Professional Documents

Culture Documents

Schuette Sues Auto Title Loan Company Liquidation, LLC To Protect Michigan Residents From Illegal Title Loans

Uploaded by

Michigan NewsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Schuette Sues Auto Title Loan Company Liquidation, LLC To Protect Michigan Residents From Illegal Title Loans

Uploaded by

Michigan NewsCopyright:

Available Formats

Schuette Sues Auto Title Loan Company Liquidation, LLC to

Protect Michigan Residents from Illegal Title Loans

Contact: Andrea Bitely 517-373-8060

January 14, 2016

LANSING Michigan Attorney General Bill Schuette today filed a complaint and motion

requesting a Temporary Restraining Order and a Preliminary Injunction in Ingham County Circuit

Court against Liquidation, LLC and several associated alias companies demanding the company

stop collection activities on illegal title loans they provided to Michigan consumers. The court granted

the request for a temporary restraining order and set a hearing date of January 27, 2016 for the

preliminary injunction.

The suit alleges that Liquidation, LLC provides unlawful vehicle title loans. They are not

authorized to do business in Michigan as a pawnbroker or even a Limited Liability Company and

they have burdened more than 440 Michigan consumers with exorbitant triple-digit interest rates

ranging from 161.95% to 251.03%. Through an online application process, Michigan consumers

arranged for the loans for amounts ranging from $1,000 to $5,000, and secured the loans with a

vehicle they owned outright.

Liquidation, LLC required possession of the vehicle title and the installation of a GPS tracking

device on the borrowers vehicle before providing the loan. Consumers were generally not provided

with a copy of the loan documents, and in the few cases they were, the documents were not

provided until after Liquidation, LLC had the borrowers vehicle title.

This companys business model appears designed to take advantage of financially vulnerable

consumers with damaged credit histories, said Schuette. For many of these consumers, their

vehicle is likely their largest asset and only means of transportation, making these illegal loans

devastating to their pocket books and even to their ability to go to work.

This action follows on the heels of Schuettes December Cease and Desist Order to Liquidation,

LLC under the Regulation of Collection Practices Act and a Notice of Intended Action under the

Consumer Protection Act. The December Cease and Desist Order was shared with over 1,000

Michigan businesses that might unknowingly assist Liquidation, LLC with repossession of vehicles or

other related services.

Liquidation, LLC loans were generally required to be repaid over 6 to 12 months, with a final

balloon payment exceeding the amount that the consumer actually borrowed.

Liquidation, LLC associated company aliases include:

Vehicle Liquidation, LLC

Autoloans, LLC

Auto Loans, LLC

Car Loan, LLC

Sovereign Lending Solutions, LLC

Sovereign Lending, LLC

Management Solutions, LLC

Loan Servicing Solutions, LLC

Consumers with loans through Liquidation, LLC or one of the alias company names who had their

vehicle repossessed on or after December 7, 2015, or who still have their vehicle, should contact the

Attorney Generals office to make sure we have a record of your situation. Consumers for whom we

do not already have a written complaint will be asked to file one.

Documents of interest:

Online Consumer Complaint Form

Printable Consumer Complaint Form

Liquidation, LLC Order to Cease and Desist

Liquidation, LLC Temporary Restraining Order

Liquidation, LLC Complaint for Ex Parte TRO, and for Preliminary and Permanent Injunctive

Relief

Liquidation, LLC Motion for a Temporary Restraining Order

Liquidation, LLC Brief in Support of Motion for a TRO

Auto Title Loans Consumer Alert

To help educate consumers on the many perils associated with vehicle title loans, Schuette is

also calling attention to his Auto Title Loans consumer alert. The alert explains that vehicle title

loans involving the lender taking physical possession of the borrowers vehicle title are risky and not

permitted by Michigans lending laws. The alert also covers the various interest rates that may be

charged on Michigan consumer loans and when it is appropriate to report a company to the Attorney

Generals Consumer Protection Division.

###

You might also like

- Nderstanding AR Inancing: U F Y CDocument4 pagesNderstanding AR Inancing: U F Y Ccalirican15No ratings yet

- Your Credit Rights ExplainedDocument5 pagesYour Credit Rights ExplainedMattpeckNo ratings yet

- ARE YOU SMARTER THAN A CAR DEALER: What Is the DiscountFrom EverandARE YOU SMARTER THAN A CAR DEALER: What Is the DiscountRating: 3.5 out of 5 stars3.5/5 (3)

- Credit Score Power: A View into the Misunderstood Rules of Credit and What Makes for the Best ScoresFrom EverandCredit Score Power: A View into the Misunderstood Rules of Credit and What Makes for the Best ScoresRating: 5 out of 5 stars5/5 (1)

- 46 Consumer Reporting Agencies Investigating YouFrom Everand46 Consumer Reporting Agencies Investigating YouRating: 4.5 out of 5 stars4.5/5 (6)

- Repair Your Credit Score: The Ultimate Personal Finance Guide. Learn Effective Credit Repair Strategies, Fix Bad Debt and Improve Your Score.From EverandRepair Your Credit Score: The Ultimate Personal Finance Guide. Learn Effective Credit Repair Strategies, Fix Bad Debt and Improve Your Score.No ratings yet

- Fraud: The Following Concepts Will Be Developed in This ChapterDocument24 pagesFraud: The Following Concepts Will Be Developed in This ChapterAnonymous SmPtG2AHNo ratings yet

- Disclosure CarDocument82 pagesDisclosure CarCheryl WestNo ratings yet

- Sample of Complaint About A Billing ErrorDocument1 pageSample of Complaint About A Billing ErrorRebecca GutierrezNo ratings yet

- Block Fraudulent Credit Report InfoDocument2 pagesBlock Fraudulent Credit Report InfoYawNyarkoNo ratings yet

- Donna Soutter v. Equifax Information Services, 4th Cir. (2012)Document19 pagesDonna Soutter v. Equifax Information Services, 4th Cir. (2012)Scribd Government DocsNo ratings yet

- Debt Dispute LetterDocument1 pageDebt Dispute LetterArmond TrakarianNo ratings yet

- Arbitration ProcessDocument47 pagesArbitration ProcessLemuel Kim TabinasNo ratings yet

- Biolsi V Jefferson Capital Systems LLC FDCPA Complaint Debt CollectionDocument8 pagesBiolsi V Jefferson Capital Systems LLC FDCPA Complaint Debt CollectionghostgripNo ratings yet

- Sample Letter 12 Notification of LawsuitDocument2 pagesSample Letter 12 Notification of LawsuitJulian GarciaNo ratings yet

- 15 FdcpaDocument3 pages15 Fdcpadhondee130% (1)

- Contract of SaleDocument3 pagesContract of SaleMitch De OcampoNo ratings yet

- Letters To Loan Servicers Re COVID-19 Impact On Private LoansDocument52 pagesLetters To Loan Servicers Re COVID-19 Impact On Private LoansKaylaNo ratings yet

- Ana Cordero 116 W 238 ST Apt 6E Bronx NY 10463-4221: REF: Account # NZ3486Document1 pageAna Cordero 116 W 238 ST Apt 6E Bronx NY 10463-4221: REF: Account # NZ3486jamesdeciliaNo ratings yet

- Woman Files Lawsuit To Prove She Is AliveDocument15 pagesWoman Files Lawsuit To Prove She Is AliveFindLawNo ratings yet

- NAME OF MEDICAL HERE To Release My Medical Information To A ThirdDocument2 pagesNAME OF MEDICAL HERE To Release My Medical Information To A Thirdgabby maca100% (1)

- CFPB Think-Finance Complaint 112017Document32 pagesCFPB Think-Finance Complaint 112017Clara Ferguson-MattoxNo ratings yet

- Food Assistance: SNAP, WIC, CSFPDocument2 pagesFood Assistance: SNAP, WIC, CSFPjgstorandt44No ratings yet

- Heiko Goldenstein v. Repossessors Inc., 3rd Cir. (2016)Document15 pagesHeiko Goldenstein v. Repossessors Inc., 3rd Cir. (2016)Scribd Government DocsNo ratings yet

- Exotic Car RentalDocument2 pagesExotic Car Rentalalexmark29No ratings yet

- 87 Things You Need To Know Before You File Before You FileDocument45 pages87 Things You Need To Know Before You File Before You FilenguyenthaimyanNo ratings yet

- Demand For Arbitration Before JAMSDocument4 pagesDemand For Arbitration Before JAMSspork77No ratings yet

- FCRA Release For Credit Report 16SEP2011Document1 pageFCRA Release For Credit Report 16SEP2011Marianne BokmaNo ratings yet

- Alabama Collection LawDocument6 pagesAlabama Collection LawBradNo ratings yet

- Dan Bui - Motion For Early Terminatino of ProbationDocument4 pagesDan Bui - Motion For Early Terminatino of ProbationJennifer Le100% (1)

- Credit RepairDocument8 pagesCredit RepairsoyeaNo ratings yet

- There Are 3 Types of Car Loans Available in IndiaDocument11 pagesThere Are 3 Types of Car Loans Available in IndiaAshis Kumar MuduliNo ratings yet

- FDCPA Claims Should Not Be Barred During Bankruptcy ProceedingsDocument28 pagesFDCPA Claims Should Not Be Barred During Bankruptcy ProceedingsJackNo ratings yet

- Ach Payment - Facebook-Discharge Debt LetterDocument2 pagesAch Payment - Facebook-Discharge Debt LetterJohnson DamitaNo ratings yet

- How To Remove A Name From A Mortgage No Refinance OptionDocument1 pageHow To Remove A Name From A Mortgage No Refinance Optionkenny byrnesNo ratings yet

- Contract For Credit Restoration ServDocument8 pagesContract For Credit Restoration Servanon-716426100% (3)

- Sample Debt Validation Letter For Debt CollectorsDocument7 pagesSample Debt Validation Letter For Debt Collectorsgabby macaNo ratings yet

- Master Opt Out Letter Revised 3Document4 pagesMaster Opt Out Letter Revised 3Erika EsquivelNo ratings yet

- How To Protect Yourself From Debt CollectorsDocument5 pagesHow To Protect Yourself From Debt CollectorsHarvey18100% (2)

- C J S - S G: Ollecting ON A Udgment TEP BY TEP UideDocument14 pagesC J S - S G: Ollecting ON A Udgment TEP BY TEP UidescribdNo ratings yet

- Hospital's Legal Opinion On Chapter 55ADocument8 pagesHospital's Legal Opinion On Chapter 55AEmily Featherston GrayTvNo ratings yet

- DV LetterDocument2 pagesDV LetterbrocgiddensNo ratings yet

- Repossession DisputeDocument2 pagesRepossession Disputetpeeples60% (5)

- Talent6 5419 Hollywood Blvd. Suite C727 Hollywood, CA 90027Document9 pagesTalent6 5419 Hollywood Blvd. Suite C727 Hollywood, CA 90027bambini84No ratings yet

- Acquittal Release PaymentDocument3 pagesAcquittal Release PaymentMaureen Encarnacion MalazarteNo ratings yet

- Credit report public record dispute letterDocument1 pageCredit report public record dispute letterYawNyarkoNo ratings yet

- Credit Cleanup Instructions: 4 Easy StepsDocument1 pageCredit Cleanup Instructions: 4 Easy StepsMichael KovachNo ratings yet

- Stopping Zombie Debt Collectors from Terrorizing ConsumersDocument60 pagesStopping Zombie Debt Collectors from Terrorizing ConsumersDavid StarkeyNo ratings yet

- Accepted Offer Addendum-CounterDocument16 pagesAccepted Offer Addendum-Counterrealestate6199No ratings yet

- PublishedDocument21 pagesPublishedScribd Government DocsNo ratings yet

- Credit Repair Agreement 1Document3 pagesCredit Repair Agreement 159000000100% (6)

- Financing - Study SheetDocument6 pagesFinancing - Study SheetAnand100% (1)

- Response Brief On Chicago's Motion To Dismiss The Red Light Camera Class Action 17 April 2015Document33 pagesResponse Brief On Chicago's Motion To Dismiss The Red Light Camera Class Action 17 April 2015Patrick J Keating100% (1)

- Student Loan Letter 2ADocument1 pageStudent Loan Letter 2AKadir WisdomNo ratings yet

- Federal Laws Help Victims Remove Inaccurate Info and Unauthorized Charges After Identity TheftDocument12 pagesFederal Laws Help Victims Remove Inaccurate Info and Unauthorized Charges After Identity TheftAkil Bey100% (1)

- 12 CFR 1024.35 - Error Resolution ProceduresDocument3 pages12 CFR 1024.35 - Error Resolution Proceduresmptacly9152No ratings yet

- Errors and Gotchas ReportDocument37 pagesErrors and Gotchas ReportJack Newsman100% (2)

- To Our Customers: DuMouchellesDocument1 pageTo Our Customers: DuMouchellesMichigan NewsNo ratings yet

- MPSC Fines DTE Energy $840,000 For Improper Billing, ShutoffsDocument2 pagesMPSC Fines DTE Energy $840,000 For Improper Billing, ShutoffsMichigan NewsNo ratings yet

- Schuette Files For Reinstatement of Charges Against CMU Sexual Assault Suspect, New Court Date SetDocument1 pageSchuette Files For Reinstatement of Charges Against CMU Sexual Assault Suspect, New Court Date SetMichigan NewsNo ratings yet

- Detroit Crime Blotter For Thursday, March 21, 2018Document18 pagesDetroit Crime Blotter For Thursday, March 21, 2018Michigan NewsNo ratings yet

- West Michigan Physician Summarily Suspended For Alleged Criminal Sexual Conduct With PatientsDocument1 pageWest Michigan Physician Summarily Suspended For Alleged Criminal Sexual Conduct With PatientsMichigan NewsNo ratings yet

- Lincoln Park Man To Pay $45,650 in Restitution For Embezzling Charitable Groups' FundsDocument2 pagesLincoln Park Man To Pay $45,650 in Restitution For Embezzling Charitable Groups' FundsMichigan NewsNo ratings yet

- Schuette Charges Two in Insurance Fraud Scheme After Joint Investigation With Department of Insurance and Financial ServicesDocument2 pagesSchuette Charges Two in Insurance Fraud Scheme After Joint Investigation With Department of Insurance and Financial ServicesMichigan NewsNo ratings yet

- Michigan Liquor Control Commission Suspends Oakland County Gas Station's Liquor License For 102 DaysDocument1 pageMichigan Liquor Control Commission Suspends Oakland County Gas Station's Liquor License For 102 DaysMichigan NewsNo ratings yet

- Massage Therapist Summarily Suspended For Criminal Sexual ConductDocument1 pageMassage Therapist Summarily Suspended For Criminal Sexual ConductMichigan NewsNo ratings yet

- Shots FiredDocument2 pagesShots FiredMichigan NewsNo ratings yet

- ShootingsDocument4 pagesShootingsMichigan NewsNo ratings yet

- Schuette Seven Current and Former Police Officers Charged With 101 Felony Counts Related To Fraudulent Auto InspectionsDocument3 pagesSchuette Seven Current and Former Police Officers Charged With 101 Felony Counts Related To Fraudulent Auto InspectionsMichigan NewsNo ratings yet

- Southfield Physician's Controlled Substance License Summarily Suspended For OverprescribingDocument1 pageSouthfield Physician's Controlled Substance License Summarily Suspended For OverprescribingMichigan NewsNo ratings yet

- Tuberculosis Exposure at Three Southeast Michigan Healthcare Facilities Being InvestigatedDocument2 pagesTuberculosis Exposure at Three Southeast Michigan Healthcare Facilities Being InvestigatedMichigan NewsNo ratings yet

- $18M in Federal Grants Available To Public and Non-Profit Groups To Provide Services To Crime VictimsDocument2 pages$18M in Federal Grants Available To Public and Non-Profit Groups To Provide Services To Crime VictimsMichigan NewsNo ratings yet

- Livonia Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesDocument2 pagesLivonia Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesMichigan NewsNo ratings yet

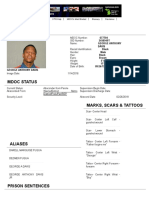

- Offender Tracking Information System (OTIS) - Offender ProfileDocument2 pagesOffender Tracking Information System (OTIS) - Offender ProfileMichigan NewsNo ratings yet

- Michigan's Statewide Graduation Rate Hits 80 Percent Graduation Rate Increases 0.53 Percent, Dropout Rate DeclinesDocument3 pagesMichigan's Statewide Graduation Rate Hits 80 Percent Graduation Rate Increases 0.53 Percent, Dropout Rate DeclinesMichigan NewsNo ratings yet

- Prosecutor Worthy Charges Police Officers With Murder, Misconduct and Other ChargesDocument7 pagesProsecutor Worthy Charges Police Officers With Murder, Misconduct and Other ChargesMichigan NewsNo ratings yet

- Detroit Pharmacist Summarily Suspended For $6 Million Health Care and Wire FraudDocument1 pageDetroit Pharmacist Summarily Suspended For $6 Million Health Care and Wire FraudMichigan NewsNo ratings yet

- DNR Deer Poaching Investigation Results in Sentencing of Allegan County ManDocument2 pagesDNR Deer Poaching Investigation Results in Sentencing of Allegan County ManMichigan NewsNo ratings yet

- Lt. Gov. Calley: Nearly 5,700 Naloxone Orders Dispensed in Last Six Months 1,800 Through Standing OrderDocument2 pagesLt. Gov. Calley: Nearly 5,700 Naloxone Orders Dispensed in Last Six Months 1,800 Through Standing OrderMichigan NewsNo ratings yet

- State Police Motor Carrier Officers Join Forces To Fight Human TraffickingDocument1 pageState Police Motor Carrier Officers Join Forces To Fight Human TraffickingMichigan NewsNo ratings yet

- Meijer Joins Growing Group of Retail Pharmacies To Integrate With MAPS To Prevent Opioid AbuseDocument2 pagesMeijer Joins Growing Group of Retail Pharmacies To Integrate With MAPS To Prevent Opioid AbuseMichigan NewsNo ratings yet

- 2018 Lake Sturgeon Season On Black Lake Begins Feb. 3 at 8 A.M.Document3 pages2018 Lake Sturgeon Season On Black Lake Begins Feb. 3 at 8 A.M.Michigan NewsNo ratings yet

- Schuette: Orchard Lake Restaurant Sushi Samurai Sentenced in Tax Embezzlement Scheme, Owners Will Pay Almost $1 Million in RestitutionDocument2 pagesSchuette: Orchard Lake Restaurant Sushi Samurai Sentenced in Tax Embezzlement Scheme, Owners Will Pay Almost $1 Million in RestitutionMichigan NewsNo ratings yet

- Detroit Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesDocument1 pageDetroit Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesMichigan NewsNo ratings yet

- State Police To Participate in Multi-State Commercial Vehicle Enforcement Operation Involving I-94Document2 pagesState Police To Participate in Multi-State Commercial Vehicle Enforcement Operation Involving I-94Michigan NewsNo ratings yet

- West Nile Virus Found in Michigan Ruffed GrouseDocument6 pagesWest Nile Virus Found in Michigan Ruffed GrouseMichigan NewsNo ratings yet

- Have You Been The Victim of Sexual Harassment? Consider Filing A Complaint Under Michigan Civil Rights LawDocument3 pagesHave You Been The Victim of Sexual Harassment? Consider Filing A Complaint Under Michigan Civil Rights LawMichigan NewsNo ratings yet

- 3RT10241AB00 Datasheet enDocument7 pages3RT10241AB00 Datasheet enanon_92005543No ratings yet

- Powerful Technical Computing with MathematicaDocument3 pagesPowerful Technical Computing with MathematicazoksiNo ratings yet

- Martek Navgard BnwasDocument4 pagesMartek Navgard BnwasСергей БородинNo ratings yet

- Global POVEQ NGADocument2 pagesGlobal POVEQ NGABonifaceNo ratings yet

- CT2003 LevelMeasurementP1 TechReport1 1Document27 pagesCT2003 LevelMeasurementP1 TechReport1 1Vignesh RajanNo ratings yet

- Denny Darmawan Diredja: Professional Attributes / Skills ExperiencesDocument2 pagesDenny Darmawan Diredja: Professional Attributes / Skills ExperiencesIntan WidyawatiNo ratings yet

- Medical ParasitologyDocument33 pagesMedical ParasitologyAlexander Luie Jhames SaritaNo ratings yet

- SITXWHS001 Participate in Safe Work Practices - Training ManualDocument82 pagesSITXWHS001 Participate in Safe Work Practices - Training ManualIsuru AbhimanNo ratings yet

- Chapter 2 (Teacher)Document19 pagesChapter 2 (Teacher)ajakazNo ratings yet

- Conflict Analysis Tools PDFDocument12 pagesConflict Analysis Tools PDFApeuDerrop0% (1)

- Technology Unit 1 UTUDocument19 pagesTechnology Unit 1 UTUDaNo ratings yet

- PESU BTech Jan2017 6thsemCourseInfoDocument51 pagesPESU BTech Jan2017 6thsemCourseInforakshithrajNo ratings yet

- Vandergrift - Listening, Modern Theory & PracticeDocument6 pagesVandergrift - Listening, Modern Theory & PracticeKarolina CiNo ratings yet

- List of Steel Products Made in The UK PDFDocument120 pagesList of Steel Products Made in The UK PDFAntonio MarrufoNo ratings yet

- SC WD 1 WashHandsFlyerFormatted JacobHahn Report 1Document3 pagesSC WD 1 WashHandsFlyerFormatted JacobHahn Report 1jackson leeNo ratings yet

- Tutorial Letter 101/3/2018: Internal Auditing: Theory & PrinciplesDocument39 pagesTutorial Letter 101/3/2018: Internal Auditing: Theory & PrinciplesSAMANTHANo ratings yet

- Slimline: Switch Disconnector Fuse, SR 63-630 ADocument46 pagesSlimline: Switch Disconnector Fuse, SR 63-630 AЕвгений МатвеевNo ratings yet

- Project Proposal ApprovedDocument2 pagesProject Proposal ApprovedRonnel BechaydaNo ratings yet

- Newman News January 2017 EditionDocument12 pagesNewman News January 2017 EditionSonya MathesonNo ratings yet

- Keyence cv700 - Man2Document232 pagesKeyence cv700 - Man2kamaleon85No ratings yet

- Si New Functions 3 1 eDocument152 pagesSi New Functions 3 1 ecmm5477No ratings yet

- SELECTING A DISTILLATION COLUMN CONTROL STRATEGYDocument12 pagesSELECTING A DISTILLATION COLUMN CONTROL STRATEGYinstrutech0% (1)

- User Interface Analysis and Design TrendsDocument38 pagesUser Interface Analysis and Design TrendsArbaz AliNo ratings yet

- Anectodal RecordsDocument10 pagesAnectodal RecordsSchahyda ArleyNo ratings yet

- Sujit Kumar Rout, Rupashree Ragini Sahoo, Soumya Ranjan Satapathy, Barada Prasad SethyDocument7 pagesSujit Kumar Rout, Rupashree Ragini Sahoo, Soumya Ranjan Satapathy, Barada Prasad SethyPrabu ThannasiNo ratings yet

- Chapter 2 EnglishDocument9 pagesChapter 2 Englishdgdhdh_66No ratings yet

- 04 Vendor Registration TrainingDocument16 pages04 Vendor Registration TrainingAhmad Ramin AbasyNo ratings yet

- MGN 363Document14 pagesMGN 363Nitin PatidarNo ratings yet

- Essential Components of an Effective Road Drainage SystemDocument11 pagesEssential Components of an Effective Road Drainage SystemRaisanAlcebarNo ratings yet

- Chapter 7, 8, 9Document11 pagesChapter 7, 8, 9Rubilyn IbarretaNo ratings yet