Professional Documents

Culture Documents

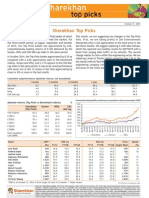

Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) Sharekhan Sensex Nifty CNX (Top Picks) Mid-Cap

Uploaded by

chetanjecOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) Sharekhan Sensex Nifty CNX (Top Picks) Mid-Cap

Uploaded by

chetanjecCopyright:

Available Formats

Visit us at www.sharekhan.

com

May 02, 2015

Sharekhan Top Picks

The Indian stock market continued to lose ground in April

and the index returns turned negative for the calendar year

2015. In fact, the Indian equity market has underperformed

the other emerging markets in the last few months due to

rising concerns over a subdued growth in the earnings of the

domestic corporates, a possibility of a delayed revival in

economic activity, unseasonal rains and an initial forecast of

a weak monsoon for this year. To top it all, the uncertainties

related to the minimum alternate tax applicable to the

foreign institutional investors retrospectively added to the

weakness in the Indian markets.

The benchmark indices, Nifty, Sensex and CNX Mid-cap Index,

closed marginally down by 1% to 2% each for the first four

months of CY2015 whereas Sharekhans Top Picks basket gave

a decent positive return of 8.7% (gross of brokerage) in the

same period. In April also, the Top Picks basket performed

relatively better, declining by 2.8% as against a drop of 3.4%

in the Sensex and a fall of 3.6% in the Nifty.

This month, we are not making any changes in the Top Picks

folio. We believe that the Indian market could continue to

hover around the existing range for the next few weeks, if

not months, and the portfolio is largely aligned for the

anticipated market condition.

Consistent outperformance (absolute returns; not annualised)

Top Picks

Sensex

Nifty

CNX Mid-cap

3 months

6 months

1 year

3 years

5 years

-2.8

-3.4

-3.6

-2.4

1.7

-7.4

-7.1

-3.3

14.9

-3.2

-1.6

7.2

61.3

20.3

21.8

43.8

151.2

60.6

61.8

77.6

124.6

60.1

62.4

64.7

Absolute returns (Top Picks vs benchmark indices)

(%)

Sharekhan

(Top Picks)

Sensex

Nifty

CNX

Mid-cap

8.7

63.6

12.4

35.1

-20.5

16.8

116.1

399.1

-1.8

29.9

8.5

26.2

-21.2

11.5

76.1

169.2

-1.1

30.9

6.4

29.0

-21.7

12.9

72.0

168.5

0.8

55.1

-5.6

36.0

-25.0

11.5

114.0

250.3

CY2015

CY2014

CY2013

CY2012

CY2011

CY2010

CY2009

Since Inception

(Jan 2009)

(%)

1 month

Constantly beating Nifty and Sensex (cumulative returns) since April 2009

Please note the returns are based on the assumption that at the beginning of each month an equal amount was invested in each stock of the Top Picks basket

Name

Apollo Tyres

Ashok Leyland

Cadila Healthcare

Gateway Distriparks

HDFC Bank ^

Lupin

Maruti Suzuki ^

PTC India Financials

TCS ^

Thomas Cook

Yes Bank ^

Zee Entertainment

CMP*

(Rs)

FY14

PER (x)

FY15E

FY16E

FY14

RoE (%)

FY15E

173

70

1,697

354

989

1,773

3,732

53

2,467

231

840

313

8.4

NA

43.3

27.0

28.0

43.2

40.5

10.4

25.2

18.8

18.7

33.6

7.8

99.4

35.2

20.4

24.2

33.4

30.4

10.2

24.6

41.3

17.5

30.1

7.3

23.2

21.3

18.8

19.9

27.8

21.7

7.0

20.1

46.3

15.0

27.4

26.4

NA

21.9

17.5

21.3

26.5

14.1

16.1

35.2

12.2

25.0

20.6

21.9

4.3

21.4

21.5

19.4

26.4

16.6

14.8

29.5

13.3

21.3

19.8

*CMP as on April 30, 2015 # Price target for next 6-12 months

^Actual numbers for FY2015

Price

FY16E target (Rs)#

19.4

15.1

26.7

21.7

18.8

24.4

20.1

19.3

29.5

16.3

18.6

19.5

260

76

2,060

445

1,260

2,300

4,400

90

3,000

250

930

400

Upside

(%)

50

9

21

26

27

30

18

69

22

8

11

28

For Private Circulation only

REGISTRATION DETAILS Regd Add: Sharekhan Limited, 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg Railway Station, Kanjurmarg

(East), Mumbai 400042, Maharashtra. Tel: 022 - 61150000. Sharekhan Ltd.: SEBI Regn. Nos. BSE - INB/INF011073351 ; BSE- CD ; NSE- INB/INF231073330; CD-INE231073330;

MCX Stock Exchange - INB/INF261073333 ; CD-INE261073330 ; DP - NSDL-IN-DP-NSDL-233-2003 ; CDSL-IN-DP -CDSL-271-2004 ; PMS-INP000000662 ; Mutual Fund-ARN 20669;

Commodity trading through Sharekhan Commodities Pvt. Ltd.: MCX-10080 ; (MCX/TCM/CORP/0425) ; NCDEX-00132 ; (NCDEX/TCM/CORP/0142) ; NCDEX SPOT-NCDEXSPOT/

116/CO/11/20626 ; For any complaints email at igc@sharekhan.com; Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant exchanges and

Dos & Donts by MCX & NCDEX and the T & C on www.sharekhan.com before investing.

sharekhan top picks

Name

CMP

Apollo Tyres

Remarks:

PER (x)

RoE (%)

Price

Upside

(Rs)

FY14

FY15E

FY16E

FY14

FY15E

FY16E

target (Rs)

(%)

173

8.4

7.8

7.3

26.4

21.9

19.4

260

50

Apollo Tyres is a leading player in the domestic passenger car and truck tyre segments. The tyre industrys volume

has been subdued, given the weak macro environment. We expect the demand to improve in FY2016 with a pickup in the economy and higher utilisation of commercial vehicles (CV).

The profitability of the tyre companies has improved, given the soft natural rubber prices. Additionally, a slide in

crude oil prices and its impact on crude derivatives, such as synthetic rubber and carbon black, have led to

expansion of the gross profit margin (GPM). This benefit is expected to continue in FY2016 and margins are

expected to remain elevated.

The European operations too have reported a strong performance with a strong volume growth and high profitability.

The company will be investing EUR200 million for setting up a greenfield facility in Eastern Europe which will

start production in Q4FY2017 and cater to the long-term growth in Europe. Additionally, it will invest Rs2,000

crore in its Indian operations for capacity expansion.

We like the stock for its consistent performance and long-term growth prospects (expansion in Europe and Chennai)

and have a Buy recommendation on it.

Ashok Leyland

Remarks:

70

NA

99.4

23.2

NA

4.3

15.1

76

Ashok Leyland Ltd (ALL) is the second largest CV manufacturer in India with a market share of 25% in the heavy

truck segment and an even higher share of about 40% in the bus segment. Given the scale of economic slowdown,

the segment had halved over FY2012-14. With the pick-up in the economy a sharp recovery is expected in the

segment.

ALL entered the light CV (LCV) segment with the launch of the Dost in joint venture (JV) with Nissan. The JV has

additionally launched the Partner LCV and Stile van. Going forward, we expect ALL to gain a foothold in the LCV

segment and expand its market share.

The company is also concentrating on verticals other than CVs to de-risk its business model. It has a strong

presence in exports and continues to expand in newer geographies. The diesel genset business is also showing

signs of a recovery after a tepid performance in FY2013-14. Additionally, ALLs defence business is expected to get

a leg-up due to the governments focus on indigenous manufacture of defence products and FDI in the sector.

ALLs operating profit margin (OPM) has recovered from the lows on the back of a reduction in discounts and price

hikes taken by the company. Its margins are expected to expand further, given the operating leverage. ALL has

raised Rs660 crore via a qualified institutional placement and sold non-core assets to pare its debts. With no

significant capital expenditure (capex) planned, we expect the balance sheet to get de-leveraged and return

ratios to improve.

Sharekhan

May 2015

sharekhan top picks

Name

CMP

Cadila Healthcare

Remarks:

PER (x)

RoE (%)

Price

Upside

(Rs)

FY14

FY15E

FY16E

FY14

FY15E

FY16E

target (Rs)

(%)

1,697

43.3

35.2

21.3

21.9

21.4

26.7

2,060

21

Cadila Healthcare is set to enter a high-growth trajectory, thanks to its aggressive product filings in the USA and

Latin America, a recovery in its joint venture business and the launch of niche products in the Indian market

including the generic version of Gilead Sciences' Hepatitis C drug, Sofosbuvir, in India under the brand name

SoviHep.

Cadila Healthcare, which generates close to 36% of its total revenues from the US market, is likely to be among

the key beneficiaries of a favourable business environment in the generic space. The company has over 145

abbreviated new drug applications (ANDAs) pending approval out of 230 ANDAs filed with the US Food and Drug

Administration (USFDA) that will unfold over the next two to three years. We expect the company to see a

revenue compounded annual growth rate (CAGR) of 34% over FY2014-17 in the US market.

We expect the company to record overall revenue and profit CAGR of 20% and 38% over FY2014-17 respectively

from the base business. The OPM of the company will see a sustained expansion of over 600BPS in the next three

years, mainly on the back of stronger traction in the branded business in India and Latin America, a better generic

pricing scenario in the USA and optimisation of capabilities in the joint venture business. We recommend a Buy

rating on the stock with a price target of Rs2,060, which implies 20x FY2017E EPS.

Gateway Distriparks

Remarks:

354

27.0

20.4

18.8

17.5

21.5

21.7

445

26

An improvement in exim trade along with a rise in port traffic at the major ports signals an improving business

environment for the logistic companies. Gateway Distriparks being a major player in the container freight station

(CFS) and rail logistic segments is expected to witness an improvement in the volumes of its CFS and rail divisions

going ahead.

The improving trend in the rail freight and cold chain subsidiaries would sustain on account of the recent efforts

to control costs and improve utilisation.

We continue to have faith in the companys long-term growth story based on the expansion of each of its three

business segments, ie CFS, rail transportation and cold storage infrastructure segments. The coming on stream of

the Faridabad facility and the strong operational performance will further enhance the performance of the rail

operations. Also, the expected turnaround in the global trade should have a positive impact on the CFS operations.

Given the improvement in the profitability led by lower non-performing asset (NPA) provisions, a healthy growth

in the core income and improved operating metrics, we recommend a Buy with a price target of Rs445.

Sharekhan

May 2015

sharekhan top picks

Name

HDFC Bank

Remarks:

CMP

PER (x)

RoE (%)

Price

Upside

(Rs)

FY14

FY15E

FY16E

FY14

FY15E

FY16E

target (Rs)

(%)

989

28.0

24.2

19.9

21.3

19.4

18.8

1,260

27

HDFC Bank has a strong presence in the retail segment (~50% of the book) and therefore has been able to maintain

a strong growth in loans even in tough times. Going ahead, with a recovery in the economy and improving

sentiment in consumer sectors, the loan growth will improve further which will drive the profitability.

With a current account and savings account (CASA) ratio of 41% and a high proportion of retail deposits, the cost

of funds remains among the lowest in the system and helps to maintain a higher net interest margin (NIM). In

addition, the banks loan growth is led by high yielding products such as personal loans, vehicle loans, credit card,

mortgages etc which has a positive impact on the NIM.

The bank maintains impeccable asset quality and its NPA ratios are among the lowest in the system. Given the

banks stringent credit appraisal procedures and insignificant exposure to troubled sectors, it is expected to

maintain robust asset quality.

HDFC Bank is adequately capitalised and further capital raising of Rs10,000 crore will boost its capital ratios and

help to tap the growth opportunities going ahead. The bank is likely to maintain healthy return on equity (RoE) of

19-20% and return on asset (RoA) of 1.8% on a sustainable basis. Therefore, we expect the valuation premium that

it enjoys compared with the other private banks to expand further.

Lupin

Remarks:

1,773

43.2

33.4

27.8

26.5

26.4

24.4

2,300

30

A vast geographical presence, focus on niche segments like oral contraceptives, ophthalmic products, para-IV

filings and branded business in the USA are the key elements of growth for Lupin. The company has remarkably

improved its brand equity in the domestic and international generic markets to occupy a significant position in

the branded formulation business. Its inorganic growth strategy has seen a stupendous success in the past. The

company is now debt-free and that enhances the scope for inorganic initiatives.

The management has given a guidance to sustain the OPM at 27% to 28% in FY2015 (vs 25% in FY2014) which

especially impress us. Lupin has recently forged an alliance with Merck Serono to out-licence select drugs and

signed an agreement with Salix Pharma to in-licence products for the Canadian market. These initiatives will

support growth in the long term.

Lupin is expected to see stronger traction in the US business on the back of the key generic launches in recent

months and a strong pipeline in the US generic business (over 95 ANDAs pending approvals including 86 first-to-file

drugs) to ensure the future growth. The key products that are going to provide a lucrative generic opportunity for

the company include Nexium (market size of $2.2 billion), Lunesta (market size of $800 million) and Namenda

(market size of $1.75 billion) that will be going out of patent protection in CY2015. The company has recently got

the Foreign Investment Promotion Boards clearance to raise the investment limit for foreign institutional investors

to 49% from 32% currently.

Sharekhan

May 2015

sharekhan top picks

Name

CMP

Maruti Suzuki

Remarks:

PER (x)

RoE (%)

Price

Upside

(Rs)

FY14

FY15E

FY16E

FY14

FY15E

FY16E

target (Rs)

(%)

3,732

40.5

30.4

21.7

14.1

16.6

20.1

4,400

18

Maruti Suzuki India Ltd (MSIL) is the market leader in the domestic passenger vehicle (PV) industry. In FY2015, as

against an industry growth of a modest 3.9% MSIL has grown its volumes by 11.1% and in the process expanded its

market share by 441BPS to 45%.

The company has further strengthened its sales and service network. Additionally, the drive undertaken by its

management to tap the potential in rural areas paid rich dividends in difficult times for the industry and in times

of rising competitive intensity; this reaffirms the resilience of MSILs positioning and business model.

The recent launches of Celerio and Alto K10 with the new automatic manual transmission have enthused the

market and the company plans to offer the same in other models too. MSIL has a pipeline of new launches over the

next few years with the most important being the entry into the compact utility vehicle and LCV segments.

We expect customer sentiment to improve on the back of a strong government at the centre. Additionally the PV

segment is expected to benefit from the pent-up demand over the past two years; this will benefit MSIL the most

due to its high market share in the entry level segment. The recent depreciation of the Japanese Yen is expected

to boost profitability.

PTC India Financials

Remarks:

53

10.4

10.2

7.0

16.1

14.8

19.3

90

69

PTC India Financial Services (PFS) stands to benefit from the governments strong thrust on the renewable energy

sector (mainly solar and wind) which should result in a robust growth in the loan book (at a 40% CAGR over

FY2014-17). About 70% of the incremental disbursement will be from the renewable segments (loan sanction

pipeline of ~Rs7,000 crore or 1.2x of the existing loan book) which has lesser quality issues due to a low gestation

period and fuel supply risk, thanks to fiscal support from the government.

Given the favourable interest rate scenario, the interest spreads may sustain at healthy levels (~4.3%). Any likely

downward movement in the hedging cost will further reduce the funding cost. The company also has ~Rs300 crore

of equity investments in power projects; these have appreciated significantly and will result in substantial gains

going ahead.

We expect PFS to register a strong growth in earnings (~40% CAGR over FY2014-17 excluding the one-off gains of

FY2014) without factoring in the gains on its equity investments. The asset quality is likely to remain robust and

the company is likely to deliver high RoAs (~3.5%) which leaves scope for more upside.

Sharekhan

May 2015

sharekhan top picks

Name

TCS

Remarks:

CMP

PER (x)

RoE (%)

Price

Upside

(Rs)

FY14

FY15E

FY16E

FY14

FY15E

FY16E

target (Rs)

(%)

2,467

25.2

24.6

20.1

35.2

29.5

29.5

3,000

22

TCS pioneered the IT services outsourcing business from India and is the largest IT service firm in the country. It

is a leader in most service offerings and has further consolidated its position as a full-service provider by delivering

a robust financial and operational performance consistently over the years.

The consistency and predictability of the earnings performance has put the company on the top of its league.

Moreover, the quality of its performance has also been quite impressive, ie it has been able to report a broadbased growth in all its service lines, geographies and verticals consistently.

Though cross-currency headwinds and softness in some verticals will affect the earnings in the near term, we

believe the overall improvement in the USA will drive the growth in the coming years. Also, the companys

increasing capabilities in the digital space, which is a high-growth area, consolidates its position among the toptier global IT companies. We maintain TCS as our top pick in the IT sector and have a Buy rating on the stock.

Thomas Cook

Remarks:

231

18.8

41.3

46.3

12.2

13.3

16.3

250

Thomas Cook India Ltd (TCIL) is an integrated leisure travel company with offerings across the value chain

including travel services, holiday packages and foreign exchange services. The improvement in the foreign tourist

arrivals in India and improving sentiments of the domestic travelers would help TCILs travel and financial services

businesses to post a better performance in the coming years.

Quess Corp (a human resource management business acquired in early 2013) has exponentially grown its consolidated

revenues to Rs1,401 crore in FY2014 from merely Rs49 crore in FY2009. The business is well poised to grow at a

CAGR of 30% in the coming years.

An improving financial performance of Sterling and value unlocking potential in Quess Corp are re-rating triggers.

We maintain our Buy rating with a price target of Rs250.

Sharekhan

May 2015

sharekhan top picks

Name

CMP

Yes Bank

Remarks:

PER (x)

RoE (%)

Price

Upside

(Rs)

FY14

FY15E

FY16E

FY14

FY15E

FY16E

target (Rs)

(%)

840

18.7

17.5

15.0

25.0

21.3

18.6

930

11

Given a decline in inflation and the possibility of further reduction in the policy rates by the Reserve Bank of

India, the cost of funds will reduce and benefit Yes Bank. In addition, the banks investment book stands to

benefit from a fall in bond yields due to surplus statutory liquidity ratio securities and substantial corporate bond

book (~Rs10,000 crore). The bank will also be included in the Nifty index which will be positive for the stock.

The bank is well capitalised (tier-I capital adequacy ratio of 12.2%) and is likely to benefit from the revival in the

economy which will result in a strong growth in advances. Apart from the decline in the funding cost, there are

other structural drivers of margins: (a) a rising CASA ratio, and (b) focus on retail, and small and medium enterprise

lending. Hence, we expect an uptick of 15-20 basis points in the margins over FY2017.

We expect Yes Banks earnings to grow at healthy rates (about 22% CAGR over FY2014-17) driven by an expansion

in the NIM and an uptick in the non-interest income. The asset quality remains robust and the quality is likely to

sustain going ahead. The return ratios are expected to improve further (RoA of 1.7% and RoE of 20%) resulting in

better valuations. We have rolled over our valuations to FY2017 estimates resulting in a fresh price target of

Rs930 (2.4x FY2017E book value). We maintain our Buy rating on the stock.

Zee Entertainment

Remarks:

313

33.6

30.1

27.4

20.6

19.8

19.5

400

28

Among the key stakeholders of the domestic TV industry, we expect the broadcasters to be the prime beneficiary

of the mandatory digitisation process initiated by the government. The broadcasters would benefit from higher

subscription revenues at the least incremental capex as the subscriber declaration improves in the cable industry.

The management maintains that the advertisement spending will continue to grow in double digits going ahead

and ZEEL will be able to outperform the same. The growth in the advertisement spending will be driven by an

improvement in the macro-economic factors and the fact the ZEEL is well placed to capture the emerging

opportunities being a leader in terms of market share.

ZEEL is well placed to benefit from the digitisation theme and the overall recovery in the macro economy. Also,

the success of the newly launched channel, &TV, would augur well and improve the companys position in the

general entertainment channel space. We have a Buy rating on the stock with a price target of Rs400.

Sharekhan Limited, its analyst or dependant(s) of the analyst might be holding or having a position in the companies mentioned in the article.

Disclaimer

This document has been prepared by Sharekhan Ltd. (SHAREKHAN) and is intended for use only by the person or entity to which it is addressed to. This document may contain confidential and/or privileged material and is not for any type of circulation and any

review, retransmission, or any other use is strictly prohibited. This document is subject to changes without prior notice. This document does not constitute an offer to sell or solicitation for the purchase or sale of any financial instrument or as an official

confirmation of any transaction. Though disseminated to all customers who are due to receive the same, not all customers may receive this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report.

The information contained herein is obtained from publicly available data or other sources believed to be reliable and SHAREKHAN has not independently verified the accuracy and completeness of the said data and hence it should not be relied upon as such.

While we would endeavour to update the information herein on a reasonable basis, SHAREKHAN, its subsidiaries and associated companies, their directors and employees (SHAREKHAN and affiliates) are under no obligation to update or keep the information

current. Also, there may be regulatory, compliance, or other reasons that may prevent SHAREKHAN and affiliates from doing so. This document is prepared for assistance only and is not intended to be and must not alone be taken as the basis for an investment

decision. Recipients of this report should also be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The user assumes the entire risk of any use made of this information. Each recipient

of this document should make such investigations as he deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult his own

advisors to determine the merits and risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. We do not undertake to advise you as to any change of our views. Affiliates of SHAREKHAN may have issued other

reports that are inconsistent with and reach different conclusion from the information presented in this report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to

law, regulation or which would subject SHAREKHAN and affiliates to any registration or licencing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons

in whose possession this document may come are required to inform themselves of and to observe such restriction. Either SHAREKHAN or its affiliates or its directors or employees/representatives/clients or their relatives may have position(s), make market, act

as principal or engage in transactions of purchase or sell of securities, from time to time or may be materially interested in any of the securities or related securities referred to in this report and they may have used the information set forth herein before

publication. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company mentioned herein. Without limiting any of the foregoing, in no event shall SHAREKHAN, any of its affiliates or any third party involved

in, or related to, computing or compiling the information have any liability for any damages of any kind. The analyst certifies that all of the views expressed in this document accurately reflect his or her personal views about the subject company or companies

and its or their securities and do not necessarily reflect those of SHAREKHAN. Further, no part of the analysts compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this document.

Compliance Officer: Ms. Namita Amod Godbole; Tel: 022-6115000; e-mail: compliance@sharekhan.com Contact: myaccount@sharekhan.com

Sharekhan

May 2015

You might also like

- Conceptions and Dimensions of DevelopmentDocument19 pagesConceptions and Dimensions of DevelopmentGrace Talamera-Sandico100% (1)

- 15 Stocks Oct15th2018Document4 pages15 Stocks Oct15th2018ShanmugamNo ratings yet

- Testing PlanDocument2 pagesTesting PlanAngMniNo ratings yet

- Far Eastern University: Post-Test1-Cash and Cash EquivalentsDocument9 pagesFar Eastern University: Post-Test1-Cash and Cash EquivalentschristineNo ratings yet

- RTC Bukidnon Writ PossessionDocument6 pagesRTC Bukidnon Writ PossessionAngelei Tecson Tigulo100% (1)

- Account Statement 101021 090122Document31 pagesAccount Statement 101021 090122Mohammed jawedNo ratings yet

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocument7 pagesSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapRajesh KarriNo ratings yet

- Sharekhan Top Picks: CMP As On September 01, 2014 Under ReviewDocument7 pagesSharekhan Top Picks: CMP As On September 01, 2014 Under Reviewrohitkhanna1180No ratings yet

- SharekhanTopPicks 31082016Document7 pagesSharekhanTopPicks 31082016Jigar ShahNo ratings yet

- Sharekhan Top Picks Analysis and Stock RecommendationsDocument7 pagesSharekhan Top Picks Analysis and Stock RecommendationsAnonymous W7lVR9qs25No ratings yet

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocument7 pagesSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapJignesh RampariyaNo ratings yet

- AnandRathi Relaxo 05oct2012Document13 pagesAnandRathi Relaxo 05oct2012equityanalystinvestorNo ratings yet

- Sharekhan Top PicksDocument7 pagesSharekhan Top PicksLaharii MerugumallaNo ratings yet

- Fresh Capacities To Drive Growth Buy: Rating: Buy Target Price: 1,310 Share Price: 970Document10 pagesFresh Capacities To Drive Growth Buy: Rating: Buy Target Price: 1,310 Share Price: 970Vidhi MehtaNo ratings yet

- La Opala RG - Initiating Coverage - Centrum 30062014Document21 pagesLa Opala RG - Initiating Coverage - Centrum 30062014Jeevan PatwaNo ratings yet

- Muhurat Picks 2015: Company CMP Target Upside (%)Document12 pagesMuhurat Picks 2015: Company CMP Target Upside (%)abhijit99541623974426No ratings yet

- SharekhanTopPicks 070511Document7 pagesSharekhanTopPicks 070511Avinash KowkuntlaNo ratings yet

- SBICap Diwali 2016Document16 pagesSBICap Diwali 2016penumudi233No ratings yet

- Mid-Cap Marvels: RCM ResearchDocument20 pagesMid-Cap Marvels: RCM ResearchmannimanojNo ratings yet

- Diwali-Picks Microsec 311013 PDFDocument14 pagesDiwali-Picks Microsec 311013 PDFZacharia VincentNo ratings yet

- Sharekhan Top Picks: November 30, 2012Document7 pagesSharekhan Top Picks: November 30, 2012didwaniasNo ratings yet

- India Strategy-July 2014Document290 pagesIndia Strategy-July 2014SUKHSAGAR1969No ratings yet

- J Street Vol 310Document10 pagesJ Street Vol 310JhaveritradeNo ratings yet

- MID-CAP CORNER: Automotive recovery to aid Amtek Auto; Firstsource turns around; Indiabulls Power to gain from plantsDocument1 pageMID-CAP CORNER: Automotive recovery to aid Amtek Auto; Firstsource turns around; Indiabulls Power to gain from plantspuneetdubeyNo ratings yet

- J Street Volume 283Document10 pagesJ Street Volume 283JhaveritradeNo ratings yet

- GEPL Top 10 Value Stock Picks PDFDocument12 pagesGEPL Top 10 Value Stock Picks PDFPravin YeluriNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument20 pagesMarket Outlook Market Outlook: Dealer's DiaryangelbrokingNo ratings yet

- J STREET Volume 317Document10 pagesJ STREET Volume 317JhaveritradeNo ratings yet

- Dolat PreferredDocument45 pagesDolat PreferredAnonymous W7lVR9qs25No ratings yet

- Top PicksDocument7 pagesTop PicksKarthik KoutharapuNo ratings yet

- Market Outlook 11th August 2011Document4 pagesMarket Outlook 11th August 2011Angel BrokingNo ratings yet

- SBI Securities Morning Update - 13-01-2023Document7 pagesSBI Securities Morning Update - 13-01-2023deepaksinghbishtNo ratings yet

- Muhurat Picks 2012 Muhurat Picks 2012 Muhurat Picks 2012Document8 pagesMuhurat Picks 2012 Muhurat Picks 2012 Muhurat Picks 2012Mahendra PratapNo ratings yet

- J Street Volume 262Document8 pagesJ Street Volume 262JhaveritradeNo ratings yet

- Diwali Icici 081112Document8 pagesDiwali Icici 081112Mintu MandalNo ratings yet

- JSTREET Volume 319Document10 pagesJSTREET Volume 319JhaveritradeNo ratings yet

- Market Outlook: Dealer's DiaryDocument24 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- SBI Securities Morning Update - 18-01-2023Document7 pagesSBI Securities Morning Update - 18-01-2023deepaksinghbishtNo ratings yet

- Diwali PicksDocument9 pagesDiwali PicksFinpathNo ratings yet

- Top Picks Sep 2012Document15 pagesTop Picks Sep 2012kulvir singNo ratings yet

- Axis Enam MergerDocument9 pagesAxis Enam MergernnsriniNo ratings yet

- Top 10 Stocks Motilal OswalDocument74 pagesTop 10 Stocks Motilal OswalAbhiroop DasNo ratings yet

- Market Outlook 16th March 2012Document4 pagesMarket Outlook 16th March 2012Angel BrokingNo ratings yet

- Stock Investment Tips Recommendation - Buy Stocks of Shree Cement With Target Price Rs.4791Document20 pagesStock Investment Tips Recommendation - Buy Stocks of Shree Cement With Target Price Rs.4791Narnolia Securities LimitedNo ratings yet

- GSK Consumer: Excessive Price Hikes May Upset Price-Value EquationDocument6 pagesGSK Consumer: Excessive Price Hikes May Upset Price-Value EquationHimanshuNo ratings yet

- CRISIL Research Ier Report Alok Industries 2012Document38 pagesCRISIL Research Ier Report Alok Industries 2012Akash MohindraNo ratings yet

- Cautious and Choosy Quality To The ForeDocument10 pagesCautious and Choosy Quality To The ForeallkashishNo ratings yet

- Sharekhan Top Picks: October 01, 2011Document7 pagesSharekhan Top Picks: October 01, 2011harsha_iitmNo ratings yet

- Market Outlook 24th DecDocument14 pagesMarket Outlook 24th DecAngel BrokingNo ratings yet

- Pakistan State Oil: SecuritiesDocument16 pagesPakistan State Oil: SecuritiesAmmad SheikhNo ratings yet

- Sharekhan recommends Axis Bank, BHEL, Cadila Healthcare in October 2012 Top PicksDocument7 pagesSharekhan recommends Axis Bank, BHEL, Cadila Healthcare in October 2012 Top PicksSoumik DasNo ratings yet

- IDirect MuhuratPicks 2014Document8 pagesIDirect MuhuratPicks 2014Rahul SakareyNo ratings yet

- Market Outlook 2nd January 2012Document3 pagesMarket Outlook 2nd January 2012Angel BrokingNo ratings yet

- Stock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedDocument24 pagesStock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedNarnolia Securities LimitedNo ratings yet

- Economy News: Morning Insight July 22, 2011Document13 pagesEconomy News: Morning Insight July 22, 2011डॉ. विनय कुमार पंजियारNo ratings yet

- Nivesh Stock PicksDocument13 pagesNivesh Stock PicksAnonymous W7lVR9qs25No ratings yet

- Preview+ +Logistics+SectorDocument5 pagesPreview+ +Logistics+SectorNihal Mahesh JhamNo ratings yet

- Mid Cap Ideas - Value and Growth Investing 250112 - 11 - 0602120242Document21 pagesMid Cap Ideas - Value and Growth Investing 250112 - 11 - 0602120242Chetan MaheshwariNo ratings yet

- Rallis India: Performance HighlightsDocument10 pagesRallis India: Performance HighlightsHitechSoft HitsoftNo ratings yet

- Stock Update Cadila Healthcare: IndexDocument5 pagesStock Update Cadila Healthcare: Indexvaithy71No ratings yet

- Market View: Market Is at Crucial JunctionDocument10 pagesMarket View: Market Is at Crucial JunctionJhaveritradeNo ratings yet

- Fortnightly: Ipca LabDocument5 pagesFortnightly: Ipca Labbinoy666No ratings yet

- Asian Economic Integration Report 2018: Toward Optimal Provision of Regional Public Goods in Asia and the PacificFrom EverandAsian Economic Integration Report 2018: Toward Optimal Provision of Regional Public Goods in Asia and the PacificNo ratings yet

- 1 Programme Guide 2016Document199 pages1 Programme Guide 2016chetanjecNo ratings yet

- How To Score 110+ Marks in IBPS Clerk Mains 2015 - NagpurTimeDocument6 pagesHow To Score 110+ Marks in IBPS Clerk Mains 2015 - NagpurTimechetanjecNo ratings yet

- Myuyapplnform SCDocument3 pagesMyuyapplnform SCchetanjecNo ratings yet

- PF WithdrawlDocument1 pagePF WithdrawlchetanjecNo ratings yet

- Difference Between Trust and Society in IndiaDocument35 pagesDifference Between Trust and Society in IndiachetanjecNo ratings yet

- Sample Rti Application FormDocument1 pageSample Rti Application Formmganesan6767No ratings yet

- Don't Delay EPF Withdrawal - Business Standard NewsDocument8 pagesDon't Delay EPF Withdrawal - Business Standard NewschetanjecNo ratings yet

- United Nations Convention On The Rights of Persons With DisabilitiesDocument28 pagesUnited Nations Convention On The Rights of Persons With DisabilitiesPiney MartinNo ratings yet

- Office Memorandum.Document1 pageOffice Memorandum.chetanjecNo ratings yet

- My Value Trade Equity DP NSDL FormDocument56 pagesMy Value Trade Equity DP NSDL FormchetanjecNo ratings yet

- Just As I Go On .. Wipro TechDocument9 pagesJust As I Go On .. Wipro TechchetanjecNo ratings yet

- Ark ShahCh-Guide To Success-RUDocument26 pagesArk ShahCh-Guide To Success-RUchetanjecNo ratings yet

- MVT Equity FormDocument41 pagesMVT Equity FormchetanjecNo ratings yet

- My Value Trade Commodity FormDocument52 pagesMy Value Trade Commodity FormchetanjecNo ratings yet

- FIRAgainst Sonia GandhiDocument7 pagesFIRAgainst Sonia GandhichetanjecNo ratings yet

- IDirect Gladiatorstocks Series7Document24 pagesIDirect Gladiatorstocks Series7chetanjecNo ratings yet

- AngelBrokingResearch SuryaRoshni IC 290415Document16 pagesAngelBrokingResearch SuryaRoshni IC 290415chetanjecNo ratings yet

- Register for NTPC Executive Trainee roleDocument1 pageRegister for NTPC Executive Trainee rolechetanjecNo ratings yet

- FIRAgainst Sonia GandhiDocument7 pagesFIRAgainst Sonia GandhichetanjecNo ratings yet

- Application FormDocument3 pagesApplication FormchetanjecNo ratings yet

- Java Basics: Control Statements, Operators & Data TypesDocument82 pagesJava Basics: Control Statements, Operators & Data TypeschetanjecNo ratings yet

- J2EE - v1 1Document88 pagesJ2EE - v1 1chetanjecNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961NishantNo ratings yet

- Soal Bahasa Inggris 75Document7 pagesSoal Bahasa Inggris 75dedyNo ratings yet

- Chapter 1 Introduction To Wealth Management CompressedDocument22 pagesChapter 1 Introduction To Wealth Management Compressedikeshav003No ratings yet

- Proposal Form: Single Life Traditional Plans Full UnderwritingDocument14 pagesProposal Form: Single Life Traditional Plans Full Underwritingankitag612No ratings yet

- ECS Mandate Form for Credit Card PaymentsDocument1 pageECS Mandate Form for Credit Card Payments0sandeepNo ratings yet

- Executive Summary: Assets and Liability Management by Banks in IndiaDocument50 pagesExecutive Summary: Assets and Liability Management by Banks in IndiaHemal ShahNo ratings yet

- Unit - 3 Technical AnalysisDocument24 pagesUnit - 3 Technical AnalysisNishant SharmaNo ratings yet

- My Internship ProposalDocument7 pagesMy Internship Proposalsourav4730No ratings yet

- DS Nov Tribal Part2 LRDocument31 pagesDS Nov Tribal Part2 LRmiller999No ratings yet

- 20. THPT-Đồng-Đậu-Vĩnh-Phúc-Lần-1-2019Document18 pages20. THPT-Đồng-Đậu-Vĩnh-Phúc-Lần-1-2019Quynh NguyenNo ratings yet

- Middleton Pathogenic FinanceDocument26 pagesMiddleton Pathogenic Financerichardck61No ratings yet

- Confessions of A Shopaholic Credit Lesson PlanDocument8 pagesConfessions of A Shopaholic Credit Lesson PlanElvina ArapahNo ratings yet

- MB038 PDFDocument352 pagesMB038 PDFSelvakumar RNo ratings yet

- ACC112 Midterm RevisionDocument17 pagesACC112 Midterm Revisionhabdulla_2No ratings yet

- PMCM Company Deck June 2018Document32 pagesPMCM Company Deck June 2018Hannes Sternbeck FryxellNo ratings yet

- Assignment 1Document3 pagesAssignment 1kannadhass0% (1)

- Annual Report 2015: The Way ForwardDocument316 pagesAnnual Report 2015: The Way ForwardAsif RafiNo ratings yet

- FDIC Answer To ComplaintDocument31 pagesFDIC Answer To ComplaintLucy KirschingerNo ratings yet

- Levy Hermanos vs. Pedro Paterno: FactsDocument5 pagesLevy Hermanos vs. Pedro Paterno: FactsFrance SanchezNo ratings yet

- Housing Finance Scenario in IndiaDocument9 pagesHousing Finance Scenario in IndiaTanvi AhujaNo ratings yet

- Merchant BankingDocument19 pagesMerchant BankingMiral PatelNo ratings yet

- HBL FinalDocument74 pagesHBL Finalasif_ufd100% (1)

- The Success of Rural Microfinance at Grameen Bank in BangladeshDocument10 pagesThe Success of Rural Microfinance at Grameen Bank in BangladeshNafiz FahimNo ratings yet

- Kyc NormsDocument3 pagesKyc NormsShubhanjaliNo ratings yet

- MSc Dissertation TopicsDocument8 pagesMSc Dissertation TopicsSweetMikanNo ratings yet