Professional Documents

Culture Documents

Global Macro Commentary March 30 - Putting The Cart in Front of The Horse

Uploaded by

dpbasicOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Global Macro Commentary March 30 - Putting The Cart in Front of The Horse

Uploaded by

dpbasicCopyright:

Available Formats

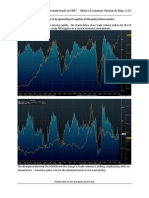

Global Macro Commentary

TheCartsinFrontoftheHorse

Wednesday, March

30, 2016

Guy Haselmann

(212) 225-6686

Director, Capital Markets Strategy

John Zawada

Director, US Rate Sales

TheCartsinFrontoftheHorse

MarketshaveoverreactedtoYellensspeech.Idonotbelievethatshewasasemphaticallydovishasthepressor

euphoricmarketsheralded.Thefloodintoriskassetsthisweekwillsoonprovetobeahugemistakeoverthenext

fewweeksandmonths.Ibeseechinvestorstowritedownyesterdaysclosingpricesinvariousmarketsandcompare

themtomonthendpricesineachmonthfortherestoftheyear.Ibetinvestorswilllookbackatthisweekasa

mistakeandtakeheedoftheterribleupsideversusdownsidepotentialatcurrentvaluations.

o Inthenearfuture,Ibet(materially):thedollarwillbehigher;theSPX,oil,andhighgradeindexeswillbe

lower;theTreasuryyieldcurvewillbeflatter;and,theUST/Bundspreadwillbenarrower.

Inmyopinion,YellenwasmerelytryingtobringclarityaftertheconfusionthatarosefromtheMarchmeetingand

pressconference.HerspeechwasnotintendedtopaintamoredovishFed,butrathertotrytocommunicatewhat

theFedhasbeensayingforquitesometime.Iwilloutlinethisinaminute.Theconfusionisbecauseherwordsfollow

shiftsintheuselessdotplotandbecausetheFOMCsneverdefineddatadependencyhadseeminglyreachedits

goalswithoutanaccompaniedratehike.

Yellensspeechbasicallysaidthattheeconomyandinflationcouldgoupordown,andtheFedwillreactaccordingly.

Sheaddedthatsinceratesweresolowthatthereisanasymmetricalskew,wherebytheFedhasmoreammunitionto

hikethantocut.Duetothisskew,theFOMCmustbecautiousandgradual.Shesaidtheworldisanuncertainplace,

hence,greatcautionisparticularlyprudent.Thereisnothingnewhererelativetopriormessages.

ManybelievethatChairYellenwaswrestlingthedovishmessagebackawayfromsomerecenthawkishcomments

madebyotherFOMCmembers.Idisagree.Itseemsmorelikethemarketishearingwhatitwantstobelieve.Nothing

newwasascertainedaboutFedthinking,however,afewimportantmarketrelatedfactorswerewitnessed.

Welearnedthatmarketdirectioncontinuestobedrivenbyherdinginvestorswhobelievethatmore(orlonger

periodsof)accommodationwillliftassetpricestoeverhigherlevels.Thisstrategyisbecomingevermoredangerous.

Higherpricesmeanlowerfuturereturns.Higherpricesrequiregreateramountsofeconomicreflationtojustify

valuations.Greateramountsofaccommodationarerequiredtoliftpricesevenfurther,butproblematicallythereis

littleeffectivemonetaryorfiscalslacklefttodoso.

Marketsremaindangerouslydependentonaggressivecentralbankinvolvement.TheFedandothercentralbanks

mustbegradualbecauseaquickexitplanwouldcertainlywreakhavoconfinancialmarkets.FOMCmembersadmit

therecouldbesomebumpiness,butIsuspectthatsecretlythey(rightly)fearmuchgreatermarketfallout.

ItmakesnosensetomethatFOMCmembersconstantlysaythattheyneedtohaveconfidencethattheir2%inflation

objectivewillbemetbeforeliftingrates.Thisstatementdoesnotquestionwhymonetarypolicyhasfailedtoachieve

theexpectedlevelsofgrowthandinflation.Thisstatementfullyreliesonthepremisethatmonetaryaccommodation

iswhatisnecessarytoachieve2%inflationandfullemployment.

Isntitpossiblethattheglobalization,theinternet,agingsocieties,andmassiveindebtednesscouldpreventcentral

banksfromfurtherprogresstowardhighergoalsandeconomicperformance?Isntitpossiblethatlowandnegative

ratesmightbecounterproductivetosuchgoals(seemyMarch8note,TheHCurve)?

Unfortunately,Fedofficialsspeakliketheycanachieveeconomicnirvana,oratleastdomorethanisrealistic.Itseems

tomethatpreciselypinpointingexacteconomictargetsfortheUS$18trillionglobaleconomyismicromanagement

atitsextreme.Thereisanunhealthyhubrisinoverpromisingwhatcanbedelivered.Lastweek,PhiladelphiaFed

PresidentHarkerrefreshinglystatedthattheFedshouldhavehumilityinthelimitsofmonetarypolicy.

Theintentionofrecentcentralbankpolicieshasbeentoliftassetpricesandencourageriskseeking.Ifailtoseehow

loweringratesbelowacertainlevel,orhowbuyingmanytrillionsofdollarsofassets,properlyhelpsthereal

economy.Itseemslikethecartisbeingputinfrontofthehorse.Iftherealeconomyisstrongthenassetprices

shouldrisetotheappropriatelevel,notviceversa.

Idoubttherewerepotentialborrowerswhowaitedtoborrowoncerateshitzero,becausetheywerewaitingtodo

betterwithnegativerates.Onthecontrary,nearzeroandnegativeratescrushpension,insuranceandbanking

models.Theyhurtsmallsaversandcausethemtoretrenchevenfurther.Theydamagecapitalmarketsandencourage

speculation.Theyincreaseuncertainty,harmingthewillingnessforinvestmentinthecapitalprojectsnecessaryfor

longrunimprovementintherealeconomy.

Investingtodayismoreaboutpsychologythanvaluation.Lowerforlongermaynotbuytime.Onthecontrary,it

risksfinancialinstabilityandcomplicatescentralbankexitstrategies.Formostcompanies,revenueandprofitgrowth

willbeelusive.Marketshaveenteredadangerousgameofchicken.Investorsshouldworrylessaboutmissingthe

upsideorinfindingcapitalgains,andworrymoreaboutlimitingcapitalloss.

Howdoyoutellifyouverunoutofinvisibleink?StevenWright

You might also like

- Anatomy of the Bear: Lessons from Wall Street's four great bottomsFrom EverandAnatomy of the Bear: Lessons from Wall Street's four great bottomsRating: 4 out of 5 stars4/5 (3)

- Global Macro Roundup & Preview (26 July, 2017)Document8 pagesGlobal Macro Roundup & Preview (26 July, 2017)ahmadfz1No ratings yet

- Alpha Fractal ReportDocument7 pagesAlpha Fractal Reportapi-213311303No ratings yet

- 2013 09sep015 Update and CommentaryDocument5 pages2013 09sep015 Update and CommentaryRoger StephensNo ratings yet

- Thackray Newsletter 2016 09 SeptemberDocument9 pagesThackray Newsletter 2016 09 SeptemberdpbasicNo ratings yet

- Tear Sheet July 2016Document26 pagesTear Sheet July 2016Dr Bugs TanNo ratings yet

- Gs Macro Out Look 20171Document62 pagesGs Macro Out Look 20171VladimirNo ratings yet

- Signs of Risk Aversion ReturnsDocument5 pagesSigns of Risk Aversion ReturnsValuEngine.comNo ratings yet

- Weekly Market Commentary 03282016Document5 pagesWeekly Market Commentary 03282016dpbasicNo ratings yet

- Send An Email To Eirik - Moe@gmail - Com If You Would Like To Be Added To The Distribution ListDocument6 pagesSend An Email To Eirik - Moe@gmail - Com If You Would Like To Be Added To The Distribution ListEirik W. MoeNo ratings yet

- 11/6/14 Global-Macro Trading SimulationDocument18 pages11/6/14 Global-Macro Trading SimulationPaul KimNo ratings yet

- Market Update 5-29-12Document13 pagesMarket Update 5-29-12keika123No ratings yet

- The Bark Is Worse Than The BiteDocument6 pagesThe Bark Is Worse Than The BitedpbasicNo ratings yet

- Calling All Traders Get Ready To Make Money Shorting The MarketDocument5 pagesCalling All Traders Get Ready To Make Money Shorting The MarketMarci HajduNo ratings yet

- Investment Strategy: "She's Come Undun"Document5 pagesInvestment Strategy: "She's Come Undun"careyescapitalNo ratings yet

- Market Analysis Nov 2022Document12 pagesMarket Analysis Nov 2022Muhammad SatrioNo ratings yet

- 06-06-2011 10:27 AM A Converation Between A Sell-Side Rates Trader & Buy-Side Equities TraderDocument5 pages06-06-2011 10:27 AM A Converation Between A Sell-Side Rates Trader & Buy-Side Equities Traderapi-80847199No ratings yet

- 0320 US Fixed Income Markets WeeklyDocument96 pages0320 US Fixed Income Markets WeeklycwuuuuNo ratings yet

- 2011 04 25 - Philly Fed and Housing Price Misses Fail To Derail Holiday-Shortened Rally Ahead of Easter WeekendDocument10 pages2011 04 25 - Philly Fed and Housing Price Misses Fail To Derail Holiday-Shortened Rally Ahead of Easter WeekendNaufal SanaullahNo ratings yet

- Trading Range IntactDocument8 pagesTrading Range IntactAnonymous Ht0MIJNo ratings yet

- Global Macro Commentary Dec 19Document3 pagesGlobal Macro Commentary Dec 19dpbasicNo ratings yet

- Beginning of Bear Market..Document7 pagesBeginning of Bear Market..Ajay shahNo ratings yet

- Recap of Last Week's Watchlist:: Weekly Watchlist For Free MembersDocument7 pagesRecap of Last Week's Watchlist:: Weekly Watchlist For Free MembersSebastian NilssonNo ratings yet

- Lane Asset Management Stock Market and Economic Commentary July 2012Document7 pagesLane Asset Management Stock Market and Economic Commentary July 2012Edward C LaneNo ratings yet

- August 022010 PostsDocument150 pagesAugust 022010 PostsAlbert L. PeiaNo ratings yet

- Daily market review and trading levels Nov 6Document4 pagesDaily market review and trading levels Nov 6Ayesha YasinNo ratings yet

- Marc Faber May 5Document3 pagesMarc Faber May 5variantperception100% (1)

- NA Equity Strategy (Market Update) - February 6, 2014Document5 pagesNA Equity Strategy (Market Update) - February 6, 2014dpbasicNo ratings yet

- Alpha Fractal ReportDocument14 pagesAlpha Fractal Reportapi-213311303No ratings yet

- Lane Asset Management Stock Market Commentary For October 2013Document9 pagesLane Asset Management Stock Market Commentary For October 2013Edward C LaneNo ratings yet

- Perspective: Economic and MarketDocument4 pagesPerspective: Economic and MarketdpbasicNo ratings yet

- Saut 05 03 10Document5 pagesSaut 05 03 10careyescapitalNo ratings yet

- Is The Market About To CrashDocument21 pagesIs The Market About To CrashSoren K. GroupNo ratings yet

- The Sentiment Signal Suggesting Stocks Could Go FlatDocument4 pagesThe Sentiment Signal Suggesting Stocks Could Go FlatAnonymous TApDKFNo ratings yet

- 2016 - Adapt To A Changing LandscapeDocument3 pages2016 - Adapt To A Changing LandscapeAnonymous cekPJylABoNo ratings yet

- Roumell Update - 2Q2013Document8 pagesRoumell Update - 2Q2013CanadianValueNo ratings yet

- Market Analysis Feb 2024Document17 pagesMarket Analysis Feb 2024Subba TNo ratings yet

- Top Trading OpportunitiesDocument25 pagesTop Trading Opportunitiestanyan.huangNo ratings yet

- Option Strategist 4 1 16Document10 pagesOption Strategist 4 1 16api-313709130No ratings yet

- LAM Commentary July 2011Document8 pagesLAM Commentary July 2011Edward C LaneNo ratings yet

- Chart Review - Can We Rotate Back To EM? Macro Economic Research May 2013Document4 pagesChart Review - Can We Rotate Back To EM? Macro Economic Research May 2013kcousinsNo ratings yet

- Tactical Investor - Secrets To Inteligent InvestingDocument13 pagesTactical Investor - Secrets To Inteligent InvestingWl4dNo ratings yet

- Hoisington Quarterly Review and Outlook - Second Quarter 2015Document12 pagesHoisington Quarterly Review and Outlook - Second Quarter 2015richardck61No ratings yet

- 11/3/14 Global-Macro Trading SimulationDocument20 pages11/3/14 Global-Macro Trading SimulationPaul KimNo ratings yet

- Weekly 5th June 2023 - Speculative InvestorDocument21 pagesWeekly 5th June 2023 - Speculative InvestorQizhi NeoNo ratings yet

- TomT Stock Market Model 2012-05-20Document20 pagesTomT Stock Market Model 2012-05-20Tom TiedemanNo ratings yet

- 29 July 2011 FX WEEKLY Dollar Ambiguities Amplified COMPLETEDocument18 pages29 July 2011 FX WEEKLY Dollar Ambiguities Amplified COMPLETEtimurrsNo ratings yet

- 11/16/12 Market MemoDocument1 page11/16/12 Market Memoapi-80847199No ratings yet

- 11/4/14 Global-Macro Trading SimulationDocument20 pages11/4/14 Global-Macro Trading SimulationPaul KimNo ratings yet

- Perspective: Economic and MarketDocument10 pagesPerspective: Economic and MarketdpbasicNo ratings yet

- 80th Birthday Wishes for Dalai Lama amid Planetary WarningDocument4 pages80th Birthday Wishes for Dalai Lama amid Planetary WarningGauriGanNo ratings yet

- Vital Signs: Tipping Point?!Document4 pagesVital Signs: Tipping Point?!trade100No ratings yet

- Spy vs. Spy: Which Chart Pattern Will Prevail?Document3 pagesSpy vs. Spy: Which Chart Pattern Will Prevail?Anonymous TApDKFNo ratings yet

- 1st JuneDocument8 pages1st JuneJohn HowellNo ratings yet

- 2nd Quarter 2004 CommentaryDocument2 pages2nd Quarter 2004 CommentaryNelson Roberts Investment AdvisorsNo ratings yet

- FX 20140417Document2 pagesFX 20140417eliforuNo ratings yet

- Bullard Presentation Feb 2016Document31 pagesBullard Presentation Feb 2016ZerohedgeNo ratings yet

- 2000.05.06 - Elliott Wave Theorist - Interim ReportDocument2 pages2000.05.06 - Elliott Wave Theorist - Interim ReportBudi MulyonoNo ratings yet

- Eekly Conomic Pdate: Doug Potash PresentsDocument2 pagesEekly Conomic Pdate: Doug Potash PresentsDoug PotashNo ratings yet

- Thackray Newsletter 2018 08 AugustDocument9 pagesThackray Newsletter 2018 08 AugustdpbasicNo ratings yet

- Retirement 20/20: The Right Advice Can Bring Your Future Into FocusDocument12 pagesRetirement 20/20: The Right Advice Can Bring Your Future Into FocusdpbasicNo ratings yet

- BMO ETF Portfolio Strategy Report: Playing Smart DefenseDocument7 pagesBMO ETF Portfolio Strategy Report: Playing Smart DefensedpbasicNo ratings yet

- The Race of Our Lives RevisitedDocument35 pagesThe Race of Our Lives RevisiteddpbasicNo ratings yet

- Fidelity Multi-Sector Bond Fund - ENDocument3 pagesFidelity Multi-Sector Bond Fund - ENdpbasicNo ratings yet

- TL Secular Outlook For Global GrowthDocument12 pagesTL Secular Outlook For Global GrowthdpbasicNo ratings yet

- Credit Suisse Investment Outlook 2018Document64 pagesCredit Suisse Investment Outlook 2018dpbasic100% (1)

- SSRN Id3132563Document13 pagesSSRN Id3132563dpbasicNo ratings yet

- GMOMelt UpDocument13 pagesGMOMelt UpHeisenberg100% (2)

- Thackray Newsletter 2017 09 SeptemberDocument9 pagesThackray Newsletter 2017 09 SeptemberdpbasicNo ratings yet

- 2018 OutlookDocument18 pages2018 OutlookdpbasicNo ratings yet

- Thackray Seasonal Report Storm Warning 2017-May-05Document12 pagesThackray Seasonal Report Storm Warning 2017-May-05dpbasic100% (1)

- Otlk-Bklt-Ret-A4 1711Document48 pagesOtlk-Bklt-Ret-A4 1711dpbasicNo ratings yet

- Etf PSR q4 2017 eDocument7 pagesEtf PSR q4 2017 edpbasicNo ratings yet

- Thackray Newsletter 2017 09 SeptemberDocument4 pagesThackray Newsletter 2017 09 SeptemberdpbasicNo ratings yet

- Thackray Newsletter 2017 07 JulyDocument8 pagesThackray Newsletter 2017 07 JulydpbasicNo ratings yet

- Thackray Newsletter 2017 01 JanuaryDocument11 pagesThackray Newsletter 2017 01 JanuarydpbasicNo ratings yet

- Retirement 20/20: The Right Advice Can Bring Your Future Into FocusDocument12 pagesRetirement 20/20: The Right Advice Can Bring Your Future Into FocusdpbasicNo ratings yet

- Thackray Newsletter: - Know Your Buy & Sells A Month in AdvanceDocument11 pagesThackray Newsletter: - Know Your Buy & Sells A Month in AdvancedpbasicNo ratings yet

- From Low Volatility To High GrowthDocument4 pagesFrom Low Volatility To High GrowthdpbasicNo ratings yet

- Hot Charts 9feb2017Document2 pagesHot Charts 9feb2017dpbasicNo ratings yet

- TL What It Would Take For U.S. Economy To GrowDocument8 pagesTL What It Would Take For U.S. Economy To GrowdpbasicNo ratings yet

- Special Report 30jan2017Document5 pagesSpecial Report 30jan2017dpbasicNo ratings yet

- Boc Policy MonitorDocument3 pagesBoc Policy MonitordpbasicNo ratings yet

- GeopoliticalBriefing 22nov2016Document6 pagesGeopoliticalBriefing 22nov2016dpbasicNo ratings yet

- INM 21993e DWolf Q4 2016 NewEra Retail SecuredDocument4 pagesINM 21993e DWolf Q4 2016 NewEra Retail SecureddpbasicNo ratings yet

- CMX Roadshow Final November 2016Document25 pagesCMX Roadshow Final November 2016dpbasicNo ratings yet

- Peloton Webinar September 26-2016Document26 pagesPeloton Webinar September 26-2016dpbasicNo ratings yet

- Hot Charts 17nov2016Document2 pagesHot Charts 17nov2016dpbasicNo ratings yet

- The Trumpquake - Special Report 10nov2016Document5 pagesThe Trumpquake - Special Report 10nov2016dpbasicNo ratings yet

- Abra Valley College Vs AquinoDocument1 pageAbra Valley College Vs AquinoJoshua Cu SoonNo ratings yet

- Benzon CaseDocument3 pagesBenzon Casejulieanne07100% (1)

- Fundamentals of Real Estate ManagementDocument1 pageFundamentals of Real Estate ManagementCharles Jiang100% (4)

- Case Study 2 F3005Document12 pagesCase Study 2 F3005Iqmal DaniealNo ratings yet

- Gattu Madhuri's Resume for ECE GraduateDocument4 pagesGattu Madhuri's Resume for ECE Graduatedeepakk_alpineNo ratings yet

- Khadi Natural Company ProfileDocument18 pagesKhadi Natural Company ProfileKleiton FontesNo ratings yet

- BlueDocument18 pagesBluekarishma nairNo ratings yet

- Week 3 SEED in Role ActivityDocument2 pagesWeek 3 SEED in Role ActivityPrince DenhaagNo ratings yet

- AKTA MERGER (FINAL) - MND 05 07 2020 FNLDocument19 pagesAKTA MERGER (FINAL) - MND 05 07 2020 FNLNicoleNo ratings yet

- Sav 5446Document21 pagesSav 5446Michael100% (2)

- WitepsolDocument21 pagesWitepsolAnastasius HendrianNo ratings yet

- Chapter 7 - Cash BudgetDocument23 pagesChapter 7 - Cash BudgetMostafa KaghaNo ratings yet

- 2006-07 (Supercupa) AC Milan-FC SevillaDocument24 pages2006-07 (Supercupa) AC Milan-FC SevillavasiliscNo ratings yet

- 7458-PM Putting The Pieces TogetherDocument11 pages7458-PM Putting The Pieces Togethermello06No ratings yet

- Bar Exam 2016 Suggested Answers in Political LawDocument15 pagesBar Exam 2016 Suggested Answers in Political LawYlnne Cahlion KiwalanNo ratings yet

- 9 QP - SSC - MOCK EXAMDocument5 pages9 QP - SSC - MOCK EXAMramNo ratings yet

- MSDS Summary: Discover HerbicideDocument6 pagesMSDS Summary: Discover HerbicideMishra KewalNo ratings yet

- Railway RRB Group D Book PDFDocument368 pagesRailway RRB Group D Book PDFAshish mishraNo ratings yet

- Continuation in Auditing OverviewDocument21 pagesContinuation in Auditing OverviewJayNo ratings yet

- Haul Cables and Care For InfrastructureDocument11 pagesHaul Cables and Care For InfrastructureSathiyaseelan VelayuthamNo ratings yet

- 50TS Operators Manual 1551000 Rev CDocument184 pages50TS Operators Manual 1551000 Rev CraymondNo ratings yet

- UKIERI Result Announcement-1Document2 pagesUKIERI Result Announcement-1kozhiiiNo ratings yet

- Dinsmore - Gantt ChartDocument1 pageDinsmore - Gantt Chartapi-592162739No ratings yet

- Dairy DevelopmentDocument39 pagesDairy DevelopmentHemanth Kumar RamachandranNo ratings yet

- 1.1 Introduction To Networks - Networks Affect Our LivesDocument2 pages1.1 Introduction To Networks - Networks Affect Our LivesCristian MoralesNo ratings yet

- Qatar Airways E-ticket Receipt for Travel from Baghdad to AthensDocument1 pageQatar Airways E-ticket Receipt for Travel from Baghdad to Athensمحمد الشريفي mohammed alshareefiNo ratings yet

- Fundamental of Investment Unit 5Document8 pagesFundamental of Investment Unit 5commers bengali ajNo ratings yet

- Chill - Lease NotesDocument19 pagesChill - Lease Notesbellinabarrow100% (4)

- Usa Easa 145Document31 pagesUsa Easa 145Surya VenkatNo ratings yet

- Eritrea and Ethiopia Beyond The Impasse PDFDocument12 pagesEritrea and Ethiopia Beyond The Impasse PDFThe Ethiopian AffairNo ratings yet