLOW

('Mn)

200

100

0

-100

-200

-300

-400

-500

-600

Traded Companies

69

87

-4

LGL

SEYB(X)

LFIN

CTHR

DIST

LIOC

NDB

SAMP

EXPO

JKH

42

-21

-518

-2

-2

-1

-1

3

4

5

6

26

-10

-5

Net FII

TOP 5 GAINERS

CEYLON LEATHER [W0014]

MORISONS

CITRUS LEISURE [W0019]

HUEJAY

MORISONS [X]

TOP 5 TURNOVER

10

15

20

25

30

Estimated Value (LKR 'Mn)

Today

Previous

2.70

2.40

320.30

285.00

1.00

0.90

68.40

62.00

264.00

Price

241.10

Change (%)

TOP 5 LOSERS

Today

Previous

Change (%)

12.50% S M B LEASING [X]

0.40

0.50

-20.00%

12.39% BLUE DIAMONDS [X]

0.70

0.80

-12.50%

11.11% MIRAMAR

59.20

65.60

-9.76%

10.32% HAYLEYS FIBRE

39.50

43.00

-8.14%

9.50% CEYLINCO INS. [X]

Volume

Turnover

('Mn)

('Mn)

TOP 5 VOLUME

525.40

Price

569.90

-7.81%

Volume

Turnover

('Mn)

('Mn)

DFCC BANK PLC

215.00

0.2

49.93 AMANA TAKAFUL

1.40

1.8

2.52

JKH

228.20

0.2

37.28 ASIA ASSET

1.80

1.2

2.10

VALLIBEL ONE

22.80

1.0

23.06 VALLIBEL

7.60

1.1

8.35

SAMPATH

248.10

0.1

16.50 VALLIBEL ONE

22.80

1.0

23.06

HNB

204.90

0.1

13.94 SOFTLOGIC

14.30

0.7

10.25

First Capital Equities (Pvt) Ltd

No.1, Lake Crescent,

Colombo 2

Sales Desk:

+94 11 2145 000

Fax:

+94 11 2145 050

HEAD OFFICE

BRANCHES

No.1, Lake Crescent,

Matara

Negombo

Colombo 2

No. 24, Mezzanine Floor,

No.72A, 2/1,

Sales Desk:

+94 11 2145 000 E.H. Cooray Building,

Old Chilaw Road,

Fax:

+94 11 2145 050 Anagarika Dharmapala Mw,

Negombo

Matara

Tel:

+94 41 2237 636

Tel:

Jaliya Wijeratne

+94 71 5329 602

Negombo

SALES

+94 31 2233 299

BRANCHES

CEO

Priyanka Anuruddha

+94 76 6910 035

Priyantha Wijesiri

+94 76 6910 036

Colombo

Nishantha Mudalige

+94 76 6910 041

Matara

Anushka Buddhika

+94 77 9553 613

Sumeda Jayawardana

+94 76 6910 038

Gamini Hettiarachchi

+94 76 6910 039

Thushara Abeyratne

+94 76 6910 037

Nishani Prasangi

+94 76 6910 033

Ishanka Wickramanayaka

+94 77 7611 200

RESEARCH

Dimantha Mathew

+94 11 2145 016

Reshan Wediwardana

+94 11 2145 017

Michelle Weerasinghe

+94 11 2145 018

FIRST CAPITAL GROUP

HEAD OFFICE

BRANCHES

No. 2, Deal Place,

Matara

Kurunegala

Kandy

Colombo 3

No. 24, Mezzanine Floor,

No. 6, 1st Floor,

No.213-215,

Tel:

E.H. Cooray Building,

Union Assurance Building,

Peradeniya Road,

Anagarika Dharmapala Mawatha,

Rajapihilla Mawatha,

Kandy

Matara

Kurunegala

+94 11 2576 878

Tel:

+94 41 2222 988

Tel:

+94 37 2222 930

Tel:

+94 81 2236 010

Disclaimer:

This Review is prepared and issued by First Capital Equities (Pvt) Ltd. based on information in the public domain, internally developed and other sources, believed to be

correct. Although all reasonable care has been taken to ensure the contents of the Review are accurate, First Capital Equities (Pvt) Ltd and/or its Directors,

employees, are not responsible for the correctness, usefulness, reliability of same. First Capital Equities (Pvt) Ltd may act as a Broker in the investments which are the

subject of this document or related investments and may have acted on or used the information contained in this document, or the research or analysis on which it is

based, before its publication. First Capital Equities (Pvt) Ltd and/or its principal, their respective Directors, or Employees may also have a position or be otherwise interested

in the investments referred to in this document. This is not an offer to sell or buy the investments referred to in this document. This Review may contain data which are

inaccurate and unreliable. You hereby waive irrevocably any rights or remedies in law or equity you have or may have against First Capital Equities (Pvt) Ltd with respect to

the Review and agree to indemnify and hold First Capital Equities (Pvt) Ltd and/or its principal, their respective directors and employees harmless to the fullest extent

allowed by law regarding all matters related to your use of this Review. No part of this document may be reproduced, distributed or published in whole or in part by any

means to any other person for any purpose without prior permission.

You might also like

- Wei 20150904 PDFDocument18 pagesWei 20150904 PDFRandora LkNo ratings yet

- Weekly Foreign Holding & Block Trade Update: Net Buying Net SellingDocument4 pagesWeekly Foreign Holding & Block Trade Update: Net Buying Net SellingRandora LkNo ratings yet

- Weekly Update 04.09.2015 PDFDocument2 pagesWeekly Update 04.09.2015 PDFRandora LkNo ratings yet

- Daily 01 09 2015 PDFDocument4 pagesDaily 01 09 2015 PDFRandora LkNo ratings yet

- 03 September 2015 PDFDocument9 pages03 September 2015 PDFRandora LkNo ratings yet

- Global Market Update - 04 09 2015 PDFDocument6 pagesGlobal Market Update - 04 09 2015 PDFRandora LkNo ratings yet

- Global Market Update - 04 09 2015 PDFDocument6 pagesGlobal Market Update - 04 09 2015 PDFRandora LkNo ratings yet

- Sri0Lanka000Re0ounting0and0auditing PDFDocument44 pagesSri0Lanka000Re0ounting0and0auditing PDFRandora LkNo ratings yet

- Earnings Update March Quarter 2015 05 06 2015 PDFDocument24 pagesEarnings Update March Quarter 2015 05 06 2015 PDFRandora LkNo ratings yet

- Press 20150831ebDocument2 pagesPress 20150831ebRandora LkNo ratings yet

- ICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCDocument3 pagesICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCRandora LkNo ratings yet

- Earnings & Market Returns Forecast - Jun 2015 PDFDocument4 pagesEarnings & Market Returns Forecast - Jun 2015 PDFRandora LkNo ratings yet

- Press 20150831ea PDFDocument1 pagePress 20150831ea PDFRandora LkNo ratings yet

- CCPI - Press Release - August2015 PDFDocument5 pagesCCPI - Press Release - August2015 PDFRandora LkNo ratings yet

- Results Update Sector Summary - Jun 2015 PDFDocument2 pagesResults Update Sector Summary - Jun 2015 PDFRandora LkNo ratings yet

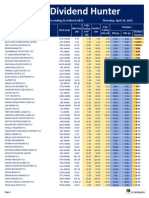

- Dividend Hunter - Mar 2015 PDFDocument7 pagesDividend Hunter - Mar 2015 PDFRandora LkNo ratings yet

- Results Update For All Companies - Jun 2015 PDFDocument9 pagesResults Update For All Companies - Jun 2015 PDFRandora LkNo ratings yet

- Dividend Hunter - Apr 2015 PDFDocument7 pagesDividend Hunter - Apr 2015 PDFRandora LkNo ratings yet

- BRS Monthly (March 2015 Edition) PDFDocument8 pagesBRS Monthly (March 2015 Edition) PDFRandora LkNo ratings yet

- Dividend Hunter - Mar 2015 PDFDocument7 pagesDividend Hunter - Mar 2015 PDFRandora LkNo ratings yet

- Daily - 23 04 2015 PDFDocument4 pagesDaily - 23 04 2015 PDFRandora LkNo ratings yet

- The Morality of Capitalism Sri LankiaDocument32 pagesThe Morality of Capitalism Sri LankiaRandora LkNo ratings yet

- N D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Document5 pagesN D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Randora LkNo ratings yet

- CRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFDocument12 pagesCRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFRandora LkNo ratings yet

- Janashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFDocument9 pagesJanashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFRandora LkNo ratings yet

- Chevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFDocument9 pagesChevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFRandora LkNo ratings yet

- Microfinance Regulatory Model PDFDocument5 pagesMicrofinance Regulatory Model PDFRandora LkNo ratings yet

- Daily Stock Watch 08.04.2015 PDFDocument9 pagesDaily Stock Watch 08.04.2015 PDFRandora LkNo ratings yet

- GIH Capital Monthly - Mar 2015 PDFDocument11 pagesGIH Capital Monthly - Mar 2015 PDFRandora LkNo ratings yet

- Weekly Foreign Holding & Block Trade Update - 02 04 2015 PDFDocument4 pagesWeekly Foreign Holding & Block Trade Update - 02 04 2015 PDFRandora LkNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Chapter 13Document120 pagesChapter 13yongNo ratings yet

- Marketing Strategy for a Luxury HotelDocument25 pagesMarketing Strategy for a Luxury HotelainulmardhiyahNo ratings yet

- Cases From Management Accounting PracticesDocument145 pagesCases From Management Accounting Practicesarjunnaik_21No ratings yet

- Englres Final Research Paper - Peswani and VillavicencioDocument23 pagesEnglres Final Research Paper - Peswani and VillavicencioNeel PeswaniNo ratings yet

- IS MONOPOLY FATAL FOR THE FIRMS GROWTHDocument15 pagesIS MONOPOLY FATAL FOR THE FIRMS GROWTHDrishya GangammaNo ratings yet

- Procedure With Regards To Transfer of SharesDocument4 pagesProcedure With Regards To Transfer of SharesKathc AzurNo ratings yet

- Visionspring in India: Enabling Affordable Eyeglasses For The PoorDocument11 pagesVisionspring in India: Enabling Affordable Eyeglasses For The PoorNicolasNo ratings yet

- Apparel Dictionary Very UsefulDocument9 pagesApparel Dictionary Very Usefulmorshed_mahamud7055No ratings yet

- Gets InglesDocument1,088 pagesGets InglesKjatunMayu Gutierrez100% (6)

- How Do Brands Exploit Impulsive Buying?Document42 pagesHow Do Brands Exploit Impulsive Buying?Rishav Saha100% (1)

- Procurement Saving Handbook - Vers1 07 - V1Document148 pagesProcurement Saving Handbook - Vers1 07 - V1GeronimoNo ratings yet

- Air Extras 00Document3 pagesAir Extras 00daygsNo ratings yet

- How persuaders manipulate our shopping and spendingDocument4 pagesHow persuaders manipulate our shopping and spendingJoshua JethrohNo ratings yet

- Consignment Sales AnswersDocument4 pagesConsignment Sales AnswersLovelyNo ratings yet

- Strategic Sourcing FrameworkDocument19 pagesStrategic Sourcing Frameworkdipeshdutta86649No ratings yet

- Consumer and Organizational MarketsDocument26 pagesConsumer and Organizational MarketsMaryjoy Valerio0% (1)

- Essar SteelDocument52 pagesEssar SteelMukesh SharmaNo ratings yet

- Human Resource Management Process in Big Bazaar: in Partial Fulfillment of The Requirements For The Degree ofDocument44 pagesHuman Resource Management Process in Big Bazaar: in Partial Fulfillment of The Requirements For The Degree ofDHARMENDER YADAVNo ratings yet

- Mba-Iii-Retail Management NotesDocument84 pagesMba-Iii-Retail Management NotesRonit t.eNo ratings yet

- MMS Negotiation and Selling Skills ElectiveDocument2 pagesMMS Negotiation and Selling Skills ElectiveAkshada VinchurkarNo ratings yet

- SS 08 Quiz 1 - AnswersDocument82 pagesSS 08 Quiz 1 - AnswersVan Le Ha100% (3)

- Consumer Behavior Insights Towards LakmeDocument50 pagesConsumer Behavior Insights Towards LakmeLav Chaudhary50% (2)

- Principles of Financial Accounting PDFDocument318 pagesPrinciples of Financial Accounting PDFRalph Aries Almeyda Alvarez100% (2)

- Unit - 3 Consignment: Learning OutcomesDocument36 pagesUnit - 3 Consignment: Learning OutcomesPrathamesh KambleNo ratings yet

- Accounting DefinationDocument3 pagesAccounting DefinationNooray MalikNo ratings yet

- Shalv 19229 SipDocument37 pagesShalv 19229 Sip1820 SHALV GUPTANo ratings yet

- Testimony of Diana Robinson From Food Chain Workers AllianceDocument2 pagesTestimony of Diana Robinson From Food Chain Workers AllianceStreet Vendor ProjectNo ratings yet

- ONGC House Building Advance FormDocument3 pagesONGC House Building Advance Formrahul100% (1)

- Alko PDFDocument3 pagesAlko PDFPankaj Kumar0% (1)

- CRM: Customer Relationship ManagementDocument18 pagesCRM: Customer Relationship ManagementMallutechz 4 UNo ratings yet