Professional Documents

Culture Documents

Week 1 - Introduction & GDP

Uploaded by

kevinucamCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Week 1 - Introduction & GDP

Uploaded by

kevinucamCopyright:

Available Formats

MGEA06 LEC 01, LEC 02 & LEC 60

Introduction to Macroeconomics:

A Mathematical Approach

Winter 2017

MGEA06 Week 1 Iris Au 1

Introduction

Professor: Iris Au

Class format:

Lecture:

There are 2 regular sections and 1 online section.

Lectures will be taped and will be available on WebOption.

Tutorials:

Weekly tutorials had been taped and will be available on WebOption.

Teaching Assistants office hours:

We have 12 TAs and they will hold weekly office hours (start in Week 2).

TA office: IC 225

The schedule of their office hours has been posted on Blackboard.

Professor Aus office hours:

Office: IC 282

Office hours: Monday, 11:00am 12:00pm & Tuesday, 9:30am 11:00am

Course Coordinator: Arif Toor

Email: mgea06headta@utsc.utoronto.ca

He handles issues related to the administrative part of the course such as

technical difficulties in viewing online materials, TAs office hours, and etc.

MGEA06 Week 1 Iris Au 2

Required text: Krugman, Wells, Au, and Parkinson, Macroeconomics, 2nd

Canadian edition, Worth, 2014.

The new course text package in the bookstore comes in 2 options: a

paperback and a loose leaf. It includes the Sapling access code. The study

guide also comes at NO additional cost with the package. Although it is not

mandatory, the study guide is strongly recommended because it provides

additional practice.

Grading schemes:

Online assignments (best 5 out of 6) 15%

Midterm 35%

Final Exam 50%

For those who have attempted the midterm, improvement will be taken nto

consideration when assigning the overall grade. If you do better in the final

exam, your midterm marks will be replaced by your final exam marks (i.e.,

your final exam will count for 85%).

If anyone miss the midterm with legitimate reason, you must submit proper

documentation to the course coordinator within one week after the midterm

is written in order for us to transfer your midterm weight to the final exam.

If proper documentation is NOT being submitted in a timely manner, you

will receive a grade of ZERO in the midterm (i.e., your midterm weight will

not be transferred to the final exam and your final exam will count for 50%).

MGEA06 Week 1 Iris Au 3

Assignments:

Six online assignments will be given out throughout the term.

Only the best 5 assignments out of 6 will be counted for grades.

You need a Sapling access code to complete the assignments.

If you get a new course package, the code is already included.

If you get a used text, the option of getting a stand-alone access code is

available from the Sapling site.

See instructions posted on Blackboard on how to set up an account.

MGEA06 Week 1 Iris Au 4

Chapters 6 & 7 Introduction & The Measurement of GDP

Outline

What is macroeconomics? (Chapter 6)

The national accounts. (Chapter 7)

What is Gross Domestic Product (GDP)?

3 approaches to measure GDP.

Nominal GDP vs. Real GDP

Price indexes. (Chapter 7)

Consumer price index (CPI) vs. GDP deflator.

MGEA06 Week 1 Iris Au 5

Chapter 6 Macroeconomics: The Big Picture

Macroeconomics is about the big picture, i.e., it is the study of the behaviour

of the economy as a whole.

Macroeconomics look at things in a different way than microeconomics, we

focus on:

The interactions of different sectors in an economy (instead of what

happens in a specific market and we cannot just add things up).

Macro has a strong policy focus.

Issues that macroeconomists will look at:

Causes of the business cycles the short-run alternation between

recessions and expansions.

Factors that affecting the unemployment rate.

What should policy makers (the government and the central bank) do to

smooth out the business cycles?

Causes and costs of inflation.

What determine the long-run economic growth?

Our interactions with the rest of the world (exchange rate, trade balance).

MGEA06 Week 1 Iris Au 6

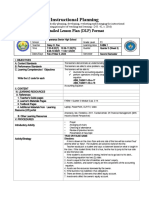

Figure 7-1 An Expanded Circular-Flow Diagram

Note:

Total spending on final goods and services = consumer spending +

investment spending + government purchases of goods and services +

exports imports

Total spending on final goods and services = Total value of all final goods

and services produced within a country (Gross domestic product)

MGEA06 Week 1 Iris Au 7

Chapter 7 GDP and the CPI: Tracking the Macroeconomy

The National Account

Gross Domestic Product

Gross domestic product (GDP) is the total value of all final goods and

services produced in the economy during a given year.

It only includes goods and services sold to final/end users, i.e.,

intermediate goods and services are not counted.

It looks at the value of products produced within the economy.

There are 3 ways to measure GDP, and they are:

1) The value-added approach.

2) The expenditure approach.

3) The income approach.

The Value-Added Approach

This approach focuses on the value added of each producer in the economy.

Value added = Value of the sales Value of the purchases of intermediate

goods and services.

MGEA06 Week 1 Iris Au 8

Example: An economy consists of 3 firms only Canadian Ore, Inc. (CO),

Canadian Steel, Inc. (CS), and Canadian Motors, Inc. (CM).

Canadian Ore Canadian Steel Canadian Motors

(ore sold to (steel sold to (car sold to

CS) CM) consumers)

Sales $4200 $9000 $21500

Intermediate goods $0 $4200 $9000

Wages $2000 $3700 $10000

Interest payments $1000 $600 $1000

Rent $200 $300 $500

Profit $1000 $200 $1000

Using the value-added approach to find the GDP.

Value-added of Canadian Ore =

Value-added of Canadian Steel =

Value-added of Canadian Motors =

GDP =

MGEA06 Week 1 Iris Au 9

The Expenditure Approach

It adds up expenditure on domestically produced final goods and services by

households, firms, governments, and foreign buyers.

Total expenditure is the sum of 4 major categories:

1) Consumption (C) spending by households on goods and services.

2) Investment (I) spending on goods that are not for present consumption.

There are 3 types of investment:

Business fixed investment the purchases of capital equipment,

machinery and production plants.

Residential investment the building of new houses.

Inventory investment the change in the quantity of goods that firms

hold in storage, including materials and supplies, work in process, and

finished goods.

3) Government spending (G) spending on goods and services by different

levels of government, exclusive of government transfer payments.

4) Net exports (NX), NX = Exports (X) Imports (IM)

Consumption, investment, and government spending may include

imported goods (goods made in foreign countries), and these imported

goods should not be included in the countrys GDP; thus, we need to

subtract imports.

MGEA06 Week 1 Iris Au 10

According to the expenditure approach, GDP is given by:

GDP = C + I + G + X IM = C + I + G + NX

Example (continued):

Canadian Ore Canadian Steel Canadian Motors

(ore sold to (steel sold to (car sold to

CS) CM) consumers)

Sales $4200 $9000 $21500

Intermediate goods $0 $4200 $9000

Wages $2000 $3700 $10000

Interest payments $1000 $600 $1000

Rent $200 $300 $500

Profit $1000 $200 $1000

Using the expenditure approach to find the GDP.

GDP, Expenditure Base, at market price, 2015, in billions of dollars

Billions of dollars % of GDP

Consumption $1112.636 56.0%

Investment $472.372 23.8%

Government spending $447.517 22.5%

Net exports $47.4 2.4%

Exports $622.832 31.6%

Imports $670.232 32.5%

Statistical discrepancy $0.529 0.0%

GDP $1985.654 100%

Source: Statistics Canada, Table 380-0064.

MGEA06 Week 1 Iris Au 11

The Income Approach

It looks at income earned from production of goods and services.

There are two sources of income:

1) Factor incomes income earned by factors of production or inputs such

as wages, salaries, interest, rent, business profits.

2) Non-factor payments the difference between the prices paid for final

goods and services and the amount received by production factors before

income taxes are removed. Non-factor payments include net indirect

taxes, capital depreciation.

Example (continued):

Canadian Ore Canadian Steel Canadian Motors

(ore sold to (steel sold to (car sold to

CS) CM) consumers)

Sales $4200 $9000 $21500

Intermediate goods $0 $4200 $9000

Wages $2000 $3700 $10000

Interest payments $1000 $600 $1000

Rent $200 $300 $500

Profit $1000 $200 $1000

Using the income approach to find the GDP.

Wages =

Interest payments =

Rent =

Profit =

GDP =

MGEA06 Week 1 Iris Au 12

GDP, Income Base, at market price, 2015, in billions of dollars

Billions of dollars % of GDP

Factor income $1430.889 72%

Wages & salaries $1024.229

Business profits $231.094

Other income $175.566

Non-factor payments $555.294 28%

Capital depreciation $338.811

Net indirect taxes $216.483

Statistical discrepancy $0.529 0.0%

GDP $1985.654 100%

Source: Statistics Canada, Table 380-0063.

Both expenditure approach and the income approach gave the same GDP.

Why?

MGEA06 Week 1 Iris Au 13

What GDP Tells Us

GDP is the most commonly used measure of the size of an economy, which

allows us to compare a countrys economic performance to other countries.

However, the following items are not included in the GDP:

Inputs and intermediate goods and services.

Used goods.

Financial assets such as bonds, stocks, mutual funds.

Foreign-produced goods and services.

Household production and volunteer work.

Underground economy transactions and illegal activities.

Harm done to the environment during the production or consumption of

goods.

Gross domestic product (GDP) vs. Gross national product (GNP)

GDP measures the sum of all final goods and services produced within a

country.

GNP measures the sum of all final goods and services produced by a

countrys residents.

GNP = GDP + (Income earned by Canadian outside Canada

Income earned by foreigners in Canada)

GNP = GDP + Net factor income earned abroad

MGEA06 Week 1 Iris Au 14

Real GDP: A Measure of Aggregate Output

We have to be careful when using GDP to make comparisons over time

because an increase in GDP might cause by increases in prices of goods and

services, an increase in production, or a combination of both.

To have an accurate measure of economic growth, we look at real GDP.

Calculating Real GDP

Nominal GDP measures the value of all final goods and services produced in

the economy during a given year, calculated using the prices in the year in

which the output is produced (i.e., the current year prices).

n

Nominal GDPt (NGDPt) = P1,tQ1,t + P2,tQ2,t + Pn,tQn,t = Pi, t Qi, t

i 1

where Pi,t = price of good i in time t

Qi,t = quantity of good i produced in time t

Real GDP measures the total value of all final goods and services produce in

the economy during a given year, calculated using the prices of a selected

base year.

n

Real GDPt (RGDPt) = Pi, Base yearQi, t

i 1

MGEA06 Week 1 Iris Au 15

Example: Let Year 1 be the base year.

Price Quantity

Year Good X Good Y Good X Good Y

1 $1 $2 10 15

2 $1.5 $3 20 30

3 $2 $4 20 30

Find the nominal GDP. (Use current year quantities & current year prices).

Compute the real GDP (Use current year quantities & base year prices).

MGEA06 Week 1 Iris Au 16

What Real GDP Doesnt Measure

Real GDP takes out the effect of price changes on the value of production.

However, a country with a larger population tends to have a higher GDP.

To eliminate the effect of differences in population size, we look at real GDP

per capita.

Real GDP

Real GDP per capita =

Population

Real GDP per capita is a commonly used measure to compare labour

productivity across countries. Some even use it to compare living standard

across countries because countries with higher real GDP per capita tend to

have higher living standard. But, we need to use it with caution because:

It only gives us a measure of the economys average output per person; it

ignores the distribution of output.

It does not address how a country uses that output to affect living

standards.

MGEA06 Week 1 Iris Au 17

Price Indexes and the Aggregate Price Level

In this section, we will learn how to measure the aggregate price level, the

measure of the overall level of prices in the economy.

Market Baskets and Price Indexes

There are different price indexes such as the consumer price index (CPI), the

producer price index, and the GDP deflator.

The inflation rate is the percentage change of a price index.

The Consumer Price Index (CPI)

It measures how fast the cost of a basket of goods and services bought by a

typical Canadian household has changed over time, which is the most

commonly used measure to compute inflation rate

It uses a fixed basket of goods and services because the quantities in the

basket, i.e., the weights of the basket, are held fixed at the base-year level.

To construct the CPI, Statistics Canada will:

Choose a base year.

Determine the market basket of goods and services purchased by a

typical household.

n

Compute the cost of that basket in different year, i.e., Pi, t Qi, Base year

i 1

Cost of (fixed) market basket in year t

CPI in year t = 100

Cost of (fixed) market basket in base year

MGEA06 Week 1 Iris Au 18

Figure 7-6 The Makeup of the Consumer Price Index in 2011

MGEA06 Week 1 Iris Au 19

Other Price Measures

The other price measures that are widely used to track changes in prices are:

1) Industrial producer price index (IPPI)

It measures the wholesale cost of a typical fixed basket of good purchased

by producers, items enter IPPI include raw materials such as coal, steel,

and other inputs such as electricity.

The IPPI tends to respond to inflationary or deflationary pressure more

quickly than the CPI, it serves as a leading indicator of changes in the

inflation rate.

2) GDP deflator

It is a current weighted price index, i.e., it uses the currently quantities of

all goods and services that enter into GDP as weights.

The GDP deflator for a year t is given as:

Nominal GDP in year t

GDP deflator in year t = 100

Real GDP in year t

MGEA06 Week 1 Iris Au 20

Example: The economy only produces 2 goods & they are bought by

households only.

Year 1 (Base year) Year 2 (Current year)

Price Quantity Price Quantity

Good X $3 4 $5 6

Good Y $10 2 $30 1.5

Use the CPI to find the % in Prices from Year 1 to Year 2

Cost of base-year basket in year 1, COB1:

Cost of base-year basket in year 2, COB2:

COB1

CPI1 = 100

COBbase year

COB2

CPI2 = 100

COBbase year

MGEA06 Week 1 Iris Au 21

Year 1 (Base year) Year 2 (Current year)

Price Quantity Price Quantity

Good X $3 4 $5 6

Good Y $10 2 $30 1.5

Use the GDP Deflator to find the % in Prices from Year 1 to Year 2

Nominal GDP in year 2, NGDP2:

Real GDP in year 2, RGDP2:

GDP defalotr1 = 100 (because year 1 is the base year)

NGDP2

GDP deflator2 = 100

RGDP2

MGEA06 Week 1 Iris Au 22

Differences between the GDP deflator and the CPI

1) The CPI uses the bundle purchased by a typical household; while the GDP

deflator uses the bundle produced within the country.

Changes in the prices of imported consumption goods.

GDP deflator:

CPI:

Changes in the prices of domestically produced goods that are only

bought by firms or government.

GDP deflator:

CPI:

2) The GDP deflator uses the bundle that is currently produced and the CPI

uses a fixed bundle (the base-year bundle)

MGEA06 Week 1 Iris Au 23

Figure 7-9 The CPI, the IPPI, and the GDP Deflator

MGEA06 Week 1 Iris Au 24

You might also like

- Accounts Receivable T Account AnalysisDocument2 pagesAccounts Receivable T Account AnalysiskevinucamNo ratings yet

- Current Events AssignmentDocument1 pageCurrent Events AssignmentkevinucamNo ratings yet

- PSYB10 Syllabus Fall 2016, P. 1 of 6: ProfessorDocument7 pagesPSYB10 Syllabus Fall 2016, P. 1 of 6: ProfessorkevinucamNo ratings yet

- Postlab Questions: Position-Time Graph (Train A) Position-Time Graph (Train B)Document3 pagesPostlab Questions: Position-Time Graph (Train A) Position-Time Graph (Train B)kevinucamNo ratings yet

- α−decay X He X: Four principal decay modes of unstable nucleiDocument3 pagesα−decay X He X: Four principal decay modes of unstable nucleikevinucamNo ratings yet

- EconomicsssDocument2 pagesEconomicssskevinucamNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Shanghai Mitsubishi Elevator Produces One Millionth UnitDocument3 pagesShanghai Mitsubishi Elevator Produces One Millionth Unitرياض ريزوNo ratings yet

- IAS 33 Earnings Per Share: ImportanceDocument8 pagesIAS 33 Earnings Per Share: Importancemusic niNo ratings yet

- SK and LYDO M&E Templates 2022Document11 pagesSK and LYDO M&E Templates 2022Joemar CaprancaNo ratings yet

- DFMA Lab 1Document13 pagesDFMA Lab 1roshni muthaNo ratings yet

- Case Study LawDocument3 pagesCase Study Lawabdul waleed100% (3)

- ECONTWO: EXERCISE 1 KEYDocument6 pagesECONTWO: EXERCISE 1 KEYIrvinne Heather Chua GoNo ratings yet

- Traffic Growth Rate EstimationDocument6 pagesTraffic Growth Rate Estimationmanu1357No ratings yet

- DMA Capital Africa Finance Series - Sovereign Wealth Funds Global Insight For African StatesDocument10 pagesDMA Capital Africa Finance Series - Sovereign Wealth Funds Global Insight For African StatesDMA Capital GroupNo ratings yet

- Sales-Competitive Advantage On PantaloonsDocument19 pagesSales-Competitive Advantage On PantaloonsPrameela BurugaNo ratings yet

- KijamiiDocument16 pagesKijamiiRawan AshrafNo ratings yet

- Management Information System: (Canara Bank)Document13 pagesManagement Information System: (Canara Bank)Kukki SengarNo ratings yet

- SIC 31 GuidanceDocument4 pagesSIC 31 GuidanceFrancisCzeasarChuaNo ratings yet

- Government of Karnataka's Chief Minister's Self-Employment Program DetailsDocument4 pagesGovernment of Karnataka's Chief Minister's Self-Employment Program DetailsHajaratali AGNo ratings yet

- Apple Production Facilities ShiftDocument2 pagesApple Production Facilities ShiftSamarth GargNo ratings yet

- The Phuket Beach CaseDocument4 pagesThe Phuket Beach Casepeilin tongNo ratings yet

- TDS On Real Estate IndustryDocument5 pagesTDS On Real Estate IndustryKirti SanghaviNo ratings yet

- Acounting For Business CombinationsDocument20 pagesAcounting For Business CombinationsMathew EstradaNo ratings yet

- DLP Fundamentals of Accounting 1 - Q3 - W3Document5 pagesDLP Fundamentals of Accounting 1 - Q3 - W3Daisy PaoNo ratings yet

- UPS, Inc. Strategy FormulationDocument16 pagesUPS, Inc. Strategy FormulationSusan Arrand100% (1)

- Short Iron Condor Spread - FidelityDocument8 pagesShort Iron Condor Spread - FidelityanalystbankNo ratings yet

- Business OrganisationsDocument3 pagesBusiness OrganisationsAnca PandeleaNo ratings yet

- Trade Discount and Trade Discount Series.Document31 pagesTrade Discount and Trade Discount Series.Anne BlanquezaNo ratings yet

- ACCA F5 Introduction To The PaperDocument4 pagesACCA F5 Introduction To The Paperalimran77No ratings yet

- Unit 2 Income From SalariesDocument21 pagesUnit 2 Income From SalariesShreya SilNo ratings yet

- Multiple Choice Questions: 44 Hilton, Managerial Accounting, Seventh EditionDocument36 pagesMultiple Choice Questions: 44 Hilton, Managerial Accounting, Seventh EditionKing MercadoNo ratings yet

- Risk and Return 2Document2 pagesRisk and Return 2Nitya BhakriNo ratings yet

- Inventory Management 21 PankajDocument34 pagesInventory Management 21 PankajPankaj Tadaskar TadaskarNo ratings yet

- CH IndiaPost - Final Project ReportDocument14 pagesCH IndiaPost - Final Project ReportKANIKA GORAYANo ratings yet

- Bsbfia401 2Document2 pagesBsbfia401 2nattyNo ratings yet

- SFA Exam Notice FAQ Apr 2019Document5 pagesSFA Exam Notice FAQ Apr 2019Lei JianxinNo ratings yet