Professional Documents

Culture Documents

CFR Report Dabur 2 Page PDF

Uploaded by

Gautam BaruaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CFR Report Dabur 2 Page PDF

Uploaded by

Gautam BaruaCopyright:

Available Formats

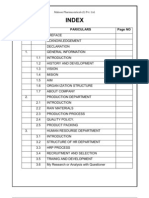

Corporate Financial Reporting & Analysis

Project Report

Financial Analysis of Dabur India Limited

Submitted By:

Vivek Jain

Shavir Bansal

Shubham Gupta

Vikram Anand

Udit Chandana

(Section F)

0404/51

0337/51

0347/51

0393/51

0381/51

DABUR FINANCIAL HIGHLIGHTS

BALANCE SHEET

BALANCE SHEET

MAR'14

MAR'13

MAR'12

MAR'11

MAR'10

Shareholder's Funds

Total Non-Current

Liabilities

Total Current

Liabilities

Total Equity &

Liability

ASSETS

Total Non-Current

Assets

19023.4

15656.1

13032.7

11011.6

7493.8

3555.1

3470.3

3910.9

3829.1

1219.2

11413.8

12441.1

11473.8

9238.4

8721.6

33992.3

31567.5

28417.4

24079.1

17434.6

14246.8

12186.2

11273.2

10105.9

5729.1

Total Current Assets

19745.5

19381.3

16605.9

13973.2

11678.1

Industry Outlook

Dabur has shown consistent performance in the last 5 years. It has

been able to build on its performance steadily with rapid growth in

the shareholders growth and total assets. Its market capitalization

has almost tripled and the share price has almost quadrupled in 5

years which is a phenomenal performance.

In 2010, Dabur undertook its 4 year plan up to 2014, which aimed

at doubling its consolidate Sales Revenue to INR 70,000M. Driven

by its Project Double, it was able to successfully surpass this target

in fiscal year ending 14. The rural outreach has spanned across

approximately 38000 villages from a lowly 14000 villages in 2009

INCOME STATEMENT

MAR'14

P&L Statement

MAR'13

MAR'12

MAR'11

MAR'10

Net Sales

48700.8

43493.9

37575.4

32806.1

28559.6

Total Expenditure

40443.6

36265

31279.3

26609.7

23251.7

PBIDT (Excl OI)

8257.2

7228.9

6296.1

6196.4

5307.9

Operating Profit

9352.9

8171.2

6847.5

6459.9

5724.3

Profit Before Tax

8613.3

7496.7

5870.3

5962.6

5270.3

6721

5909.8

4632.4

4714.1

4333.3

BASIC

3.85

3.39

2.66

2.71

2.5

DILUTED

3.83

3.37

2.64

2.69

2.49

MAR'13

MAR'12

MAR'11

861.33

749.67

631.92

596.26

527.03

715.21

702.55

520.12

351.54

499.59

-101.41

-343.11

-218.58

-228.82

-259.65

-534.85

-327.77

-232.66

-94.22

-227.87

78.95

31.67

68.88

28.5

12.07

67.39

35.72

192.41

163.91

151.84

143.36

64.59

261.29

192.41

163.91

Profit After Tax

Earnings / share

Accounting Policies

Depreciation on Fixed Assets has been provided on straight

line method

Inventories are valued on the weighted Average Cost method

of accounting to make sure that none of the values are over or

under stated

In 2012, fixed Assets purchased for less than Rs. 5000 were

depreciated at the rate of 100% while in 2013, fixed Assets

purchased for less than 0.05 were depreciated at the rate of

100%. In 2014, fixed assets purchased for less than 0.0005

were depreciated at the rate of 100%.

CASH FLOW STATEMENT

Parameters

Net Profit Before

Taxes

Cash Flow from

operating activities

Cash Flow from

investing activities

Cash Flow from

financing activities

Net cash and cash

equivalents

Opening Cash & Cash

Equivalents

Closing Cash & Cash

Equivalent

MAR'14

Interpretation of Balance sheet & Income statement

MAR'10

Shareholder funds have seen a continuous rise from INR 7494M

to INR 19023M- driven by a substantial growth in the Reserves

& Surplus account

Value of its secured or unsecured loan is close to 0- indicates the

firms strong financial position as they rely on equity and not

liability to finance their assets

Standalone Net Sales for the firm have grown staggeringly from

INR 28559M to INR 48700M

PAT fell for the financial year Mar 12 from INR 4714M to INR

4632M -can be explained from rise in the raw material prices

Interpretation of Financial Statements

Cash Flow from operating activity has always been able to overpower its negative effect

Repayment of Short Term Loans increased from INR 481M to INR 1918M. -not a good sign as company might be holding up the payment to its

creditors for some time

Trade Receivables has increased by INR 524.7M suggesting that the firm has increased its credit sales over the past year

depreciation has increased constantly in sync with the increase in assets, and does not reflect the non-uniform distribution of a Written Down

Value method

Dabur & Competitors

1000

800

600

Other

Income

Profit After

Tax

Operating

Profit

400

200

0

Total

Expenditure

Net Sales

120.00%

100.00%

80.00%

60.00%

40.00%

20.00%

0.00%

Net Sales

Daburs liquidity ratios quick (1.73) and current (0.81) stand better to its

competitors of Marico & Godrej -reflects strong cash position

Though companys equity has grown substantially by over 150%, primarily

fuelled by the increases in Reserves & Surplus account, growth for Maricos

and Godrejs equity account has been close to the tune of 250%. Thus

Daburs growth has been slightly sluggish with comparison to the industry

When compared to Marico, we see a stark difference in Daburs NonCurrent Liability account.

The growth in total assets owned by Dabur has been significantly lower

(93%) as compared to Marico (166%) and Godrej (344%). Though Godrejs

increase in assets has in turn substantially increased its liability account,

Dabur still is far behind its other competitor Marico

Daburs FLM has fallen to 1.8 in March 14 which clearly indicates the

managements ideology on focusing growth driven by equity rather than

liability

Total

Expenditure

Operating

Profit

Profit After

Tax

Daburs Performance

Net Sales for Dabur grew by 70% from 10 levels as compared to 80% for

Marico and 220% for Godrej.

Total expenditure for Dabur as a percentage of its revenue (~80%) falls

somewhere in between that of Marico (84%) and Godrej (77%)

80.00%

Total Current

Liabilities

60.00%

40.00%

Total NonCurrent

Liabilities

20.00%

Shareholder's

Funds

Total NonCurrent

Assets

0.00%

5 year average profit margin for Dabur is lower than both Marico and Godrej.

This is possibly because it did not increase its product price in tandem with

the increase in expenses and thus lost out on the margins

Though the profit margins for Dabur is lower than Marico and Godrej, its

EBIDTA as a proportion of its Sales is higher than both the competitors,

indicating that the apparent bottom line is affected a lot by exceptional

income and losses. It can thus be concluded that Dabur has a less volatile

and reliable bottom line as compared to Godrej

Conclusion

Dabur has shown impressive

performance over the past 5years with

consolidated net sales doubling to INR

7,000 Cr. It boasts of a strong liquidity

position with both its current and quick

asset ratios standing at a healthy 1.7

and 0.8 respectively. However, its profit

margins are lower than the major

competitor Godrej. It has tried to improve

upon its leverage with focusing more on

equity financing than liability financing.

According to us, Dabur has been slightly

over-cautious in its approach. It can go

on an aggressive path with more

expansion and portfolio enlargement,

improving its overall margins and ROE

Financial Strengths & Weaknesses

In the last 5 years, Dabur has ensured low debt to equity ratio and

brought it down every year. It is also the lowest among its

competitors ensuring more stability.

In the last 5 years, Dabur has successfully increased its Interest

Coverage Ratio to 45 from 40 and this has been almost double as

compared to its competitor Godrej and Marico

Another of Daburs strength is his efficient employment of its current

assets and over the years course it has ensured marginal increase in

current asset turnover every year

One of the areas of concerns for Dabur are its profitability ratios

which has been constant over the five years (Gross Profit Margin

0.168, Operating Profit 0.190 and Profit Margin 0.136). Though these

are healthy but could be improved.

From an investor point of view, Daburs EPS is lowest among the

three (3.85 as compared to 16.59 of Godrej and 8.95 of Marico), As

company has been able to increase sales consistently and the stock

gave 5 year long term 280% return , company can afford to go for

increasing EPS

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- LIC plans major shakeup of Escorts boardDocument6 pagesLIC plans major shakeup of Escorts boardqubrex1No ratings yet

- Cambridge International Examinations Cambridge International General Certificate of Secondary EducationDocument20 pagesCambridge International Examinations Cambridge International General Certificate of Secondary EducationAung Zaw HtweNo ratings yet

- Bangladesh's Net Financial Account, Capital Flows, Balance of Payments and Trade Deficit Trends from 2014-2020Document4 pagesBangladesh's Net Financial Account, Capital Flows, Balance of Payments and Trade Deficit Trends from 2014-2020FahimHossainNitolNo ratings yet

- Partnership Agreement Investment BreakdownDocument13 pagesPartnership Agreement Investment BreakdownSlamet S89% (9)

- Financial ManagementDocument96 pagesFinancial ManagementAngelaMariePeñarandaNo ratings yet

- Ap Workbook PDFDocument44 pagesAp Workbook PDFLovely Jay AbanganNo ratings yet

- Financial Behavior Amongst Undergraduate Students With and Without Financial Education: A Case Among University Malaysia Sabah UndergradesDocument15 pagesFinancial Behavior Amongst Undergraduate Students With and Without Financial Education: A Case Among University Malaysia Sabah UndergradesNajmi AimanNo ratings yet

- EFU Life Insurance Group ReportDocument20 pagesEFU Life Insurance Group ReportZawar Afzal Khan0% (1)

- BRM ProjectDocument23 pagesBRM ProjectimaalNo ratings yet

- Reformulated Chatbot Framework: 1. Account ManagementDocument2 pagesReformulated Chatbot Framework: 1. Account Managementakash paulNo ratings yet

- DocxDocument352 pagesDocxsino akoNo ratings yet

- Strategic Cost ManagementDocument71 pagesStrategic Cost ManagementJamaica RumaNo ratings yet

- Auditing 2&3 Theories Reviewer CompilationDocument9 pagesAuditing 2&3 Theories Reviewer CompilationPaupauNo ratings yet

- Postgraduate Applicant Information (Int)Document4 pagesPostgraduate Applicant Information (Int)Simon lundaNo ratings yet

- Makaon Final2Document46 pagesMakaon Final2Keyur MehtaNo ratings yet

- Corporate Finance Assignment 1Document6 pagesCorporate Finance Assignment 1Kûnãl SälîañNo ratings yet

- Understanding LiabilitiesDocument2 pagesUnderstanding LiabilitiesXienaNo ratings yet

- Iibf BcsbiDocument6 pagesIibf BcsbivikramNo ratings yet

- Reviewing The Ambit of Control' Apropos To The Objective of Mandatory Bids': An Analysis Under The Takeover RegulationsDocument32 pagesReviewing The Ambit of Control' Apropos To The Objective of Mandatory Bids': An Analysis Under The Takeover Regulationsyarramsetty geethanjaliNo ratings yet

- Pertemuan 6 - Financial AnalysisDocument35 pagesPertemuan 6 - Financial Analysisdyah ayu kusuma wardhaniNo ratings yet

- Actuarial and Technical Aspects of TakafulDocument22 pagesActuarial and Technical Aspects of TakafulCck CckweiNo ratings yet

- Chapter 18 Government GrantsDocument6 pagesChapter 18 Government Grantsalexandra rausaNo ratings yet

- Lembar Jawaban Pt. CahayaDocument16 pagesLembar Jawaban Pt. CahayaAnii AstutiNo ratings yet

- Micro-Finance Management & Critical Analysis in IndiaDocument47 pagesMicro-Finance Management & Critical Analysis in IndiaSABUJ GHOSH100% (1)

- Employee Stock Option PlanDocument7 pagesEmployee Stock Option Plankrupalee100% (1)

- LMT MercDocument128 pagesLMT MercCj GarciaNo ratings yet

- What Is Microfinance and What Does It PromiseDocument16 pagesWhat Is Microfinance and What Does It PromiseZahid BhatNo ratings yet

- Uganda Ecumenical Church Loan Fund LTD V Mary FlorDocument3 pagesUganda Ecumenical Church Loan Fund LTD V Mary FlorReal TrekstarNo ratings yet

- AR PresentationDocument32 pagesAR PresentationSaq IbNo ratings yet

- Credit Ratings in Insurance Regulation: The Missing Piece of Financial ReformDocument32 pagesCredit Ratings in Insurance Regulation: The Missing Piece of Financial ReformRishi KumarNo ratings yet