Professional Documents

Culture Documents

UM02CBBA02 - 07 - Corporate Accounting I

Uploaded by

RiteshHPatelOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UM02CBBA02 - 07 - Corporate Accounting I

Uploaded by

RiteshHPatelCopyright:

Available Formats

..

sc--(A 15 8)

No. of printed pages: 3

SARDAR PATEL UNIVERSITY

BBA (II Semester) Examination

Monday, 30 March 2015

2.30 - 4.30 pm

UM02CBBA02/07 - Corporate Accounting

Total Marks: 60

0.1

(A)

(8)

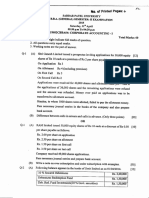

Prashant limited issued 50,000 Equity Shares of RS.1o each at a [10]

premium RS.2 per share, payable as RS.3 per share on application,

RS.5 per share (including premium) on allotment, RS.2 per share on

the First

Call and RS.2 per share on the Final Call, the issue was

I

oversubscribed three times and applications for 30,000 shares were

rejected. Remaining applicants were allotted pro-rata and excess

application Money was retained for Subsequent Calls. Assume that

all the Calls were received in due course.

Pass necessary journal entries.

Describe Types of Share Capital.

[05]

OR

0.1

(A)

[10]

(1)

(2)

Sonata limited issued 10,000 equity shares of Rs.10 each at

10% discount payable ad Rs.25 per share on application, Rs.25 per

share allotment and Rs.20 per share each on First Call and Second

Call. Company received applications for 12000 Shares and excess

application Money was refunded.

Subsequent Calls were received in due course, except,

Mr. X made Full payment on 50 shares with allotment money.

Mr. Y failed to pay Second Call on 60 shares.

(8)

Write provisions relating to issue of shares at discount.

[05]

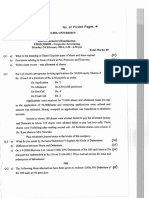

0.2

SUN limited issued 10,000, 9% Secured debentures of Rs.100 each

at 5% discount on 1-4-2006. The interest on debentures is paid and

payable on 31st March every year For the purpose of redemption of

debentures Company decided to appropriate Rs. 80,000 every year

and invest the same in 8% marketable securities. The debentures

are to be redeemed at the end of ten years.

Pass all necessary journal entries in the books of Company for

First three years.

OR

[15]

0.2

(A)

On 1-4-2007 MTK limited issued 6000, 9% debentures of RS.100 [06]

each at Rs.95 per debenture. As per the terms of issue the

debentures are to be repaid in four equal annual installments

commencing from 31-3-2008. The discount on debentures is to be

written off in a suitable proportion.

Prepare Debentures Discount A/c.

(8)

Give journal entries for the following.

[05]

1. Paras limited issued 5000, 8% debentures of RS.100 each at

4% discount, redeemable with 5% premium after five years.

2. Krishna limited converted 6000, 10% debentures of Rs.1 00 each by

issue of Four equity shares of Rs.10 each in exchange of every

debenture.

(C)

Write note on Debenture Redemption Fund.

[04]

pital

0.3

Balance Sheet of Ravi Limited is as under on 31-3-12:

Assets

Other

700000

120000

Rs.

Cash

& Current

BankRs. assets

460000

170000

Liabilities

750000

1450000

250000

190000

75000

10000

175000

[15]

Fixed

Investments

Assets

1450000

On 1-4-12 the company decided to redeem the redeemable preference

shares with 10 % premium. For this purpose half of the investments were

sold for RS.55,000 and new 10,000 equity shares of Rs. 10 each were

issued at par.

After the redemption of redeemable preference shares the equity

shareholders were given bonus shares in the ratio of one share of RS.10

each for every Five shares held on 31-3-12.

Give journal entries and prepare Balance Sheet of the Company thereafter.

OR

0.3

(A)

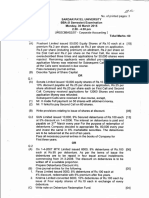

Following balances appeared in the books of Swastik Limited on 1-4-2011.

[09]

Rs.

(B)

8% Red. Pref. Share Capital (80% paid-up) 2,40,000

Share premium

20,000

General reserve

1,90,000

Profit & Loss Alc

60,000

Cash & Bank

2,25,000

The Red. Pref. Shares are to be redeemed after observing legal

provisions with 10% premium. For this purpose 1000, 7% Cumulative

Preference Shares of RS.100 each were issued at par.

Give journal entries

Discuss the provisions and guidelines for issue of Bonus Shares.

[06]

0.4

Prepare Profit & Loss Alc and Profit & Cost Alc for the year and Balance

sheet as on 31-3-2012. From the following balances and additional

information of Chandan Limited.

17000

828000

Provident

Creditors

Fund

430008000

250004000

22000

14000

2000

8000

General

Shares'

Credit

reserve

Forfeiture

Balances

Rs.

alc

Rs.

28500

4000

225000

150000

21000

200000

160000

12000

12000

Interest

2

Unclaimed

&

dividend

dividend

80000

4500

30003000

4

3000

8%

Debentures

182000

160000

20000

30000

35000

70000

5000

Debit

Balances

Share

Capital

Capital

reserve

Public

deposits

Sinking

Fund

&

Loss

Alc (1-4-11)

Gross

profit

Bills

Profit

payable

Bank

loan

(secured)

[15]

828000

Additional Information:

1.

Depreciation is to be provided at 4% on Land-Buildings and PlantMachinery.

2.

Out of debtors RS.10,000 are due for more than Six months and bad

debts reserve is to be Kept 5%

3.

For current year provision for tax is required Rs.40,000

4.

One Fourth of debenture discount is to be written off

5.

The directors have recommended 10% dividend on shares after

appropriation of Rs. 10,000 to General Reserve and

RS.5000 to Sinking Fund.

OR

0.4

(A)

(B)

(C)

Write a note on Profit & Loss Appropriation Account.

Explain contingent liabilities with at least Four illustrations.

How will you show the following items in the final accounts of a company?

1. Share Transfer Fees

2. Calls in arrears

3. Goodwill

4. Interim dividend

5. Preliminary expenses not written off

6. Bank overdraft

7. IDBI Bonds

8. Director fees

9. Share premium

10. Staff Provident Fund

[05]

[05]

[05]

You might also like

- 0FLTPDocument40 pages0FLTPRiteshHPatelNo ratings yet

- Annual Report of CMADocument66 pagesAnnual Report of CMARiteshHPatelNo ratings yet

- List of Select AbbreviationsDocument2 pagesList of Select AbbreviationsRiteshHPatelNo ratings yet

- UM04CBBA04 - 09 - Statistics For Management IIDocument2 pagesUM04CBBA04 - 09 - Statistics For Management IIDrRitesh PatelNo ratings yet

- Ambuja Cement Media Release For Quarter Year Ended 31 Dec 2015Document2 pagesAmbuja Cement Media Release For Quarter Year Ended 31 Dec 2015RiteshHPatelNo ratings yet

- Indian Cement IndustryDocument69 pagesIndian Cement IndustryRiteshHPatelNo ratings yet

- Final Website Notification Teaching PositionsDocument47 pagesFinal Website Notification Teaching PositionsRiteshHPatelNo ratings yet

- UM02CBBA04 - Corporate Accounting - IDocument4 pagesUM02CBBA04 - Corporate Accounting - IRiteshHPatelNo ratings yet

- January 2014Document52 pagesJanuary 2014RiteshHPatelNo ratings yet

- Corporate Accounting exam questions and entriesDocument4 pagesCorporate Accounting exam questions and entriesRiteshHPatelNo ratings yet

- Corporate Accounting I exam questions and solutionsDocument3 pagesCorporate Accounting I exam questions and solutionsRiteshHPatelNo ratings yet

- Standard CostingDocument1 pageStandard CostingRiteshHPatelNo ratings yet

- No - of Printed PagesDocument4 pagesNo - of Printed PagesRiteshHPatelNo ratings yet

- UM02CBBA02 - 07 - Corporate Accounting IDocument3 pagesUM02CBBA02 - 07 - Corporate Accounting IRiteshHPatelNo ratings yet

- Corporate Accounting I exam questions and solutionsDocument3 pagesCorporate Accounting I exam questions and solutionsRiteshHPatelNo ratings yet

- QDocument3 pagesQRiteshHPatelNo ratings yet

- UM02CBBA02 - 07 - Corporate Accounting IDocument3 pagesUM02CBBA02 - 07 - Corporate Accounting IRiteshHPatelNo ratings yet

- Shri D. N. Institute of Business Administration, Anand.: All The BestDocument1 pageShri D. N. Institute of Business Administration, Anand.: All The BestRiteshHPatelNo ratings yet

- AfmDocument2 pagesAfmRiteshHPatelNo ratings yet

- All The Best: Shri D. N. Institute of Business Administration, AnandDocument1 pageAll The Best: Shri D. N. Institute of Business Administration, AnandRiteshHPatelNo ratings yet

- Shri D. N. Institute of Business Administration, Anand.: All The BestDocument1 pageShri D. N. Institute of Business Administration, Anand.: All The BestRiteshHPatelNo ratings yet

- Top CSR reference books for professionalsDocument1 pageTop CSR reference books for professionalsRiteshHPatelNo ratings yet

- Sol20 4eDocument73 pagesSol20 4eRiteshHPatel100% (1)

- Money Market Is The Part of Financial Market Where Instruments With High Liquidity and Very ShortDocument3 pagesMoney Market Is The Part of Financial Market Where Instruments With High Liquidity and Very ShortRiteshHPatelNo ratings yet

- The C PreprocessorDocument115 pagesThe C PreprocessorDrRitesh PatelNo ratings yet

- Indian History Since 1857Document41 pagesIndian History Since 1857mohankrishna75100% (2)

- Award Name Sports Personality DiscriptionDocument1 pageAward Name Sports Personality DiscriptionRiteshHPatelNo ratings yet

- Hazard Mitigation Strategies For Reducing Impacts Of Hurricanes And EarthquakesDocument9 pagesHazard Mitigation Strategies For Reducing Impacts Of Hurricanes And EarthquakesRiteshHPatelNo ratings yet

- 1Document2 pages1RiteshHPatelNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 5 Parkin Samantha Chapter 2 - Measuring Your Financial Health and Making A PlanDocument6 pages5 Parkin Samantha Chapter 2 - Measuring Your Financial Health and Making A Planapi-245262597100% (1)

- 2Document3 pages2Ruth TenajerosNo ratings yet

- Securitization of DebtDocument52 pagesSecuritization of Debtnjsnghl100% (1)

- Working Capital Management and Banks' Performance: Evidence From IndiaDocument13 pagesWorking Capital Management and Banks' Performance: Evidence From Indiaboby.prashantkumar.boby066No ratings yet

- Trend Analysis Balance SheetDocument4 pagesTrend Analysis Balance Sheetrohit_indiaNo ratings yet

- Credit Rating AgenciesDocument20 pagesCredit Rating AgenciesKrishna Chandran PallippuramNo ratings yet

- Notification No. 15/2021-Central Tax (Rate)Document2 pagesNotification No. 15/2021-Central Tax (Rate)santanu sanyalNo ratings yet

- White Paper On KP Budget 2014-15Document132 pagesWhite Paper On KP Budget 2014-15PTI Official100% (1)

- A Study On Financial Statement Analysis in Tirumala Milk Products Pvt. LTD., PalamanerDocument7 pagesA Study On Financial Statement Analysis in Tirumala Milk Products Pvt. LTD., Palamanersree anugraphicsNo ratings yet

- English For Business Banking Finance AccountingDocument66 pagesEnglish For Business Banking Finance AccountingnatasyaNo ratings yet

- MCQ NpoDocument6 pagesMCQ NpoSurya ShekharNo ratings yet

- MCQ's On EconomicsDocument42 pagesMCQ's On EconomicsDHARMA DAZZLENo ratings yet

- 1600 FinalDocument4 pages1600 FinalReese QuinesNo ratings yet

- FS Preparation and Correcting A TBDocument11 pagesFS Preparation and Correcting A TBJulia Mae AlbanoNo ratings yet

- SSM Lab 1Document17 pagesSSM Lab 1Rishi JainNo ratings yet

- Sub Order LabelsDocument2 pagesSub Order LabelsZeeshan naseemNo ratings yet

- The Concepts and Practice of Mathematical Finance: Second EditionDocument8 pagesThe Concepts and Practice of Mathematical Finance: Second EditionChâu GiangNo ratings yet

- Supergrowth PDFDocument9 pagesSupergrowth PDFXavier Alexen AseronNo ratings yet

- Final Assignment AstDocument6 pagesFinal Assignment AstAngelica CerioNo ratings yet

- Project Appraisal of Power Project-A Case of Private Sector UtilityDocument65 pagesProject Appraisal of Power Project-A Case of Private Sector Utilityvineet sarawagi50% (2)

- Integration Layout TXT Suministrolr Aeat Sii v5Document53 pagesIntegration Layout TXT Suministrolr Aeat Sii v5Murdum MurdumNo ratings yet

- Muslim Women Entrepreneurs: A Study On Success FactorsDocument14 pagesMuslim Women Entrepreneurs: A Study On Success FactorsBadiu'zzaman FahamiNo ratings yet

- Quantitative Techniques For Decision Making - CasesDocument6 pagesQuantitative Techniques For Decision Making - CasesPragya SinghNo ratings yet

- TT IIIDocument21 pagesTT IIIVedha ThangavelNo ratings yet

- Philippine Taxation History and SystemDocument58 pagesPhilippine Taxation History and SystemThea MallariNo ratings yet

- Natural Gas Market of EuropeDocument124 pagesNatural Gas Market of EuropeSuvam PatelNo ratings yet

- Aeropostale Checkout ConfirmationDocument3 pagesAeropostale Checkout ConfirmationBladimilPujOlsChalasNo ratings yet

- 12 Swedish Match Philippines Inc. vs. The Treasurer of The City of ManilaDocument2 pages12 Swedish Match Philippines Inc. vs. The Treasurer of The City of ManilaIrene Mae GomosNo ratings yet

- Study On Efficacy of PSB Loan in 59 MinutesDocument33 pagesStudy On Efficacy of PSB Loan in 59 MinutesNeeraj kumar75% (4)

- Professional Associates The Valuation and Muccadam Company of Asif SahuDocument8 pagesProfessional Associates The Valuation and Muccadam Company of Asif Sahuasifsahu100% (1)