Professional Documents

Culture Documents

How Acquisitions Led to the Downfall of WorldCom, Enron, and Tyco

Uploaded by

Jamille0 ratings0% found this document useful (0 votes)

149 views3 pagesOriginal Title

WorldCom was founded in 1983 as Long Distance Discount Services.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

149 views3 pagesHow Acquisitions Led to the Downfall of WorldCom, Enron, and Tyco

Uploaded by

JamilleCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

WorldCom was founded in 1983 as Long

Distance Discount Services. Monks and Minow

says that WorldCom relied heavily on acquisition

to fuel its growth (577). Since its founding

through 1999, WorldCom made 60 acquisitions

on its way to becoming the second largest long

distance company in the United States. Monks

and Minow noted that almost all of WorldComs

acquisitions were paid with WorldCom stock.

Enron was founded in 1985 with its

headquarters in Huston Texas. During the 1990s

Enron transformed itself from a small gas

pipeline company into the largest energy trader

in the world. The company effectively

abandoned interest in producing or transporting

energy and made itself the key trader in

electronic energy markets. Clarke says that

Enron business model appeared to be based on

brilliant innovation, but it was the dramatic and

sustained profit growth that really captivated

investors (152).

Tyco, on the other hand, was founded in 1960

by Arthur J. Rosenberg. It was initially a

research laboratory that produced science and

energy material products. The company went

public in 1964. Bhattacharya says that Tyco was

in the spree of acquiring other companies right

from the beginning (334).

What did they do wrong? When? WorldCom

collapsed because of Bernard Ebbers orgy of

acquisitions. During the 1990s the pace of

growth was excessive, outrunning WorldComs

capacity to integrate its acquisitions, but also

many of the purchases were ill judged on

strategic or costs grounds (Micklethwait 73).

The excessive costs and heavy loan burden

incurred during the acquisition spree meant that

the company was not able to ride the shock of

the downturn in the telecoms market.

Micklethwait further noted that the fraud did not

cause WorldComs downfall; it occurred in order

to cover up the deficiencies in Ebbers

management, and was allowed to occur

because of the total failure of internal and

external controls (73).

The fall of Enron started in the 1990s. During

this period it was noted that in order to

accomplish it objectives Enron relied heavily on

complicated transactions with convoluted

financing and accounting structures. Clarke says

that the company carried out transactions with

multiple special purpose entities, hedges,

derivatives, swaps, forward contracts and

prepaid contracts (152). When Enron

encountered business problems, the chief

financial officer created off-balance sheet

entities to hide tens of billions of liabilities and

boost reported earnings. Enron executives

devised complex financial schemes to defraud

Enron and its shareholders through transactions

with off the books partnerships that made the

company look far more profitable than it was

(Clarke 152).

By 1968 Tyco had acquired 16 companies and it

achieved its rapid growth acquisitions, which

were in the areas of manufacturing, packaging

products, plastics and undersea fiber optic

cable. Bhattacharya says that by 1980s the

company formed into subsidiaries based on

different business categories. During 80s and

90s Tyco acquired about 40 companies. In 1999

Tyco was alleged to have indulged in accounting

irregularities, and this negative news in the

media pulled the Tyco stock during the year with

its stock declining with 80% in value.

Who was involved? Bernard Ebbers played

major role in the downfall of WorldCom.

Micklethwait indicated that Ebbers is not

contented with running a huge global

enterprise, he built a personal empire. To

finance these purchases, Ebbers took on a huge

volume of debt estimated at between $500

million and $1 billion at its peak using WorldCom

stock as collateral. Scott Sullivan used certain

accounting treatment that had no basis in the

generally accepted accounting principle. These

activities were supported by David Myers,

controller at WorldCom. This was on the basis

that it was the general practice at WorldCom to

make accounting entries that were not

supported by documentation at the directive

verbal or through e-mail of the top brass of the

company. Sullivan was responsible for much of

the manipulation of line costs. Arthur Andersen

played a role in the collapse of WorldCom. This

is because, according to Micklethwait, he did not

exert considerable control over the companys

reporting systems (70). In 1990s, Andersen

revised its audit approach from one of heavy,

detailed testing to a risk-based model, which

required fewer audit hours. Andersen was

willing to rely heavily on managements own

explanations, without, it seems much hard

questioning Research shows that Enrons chief

financial officer reaped over $30 million from

dubious transactions between Enron and the

partnerships, while other executives made

millions more. Markham says that Enron chief

executive officer was involved, because the SPE

structures were centred in the Financial

Reporting Group (110). Andrew Fastow was

indicted on October 31 2002 for wire fraud,

money laundering, obstruction of justice, and

conspiracy aiding and abetting. Kenneth Lay

was the Enrons former chief executive and

chairman since 1986, was also involved in

overseeing subsequent acquisitions. David

Duncan Enrons chief auditor at Andersen

played a key role in shredding key documents

relating to the case. This is because it was his

job to check Enrons accounts.

Does the company still exist? Yes WorldCom

still exists, but under different trade name

(MCI). Monks and Minow says that WorldComs

place in history was not limited to a well-timed

legislative intervention (576). In July 2002,

WorldCom became the largest U.S. Company

ever to file for bankruptcy protection. A year and

a half after emerging from bankruptcy

protection, WorldCom then known as MCI

merged into Verizon.

After the scandal

Enron still exists as a shell corporation without

assets. This is because the company emerged

from bankruptcy in November of 2004. In

September 2006, Enron sold Prisma Energy

International, and it was to be dissolved after

the restructuring process. Tyco still exists and

its survival proves that some companies can

survive major ethical scandals if they take the

correct courses of action. Company still restated

its financial results by hundreds of millions of

dollars. Companys existence is on the basis that

the company took measures to restore

shareholders confidence (Ferrell and Fraedrich

445).

What happened to the stockholders of the

company? Moyer, McGuigan and Kretlow say

that stockholders of WorldCom lost virtually all

their investment, as the company emerged from

bankruptcy proceedings (227). The estimated

value of the newly reconstituted MCI (the new

name for the company) was about $13 billion, a

far cry from its peak value of $194 billion.

Moyer, McGuigan and Kretlow also indicated

that of the $13 billion, about $8 billion was to be

inform of stock, when the company emerged

from bankruptcy proceedings (227). This stock

went to bondholders of the old firm, and an

estimate of $5.5 billion was to be in the form of

debt that was to be awarded to other creditors.

The stockholders fared badly losing the value of

their entire investment.

The Tyco scandal cost stockholders who lost

directly through the loss due to malfeasance by

top mangers as well as from decreases in share

prices. The Tyco scandal cost owners of CIT

who spent at least $20 million on Walsh to

broker the Tyco-CIT deal and whose company

lost goodwill (Ferrel and Fraedrich 445). On the

other hand the stockholders at Enron lost their

stock. At the same time, investors and

employees whose retirement plans included

large amounts of Enron stock lost their wealth.

Punishment to those involved WorldComs

chief financial officer Scott Sullivan pleaded

guilty to conspiracy, fraud and making false

statements to regulators about WorldComs

financial condition. Bernard Ebbers was also

eventually convicted of conspiracy, fraud, and

filing false documents with regulators and was

sentenced to 25 years in prison (Monks and

Minow 576). According to Thornburgh, the two

major officials of WorldCom involved in the

fraud were convicted in federal court of serious

criminal charges, with Bernard Ebbers receiving

a twenty five year jail sentence and Scott

Sullivan a five year term (368). Other

subordinates,

who

cooperated

in

the

investigation, received lesser sentences. No one

evidently involved appears to have escaped

punishment. Following the Enron scandal,

Kenneth Lay was convicted of multiple counts

on charges of conspiracy to commit bank fraud,

wire fraud and giving false statements. He

however died before he was officially sentenced.

The charges would have been life imprisonment.

Franzese says that Jeff Skilling held the position

of chief operations officer. In May 2006 along

with Kenneth Lay was found guilty on federal

charges of committing securities fraud and

insider trading (235). As a result he received 24

years sentence in federal prison. Andrew

Fastow, who was the former chief financial

officer, was one of the masterminds behind

Enron scandal and he received six years

sentence in a federal prison. He was also forced

to forfeit $24 million of his assets. Following the

Tyco scandal, Dennis Kozlowski was sentenced

in 2005 to twenty fives in jail for grand larceny,

securities fraud and other crimes of stealing

$137 million in unauthorized bonuses as well as

selling $410 million in inflated stock. The chief

financial officer of Tyco Mark H. Swartz was

charged and sentenced to 3 years in prison for

misappropriating more than $170 million from

the company. Former general counsel Mark A.

Belnick was also charged with concealing $14

million in personal loans.

Lessons learned from the research The

collapse of Enron, Tyco and WorldCom

according to Monks and Minow illustrates the

importance

of

strong

well-functioning

gatekeepers, including boards of directors

auditors and securities analysts in protecting

investors (580). In times of market and sector

expansions, such as the one from which

WorldCom, Enron and Tyco benefited in the

1990s such checks may seem superfluous or

even overly burdensome. Such checks ensure

that managements, such as WorldCom, Enron

and Tyco are confronted with competitive

pressures and a shaky business model does not

succumb to the temptation to fudge the

numbers. The three scandals offer major

lessons for the business world especially in

areas of corporate conduct.

Leadership in organizations is expected to help

set the tone for the rest of the organization and

to establish both norms and culture that

reinforce the importance of ethical behaviour. It

is important to note that the basic premise

behind ethical leadership is that since top

managers serve as role models for others, their

every action is a subject to scrutiny. It is

therefore important that CEOs and CFOs vouch

personally for the truthfulness and fairness of

their firms financial disclosures. The WorldCom,

Enron and Tyco scandals reveal the decreasing

tolerance that todays government and investors

have for misconduct in any form, because the

board of directors in the three organizations

faced consequences, as a result of their

unethical behavio

You might also like

- Hearsay Exercises 1Document2 pagesHearsay Exercises 1api-268713498No ratings yet

- The Crooked EDocument3 pagesThe Crooked EJahziel Lim Irabon100% (2)

- Chapter 7Document7 pagesChapter 7JamilleNo ratings yet

- Corporate Governance Analysis of TYCODocument15 pagesCorporate Governance Analysis of TYCOlpeless100% (1)

- Enron ScandalDocument24 pagesEnron Scandalmano102100% (1)

- THE REVISED RULES ON CIVIL PROCEDURE (Codal Reviewer)Document62 pagesTHE REVISED RULES ON CIVIL PROCEDURE (Codal Reviewer)Angelica Sendaydiego Ventayen75% (4)

- Motion To RecuseDocument1 pageMotion To RecuseMaynard1965No ratings yet

- EntrinaDocument7 pagesEntrinaevemil berdinNo ratings yet

- Current Business Affairs: Assignment-1Document17 pagesCurrent Business Affairs: Assignment-1Salman JanNo ratings yet

- Top 10 Corporate Scandals: 10. Union CarbideDocument13 pagesTop 10 Corporate Scandals: 10. Union CarbideSandiep SinghNo ratings yet

- EnronDocument8 pagesEnronjualNo ratings yet

- ENRON SCANDAL REPORT EXPOSES $600M FRAUDDocument12 pagesENRON SCANDAL REPORT EXPOSES $600M FRAUDJOEMARI CRUZNo ratings yet

- Enron, Worldcom, TycoDocument6 pagesEnron, Worldcom, TycoLealyn Martin BaculoNo ratings yet

- How Enron's Fraud Led to Collapse and New RegulationsDocument5 pagesHow Enron's Fraud Led to Collapse and New RegulationsShubhankar ThakurNo ratings yet

- Business Judgment RuleDocument15 pagesBusiness Judgment RuleSAI SUVEDHYA RNo ratings yet

- Assignment - 5: International Finance and Forex ManagementDocument8 pagesAssignment - 5: International Finance and Forex ManagementAnika VarkeyNo ratings yet

- White Collar CrimesDocument9 pagesWhite Collar CrimesandrewNo ratings yet

- Case Study On WorldComDocument8 pagesCase Study On WorldComsateybanik100% (4)

- Audit CaseDocument30 pagesAudit CaseAnnisa Kurnia100% (1)

- WorldCom's Rise and Fall: A Case of Failed Corporate GovernanceDocument4 pagesWorldCom's Rise and Fall: A Case of Failed Corporate Governancejainender80No ratings yet

- Edades, Angelica T. Bsba-Fm The Enron'S CollapseDocument7 pagesEdades, Angelica T. Bsba-Fm The Enron'S Collapsearman atipNo ratings yet

- Major Corporate Scams PresentationDocument24 pagesMajor Corporate Scams PresentationGanesh Prasad PandaNo ratings yet

- Muhammad Syahrin Bin Zulkefly 2019848422 BA242 5B FIN657 Sir Mohd Husnin Bin Mat YusofDocument3 pagesMuhammad Syahrin Bin Zulkefly 2019848422 BA242 5B FIN657 Sir Mohd Husnin Bin Mat YusofsyahrinNo ratings yet

- Sarbanes-Oxley Act StudyDocument153 pagesSarbanes-Oxley Act StudyHOD CommerceNo ratings yet

- Enron Scandal: The Fall of A Wall Street Darling: "America's Most Innovative Company"Document19 pagesEnron Scandal: The Fall of A Wall Street Darling: "America's Most Innovative Company"Jamielyn Dy DimaanoNo ratings yet

- Case Study (Ethical Issues)Document10 pagesCase Study (Ethical Issues)Abelle Rina Villacencio GallardoNo ratings yet

- Final Draft On Auditing Term PaperDocument11 pagesFinal Draft On Auditing Term PaperMoud KhalfaniNo ratings yet

- Accounting ScandalsDocument4 pagesAccounting Scandalsyakubu I saidNo ratings yet

- Tyco InternationalDocument2 pagesTyco InternationalMichael FordNo ratings yet

- Value Creation Through Corporate GovernanceDocument11 pagesValue Creation Through Corporate GovernanceAbdel AyourNo ratings yet

- Enron CorporationDocument8 pagesEnron CorporationNadine Clare FloresNo ratings yet

- Tyco - Shareholder Rights and Executive Compensation ScandalDocument4 pagesTyco - Shareholder Rights and Executive Compensation ScandalMary Jane TanNo ratings yet

- Reading Assignment 8 (Royal Bank of Scotland)Document14 pagesReading Assignment 8 (Royal Bank of Scotland)Valentine AyiviNo ratings yet

- Examples of Agency ProblemsDocument3 pagesExamples of Agency ProblemsdaleNo ratings yet

- EnronDocument6 pagesEnronRohit KumarNo ratings yet

- Assignment in ACCPr119Document5 pagesAssignment in ACCPr119Kelly Juanerio CardejonNo ratings yet

- Running Header: ENRON COLLAPSE 1Document10 pagesRunning Header: ENRON COLLAPSE 1Ezekiel MasiraNo ratings yet

- Answers - Test - Pmba Business EthicsDocument6 pagesAnswers - Test - Pmba Business EthicsKuzi TolleNo ratings yet

- ENRON: From Energy Giant to Corporate CollapseDocument3 pagesENRON: From Energy Giant to Corporate CollapseErniza Md BadursahNo ratings yet

- A62JonathanHGabrielMisdirectDocument21 pagesA62JonathanHGabrielMisdirectCamilo OvalleNo ratings yet

- De La Salle Lipa College of Business, Economics, Accountancy and ManagementDocument4 pagesDe La Salle Lipa College of Business, Economics, Accountancy and ManagementDanica Austria DimalibotNo ratings yet

- Worldcom - Executive Summary Company BackgroundDocument4 pagesWorldcom - Executive Summary Company BackgroundYosafat Hasvandro HadiNo ratings yet

- Case Study: 4.2 Enron-A Classic Corporate Governance CaseDocument3 pagesCase Study: 4.2 Enron-A Classic Corporate Governance CaseTiago SampaioNo ratings yet

- WorldCom ScandalDocument2 pagesWorldCom ScandalKerry1201No ratings yet

- Managerial Ethics - The Ethics of Market Abuse - XLRI 2015Document54 pagesManagerial Ethics - The Ethics of Market Abuse - XLRI 2015chinum1No ratings yet

- Tyco ScandalDocument5 pagesTyco ScandalJeraldine CerdanNo ratings yet

- Ankit Jain Rohan Sharma Tushar Shigwan Sneha Agrawal Sujay Bachewar Abhinandan Nandanikar Abhilash Nair Payal ModyDocument20 pagesAnkit Jain Rohan Sharma Tushar Shigwan Sneha Agrawal Sujay Bachewar Abhinandan Nandanikar Abhilash Nair Payal ModypuneethkunderNo ratings yet

- The Rise and Fall of WorldcomDocument13 pagesThe Rise and Fall of WorldcomChriztal TejadaNo ratings yet

- WorldCom CaseDocument9 pagesWorldCom CaseunjustvexationNo ratings yet

- Enron Scandal: A Corporate View: Analyzed and Prepared by Group 6Document17 pagesEnron Scandal: A Corporate View: Analyzed and Prepared by Group 6PankajYadavNo ratings yet

- Enron Scandal PresentationDocument11 pagesEnron Scandal PresentationYujia JinNo ratings yet

- 10 1 1 692 7701 PDFDocument35 pages10 1 1 692 7701 PDFJulie Anthonette RistonNo ratings yet

- Sythesis 8Document7 pagesSythesis 8Jhonerl YbañezNo ratings yet

- Enron Scandal The Fall of A Wall Street DarlingDocument3 pagesEnron Scandal The Fall of A Wall Street DarlingAnonymous 2LqTzfUHY50% (2)

- Enron Scandal - How the Sarbanes-Oxley Act Sought to Prevent Future Accounting FraudsDocument12 pagesEnron Scandal - How the Sarbanes-Oxley Act Sought to Prevent Future Accounting Fraudssruthi karthiNo ratings yet

- Acc394 - Edited Case Study Answers 1Document10 pagesAcc394 - Edited Case Study Answers 1api-607959293No ratings yet

- Enron and Waste Management Scandals Exposed Accounting FraudDocument9 pagesEnron and Waste Management Scandals Exposed Accounting FraudHannah Brynne UrreraNo ratings yet

- Sarthy Govern Study v1 by Raghav AgarwalDocument83 pagesSarthy Govern Study v1 by Raghav AgarwalRushil ShahNo ratings yet

- The 10 Worst Corporate Accounting Scandals of All Time..Document5 pagesThe 10 Worst Corporate Accounting Scandals of All Time..Tamirat Eshetu Wolde100% (1)

- Tyco Fraud CaseDocument7 pagesTyco Fraud CaseAlisha Ashish88% (8)

- TOP 10 Corporate Scandal: Chronological OrderDocument11 pagesTOP 10 Corporate Scandal: Chronological OrderNiken PratiwiNo ratings yet

- World Com ScandalDocument7 pagesWorld Com ScandalAddis FikruNo ratings yet

- Tyco Fraud Case StudyDocument12 pagesTyco Fraud Case Studybb2No ratings yet

- Partnership Admission Problems and Solutions under 40 CharactersDocument2 pagesPartnership Admission Problems and Solutions under 40 CharactersJamilleNo ratings yet

- Threat of Substitute ProductsDocument1 pageThreat of Substitute ProductsJamilleNo ratings yet

- The Scientific Discipline in The Field of Physical Geography That Deals With The Water Cycle Is Called HydrologyDocument7 pagesThe Scientific Discipline in The Field of Physical Geography That Deals With The Water Cycle Is Called HydrologyJamilleNo ratings yet

- The Problem and Its BackgroundDocument33 pagesThe Problem and Its BackgroundJamilleNo ratings yet

- Chapter 17: Mergers, Lbos, Divestitures, and Business FailureDocument44 pagesChapter 17: Mergers, Lbos, Divestitures, and Business FailureJamille100% (1)

- Bargaining Power of BuyersDocument1 pageBargaining Power of BuyersRufino Gerard MorenoNo ratings yet

- FinAc 3 by Robles Chap 9 PDFDocument3 pagesFinAc 3 by Robles Chap 9 PDFJamilleNo ratings yet

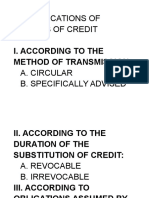

- Classifications of Letters of Credit: I. According To The Method of TransmissionDocument4 pagesClassifications of Letters of Credit: I. According To The Method of TransmissionJamilleNo ratings yet

- Good Housekeeping & TQMDocument3 pagesGood Housekeeping & TQMJamille50% (2)

- TB CH 2 ProductivityDocument15 pagesTB CH 2 ProductivitybecNo ratings yet

- TB CH 1 IntroductionDocument16 pagesTB CH 1 IntroductionColor BlueNo ratings yet

- Communication IsDocument3 pagesCommunication IsJamilleNo ratings yet

- T04 - Long-Term Construction-Type ContractsDocument11 pagesT04 - Long-Term Construction-Type Contractsjunlab0807No ratings yet

- Intensity of Rivalry Among CompetitorsDocument1 pageIntensity of Rivalry Among CompetitorsJamilleNo ratings yet

- TB CH 1 IntroductionDocument16 pagesTB CH 1 IntroductionColor BlueNo ratings yet

- Communication Noise Model ExplainedDocument2 pagesCommunication Noise Model ExplainedJamilleNo ratings yet

- Assessment On Philippine National Railway For System Efficiency, Service Improvements and Future DevelopmentsDocument1 pageAssessment On Philippine National Railway For System Efficiency, Service Improvements and Future DevelopmentsJamilleNo ratings yet

- Bargaining Power of SuppliersDocument1 pageBargaining Power of SuppliersJamilleNo ratings yet

- Week Before 6ix9ine Sentencing His Lawyer Asks For Time Served Citing Trial Danger by Matthew Russell Lee, Patreon Scope ThreadDocument8 pagesWeek Before 6ix9ine Sentencing His Lawyer Asks For Time Served Citing Trial Danger by Matthew Russell Lee, Patreon Scope ThreadMatthew Russell LeeNo ratings yet

- Sanctions Exclusive Remedy For Bad Faith/Uncooperative Litigation Tactics in California Family Law Proceeding - Divorce - Family CourtDocument3 pagesSanctions Exclusive Remedy For Bad Faith/Uncooperative Litigation Tactics in California Family Law Proceeding - Divorce - Family CourtCalifornia Judicial Branch News Service - Investigative Reporting Source Material & Story Ideas100% (1)

- 7 People V GuillermoDocument10 pages7 People V GuillermoDuffy DuffyNo ratings yet

- Dissertation Synopsis Abhijeet Singh 001Document7 pagesDissertation Synopsis Abhijeet Singh 001Abhijeet SinghNo ratings yet

- Lie Detection and InterrogationDocument3 pagesLie Detection and InterrogationSkier Mish100% (1)

- Different Aspects of Section 173 (8) CRPCDocument8 pagesDifferent Aspects of Section 173 (8) CRPCDolphinNo ratings yet

- Major CrimesDocument65 pagesMajor Crimesfede6790No ratings yet

- People v. FerminDocument2 pagesPeople v. FerminDanielle Lim100% (1)

- Everybody Hates The Phone CompanyDocument117 pagesEverybody Hates The Phone CompanycfaberNo ratings yet

- Roma Drug v. RTCDocument2 pagesRoma Drug v. RTCSarah RosalesNo ratings yet

- Doe v. Black Civil ComplaintDocument19 pagesDoe v. Black Civil ComplaintChefs Best Statements - NewsNo ratings yet

- J. Laguilles - Frequent Areas of Concern PDFDocument4 pagesJ. Laguilles - Frequent Areas of Concern PDFCaumeron M. CooksNo ratings yet

- Criminal Law EssentialsDocument2 pagesCriminal Law EssentialsBradNo ratings yet

- Jones v. Rath Packing Co., 430 U.S. 519 (1977)Document26 pagesJones v. Rath Packing Co., 430 U.S. 519 (1977)Scribd Government DocsNo ratings yet

- Advancement Handbook MAADocument149 pagesAdvancement Handbook MAAJonathan KemperNo ratings yet

- Beatriz P Wassmer Vs Francisco X Velez, 12 SCRA 648 - CASE DIGESTDocument2 pagesBeatriz P Wassmer Vs Francisco X Velez, 12 SCRA 648 - CASE DIGESTliezl100% (1)

- E. L. Peralta For Appellant. Office of The Solicitor General Felix Bautista Angelo and Solicitor Ramon L. Avanceña For AppelleeDocument4 pagesE. L. Peralta For Appellant. Office of The Solicitor General Felix Bautista Angelo and Solicitor Ramon L. Avanceña For AppelleeDredd LelinaNo ratings yet

- 1855 Treaty Press ReleaseDocument54 pages1855 Treaty Press ReleaseHonorTheEarthNo ratings yet

- Joint tortfeasors and liabilities under 38 charactersDocument9 pagesJoint tortfeasors and liabilities under 38 charactersVaishaliNo ratings yet

- OMBUDSMAN v. MAPOYDocument2 pagesOMBUDSMAN v. MAPOYSachieCasimiroNo ratings yet

- People v. Mora Dumpo 62 Phil 146Document4 pagesPeople v. Mora Dumpo 62 Phil 146compiler123No ratings yet

- Elements of Qualified Theft and Malicious MischiefDocument3 pagesElements of Qualified Theft and Malicious MischiefRojusandino Acevedo YlaganNo ratings yet

- Latin MaximDocument75 pagesLatin MaximClint M. MaratasNo ratings yet

- Unit 8.the Hierarchy of English CourtsDocument33 pagesUnit 8.the Hierarchy of English CourtsRaven471No ratings yet

- 2 Republic V YahonDocument6 pages2 Republic V YahonCai CarpioNo ratings yet

- Suggested Answers To The 2015 Remedial Law Bar Examination - RemDocument12 pagesSuggested Answers To The 2015 Remedial Law Bar Examination - RemNympa Villanueva100% (1)

- Set 2Document2 pagesSet 2CloieRjNo ratings yet