Professional Documents

Culture Documents

Cag Aligarh University

Uploaded by

PGurus0 ratings0% found this document useful (0 votes)

383 views10 pagesFindings of the Office of CAG in improprieties in Aligarh Muslim University.

Copyright

© © All Rights Reserved

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFindings of the Office of CAG in improprieties in Aligarh Muslim University.

Copyright:

© All Rights Reserved

0 ratings0% found this document useful (0 votes)

383 views10 pagesCag Aligarh University

Uploaded by

PGurusFindings of the Office of CAG in improprieties in Aligarh Muslim University.

Copyright:

© All Rights Reserved

You are on page 1of 10

BeSSs cI

aS ARE Sy

/ oars

4 a 16 frees Bee Lore

i Cis oe

eral

oe ay 7

Be Het inne .

Wy Binge ‘|

rl

vuwvuwvvu vv EU eee Oo UU

Tho Director had cubmitted tha adjustmant of billc/voucher on May 25, 2015. By

adjusting the bills/vouchers the misappropriation/defalcation of Rs. 9.00 lakh

‘cannot be ruled out.

The above matters brought to the notice of higher authority for taking appropriate

action in the above case ofirregular adjustment of Rs. 9.00 lakh.

Part 1 (A)

ora No 1&Unauthorted expendhure of Rs, 46.33 lakh incured on

(a)As Rule 132 of GFR-2005 the following procedure in respect of Execution of

Works will be followed and wherein it has been mentioned that the broad

procedure to be followed by a Ministry or Department for execution of works under

its own arrangements shall be as under:

(i the detailed procedure relating to expenditure on such works shall be prescribed

by departmental regulations framed in consultation with the Accounts Officer,

generally based on the procedures and the principles underlying the financial and

accounting rules prescribed for similar works carried out by the CPWD;

(i) Preparation of detailed design and estimates shall precede any sanction for

works;

(ii) No work shatl be undertaken before issue of Administrative Approval and

Expenditure Sanction by the competent Authority on the basis of estimates frarned;

{WvlOpen tenders will be called for works costing Rupees five lakhs to Rupees ten

lakhs; ‘

(¥) Limited tenders will be called for works costing less than Rupees five lakhs;

(U)execution of Contract Agreement or Award of work should be done before

commencement of the work:

(vii) Final payment for work shall be made only.on the personal certificate of the

officer-in-charge of execution of the work in the format given below:

ah Executing Officer of (Name of the

C2

.

2

>

®

2

»

>

>

.

.

>

>

>

>

.

’

>

(iv)Eacess paymentto contractor Tos

From Scrutiny of records in respect of adjustments relating to advance of Rs. 10.00

lakh revealed that the payment of Rs. 3.37 lakh on 8-11-2014 and Rs. 4.26 lakh on

28-11-2014

works.

_ Of GFR2005. In adcition to the abovethe Chairman/ Coordinator did not deduct 2per

Cent income taxof Rs. 0.15 lakh, 4 per cent Vat amounting toRs. 0.20 lakh, per cent

Labourcess of Rs. 0.08 lakh and Jper centwater charges of Rs. 0.08 lakh. Thus the

excess payment of Rs. 0.46 lakh was made to M/S Shakeel Enterprises. The said

{v) Materiat Procured costing Rs. 5.53 lakh without inviting tender

m their bills as detailed below:

3. Name ot tm

x WSs Conte

z M/S ass Centre

3 Is 5.5. industries

4 [0a [aaatia [5s indies

5. [235 | oaataa | n/s bexpak Ugnthoise

6 | 281 [07-38-14 [MA svortove rrricing outs

%__| 282 | 06-1134 | /SsestoveFurtshiog house

[252 | 08-1234 | M/s Srivastava Furnishing hose 38213

"Same items

[7a [oon [nftinovaton 34400)

a0 [ aa [aati | WS Wind Eee ca

“Treat | sansa

eer eerie

contractor, non-preparation of estimate for the whole items, Electrical goods and!

others itemswere purchased in violation of the GER-2008, Finance Officer or his

representative was not invited in the meeting to maintain iransparency, the

re the possiblity of the misappropriation/

_Sefaleation of government money and undue advantage to contractor cannot be

‘uled oul. The DFO Student Section did not check the adjustments of advances

which were submitted by the Chairman asdeduction of statutory dues from the bills

‘of the contractor and suppliers was not carried out and work was executed without

a

GS Per 5.11 of Xil Plan Guidelinesafter the approval by the Building Committee, the

qhversity may place the proposal for the building project, before Finance

Committee forts approval along with a certificate that the plans and estimate are

in conformity with the normsas suggested by the UGC.

AS per 5.13(iii) of Xil Plan Guidelines the work relating to planning , architectural

dtesign, structural design and preparation of estimates and supervision of

Construction work may be entrusted to a firm of architect, or other government or

Semi-government agencies, and the actual execution of work may be entrusted to

the University’s Engineering department.

‘8s per 5.16 of Xil Plan Guidelines the plans and estimates fora construction project

should be approved ty the Building Committee of the University. Inthe meeting of

the Building Committee at least two members with Engineering and Architectural

background should invariably be present,

As per 6.6 of Xil Plan Guidelinesdocuments to be placed before the Building

Committee end Finance Committee and‘ formats of Utilisation Certificate to be

Submitted to UGC for release of further grant and completion certificate documents

to be submitted at the time of finalization of Xil Plan is annexed at Annexure —I,

WA, MB, NC, 0, HE, 1, 1G, 1H, 1, AK,

AS Per 5.6 of Xil Plan Guidelinesthe Building Committee should be responsible for

Finalizing the plans and estimates of the various building projects proposed to the

UGC and for ensuring the completion of the buildings in accordance with the

approved plans and estimates and proper utlization of the funds received from the

UGC the Government, and from the University,

‘As Rule 132 of GFR-(ii) no work shall be undertaken before issue of Administrative

Approval and Expenditure Sanction by the competent Authority on the basis of

estimates framed,

‘As pet Section 2 of CPWO Manual, Stages for Execution of Works

2.2 Pro-tequisites for execution of works

42

DRA AAA RH MAH HAH HAAR

nA RRND

nN Nn

on

General

‘The general condition of account of Aligarh Musfim Uriversity for the year 2014-15

vas found io be satisfactory subject to.ebservations madein the inspection Report.

Disclaimer

‘The inspection report has been prepared on the bass of information furnished and

ree availabe by the Finance Officer of Aligarh Musi University, Aligarh. The

office of Pr. Director of Audit (C) Lucknow ranch AllahiGad disclaims any

esponsibility for aay information/nominformation on the Part of Finance Office

‘Aligarh Muslin University, Aligarh.

seo

oie

‘sr. Audit Officer (HOrs)

96

FRBORC

An HRnRAHD DEAD

an

DAannnnannhhennnnnann

You might also like

- Madurai HC Palani Temple JudgmentDocument22 pagesMadurai HC Palani Temple JudgmentPGurus100% (2)

- Telegraph 1Document1 pageTelegraph 1PGurusNo ratings yet

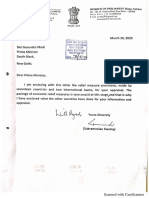

- Letter To Prime Minister On AIIMS Investigation of SSRDocument3 pagesLetter To Prime Minister On AIIMS Investigation of SSRPGurusNo ratings yet

- Subramanian Swamy's Letter To Speaker On Sonia Faking Qualifications Sept 28, 2020Document3 pagesSubramanian Swamy's Letter To Speaker On Sonia Faking Qualifications Sept 28, 2020PGurusNo ratings yet

- The Hindu Group Salary Cuts LetterDocument2 pagesThe Hindu Group Salary Cuts LetterPGurus100% (1)

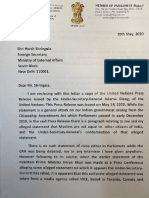

- Subramanian Swamy's Letter To PM On Uttarakhand Temple Board May 27, 2020Document2 pagesSubramanian Swamy's Letter To PM On Uttarakhand Temple Board May 27, 2020PGurusNo ratings yet

- Letter To Prime MinisterDocument2 pagesLetter To Prime MinisterPGurus100% (1)

- Dr. K Kathirvel vs. CBI (Status Report)Document20 pagesDr. K Kathirvel vs. CBI (Status Report)PGurus100% (1)

- CFD factFindingCommittee ReportDocument49 pagesCFD factFindingCommittee ReportPGurus100% (1)

- Subramanian Swamy's Letter To Foreign Sec On Defmation Action Against UN Under Sec May 20, 2013Document3 pagesSubramanian Swamy's Letter To Foreign Sec On Defmation Action Against UN Under Sec May 20, 2013PGurus100% (2)

- Section 144 DetailsDocument2 pagesSection 144 DetailsPGurusNo ratings yet

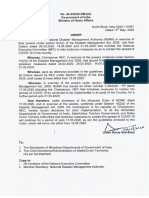

- Lockdown Extension & Guidelines - Press Release - 1st MayDocument7 pagesLockdown Extension & Guidelines - Press Release - 1st MayPGurusNo ratings yet

- Swamy Legal Notice To Indian ExpressDocument12 pagesSwamy Legal Notice To Indian ExpressPGurusNo ratings yet

- MHA Order Dt. 30.5.2020 With Guidelines On Extension of LD in Containment Zones and Phased ReopeningDocument8 pagesMHA Order Dt. 30.5.2020 With Guidelines On Extension of LD in Containment Zones and Phased ReopeningPGurusNo ratings yet

- APPWW Opposition To St. Paul ResolutionDocument3 pagesAPPWW Opposition To St. Paul ResolutionPGurusNo ratings yet

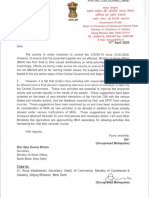

- MHA Order Dt. 17.5.2020 On Extension of Lockdown Till 31.5.2020 With Guidelines On Lockdown MeasuresDocument9 pagesMHA Order Dt. 17.5.2020 On Extension of Lockdown Till 31.5.2020 With Guidelines On Lockdown MeasuresThe Indian Express75% (16)

- Journalist UnionsDocument6 pagesJournalist UnionsPGurusNo ratings yet

- Delhi Govt SuggestionsDocument7 pagesDelhi Govt SuggestionsPGurusNo ratings yet

- Indian Express CEO LetterDocument3 pagesIndian Express CEO LetterPGurusNo ratings yet

- CommerceMin DirectiveDocument4 pagesCommerceMin DirectivePGurusNo ratings yet

- Press Note 1Document6 pagesPress Note 1PGurusNo ratings yet

- Press Note 2Document7 pagesPress Note 2PGurusNo ratings yet

- CM Letter PalgharDocument4 pagesCM Letter PalgharPGurusNo ratings yet

- Tax Department Notice To NDTVDocument32 pagesTax Department Notice To NDTVThe WireNo ratings yet

- PM Speech On March 24, 2020Document6 pagesPM Speech On March 24, 2020PGurusNo ratings yet

- Dr. Shiva Ayyadurai's Letter To President Donald TrumpDocument4 pagesDr. Shiva Ayyadurai's Letter To President Donald TrumpPGurus96% (24)

- GuidelinesDocument6 pagesGuidelinesThe Indian ExpressNo ratings yet

- DR Swamy S Letter To PM 2020 03 20Document6 pagesDR Swamy S Letter To PM 2020 03 20PGurus100% (3)

- HMO Directives On The 21-Day Lock DownDocument1 pageHMO Directives On The 21-Day Lock DownPGurusNo ratings yet

- 04 - Press Release On FM's Comments On SBI ChairmanDocument2 pages04 - Press Release On FM's Comments On SBI ChairmanPGurus0% (2)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)