Professional Documents

Culture Documents

Trial Balance Example

Uploaded by

Cabral Mar0 ratings0% found this document useful (0 votes)

7 views3 pagestrial balance sample

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenttrial balance sample

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views3 pagesTrial Balance Example

Uploaded by

Cabral Martrial balance sample

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

The last two steps in the accounting process are

preparing a trial balance and then preparing the

balance sheet and income statement. This information

is provided in order to communicate the financial

position of the entity to interested parties.

TRIAL BALANCE

A trial balance is a list and total of all the debit and

credit accounts for an entity for a given period

usually a month. The format of the trial balance is a

two-column schedule with all the debit balances listed

in one column and all the credit balances listed in the

other. The trial balance is prepared after all the

transactions for the period have been journalized and

posted to the General Ledger.

Key to preparing a trial balance is making sure that all

the account balances are listed under the correct

column. The appropriate columns are as follows:

Assets = Debit balance

Liabilities = Credit balance

Expenses = Debit Balance

Equity = Credit balance

Revenue = Credit balance

Should an account have a negative balance, it is

represented as a negative number in the appropriate

column. For example, if the company is $500 into the

overdraft in the checking account the balance would

be entered as -$500 or ($500) in the debit

column. The $500 negative balance is NOT listed in

the credit column.

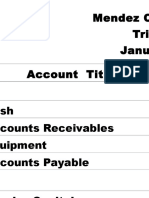

Example Trial Balance:

1. In your program, or on the paper, which should have at

least three columns, list all of the accounts still open on the

general ledger.

2. Next, list the balances of these accounts. ...

3. Finally, add up the debit balances, then the credit

balances.

Trial Balance Example: How to Prepare This Simple

Statement

https://blog.udemy.com/trial-balance-example/

Trial Balance Example: How to Prepare This Simple

Statement

MARCH 28, 2014 BY MATTHEW JOHNSON

You might also like

- Mendez Catering Services Trial Balance January 31, 2014 Account TitlesDocument18 pagesMendez Catering Services Trial Balance January 31, 2014 Account TitlesCabral MarNo ratings yet

- Beauty of Mathematics Reflective Essay Activity 2 HoursDocument3 pagesBeauty of Mathematics Reflective Essay Activity 2 HoursCabral MarNo ratings yet

- Generalization: All Four-Sided Figures Have Four Right AnglesDocument3 pagesGeneralization: All Four-Sided Figures Have Four Right AnglesCabral MarNo ratings yet

- Transmission of SoundDocument2 pagesTransmission of SoundCabral MarNo ratings yet

- SAG - Computer Hardware Servicing NC IIDocument2 pagesSAG - Computer Hardware Servicing NC IIJek KejNo ratings yet

- Introduction To Microsoft Power Point 2007Document23 pagesIntroduction To Microsoft Power Point 2007Indika RathnindaNo ratings yet

- Safety Precaution in Electrical Wiring InstallationDocument2 pagesSafety Precaution in Electrical Wiring InstallationCabral MarNo ratings yet

- Major Types of ResearchDocument18 pagesMajor Types of ResearchCabral Mar100% (3)

- Identifying and Selecting Curriculum MaterialsDocument23 pagesIdentifying and Selecting Curriculum MaterialsCabral MarNo ratings yet

- Creating ChartDocument18 pagesCreating ChartCabral MarNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- CIR Vs MarubeniDocument11 pagesCIR Vs MarubeniShane Fernandez JardinicoNo ratings yet

- Sunteck Realty LTD.: Earnings Update Q3 FY2019Document34 pagesSunteck Realty LTD.: Earnings Update Q3 FY2019Imran MulaniNo ratings yet

- NLG - Annual Report 2016Document48 pagesNLG - Annual Report 2016Kiva DangNo ratings yet

- DO - 029 - S2011 Revised Guidelines On Preparation of ABCDocument6 pagesDO - 029 - S2011 Revised Guidelines On Preparation of ABCroldskiNo ratings yet

- Chapter 1 - True or False Part 2Document3 pagesChapter 1 - True or False Part 2Chloe Gabriel Evangeline ChaseNo ratings yet

- Responsibility Accounting and Transfer PricingDocument2 pagesResponsibility Accounting and Transfer PricingLaraNo ratings yet

- Mid Term PracticeDocument12 pagesMid Term PracticeOtabek KhamidovNo ratings yet

- ACCA F3 China Slidesv2Document129 pagesACCA F3 China Slidesv2JoeFSabater50% (2)

- I B.com 202c - Business EnvironmentDocument23 pagesI B.com 202c - Business EnvironmentNaveen KalakatNo ratings yet

- ACC 200 Quiz #2 - Chapters 4, 5 and 6Document4 pagesACC 200 Quiz #2 - Chapters 4, 5 and 6Idrees ShinwaryNo ratings yet

- 5 10 12a 6ADocument12 pages5 10 12a 6AVidya1986No ratings yet

- Corporate Finance MCQsDocument0 pagesCorporate Finance MCQsonlyjaded4655100% (1)

- Options Trading IQ IC Trading Plan v2Document3 pagesOptions Trading IQ IC Trading Plan v2dhana2020No ratings yet

- Factors Affecting The Choice of The Sourse of FundsDocument3 pagesFactors Affecting The Choice of The Sourse of Fundsmudey100% (2)

- Match Fixing in Soccer OrganizationDocument20 pagesMatch Fixing in Soccer OrganizationHanky TambunanNo ratings yet

- Finite Math Final ProjectDocument14 pagesFinite Math Final Projectapi-396001914No ratings yet

- Takehome - Quiz - Manac - Docx Filename - UTF-8''Takehome Quiz Manac-1Document3 pagesTakehome - Quiz - Manac - Docx Filename - UTF-8''Takehome Quiz Manac-1Sharmaine SurNo ratings yet

- TAX-07-GROSS-INCOME (With Answers)Document12 pagesTAX-07-GROSS-INCOME (With Answers)Kendrew SujideNo ratings yet

- Commissioner of Internal Revenue vs. ST Luke's Medical CenterDocument1 pageCommissioner of Internal Revenue vs. ST Luke's Medical CenterTJ Dasalla GallardoNo ratings yet

- Payroll US Best PracticesDocument7 pagesPayroll US Best PracticesJuba99350No ratings yet

- Financial Ratios ExplainedDocument11 pagesFinancial Ratios ExplainedCody BentleyNo ratings yet

- 12 Accounts Imp Accounting Admission of A Partner 1Document4 pages12 Accounts Imp Accounting Admission of A Partner 1Piyush SrivastavaNo ratings yet

- Chapter 1 TutorialDocument5 pagesChapter 1 TutorialAnisaNo ratings yet

- China Policy Financial Bonds PrimerDocument39 pagesChina Policy Financial Bonds PrimerbondbondNo ratings yet

- Firms in Competitive MarketsDocument55 pagesFirms in Competitive Marketsjehana_bethNo ratings yet

- Introduction to Computing Lab #13Document4 pagesIntroduction to Computing Lab #13Muhammad FahadNo ratings yet

- Chapter 1: Financial Management and Financial ObjectivesDocument15 pagesChapter 1: Financial Management and Financial ObjectivesAmir ArifNo ratings yet

- Absolute returns in any marketDocument20 pagesAbsolute returns in any marketLudwig CaluweNo ratings yet

- Kuroiler - NPV Financial Plan - Chick SalesDocument14 pagesKuroiler - NPV Financial Plan - Chick SalesYouth Environmental and Social Enterprises (YESE)0% (1)