Professional Documents

Culture Documents

Bluntly Media Valuatio1

Uploaded by

Srikant0 ratings0% found this document useful (0 votes)

2K views1 pagejbj

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentjbj

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2K views1 pageBluntly Media Valuatio1

Uploaded by

Srikantjbj

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Bluntly Media Valuation

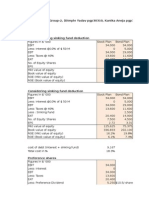

WACC calculation

For WACC, I assumed MRP as 5% and beta calculated from the exhibit 9 of the

betas. For beta calculation I have taken average unlevered beta which is given and

for D/E ratio, I took average Debt and average equity.

Formula to cal. Levered beta= unlevered beta*(1+ (1-tax)D/E ratio).

Risk free rate and cost of debt are given. For cost of equity I used CAPM model.

WACC= D/V*Kd(1-tax)+E/V*Ke = 5.7%

PV of the firm by FCFF

Assumed growth rate taken was 3%, as it should not be taken more than the

industry growth, I can also took max 3.2% not more than that.

Sales predicted on the basis of assumed growth rate.

Cost of sale, operating expenses, other current assets and depreciation predicted on

the basis of the average of previous years.

Working capital= current assets current liabilities

Capex= change in Fixed Assets

FCFF= EBIT(1-tax) + depreciation change in WC Capex

PV of intermediate CF= PV of all the cash flows given @WACC calculated.

=NPV(B53,F38:J38)

PV of Terminal Value =K39/((1+B53)^6), this is for 6 years @WACC

calculated for the calculated TV.

So, PV of the firm calculated by adding PV of Intermediate CF and PV of

Terminal Value.

PV of the Firm= 22,359.15

You might also like

- Private valuation of Bluntly Media for potential acquisitionDocument3 pagesPrivate valuation of Bluntly Media for potential acquisitionSrikant SharmaNo ratings yet

- WACC, Growth Rates, and DCF Valuation for Bluntly MediaDocument18 pagesWACC, Growth Rates, and DCF Valuation for Bluntly Mediahimanshu sagarNo ratings yet

- Case #1 Bluntly MediaDocument3 pagesCase #1 Bluntly MediaAlexandra Bento50% (2)

- Friendly Cards CaseDocument3 pagesFriendly Cards CaseJeff Farley50% (2)

- Friendly CS SolutionDocument8 pagesFriendly CS SolutionEfendiNo ratings yet

- LinearDocument6 pagesLinearjackedup211No ratings yet

- Maximizing Shareholder Value Through Optimal Dividend and Buyback PolicyDocument2 pagesMaximizing Shareholder Value Through Optimal Dividend and Buyback PolicyRichBrook7No ratings yet

- Dollarama Case DCFDocument22 pagesDollarama Case DCFDaniel Jinhong Park25% (4)

- Reversing The AMD Fusion Launch (Case Study)Document6 pagesReversing The AMD Fusion Launch (Case Study)SanyamRajvanshiNo ratings yet

- Winfield ManagementDocument5 pagesWinfield Managementmadhav1111No ratings yet

- Linear Technology Dividend Policy and Shareholder ValueDocument4 pagesLinear Technology Dividend Policy and Shareholder ValueAmrinder SinghNo ratings yet

- Asics Chasing A 2020 VisionDocument57 pagesAsics Chasing A 2020 Visionfalguni33% (3)

- Loewen Group CaseDocument2 pagesLoewen Group CaseSu_NeilNo ratings yet

- Bausch N LombDocument3 pagesBausch N LombRahul SharanNo ratings yet

- Berkshire's Bid for Carter's - Industry Fit and Quantitative AnalysisDocument2 pagesBerkshire's Bid for Carter's - Industry Fit and Quantitative AnalysisAlex TovNo ratings yet

- Jones Electrical Faces Cash Shortfall Despite ProfitsDocument5 pagesJones Electrical Faces Cash Shortfall Despite ProfitsAsif AliNo ratings yet

- Continental CarriersDocument6 pagesContinental CarriersVishwas Nandan100% (1)

- CORPORATE FINANCIAL MANAGEMENT AT LOEWEN GROUPDocument13 pagesCORPORATE FINANCIAL MANAGEMENT AT LOEWEN GROUPAmit SurveNo ratings yet

- Jones Electrical DistributionDocument6 pagesJones Electrical DistributionLoleeta H. Khaleel67% (9)

- Case Study - Linear Tech - Christopher Taylor - SampleDocument9 pagesCase Study - Linear Tech - Christopher Taylor - Sampleakshay87kumar8193No ratings yet

- Working Capital Management: Case: ALAC InternationalDocument55 pagesWorking Capital Management: Case: ALAC Internationaljk kumarNo ratings yet

- Case 16 Group 56 FinalDocument54 pagesCase 16 Group 56 FinalSayeedMdAzaharulIslamNo ratings yet

- Financial Management Case Study of O.M. Scott & Sons Company (YP50BDocument3 pagesFinancial Management Case Study of O.M. Scott & Sons Company (YP50BMurni Fitri FatimahNo ratings yet

- Jones Electrical DistributionDocument6 pagesJones Electrical DistributionMichelle Rodríguez100% (1)

- Hill Country SnackDocument8 pagesHill Country Snackkiller dramaNo ratings yet

- Jones Electrical DistributionDocument4 pagesJones Electrical Distributioncagc333No ratings yet

- NYT - Paywall - For StudentsDocument69 pagesNYT - Paywall - For StudentsSakshi Shah100% (1)

- Case BBBYDocument7 pagesCase BBBYgregordejong100% (1)

- 454K Loan for Cartwright Lumber CoDocument5 pages454K Loan for Cartwright Lumber CoRushil Surapaneni50% (2)

- Jones Electrical DistributionDocument6 pagesJones Electrical DistributionChris Mlincsek67% (3)

- Nike Inc. Case StudyDocument3 pagesNike Inc. Case Studyshikhagupta3288No ratings yet

- Dividend Policy at Linear TechnologyDocument9 pagesDividend Policy at Linear TechnologySAHILNo ratings yet

- MGT431 - Apple, Einhorn, iPrefs Group ReportDocument13 pagesMGT431 - Apple, Einhorn, iPrefs Group ReportMokshNo ratings yet

- Hampton Machine Tool CompanyDocument2 pagesHampton Machine Tool CompanySam Sheehan100% (1)

- Sealed Air Corporation's Leveraged Recapitalization (A)Document7 pagesSealed Air Corporation's Leveraged Recapitalization (A)Jyoti GuptaNo ratings yet

- Outreach Networks Case StudyDocument9 pagesOutreach Networks Case Studymothermonk100% (3)

- Jones Electrical DistributionDocument12 pagesJones Electrical DistributionJohnNo ratings yet

- Facebook IPO Valuation AnalysisDocument13 pagesFacebook IPO Valuation AnalysisMegha BepariNo ratings yet

- WorldWide Paper CaseDocument8 pagesWorldWide Paper CaseSteve LuNo ratings yet

- GR-II-Team 11-2018Document4 pagesGR-II-Team 11-2018Gautam PatilNo ratings yet

- Yell U.K. Valuation Analysis for $1.8B AcquisitionDocument5 pagesYell U.K. Valuation Analysis for $1.8B AcquisitionAdithi RajuNo ratings yet

- Hill Country Snack Foods Co - UDocument4 pagesHill Country Snack Foods Co - Unipun9143No ratings yet

- Questions - Linear Technologies CaseDocument1 pageQuestions - Linear Technologies CaseNathan Toledano100% (1)

- American Chemical CorporationDocument8 pagesAmerican Chemical CorporationAnastasiaNo ratings yet

- Asics Case AnalysisDocument5 pagesAsics Case AnalysisRahul RoyNo ratings yet

- Accounting For Frequent Fliers CaseDocument15 pagesAccounting For Frequent Fliers CaseGlenPalmer50% (2)

- Ameritrade Case SolutionDocument31 pagesAmeritrade Case Solutionsanz0840% (5)

- Finance Simulation: Estimated Equity Value of Bel Vino CorporationDocument4 pagesFinance Simulation: Estimated Equity Value of Bel Vino Corporationvardhan73% (11)

- Destin Brass Case Study SolutionDocument5 pagesDestin Brass Case Study SolutionAmruta Turmé100% (2)

- Analyzing Mercury Athletic Footwear AcquisitionDocument5 pagesAnalyzing Mercury Athletic Footwear AcquisitionCuong NguyenNo ratings yet

- Facebook IPO Performance and ValuationDocument4 pagesFacebook IPO Performance and ValuationHanako Taniguchi PoncianoNo ratings yet

- Case 34 - The Wm. Wrigley Jr. CompanyDocument72 pagesCase 34 - The Wm. Wrigley Jr. CompanyQUYNH100% (1)

- The Loewen Group, IncDocument5 pagesThe Loewen Group, IncManvi Govil0% (1)

- Midterm Review - Key ConceptsDocument10 pagesMidterm Review - Key ConceptsGurpreetNo ratings yet

- Valuation of Corporation: Drivers of Value CreationDocument60 pagesValuation of Corporation: Drivers of Value CreationUzzaam HaiderNo ratings yet

- Financial Management - Kendle QuesuestionsDocument4 pagesFinancial Management - Kendle QuesuestionsDr Rushen SinghNo ratings yet

- Risk Free: Special Dividend Effect On Beta: Chrysler, The Automotive Manufacturer, Had ADocument18 pagesRisk Free: Special Dividend Effect On Beta: Chrysler, The Automotive Manufacturer, Had AAshutosh TulsyanNo ratings yet

- DCF Valuation- Aswath DamodaranDocument60 pagesDCF Valuation- Aswath DamodaranUtkarshNo ratings yet

- Business Valuation (FCFF)Document5 pagesBusiness Valuation (FCFF)Akshat JainNo ratings yet

- Discounted Cash Flow (DCF) : How To Use DCF Method For Stock Valuation? (Calculator)Document18 pagesDiscounted Cash Flow (DCF) : How To Use DCF Method For Stock Valuation? (Calculator)Jeet SinghNo ratings yet

- FAQDocument4 pagesFAQSrikantNo ratings yet

- ErpDocument35 pagesErpSrikantNo ratings yet

- GymReport 1Document24 pagesGymReport 1SrikantNo ratings yet

- Session PlanDocument11 pagesSession PlanSrikantNo ratings yet

- Case StudyDocument7 pagesCase StudySrikantNo ratings yet

- Pricing CaseDocument6 pagesPricing CaseSrikantNo ratings yet

- Hks671 PDF EngDocument21 pagesHks671 PDF EngSrikantNo ratings yet

- Integrated Services Marketing Communications: Provider GAP 4Document20 pagesIntegrated Services Marketing Communications: Provider GAP 4SrikantNo ratings yet

- Revised 21-26th NOVDocument2 pagesRevised 21-26th NOVSrikantNo ratings yet

- GUIDE To The Library Classification System: Austin Community College Library Services 7/30/2015, B. YoungDocument2 pagesGUIDE To The Library Classification System: Austin Community College Library Services 7/30/2015, B. YoungSrikantNo ratings yet

- Promotional Marketing Project ReportDocument11 pagesPromotional Marketing Project ReportSagar SachdevaNo ratings yet

- Social Entrepreneurship PT 2Document9 pagesSocial Entrepreneurship PT 2DeeptiBandooniNo ratings yet

- Session Plan - Services Marketing 2015-17 BatchDocument8 pagesSession Plan - Services Marketing 2015-17 BatchSrikantNo ratings yet

- SM FinalDocument23 pagesSM FinalSrikantNo ratings yet

- 01 SGDockers VFDocument26 pages01 SGDockers VFSrikantNo ratings yet

- The Business Plan NotesDocument4 pagesThe Business Plan NotesSrikantNo ratings yet

- CSR ProposalDocument17 pagesCSR ProposalSrikantNo ratings yet

- CSR & Business EthicsDocument6 pagesCSR & Business EthicsSrikant SharmaNo ratings yet

- India Civil Aviation Sector Report Analyzes Competition IssuesDocument80 pagesIndia Civil Aviation Sector Report Analyzes Competition IssuesitssosimpleNo ratings yet

- SaveDocument36 pagesSaveSarvjeet ParmarNo ratings yet

- HBR StrategiesDocument64 pagesHBR StrategiesSrikantNo ratings yet

- How Nascent Institutions Build Their BrandDocument5 pagesHow Nascent Institutions Build Their BrandSrikantNo ratings yet

- Ayush SendDocument6 pagesAyush SendSrikantNo ratings yet

- Maternity Hospital Research on Smoking, Gender Satisfaction and Baby WeightDocument15 pagesMaternity Hospital Research on Smoking, Gender Satisfaction and Baby WeightSrikantNo ratings yet

- Manpower PlanningDocument2 pagesManpower PlanningSrikantNo ratings yet