Professional Documents

Culture Documents

Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)

Uploaded by

Shyam SunderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

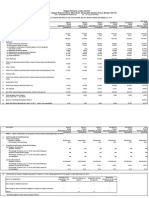

Unaudited Financial Results for the Quarter Ended on September 30, 2015

PART I

Particuars

3 Months

Ended

30-09-2015

Unaudited

Preceding

3 Months

Ended

30-06-2015

Unaudited

Rs. in Lacs

Corresponding 3 Year to Date

Year to Date

Months Ended

Figures for

Figures for the

30-09-2014

Current Period Previous Year Previous Year

Ended

in the Previous

Ended

Ended

31-03-2015

Year

30-09-2015

30-09-2014

Unaudited

Unaudited

Unaudited

Audited

Income from Operations

(a) Net Sales / Income from Operations (Net of excise duty)

(b) Other Operating Income

Total Income from Operations (net)

Expenses

(a) Cost of materials consumed

(b) Purchase of stock-in-trade

Changes in inventories of finished goods,

(c) work-in-progress and stock-in-trade

(d) Employee expenses & benefits

(e) Depreciation and amortisation expense

(f) Other expenses

0.23

0.67

0.23

0.56

0.25

2.17

0.45

1.23

0.70

2.40

1.00

2.99

Total Expenses

0.90

0.78

2.42

1.68

3.10

3.99

-0.90

-0.78

-2.42

-1.68

-3.10

0.54

0.54

0.54

1.08

1.08

-3.99

2.16

-0.36

3 Profit/(Loss) from Operations before other Income, Finance costs

and Exceptional Items (1-2)

4 Other Income

5 Profit/Loss from ordinary activities before finance costs and

exceptional Items (3+4)

-0.24

-1.88

-0.60

-2.02

-1.83

6 Finance Costs

7 Profit/Loss from ordinary activities after finance costs but before

exceptional items (5-6)

0.00

-0.36

-0.24

-1.88

-0.60

-2.02

-1.83

8 Exceptional Items

9 Profit/Loss from Ordinary Activities before tax (7-8)

-0.36

-0.24

-1.88

-0.60

-2.02

-1.83

10 Tax Expense

11 Net Profit/ Loss from Ordinary Activites after Tax (9-10)

-0.36

-0.24

-1.88

-0.60

-2.02

-1.83

12 Extraordinary Item (net of tax expense)

13 Net Profit/ Loss for the period (11-12)

-0.36

-0.24

-1.88

-0.60

-2.02

-1.83

427.35

427.35

427.35

427.35

427.35

427.35

17 Paid up Equity Share Capital (Face Value Rs.10/- per share)

18 Reserve excluding Revaluation Reserves as per balance sheet of

previous accounting year

19 i Earning Per Share (before extraordinary items)

-0.008

-0.006

-0.044

-0.014

-0.047

-0.04

19 ii Earning Per Share (after extraordinary items)

-0.008

-0.006

-0.044

-0.014

-0.047

-0.04

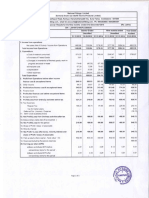

Unaudited Financial Results for the Quarter Ended on September 30, 2015

PART II

Particuars

A PARTICULARS OF SHAREHOLDING

1 Public Shareholding

- Number of shares

- Percentage of shareholding

2 Promoters and promoter group Shareholding

a) Pledged/Encumbered

- Number of shares

- Percentage of shares (as a % of the total shareholding of

promoter and promoter group)

- Percentage of shares (as a% of the total share capital of the

company)

b) Non-encumbered

- Number of Shares

- Percentage of shares (as a % of the total shareholding of

promoter and promoter group)

- Percentage of shares (as a% of the total share capital of the

company)

3 Months

Ended

30-09-2015

Preceding

3 Months

Ended

30-06-2015

Corresponding 3 Year to Date

Year to Date

Months Ended

Figures for

Figures for the

30-09-2014

Current Period Previous Year Previous Year

Ended

in the Previous

Ended

Ended

31-03-2015

Year

30-09-2015

30-09-2014

30,61,450

71.64%

30,61,450

71.64%

30,61,450

71.64%

30,61,450

71.64%

30,61,450

71.64%

30,61,450

71.64%

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

12,12,050

12,12,050

12,12,050

12,12,050

12,12,050

12,12,050

100%

100%

100%

100%

100%

100%

28.36%

28.36%

28.36%

28.36%

28.36%

28.36%

INVESTOR COMPLAINTS

3 Months Ended (30/09/2015)

Pending at the beginning of the quarter

NIL

Received during the quarter

NIL

Disposed off during the quarter

NIL

NIL

Remaining unresolved at the end of the quarter

Notes:

1 The unaudited financial statements for the quarter ended on September 30, 2015 as reviewed by the Audit Committee and approved by the Board of Directors at their

meeting held on November 14, 2015. The information presented above is extracted from the financial statement.

2 EPS has been calculated in accordance with AS-20 issued by ICAI.

3 The Business of the Company falls under a single segment for the purpose of Accounting Standard As-17, issued by The Institute of Chartered Accountants of India.

4 Previous period/year figures have been regrouped/rearranged, wherever found necessary.

5 No investor complaints were pending in the beginning and end of the quarter ended September 2015.

For Raymed Labs Limited

Ajai Goyal

Place: Saharanpur

Date: 14-11-2015

Statement of Assets and Liabilities

Rs. in Lacs

Particulars

A

1

2

3

4

EQUITY AND LIABILITIES

Shareholders' Funds

(a) Share Capital

(b) Reserves and Surplus

(c) Money Received Against Share Warrants

Sub-total - Shareholders' Funds

Share Application Money Pending Allotment

Minority Interest

Non-Current Liabilities

(a) Long-Term Borrowings

(b) Deferred Tax Liabilities (net)

(c) Other Long-Term Liabilities

(d) Long-Term Provisions

Sub-total - Non-Current Liabilities

Current Liabilities

(a) Short-Term Borrowings

(b) Trade Payables

(c) Other Current Liabilities

(d) Short-Term Provisions

Sub-total - Current Liabilities

For Raymed Labs Limited

Ajai Goyal

Managing Director

Place: Saharanpur

Date: 14-11-2014

Unaudited

Audited

427.35

427.35

198.60

4.04

202.64

199.60

3.75

203.35

629.99

630.70

20.20

20.20

20.20

20.20

2.49

0.16

6.10

8.75

2.49

0.49

7.10

10.08

TOTAL - ASSETS

Profit and Loss Account

28.96

601.03

30.28

600.42

TOTAL APPLICATION OF FUNDS

629.99

630.70

ASSETS

1 Non-Current Assets

(a) Fixed Assets

(b) Goodwill on Consolidation

(c) Non-current Investments

(d) Deferred Tax Assets (net)

(e) Long-term Loans and Advances

(f) Other Non-current Assets

Sub-total - Non-Current Assets

2 Current Assets

(a) Current Investments

(b) Inventories

(c) Trade Receivables

(d) Cash and Cash Equivalents

(e) Short-term Loans and Advances

(f) Other Current Assets

Sub-total - Current Assets

previous year ended

31-03-2015

427.35

427.35

TOTAL - EQUITY AND LIABILITIES

B

6 months ended

30-09-2015

You might also like

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document5 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document11 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results With Results Press Release & Limited Review Report For Sept 30, 2015 (Result)Document10 pagesFinancial Results With Results Press Release & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Company Update)Document7 pagesFinancial Results & Limited Review For June 30, 2015 (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- BEML Limited: (A Govt. of India Mini Ratna Company Under Ministry of Defence)Document3 pagesBEML Limited: (A Govt. of India Mini Ratna Company Under Ministry of Defence)Kapil SharmaNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Announces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Document4 pagesAnnounces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document9 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Statement of Assets & Liabilties As On September 30, 2016 (Result)Document2 pagesStatement of Assets & Liabilties As On September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2015 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document8 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For December 31, 2015 (Result)Document1 pageFinancial Results For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Document5 pagesAnnounces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document6 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For March 31, 2015 (Standalone) (Audited) (Result)Document2 pagesFinancial Results For March 31, 2015 (Standalone) (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document16 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2015 (Result)Document3 pagesStandalone Financial Results For March 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2015 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2015 (Result)Shyam SunderNo ratings yet

- Updates Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesUpdates Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Document4 pagesColgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Aditya MishraNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For December 31, 2015 (Result)Document2 pagesFinancial Results & Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results For March 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results For March 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Chapter 5 Installment Liquidation Graded Problem SolutionDocument24 pagesChapter 5 Installment Liquidation Graded Problem SolutionChris Jobert AlmacenNo ratings yet

- Managerial Accounting AssignmentsDocument3 pagesManagerial Accounting Assignmentslovely reyesNo ratings yet

- It FinalsDocument11 pagesIt FinalsHea Jennifer AyopNo ratings yet

- CHapter 25 Financial Accounting Vol1Document8 pagesCHapter 25 Financial Accounting Vol1Judith GabuteroNo ratings yet

- Treynor Black ModelDocument20 pagesTreynor Black ModelVaidyanathan RavichandranNo ratings yet

- MGT ACC3Document46 pagesMGT ACC3MsKhan0078No ratings yet

- Consolidated Balance Sheet and Statement of Profit and Loss for Godrej IndustriesDocument2 pagesConsolidated Balance Sheet and Statement of Profit and Loss for Godrej IndustriesLovish Goyal (Admn. No : 5850)No ratings yet

- Lbo DCF ModelDocument36 pagesLbo DCF ModelVarun VermaNo ratings yet

- Answer Key Entrepreneurship ExamDocument4 pagesAnswer Key Entrepreneurship ExamMark Phil SaluyaNo ratings yet

- Corporate Finance EssentialsDocument239 pagesCorporate Finance Essentialsssj9No ratings yet

- 1422pdf PDF FreeDocument48 pages1422pdf PDF FreeFernando III PerezNo ratings yet

- Audit procedures for key risk areas in Sophie & Co. BhdDocument16 pagesAudit procedures for key risk areas in Sophie & Co. BhdLoo Bee YeokNo ratings yet

- 4 Assignment 4 PDFDocument2 pages4 Assignment 4 PDFasmelash gideyNo ratings yet

- PT SURYA PERTIWI Tbk 2019 Consolidated Financial StatementsDocument119 pagesPT SURYA PERTIWI Tbk 2019 Consolidated Financial StatementsMr MegatronicNo ratings yet

- MHB Audited Financial Statements 31dec2019Document66 pagesMHB Audited Financial Statements 31dec2019Izzaty RidzuanNo ratings yet

- Individual Taxation ExercisesDocument3 pagesIndividual Taxation ExercisesMargaux CornetaNo ratings yet

- NipponIndia ETF Gold BeESDocument5 pagesNipponIndia ETF Gold BeESAnoop MannadathilNo ratings yet

- Trick To Remember Credit & DebitDocument3 pagesTrick To Remember Credit & Debitរ័ត្នវិសាល (Rathvisal)100% (1)

- 1 20Document3 pages1 20XhaNo ratings yet

- TN-Thanh Toán Quốc TếDocument13 pagesTN-Thanh Toán Quốc Tế13-Đình T.QNo ratings yet

- Intacc 3Document26 pagesIntacc 3Maria DubloisNo ratings yet

- CFAS - Statement of Changes in Equity and Notes To FS - Quiz 4 - SY2019 2020Document19 pagesCFAS - Statement of Changes in Equity and Notes To FS - Quiz 4 - SY2019 2020Ivy RosalesNo ratings yet

- The Balance Sheet and NotesDocument47 pagesThe Balance Sheet and NotesJoyce Ann Agdippa BarcelonaNo ratings yet

- 0000000585437616Document11 pages0000000585437616SoniaChichNo ratings yet

- Mergers and AcquisionDocument5 pagesMergers and AcquisionN-aineel DesaiNo ratings yet

- 1 Advact 3 ConventionalDocument6 pages1 Advact 3 ConventionalChristine Jane RamosNo ratings yet

- Presentation 1Document9 pagesPresentation 1Jagannath KalyanaramanNo ratings yet

- Stockholders Meeting ActivityDocument7 pagesStockholders Meeting ActivityAngelKate MicabaniNo ratings yet

- CMF Day0 SY CMF-OESY-01 Ver1 PDFDocument20 pagesCMF Day0 SY CMF-OESY-01 Ver1 PDFRaj SharmaNo ratings yet

- Horizontal Analysis:: James Corporation Comparative Statement of Financial PositionDocument7 pagesHorizontal Analysis:: James Corporation Comparative Statement of Financial PositionJohn Francis IdananNo ratings yet