Professional Documents

Culture Documents

Seal Datasheet - Trading Derivative

Uploaded by

Seal-Software0 ratings0% found this document useful (0 votes)

79 views2 pagesSeal Contract Discovery & Analytics helps organizations answer these types of questions on a daily basis. Organizations can leverage Seal in order to navigate the fast moving business environment and ever increasing regulatory requirements.

Original Title

Seal datasheet | trading derivative

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSeal Contract Discovery & Analytics helps organizations answer these types of questions on a daily basis. Organizations can leverage Seal in order to navigate the fast moving business environment and ever increasing regulatory requirements.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

79 views2 pagesSeal Datasheet - Trading Derivative

Uploaded by

Seal-SoftwareSeal Contract Discovery & Analytics helps organizations answer these types of questions on a daily basis. Organizations can leverage Seal in order to navigate the fast moving business environment and ever increasing regulatory requirements.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

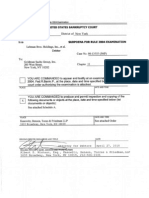

Datasheet

Trading & Derivative

Contract Discovery

True Derivative Agreement Insight and Compliance Oversight and

Regulation Management

On Monday morning Moodys has downgraded bank ABCs credit rating. ABC has

thousands of derivative agreements, but does not know which ones have trigger events

based on their new credit rating. Unsure of the consequences that could occur or actions

ABC is contractually obliged to perform, ABC needs answers.

Seal Contract Discovery & Analytics helps organizations answer these types of questions on

a daily basis. Organizations can leverage Seal in order to navigate the fast moving business

environment and ever increasing regulatory requirements.

So Why is This Oversight Important?

American International Group (AIG) lost more than US $18 billion through a subsidiary

over the preceding three quarters on credit default swaps (CDSs).

The United States Federal Reserve Bank announced the creation of a secured credit

facility of up to US $85 billion, to prevent the companys collapse by enabling AIG to

meet its obligations to deliver additional collateral to its credit default swap trading

partners.

So What Does This Mean?

It means that the traditional or shall we say archaic way of managing these agreements,

addendums and reference data within no longer represent the complexity and granularity

needed. Organizations today need to be able to respond to Risk Weighted Asset

calculations, liquidity reporting, collateral management as well as compliance with DoddFrank, EMIR, CASS, MiFID, etc.

Financial and other trading institutions have a plethora of derivative agreements (ISDA,

CSA, GMRA, GMSLA) with a rapidly increasing number of counterparties up to tens or

even hundreds of thousands in a single institution. It has become increasingly necessary to

quickly find the specific provisions within thousands of derivative agreements.

www.seal-software.com

Copyright 2016. Seal Software Limited. All rights reserved.

Datasheet

How Can Seal Help?

Seal works alongside in-house legal departments. Seals advanced classification and

search technology allows organizations to quickly classify contracts. The result is a fully

searchable, cleansed derivative agreement repository that is continually improving and

proactive analysis that alerts you to revenue opportunities and risks.

Using advanced technology, capable of learning as it goes, Seal extracts over 100 prebuilt

contractual extraction policies. Users can easily create additional extraction policies using

an easy step by step wizard.

Your organization will teach and improve Seal based on your own organizations specific

derivative agreement provisions which improves the accuracy and relevancy as it relates to

your specific needs.

Using this technology organizations have the ability to define advanced policies that can

detect clause groups that alter the meaning of the actual contract and immediately present

this to review for confirmation.

How Seal Contract Discovery Works for You

Discovers contract documents stored on hard drives, network drives, software

solutions, file shares, etc.

Recognizes contract documents stored as text, DOC, PDF, image and other formats.

Copies the discovered files to a secure, protected location.

Ensures the discovered contractual documents as well as terms/clauses within those

documents can be easily searched.

Enables revisers to quickly extract tabular data from contracts and import into excel.

Identifies high risk and high value clauses.

Can load the contract documents it discovers into new or existing CLM, CRM and other

systems.

Metadata Extraction Policy creation via an intuitive wizard multi step process.

Contact Seal

Americas Headquarters

201 Mission Street, Suite 2250

San Francisco

CA 94105. USA.

T: + 1 650 938-SEAL (7325)

info@seal-software.com

European Headquarters

1-2 Hatfields, Waterloo

London

SE1 9PG, United Kingdom.

T: + 44 203 735 9898

info@seal-software.com

www.seal-software.com

Copyright 2016. Seal Software Limited. All rights reserved.

You might also like

- Impact of Brexit On Your Business - How Contracts Play A RoleDocument3 pagesImpact of Brexit On Your Business - How Contracts Play A RoleSeal-SoftwareNo ratings yet

- Seal Software Version 5 - Putting Power Into The Hands of UsersDocument5 pagesSeal Software Version 5 - Putting Power Into The Hands of UsersSeal-SoftwareNo ratings yet

- IFRS 16 - Seal Software - Contract ManagementDocument2 pagesIFRS 16 - Seal Software - Contract ManagementSeal-SoftwareNo ratings yet

- Contract Management and Technology - Seal SoftwareDocument3 pagesContract Management and Technology - Seal SoftwareSeal-SoftwareNo ratings yet

- Seal Datasheets - Seal PresentationsDocument3 pagesSeal Datasheets - Seal PresentationsSeal-SoftwareNo ratings yet

- IFRS 16 - Seal Software - Contract ManagementDocument2 pagesIFRS 16 - Seal Software - Contract ManagementSeal-SoftwareNo ratings yet

- Contract Lifecycle Process - Seal SoftwareDocument3 pagesContract Lifecycle Process - Seal SoftwareSeal-SoftwareNo ratings yet

- CLM (Contract Lifecycle Management) - Seal SoftwareDocument3 pagesCLM (Contract Lifecycle Management) - Seal SoftwareSeal-SoftwareNo ratings yet

- IFRS 16 - Seal Software - Contract ManagementDocument2 pagesIFRS 16 - Seal Software - Contract ManagementSeal-SoftwareNo ratings yet

- Seal Datasheet Procurement and Sourcing PDFDocument2 pagesSeal Datasheet Procurement and Sourcing PDFSeal-SoftwareNo ratings yet

- Regulatory Compliance - Seal Contract AnalysisDocument3 pagesRegulatory Compliance - Seal Contract AnalysisSeal-SoftwareNo ratings yet

- Contract Lifecycle Management - Seal SoftwareDocument4 pagesContract Lifecycle Management - Seal SoftwareSeal-SoftwareNo ratings yet

- Seal Datasheets - Seal PresentationsDocument3 pagesSeal Datasheets - Seal PresentationsSeal-SoftwareNo ratings yet

- Contract Lifecycle Management - Seal SoftwareDocument4 pagesContract Lifecycle Management - Seal SoftwareSeal-SoftwareNo ratings yet

- Contract Lifecycle Management - Seal SoftwareDocument4 pagesContract Lifecycle Management - Seal SoftwareSeal-SoftwareNo ratings yet

- Contract Lifecycle Management - Seal SoftwareDocument3 pagesContract Lifecycle Management - Seal SoftwareSeal-SoftwareNo ratings yet

- Seal Datasheet Procurement and Sourcing PDFDocument2 pagesSeal Datasheet Procurement and Sourcing PDFSeal-SoftwareNo ratings yet

- Seal Datasheet Procurement and Sourcing PDFDocument2 pagesSeal Datasheet Procurement and Sourcing PDFSeal-SoftwareNo ratings yet

- Mitigate Against Potential Litigation Threats With Effective Contract Management PracticesDocument2 pagesMitigate Against Potential Litigation Threats With Effective Contract Management PracticesSeal-SoftwareNo ratings yet

- Seal Datasheet - Contract AbstractionDocument3 pagesSeal Datasheet - Contract AbstractionSeal-SoftwareNo ratings yet

- Seal Datasheet - M&A ProcessDocument2 pagesSeal Datasheet - M&A ProcessSeal-SoftwareNo ratings yet

- Seal Datasheet - M&A ProcessDocument2 pagesSeal Datasheet - M&A ProcessSeal-SoftwareNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- ASF AgendaDocument23 pagesASF Agendaank333No ratings yet

- Charting A Course Through The CDS Big Bang-FitchDocument15 pagesCharting A Course Through The CDS Big Bang-Fitch83jjmackNo ratings yet

- What Went Wrong at AIGDocument6 pagesWhat Went Wrong at AIGnguyenduongthungocNo ratings yet

- Systematic Credit Investing: An Overview of Our ApproachDocument16 pagesSystematic Credit Investing: An Overview of Our ApproachCharles FattoucheNo ratings yet

- Education: John C. HullDocument11 pagesEducation: John C. HullsstyxerNo ratings yet

- Markit Itraxx Europe Series 30 RulebookDocument14 pagesMarkit Itraxx Europe Series 30 RulebookeddjkNo ratings yet

- Chap 001Document40 pagesChap 001AhmedNo ratings yet

- T1-FRM-4-Ch4-Transfer-Mech-v3.1 - Study NotesDocument16 pagesT1-FRM-4-Ch4-Transfer-Mech-v3.1 - Study NotescristianoNo ratings yet

- Statement Notice of Subpoena Issued Pursuan - StatementDocument16 pagesStatement Notice of Subpoena Issued Pursuan - StatementTroy UhlmanNo ratings yet

- The Famous New Bubbles of The 21st Century: Cases of Irrational ExuberanceDocument73 pagesThe Famous New Bubbles of The 21st Century: Cases of Irrational ExuberanceJohn TaskinsoyNo ratings yet

- Credit Risk Measurement and ManagementDocument469 pagesCredit Risk Measurement and ManagementChinh Kiều100% (3)

- BlueCrest 2011 ADV Part 2a BrochureDocument49 pagesBlueCrest 2011 ADV Part 2a BrochureWho's in my FundNo ratings yet

- Dcom510 Financial DerivativesDocument238 pagesDcom510 Financial DerivativesRavi Kant sfs 1No ratings yet

- Ch. 18 - Derivatives & Risk ManagementDocument58 pagesCh. 18 - Derivatives & Risk ManagementAngeline ManuelNo ratings yet

- Bear Stearns Collapse Due to Risky CDO BetsDocument15 pagesBear Stearns Collapse Due to Risky CDO BetsJaja JANo ratings yet

- Bisbull 38Document9 pagesBisbull 38readerNo ratings yet

- Blackstone and The Sale of Citigroup's Loan PortfolioDocument10 pagesBlackstone and The Sale of Citigroup's Loan PortfolioRonak Jain0% (1)

- CEFA Examination Syllabus 2021Document30 pagesCEFA Examination Syllabus 2021Erico Cortez Fioravante AgnelloNo ratings yet

- CMA FRTB Banks Regulatory Capital Calculations Just Got More Complicated AgainDocument18 pagesCMA FRTB Banks Regulatory Capital Calculations Just Got More Complicated AgainDependra KhatiNo ratings yet

- Credit Derivatives: CDS, CDO and CLO: SimplifiedDocument5 pagesCredit Derivatives: CDS, CDO and CLO: Simplifiedmani singhNo ratings yet

- Dashboards and Key Performance IndicatorsDocument58 pagesDashboards and Key Performance IndicatorsodrakkirNo ratings yet

- Lehman Brothers Case StudyDocument5 pagesLehman Brothers Case StudykrishhonlineNo ratings yet

- Big Short Presentation - Tulane TemplateDocument25 pagesBig Short Presentation - Tulane TemplateDave SislenNo ratings yet

- Credit Default Swaps (CDS) and Financial Guarantee (FG) InsuranceDocument33 pagesCredit Default Swaps (CDS) and Financial Guarantee (FG) InsuranceGeorge Lekatis100% (1)

- Index - 2018 - FinTech and The Remaking of Financial InstitutionsDocument20 pagesIndex - 2018 - FinTech and The Remaking of Financial InstitutionsJim WangNo ratings yet

- SwapsDocument38 pagesSwapsNavleen KaurNo ratings yet

- Structured Credit and Equity Product PDFDocument480 pagesStructured Credit and Equity Product PDFRach3ch100% (1)

- What Will Happen If Dollar CollapsedDocument7 pagesWhat Will Happen If Dollar CollapsedMoneyShifuNo ratings yet

- Structured Product - Credit Linked NoteDocument8 pagesStructured Product - Credit Linked Notelaila22222lailaNo ratings yet

- How MBS, CDOs and CDS Contributed to the 2008 Housing CrisisDocument5 pagesHow MBS, CDOs and CDS Contributed to the 2008 Housing CrisisАлександр НефедовNo ratings yet