Professional Documents

Culture Documents

Lemigas Presentation

Uploaded by

Ryan HafizCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lemigas Presentation

Uploaded by

Ryan HafizCopyright:

Available Formats

IEEJ:May 2003

NATURAL GAS UTILIZATION

IN INDONESIA

SYMPOSIUM ON PACIFIC ENERGY COOPERATION

(SPEC) 2003

Tokyo, 12-13 February 2003

Dr.-Ing. Evita H. Legowo

DIRECTOR

RESEARCH AND DEVELOPMENT CENTRE FOR

OIL AND GAS TECHNOLOGY

LEMIGAS

INDONESIA

IEEJ:May 2003

AGENDA

NATURAL GAS UTILIZATION

IN INDONESIA

INTRODUCTION

INDONESIA GAS RESERVES STATUS

THE ASEAN PROVED GAS RESERVES STATUS

THE WORLD PROVED GAS RESERVES STATUS

THE WORLD ENERGY DEMAND

GAS BUSINESS STRATEGY

CHANGES OF GAS MARKET

INDONESIA GAS BUSINESS

INDONESIA GAS BUSINESS STAGES

NEW OIL AND GAS LAW

DEVELOPMENT OF GAS UTILIZATION IN

INDONESIA

IEEJ:May 2003

INTRODUCTION

WHY NATURAL GAS ??

Natural

Natural

Natural

Natural

Gas

Gas

Gas

Gas

is

is

is

is

not Oil,

much cleaner burning than oil or coal,

one of the cleanest energy,

fuel of choice.

NATURAL GAS IS THE FUTURE PRINCE OF ENERGY

The trend in 21th century was a move away from fuels with many

Carbon atoms to fuel with few or no carbon atoms called

decarbonization,

Decarbonization is the progressive reduction in the amount of

carbon used to produce a given amount of energy.

IEEJ:May 2003

INDONESIA GAS RESERVES

STATUS JANUARY 01, 2002

PRODUCING FIELDS

NON PRODUCING FIELDS

POSSIBLE

25.49%

POSSIBLE

23.30%

PROVEN

58.55%

PROBABLE

18.15%

PROVEN

46.82%

PROBABLE

27.69%

Producing Fields

Non Producing Fields

64.949,64

111.638,87

BSCF

BSCF

Total

176.588,51

BSCF

IEEJ:May 2003

INDONESIAS NATURAL GAS RESERVES

RESERVES:166 TCF

SOUTH CHINA SEA

UNCOMMITTED:98 TCF

NATUNA: 49 TCF

NATUNA: 46 TCF

SUMATRA: 35 TCF

KALIMANTAN: 47 TCF

SUMATRA: 12 TCF

KALIMANTAN: 15 TCF

OTHER ISLANDS: 24 TCF*

OTHER ISLANDS: 24 TCF*

INDIAN OCEAN

JAVA: 11 TCF

JAVA: 1.5 TCF

*: 20 TCF additional resources

are recently indicated in

Central Sulawesi

IEEJ:May 2003

The Indonesia Basin Status

100

105

110

115

120

125

130

135

140

-5

-10

Produced

Not explored yet

Have been drilled,

discovered, not

produced yet.

Have been drilled,

not discovered yet

IEEJ:May 2003

The Asean Proved Gas Reserves Status

VIETNAM

7%

CAMBODIA

9%

PHILIPPINE

1%

3%

BRUNEI

51%

INDONESIA

29%

MALAYSIA

ASEAN TOTAL : + 361 TSCF

IEEJ:May 2003

The World Proved Gas Reserves Status

AFRICA

7%

ASEAN

NORTH

AMERICA

5%

7%

SOUTH

AMERICA

5%

38%

35%

EX-UNI SOVIET

MIDDLE EAST

3%

EUROPE

WORLD TOTAL : + 5300 TSCF

IEEJ:May 2003

The Indonesia Energy Demand

ENERGY

2000

2010

OIL

294.60 MMBOE

54.84 %

334.45 MMBOE

42.69 %

NAT. GAS

148.79 MMBOE

27.70 %

210.78 MMBOE

26.90 %

COAL

61.29 MMBOE

11.40 %

181.09 MMBOE

23.11 %

HYDRO

28.85 MMBOE

5.37 %

51.93 MMBOE

6.63 %

3.69 MMBOE

0.69 %

5.27 MMBOE

0.67 %

GEOTHERMAL

TOTAL

537.22 MMBOE

100%

783.52 MMBOE

100%

IEEJ:May 2003

The World Energy Demand @ 2001

HYDRO

5%

NUCLEAR

6%

RENEWABLE

1%

OTHERS

5%

OIL

40%

WOOD

11%

21%

GAS

22%

COAL

@ YR 2025 OIL DEMAND = GAS DEMAND + 120 MMBOE/D

IEEJ:May 2003

GAS BUSINESS STRATEGY

GAS BUSINESS CHARACTERISTICS

Product creates its own demand

Gas has specific markets,

Gas moves in an integrated chain. All parts of a gas

chain are economically interdependent,

Its market cannot be taken for granted,

Long term contract dominates through to distributor,

Decision should be taken by those whom they effect,

The arrangement for one gas project is generally not

transferable to another, because each one is highly

individual,

Displaces tradable fuels.

IEEJ:May 2003

GAS BUSINESS STRATEGY

Gas price is the key role of the gas business,

Gas price is not universal,

Principle of supply and demand balance,

Gas transmission and distribution system is artery of

the gas business,

Propose gas pipe line & infrastructure in Indonesia +

Asean + China,

Inter states & provincial authorities cooperate to

develop and invest in the end users of gas.

IEEJ:May 2003

FROM GAS RESOURCES

TO GAS BUSINESS DEVELOPMENT

Gas

Resources

Field Development

Production

Processing

Extraction

Transportation

Distribution

Exploration

Discovery

Reserves Assessment

Well Deliverability

Gas Composition

Market

Industrial

Petrochemical

Power Generation

City Gas, House Hold,

Transportation

LNG, LPG, CNG, GTL and

other related gas product

IEEJ:May 2003

CHANGES OF GAS MARKET

HISTORY

Natural Gas starts to play an important role as a

worldwide commodity in 1970s decade, The crisis in oil

supply in 1973 and the environmental issue have been the

major reasons in stimulating an increase of gas utilization,

Nowadays,the countrys natural gas is utilized in very wide

area as feedstock for industries such as methanol,

ammonia, steel industry, petrochemicals, power

generation, also be found as LNG, LPG , CNG, GTL, BBG.

More than 4.45 BSCF/D of natural gas produced in

Indonesia is exported as LNG. LNG business has made

Indonesia the biggest exporting country in the world,

Since 1996 the significant changes in the LNG business,

indicated by the shifting of the traditionally producers

market to buyers market,

The LNG business will become tougher in the future.

IEEJ:May 2003

A CHANGING MARKET

1. Since 1996 the significant changes in the LNG business,

indicated by the shifting of the traditionally producers

market to buyers market,

2. The LNG business will become tougher and complex in the

future indicated by jointly of multi seller and multi buyers,

3. The seller(s) participating to develop and invest in the end

gas user(s) (downstream), or the gas user(s) participating

to develop and invest in upstream sector,

4. Integrated Gas Pipe-line inter states,

IEEJ:May 2003

INDONESIA GAS BUSINESS

STAGES

PAST (since 1963)

Gas for fertilizer plant (PUSRI)

Low Price

Gas flare

PRESENT (2002)

Gas for LNG (export)

Gas for Power Generation, petrochemical, (domestic),

Gas for fertilizer plants, industrials feedstock

FUTURE (?)

Gas priority for domestic market LNG & Pipe

Gas,Transportation

Gas for Power Generation, petrochemical, fertilizer

plants, industrials feedstock

Gas for LNG & Pipe Gas,(export)

Added Value

IEEJ:May 2003

INDONESIA GAS BUSINESS and CONTROL

BASED ON 0IL & GAS LAW No.22/2001

Article 8, Paragraph (1) :

Government gives priority to the utilization of natural

gas for domestic needs and has a duty to provide

strategic reserves of Natural Oil to support the supply

of the domestic Oil Fuel that shall be further regulated

by Government Regulation

Article 8, Paragraph (3) :

The conduct of natural gas transportation activities

through pipe lines that concern public interest, shall be

regulated to the extent that it is open for all users.

IEEJ:May 2003

INDONESIA GAS BUSINESS and CONTROL

BASED ON 0IL & GAS LAW No.22/2001

Article 23, Paragraph (1) :

Business licenses required for Oil activities and/or Natural Gas

activities as referred to in paragraph (1) shall be distinguished as

follows :

- Processing business licenses

- Transporting business licenses

- Storage business licenses

- Trading business licenses

Article 27, Paragraph (1, 2, and 3) :

1. The Ministery shall stipulate a master plant for national

network for the transmission and distribution on Natural Gas

2. A Business Entity holding a Business License for Natural Gas

Transportation through the pipeline shall only be given a certain

Transportation segment.

3. A Business Entity holding a Business License for Natural Gas

Trading through the pipeline shall only be given a certain

Trading area.

IEEJ:May 2003

GAS PRICE BASED ON 0IL & GAS LAW

No.22/2001

Article 28, Paragraph (2) :

Price for oil fuels and natural gas shall be left to the mechanism

of healthy and fair business competition.

Article 46, Paragraph (1) point d, e, and f :

The duty of the Regulatory Body as referred to in paragraph (1)

shall cover the regulation and stipulation concerning :

d. The tariff of natural gas transportation through the pipe line,

e. The price of natural gas for households and small scale

costumers,

f. The natural gas transmission and distribution business,

IEEJ:May 2003

INDONESIAN GAS PRODUCTION*)

Status December 2002 Production Average (MMSD)

TOT. PSC & INDONESIA

(MMSCF)

9000

8000

7000

6000

5000

4000

3000

2000

1000

0

Apr. May June July Aug. Sept. Oct. Nov. Dec.

TOT. PSC (MMSCF)

*) The IOG Chronicle, January 2003

TOT. INDONESIA (MMSCF)

IEEJ:May 2003

INDONESIAS TOP 10 GAS PRODUCERS*)

Status December 2002 Estimate

2500

2.360

2000

MMSCFD

1.610,64

1500

1.226

794,87

1000

760

538

243,98

153,93

500

98,56 90,36

0

Total FinaElf

ExxonMobil Oil Indonesia

VICO

Pertamina

BP Indonesia

ConocoPhilips Ltd

Unocal Indonesia

PetroChina International Ind. Ltd

Caltex Pacific Indonesia

Premier Oil

*) The IOG Chronicle, January 2003

IEEJ:May 2003

Gas Infrastruktur (Pipelines)

INDONESIAS NATURAL GAS INFRASTRUCTURE

To Malaysia

Banda Aceh

Arun

Pangkalanbrandan

Medan

To Malaysia

SOUTH CHINA SEA

To Thailand

West Natuna

PACIFIC OCEAN

East Natuna

Sibolga

Dumai

Duri

Padang

To Singapore

Manado

Batam

Pontianak

Bontang

Sekernan

Badak

Sorong

Wiriagar

Grissik

Prabumulih

Palembang

Pagardewa

Soroako

Banjarmasin

A

DI

IN

Sengkang

N

EA

OC

N

Cilegon

Makasar

Jakarta

Cirebon

Semarang

Surabaya Pagerungan

Gas Pipeline Legend:

: existing

: near future or future

: under study

Banyuwangi

Denpasar

LPG Plant:

GTL Study:

: Existing

: Future

IEEJ:May 2003

TANGGUH LNG Project

Indonesian LNG Centres

1. Country and Name of

Gas Field Location

The gas resource for the

Tangguh LNG project is

located in the western part of

Papua province, which lies in

eastern Indonesia.

IEEJ:May 2003

2. Proven Recoverable Reserve Volume of Gas Fields

Tangguhs proven gas reserves currently amount to 14.4 TCF of which 5.8 TCF have been

reserved or committed to support supplies to other LNG buyers.

The table below summarizes Tangguh proven gas reserves by field:

Gas field

Proven reserves (TCF)

Vorwata

10.4

Wiriagar Deep

3.0

Other 4 fields

1.0

Total Proven Reserves

14.4

In addition to the 14.4 TCF of proven reserves, the six gas fields are estimated to

contain 3.9 TCF of probable reserves and 5.4 TCF od possible reserves.

Since 4.5 TCF of Tangguh gas reserves are required to supply a 3.5 million to per year

(mtpa) LNG train for 20 years, the Tangguh gas fields can already support a multi-train

LNG development.

IEEJ:May 2003

DEVELOPMENT OF GAS UTILIZATION IN INDONESIA

GAS PRODUCTION & UTILIZATION 2002

MMSCFD

PERTAMINA

PERTAMINA

&&

CONTRACTORS

CONTRACTORS

GAS

PRODUCTION

2,853.83 BSCF

( 7.818 BSCFD)

(%)

LPG

35.10

0.45

LNG

5,235.00

66.95

FERTILIZER

630.50

8.06

P. GENERATION

696.50

8.91

GAS COMPANY

236.40

3.02

STEEL MILL

78.90

1.01

OTHER IND.

414.00

5.31

FLARED & LOSS

491.40

6.28

7,818.70

100.00

IEEJ:May 2003

OPPORTUNITY OF INVESTMENT ON

DOWN STREAM BUSINESS IN INDONESIA

PROCESSING

TRANSPORTING

STORAGE

TRADING

FOR

FUELS

LUBRICATING OIL

GAS

IEEJ:May 2003

MATTERS TO BE DONE

WE HAVE REMAINING RESERVE + 176 TSCF OF GAS

INCREASING GAS DEMAND IN THE FUTURE

TECHNOLOGY & INFRASTRUCTURE

MARKET AND REGULATION SYSTEM

GAS PRICING POLICY

NEED INTEGRATED STRATEGY !

IEEJ:May 2003

PREPARING GAS UTILIZATION STRATEGY

IN INDONESIA

Background

Fuel component in energy mix in Indonesia at present is

still very great (about 60%)

At present national gas reserves have achieved

approximately 170 TCF (committed and uncommitted). With

the total use at present is 8.2 BCFD, so the existing

reserves can serve for 30 years, both for domestic and

export

So far the fact shows that gas utilization is still under 40%

from the total national energy demands. There are some

obstacles in gas utilization such as; lack of domestic

infrastructures. It is therefore, in order to increase gas

utilization in the country either as raw materials for

industry or fuel including vehicle fuels, optimal and

appropriate gas utilization strategy should be formed.

IEEJ:May 2003

PREPARING GAS UTILIZATION STRATEGY

IN INDONESIA

This strategy is based on among others :

the potential supply and gas demand based on the

amount of gas reserves to the geographical location

of the majority of consumers throughout Indonesia

infrastructure

technology

development

and

gas

utilization

gas price policy based on the area, sector and

utilization

types of gas utilization

clearness of gas utilization policy

coordination between producers, transporters and

consumers and clearnes of district government role in

gas utilization.

IEEJ:May 2003

CONCLUDING REMARKS

To speed up new field development project need

conducive regulation investment, transparency

between producer, transporter, trader and

consumer,

The most critical issues in gas business

development

are

competitive

gas

price,

infrastructure, availability and conducive climate

for investment,

By product revenues and the development of value

added markets, such as NGL products, are of

increasing importance given current expectations

of constant real process,

IEEJ:May 2003

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- PCTFEDocument20 pagesPCTFEHardik GandhiNo ratings yet

- Oil and Gas Production Handbook Ed3x0 - WebDocument230 pagesOil and Gas Production Handbook Ed3x0 - WebMARIANNo ratings yet

- GSPC Gas Distribution and CNG StationsDocument70 pagesGSPC Gas Distribution and CNG StationsSajid100% (1)

- Fuel System OptimizationDocument4 pagesFuel System OptimizationMariappan NaNo ratings yet

- Boiler Efficiency Guide PDFDocument24 pagesBoiler Efficiency Guide PDFShafqat Afridi100% (1)

- Thermochemical ConversionDocument31 pagesThermochemical ConversionerkiruthirajNo ratings yet

- Sigtto Catalogue January 2023Document52 pagesSigtto Catalogue January 2023Snow JohnNo ratings yet

- (BP Process Safety Series) BP Safety Group-Safe Furnace and Boiler Firing-Institution of Chemical Engineers (IChemE) (2005)Document86 pages(BP Process Safety Series) BP Safety Group-Safe Furnace and Boiler Firing-Institution of Chemical Engineers (IChemE) (2005)William Villarreal100% (6)

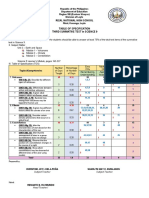

- Rizal National High School Table of Specification Third Summative Test in Science 9Document5 pagesRizal National High School Table of Specification Third Summative Test in Science 9Christine Joy DelaPena Sanico100% (20)

- Mag 14 2017 August 1Document68 pagesMag 14 2017 August 1Ravikumar mahadevNo ratings yet

- Green Steel AssuranceDocument6 pagesGreen Steel AssuranceRajat SinghNo ratings yet

- PP Aaa PP1 114Document49 pagesPP Aaa PP1 114Rabah AmidiNo ratings yet

- Petrochemical 1Document68 pagesPetrochemical 1AnilKumarNo ratings yet

- IBF IBM MBA MBAEman Tier 4 InformationDocument1 pageIBF IBM MBA MBAEman Tier 4 InformationRyan HafizNo ratings yet

- LNG Outlook 2018Document12 pagesLNG Outlook 2018Ryan HafizNo ratings yet

- Novel Method Gas Separation-PresentationDocument43 pagesNovel Method Gas Separation-PresentationelelefanterozadoNo ratings yet

- Online, Part Time Study: Scott Sutherland School of Architecture and Built EnvironmentDocument19 pagesOnline, Part Time Study: Scott Sutherland School of Architecture and Built EnvironmentRyan HafizNo ratings yet

- Unit, Dimensional Analysis, and Simple Chemical Process SystemDocument24 pagesUnit, Dimensional Analysis, and Simple Chemical Process SystemRyan HafizNo ratings yet

- End Users Latin America Oil GasDocument3 pagesEnd Users Latin America Oil GasvatolocogrNo ratings yet

- Air and BurningDocument11 pagesAir and Burningsanat kr pratihar100% (1)

- Indonesia Back On The Exploration Map With Eni's DiscoveryDocument4 pagesIndonesia Back On The Exploration Map With Eni's DiscoveryVincensius PratamaNo ratings yet

- ABHIL - B - R NewDocument4 pagesABHIL - B - R NewGodwin GodwinNo ratings yet

- Chemistry Data Booklet PDFDocument15 pagesChemistry Data Booklet PDFShaz BhattiNo ratings yet

- E Procurement Process at Ongc LTDDocument84 pagesE Procurement Process at Ongc LTDPriyanka Virmani100% (1)

- Improving Commercial Kitchen HWS PerformanceDocument44 pagesImproving Commercial Kitchen HWS PerformanceJeganath KabilNo ratings yet

- Can High Pressure CO2 System Be Used For Inerting System For Pulverized Coal Silos?Document3 pagesCan High Pressure CO2 System Be Used For Inerting System For Pulverized Coal Silos?Shashi RanjanNo ratings yet

- Keselamatan Gas Di Pepasangan Dobi Dan Sektor Komersial: Nur Waheeda WahabDocument48 pagesKeselamatan Gas Di Pepasangan Dobi Dan Sektor Komersial: Nur Waheeda WahabMarvin IgatNo ratings yet

- Highway Wind TurbineDocument4 pagesHighway Wind TurbineAizaz AhmadNo ratings yet

- Presentation 6 - Overview of Renewable Energy Resources - Najwa BugaighisDocument49 pagesPresentation 6 - Overview of Renewable Energy Resources - Najwa BugaighisnajwaNo ratings yet

- Sustainability of The Energy Sector in Jordan: Challenges and OpportunitiesDocument25 pagesSustainability of The Energy Sector in Jordan: Challenges and OpportunitiesKelsey OlivarNo ratings yet

- SPE Paper 69679Document11 pagesSPE Paper 69679Nicholas Garrett100% (2)

- Use of Biogas in Fuel CellsDocument18 pagesUse of Biogas in Fuel CellsManoj KumarNo ratings yet

- Green Chemistry - BiodieselDocument21 pagesGreen Chemistry - Biodieselkavikumar venkatajalamNo ratings yet

- API USA DS2 en Excel v2 10181458Document472 pagesAPI USA DS2 en Excel v2 10181458arbil0110No ratings yet

- KS3 Energy RevisionDocument5 pagesKS3 Energy RevisionAdina GuttentagNo ratings yet