Professional Documents

Culture Documents

Abbreviated Accounts To Companies House To 30nov05

Uploaded by

JulianOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Abbreviated Accounts To Companies House To 30nov05

Uploaded by

JulianCopyright:

Available Formats

MERIDIAN DIGITAL LIMITED

ABBREVIATED FINANCIAL STATEMENTS

FOR THE YEAR ENDING 30 NOVEMBER 2005

INDEX TO THE ACCOUNTS

Pages

1

Abbreviated Balance Sheet

2 to 3

Notes to the Abbreviated Accounts

The companys registered number is 4596774.

Meridian Digital Limited

Abbreviated Balance Sheet

At 30 November 2005

2005

2004

392

FIXED ASSETS

Tangible assets

CURRENT ASSETS

Debtors falling due within one year

Cash at bank and in hand

2,585

100

2,685

0

100

100

CREDITORS: Amounts falling due within one year

6,766

NET CURRENT ASSETS

(4,081)

100

(3,690)

100

100

(3,790)

100

0

(3,690)

100

CAPITAL AND RESERVES

Called-up share capital

Profit and loss account

In approving these financial statements as directors of the company we hereby confirm that:

a) for the year in question the company was entitled to exemption from audit under Section 249A(1) of the

Companies Act 1985;

b) no notice has been deposited under Section 249B(2) requesting that an audit be conducted for the year

ended 30 November 2005; and

c) we acknowledge our responsibilities for:

i) ensuring that the company keeps accounting records which comply with Section 221, and

ii) preparing accounts which give a true and fair view of the state of affairs of the company as at the

end of the financial year and of its loss for the financial year then ended in accordance with the

requirements of Section 226, and which otherwise comply with the provisions of the Companies Act

relating to accounts, so far as applicable to the company.

These abbreviated accounts have been prepared in accordance with the special provisions of Part VII of the

Companies Act 1985 relating to small companies.

These abbreviated accounts were approved by the board of directors on 28 September 2006

A. Smith, Director.

The notes on pages 2 to 3 form part of these accounts.

Page 1

Meridian Digital Limited

Notes to the Abbreviated Accounts

For the year ended 30 November 2005

I.

ACCOUNTING POLICIES

I.a.

Basis of accounting

The accounts have been prepared under the historical cost convention.

I.b.

Tangible fixed assets

Fixed assets are shown at historical cost.

Depreciation is provided, after taking account of any grants receivable, at the following annual

rates in order to write off each asset over its estimated useful life by the reducing balance

method.

I.c.

2005

%

2004

%

Equipment in first year of ownership

40%

40%

Equipment

25%

25%

Taxation

Corporation tax payable is provided on taxable profits on the current rate. Advance corporation

tax payable on dividends paid or provided for in the year is written off.

II.

Tangible fixed assets

2005

2004

653

At start of year

For the year

0

261

0

0

At end of year

261

Cost

At start of year

At end of year

Depreciation

Net book amounts

At end of year

392

Page 2

III.

CALLED UP SHARE CAPITAL

2005

2004

100

100

100

100

Authorised:

100 Ordinary shares of 1 each

Allotted, issued and fully paid

100 Ordinary shares of 1 each

Page 3

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Current Pay Statement: This Is A Statement of Earnings and Deductions. This Pay Statement Is Non-NegotiableDocument1 pageCurrent Pay Statement: This Is A Statement of Earnings and Deductions. This Pay Statement Is Non-Negotiablekevin kuhnNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Foreign Status Certificate for Tax WithholdingDocument1 pageForeign Status Certificate for Tax WithholdinghectorNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- 2-Cost Plus Fixed Fee Sample InvoiceDocument4 pages2-Cost Plus Fixed Fee Sample Invoicekoyangi jagiyaNo ratings yet

- TDS TCS Payment RCMDocument16 pagesTDS TCS Payment RCMpinkiecullenNo ratings yet

- PFRS 3, Business Combination: A) Formation of A Joint Venture - PFRS 11, Joint ArrangementsDocument7 pagesPFRS 3, Business Combination: A) Formation of A Joint Venture - PFRS 11, Joint ArrangementsBhosx KimNo ratings yet

- Quiz No. 2 Chapter 3-4Document17 pagesQuiz No. 2 Chapter 3-4Mitchie FaustinoNo ratings yet

- 02B Income Taxes: Clwtaxn de La Salle UniversityDocument35 pages02B Income Taxes: Clwtaxn de La Salle UniversityTrisha RuzolNo ratings yet

- The Kenya Revenue Authority Has Implemented A VAT Special TableDocument2 pagesThe Kenya Revenue Authority Has Implemented A VAT Special Tablebenedict KulobaNo ratings yet

- Assessment ProcedureDocument7 pagesAssessment ProcedureVachanamrutha R.VNo ratings yet

- TDS Tax Deduction at Source: Prepared By: Visharad ShuklaDocument25 pagesTDS Tax Deduction at Source: Prepared By: Visharad ShuklaPriyanshi GandhiNo ratings yet

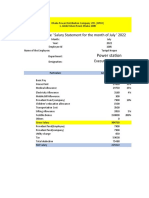

- Tariqul Hoque ' Salary Statement For The Month of July ' 2022Document6 pagesTariqul Hoque ' Salary Statement For The Month of July ' 2022Sadman Rafid FardeenNo ratings yet

- Import of Vehicles Rules FDRDocument14 pagesImport of Vehicles Rules FDRHamid AliNo ratings yet

- Sum: 2 (Calculate Bus Fare To Be Charged)Document3 pagesSum: 2 (Calculate Bus Fare To Be Charged)chirag shahNo ratings yet

- NCA SummaryDocument5 pagesNCA Summary465jgbgcvfNo ratings yet

- BIR Form 2306 Certificate of Final Tax Withheld At SourceDocument4 pagesBIR Form 2306 Certificate of Final Tax Withheld At SourceBen Carlo RamosNo ratings yet

- 2307 Jan 2018 ENCS v3.1Document90 pages2307 Jan 2018 ENCS v3.1Lex AmarieNo ratings yet

- PARTH SHARMA - 1543 - Valuation of Goods - 2020 PDFDocument21 pagesPARTH SHARMA - 1543 - Valuation of Goods - 2020 PDFparth sharmaNo ratings yet

- Estate Tax Chapter SummaryDocument4 pagesEstate Tax Chapter SummaryPJ PoliranNo ratings yet

- Acc324 MidsDocument8 pagesAcc324 MidsAccounting GuyNo ratings yet

- The Following Transactions Are For Iqaluit LTD Which Has AnDocument2 pagesThe Following Transactions Are For Iqaluit LTD Which Has AnBube KachevskaNo ratings yet

- Interim Financial Reporting RequirementsDocument4 pagesInterim Financial Reporting RequirementsJoyce Anne GarduqueNo ratings yet

- Charges and Credits:: Network Solutions, LLC 12808 Gran Bay Parkway West Jacksonville, FL32258Document1 pageCharges and Credits:: Network Solutions, LLC 12808 Gran Bay Parkway West Jacksonville, FL32258Jhiancarlo Asencio PananaNo ratings yet

- H and M Hennes and Mauritz Retail Private LimitedDocument20 pagesH and M Hennes and Mauritz Retail Private LimitedSoumya Saswat PandaNo ratings yet

- Tax CardDocument18 pagesTax CardQamar AbbasNo ratings yet

- Decree or Final Support - Jacon D. Degiulio V Heather E. RussellDocument31 pagesDecree or Final Support - Jacon D. Degiulio V Heather E. RussellthesacnewsNo ratings yet

- Status Update: Features of CREATEDocument18 pagesStatus Update: Features of CREATEMarkie GrabilloNo ratings yet

- Nepalese Farmer Income CertificatesDocument6 pagesNepalese Farmer Income CertificatesSuresh ChyNo ratings yet

- Form A: Paper-setting Blank Corporate Taxation ExamDocument3 pagesForm A: Paper-setting Blank Corporate Taxation ExamIshika PansariNo ratings yet

- CH 06Document31 pagesCH 06cushin200975% (4)

- TAX317 TEST Q Dec2021Document10 pagesTAX317 TEST Q Dec2021sharifah nurshahira sakinaNo ratings yet