Professional Documents

Culture Documents

MAGISTER AKUNTANSI

Uploaded by

Teguh PurnamaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MAGISTER AKUNTANSI

Uploaded by

Teguh PurnamaCopyright:

Available Formats

Program Studi Magister Akuntansi

Fakultas Ekonomi Universitas Widyatama

SILABUS/S

AP

Tgl. Berlaku : Mei 2012

Tgl. Revisi : -

Versi/Revisi : 01/00

Kode Dok.: FRM-01

SILABUS/SAP MATA KULIAH

RISK MANAGEMENT

3 SKS

Deskripsi dan tujuan mata kuliah

Risiko berkaitan dengan kondisi terjadinya deviasi yang menyebabkan kerugian.

Dalam dunia usaha, kondisi ini senantiasa ada dan menuntut perhatian manajemen

untuk mengelolanya dengan tepat. Inti pembahasan Manajemen risiko meliputi

identifikasi atas risiko yang ada, mengukur beratnya risiko, dan menanganinya dengan

pendekatan / strategi tertentu.

Setelah mengikuti perkuliahan ini mahasiswa diharapkan mampu menjelaskan konsep

risiko dan manajemen risiko, mengidentifikasi, mengukur, dan mengendalikan risiko

baik ditangani sendiri maupun dialihkan pada pihak lain.

Metodologi pengajaran

Kuliah Tatap Muka

Reading Assignment

Presentasi dan Diskusi Kelas

Studi Kasus dan Problem Solving

Kehadiran

Peserta didik diharapkan selalu menghadiri perkuliahan dan diwajibkan untuk hadir

minimal 75% atau 11 kali dari 14 kali pertemuan. Apabila peserta didik kehadirannya

kurang dari 75% (11 pertemuan) maka tidak diperkenankan untuk mengikuti Ujian

Akhir Semester (UAS).

Bahan Bacaan

1. Dimitris N. Chorafas, 2008, Risk Accounting and Risk Management for Accountants,

CIMA Publisher.

2. Carol Alexander, 2003, Operational Risk, Regulation, Analysis and Management,

Prentice Hall.

3. Allen, Boudoukh and Saunders, 2004, Understanding Market, Credit and

Operational Risk.

4. Mamduh, 2009, Manajemen Risiko, UPP STIM YKPN.

Evaluasi Hasil Belajar

UAS 30%,

UTS 30%,

Tugas Individu 10%

1 | Page

Program Studi Magister Akuntansi

Fakultas Ekonomi Universitas Widyatama

Tugas Kelompok dan Presentasi 10%,

Partisipasi 10%

Quiz Test 10%.

Jadwal Pertemuan

Perkuliahan terdiri dari 16 kali pertemuan termasuk UTS dan UAS dengan durasi waktu

50 menit/SKS.

No

1

Pokok Bahasan

Risk and the

Accounting

Profession:

Volatility,

Uncertainty and

Non Traditional

Risks

Risk Management

Beyond classical accounting

and the Accountant Thinking out of the box

Case studies: GE and Amaranth

Newtons principles in analytics

A risk protection strategy

Paretos law in management accounting

Using the cash account for risk control

Duties and

The accountants mission in risk control

Responsibilities in

Creative accounting

Risk Accounting

Business risk

Business risk factors: an example

Monitoring assets and liabilities

IFRS, accounting standards and

transparency

Personal accountability

Accounting for Total Understanding total exposure

Exposure: A Case

A real-life case study on total counterparty

Study

risk

Understanding where the risks really lie

Correlation coefficients

Correlation are specific to the institution

Confidence intervals

Dynamic financial analysis

Credit Risk

Credit risk defined

Counterparty risk

Counterparty risk with hedge funds: a case

study

Credit policy

Corporate lending and collateral

Credit and other limits

Stress tests for credit risk

Credit Risk

Concepts underpinning credit risk transfer

Mitigation

For and against credit derivatives

Exposure associated with credit risk

transfer

Collateralized debt obligations

6.

2 | Page

Sub. Pokok Bahasan

Risk defined

Non-traditional risks

Volatility patterns

Financial derivatives

Risk is a cost

The science of risk management

Daftar Pustaka

1. Dimitris N.

Chorafas,

2008, Risk

Accounting

and Risk

Management

for

Accountants,

CIMA

Publisher.

2. Carol

Alexander,

2003,

Operational

Risk,

Regulation,

Analysis and

Management,

Prentice Hall.

3. Allen,

Boudoukh

and

Saunders,

2004,

Understandin

g Market,

Credit and

Operational

Risk.

4. Mamduh,

2009,

Manajemen

Risiko, UPP

STIM YKPN.

Program Studi Magister Akuntansi

Fakultas Ekonomi Universitas Widyatama

Market Risk

Position Risk

Beyond Credit Risk

and Market Risk

10

Basel II and the

Accountant

11

Operational Risks

12

Risk Based Pricing

13

Value at Risk

14

Board of Directors

and Risk

Management

3 | Page

Credit default swaps

The market for credit derivatives and its

liquidity

Market risk defined

Trading book risk

Challenges to valuation of the trading book

Interest rate risk and organizational risk

Interest rate risk and foreign exchange risk

Stress tests for market risk

UJIAN TENGAH SEMESTER

Position risk defined

Credit risk concentration

Market risk concentration

Position risk with debt instruments

Position risk with equities

Risk appetite

Risk of ruin

Liquidity risk

Event risk

Legal risk

Longevity risk: a case study

Payment risk

Risk must be controlled intra-day

The base II framework

Competitive impact of basel II

Accounting-based indicators

Tier-1, Tier-2, Tier-3 capital and the hybrids

The high risk of too little capital

Innovation in risk management: market

discipline and operational risk

Return on investment from Basel II would

be better governance

Top-Down Approaches to Opeartional Risk

Measurement

Bottom-Up Approaches to Operational Risk

Measurement

Hedging Operational Risk

Counting the odds

Primary and consequential risks

Pricing risk

Mispricing credit risk

Marking to market

Marking to model

Beyond valuation models

Economics underlying VaR measurement

Diversification and VaR

Riskcontrol requires unconventional

thinking

The boards responsibilities in

macroeconomics

A devils advocate in risk management

Risk management is like pre-trial

1. Dimitris N.

Chorafas,

2008, Risk

Accounting

and Risk

Management

for

Accountants,

CIMA

Publisher.

2. Carol

Alexander,

2003,

Operational

Risk,

Regulation,

Analysis and

Management,

Prentice Hall.

3. Allen,

Boudoukh

and

Saunders,

2004,

Understandin

g Market,

Credit and

Operational

Risk.

4. Mamduh,

2009,

Manajemen

Risiko, UPP

STIM YKPN.

Program Studi Magister Akuntansi

Fakultas Ekonomi Universitas Widyatama

preparation

Helping boards members to understand risk

and return

The risk management committee of the

board

The boards responsibility for reputational

risk

UJIAN AKHIR SEMESTER

Disahkan oleh :

Dekan Fakultas Ekonomi

Dr. H. Islahuzzaman, S.E.,

M.Si., Ak

4 | Page

Diperiksa oleh :

Ketua Program Magister

Akuntansi

Prof. Dr. H. Karhi N Sardjudin,

M.M., Ak.

Disusun oleh :

Dosen Pembina

Dr. Nina Nurani, S.H.,

M.Si.

Nunung Badruzaman,

Drs., MSPA., MBA.,

CAF., Ak.

You might also like

- Enterprise Risk ManagementDocument19 pagesEnterprise Risk ManagementRafina RamadhantiNo ratings yet

- Manajemen Resiko BisnisDocument5 pagesManajemen Resiko BisnisLeni Nadiya LubisNo ratings yet

- Rama Alif Elsanjaya 1911011073 Menrisk 2Document10 pagesRama Alif Elsanjaya 1911011073 Menrisk 2RamaNo ratings yet

- MAN 308 Business & Risk ManagementDocument25 pagesMAN 308 Business & Risk ManagementAdi TjokrohadidjojoNo ratings yet

- Manajemen Risiko DINDA NPPSDocument51 pagesManajemen Risiko DINDA NPPSAzizah RamadhaniaNo ratings yet

- Analisa Dan Evaluasi Risiko KELOMPOK 2Document16 pagesAnalisa Dan Evaluasi Risiko KELOMPOK 2adelia janiceNo ratings yet

- Artikel - Mengukur Risiko Dengan Var - Jurnal Ilmu ManajemenDocument16 pagesArtikel - Mengukur Risiko Dengan Var - Jurnal Ilmu ManajemenDaudSutrisnoNo ratings yet

- Tugas Makalah Manajemen Resiko FinansialDocument8 pagesTugas Makalah Manajemen Resiko FinansialKatrin SilabanNo ratings yet

- ANALISIS RESIKO PERUSAHAANDocument9 pagesANALISIS RESIKO PERUSAHAANMuhajir Akbar SadekNo ratings yet

- Manajemen Risiko Perbankan-Makalah SMSTR 03Document22 pagesManajemen Risiko Perbankan-Makalah SMSTR 03Anonymous ASE10OC100% (1)

- Tugas Kelompok Manajemen RisikoDocument4 pagesTugas Kelompok Manajemen Risikoachmad ariefNo ratings yet

- M-6 Manajemn Risiko-Seminar PajakDocument14 pagesM-6 Manajemn Risiko-Seminar PajakjarvisstroompajakNo ratings yet

- Manajemen RisikoDocument1 pageManajemen RisikoPoison ProjectNo ratings yet

- BAB 11 Manajemen Risiko KeuanganDocument22 pagesBAB 11 Manajemen Risiko KeuanganRachmat Saleh HadinugrahaNo ratings yet

- S2.MENRIS - Pertemuan 1.Document10 pagesS2.MENRIS - Pertemuan 1.lingga sastrawijayaNo ratings yet

- Makalah Pendekatan Kualitatif Dalam Penanganan ResikoDocument13 pagesMakalah Pendekatan Kualitatif Dalam Penanganan ResikoBankJeckNo ratings yet

- MenriskDocument8 pagesMenriskNisaul MaghfirohNo ratings yet

- 78 137 1 SMDocument8 pages78 137 1 SMFuad ArifNo ratings yet

- Kelompok 2 - Manajemen Risiko - Teknik-Teknik Manajemen Risiko - MakalahDocument10 pagesKelompok 2 - Manajemen Risiko - Teknik-Teknik Manajemen Risiko - Makalahbrian LimanjayaNo ratings yet

- Manajemen Resiko AgribisnisDocument11 pagesManajemen Resiko AgribisnisnovanNo ratings yet

- Aulia Rahmi 3320130 Artikel Uts MKSDocument4 pagesAulia Rahmi 3320130 Artikel Uts MKSAulia RahmiNo ratings yet

- MANAJEMEN RISIKO BPKPDocument9 pagesMANAJEMEN RISIKO BPKPSutan RusdiNo ratings yet

- MANAJEMEN RISIKO KREDITDocument18 pagesMANAJEMEN RISIKO KREDITNabil Fadilah100% (1)

- 105 Kapita Selekta Pajak M-5 Manajemen Risiko PajakDocument13 pages105 Kapita Selekta Pajak M-5 Manajemen Risiko PajakPASCA/1620104031/AKMAD LUTFINo ratings yet

- Penilaian RisikoDocument8 pagesPenilaian RisikoDwita NinziNo ratings yet

- Tugas Individu Lecture 7 - Efektifitas Manajemen Risiko - Adeantiko Riza Febiunca - 242221073Document10 pagesTugas Individu Lecture 7 - Efektifitas Manajemen Risiko - Adeantiko Riza Febiunca - 242221073adeantiko.riza.febiunca-2022No ratings yet

- Tahapan Manajemen RisikoDocument21 pagesTahapan Manajemen RisikoRifky Budi SetiawanNo ratings yet

- Manajemen Risiko PerusahaanDocument7 pagesManajemen Risiko PerusahaanPuja WafiqNo ratings yet

- 1 +Pengertian+Risiko+&+MANAJEMEN+RISIKODocument25 pages1 +Pengertian+Risiko+&+MANAJEMEN+RISIKOMardhiah SiregarNo ratings yet

- RM_ManajemenRisikoDocument27 pagesRM_ManajemenRisikobella widyaNo ratings yet

- ANALISIS RISIKO PERUSAHAANDocument4 pagesANALISIS RISIKO PERUSAHAANBl ShirtinaNo ratings yet

- JUDULDocument5 pagesJUDULBahrul HidayahNo ratings yet

- Manejemen Resiko Pada Bank Syariah Mandiri Cabang Bogor - Kasus Kredit FiktifDocument19 pagesManejemen Resiko Pada Bank Syariah Mandiri Cabang Bogor - Kasus Kredit FiktifAbd Karim Basir69% (16)

- RISK RESPONSEDocument11 pagesRISK RESPONSEDzaky NaufalNo ratings yet

- Manajemen Risiko Kredit Fix BGTDocument14 pagesManajemen Risiko Kredit Fix BGTAyundah SugihartoNo ratings yet

- Soal Manajemen Resiko Rekam MedisDocument4 pagesSoal Manajemen Resiko Rekam MedisUswatun HasanahNo ratings yet

- Manajemen Risiko KeuanganDocument14 pagesManajemen Risiko KeuanganAbang Muhamad Irvan KNo ratings yet

- Tax Risk Management - WordDocument25 pagesTax Risk Management - WordAsmeri Wang100% (5)

- Manajemen ResikoDocument11 pagesManajemen ResikotamiuthamiNo ratings yet

- RISIKO BISNISDocument6 pagesRISIKO BISNISfitriaNo ratings yet

- RISIKO BANKDocument8 pagesRISIKO BANKHamdaniNo ratings yet

- Manajemen Risiko Pada Industri Dan Antisipasi Risiko BisnisDocument13 pagesManajemen Risiko Pada Industri Dan Antisipasi Risiko BisnisNetra MandiriNo ratings yet

- Learning Journal Audit Internal Pertemuan Ke 8Document4 pagesLearning Journal Audit Internal Pertemuan Ke 8yellowpinkeuNo ratings yet

- Akuntansi InternasionalDocument20 pagesAkuntansi InternasionalulynuhayukhaNo ratings yet

- Resiko PengendalianDan AssuranceDocument6 pagesResiko PengendalianDan Assuranceblackpapper850No ratings yet

- Kelompok 1 - Kelas E8 - Materi Pengantar Manajemen ResikoDocument21 pagesKelompok 1 - Kelas E8 - Materi Pengantar Manajemen ResikoCandra WirditaNo ratings yet

- Bahan MA - 12 - ResikoDocument11 pagesBahan MA - 12 - ResikoDian HendrawanNo ratings yet

- Manajemen ResikoDocument15 pagesManajemen ResikoShatria Sholihin PutraNo ratings yet

- Manajemen Resiko ProsesDocument9 pagesManajemen Resiko ProsesPASCA/1620104041/ROHMAN PRANOTONo ratings yet

- Bab 3 Penentuan RisikoDocument18 pagesBab 3 Penentuan RisikofadilasriNo ratings yet

- Manajemen Agribisnis: Manajemen Resiko UBDocument3 pagesManajemen Agribisnis: Manajemen Resiko UBM Diqqi van PieterNo ratings yet

- MANAJEMEN RISIKO UMKMDocument2 pagesMANAJEMEN RISIKO UMKMmentari fazrinniaNo ratings yet

- RISIKO BANKDocument6 pagesRISIKO BANKmyrul syafiqNo ratings yet

- Makalah Kelompok 1 Risiko KeuanganDocument30 pagesMakalah Kelompok 1 Risiko Keuanganirvan febrian123No ratings yet

- UAS - Farhan Khoirullah - 1518620010Document8 pagesUAS - Farhan Khoirullah - 1518620010redinda permata.ANo ratings yet

- 01 Muhammad Rudinni B Manajemen RisikoDocument4 pages01 Muhammad Rudinni B Manajemen RisikoMuhammad RudinniNo ratings yet

- MANRISK SeninDocument7 pagesMANRISK SeninSalomo GalihNo ratings yet

- Tugas Resume MKPK Manajemen Risiko - Endah Puji Lestari - 21808141038Document8 pagesTugas Resume MKPK Manajemen Risiko - Endah Puji Lestari - 21808141038Rainito Aditya RizanaldiFENo ratings yet

- Ekonomi makro menjadi sederhana, berinvestasi dengan menafsirkan pasar keuangan: Cara membaca dan memahami pasar keuangan agar dapat berinvestasi secara sadar berkat data yang disediakan oleh ekonomi makroFrom EverandEkonomi makro menjadi sederhana, berinvestasi dengan menafsirkan pasar keuangan: Cara membaca dan memahami pasar keuangan agar dapat berinvestasi secara sadar berkat data yang disediakan oleh ekonomi makroNo ratings yet

- Pendekatan sederhana untuk psikologi investasi: Cara menerapkan strategi psikologis dan sikap trader pemenang untuk trading online yang suksesFrom EverandPendekatan sederhana untuk psikologi investasi: Cara menerapkan strategi psikologis dan sikap trader pemenang untuk trading online yang suksesRating: 1 out of 5 stars1/5 (1)

- PPH BonusDocument2 pagesPPH BonusTeguh PurnamaNo ratings yet

- Optimized Gubernur DaftarDocument55 pagesOptimized Gubernur DaftarTeguh PurnamaNo ratings yet

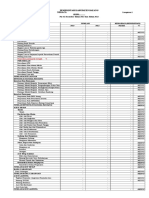

- Format Lampiran Laporan Akhir Tahun 20133Document27 pagesFormat Lampiran Laporan Akhir Tahun 20133Teguh PurnamaNo ratings yet

- Aplikasi Akuntansi Excel (Sampel Manufaktur)Document40 pagesAplikasi Akuntansi Excel (Sampel Manufaktur)uparp57% (7)

- 1 479219328987Document11 pages1 479219328987Gamel PakpahanNo ratings yet

- FENOMENADocument14 pagesFENOMENATeguh PurnamaNo ratings yet

- Agenda GuruDocument6 pagesAgenda GuruTeguh PurnamaNo ratings yet

- Akuntansi Syariah 2 TabelDocument18 pagesAkuntansi Syariah 2 TabelTeguh PurnamaNo ratings yet

- Surat KjaDocument1 pageSurat KjaTeguh PurnamaNo ratings yet

- MANAJEMENDocument30 pagesMANAJEMENYoichi HirumaNo ratings yet

- Disaat Daku TuaDocument1 pageDisaat Daku TuaSiti ErmaNo ratings yet

- AKUNTANSIDocument3 pagesAKUNTANSITeguh PurnamaNo ratings yet

- Administrasi GuruDocument1 pageAdministrasi GuruTeguh PurnamaNo ratings yet

- Aku Bukan Bang ToyibDocument1 pageAku Bukan Bang ToyibTeguh PurnamaNo ratings yet

- Sensasi Tahun Baru di 5 Kota DuniaDocument79 pagesSensasi Tahun Baru di 5 Kota Duniafredrich schotudhschauftern100% (3)

- SEMINAR AUDITINGDocument3 pagesSEMINAR AUDITINGTeguh PurnamaNo ratings yet

- Aplikasi Akuntansi Excel (Sampel Manufaktur)Document40 pagesAplikasi Akuntansi Excel (Sampel Manufaktur)uparp57% (7)

- Lampiran Aktiva & Penyusutan 2016Document300 pagesLampiran Aktiva & Penyusutan 2016Teguh PurnamaNo ratings yet

- Silabus SimDocument3 pagesSilabus SimTeguh PurnamaNo ratings yet

- SEMINAR AUDITINGDocument3 pagesSEMINAR AUDITINGTeguh PurnamaNo ratings yet

- SILABUS Audit ManajemenDocument3 pagesSILABUS Audit ManajemenTeguh Purnama100% (1)

- Rekap Kap 4 - Feed BackDocument2,228 pagesRekap Kap 4 - Feed BackTeguh PurnamaNo ratings yet

- Daftar UndanganDocument2 pagesDaftar UndanganTeguh PurnamaNo ratings yet

- SILABUS Audit SistemDocument4 pagesSILABUS Audit SistemTeguh PurnamaNo ratings yet

- Aplikasi Akuntansi Excel (Sampel Manufaktur)Document40 pagesAplikasi Akuntansi Excel (Sampel Manufaktur)uparp57% (7)

- Komputer AkuntansiDocument21 pagesKomputer AkuntansiTeguh PurnamaNo ratings yet

- Kamus BPRDocument3 pagesKamus BPRTeguh PurnamaNo ratings yet

- Ukg SMKDocument13 pagesUkg SMKTeguh PurnamaNo ratings yet

- SILABUS Seminar AuditDocument3 pagesSILABUS Seminar AuditTeguh PurnamaNo ratings yet

- Post Test AkuntansiDocument33 pagesPost Test AkuntansiTeguh PurnamaNo ratings yet