Professional Documents

Culture Documents

Manila Standard Today - Business Daily Stock Review (May 08, 2015)

Uploaded by

Manila Standard TodayOriginal Title

Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Manila Standard Today - Business Daily Stock Review (May 08, 2015)

Uploaded by

Manila Standard TodayCopyright:

SATURDAY: MAY 9, 2015

B2

BUSINESS

business@thestandard.com.ph

extrastory2000@gmail.com

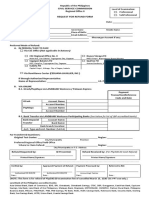

MST Business Daily Stocks Review

Friday, May 8, 2015

52 Weeks Previous

High Low STOCKS

Close

High Low

Close

7.88

75.30

124.40

104.00

63.00

2.49

4.20

4.00

18.48

31.60

9.50

0.92

2.95

890.00

1.01

99.40

1.46

75.00

94.95

137.00

361.20

59.00

174.80

1700.00

127.90

2.50 AG Finance

7.46

66.00 Asia United Bank

70.80

84.60 Banco de Oro Unibank Inc. 110.20

84.50 Bank of PI

100.60

45.80 China Bank

46.75

1.97 BDO Leasing & Fin. INc. 2.50

2.03 Bright Kindle Resources 2.07

8.70 Citystate Savings

10.18

12.02 COL Financial

15.30

23.55 Eastwest Bank

21.75

6.30 Filipino Fund Inc.

7.40

0.74 First Abacus

0.78

1.75 I-Remit Inc.

1.77

625.00 Manulife Fin. Corp.

785.00

0.225 MEDCO Holdings

0.450

78.00 Metrobank

93.55

0.90 Natl. Reinsurance Corp. 1.08

58.00 Phil Bank of Comm

30.60

76.50 Phil. National Bank

75.25

95.00 Phil. Savings Bank

94.00

276.00 PSE Inc.

318.00

45.00 RCBC `A

45.00

107.60 Security Bank

167.40

1200.00 Sun Life Financial

1440.00

66.00 Union Bank

66.50

FINANCIAL

7.83

7.25

70.80 70.00

111.20 109.50

102.00 100.40

47.30

46.75

2.51

2.51

2.06

2.05

10.00 10.00

15.36 15.10

22.80 21.70

7.41

7.40

0.75

0.75

1.78

1.78

820.00 820.00

0.440 0.440

93.60 92.50

1.06

0.98

30.60 30.50

76.10 75.25

94.00 94.00

318.00 317.00

45.60 45.00

171.50 168.20

1440.00 1440.00

66.50 66.00

INDUSTRIAL

42.75 42.00

1.65

1.57

1.08

1.08

2.08

2.06

11.50 11.32

51.00 48.40

90.00 90.00

19.58 19.20

135.00 135.00

30.85 27.40

62.00 61.00

2.41

2.21

1.78

1.77

12.96 12.80

21.000 20.45

11.46 11.30

8.09

8.03

10.40 10.28

1.90

1.75

15.44 14.66

28.55 27.55

94.00 92.00

14.40 14.10

0.4300 0.4200

14.20 14.00

6.18

6.03

0.590 0.590

210.80 20.92

10.22 10.12

36.45 36.45

2.60

2.55

25.00 24.70

29.05 28.00

7.800

7.600

265.00 262.80

4.09

3.90

4.26

4.12

9.80

9.69

4.49

4.40

11.60 11.38

4.04

3.98

2.35

2.28

2.40

2.29

5.07

5.02

1.93

1.86

6.40

6.20

190.00 183.00

4.16

4.16

1.63

1.59

0.167 0.160

1.38

1.38

2.23

2.19

214.00 201.60

0.70

0.67

1.36

1.33

HOLDING FIRMS

0.470 0.455

57.90

57.30

25.00 24.30

7.04

7.04

1.68

1.50

0.335 0.310

0.34

0.31

808.50 800.00

8.29

8.20

14.92 14.60

3.50

3.48

4.32

4.32

0.285 0.275

1305.00 1288.00

6.45

6.40

73.00 70.15

6.26

6.26

8.90

8.65

0.73

0.72

15.50 15.18

0.67

0.67

4.63

4.57

5.10

4.99

0.0380 0.0380

1.400 1.400

1.210 1.120

67.20

66.85

910.00 903.00

1.24

1.23

0.84

0.83

250.00 250.00

98.00 96.00

0.3750 0.3700

PROPERTY

9.000 8.840

9.46

9.46

Net Foreign

Change Volume

Trade/Buying

7.50

70.50

111.20

101.00

47.25

2.51

2.05

10.00

15.34

22.80

7.40

0.75

1.78

820.00

0.440

93.00

0.98

30.50

76.00

94.00

317.00

45.00

169.40

1440.00

66.20

0.54

(0.42)

0.91

0.40

1.07

0.40

(0.97)

(1.77)

0.26

4.83

0.00

(3.85)

0.56

4.46

(2.22)

(0.59)

(9.26)

(0.33)

1.00

0.00

(0.31)

0.00

1.19

0.00

(0.45)

46,900

170,870

1,830,060

1,988,640

101,800

1,000

313,000

400

6,900

3,661,100

30,100

30,000

11,000

100

870,000

2,758,550

116,000

14,100

28,700

170

27,400

626,500

710,700

45

20,110

42.00

1.65

1.08

2.07

11.32

51.00

90.00

19.56

135.00

27.40

62.00

2.41

1.77

12.94

20.800

11.42

8.05

10.28

1.88

15.00

27.55

93.90

14.10

0.4300

14.20

6.10

0.590

210.00

10.18

36.45

2.55

24.85

28.65

7.600

265.00

4.08

4.15

9.71

4.40

11.60

4.00

2.30

2.35

5.06

1.86

6.20

187.00

4.16

1.61

0.167

1.38

2.19

202.00

0.69

1.35

(2.44)

1.85

(0.92)

0.00

0.00

2.00

0.00

2.19

0.00

(10.02)

0.00

9.05

0.00

(0.15)

(0.24)

(0.35)

0.00

(0.77)

(1.05)

0.00

(3.33)

(0.05)

(2.76)

2.38

1.14

(1.29)

0.00

0.48

(0.20)

7.21

(8.27)

0.20

0.53

0.00

0.91

4.08

(2.35)

(0.10)

18.28

1.75

0.00

0.00

(2.08)

0.20

2.20

(2.97)

(1.58)

(0.95)

(1.83)

3.09

0.73

(0.45)

(5.16)

(1.43)

0.00

2,288,700 (80,831,590.00)

5,000

500,000 (54,000.00)

147,000

41,400.00

200

1,220

90

3,600.00

17,400

20

211,200 14,125.00

43,950

(1,063,910.00)

10,844,000 (239,240.00)

47,000

41,400

2,695,800 1,067,925.00

583,400 (2,134,864.00)

12,662,900 (13,663,213.00)

32,600

148,140.00

13,000

23,900

7,370,300 (73,994,295.00)

81,770

2,075,149.00

15,900

30,000

83,800

119,000.00

29,600

210,000

952,800 58,697,986.00

454,000 (1,597,296.00)

100

46,000

1,315,300 7,608,260.00

1,066,700 (4,495,215.00)

23,500

59,900

4,773,704.00

62,000

7,686,000 (7,254,710.00)

537,600 (2,077,220.00)

10,000

19,800

426,000 868,000.00

825,000

635,000

319,600 1,457,026.00

39,000

7,200

104,790

(18,609,426.00)

4,000

829,000 393,000.00

6,950,000 (56,350.00)

1,000

2,068,000

5,664,310 (479,125,930.00)

1,485,000

247,000

1,019,204.50

(59,773,703.00)

(10,164,893.00)

698,940.00

(148,000)

52 Weeks Previous

High Low STOCKS

Close

High Low

Close

1.99

2.07

40.00

6.15

5.40

5.60

1.54

1.48

0.201

0.98

0.305

2.25

1.87

6.34

5.73

0.180

0.72

27.00

8.54

31.80

2.29

3.60

20.60

1.02

7.56

1.96

8.59

0.91

1.29

29.10

4.10

4.96

2.80

0.89

0.97

0.083

0.445

0.188

1.40

1.42

2.80

4.13

0.090

0.39

23.00

2.57

21.35

1.64

3.08

15.08

0.69

3.38

1.00

5.69

Net Foreign

Change Volume

Trade/Buying

A. Brown Co., Inc.

0.72

Araneta Prop `A

1.300

Ayala Land `B

40.40

Belle Corp. `A

4.12

Cebu Holdings

5.13

Cebu Prop. `A

6.45

Century Property

0.89

Cityland Dev. `A

1.10

Crown Equities Inc.

0.158

Cyber Bay Corp.

0.465

Ever Gotesco

0.190

Global-Estate

1.36

Filinvest Land,Inc.

1.88

Keppel Properties

5.50

Megaworld

5.42

MRC Allied Ind.

0.123

Phil. Realty `A

0.5000

Phil. Tob. Flue Cur & Redry 31.00

Primex Corp.

7.30

Robinsons Land `B

29.00

Rockwell

1.75

Shang Properties Inc.

3.30

SM Prime Holdings

19.90

Sta. Lucia Land Inc.

0.77

Starmalls

7.00

Suntrust Home Dev. Inc. 1.000

Vista Land & Lifescapes 7.400

0.72

0.71

0.71

(1.39)

1.300 1.290

1.290 (0.77)

40.40 39.55

39.80 (1.49)

4.15

4.11

4.12

0.00

5.18

5.13

5.13

0.00

6.45

6.45

6.45

0.00

0.89

0.87

0.89

0.00

1.10

1.10

1.10

0.00

0.158 0.156

0.156 (1.27)

0.460 0.450

0.450 (3.23)

0.182 0.182

0.182 (4.21)

1.37

1.36

1.36

0.00

1.92

1.86

1.87

(0.53)

6.04

5.48

5.48

(0.36)

5.44

5.36

5.41

(0.18)

0.127 0.127

0.127 3.25

0.4900 0.4600

0.4700 (6.00)

27.40

23.50

24.05 (22.42)

7.32

7.30

7.30

0.00

29.20 28.90

29.10 0.34

1.76

1.75

1.76

0.57

3.30

3.30

3.30

0.00

19.94 19.64

19.64 (1.31)

0.77

0.75

0.76

(1.30)

7.00

6.56

6.56

(6.29)

1.000 0.990

0.990 (1.00)

7.550

7.360

7.410 0.14

SERVICES

1.97 2GO Group

6.40

6.50

6.34

6.50

1.56

32.50 ABS-CBN

62.20

62.50 61.90

62.10 (0.16)

1.00 Acesite Hotel

1.04

1.04

1.03

1.04

0.00

0.60 APC Group, Inc.

0.670

0.690 0.660

0.660 (1.49)

10.00 Asian Terminals Inc.

13.66

13.70 13.60

13.70 0.29

9.61 Bloomberry

11.60

11.66 11.50

11.50 (0.86)

0.0770 Boulevard Holdings

0.1010

0.1010 0.1010

0.1010 0.00

2.95 Calata Corp.

4.63

4.62

4.12

4.23

(8.64)

46.55 Cebu Air Inc. (5J)

84.00

85.00 84.00

84.30 0.36

10.14 Centro Esc. Univ.

10.00

10.00 10.00

10.00 0.00

5.88 DFNN Inc.

7.16

7.07

7.00

7.00

(2.23)

1600.00 Globe Telecom

2196.00

2200.00 2182.00

2184.00 (0.55)

5.95 GMA Network Inc.

6.20

6.26

6.20

6.21

0.16

30.00 Grand Plaza Hotel

32.00

30.40 23.50

30.40 (5.00)

1.36 Harbor Star

1.44

1.45

1.45

1.45

0.69

105.00 I.C.T.S.I.

109.90

110.60 108.00

109.00 (0.82)

3.01 Imperial Res. `A

6.50

7.00

6.01

7.00

7.69

0.012 IP E-Game Ventures Inc. 0.014

0.013 0.013

0.013 (7.14)

0.036 Island Info

0.224

0.230 0.223

0.226 0.89

1.200 ISM Communications

1.2800

1.2500 1.2500

1.2500 (2.34)

2.34 Jackstones

2.50

2.50

2.42

2.43

(2.80)

6.50 Leisure & Resorts

9.42

9.50

9.42

9.42

0.00

1.69 Liberty Telecom

2.09

2.09

2.05

2.09

0.00

1.10 Lorenzo Shipping

1.30

1.29

1.28

1.29

(0.77)

2.00 Macroasia Corp.

2.00

2.13

2.04

2.13

6.50

1.05 Manila Broadcasting

68.25

95.50 35.00

46.85 (31.36)

0.490 Manila Bulletin

0.680

0.670 0.670

0.670 (1.47)

1.80 Manila Jockey

2.00

2.00

2.00

2.00

0.00

8.70 Melco Crown

8.66

9.17

8.68

9.14

5.54

0.34 MG Holdings

0.365

0.360 0.360

0.360 (1.37)

0.37 NOW Corp.

0.430

0.435 0.430

0.430 0.00

14.54 Pacific Online Sys. Corp. 18.42

18.50 18.50

18.50 0.43

3.00 PAL Holdings Inc.

4.90

4.89

4.85

4.85

(1.02)

2.28 Paxys Inc.

3.00

3.05

3.05

3.05

1.67

79.00 Phil. Seven Corp.

139.00

140.00 139.90

139.90 0.65

4.39 Philweb.Com Inc.

14.74

14.76 14.68

14.74 0.00

2726.00 PLDT Common

2822.00

2858.00 2822.00

2836.00 0.50

0.380 PremiereHorizon

0.660

0.670 0.650

0.660 0.00

0.32 Premium Leisure

1.600

1.640 1.600

1.610 0.63

31.45 Puregold

39.50

39.95 39.55

39.55 0.13

60.55 Robinsons RTL

84.95

85.80 84.80

85.50 0.65

7.59 SSI Group

10.56

10.70 10.30

10.30 (2.46)

6.45 Travellers

6.70

6.70

6.61

6.65

(0.75)

0.305 Waterfront Phils.

0.335

0.325 0.325

0.325 (2.99)

1.04 Yehey

1.290

1.300 1.300

1.300 0.78

MINING & OIL

0.0043 Abra Mining

0.0053

0.0005 0.0053

0.0054 1.89

1.72 Apex `A

3.00

3.04

2.90

3.04

1.33

8.65 Atlas Cons. `A

8.03

8.22

8.03

8.20

2.12

0.236 Basic Energy Corp.

0.255

0.255 0.255

0.255 0.00

6.98 Benguet Corp `B

6.6000

8.0000 7.1700

8.0000 21.21

0.61 Century Peak Metals Hldgs 1.03

1.03

1.03

1.03

0.00

0.78 Coal Asia

0.89

0.89

0.88

0.89

0.00

5.99 Dizon

7.90

7.92

7.71

7.73

(2.15)

1.08 Ferronickel

1.92

1.92

1.83

1.85

(3.65)

0.330 Geograce Res. Phil. Inc. 0.365

0.370 0.365

0.365 0.00

0.2130 Lepanto `A

0.231

0.233 0.230

0.232 0.43

0.2160 Lepanto `B

0.236

0.241 0.236

0.241 2.12

0.014 Manila Mining `A

0.0150

0.0150 0.0140

0.0140 (6.67)

0.014 Manila Mining `B

0.0140

0.0160 0.0140

0.0150 7.14

3.660 Marcventures Hldgs., Inc. 4.52

4.50

4.30

4.34

(3.98)

20.20 Nickelasia

26.85

27.35

26.45

26.70 (0.56)

2.11 Nihao Mineral Resources 3.98

4.02

3.87

3.92

(1.51)

0.365 Omico

0.7100

0.7100 0.7100

0.7100 0.00

1.54 Oriental Peninsula Res. 2.140

2.150 2.100

2.150 0.47

0.012 Oriental Pet. `A

0.0130

0.0130 0.0120

0.0130 0.00

5.40 Petroenergy Res. Corp. 4.49

4.50

4.40

4.49

0.00

7.26 Philex `A

7.10

7.11

7.09

7.09

(0.14)

2.27 PhilexPetroleum

1.50

1.65

1.49

1.50

0.00

0.015 Philodrill Corp. `A

0.017

0.017 0.016

0.016 (5.88)

115.90 Semirara Corp.

163.00

163.50 162.70

162.80 (0.12)

3.67 TA Petroleum

5.52

5.87

5.52

5.73

3.80

PREFERRED

33.00 ABS-CBN Holdings Corp. 62.95

62.95 62.55

62.75 (0.32)

101.50 First Gen G

119.10

119.00 119.00

119.00 (0.08)

480.00 GLOBE PREF P

511.00

513.00 513.00

513.00 0.39

5.88 GMA Holdings Inc.

5.95

5.95

5.95

5.95

0.00

6.50 Leisure and Resort

1.09

1.09

1.09

1.09

0.00

997.00 PCOR-Preferred A

1060.00 1055.00 1050.00

1050.00 (0.94)

1011.00 PF Pref 2

1045.00

1045.00 1045.00

1045.00 0.00

74.20 SMC Preferred A

76.10

76.10 75.95

76.10 0.00

75.00 SMC Preferred C

86.95

87.00

83.50

87.00 0.06

1.00 Swift Pref

2.20

2.20

2.20

2.20

0.00

WARRANTS & BONDS

0.8900 LR Warrant

4.160

4.170 4.130

4.160 0.00

SME

2.40 Double Dragon

9.69

10.06 9.72

9.89

2.06

3.50 Makati Fin. Corp.

8.30

8.24

6.10

8.24

(0.72)

13.50 IRipple E-Business Intl 75.50

77.65

74.00

77.65 2.85

5.95 Xurpas

9.10

9.30

9.08

9.13

0.33

EXCHANGE TRADED FUNDS

105.60 First Metro ETF

127.00

127.10 126.20

126.20 (0.63)

1,266,000

136,000 76,110.00

5,640,000 (167,069,065.00)

556,000 554,000.00

30,100

200

6,225,000 (3,744,600.00)

5,000

1,880,000

3,410,000

40,000

2,215,000 (2,037,440.00)

9,935,000 (1,725,650.00)

5,000

14,866,700 (17,701,908.00)

20,000

272,000 24,000.00

42,800

129,000

4,200,900 16,617,810.00

165,000

103,000

7,322,400 (9,700,410.00)

332,000

122,200

120,000

4,271,700 (12,303,678.00)

MST

47.00 35.60 Aboitiz Power Corp.

43.05

5.00

1.60 Agrinurture Inc.

1.62

1.66

1.04 Alliance Tuna Intl Inc.

1.09

2.36

1.41 Alsons Cons.

2.07

15.30 7.92 Asiabest Group

11.32

113.00 40.30 Bogo Medelin

50.00

148.00 32.00 C. Azuc De Tarlac

90.00

20.60 14.60 Century Food

19.14

125.00 62.50 Chemphil

135.00

32.00 10.08 Cirtek Holdings (Chips) 30.45

65.80 29.15 Concepcion

62.00

Crown Asia

2.21

4.57

1.04 Da Vinci Capital

1.77

23.35 10.72 Del Monte

12.96

21.60 8.44 DNL Industries Inc.

20.850

12.98 9.79 Emperador

11.46

9.13

5.43 Energy Devt. Corp. (EDC) 8.05

12.34 9.54 EEI

10.36

2.89

1.06 Euro-Med Lab

1.90

17.00 8.61 Federal Res. Inv. Group 15.00

31.80 18.06 First Gen Corp.

28.50

109.00 67.90 First Holdings A

93.95

20.75 14.00 Ginebra San Miguel Inc. 14.50

0.820 0.0076 Greenergy

0.4200

15.30 13.24 Holcim Philippines Inc. 14.04

9.40

3.12 Integ. Micro-Electronics 6.18

0.98

0.395 Ionics Inc

0.590

241.00 168.00 Jollibee Foods Corp.

209.00

12.50 8.65 Lafarge Rep

10.20

79.00 34.10 Liberty Flour

34.00

3.95

2.30 LMG Chemicals

2.78

33.90 24.40 Manila Water Co. Inc.

24.80

90.00 16.20 Maxs Group

28.50

13.98 7.62 Megawide

7.600

292.40 250.20 Mla. Elect. Co `A

262.60

5.00

3.37 Panasonic Mfg Phil. Corp. 3.92

5.25

3.87 Pepsi-Cola Products Phil. 4.25

13.04 9.00 Petron Corporation

9.72

6.80

3.70 Phil H2O

3.72

14.50 9.94 Phinma Corporation

11.40

7.03

3.03 Phoenix Petroleum Phils. 4.00

3.40

2.22 Phoenix Semiconductor 2.30

4.50

1.00 Pryce Corp. `A

2.40

6.68

4.72 RFM Corporation

5.05

7.86

1.65 Roxas and Co.

1.82

8.10

6.00 Roxas Holdings

6.39

253.00 201.60 San MiguelPure Foods `B 190.00

5.50

4.10 SPC Power Corp.

4.20

3.28

1.67 Splash Corporation

1.64

0.315 0.122 Swift Foods, Inc.

0.162

2.50

1.02 TKC Steel Corp.

1.37

2.68

2.01 Trans-Asia Oil

2.20

226.60 143.40 Universal Robina

213.00

1.30

0.670 Vitarich Corp.

0.70

2.17

1.39 Vulcan Indl.

1.35

0.70

59.20

31.85

7.39

2.27

3.40

3.35

800.00

11.06

84.00

3.35

5.14

0.66

1380.00

6.68

72.60

6.66

9.25

0.90

18.90

0.73

5.53

6.55

0.0670

2.31

0.84

87.00

934.00

2.20

1.39

390.00

156.00

0.710

0.45 Abacus Cons. `A

0.470

48.10 Aboitiz Equity

56.80

20.85 Alliance Global Inc.

24.50

6.62 Anscor `A

7.04

1.210 Asia Amalgamated A

1.56

1.40 ATN Holdings A

0.335

1.60 ATN Holdings B

0.34

600.00 Ayala Corp `A

808.50

7.390 Cosco Capital

8.20

14.18 DMCI Holdings

14.92

2.60 F&J Prince A

3.48

4.25 Filinvest Dev. Corp.

4.30

0.144 Forum Pacific

0.285

818.00 GT Capital

1295.00

5.30 House of Inv.

6.39

46.60 JG Summit Holdings

72.30

3.52 Keppel Holdings `B

6.78

4.43 Lopez Holdings Corp.

8.91

0.59 Lodestar Invt. Holdg.Corp. 0.72

12.00 LT Group

15.54

0.580 Mabuhay Holdings `A

0.67

4.22 Metro Pacific Inv. Corp. 4.60

4.50 Minerales Industrias Corp. 5.00

0.036 Pacifica `A

0.0380

1.23 Prime Media Hldg

1.400

0.450 Prime Orion

1.160

66.70 San Miguel Corp `A

67.20

709.50 SM Investments Inc.

910.00

1.13 Solid Group Inc.

1.18

0.93 South China Res. Inc.

0.83

170.00 Transgrid

250.00

85.20 Top Frontier

98.00

0.200 Unioil Res. & Hldgs

0.3750

10.50

26.95

6.01 8990 HLDG

8.850

12.00 Anchor Land Holdings Inc. 10.48

(277,200.00)

(57,035,613.00)

(1,130,147.50)

1,572,320.00

23,295,720.00

33,748,130.00

6,600.00

0.460 (2.13)

57.65 1.50

24.50 0.00

7.04

0.00

1.50

(3.85)

0.310 (7.46)

0.31

(8.82)

805.00 (0.43)

8.21

0.12

14.60 (2.14)

3.50

0.57

4.32

0.47

0.285 0.00

1293.00 (0.15)

6.40

0.16

70.75 (2.14)

6.26

(7.67)

8.72

(2.13)

0.72

0.00

15.50 (0.26)

0.67

0.00

4.61

0.22

4.99

(0.20)

0.0380 0.00

1.400 0.00

1.180 1.72

66.85 (0.52)

906.00 (0.44)

1.23

4.24

0.83

0.00

250.00 0.00

97.00 (1.02)

0.3700 (1.33)

420,000

1,324,140 1,877,652.00

6,021,500 (72,260,875.00)

4,800

(28,160.00)

115,000

24,660,000

5,160,000 86,000.00

141,210 (21,750,930.00)

1,268,000 (487,775.00)

3,412,400 (38,608,414.00)

10,000

5,000

230,000

197,775

(84,845,005.00)

506,500 1,280,000.00

2,196,390 (7,543,721.00)

5,900

585,800 (3,090,515.00)

174,000

579,700 (539,462.00)

45,000

29,515,000 64,742,680.00

95,100

1,500,000

1,000

5,834,000 (250,290.00)

321,620 (12,228,646.00)

20,012

(110,576,960.00)

3,000

(2,460.00)

100,000

20

27,140

(2,412,427.00)

1,460,000

8.840

9.46

139,200

200

(0.11)

(9.73)

10.50

66.00

1.44

1.09

12.46

15.82

0.1460

4.61

99.10

12.30

9.00

2090.00

8.41

33.00

1.97

119.50

7.00

0.017

0.8200

2.2800

5.93

12.28

2.85

2.20

3.20

5.90

1.97

2.46

15.20

0.62

1.040

22.80

6.41

4.00

110.20

14.00

3486.00

0.710

2.28

48.50

90.10

11.60

10.20

0.490

1.60

0.0098

5.45

17.24

0.330

12.80

1.20

1.73

10.98

4.20

0.48

0.455

0.475

0.023

0.026

8.20

49.20

4.27

1.030

3.06

0.020

7.67

12.88

10.42

0.040

420.00

9.00

70.00

120.00

515.00

8.21

12.28

1060.00

1047.00

76.90

84.80

1.34

6.98

10.96

15.00

88.00

12.88

130.70

Trading Summary

FINANCIAL

INDUSTRIAL

HOLDING FIRMS

PROPERTY

SERVICES

MINING & OIL

GRAND TOTAL

SHARES

16,171,911

72,859,630

86,481,859

83,949,079

85,497,528

393,014,111

745,494,893

T op G ainers

VALUE

1,223,586,517.99

2,228,043,245.98

1,365,142,551.47

679,754,834.776

834,745,065.59

429,208,522.619

6,837,298,368.68

STOCKS

FINANCIAL

1,792.94 (UP) 8.38

INDUSTRIAL

12,082.63 (DOWN) 213.59

HOLDING FIRMS

6,950.49 (DOWN) 32.96

PROPERTY

3,186.53 (UP) 32.71

SERVICES

2,124.28 (UP) 1.74

MINING & OIL

15,472.22 (DOWN) 34.59

PSEI

7,763.21 (DOWN) 53.06

All Shares Index

4,487.81 (DOWN) 28.11

Gainers: 71 Losers: 101; Unchanged: 57; Total: 229

145,000 (77,400.00)

23,610

39,000

2,317,000 (1,505,660.00)

12,500

3,642,900 4,393,290.00

6,970,000

1,798,000

208,850 (10,926,771.00)

13,500

269,000

32,385

(20,887,170.00)

106,500

2,000

6,000

1,280,350 23,021,938.00

105,000

1,000,000

1,820,000 (18,400.00)

665,000

69,000

768,800 2,688,468.00

10,000

(14,350.00)

23,000

103,000

49,530

38,000

80,000

7,547,000 (8,816,662.00)

500,000

60,000

700

6,000

24,250.00

4,000

280

118,600

69,055

8,442,620.00

5,078,000 (396,000.00)

39,965,000 (24,534,690.00)

1,909,500 (20,383,980.00)

329,630 18,866,224.00

3,918,100 (4,057,680.00)

1,097,900 (330,491.00)

10,000

(3,250.00)

1,000

103,000,000 121,900.00

45,000

60,800.00

31,300

200,000

21,100

146,190.00

5,000

212,000

6,800

58,150,000 (9,083,160.00)

170,000

5,240,000

30,000

2,600,000

81,400,000 (10,500.00)

295,000 (252,200.00)

5,345,900 33,862,605.00

3,053,000 71,840.00

30,000

146,000

5,800,000

139,000

101,500

4,733,000 29,800.00

120,700,000 (144,000.00)

892,360 75,835,310.00

616,500 27,840.00

222,990 (729,381.50)

30,000

1,460

57,000

2,237,000

1,000

240

83,660

98,090

(4,988,580.00)

7,000

118,000

6,965,500 2,030,664.00

400

980

532,600 2,277,806.00

21,220

149,230.00

T op L osers

Close

(P)

Change

(%)

STOCKS

Close

(P)

Change

(%)

Benguet Corp `B'

8.0000

21.21

Manila Broadcasting

46.85

(31.36)

Phil H2O

4.4

18.28

Phil. Tob. Flue Cur & Redry

24.05

(22.42)

Crown Asia

2.41

9.05

Cirtek Holdings (Chips)

27.4

(10.02)

Imperial Res. `A'

7.00

7.69

Anchor Land Holdings Inc.

9.46

(9.73)

Liberty Flour

36.45

7.21

Natl. Reinsurance Corp.

0.98

(9.26)

Manila Mining `B'

0.0150

7.14

ATN Holdings B

0.31

(8.82)

Macroasia Corp.

2.13

6.50

Calata Corp.

4.23

(8.64)

Melco Crown

9.14

5.54

LMG Chemicals

2.55

(8.27)

Eastwest Bank

22.8

4.83

Keppel Holdings `B'

6.26

(7.67)

Manulife Fin. Corp.

820.00

4.46

ATN Holdings A

0.310

(7.46)

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Manila Standard Today - Business Daily Stocks Review (December 23, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (December 23, 2014)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 25, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 25, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 9, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 9, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 8, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 8, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 29, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 29, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 3, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 3, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 5, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 4, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 15, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 15, 2015)Guillerson AlanguilanNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 20, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 20, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 2, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 2, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Document1 pageManila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 5, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 5, 2014)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 26, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 26, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 15, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 15, 2015)Guillerson AlanguilanNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (July 3, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (July 3, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 6, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 6, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 22, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 22, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 18, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 18, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 13, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 13, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 12, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 12, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 11, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 11, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Document1 pageManila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 5, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 6, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 6, 2015)Manila Standard TodayNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- List of Top 100 Stockholders of PNB As of March 31, 2021Document7 pagesList of Top 100 Stockholders of PNB As of March 31, 2021Jonathan GabineraNo ratings yet

- Case DigestDocument2 pagesCase Digestlawdocs pinasNo ratings yet

- Blue Chip CompaniesDocument4 pagesBlue Chip Companiesfunn1kNo ratings yet

- Summary of Corresponding Fees of BSP Supervised Financial Institutions (Bsfis) From The Survey Submitted For End-July 2019Document2 pagesSummary of Corresponding Fees of BSP Supervised Financial Institutions (Bsfis) From The Survey Submitted For End-July 2019tektitemoNo ratings yet

- Manila Standard Today - Business Daily Stock Review (November 28, 2014)Document1 pageManila Standard Today - Business Daily Stock Review (November 28, 2014)Manila Standard TodayNo ratings yet

- 1580823068890043Document6 pages1580823068890043Cristopher Dave CabañasNo ratings yet

- List BancNet Member BanksDocument2 pagesList BancNet Member BanksTara NahNo ratings yet

- Revised RRF CSC Ro IIDocument1 pageRevised RRF CSC Ro IIGerome Patrick RazaNo ratings yet

- NothingDocument4 pagesNothingSofia Louisse C. FernandezNo ratings yet

- Philippine Stock Exchange: Head, Disclosure DepartmentDocument6 pagesPhilippine Stock Exchange: Head, Disclosure DepartmentJeanneNo ratings yet

- 2023 Assigned CasesDocument2 pages2023 Assigned CasesForro Danilo Jr.No ratings yet

- CPAF Nu Skin Commission Payment Authorization FormDocument1 pageCPAF Nu Skin Commission Payment Authorization FormCj CarabbacanNo ratings yet

- Book 2Document18 pagesBook 2Genina Mae AlcasidNo ratings yet

- BDO Official ReceiptsDocument6 pagesBDO Official ReceiptsGareth TiuNo ratings yet

- List of CasesaDocument9 pagesList of CasesaFayda CariagaNo ratings yet

- Functions and Operations of The Bangko Sentral NG Pilipinas (PPT Version)Document41 pagesFunctions and Operations of The Bangko Sentral NG Pilipinas (PPT Version)kim byunooNo ratings yet

- 60Document3 pages60Rebuild BoholNo ratings yet

- LCF MembersDocument7 pagesLCF MembersMark Joseph BajaNo ratings yet

- Logbook Monica EnriquezDocument5 pagesLogbook Monica EnriquezJamie Lynne BergadoNo ratings yet

- PSE Daily Quotations Report for March 12, 2013Document7 pagesPSE Daily Quotations Report for March 12, 2013srichardequipNo ratings yet

- Sales and Lease Atty. Busmente Compiled List of TopicsDocument3 pagesSales and Lease Atty. Busmente Compiled List of TopicsKate HizonNo ratings yet

- 33F Tower One, Ayala Triangle, Ayala Avenue Makati City, 1226 PhilippinesDocument4 pages33F Tower One, Ayala Triangle, Ayala Avenue Makati City, 1226 PhilippinesSherri BonquinNo ratings yet

- Philippine case law documents on civil law, torts, contractsDocument10 pagesPhilippine case law documents on civil law, torts, contractsEarl Justine OcuamanNo ratings yet

- Balanced FundsDocument1 pageBalanced FundsYannah HidalgoNo ratings yet

- ALI Top 100 SH - 6 30 18 PDFDocument8 pagesALI Top 100 SH - 6 30 18 PDFMarie MNo ratings yet

- Oblicon Case Book PDFDocument614 pagesOblicon Case Book PDFShiela VenturaNo ratings yet

- Historical Development of The Banking System in The PhilippinesDocument1 pageHistorical Development of The Banking System in The PhilippinesJane SudarioNo ratings yet

- Company's AddressDocument59 pagesCompany's AddressCarlNo ratings yet

- Types of Banks in The PhilippinesDocument13 pagesTypes of Banks in The PhilippinesHarka MeeNo ratings yet

- BanksDocument16 pagesBanksjofer63No ratings yet