Professional Documents

Culture Documents

Final Exam Solutions 2012 1 Spring

Uploaded by

Benny KhorCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final Exam Solutions 2012 1 Spring

Uploaded by

Benny KhorCopyright:

Available Formats

FNAN 301, Spring 2012, final, solutions

Find PV of one investment to find value of other and then when other makes single CF

1. Georgia owns two investments, A and B, that have a combined total value of $38,000.

Investment A is expected to pay $23,000 in 5 years from today and has an expected return of 4.6

percent per year. Investment B is expected to pay $32,000 in T years from today and has an

expected return of 6.4 percent per year. What is T, the number of years from today that

investment B is expected to pay $32,000?

A. A number less than 7.50 or a number greater than 10.50

B. A number equal to or greater than 7.50 but less than 8.30

C. A number equal to or greater than 8.30 but less than 9.00

D. A number equal to or greater than 9.00 but less than 9.80

E. A number equal to or greater than 9.80 but less than 10.50

1. Georgia owns two investments, A and B, that have a combined total value of $38,000.

Investment A is expected to pay $32,000 in 5 years from today and has an expected return of 4.6

percent per year. Investment B is expected to pay $23,000 in T years from today and has an

expected return of 6.4 percent per year. What is T, the number of years from today that

investment B is expected to pay $23,000?

A. A number less than 7.50 or a number greater than 10.50

B. A number equal to or greater than 7.50 but less than 8.30

C. A number equal to or greater than 8.30 but less than 9.00

D. A number equal to or greater than 9.00 but less than 9.80

E. A number equal to or greater than 9.80 but less than 10.50

1. Georgia owns two investments, A and B, that have a combined total value of $38,000.

Investment A is expected to pay $23,000 in 5 years from today and has an expected return of 6.4

percent per year. Investment B is expected to pay $32,000 in T years from today and has an

expected return of 4.6 percent per year. What is T, the number of years from today that

investment B is expected to pay $32,000?

A. A number less than 7.50 or a number greater than 10.50

B. A number equal to or greater than 7.50 but less than 8.30

C. A number equal to or greater than 8.30 but less than 9.00

D. A number equal to or greater than 9.00 but less than 9.80

E. A number equal to or greater than 9.80 but less than 10.50

1. Georgia owns two investments, A and B, that have a combined total value of $38,000.

Investment A is expected to pay $32,000 in 5 years from today and has an expected return of 6.4

percent per year. Investment B is expected to pay $23,000 in T years from today and has an

expected return of 4.6 percent per year. What is T, the number of years from today that

investment B is expected to pay $23,000?

A. A number less than 7.50 or a number greater than 10.50

B. A number equal to or greater than 7.50 but less than 8.30

C. A number equal to or greater than 8.30 but less than 9.00

D. A number equal to or greater than 9.00 but less than 9.80

E. A number equal to or greater than 9.80 but less than 10.50

FNAN 301, Spring 2012, final, solutions

Find next CF of growing perpetuity and then use growth rate to get future CF

2. Georgia owns a vending machine that is worth $38,000 and is expected to make annual cash

flows forever. The cost of capital is 9.3%. The next annual cash flow is expected in one year

from today and all subsequent cash flows are expected to grow annually by 5.7%. What is the

cash flow produced by the vending machine in 5 years from today expected to be?

2. Georgia owns a vending machine that is worth $38,000 and is expected to make annual cash

flows forever. The cost of capital is 9.3%. The next annual cash flow is expected in one year

from today and all subsequent cash flows are expected to grow annually by 5.7%. What is the

cash flow produced by the vending machine in 6 years from today expected to be?

2. Georgia owns a vending machine that is worth $38,000 and is expected to make annual cash

flows forever. The cost of capital is 9.3%. The next annual cash flow is expected in one year

from today and all subsequent cash flows are expected to grow annually by 5.7%. What is the

cash flow produced by the vending machine in 7 years from today expected to be?

2. Georgia owns a vending machine that is worth $38,000 and is expected to make annual cash

flows forever. The cost of capital is 9.3%. The next annual cash flow is expected in one year

from today and all subsequent cash flows are expected to grow annually by 5.7%. What is the

cash flow produced by the vending machine in 8 years from today expected to be?

FNAN 301, Spring 2012, final, solutions

Find payment with PV annuity and an extra, interim cash flow

3. Dat just took out a loan from the bank for $13,000. He plans to repay this loan by making a

special payment to the bank of $4,000 in 3 years and by also making equal, regular annual

payments of X per year for 5 years. If the interest rate on the loan is 12.3 percent per year and he

makes his first regular annual payment in 1 year, then what is X, Dats regular annual payment?

Assume that Dat makes two payments in 3 years: the extra payment of $4,000 and the regular

annual payment of X.

A. An amount less than $2,735.00 or an amount greater than or equal to $2,935.00

B. An amount equal to or greater than $2,735.00 but less than $2,785.00

C. An amount equal to or greater than $2,785.00 but less than $2,835.00

D. An amount equal to or greater than $2,835.00 but less than $2,885.00

E. An amount equal to or greater than $2,885.00 but less than $2,935.00

3. Dat just took out a loan from the bank for $13,000. He plans to repay this loan by making a

special payment to the bank of $4,000 in 2 years and by also making equal, regular annual

payments of X per year for 5 years. If the interest rate on the loan is 12.3 percent per year and he

makes his first regular annual payment in 1 year, then what is X, Dats regular annual payment?

Assume that Dat makes two payments in 2 years: the extra payment of $4,000 and the regular

annual payment of X.

A. An amount less than $2,735.00 or an amount greater than or equal to $2,935.00

B. An amount equal to or greater than $2,735.00 but less than $2,785.00

C. An amount equal to or greater than $2,785.00 but less than $2,835.00

D. An amount equal to or greater than $2,835.00 but less than $2,885.00

E. An amount equal to or greater than $2,885.00 but less than $2,935.00

3. Dat just took out a loan from the bank for $13,000. He plans to repay this loan by making a

special payment to the bank of $4,000 in 3 years and by also making equal, regular annual

payments of X per year for 5 years. If the interest rate on the loan is 13.2 percent per year and he

makes his first regular annual payment in 1 year, then what is X, Dats regular annual payment?

Assume that Dat makes two payments in 3 years: the extra payment of $4,000 and the regular

annual payment of X.

A. An amount less than $2,735.00 or an amount greater than or equal to $2,935.00

B. An amount equal to or greater than $2,735.00 but less than $2,785.00

C. An amount equal to or greater than $2,785.00 but less than $2,835.00

D. An amount equal to or greater than $2,835.00 but less than $2,885.00

E. An amount equal to or greater than $2,885.00 but less than $2,935.00

3. Dat just took out a loan from the bank for $13,000. He plans to repay this loan by making a

special payment to the bank of $4,000 in 2 years and by also making equal, regular annual

payments of X per year for 5 years. If the interest rate on the loan is 13.2 percent per year and he

makes his first regular annual payment in 1 year, then what is X, Dats regular annual payment?

Assume that Dat makes two payments in 2 years: the extra payment of $4,000 and the regular

annual payment of X.

A. An amount less than $2,735.00 or an amount greater than or equal to $2,935.00

B. An amount equal to or greater than $2,735.00 but less than $2,785.00

C. An amount equal to or greater than $2,785.00 but less than $2,835.00

D. An amount equal to or greater than $2,835.00 but less than $2,885.00

E. An amount equal to or greater than $2,885.00 but less than $2,935.00

3

FNAN 301, Spring 2012, final, solutions

Find annuity due value and expected return from fixed perpetuity to compare value & risk

4. Investment A has an expected return of 9.7 percent and is expected to pay $75 per year for a finite

number of years such that its first annual payment is expected later today and its last annual payment is

expected in 5 years from today. Investment B is expected to pay $31 per year forever, is expected to

make its first payment in 1 year from today, and has a value of $325. Based on the given information,

which one of the following assertions is true?

A. Investment A is more valuable than investment B and investment A has more risk than investment B

B. Investment A is more valuable than investment B and investment B has more risk than investment A

C. Investment B is more valuable than investment A and investment A has more risk than investment B

D. Investment B is more valuable than investment A and investment B has more risk than investment A

E. Investment A is equally as valuable as investment B or investment A has the same amount of risk as

investment B

4. Investment A has an expected return of 9.7 percent and is expected to pay $75 per year for a finite

number of years such that its first annual payment is expected later today and its last annual payment is

expected in 6 years from today. Investment B is expected to pay $37 per year forever, is expected to

make its first payment in 1 year from today, and has a value of $375. Based on the given information,

which one of the following assertions is true?

A. Investment A is more valuable than investment B and investment A has more risk than investment B

B. Investment A is more valuable than investment B and investment B has more risk than investment A

C. Investment B is more valuable than investment A and investment A has more risk than investment B

D. Investment B is more valuable than investment A and investment B has more risk than investment A

E. Investment A is equally as valuable as investment B or investment A has the same amount of risk as

investment B

4. Investment A has an expected return of 7.9 percent and is expected to pay $75 per year for a finite

number of years such that its first annual payment is expected later today and its last annual payment is

expected in 5 years from today. Investment B is expected to pay $29 per year forever, is expected to

make its first payment in 1 year from today, and has a value of $355. Based on the given information,

which one of the following assertions is true?

A. Investment B is more valuable than investment A and investment B has more risk than investment A

B. Investment B is more valuable than investment A and investment A has more risk than investment B

C. Investment A is more valuable than investment B and investment B has more risk than investment A

D. Investment A is more valuable than investment B and investment A has more risk than investment B

E. Investment A is equally as valuable as investment B or investment A has the same amount of risk as

investment B

4. Investment A has an expected return of 7.9 percent and is expected to pay $75 per year for a finite

number of years such that its first annual payment is expected later today and its last annual payment is

expected in 6 years from today. Investment B is expected to pay $30 per year forever, is expected to

make its first payment in 1 year from today, and has a value of $385. Based on the given information,

which one of the following assertions is true?

A. Investment B is more valuable than investment A and investment B has more risk than investment A

B. Investment B is more valuable than investment A and investment A has more risk than investment B

C. Investment A is more valuable than investment B and investment B has more risk than investment A

D. Investment A is more valuable than investment B and investment A has more risk than investment B

E. Investment A is equally as valuable as investment B or investment A has the same amount of risk as

investment B

FNAN 301, Spring 2012, final, solutions

Find missing CF associated with future value of multiple cash flows

5. If Georgia expects to invest $13,400 in 1 year from today in an account that is expected to earn

5.1 percent per year, and she expects to make another investment in the same account in 4 years

from today, then how much money does Georgia expect to invest in 4 years from today if she

expects to have $38,000 in her account in 6 years from today?

A. An amount less than $15,000 or an amount greater than or equal to $19,000

B. An amount equal to or greater than $15,000 but less than $16,000

C. An amount equal to or greater than $16,000 but less than $17,000

D. An amount equal to or greater than $17,000 but less than $18,000

E. An amount equal to or greater than $18,000 but less than $19,000

5. If Georgia expects to invest $15,200 in 1 year from today in an account that is expected to earn

5.1 percent per year, and she expects to make another investment in the same account in 4 years

from today, then how much money does Georgia expect to invest in 4 years from today if she

expects to have $38,000 in her account in 6 years from today?

A. An amount less than $15,000 or an amount greater than or equal to $19,000

B. An amount equal to or greater than $15,000 but less than $16,000

C. An amount equal to or greater than $16,000 but less than $17,000

D. An amount equal to or greater than $17,000 but less than $18,000

E. An amount equal to or greater than $18,000 but less than $19,000

5. If Georgia expects to invest $13,400 in 1 year from today in an account that is expected to earn

5.1 percent per year, and she expects to make another investment in the same account in 2 years

from today, then how much money does Georgia expect to invest in 2 years from today if she

expects to have $38,000 in her account in 6 years from today?

A. An amount less than $15,000 or an amount greater than or equal to $19,000

B. An amount equal to or greater than $15,000 but less than $16,000

C. An amount equal to or greater than $16,000 but less than $17,000

D. An amount equal to or greater than $17,000 but less than $18,000

E. An amount equal to or greater than $18,000 but less than $19,000

5. If Georgia expects to invest $15,200 in 1 year from today in an account that is expected to earn

5.1 percent per year, and she expects to make another investment in the same account in 2 years

from today, then how much money does Georgia expect to invest in 2 years from today if she

expects to have $38,000 in her account in 6 years from today?

A. An amount less than $15,000 or an amount greater than or equal to $19,000

B. An amount equal to or greater than $15,000 but less than $16,000

C. An amount equal to or greater than $16,000 but less than $17,000

D. An amount equal to or greater than $17,000 but less than $18,000

E. An amount equal to or greater than $18,000 but less than $19,000

FNAN 301, Spring 2012, final, solutions

Save with annuity and then give a growing perpetuity: what is first perpetuity CF

6. Georgia wants to create a scholarship fund by making annual savings donations to the fund for

several years before the fund starts making annual scholarship payments forever. She plans to

save $45,000 per year in a trust fund for 4 years. Her first savings donation to the trust fund is

expected in 1 year from today. What is the expected amount of the scholarship payment that the

trust fund will make in 5 years from today if the fund is expected to have a return of 8.3 percent

per year, make annual scholarship payments that grow annually by 4.4 percent forever, and make

its first annual scholarship payment in 5 years from today?

6. Georgia wants to create a scholarship fund by making annual savings donations to the fund for

several years before the fund starts making annual scholarship payments forever. She plans to

save $45,000 per year in a trust fund for 4 years. Her first savings donation to the trust fund is

expected in 1 year from today. What is the expected amount of the scholarship payment that the

trust fund will make in 5 years from today if the fund is expected to have a return of 8.3 percent

per year, make annual scholarship payments that grow annually by 3.9 percent forever, and make

its first annual scholarship payment in 5 years from today?

6. Georgia wants to create a scholarship fund by making annual savings donations to the fund for

several years before the fund starts making annual scholarship payments forever. She plans to

save $54,000 per year in a trust fund for 4 years. Her first savings donation to the trust fund is

expected in 1 year from today. What is the expected amount of the scholarship payment that the

trust fund will make in 5 years from today if the fund is expected to have a return of 8.3 percent

per year, make annual scholarship payments that grow annually by 4.4 percent forever, and make

its first annual scholarship payment in 5 years from today?

6. Georgia wants to create a scholarship fund by making annual savings donations to the fund for

several years before the fund starts making annual scholarship payments forever. She plans to

save $54,000 per year in a trust fund for 4 years. Her first savings donation to the trust fund is

expected in 1 year from today. What is the expected amount of the scholarship payment that the

trust fund will make in 5 years from today if the fund is expected to have a return of 8.3 percent

per year, make annual scholarship payments that grow annually by 3.9 percent forever, and make

its first annual scholarship payment in 5 years from today?

FNAN 301, Spring 2012, final, solutions

Find R then EAR from FV and payments

7. Dat is planning to save $47 each month for 4 years. He plans to make his first contribution to

his account in 1 month from today. If he has $900 in his account today and expects to have

$3,940.83 in his account in 4 years from today, immediately after making his last payment, then

what is the EAR that he expects to earn on his account?

A. A rate less than 8.00% or a rate greater than or equal to 9.60%

B. A rate equal to or greater than 8.00% but less than 8.40%

C. A rate equal to or greater than 8.40% but less than 8.80%

D. A rate equal to or greater than 8.80% but less than 9.20%

E. A rate equal to or greater than 9.20% but less than 9.60%

7. Dat is planning to save $47 each month for 4 years. He plans to make his first contribution to

his account in 1 month from today. If he has $900 in his account today and expects to have

$3,978.94 in his account in 4 years from today, immediately after making his last payment, then

what is the EAR that he expects to earn on his account?

A. A rate less than 8.00% or a rate greater than or equal to 9.60%

B. A rate equal to or greater than 8.00% but less than 8.40%

C. A rate equal to or greater than 8.40% but less than 8.80%

D. A rate equal to or greater than 8.80% but less than 9.20%

E. A rate equal to or greater than 9.20% but less than 9.60%

7. Dat is planning to save $47 each month for 4 years. He plans to make his first contribution to

his account in 1 month from today. If he has $900 in his account today and expects to have

$3,903.15 in his account in 4 years from today, immediately after making his last payment, then

what is the EAR that he expects to earn on his account?

A. A rate less than 8.00% or a rate greater than or equal to 9.60%

B. A rate equal to or greater than 8.00% but less than 8.40%

C. A rate equal to or greater than 8.40% but less than 8.80%

D. A rate equal to or greater than 8.80% but less than 9.20%

E. A rate equal to or greater than 9.20% but less than 9.60%

7. Dat is planning to save $47 each month for 4 years. He plans to make his first contribution to

his account in 1 month from today. If he has $900 in his account today and expects to have

$3,878.28 in his account in 4 years from today, immediately after making his last payment, then

what is the EAR that he expects to earn on his account?

A. A rate less than 8.00% or a rate greater than or equal to 9.60%

B. A rate equal to or greater than 8.00% but less than 8.40%

C. A rate equal to or greater than 8.40% but less than 8.80%

D. A rate equal to or greater than 8.80% but less than 9.20%

E. A rate equal to or greater than 9.20% but less than 9.60%

FNAN 301, Spring 2012, final, solutions

Conceptual: identify which bond has higher coupon rate and higher YTM from relative price

8. Bonds A, B, C, and D have face values of $1000, pay semi-annual coupons with the next

coupon due in 6 months, and mature in T years. Bonds A and B have different coupon rates, and

bonds C and D have different yields-to-maturity. Which assertion is true if PA > PB > 0, PD >

PC > 0, T > 0, Y > 0, and C > 0? Note that all bonds with a time-to-maturity of T have the same

time-to-maturity, all bonds with a yield-to-maturity of Y have the same yield-to-maturity (YTM),

and all bonds with a coupon rate of C have the same coupon rate.

Bond

Bond Price

Time-to-maturity

Yield-to-maturity

A

PA

T

Y

B

PB

T

Y

Bond

Bond Price

Time-to-maturity

Coupon rate

C

PC

T

C

D

PD

T

C

A. Bond A has a higher coupon rate than bond B and bond C has a higher YTM than bond D

B. Bond A has a higher coupon rate than bond B and bond D has a higher YTM than bond C

C. Bond B has a higher coupon rate than bond A and bond C has a higher YTM than bond D

D. Bond B has a higher coupon rate than bond A and bond D has a higher YTM than bond C

E. None of the above assertions is true

8. Bonds A, B, C, and D have face values of $1000, pay semi-annual coupons with the next

coupon due in 6 months, and mature in T years. Bonds A and B have different coupon rates, and

bonds C and D have different yields-to-maturity. Which assertion is true if PA > PB > 0, PC >

PD > 0, T > 0, Y > 0, and C > 0? Note that all bonds with a time-to-maturity of T have the same

time-to-maturity, all bonds with a yield-to-maturity of Y have the same yield-to-maturity (YTM),

and all bonds with a coupon rate of C have the same coupon rate.

Bond

Bond Price

Time-to-maturity

Yield-to-maturity

A

PA

T

Y

B

PB

T

Y

Bond

Bond Price

Time-to-maturity

Coupon rate

C

PC

T

C

D

PD

T

C

A. Bond A has a higher coupon rate than bond B and bond C has a higher YTM than bond D

B. Bond A has a higher coupon rate than bond B and bond D has a higher YTM than bond C

C. Bond B has a higher coupon rate than bond A and bond C has a higher YTM than bond D

D. Bond B has a higher coupon rate than bond A and bond D has a higher YTM than bond C

E. None of the above assertions is true

FNAN 301, Spring 2012, final, solutions

8. Bonds A, B, C, and D have face values of $1000, pay semi-annual coupons with the next

coupon due in 6 months, and mature in T years. Bonds A and B have different coupon rates, and

bonds C and D have different yields-to-maturity. Which assertion is true if PB > PA > 0, PD >

PC > 0, T > 0, Y > 0, and C > 0? Note that all bonds with a time-to-maturity of T have the same

time-to-maturity, all bonds with a yield-to-maturity of Y have the same yield-to-maturity (YTM),

and all bonds with a coupon rate of C have the same coupon rate.

Bond

Bond Price

Time-to-maturity

Yield-to-maturity

A

PA

T

Y

B

PB

T

Y

Bond

Bond Price

Time-to-maturity

Coupon rate

C

PC

T

C

D

PD

T

C

A. Bond A has a higher coupon rate than bond B and bond C has a higher YTM than bond D

B. Bond A has a higher coupon rate than bond B and bond D has a higher YTM than bond C

C. Bond B has a higher coupon rate than bond A and bond C has a higher YTM than bond D

D. Bond B has a higher coupon rate than bond A and bond D has a higher YTM than bond C

E. None of the above assertions is true

8. Bonds A, B, C, and D have face values of $1000, pay semi-annual coupons with the next

coupon due in 6 months, and mature in T years. Bonds A and B have different coupon rates, and

bonds C and D have different yields-to-maturity. Which assertion is true if PB > PA > 0, PC >

PD > 0, T > 0, Y > 0, and C > 0? Note that all bonds with a time-to-maturity of T have the same

time-to-maturity, all bonds with a yield-to-maturity of Y have the same yield-to-maturity (YTM),

and all bonds with a coupon rate of C have the same coupon rate.

Bond

Bond Price

Time-to-maturity

Yield-to-maturity

A

PA

T

Y

B

PB

T

Y

Bond

Bond Price

Time-to-maturity

Coupon rate

C

PC

T

C

D

PD

T

C

A. Bond A has a higher coupon rate than bond B and bond C has a higher YTM than bond D

B. Bond A has a higher coupon rate than bond B and bond D has a higher YTM than bond C

C. Bond B has a higher coupon rate than bond A and bond C has a higher YTM than bond D

D. Bond B has a higher coupon rate than bond A and bond D has a higher YTM than bond C

E. None of the above assertions is true

FNAN 301, Spring 2012, final, solutions

Find semi-annual coupon from return and then find coupon rate

9. Bonds issued by Erie Shipping were priced at $976.00 six months ago and are priced at

$971.00 today. The bonds have a face value of $1,000, pay semi-annual coupons, and just made

a coupon payment. The bonds had a percentage return over the past six months of 5.6%. What

is the coupon rate of the bonds?

9. Bonds issued by Erie Shipping were priced at $926.00 six months ago and are priced at

$923.00 today. The bonds have a face value of $1,000, pay semi-annual coupons, and just made

a coupon payment. The bonds had a percentage return over the past six months of 5.6%. What

is the coupon rate of the bonds?

9. Bonds issued by Erie Shipping were priced at $976.00 six months ago and are priced at

$971.00 today. The bonds have a face value of $1,000, pay semi-annual coupons, and just made

a coupon payment. The bonds had a percentage return over the past six months of 6.5%. What

is the coupon rate of the bonds?

9. Bonds issued by Erie Shipping were priced at $926.00 six months ago and are priced at

$923.00 today. The bonds have a face value of $1,000, pay semi-annual coupons, and just made

a coupon payment. The bonds had a percentage return over the past six months of 6.5%. What

is the coupon rate of the bonds?

10

FNAN 301, Spring 2012, final, solutions

Find current price from expected dividend and price in quarter with annual expected return

10. Erie Shipping stock pays quarterly dividends and has an expected annual return of 13.2

percent. The stock is expected to have a share price of $23.68 immediately after paying its next

quarterly dividend in 3 months from today and is expected to have a share price of $24.11

immediately after paying its quarterly dividend in 6 months from today. What is the current price

of Erie Shipping stock if the quarterly dividend in 3 months from today is expected to be $1.29?

A. An amount less than $24.00 or an amount greater than or equal to $54.00

B. An amount equal to or greater than $24.00 but less than $26.00

C. An amount equal to or greater than $26.00 but less than $28.00

D. An amount equal to or greater than $28.00 but less than $46.00

E. An amount equal to or greater than $46.00 but less than $54.00

10. Erie Shipping stock pays quarterly dividends and has an expected annual return of 13.2

percent. The stock is expected to have a share price of $23.68 immediately after paying its next

quarterly dividend in 3 months from today and is expected to have a share price of $24.11

immediately after paying its quarterly dividend in 6 months from today. What is the current price

of Erie Shipping stock if the quarterly dividend in 3 months from today is expected to be $1.92?

A. An amount less than $24.00 or an amount greater than or equal to $54.00

B. An amount equal to or greater than $24.00 but less than $26.00

C. An amount equal to or greater than $26.00 but less than $28.00

D. An amount equal to or greater than $28.00 but less than $46.00

E. An amount equal to or greater than $46.00 but less than $54.00

10. Erie Shipping stock pays quarterly dividends and has an expected annual return of 13.2

percent. The stock is expected to have a share price of $26.38 immediately after paying its next

quarterly dividend in 3 months from today and is expected to have a share price of $27.11

immediately after paying its quarterly dividend in 6 months from today. What is the current price

of Erie Shipping stock if the quarterly dividend in 3 months from today is expected to be $1.29?

A. An amount less than $24.00 or an amount greater than or equal to $54.00

B. An amount equal to or greater than $24.00 but less than $26.00

C. An amount equal to or greater than $26.00 but less than $28.00

D. An amount equal to or greater than $28.00 but less than $46.00

E. An amount equal to or greater than $46.00 but less than $54.00

10. Erie Shipping stock pays quarterly dividends and has an expected annual return of 13.2

percent. The stock is expected to have a share price of $26.38 immediately after paying its next

quarterly dividend in 3 months from today and is expected to have a share price of $27.11

immediately after paying its quarterly dividend in 6 months from today. What is the current price

of Erie Shipping stock if the quarterly dividend in 3 months from today is expected to be $1.92?

A. An amount less than $24.00 or an amount greater than or equal to $54.00

B. An amount equal to or greater than $24.00 but less than $26.00

C. An amount equal to or greater than $26.00 but less than $28.00

D. An amount equal to or greater than $28.00 but less than $46.00

E. An amount equal to or greater than $46.00 but less than $54.00

11

FNAN 301, Spring 2012, final, solutions

Find g from ER, D1, and P0 computed by valuing bond

11. Georgia has one share of stock and one bond issued by Erie Shipping. The total value of the

two securities is $1,300. The bond has a YTM of 8.0 percent, an annual coupon rate of 9.8

percent, and a face value of $1,000. The bond matures in 11 years and pays semi-annual

coupons with the next one expected in 6 months. The stock is expected to pay an annual

dividend every year forever, the next dividend is expected to be $5.61 in 1 year, all subsequent

dividends are expected to grow at the same annual growth rate, and the expected return for the

stock is 11.2%. What is the annual growth rate of the stocks dividend expected to be?

11. Georgia has one share of stock and one bond issued by Erie Shipping. The total value of the

two securities is $1,300. The bond has a YTM of 8.0 percent, an annual coupon rate of 9.8

percent, and a face value of $1,000. The bond matures in 13 years and pays semi-annual

coupons with the next one expected in 6 months. The stock is expected to pay an annual

dividend every year forever, the next dividend is expected to be $6.51 in 1 year, all subsequent

dividends are expected to grow at the same annual growth rate, and the expected return for the

stock is 11.2%. What is the annual growth rate of the stocks dividend expected to be?

11. Georgia has one share of stock and one bond issued by Erie Shipping. The total value of the

two securities is $1,300. The bond has a YTM of 8.0 percent, an annual coupon rate of 9.8

percent, and a face value of $1,000. The bond matures in 13 years and pays semi-annual

coupons with the next one expected in 6 months. The stock is expected to pay an annual

dividend every year forever, the next dividend is expected to be $5.61 in 1 year, all subsequent

dividends are expected to grow at the same annual growth rate, and the expected return for the

stock is 12.1%. What is the annual growth rate of the stocks dividend expected to be?

11. Georgia has one share of stock and one bond issued by Erie Shipping. The total value of the

two securities is $1,300. The bond has a YTM of 8.0 percent, an annual coupon rate of 9.8

percent, and a face value of $1,000. The bond matures in 11 years and pays semi-annual

coupons with the next one expected in 6 months. The stock is expected to pay an annual

dividend every year forever, the next dividend is expected to be $6.51 in 1 year, all subsequent

dividends are expected to grow at the same annual growth rate, and the expected return for the

stock is 12.1%. What is the annual growth rate of the stocks dividend expected to be?

12

FNAN 301, Spring 2012, final, solutions

Find NPV and payback to decide whether to accept/reject a project

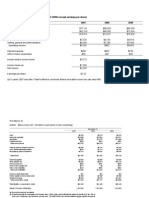

12. The following table presents information on a potential project with conventional cash flows currently being

evaluated by Erie Shipping. Which assertion about statement 1 and statement 2 is true?

Expected cash flows (number of years from today)

Opportunity cost of

0

1

2

3

4

capital

-76,000

38,000

29,000

19,000

6,000

13.2%

Statement 1: Erie Shipping would accept the project based on the projects net present value (NPV) and the NPV rule

Statement 2: Erie Shipping would accept the project based on the projects payback period and the payback rule if

the payback threshold is 2.55 years

A. Statement 1 is true and statement 2 is true

B. Statement 1 is true and statement 2 is false

C. Statement 1 is false and statement 2 is true

D. Statement 1 is false and statement 2 is false

12. The following table presents information on a potential project with conventional cash flows currently being

evaluated by Erie Shipping. Which assertion about statement 1 and statement 2 is true?

Expected cash flows (number of years from today)

Opportunity cost of

0

1

2

3

4

capital

-76,000

38,000

18,000

35,000

6,000

14.3%

Statement 1: Erie Shipping would accept the project based on the projects net present value (NPV) and the NPV rule

Statement 2: Erie Shipping would accept the project based on the projects payback period and the payback rule if

the payback threshold is 2.65 years

A. Statement 1 is false and statement 2 is false

B. Statement 1 is false and statement 2 is true

C. Statement 1 is true and statement 2 is false

D. Statement 1 is true and statement 2 is true

12. The following table presents information on a potential project with conventional cash flows currently being

evaluated by Erie Shipping. Which assertion about statement 1 and statement 2 is true?

Expected cash flows (number of years from today)

Opportunity cost of

0

1

2

3

4

capital

-67,000

38,000

24,000

12,000

6,000

12.5%

Statement 1: Erie Shipping would accept the project based on the projects net present value (NPV) and the NPV rule

Statement 2: Erie Shipping would accept the project based on the projects payback period and the payback rule if

the payback threshold is 2.55 years

A. Statement 1 is true and statement 2 is true

B. Statement 1 is true and statement 2 is false

C. Statement 1 is false and statement 2 is true

D. Statement 1 is false and statement 2 is false

12. The following table presents information on a potential project with conventional cash flows currently being

evaluated by Erie Shipping. Which assertion about statement 1 and statement 2 is true?

Expected cash flows (number of years from today)

Opportunity cost of

0

1

2

3

4

capital

-67,000

38,000

22,000

18,000

6,000

14.4%

Statement 1: Erie Shipping would accept the project based on the projects net present value (NPV) and the NPV rule

Statement 2: Erie Shipping would accept the project based on the projects payback period and the payback rule if

the payback threshold is 2.45 years

A. Statement 1 is false and statement 2 is false

B. Statement 1 is false and statement 2 is true

C. Statement 1 is true and statement 2 is false

D. Statement 1 is true and statement 2 is true

13

FNAN 301, Spring 2012, final, solutions

Find NPV with opportunity cost, terminal value, and project sale

13. Erie Shipping is evaluating the turbine project. Today, the project would require an initial investment in

equipment of $65,000. Relevant annual operating cash flows of $41,000 per year are expected in years 1, 2, and

3, and relevant operating cash flows that are not equal to $0 are expected in years 4, 5 and 6. In 4 years, the

project is expected to have an after-tax terminal value of $54,000. In 2 years, the project is expected to be sold

by Erie Shipping for an after-tax amount of $45,000. Instead of pursuing the turbine project, Erie Shipping

could sell the rights to the project to Huron Shipping for a $36,000 after-tax payment today from Huron

Shipping. The cost of capital for this project is 11 percent. What is the net present value of the turbine project?

A. An amount less than $0 or an amount equal to or greater than $70,000

B. An amount equal to or greater than $0 but less than or equal to $10,000

C. An amount equal to or greater than $10,000 but less than $20,000

D. An amount equal to or greater than $20,000 but less than $30,000

E. An amount equal to or greater than $30,000 but less than $70,000

13. Erie Shipping is evaluating the turbine project. Today, the project would require an initial investment in

equipment of $56,000. Relevant annual operating cash flows of $41,000 per year are expected in years 1, 2, and

3, and relevant operating cash flows that are not equal to $0 are expected in years 4, 5 and 6. In 4 years, the

project is expected to have an after-tax terminal value of $54,000. In 2 years, the project is expected to be sold

by Erie Shipping for an after-tax amount of $45,000. Instead of pursuing the turbine project, Erie Shipping

could sell the rights to the project to Huron Shipping for a $36,000 after-tax payment today from Huron

Shipping. The cost of capital for this project is 11 percent. What is the net present value of the turbine project?

A. An amount less than $0 or an amount equal to or greater than $70,000

B. An amount equal to or greater than $0 but less than or equal to $10,000

C. An amount equal to or greater than $10,000 but less than $20,000

D. An amount equal to or greater than $20,000 but less than $30,000

E. An amount equal to or greater than $30,000 but less than $70,000

13. Erie Shipping is evaluating the turbine project. Today, the project would require an initial investment in

equipment of $65,000. Relevant annual operating cash flows of $41,000 per year are expected in years 1, 2, and

3, and relevant operating cash flows that are not equal to $0 are expected in years 4, 5 and 6. In 4 years, the

project is expected to have an after-tax terminal value of $45,000. In 2 years, the project is expected to be sold

by Erie Shipping for an after-tax amount of $54,000. Instead of pursuing the turbine project, Erie Shipping

could sell the rights to the project to Huron Shipping for a $36,000 after-tax payment today from Huron

Shipping. The cost of capital for this project is 11 percent. What is the net present value of the turbine project?

A. An amount less than $0 or an amount equal to or greater than $70,000

B. An amount equal to or greater than $0 but less than or equal to $10,000

C. An amount equal to or greater than $10,000 but less than $20,000

D. An amount equal to or greater than $20,000 but less than $30,000

E. An amount equal to or greater than $30,000 but less than $70,000

13. Erie Shipping is evaluating the turbine project. Today, the project would require an initial investment in

equipment of $56,000. Relevant annual operating cash flows of $41,000 per year are expected in years 1, 2, and

3, and relevant operating cash flows that are not equal to $0 are expected in years 4, 5 and 6. In 4 years, the

project is expected to have an after-tax terminal value of $45,000. In 2 years, the project is expected to be sold

by Erie Shipping for an after-tax amount of $54,000. Instead of pursuing the turbine project, Erie Shipping

could sell the rights to the project to Huron Shipping for a $36,000 after-tax payment today from Huron

Shipping. The cost of capital for this project is 11 percent. What is the net present value of the turbine project?

A. An amount less than $0 or an amount equal to or greater than $70,000

B. An amount equal to or greater than $0 but less than or equal to $10,000

C. An amount equal to or greater than $10,000 but less than $20,000

D. An amount equal to or greater than $20,000 but less than $30,000

E. An amount equal to or greater than $30,000 but less than $70,000

14

FNAN 301, Spring 2012, final, solutions

Find NPV from revs/costs/investment/asset sale

14. Erie Shipping is considering a project that would last for 2 years. The project would involve an initial

investment of $270,000 for new equipment that would be sold for an expected price of $184,000 at the

end of the project in 2 years. The equipment would be depreciated to zero over 5 years using straight-line

depreciation. In years 1 and 2, relevant, incremental annual revenue from the project is expected to be

$144,000 per year and relevant, incremental annual costs for the project are expected to be $56,000 per

year. The tax rate is 40 percent and the cost of capital for the project is 5.2 percent. What is the net

present value (NPV) of the project?

14. Erie Shipping is considering a project that would last for 2 years. The project would involve an initial

investment of $270,000 for new equipment that would be sold for an expected price of $184,000 at the

end of the project in 2 years. The equipment would be depreciated to zero over 6 years using straight-line

depreciation. In years 1 and 2, relevant, incremental annual revenue from the project is expected to be

$144,000 per year and relevant, incremental annual costs for the project are expected to be $65,000 per

year. The tax rate is 40 percent and the cost of capital for the project is 5.2 percent. What is the net

present value (NPV) of the project?

14. Erie Shipping is considering a project that would last for 2 years. The project would involve an initial

investment of $270,000 for new equipment that would be sold for an expected price of $188,000 at the

end of the project in 2 years. The equipment would be depreciated to zero over 5 years using straight-line

depreciation. In years 1 and 2, relevant, incremental annual revenue from the project is expected to be

$144,000 per year and relevant, incremental annual costs for the project are expected to be $56,000 per

year. The tax rate is 40 percent and the cost of capital for the project is 5.2 percent. What is the net

present value (NPV) of the project?

14. Erie Shipping is considering a project that would last for 2 years. The project would involve an initial

investment of $270,000 for new equipment that would be sold for an expected price of $188,000 at the

end of the project in 2 years. The equipment would be depreciated to zero over 6 years using straight-line

depreciation. In years 1 and 2, relevant, incremental annual revenue from the project is expected to be

$144,000 per year and relevant, incremental annual costs for the project are expected to be $65,000 per

year. The tax rate is 40 percent and the cost of capital for the project is 5.2 percent. What is the net

present value (NPV) of the project?

Find initial CA from initial CL, NWC change, and ending NWC

15. Erie Shipping is evaluating a potential project such that the cash flow effect from the change in net

working capital (NWC) is expected to be -$20 at time 2 and the level of net working capital is expected to

be $80 at time 2. What is the level of current assets for the project expected to be at time 1 if the level of

current liabilities for the project is expected to be $230 at time 1?

15. Erie Shipping is evaluating a potential project such that the cash flow effect from the change in net

working capital (NWC) is expected to be $20 at time 2 and the level of net working capital is expected to

be $80 at time 2. What is the level of current assets for the project expected to be at time 1 if the level of

current liabilities for the project is expected to be $230 at time 1?

15. Erie Shipping is evaluating a potential project such that the cash flow effect from the change in net

working capital (NWC) is expected to be -$40 at time 2 and the level of net working capital is expected to

be $80 at time 2. What is the level of current assets for the project expected to be at time 1 if the level of

current liabilities for the project is expected to be $320 at time 1?

15. Erie Shipping is evaluating a potential project such that the cash flow effect from the change in net

working capital (NWC) is expected to be $40 at time 2 and the level of net working capital is expected to

be $80 at time 2. What is the level of current assets for the project expected to be at time 1 if the level of

current liabilities for the project is expected to be $320 at time 1?

15

FNAN 301, Spring 2012, final, solutions

OCF of 2 years using MACRS

16. Erie Shipping is evaluating a project that would require an initial investment in equipment of

$800,000 and is expected to be in operation for 4 years. MACRS depreciation would be used

with a three-year schedule where the depreciation rates in years 1, 2, 3, and 4 are 33.33%,

44.44%, 14.82%, and 7.41%, respectively. For each year of the project, Erie Shipping expects

relevant, incremental revenue associated with the project to be $158,000 and relevant,

incremental costs associated with the project to be $74,000. The tax rate is 25 percent. What is

(X plus Y) if X is the relevant operating cash flow (OCF) associated with the project expected in

year 2 of the project and Y is the relevant OCF associated with the project expected in year 4 of

the project?

16. Erie Shipping is evaluating a project that would require an initial investment in equipment of

$800,000 and is expected to be in operation for 4 years. MACRS depreciation would be used

with a three-year schedule where the depreciation rates in years 1, 2, 3, and 4 are 33.33%,

44.44%, 14.82%, and 7.41%, respectively. For each year of the project, Erie Shipping expects

relevant, incremental revenue associated with the project to be $185,000 and relevant,

incremental costs associated with the project to be $49,000. The tax rate is 25 percent. What is

(X plus Y) if X is the relevant operating cash flow (OCF) associated with the project expected in

year 2 of the project and Y is the relevant OCF associated with the project expected in year 4 of

the project?

16. Erie Shipping is evaluating a project that would require an initial investment in equipment of

$800,000 and is expected to be in operation for 4 years. MACRS depreciation would be used

with a three-year schedule where the depreciation rates in years 1, 2, 3, and 4 are 33.33%,

44.44%, 14.82%, and 7.41%, respectively. For each year of the project, Erie Shipping expects

relevant, incremental revenue associated with the project to be $194,000 and relevant,

incremental costs associated with the project to be $75,000. The tax rate is 25 percent. What is

(X plus Y) if X is the relevant operating cash flow (OCF) associated with the project expected in

year 2 of the project and Y is the relevant OCF associated with the project expected in year 4 of

the project?

16. Erie Shipping is evaluating a project that would require an initial investment in equipment of

$800,000 and is expected to be in operation for 4 years. MACRS depreciation would be used

with a three-year schedule where the depreciation rates in years 1, 2, 3, and 4 are 33.33%,

44.44%, 14.82%, and 7.41%, respectively. For each year of the project, Erie Shipping expects

relevant, incremental revenue associated with the project to be $187,000 and relevant,

incremental costs associated with the project to be $42,000. The tax rate is 25 percent. What is

(X plus Y) if X is the relevant operating cash flow (OCF) associated with the project expected in

year 2 of the project and Y is the relevant OCF associated with the project expected in year 4 of

the project?

16

FNAN 301, Spring 2012, final, solutions

Get geometric from arithmetic and all but one return

17. A stock had returns of 17%, -24%, and 13% in each of the past three years. Over the past

four years, the arithmetic average annual return for the stock was 6.5%. What was the geometric

return for the stock over the past four years?

A. A rate less than 4.00% or a rate greater than or equal to 8.00%

B. A rate equal to or greater than 4.00% but less than 5.00%

C. A rate equal to or greater than 5.00% but less than 6.00%

D. A rate equal to or greater than 6.00% but less than 7.00%

E. A rate equal to or greater than 7.00% but less than 8.00%

17. A stock had returns of 24%, -17%, and 13% in each of the past three years. Over the past

four years, the arithmetic average annual return for the stock was 6.5%. What was the geometric

return for the stock over the past four years?

A. A rate less than 4.00% or a rate greater than or equal to 8.00%

B. A rate equal to or greater than 4.00% but less than 5.00%

C. A rate equal to or greater than 5.00% but less than 6.00%

D. A rate equal to or greater than 6.00% but less than 7.00%

E. A rate equal to or greater than 7.00% but less than 8.00%

17. A stock had returns of 17%, -24%, and 13% in each of the past three years. Over the past

four years, the arithmetic average annual return for the stock was 8.5%. What was the geometric

return for the stock over the past four years?

A. A rate less than 4.00% or a rate greater than or equal to 8.00%

B. A rate equal to or greater than 4.00% but less than 5.00%

C. A rate equal to or greater than 5.00% but less than 6.00%

D. A rate equal to or greater than 6.00% but less than 7.00%

E. A rate equal to or greater than 7.00% but less than 8.00%

17. A stock had returns of 24%, -17%, and 13% in each of the past three years. Over the past

four years, the arithmetic average annual return for the stock was 8.5%. What was the geometric

return for the stock over the past four years?

A. A rate less than 4.00% or a rate greater than or equal to 8.00%

B. A rate equal to or greater than 4.00% but less than 5.00%

C. A rate equal to or greater than 5.00% but less than 6.00%

D. A rate equal to or greater than 6.00% but less than 7.00%

E. A rate equal to or greater than 7.00% but less than 8.00%

17

FNAN 301, Spring 2012, final, solutions

Get expected SD from 2 states and P0, D1, and P1 in those states

18. Shares of Erie Shipping are currently priced at $16.00 per share. The following table indicates what

could happen with the Erie Shipping stock price and dividend per share over the next year. What is the

expected standard deviation of Erie Shipping stocks returns?

Probability of Price of Erie Shipping stock Dividend paid by Erie Shipping

Outcome

outcome

in 1 year

in 1 year

Good

.2

$25.70

$1.50

Bad

.8

$14.55

$0.25

A. A rate less than 27.0% or a rate greater than or equal to 45.0%

B. A rate equal to or greater than 27.0% but less than 32.0%

C. A rate equal to or greater than 32.0% but less than 36.0%

D. A rate equal to or greater than 36.0% but less than 40.0%

E. A rate equal to or greater than 40.0% but less than 45.0%

18. Shares of Erie Shipping are currently priced at $16.00 per share. The following table indicates what

could happen with the Erie Shipping stock price and dividend per share over the next year. What is the

expected standard deviation of Erie Shipping stocks returns?

Probability of Price of Erie Shipping stock Dividend paid by Erie Shipping

Outcome

outcome

in 1 year

in 1 year

Good

.2

$26.20

$1.80

Bad

.8

$12.95

$0.25

A. A rate less than 27.0% or a rate greater than or equal to 45.0%

B. A rate equal to or greater than 27.0% but less than 32.0%

C. A rate equal to or greater than 32.0% but less than 36.0%

D. A rate equal to or greater than 36.0% but less than 40.0%

E. A rate equal to or greater than 40.0% but less than 45.0%

18. Shares of Erie Shipping are currently priced at $16.00 per share. The following table indicates what

could happen with the Erie Shipping stock price and dividend per share over the next year. What is the

expected standard deviation of Erie Shipping stocks returns?

Probability of Price of Erie Shipping stock Dividend paid by Erie Shipping

Outcome

outcome

in 1 year

in 1 year

Good

.2

$25.70

$1.50

Bad

.8

$13.75

$0.25

A. A rate less than 27.0% or a rate greater than or equal to 45.0%

B. A rate equal to or greater than 27.0% but less than 32.0%

C. A rate equal to or greater than 32.0% but less than 36.0%

D. A rate equal to or greater than 36.0% but less than 40.0%

E. A rate equal to or greater than 40.0% but less than 45.0%

18. Shares of Erie Shipping are currently priced at $16.00 per share. The following table indicates what

could happen with the Erie Shipping stock price and dividend per share over the next year. What is the

expected standard deviation of Erie Shipping stocks returns?

Probability of Price of Erie Shipping stock Dividend paid by Erie Shipping

Outcome

outcome

in 1 year

in 1 year

Good

.2

$26.20

$1.80

Bad

.8

$14.55

$0.25

A. A rate less than 27.0% or a rate greater than or equal to 45.0%

B. A rate equal to or greater than 27.0% but less than 32.0%

C. A rate equal to or greater than 32.0% but less than 36.0%

D. A rate equal to or greater than 36.0% but less than 40.0%

E. A rate equal to or greater than 40.0% but less than 45.0%

18

FNAN 301, Spring 2012, final, solutions

Conceptual: insider trading and ethics

19. According to the class overheads and basic ethics, which one of the following assertions

about insider trading, which is against the law, is true?

A. Insider trading is illegal and should not be considered as a potential approach to investing

B. Insider trading is illegal and should be considered as a potential approach to investing

C. Insider trading is legal and should not be considered as a potential approach to investing

D. Insider trading is legal and should be considered as a potential approach to investing

19

FNAN 301, Spring 2012, final, solutions

Conceptual: portfolio unsystematic and individual stock systematic risk

20. Which assertion about statement 1 and statement 2 is true?

Statement 1: A well-diversified portfolio with a beta of zero has the same amount of

unsystematic risk as the risk-free asset

Statement 2: If Royal Royale Inc. common stock has a beta of 0.75, then the company is more

likely to own and operate grocery stores than jewelry stores.

A. Statement 1 is true and statement 2 is true

B. Statement 1 is true and statement 2 is false

C. Statement 1 is false and statement 2 is true

D. Statement 1 is false and statement 2 is false

20. Which assertion about statement 1 and statement 2 is true?

Statement 1: A well-diversified portfolio with a beta of zero has the same amount of

unsystematic risk as the risk-free asset

Statement 2: If Royal Royale Inc. common stock has a beta of 0.75, then the company is more

likely to own and operate jewelry stores than grocery stores.

A. Statement 1 is true and statement 2 is true

B. Statement 1 is true and statement 2 is false

C. Statement 1 is false and statement 2 is true

D. Statement 1 is false and statement 2 is false

20. Which assertion about statement 1 and statement 2 is true?

Statement 1: A well-diversified portfolio with a beta of zero does not have the same amount of

unsystematic risk as the risk-free asset

Statement 2: If Royal Royale Inc. common stock has a beta of 0.75, then the company is more

likely to own and operate grocery stores than jewelry stores.

A. Statement 1 is true and statement 2 is true

B. Statement 1 is true and statement 2 is false

C. Statement 1 is false and statement 2 is true

D. Statement 1 is false and statement 2 is false

20. Which assertion about statement 1 and statement 2 is true?

Statement 1: A well-diversified portfolio with a beta of zero does not have the same amount of

unsystematic risk as the risk-free asset

Statement 2: If Royal Royale Inc. common stock has a beta of 0.75, then the company is more

likely to own and operate jewelry stores than grocery stores.

A. Statement 1 is true and statement 2 is true

B. Statement 1 is true and statement 2 is false

C. Statement 1 is false and statement 2 is true

D. Statement 1 is false and statement 2 is false

20

FNAN 301, Spring 2012, final, solutions

Find value of one portfolio component from value of other and all betas

21. Georgia owns 800 shares of Erie Shipping stock priced at $12 per share and some Treasury

bills. Erie Shipping stock has a beta of 0.8 and her portfolio has a beta of 0.5. What is the value

of Georgias holdings in Treasury bills?

A. An amount less than $5,000 or an amount greater than or equal to $9,000

B. An amount equal to or greater than $5,000 but less than $6,000

C. An amount equal to or greater than $6,000 but less than $7,000

D. An amount equal to or greater than $7,000 but less than $8,000

E. An amount equal to or greater than $8,000 but less than $9,000

21. Georgia owns 900 shares of Erie Shipping stock priced at $12 per share and some Treasury

bills. Erie Shipping stock has a beta of 0.8 and her portfolio has a beta of 0.5. What is the value

of Georgias holdings in Treasury bills?

A. An amount less than $5,000 or an amount greater than or equal to $9,000

B. An amount equal to or greater than $5,000 but less than $6,000

C. An amount equal to or greater than $6,000 but less than $7,000

D. An amount equal to or greater than $7,000 but less than $8,000

E. An amount equal to or greater than $8,000 but less than $9,000

21. Georgia owns 800 shares of Erie Shipping stock priced at $16 per share and some Treasury

bills. Erie Shipping stock has a beta of 0.8 and her portfolio has a beta of 0.5. What is the value

of Georgias holdings in Treasury bills?

A. An amount less than $5,000 or an amount greater than or equal to $9,000

B. An amount equal to or greater than $5,000 but less than $6,000

C. An amount equal to or greater than $6,000 but less than $7,000

D. An amount equal to or greater than $7,000 but less than $8,000

E. An amount equal to or greater than $8,000 but less than $9,000

21. Georgia owns 900 shares of Erie Shipping stock priced at $16 per share and some Treasury

bills. Erie Shipping stock has a beta of 0.8 and her portfolio has a beta of 0.5. What is the value

of Georgias holdings in Treasury bills?

A. An amount less than $5,000 or an amount greater than or equal to $9,000

B. An amount equal to or greater than $5,000 but less than $6,000

C. An amount equal to or greater than $6,000 but less than $7,000

D. An amount equal to or greater than $7,000 but less than $8,000

E. An amount equal to or greater than $8,000 but less than $9,000

21

FNAN 301, Spring 2012, final, solutions

Conceptual: expected return is positively related to beta

22. The expected return on the market is greater than the risk-free rate, which is greater than zero. Based

on the information in the table and in this paragraph, which stock is most likely to have the highest

expected return?

Geometric average Arithmetic average

Standard

annual return over annual return over

deviation of

Stock

the past 15 years

the past 15 years

Share price

Beta

returns

A

21%

29%

$5.65

0.87

12%

B

14%

26%

$4.25

1.28

21%

C

-19%

-12%

$7.25

0.64

32%

D

-11%

-4%

$6.55

1.16

22%

E

-25%

-16%

$3.45

0.72

36%

22. The expected return on the market is greater than the risk-free rate, which is greater than zero. Based

on the information in the table and in this paragraph, which stock is most likely to have the highest

expected return?

Geometric average Arithmetic average

Standard

annual return over annual return over

deviation of

Stock

the past 15 years

the past 15 years

Share price

Beta

returns

A

14%

26%

$4.25

1.45

26%

B

-19%

-13%

$5.65

0.66

31%

C

-11%

-3%

$6.55

1.57

22%

D

-25%

-17%

$5.65

0.79

35%

E

23%

29%

$3.45

0.84

13%

22. The expected return on the market is greater than the risk-free rate, which is greater than zero. Based

on the information in the table and in this paragraph, which stock is most likely to have the highest

expected return?

Geometric average Arithmetic average

Standard

annual return over annual return over

deviation of

Stock

the past 15 years

the past 15 years

Share price

Beta

returns

A

21%

27%

$4.25

0.82

12%

B

14%

26%

$3.45

1.28

17%

C

-19%

-13%

$7.25

0.64

32%

D

-11%

-3%

$5.65

1.45

21%

E

-25%

-17%

$6.55

0.77

36%

22. The expected return on the market is greater than the risk-free rate, which is greater than zero. Based

on the information in the table and in this paragraph, which stock is most likely to have the highest

expected return?

Geometric average Arithmetic average

Standard

annual return over annual return over

deviation of

Stock

the past 15 years

the past 15 years

Share price

Beta

returns

A

-25%

-17%

$5.65

0.82

21%

B

23%

29%

$6.55

0.99

13%

C

14%

26%

$7.25

1.29

26%

D

-19%

-13%

$3.45

0.57

35%

E

-11%

-3%

$4.25

1.37

19%

22

FNAN 301, Spring 2012, final, solutions

Find P1 from P0 and D1 after finding R from CAPM

23. Erie Shipping stock is currently priced at $23.50 per share and is expected to pay its next

dividend, which is expected to be $1.39, in 1 year. The stock has a beta of 0.75. The market has

an expected return of 19.0% and the risk-free rate is 7.0%. What is the stock price of Erie

Shipping expected to be in 1 year?

23. Erie Shipping stock is currently priced at $25.20 per share and is expected to pay its next

dividend, which is expected to be $1.39, in 1 year. The stock has a beta of 0.75. The market has

an expected return of 19.0% and the risk-free rate is 7.0%. What is the stock price of Erie

Shipping expected to be in 1 year?

23. Erie Shipping stock is currently priced at $23.50 per share and is expected to pay its next

dividend, which is expected to be $1.93, in 1 year. The stock has a beta of 0.75. The market has

an expected return of 17.0% and the risk-free rate is 5.0%. What is the stock price of Erie

Shipping expected to be in 1 year?

23. Erie Shipping stock is currently priced at $25.20 per share and is expected to pay its next

dividend, which is expected to be $1.93, in 1 year. The stock has a beta of 0.75. The market has

an expected return of 17.0% and the risk-free rate is 5.0%. What is the stock price of Erie

Shipping expected to be in 1 year?

Compute WACC with 2 items after finding YTM

24. Erie Shipping has 3,000,000 shares of common equity outstanding that have an expected return

of 15.40% and a current price of $15.00 each. Erie Shipping has issued 100,000 bonds with a face

value of $1,000, a market value of $850.00 each, an annual coupon rate of 8.60%, a current yield

of 10.12%, and that pay annual coupons with the next one due in 1 year. The bonds mature in 12

years. If the tax rate is 40%, what is the weighted-average cost of capital for Erie Shipping?

24. Erie Shipping has 3,000,000 shares of common equity outstanding that have an expected return

of 14.60% and a current price of $15.00 each. Erie Shipping has issued 100,000 bonds with a face

value of $1,000, a market value of $850.00 each, an annual coupon rate of 8.60%, a current yield

of 10.12%, and that pay annual coupons with the next one due in 1 year. The bonds mature in 12

years. If the tax rate is 40%, what is the weighted-average cost of capital for Erie Shipping?

24. Erie Shipping has 3,000,000 shares of common equity outstanding that have an expected return

of 15.40% and a current price of $15.00 each. Erie Shipping has issued 100,000 bonds with a face

value of $1,000, a market value of $850.00 each, an annual coupon rate of 6.40%, a current yield

of 10.12%, and that pay annual coupons with the next one due in 1 year. The bonds mature in 12

years. If the tax rate is 40%, what is the weighted-average cost of capital for Erie Shipping?

24. Erie Shipping has 3,000,000 shares of common equity outstanding that have an expected return

of 14.60% and a current price of $15.00 each. Erie Shipping has issued 100,000 bonds with a face

value of $1,000, a market value of $850.00 each, an annual coupon rate of 6.40%, a current yield

of 10.12%, and that pay annual coupons with the next one due in 1 year. The bonds mature in 12

years. If the tax rate is 40%, what is the weighted-average cost of capital for Erie Shipping?

23

FNAN 301, Spring 2012, final, solutions

Conceptual: appropriate project cost of capital from pure play and subjective approaches

25. Which assertion about statement 1 and statement 2 is true?

Statement 1: If Erie Shipping has a weighted-average cost of capital of 11.1% and is evaluating project

Z, which is a potential project that is more risky than the average-risk project at Erie Shipping, then

12.4% could be the appropriate cost of capital for Erie Shipping to use to evaluate project Z.

Statement 2: Based on the information in the following table and applying the pure play approach to

determining a projects cost of capital, 9.1% is more appropriate than both 11.1% and 13.1% for Erie

Shipping, which is a company that transports goods in ships across oceans, to use as the cost of capital

for evaluating project X, which is a potential project that would involve transporting goods in trains

over railroad tracks. Note that this statement is true if 9.1% is a more appropriate cost of capital for

project X than 11.1% and if 9.1% is also a more appropriate cost of capital for project X than 13.1%.

The statement is not true if 11.1% is a more appropriate cost of capital for project X than 9.1% or if

13.1% is a more appropriate cost of capital for project X than 9.1% or if both 11.1% and 13.1% are

more appropriate costs of capital for project X than 9.1%.

Firm

Line of business

WACC

Erie Shipping

Transports goods in ships across oceans

11.1 percent

Thomas Shipping

Transports goods in trains over railroad tracks

9.1 percent

Diversified Shipping

Transports goods in ships, trains, trucks, and airplanes

13.1 percent

A. Statement 1 is false and statement 2 is false

B. Statement 1 is false and statement 2 is true

C. Statement 1 is true and statement 2 is false

D. Statement 1 is true and statement 2 is true

25. Which assertion about statement 1 and statement 2 is true?

Statement 1: Based on the information in the following table and applying the pure play approach to

determining a projects cost of capital, 11.1% is more appropriate than both 9.1% and 13.1% for Erie

Shipping, which is a company that transports goods in ships across oceans, to use as the cost of capital

for evaluating project X, which is a potential project that would involve transporting goods in trains

over railroad tracks. Note that this statement is true if 11.1% is a more appropriate cost of capital for

project X than 9.1% and if 11.1% is also a more appropriate cost of capital for project X than 13.1%.

The statement is not true if 9.1% is a more appropriate cost of capital for project X than 11.1% or if

13.1% is a more appropriate cost of capital for project X than 11.1% or if both 9.1% and 13.1% are

more appropriate costs of capital for project X than 11.1%.

Firm

Line of business

WACC

Erie Shipping

Transports goods in ships across oceans

9.1 percent

Thomas Shipping

Transports goods in trains over railroad tracks

11.1 percent

Diversified Shipping

Transports goods in ships, trains, trucks, and airplanes

13.1 percent

Statement 2: If Erie Shipping has a weighted-average cost of capital of 9.1% and is evaluating project

Z, which is a potential project that is more risky than the average-risk project at Erie Shipping, then

10.7% could be the appropriate cost of capital for Erie Shipping to use to evaluate project Z.

A. Statement 1 is true and statement 2 is true

B. Statement 1 is true and statement 2 is false

C. Statement 1 is false and statement 2 is true

D. Statement 1 is false and statement 2 is false

24

FNAN 301, Spring 2012, final, solutions

25. Which assertion about statement 1 and statement 2 is true?

Statement 1: If Erie Shipping has a weighted-average cost of capital of 13.1% and is evaluating project

Z, which is a potential project that is more risky than the average-risk project at Erie Shipping, then

12.4% could be the appropriate cost of capital for Erie Shipping to use to evaluate project Z.

Statement 2: Based on the information in the following table and applying the pure play approach to

determining a projects cost of capital, 11.1% is more appropriate than both 9.1% and 13.1% for Erie

Shipping, which is a company that transports goods in ships across oceans, to use as the cost of capital

for evaluating project X, which is a potential project that would involve transporting goods in trains

over railroad tracks. Note that this statement is true if 11.1% is a more appropriate cost of capital for

project X than 13.1% and if 11.1% is also a more appropriate cost of capital for project X than 9.1%.

The statement is not true if 13.1% is a more appropriate cost of capital for project X than 11.1% or if

9.1% is a more appropriate cost of capital for project X than 11.1% or if both 13.1% and 9.1% are more

appropriate costs of capital for project X than 11.1%.

Firm

Line of business

WACC

Erie Shipping

Transports goods in ships across oceans

13.1 percent

Thomas Shipping

Transports goods in trains over railroad tracks

11.1 percent

Diversified Shipping

Transports goods in ships, trains, trucks, and airplanes

9.1 percent

A. Statement 1 is true and statement 2 is true

B. Statement 1 is true and statement 2 is false

C. Statement 1 is false and statement 2 is true

D. Statement 1 is false and statement 2 is false

25. Which assertion about statement 1 and statement 2 is true?

Statement 1: Based on the information in the following table and applying the pure play approach to

determining a projects cost of capital, 13.1% is more appropriate than both 9.1% and 11.1% for Erie

Shipping, which is a company that transports goods in ships across oceans, to use as the cost of capital

for evaluating project X, which is a potential project that would involve transporting goods in trains

over railroad tracks. . Note that this statement is true if 13.1% is a more appropriate cost of capital for

project X than 11.1% and if 13.1% is also a more appropriate cost of capital for project X than 9.1%.

The statement is not true if 11.1% is a more appropriate cost of capital for project X than 13.1% or if

9.1% is a more appropriate cost of capital for project X than 13.1% or if both 11.1% and 9.1% are more

appropriate costs of capital for project X than 13.1%.

Firm

Line of business

WACC

Erie Shipping

Transports goods in ships across oceans

11.1 percent

Thomas Shipping

Transports goods in trains over railroad tracks

13.1 percent

Diversified Shipping

Transports goods in ships, trains, trucks, and airplanes

9.1 percent

Statement 2: If Erie Shipping has a weighted-average cost of capital of 11.1% and is evaluating project

Z, which is a potential project that is more risky than the average-risk project at Erie Shipping, then

10.7% could be the appropriate cost of capital for Erie Shipping to use to evaluate project Z.

A. Statement 1 is true and statement 2 is true

B. Statement 1 is true and statement 2 is false

C. Statement 1 is false and statement 2 is true

D. Statement 1 is false and statement 2 is false

25

FNAN 301, Spring 2012, final, solutions

Find PV of one investment to find value of other and then when other makes single CF

1. Georgia owns two investments, A and B, that have a combined total value of $38,000.

Investment A is expected to pay $23,000 in 5 years from today and has an expected return of 4.6

percent per year. Investment B is expected to pay $32,000 in T years from today and has an

expected return of 6.4 percent per year. What is T, the number of years from today that

investment B is expected to pay $32,000?

A. A number less than 7.50 or a number greater than 10.50

B. A number equal to or greater than 7.50 but less than 8.30

C. A number equal to or greater than 8.30 but less than 9.00

D. A number equal to or greater than 9.00 but less than 9.80

E. A number equal to or greater than 9.80 but less than 10.50

To solve:

1) Find the value of investment A

2) Find the value of investment B as the combined value of both A and B minus the value of A

3) Find T, the number of years from today that investment B is expected to pay $32,000

1) Find the value of investment A