Professional Documents

Culture Documents

Cash Flow Diagrams

Uploaded by

Sachin SahooCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Flow Diagrams

Uploaded by

Sachin SahooCopyright:

Available Formats

Cash Flow Diagrams

A cash flow diagram is a pictorial representation of all cash inflows and outflows along a time

line. The time line is the horizontal scale, which is divided into time periods, usually in years.

Cash inflows and cash outflows are then located on the time-line in adherence to problem

specifications by drawing vertical lines above the axis and below the axis respectively.

A cash flow statement is not only concerned with the amount of the cash flows but also the

timing of the flows. Many cash flows are constructed with multiple time periods. For example, it

may list monthly cash inflows and outflows over a years time. It not only projects the cash

balance remaining at the end of the year but also the cash balance for each month.

Working capital is an important part of a cash flow analysis. It is defined as the amount of

money needed to facilitate business operations and transactions, and is calculated as current

assets (cash or near cash assets) less current liabilities (liabilities due during the upcoming

accounting period). Computing the amount of working capital gives you a quick analysis of the

liquidity of the business over the future accounting period. If working capital appears to be

sufficient, developing a cash flow budget may be not critical. But if working capital appears to

be insufficient, a cash flow budget may highlight liquidity problems that may occur during the

coming year.

In a nutshell, the cash flow statement is made up of 3 categories, namely operating activities,

investing activities and financing activities.

Operating activities These are revenue generating activities of the company, which normally

includes cash receipts from sale of goods and services, cash payments to suppliers for goods and

services and disposal gains and losses of fixed assets.

Investing activities These are activities that involve the acquisition and selling of fixed assets

(long termed assets like land, building or plant), cash receipts from the disposal of fixed assets

and cash payments to acquire fixed assets.

Financing activities These are activities, which change or impact the size and the composition

of owners capital. They include cash proceeds from issuing shares, or debt and payment of

dividends.

The importance of cash flow statement lies in the fact that it explains the changes in cash and

gives insight to the companys operating, investing and financial activities. Also, cash flow

statement will unveil the companys ability to generate cash to meet its short-term obligations,

thereby assessing if companys liquidity and solvency position is sound.

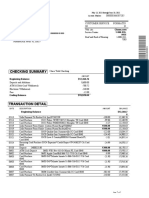

Cash Flow Diagram

upward arrows - positive cash flow (receiving the loan)

downward arrows - negative cash flow (pay off)

A cash flow statement is not only concerned with the amount of the cash flows but also the

timing of the flows. Many cash flows are constructed with multiple time periods. For example, it

may list monthly cash inflows and outflows over a years time. It not only projects the cash

balance remaining at the end of the year but also the cash balance for each month.

You might also like

- Cash Flow StatementsDocument57 pagesCash Flow StatementsMeka Raju Meka100% (2)

- Cashflow-Project-Sandhya Hema FullDocument71 pagesCashflow-Project-Sandhya Hema Fullkannan VenkatNo ratings yet

- Cash Flow Statement GuideDocument71 pagesCash Flow Statement Guidekannan Venkat100% (1)

- Cashflow-Project-Sandhya Hema FullDocument71 pagesCashflow-Project-Sandhya Hema Fullkannan VenkatNo ratings yet

- CASH FLOW STATEMENT ANALYSISDocument29 pagesCASH FLOW STATEMENT ANALYSISCASAQUIT, IRA LORAINENo ratings yet

- Cash Flow Analysis and StatementDocument127 pagesCash Flow Analysis and Statementsnhk679546100% (6)

- Cash Flow Statement ExplainedDocument45 pagesCash Flow Statement Explainedkannan VenkatNo ratings yet

- Cashflow Project SandhyaDocument71 pagesCashflow Project Sandhyatarun nemalipuriNo ratings yet

- Ch-5 Cash Flow AnalysisDocument9 pagesCh-5 Cash Flow AnalysisQiqi GenshinNo ratings yet

- Cash FlowsDocument1 pageCash FlowsgknindrasenanNo ratings yet

- Introduction to Cash Flow Statement: What is Cash Flow and How is it UsedDocument5 pagesIntroduction to Cash Flow Statement: What is Cash Flow and How is it UsedAyaz Raza100% (1)

- Understanding the Structure and Accounting of Cash Flow StatementsDocument4 pagesUnderstanding the Structure and Accounting of Cash Flow StatementsMalik JeeNo ratings yet

- Cash FlowDocument23 pagesCash FlowSundara BalamuruganNo ratings yet

- Cash Flow Note (19743)Document10 pagesCash Flow Note (19743)Abhimanyu Singh RaghavNo ratings yet

- Accounting For Managers ExtraDocument6 pagesAccounting For Managers ExtraNantha KumaranNo ratings yet

- Cash Flow StatementDocument9 pagesCash Flow StatementMUHAMMAD UMARNo ratings yet

- Acc201 Su6Document15 pagesAcc201 Su6Gwyneth LimNo ratings yet

- Cashflow Project+SandhyaDocument71 pagesCashflow Project+Sandhyaabdulkhaderjeelani1480% (5)

- Cash Flow and BudgetingDocument3 pagesCash Flow and BudgetingAdil MehmoodNo ratings yet

- Acc ContentDocument16 pagesAcc ContentSP SanjayNo ratings yet

- Summary Report - Group 2: Definition of TermsDocument8 pagesSummary Report - Group 2: Definition of TermsRigor Salonga BaldemosNo ratings yet

- Accounting FOR Managers: Vineetha Raj S1 MBADocument23 pagesAccounting FOR Managers: Vineetha Raj S1 MBAVinu VaviNo ratings yet

- Cash Flow GuideDocument50 pagesCash Flow GuideAnant AJNo ratings yet

- Finman Chapter 7 SummaryDocument2 pagesFinman Chapter 7 SummaryJoyce Anne Gevero CarreraNo ratings yet

- Cash Flow StatementDocument11 pagesCash Flow StatementAnonymous E0dOQEqIyNo ratings yet

- Fund Flow StatementDocument7 pagesFund Flow StatementVasviNo ratings yet

- Legal Tender: Understanding Cash FlowDocument6 pagesLegal Tender: Understanding Cash FlowDanica BalinasNo ratings yet

- Cash Flow Statement ExplainedDocument2 pagesCash Flow Statement ExplainedJMClosedNo ratings yet

- Fund Flow and Cash Flow AnalysisDocument20 pagesFund Flow and Cash Flow AnalysisThirumanas Kottarathil K RNo ratings yet

- The Cash Flow StatementDocument11 pagesThe Cash Flow StatementShubham ThakurNo ratings yet

- Chapter 7 Fund Flow StatementDocument37 pagesChapter 7 Fund Flow StatementMukesh Agarwal86% (7)

- What is a Cash Flow StatementDocument4 pagesWhat is a Cash Flow StatementketiNo ratings yet

- CH 15 --Narrative Report-Managing Working CapitalDocument12 pagesCH 15 --Narrative Report-Managing Working Capitaljomarybrequillo20No ratings yet

- Financial Statement Types ExplainedDocument3 pagesFinancial Statement Types ExplainedManas MohapatraNo ratings yet

- Cash Flow Statement ExplainedDocument23 pagesCash Flow Statement ExplainedAnant AJNo ratings yet

- Unit 4Document25 pagesUnit 4venkyNo ratings yet

- Account NewsDocument2 pagesAccount NewsdevachsNo ratings yet

- CFS PDFDocument50 pagesCFS PDFSubbu ..No ratings yet

- Receita KIWIFFDocument2 pagesReceita KIWIFFithallothallysdejesuslopesNo ratings yet

- Importance of Cash Flow StatementDocument2 pagesImportance of Cash Flow StatementMalik JeeNo ratings yet

- 4 Common Types of Financial Statements To Know: 1. What Is A Statmemt of Financial Position (Balance Sheets) ?Document15 pages4 Common Types of Financial Statements To Know: 1. What Is A Statmemt of Financial Position (Balance Sheets) ?Ray Allen Uy100% (1)

- Cash Flow StatementsDocument48 pagesCash Flow StatementsApollo Institute of Hospital Administration60% (5)

- Hema Project Cash FlowDocument6 pagesHema Project Cash Flowkannan VenkatNo ratings yet

- What Is A Cash Flow StatementDocument3 pagesWhat Is A Cash Flow Statementjeams vidalNo ratings yet

- Cash Flow StatementDocument11 pagesCash Flow StatementTagele gashawNo ratings yet

- Understanding the Cash Flow StatementDocument8 pagesUnderstanding the Cash Flow StatementRojesh BasnetNo ratings yet

- Unit Ii Accounting PDFDocument11 pagesUnit Ii Accounting PDFMo ToNo ratings yet

- Cash Flow AnalysisDocument7 pagesCash Flow AnalysisDr. Shoaib MohammedNo ratings yet

- Written Report - Cash Flow AnalysisDocument2 pagesWritten Report - Cash Flow AnalysisKei SenpaiNo ratings yet

- Chapter Ii - Theoretical BackgroundDocument17 pagesChapter Ii - Theoretical Backgroundpatil0055No ratings yet

- Understand Cash Flow Statements in 6 StepsDocument48 pagesUnderstand Cash Flow Statements in 6 Stepssukriti dhauniNo ratings yet

- Cash Flow Statement - NCERTDocument54 pagesCash Flow Statement - NCERTHJ ManviNo ratings yet

- Cash Flow StatementDocument46 pagesCash Flow StatementAnanyaNo ratings yet

- Chapter 6Document46 pagesChapter 6Aditya GuptaNo ratings yet

- FFS and CFSDocument28 pagesFFS and CFSAnuj DhamaNo ratings yet

- Memorandum 2Document4 pagesMemorandum 2Catie MaasNo ratings yet

- Mark DistributionDocument1 pageMark DistributionSachin SahooNo ratings yet

- EtcDocument3 pagesEtcSachin SahooNo ratings yet

- Front CompressedDocument2 pagesFront CompressedSachin SahooNo ratings yet

- Resident Certificate PDFDocument2 pagesResident Certificate PDFsandeep0% (1)

- Mpil Project TitleDocument5 pagesMpil Project TitleErik LopezNo ratings yet

- Engineering Economics & Costing AssignmnetDocument1 pageEngineering Economics & Costing AssignmnetSachin SahooNo ratings yet

- BANKING COMMITTEESDocument4 pagesBANKING COMMITTEESSachin SahooNo ratings yet

- Kurukshetra June-14Document53 pagesKurukshetra June-14PranNath100% (1)

- Gsi NotesDocument66 pagesGsi NotesHexaNotesNo ratings yet

- Selectes Study On Derivative Market: 1) Development of Financial Derivatives Market in India-A Case StudyDocument1 pageSelectes Study On Derivative Market: 1) Development of Financial Derivatives Market in India-A Case StudySachin SahooNo ratings yet

- ApplicationForm PDFDocument2 pagesApplicationForm PDFkeerthiNo ratings yet

- List of Steel Furnitures Industries in OrissaDocument3 pagesList of Steel Furnitures Industries in OrissaSachin SahooNo ratings yet

- Bank Board BureauDocument10 pagesBank Board BureauSachin SahooNo ratings yet

- DipikaDocument3 pagesDipikaSachin SahooNo ratings yet

- 14 Fundamental Principles of Management Formulated by Henry FayoDocument11 pages14 Fundamental Principles of Management Formulated by Henry FayoSachin SahooNo ratings yet

- Banking QuizDocument28 pagesBanking QuizSachin SahooNo ratings yet

- MigrationsDocument14 pagesMigrationsSachin SahooNo ratings yet

- Calculate BEP and analyze contingenciesDocument7 pagesCalculate BEP and analyze contingenciesSachin SahooNo ratings yet

- EntrepreneurshipDocument1 pageEntrepreneurshipSachin SahooNo ratings yet

- IBPS PO SyllabusDocument2 pagesIBPS PO SyllabusSachin SahooNo ratings yet

- Migration TopicsDocument3 pagesMigration TopicsSachin SahooNo ratings yet

- DR Rojalini SahooDocument5 pagesDR Rojalini SahooSachin SahooNo ratings yet

- Ugc Net EconomicsDocument17 pagesUgc Net EconomicsSachin SahooNo ratings yet

- Edp QBDocument113 pagesEdp QBSachin SahooNo ratings yet

- ECON 201 12/9/2003 Prof. Gordon: Final ExamDocument23 pagesECON 201 12/9/2003 Prof. Gordon: Final ExamManicks VelanNo ratings yet

- Multiple Choice Questions: Source: G. Mankiw, Principles of EconomicsDocument8 pagesMultiple Choice Questions: Source: G. Mankiw, Principles of EconomicsSachin Sahoo100% (4)

- Advert SingDocument3 pagesAdvert SingSachin SahooNo ratings yet

- NCERT Class XI Accountancy Part IIDocument333 pagesNCERT Class XI Accountancy Part IInikhilam.com67% (3)

- Ugc Net Economics PrintDocument11 pagesUgc Net Economics PrintSachin SahooNo ratings yet

- Insurance Digest - V3Document88 pagesInsurance Digest - V3Sachin SahooNo ratings yet

- CRM Industry LandscapeDocument26 pagesCRM Industry LandscapeAdityaHridayNo ratings yet

- Material Requirements PlanningDocument38 pagesMaterial Requirements PlanningSatya BobbaNo ratings yet

- Rural Urban MigrationDocument42 pagesRural Urban MigrationSabitha Ansif100% (1)

- Case Study - IDocument3 pagesCase Study - IMamta Singh RajpalNo ratings yet

- Assignment 1ADocument5 pagesAssignment 1Agreatguy_070% (1)

- Digital Marketing AIDA Model ExplainedDocument85 pagesDigital Marketing AIDA Model ExplainedShibaniNo ratings yet

- Request Ltr2Bank For OIDsDocument2 pagesRequest Ltr2Bank For OIDsricetech96% (48)

- Deed of Conditional Sale of Motor VehicleDocument1 pageDeed of Conditional Sale of Motor Vehicle4geniecivilNo ratings yet

- Public Limited CompaniesDocument2 pagesPublic Limited CompaniesGaurav AgarwalNo ratings yet

- Economic Modelling: Rongsheng Tang, Gaowang WangDocument20 pagesEconomic Modelling: Rongsheng Tang, Gaowang WangpalupiclaraNo ratings yet

- As and Guidance NotesDocument94 pagesAs and Guidance NotesSivasankariNo ratings yet

- AKED - Case 7Document20 pagesAKED - Case 7BernardusNo ratings yet

- Lehman Brothers Examiners Report COMBINEDDocument2,292 pagesLehman Brothers Examiners Report COMBINEDTroy UhlmanNo ratings yet

- No. Tipe Akun Kode Perkiraan NamaDocument6 pagesNo. Tipe Akun Kode Perkiraan Namapkm.sdjNo ratings yet

- Business Plan: Introductory PageDocument7 pagesBusiness Plan: Introductory PageRahil AnwarmemonNo ratings yet

- New England Compounding Center (NECC) Case Study.Document7 pagesNew England Compounding Center (NECC) Case Study.onesmusnzomo20No ratings yet

- Answer Sheet - Docx ABC PARTNERSHIPDocument14 pagesAnswer Sheet - Docx ABC PARTNERSHIPCathy AluadenNo ratings yet

- C39SN FINANCIAL DERIVATIVES- TUTORIAL-OPTION PAYOFFS AND STRATEGIESDocument11 pagesC39SN FINANCIAL DERIVATIVES- TUTORIAL-OPTION PAYOFFS AND STRATEGIESKhairina IshakNo ratings yet

- Profits and Gains of Business or ProfessionDocument13 pagesProfits and Gains of Business or Professionajaykumar0011100% (2)

- Canons of TaxationDocument2 pagesCanons of Taxationmadeeha_2475% (4)

- Estado Bancario ChaseDocument2 pagesEstado Bancario ChasePedro Ant. Núñez Ulloa100% (1)

- Presentation CoinTech2u EnglishDocument15 pagesPresentation CoinTech2u EnglishbellatanamasNo ratings yet

- Procter & Gamble: Expansion PlanDocument6 pagesProcter & Gamble: Expansion PlanSarthak AgarwalNo ratings yet

- Business Environment AnalysisDocument9 pagesBusiness Environment AnalysisHtoo Wai Lin AungNo ratings yet

- Guidelines Rice Allowance 2022Document10 pagesGuidelines Rice Allowance 2022Daisy JedhNo ratings yet

- King Abdul Aziz University: IE 255 Engineering EconomyDocument11 pagesKing Abdul Aziz University: IE 255 Engineering EconomyJomana JomanaNo ratings yet

- S 5 Bba (HRM)Document2 pagesS 5 Bba (HRM)Anjali GopinathNo ratings yet

- BOI - New LetterDocument5 pagesBOI - New Lettersandip_banerjeeNo ratings yet

- Lembar Jawaban 1-JURNALDocument9 pagesLembar Jawaban 1-JURNALClara Shinta OceeNo ratings yet

- Effects of Globalization on India's EconomyDocument21 pagesEffects of Globalization on India's EconomyakhilchibberNo ratings yet