Professional Documents

Culture Documents

SMALL BUSINESSES' CONCERNS CONFIRMED: Health Care Tax Credit Nearly Impossible To Navigate, Offers Little Help and Encourages Wage and Job Cuts

Uploaded by

sarah_swinehart0 ratings0% found this document useful (0 votes)

50 views1 pageESP is capped at 50% of the state's average small group premium. If your PP is at least 50%, you might be eligible for the tax credit. You can get back on the road to the credit by CUTTING employee WAGES.

Original Description:

Original Title

SMALL BUSINESSES’ CONCERNS CONFIRMED: Health Care Tax Credit Nearly Impossible To Navigate, Offers Little Help and Encourages Wage and Job Cuts

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentESP is capped at 50% of the state's average small group premium. If your PP is at least 50%, you might be eligible for the tax credit. You can get back on the road to the credit by CUTTING employee WAGES.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

50 views1 pageSMALL BUSINESSES' CONCERNS CONFIRMED: Health Care Tax Credit Nearly Impossible To Navigate, Offers Little Help and Encourages Wage and Job Cuts

Uploaded by

sarah_swinehartESP is capped at 50% of the state's average small group premium. If your PP is at least 50%, you might be eligible for the tax credit. You can get back on the road to the credit by CUTTING employee WAGES.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Click to follow on Twitter Click to follow on Facebook

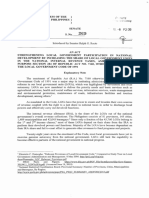

Navigating the Small Business Tax Credit

START: Do you (employer) offer health insurance to DETOUR: CALCULATION

your employees? Formula: PP = (Employer’s Share of Premium)

(Total Premium) If your PP is at If your PP is

Calculate the percentage of premiums paid (PP) by: least 50%, you less than 50%:

1. Collecting premium information on ALL health-related insurance might be STOP, you are

If, “Yes,” you policies for which you are seeking a credit. This amount eligible for the ineligible for

If, “No”:

might be represents total dollars spent by employer’s on health insurance tax credit the tax credit

STOP, you are

eligible for the ineligible for premiums (ESP).

tax credit tax credit 2. Determining the percentage of the premium paid for your

employees enrolled in self-only and family coverage. Employer can get back on the road to the credit

NOTE: ESP is capped at 50% of the state’s average small group by CUTTING WAGES or BENEFITS to spend

SECOND QUESTION: How many full-time equivalent premium. Some employers may reduce health benefits so their more for insurance

employees (FTE) do you have? premiums don’t exceed the average.

FIFTH QUESTION: You’ve finally navigated

FOURTH QUESTION: Do you pay at least 50% of your through the winding road, what size tax credit

employees’ premiums (including health, vision, dental, long-term do you qualify for?

DETOUR: CALCULATION care, nursing home care, home health care community-based care)?

Formula: FTE = (E1 x H1) + (E2 x H2) + (EN x HN) /

2080 (rounded down to the nearest whole number) DETOUR: CALCULATION

Employer can get back on the road to the credit by CUTTING

Calculate the total full-time equivalent employees If you have 10 or fewer FTE and $25,000 or less

EMPLOYEE WAGES

(FTE) by: in AAW, you receive the maximum credit (MC)

1. Calculating the number of employees (E) amount.

(excluding owners, partners, family members, and If your AAW is Taxable small business: MC = ESP x 35%

seasonal workers employed 120 days or less) If AAW is less $50,000 or Tax-exempt small employer: MC = ESP x 25%

2. Calculating the total number of hours (H) worked than $50,000 you higher:

for EACH employee (including paid vacation days, might be eligible STOP, you are

DETOUR: CALCULATION

holidays, sick leave, disability leave, layoff, jury for the tax credit ineligible for the

If you have more than 10 FTE and $25,000 or less

duty, military duty or leave of absence (capped at tax credit

in AAW, you receive a partial credit (PC1).

no more than 160 hours for an employee for a

PC1 = MC – [MC((FTE – 10) / 15)]

single continuous period)).

3. Multiplying the number hours worked for each DETOUR: CALCULATION

employee and take the sum of this calculation for Formula: AAW = (E1 x W1) + (E2 x W2) + (EN x WN) / FTE

(rounded down to the nearest $1,000) DETOUR: CALCULATION

all employees and dividing it by 2,080 hours to If you have 10 or fewer FTE and more than

arrive at the total FTE. Calculate the total wages paid to his/her employees by:

1. Taking the number of employees calculated in question 2 $25,000 in AAW, you receive a partial credit (PC2).

2. Taking the number of hours each employee worked as calculated PC2 = MC – [MC((AAW-25,000)/$25,000)]

If FTE is fewer If your FTE is in question 2

than 25 you 25 or more: 3. Determining the wage (W) that was paid for EACH employee

might be STOP, you are for each of the hours worked DETOUR: CALCULATION

eligible for the ineligible for 4. Multiplying the wage for each employee and taking the sum of If you have more than 10 FTE and more than

tax credit tax credit this calculation for all employees and dividing it by the number $25,000 in AAW, you receive a partial credit (PC3).

of FTE (see question 2) to arrive at AAW. PC3 = MC – [MC((FTE – 10)/15)] + [MC((AAW-

$25,000)/$25,000)]

Employer can get back on the road to the credit by THIRD QUESTION: What is the average annual wage (AAW) Committee on Ways & Means, Republicans

FIRING EMPLOYEES across all your employees? Ranking Member Dave Camp

May 20, 2010

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- SBN-0269: Increasing Internal Revenue Allotment (IRA) To 50 PercentDocument3 pagesSBN-0269: Increasing Internal Revenue Allotment (IRA) To 50 PercentRalph RectoNo ratings yet

- Developing Budgets, Financial Statements and Plans GuideDocument22 pagesDeveloping Budgets, Financial Statements and Plans GuideJhonissa LasquiteNo ratings yet

- Fringe Benefits TaxDocument4 pagesFringe Benefits TaxKathleen Jane SolmayorNo ratings yet

- Pdfserver Amlaw Com Law Southcalifornia TRLDocument167 pagesPdfserver Amlaw Com Law Southcalifornia TRLapi-24706121550% (2)

- FBDC Tax Deficiency CaseDocument191 pagesFBDC Tax Deficiency Casecaren kay b. adolfoNo ratings yet

- Chapter 8.ADocument18 pagesChapter 8.AtawfiqhanifmawaniNo ratings yet

- Burgum July QuarterlyDocument767 pagesBurgum July QuarterlyRob PortNo ratings yet

- Principles of Macroeconomics 8th Edition Mankiw Solutions Manual 1Document7 pagesPrinciples of Macroeconomics 8th Edition Mankiw Solutions Manual 1cynthiasheltondegsypokmj100% (26)

- Merchants in The Rural Setup in EighteenDocument4 pagesMerchants in The Rural Setup in EighteenMohammad ShahnawazNo ratings yet

- Contract BillDocument13 pagesContract Billshree prasad sahNo ratings yet

- 1040 Tax Return SummaryDocument29 pages1040 Tax Return SummaryBonilla Cesar100% (2)

- National Power Corp. v. Provincial TreasurerDocument10 pagesNational Power Corp. v. Provincial TreasurerChristian Edward CoronadoNo ratings yet

- Akash - Salary SlipDocument2 pagesAkash - Salary Slipzingo bingoNo ratings yet

- Summary of Quantities: Item No. Description Unit Quantity RemarksDocument31 pagesSummary of Quantities: Item No. Description Unit Quantity RemarksFlormin LumbaoNo ratings yet

- Regala Vs Sandiganbayan G.R. No. 105938 September 20 1996Document11 pagesRegala Vs Sandiganbayan G.R. No. 105938 September 20 1996FranzMordenoNo ratings yet

- Law Books IndexDocument24 pagesLaw Books IndexAnonymous LbLwAzNxrI100% (1)

- Modules 4-6 - Comprehensive Problem - Answer SheetDocument26 pagesModules 4-6 - Comprehensive Problem - Answer SheetLeizyl de MesaNo ratings yet

- General Banking Law CompilationDocument6 pagesGeneral Banking Law CompilationCristineNo ratings yet

- CORP-108 Tender No.57 - Manpower For RE Works-1ompDocument60 pagesCORP-108 Tender No.57 - Manpower For RE Works-1ompAnonymous NJDmHvjNo ratings yet

- 110 PDFDocument288 pages110 PDFSuresh BattaNo ratings yet

- Consumer Math Quiz 2ndDocument4 pagesConsumer Math Quiz 2ndRash GSNo ratings yet

- Dura Lex Sed LexDocument2 pagesDura Lex Sed LexKarl Marxcuz Reyes100% (1)

- Thrift Corp. Prepaid Expenses QuizDocument9 pagesThrift Corp. Prepaid Expenses QuizKristine VertucioNo ratings yet

- Flour Mill V CIRDocument2 pagesFlour Mill V CIRJefferson NunezaNo ratings yet

- Monica L Lindo Tax FormDocument2 pagesMonica L Lindo Tax Formapi-299234513No ratings yet

- Lito Corpus VDocument17 pagesLito Corpus VJayson CuberoNo ratings yet

- Dividends TaxationDocument3 pagesDividends TaxationGuruNo ratings yet

- Quries On Oracle PurchasingDocument51 pagesQuries On Oracle PurchasingNagaraju100% (1)

- Eric Lesser & Alison Silber - 2013 Joint Tax ReturnDocument2 pagesEric Lesser & Alison Silber - 2013 Joint Tax ReturnSteeleMassLiveNo ratings yet

- Ocean Carriers Project AnalysisDocument11 pagesOcean Carriers Project AnalysisSameer KumarNo ratings yet