Professional Documents

Culture Documents

MB0045 - Financial Management - Assignment - Summer 2015

Uploaded by

smu mba solved assignmentsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MB0045 - Financial Management - Assignment - Summer 2015

Uploaded by

smu mba solved assignmentsCopyright:

Available Formats

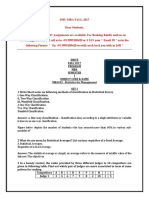

DRIVE

PROGRAM

SEMESTER

SUBJECT CODE

& NAME

BK ID

CREDITS

MARKS

SUMMER 2015

MBA/ MBADS/ MBAFLEX/ MBAHCSN3/ PGDBAN2

II

MB0045

FINANCIAL MANAGEMENT

B1628

4

60

ASSIGNMENT

SMU MBA SUMMER 2015-2016 solved Assignments are available now. (10 years of Excellency)

Dear Students,

SMU MBA SUMMER 2015 Assignments are available. For Booking, Kindly email us on

kvsude@gmail.com OR call us to +91 9995105420 or S M S your

Email ID to our mobile number.

Online Purchase Link : http://smumbaassignments.com/onlineshop

http://smumbaassignment.com

Note: Answer all questions. Kindly note that answers for 10 marks questions should be approximately

of 400 words. Each question is followed by evaluation scheme.

Q.N

o

1

Questions

Total

Marks

Critically analyze the four broad areas of strategic financing decision.

Four broad areas of strategic financing decision

Marks

10

10

What is FVIFA ? Is it different from Sinking fund factor ?

A finance company offers to pay Rs. 44,650 after five years to investors who

deposit annually Rs. 6,000 for five years. Calculate the rate of interest implicit in this

offer.

5

10

What is FVIFA ? Differentiate FVIFA and Sinking Fund

5

factor Solve the case

A firm owns a machine furnishes the following information :

Project E

Rajrappa,

Hazaribag

h

Rs.

11,87,200

Project F

Tatisilwai,

Ranchi

Rs.

10,06,700

Initial Outlay

Net Cash Inflow :

End of year 1

10,00,000

1,00,000

2

2,00,000

1,00,000

3

1,00,000

2,00,000

4

1,00,000

10,00,000

The firm follows straight line method of depreciation (permitted by the Incometax authorities).

The management of the company is now considering selling of the machine. If it

does so, the total operating costs to perform the work, now done by the

machine, will increase by Rs. 40,000 p.a.

Advise the management.

Solve the case.

4

10

10

How will you compute the cost of equity capital using CAPM ?

The Xavier Corporation, a dynamic growth firm which pays no dividends, anticipates

a long-run level of future earnings of Rs. 7 per share. The current market

price

Xaviers share is Rs. 55.45.

Floatation costs

for the sale of3 months

new equity

Creditofperiod

1 month

2 months

shares would average about 10 % of the price of the shares. What is the cost of new

Increase in sales by

-10 %

30 %

equity capital to Xavier Corporation ?

Bad debts on sales

1%

2%

5%

How will you compute the cost of equity capital using CAPM

? Solve the case

5

5

10

Jharkhand Mining ltd. has to select one of the two alternative projects

whose particulars are furnished below :

The company can arrange necessary funds @ 8 %. Compute the NPV and IRR of

each project and comment on the results.

Is there any contradiction in the results ? If so, state the reason for

such contradictions. How would you propose to resolve the contradictions ?

Solve the case

10

10

6

Premier Steel Ltd. has a present annual sales turnover of Rs. 40,00,000. The unit

sale price is Rs. 20. The variable costs are Rs. 12 per unit and fixed costs amount

to Rs. 5,00,000 per annum. The present credit period of 1 month is proposed to be

extended to either 2 or 3 months whichever is profitable. The following additional

information is available :

Fixed costs will increase by Rs. 75,000 when sales increase by 30 %. The

company requires a pre-tax return on investment of 20 %.

Evaluate the profitability of the proposals and recommend the best credit period for

the company.

Solve the case

10

10

You might also like

- Human Resources Management - NIBM - SEM 1Document3 pagesHuman Resources Management - NIBM - SEM 1smu mba solved assignmentsNo ratings yet

- Mba103 Fall 2017Document3 pagesMba103 Fall 2017smu mba solved assignmentsNo ratings yet

- FIN304 Fall 2017Document3 pagesFIN304 Fall 2017smu mba solved assignmentsNo ratings yet

- MKT301 Fall 2017Document3 pagesMKT301 Fall 2017smu mba solved assignmentsNo ratings yet

- Om0018 Fall 2017Document3 pagesOm0018 Fall 2017smu mba solved assignmentsNo ratings yet

- The Prime Objectives of Tax Planning AreDocument4 pagesThe Prime Objectives of Tax Planning Aresmu mba solved assignmentsNo ratings yet

- HRM301 Fall 2017Document3 pagesHRM301 Fall 2017smu mba solved assignmentsNo ratings yet

- MKT302 Fall 2017Document3 pagesMKT302 Fall 2017smu mba solved assignmentsNo ratings yet

- HRM302 Fall 2017Document3 pagesHRM302 Fall 2017smu mba solved assignmentsNo ratings yet

- FIN301 Fall 2017Document4 pagesFIN301 Fall 2017smu mba solved assignmentsNo ratings yet

- Om0010 Fall 2017Document3 pagesOm0010 Fall 2017smu mba solved assignmentsNo ratings yet

- MK0018 Fall 2017Document2 pagesMK0018 Fall 2017smu mba solved assignmentsNo ratings yet

- Stud - Name Class Rank Obtained: Vijetha Class II 5thDocument3 pagesStud - Name Class Rank Obtained: Vijetha Class II 5thsmu mba solved assignmentsNo ratings yet

- ISM301 Fall 2017Document2 pagesISM301 Fall 2017smu mba solved assignmentsNo ratings yet

- Mba205 Fall 2017Document3 pagesMba205 Fall 2017smu mba solved assignmentsNo ratings yet

- Sum Mba Sem 1 Spring 2017Document18 pagesSum Mba Sem 1 Spring 2017smu mba solved assignmentsNo ratings yet

- Mba202 Fall 2017Document3 pagesMba202 Fall 2017smu mba solved assignmentsNo ratings yet

- mb0052 Fall 2017Document2 pagesmb0052 Fall 2017smu mba solved assignmentsNo ratings yet

- Mba302 Fall 2017Document3 pagesMba302 Fall 2017smu mba solved assignmentsNo ratings yet

- Om0017 Fall 2017Document3 pagesOm0017 Fall 2017smu mba solved assignmentsNo ratings yet

- OM0016 Fall 2017Document3 pagesOM0016 Fall 2017smu mba solved assignmentsNo ratings yet

- MH0053 Fall 2017Document3 pagesMH0053 Fall 2017smu mba solved assignmentsNo ratings yet

- MBA104 NEW Fall 2017Document4 pagesMBA104 NEW Fall 2017smu mba solved assignments0% (1)

- Sum Mba Sem 1 Spring 2017Document18 pagesSum Mba Sem 1 Spring 2017smu mba solved assignmentsNo ratings yet

- Mba206 Fall 2017Document3 pagesMba206 Fall 2017smu mba solved assignmentsNo ratings yet

- Om0017 Winter 2016Document3 pagesOm0017 Winter 2016smu mba solved assignmentsNo ratings yet

- Mba301 Fall 2017Document2 pagesMba301 Fall 2017smu mba solved assignmentsNo ratings yet

- Om0018 Winter 2016Document3 pagesOm0018 Winter 2016smu mba solved assignmentsNo ratings yet

- OM0016 Winter 2016Document3 pagesOM0016 Winter 2016smu mba solved assignmentsNo ratings yet

- Mh0059 Winter 2016Document3 pagesMh0059 Winter 2016smu mba solved assignmentsNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- EPF Nomination FormDocument3 pagesEPF Nomination Formjhaji24No ratings yet

- Funding Early Stage Ventures Course #45-884 E Mini 4 - Spring 2011 Wednesdays, 6:30 - 9:20 P.M. Room 152 Instructor: Frank Demmler Course DescriptionDocument10 pagesFunding Early Stage Ventures Course #45-884 E Mini 4 - Spring 2011 Wednesdays, 6:30 - 9:20 P.M. Room 152 Instructor: Frank Demmler Course DescriptionBoboy AzanilNo ratings yet

- AC1025 Mock Exam Comm 2017Document17 pagesAC1025 Mock Exam Comm 2017Nghia Tuan NghiaNo ratings yet

- Applied Economics PPT 3Document9 pagesApplied Economics PPT 3Angel AquinoNo ratings yet

- Principles of Corporate PersonalityDocument27 pagesPrinciples of Corporate PersonalityLusajo Mwakibinga100% (1)

- Transparency & Accountability in AaaDocument13 pagesTransparency & Accountability in AaaCordy IkeanyiNo ratings yet

- Cases For FinalsDocument106 pagesCases For FinalsMyn Mirafuentes Sta AnaNo ratings yet

- S Glass Limited: Working Capital Management INDocument34 pagesS Glass Limited: Working Capital Management INtanu srivastava50% (2)

- White Label AtmDocument5 pagesWhite Label AtmAliza SayedNo ratings yet

- Not-for-Profit Organizations - Answers: Advanced Level Examination - Unit 08Document12 pagesNot-for-Profit Organizations - Answers: Advanced Level Examination - Unit 08Dimuthu JayasuriyaNo ratings yet

- Civil Procedure CasesDocument32 pagesCivil Procedure CasesLois DNo ratings yet

- Equity analysis of auto stocksDocument4 pagesEquity analysis of auto stocksYamunaNo ratings yet

- Financial Accounting & Reporting First Grading Examination: Name: Date: Professor: Section: ScoreDocument15 pagesFinancial Accounting & Reporting First Grading Examination: Name: Date: Professor: Section: ScoreCUSTODIO, JUSTINE A.No ratings yet

- OFFICIAL ANNOUNCEMENT DEBT BURDEN LIBERATION - M1 MASTER BOND in EnglishDocument5 pagesOFFICIAL ANNOUNCEMENT DEBT BURDEN LIBERATION - M1 MASTER BOND in EnglishWORLD MEDIA & COMMUNICATIONS88% (8)

- Liabilities: Ransfer of An Economic ResourcesDocument19 pagesLiabilities: Ransfer of An Economic ResourcesSisiw WasyerNo ratings yet

- ProjectDocument23 pagesProjectSaakshi TripathiNo ratings yet

- Benefits and ServicesDocument26 pagesBenefits and ServicesSushmit ShettyNo ratings yet

- Irctcs E Ticketing Service Electronic Reservation Slip (Personal User)Document2 pagesIrctcs E Ticketing Service Electronic Reservation Slip (Personal User)descrocNo ratings yet

- FAFSA Help Guide: A Publication of The Student Loan NetworkDocument54 pagesFAFSA Help Guide: A Publication of The Student Loan NetworkeniteworkNo ratings yet

- Strategic Management 1Document112 pagesStrategic Management 1Aashish Mehra0% (1)

- Partnership Deed FormatDocument3 pagesPartnership Deed FormatMan SinghNo ratings yet

- Revenue Regulations No. 02-40Document46 pagesRevenue Regulations No. 02-40zelayneNo ratings yet

- Ability Abrogation Accent All Abject abrogation Accepted AccordionDocument12 pagesAbility Abrogation Accent All Abject abrogation Accepted AccordionMae Anthonette RamosNo ratings yet

- Beauty SalonDocument6 pagesBeauty SalonsharatchandNo ratings yet

- Wallstreetjournaleurope 20170320 The Wall Street Journal EuropeDocument22 pagesWallstreetjournaleurope 20170320 The Wall Street Journal EuropestefanoNo ratings yet

- 2020-08-31 - Best Practices For Electrifying Rural Health Facilities - FinalDocument54 pages2020-08-31 - Best Practices For Electrifying Rural Health Facilities - FinalAdedimeji FredNo ratings yet

- Oshiba CEO Resigns OverDocument16 pagesOshiba CEO Resigns OverlizatanNo ratings yet

- Global Professional Accountant ACCA BrochureDocument12 pagesGlobal Professional Accountant ACCA BrochureRishikaNo ratings yet

- Bid BondDocument2 pagesBid BondPatrick Long100% (5)