Professional Documents

Culture Documents

Current Ratio Current Assets Current Liabilities

Uploaded by

Mamilla Babu0 ratings0% found this document useful (0 votes)

16 views4 pagesICICI Analysis

Original Title

Analysis

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentICICI Analysis

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views4 pagesCurrent Ratio Current Assets Current Liabilities

Uploaded by

Mamilla BabuICICI Analysis

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

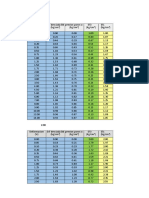

CURRENT RATIO

Current assets

Current Ratio =

Current liabilities

Calculate Current Ratio

PRIVATE LIFE INSURANCE

COMPANY 2012 2013 2014 2015 2016

AVIVA 0.73 1 0.64 0.6 0.7

BAJAJ ALLINZ 0.63 0.47 0.77 0.81 0.89

BHARTIAXA 0.84 0.84 1.04 0.79 0.93

BIRLA SUN LIFE 0.81 0.81 0.85 0.86 0.90

FUTURE GENARAL 0.78 1.06 1.21 1.39 1.43

HDFC STANDARD 1.06 0.62 0.8 0.85 1.07

ICICI PRUDENTIAL 0.57 0.37 0.41 0.53 0.67

IDBI FEDARAL 1.02 1 1.02 1.25 1.04

ING VSYA 0.97 0.83 0.97 1.8 1.17

KOTAK MAHINDRA 0.9 0.69 0.8 0.66 0.89

MAX LIFE 0.82 0.69 0.62 0.62 0.68

MET LIFE 0.72 0.53 0.62 0.77 0.88

RELIANCE 0.84 0.85 0.79 0.74 0.69

SAHARA 2.04 1.69 1.81 1.87 1.54

SBI LIFE 0.39 0.55 0.77 2.41 1.92

SRI RAM 0.93 0.66 1.05 1.44 1.23

TATA AIA 0.77 0.61 0.66 0.7 0.9

GROWTH RATE(%) 83.1

PUBLIC LIFE INSURANCE

LIC 2.48 2.25 3.72 3.08 2.82

GROWTH RATE 78.6

RETURN ON ASSETS RATIO

NET INCOME BEFORE TAXES

RETURN ON ASSETS RATIO=

TOTAL ASSETS

Calculate Return on Assets Ratio

PRIVATE LIFE INSURANCE

COMPANY 2012 2013 2014 2015 2016

AVIVA -1.84 -0.99 1.2 2.24 1.6

BAJAJ ALLINZ -1.00 0.78 1.09 1.12 1.34

BHARTIAXA -2043 -3.01 -2.3 -1.34 -2.46

BIRLA SUN LIFE -0.99 -0.57 0.39 0.50 0.69

FUTURE GENARAL -1.79 -2.86 -2.64 -0.79 -1.26

HDFC STANDARD -0.45 -0.30 -0.07 0.17 0.68

ICICI PRUDENTIAL -0.83 0.03 0.96 1.24 1.63

IDBI FEDARAL -0.82 -0.49 -0.57 -0.23 -0.59

ING VSYA -0.58 -0.54 -0.26 -0.10 -0.61

KOTAK MAHINDRA 0.05 0.27 0.27 0.63 0.94

MAX LIFE -0.49 -0.02 0.23 0.48 -0.56

MET LIFE 0.03 0.07 0.08 0.07 0.9

RELIANCE -1.73 -0.4 -0.26 0.74 0.93

SAHARA -0.40 0.72 0.44 0.30 0.56

SBI LIFE -0.05 0.26 0.22 0.16 0.33

SRI RAM 0.11 0.19 0.13 0.26 0.49

TATA AIA -1.01 -0.88 0.11 0.59 0.92

GROWTH RATE(%) 78.6

PUBLIC LIFE INSURANCE LIC 0.01 0.02 0.01 0.01 0.03

GROWTH RATE 0.00

SOLVENCY RATIO

AVAILABLE SOLVENCY MARGIN

SOLVENCY RATIO=

REQUIRED SOLVENCY MARGIN

Calculate Solvency Ratio

PRIVATE LIFE INSURANCE

COMPANY 2012 2013 2014 2015 2016

AVIVA 5.91 5.12 5.40 5.15 5.14

BAJAJ ALLINZ 2.62 2.68 3.66 5.15 4.61

BHARTIAXA 2.07 1.68 2.14 2.34 1.94

BIRLA SUN LIFE 2.44 2.11 2.89 2.99 2.56

FUTURE GENARAL 3.17 2.34 2.21 3.86 3.61

HDFC STANDARD 2.58 1.80 1.72 1.88 1.65

ICICI PRUDENTIAL 2.31 2.90 3.27 3.71 3.95

IDBI FEDARAL 6.11 4.05 6.60 6.61 6.15

ING VSYA 2.26 1.79 3.00 2.16 2.64

KOTAK MAHINDRA 2.69 2.79 2.67 3.06 3.92

MAX LIFE 3.04 3.22 3.65 5.34 5.34

MET LIFE 2.27 1.65 1.69 1.65 1.95

RELIANCE 2.5 1.86 1.66 3.53 2.53

SAHARA 3.6 4.50 4.82 5.28 5.37

SBI LIFE 2.92 2.17 2.04 5.34 3.25

SRI RAM 3.05 2.69 3.96 4.99 4.16

TATA AIA 2.51 2.11 2.16 2.84 2.17

GROWTH RATE(%) 97.2

2.8

PUBLIC LIFE INSURANCE LIC 2.51 2.11 2.16 4 2.61

GROWTH RATE 70.7

LEVERAGE RATIO

LEVARAGE RATIO=CAPITAL+ SURPLUS

Calculate Leverage Ratio

PRIVATE LIFE INSURANCE

COMPANY 2012 2013 2014 2015 2016

AVIVA 0.61 1.36 0.44 0.04 0.06

BAJAJ ALLINZ 0.60 1.01 0.36 0.50 0.54

BHARTIAXA 0.20 0.47 0.33 0.16 0.96

BIRLA SUN LIFE 1.06 2.78 1.29 0.44 2.46

FUTURE GENARAL 0.25 0.53 0.52 0.35 0.65

HDFC STANDARD 0.72 4.70 2.88 2.40 2.19

ICICI PRUDENTIAL 0.88 4.78 2.12 0.34 1.56

IDBI FEDARAL 0.65 1.36 1.07 0.63 0.64

ING VSYA 0.63 1.92 0.66 0.30 0.94

KOTAK MAHINDRA 0.31 0.38 0.41 0.46 0.43

MAX LIFE 0.98 3.19 1.56 1.12 1.26

MET LIFE 0.69 1.68 0.98 0.47 0.69

RELIANCE 0.85 2.45 1.32 0.10 1.29

SAHARA 0.18 0.26 0.18 0.21 0.62

SBI LIFE 4.02 8.65 6.83 3.26 5.64

SRI RAM 0.09 0.31 0.44 0.30 0.68

TATA AIA 0.41 0.33 0.34 0.40 0.46

GROWTH RATE(%) 85.7

PUBLIC LIFE INSURANCE LIC 320.66 320.39 364.83 304.95 354.6

GROWTH RATE 41.2

You might also like

- Debt FundsDocument38 pagesDebt FundsArmstrong CapitalNo ratings yet

- Global 11799Document1 pageGlobal 11799sunumNo ratings yet

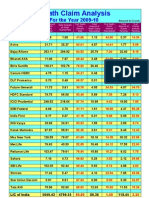

- Death Claim AnalysisDocument1 pageDeath Claim AnalysisLICkolkataNo ratings yet

- Portfolio July 2005Document10 pagesPortfolio July 2005api-3716002No ratings yet

- Debt FundsDocument36 pagesDebt FundsArmstrong CapitalNo ratings yet

- Banks Market Cap Weight Debt Equity D/EDocument2 pagesBanks Market Cap Weight Debt Equity D/Eakshay_kapNo ratings yet

- Frpa Project FileDocument12 pagesFrpa Project FileSivapathi NANo ratings yet

- 17.2. AP by Category (Jun 2023)Document1 page17.2. AP by Category (Jun 2023)susilo liloNo ratings yet

- All Equity Funds 06 Sep 2021 1201Document2 pagesAll Equity Funds 06 Sep 2021 1201AlexNo ratings yet

- Market 11 Aug 2014 3.30 PMDocument2 pagesMarket 11 Aug 2014 3.30 PMasifNo ratings yet

- Calculo Lipidico EpsaDocument1 pageCalculo Lipidico EpsaAlejandra EquiseNo ratings yet

- Assignment S1 2023 PDFDocument13 pagesAssignment S1 2023 PDFDuy Trung BuiNo ratings yet

- Balance Advantage Fund ComparisonDocument2 pagesBalance Advantage Fund ComparisonSmeet JasoliyaNo ratings yet

- Comfort FincapDocument10 pagesComfort FincapVinayakNo ratings yet

- India's Top Performing Mutual Funds TablesDocument3 pagesIndia's Top Performing Mutual Funds TablespbsoodNo ratings yet

- Report Generated by Graseed - Ai Test Id: R Date: R Test Variety: R Name: R Organization: R Email: R Comments: RDocument3 pagesReport Generated by Graseed - Ai Test Id: R Date: R Test Variety: R Name: R Organization: R Email: R Comments: RCarey JohnNo ratings yet

- Generación de Residuos Sólidos Domiciliarios y ComercialesDocument11 pagesGeneración de Residuos Sólidos Domiciliarios y ComercialesHildebrando Zambrano EspinozaNo ratings yet

- WWW - Bps.go - Id: Output Tabel DinamisDocument1 pageWWW - Bps.go - Id: Output Tabel DinamisKauKaban AL-akwanNo ratings yet

- Control de Ingreso: Anexo 01 Expediente Control de Ingreso RCA/SVT/AF/VDF/FP/2023-0056 DE FECHA 22/02/2023Document2 pagesControl de Ingreso: Anexo 01 Expediente Control de Ingreso RCA/SVT/AF/VDF/FP/2023-0056 DE FECHA 22/02/2023SENIAT VALLES DEL TUYNo ratings yet

- Financial Analysis 2 - ScribdDocument6 pagesFinancial Analysis 2 - ScribdSanjay KumarNo ratings yet

- Data Collectiion FormDocument4 pagesData Collectiion FormMARGARET WAKABANo ratings yet

- Tainwala ChemDocument10 pagesTainwala ChemGopalPatelNo ratings yet

- Polyethylene (PE) SDR-Pressure Rated Tube: Friction Loss CharacteristicsDocument24 pagesPolyethylene (PE) SDR-Pressure Rated Tube: Friction Loss CharacteristicsSaidFerdjallahNo ratings yet

- Registro TelarañaDocument9 pagesRegistro TelarañaMartin de Jesus Olamendi VergaraNo ratings yet

- Narayana Hrudayalaya RatiosDocument10 pagesNarayana Hrudayalaya RatiosMovie MasterNo ratings yet

- Year Site No Treatment Fertilizer Irrigation Fert&IrrigDocument1 pageYear Site No Treatment Fertilizer Irrigation Fert&Irrigmartin hamiltonNo ratings yet

- Polyethylene (PE) SDR-Pressure Rated Tube: Friction Loss CharacteristicsDocument24 pagesPolyethylene (PE) SDR-Pressure Rated Tube: Friction Loss CharacteristicsVismael SantosNo ratings yet

- International Fund ListDocument8 pagesInternational Fund ListArmstrong CapitalNo ratings yet

- Sugar Companies ListDocument3 pagesSugar Companies ListINSIGNIA LABS - DATANo ratings yet

- DATA SHEET Meth. 3Document41 pagesDATA SHEET Meth. 3meladbelal1234No ratings yet

- BHD Q-2 Floating Rate Calculation 01.07.2023 To 30.09.2023 NewDocument14 pagesBHD Q-2 Floating Rate Calculation 01.07.2023 To 30.09.2023 NewGopa MukhopadhyayNo ratings yet

- Ref PVC Schedule80 IPS PlasticPipeDocument1 pageRef PVC Schedule80 IPS PlasticPipesirajuddin khowajaNo ratings yet

- Starbucks Corp. Current Ratio Analysis 2017 vs 2016Document2 pagesStarbucks Corp. Current Ratio Analysis 2017 vs 2016TimNo ratings yet

- Padmavati Palace RA03Document11 pagesPadmavati Palace RA03Abhishek PandeyNo ratings yet

- Org Chart-SreekumaarDocument15 pagesOrg Chart-Sreekumaarapi-19728905No ratings yet

- Baza de Date GCDocument16 pagesBaza de Date GCAchim MihaiNo ratings yet

- Comparison of All Mutual Funds: Anish Vyas Roll No: 2Document12 pagesComparison of All Mutual Funds: Anish Vyas Roll No: 2Anish VyasNo ratings yet

- Contoh IKAAADocument57 pagesContoh IKAAABintang LestariNo ratings yet

- Solvency Ratio of Life InsurersDocument2 pagesSolvency Ratio of Life InsurersSundararajan SrinivasanNo ratings yet

- SBI Life Daily Reports and Contest Update As On 10th Jan'2023Document5 pagesSBI Life Daily Reports and Contest Update As On 10th Jan'2023Saurabh MaheshwariNo ratings yet

- Polyethylene (PE) SDR-Pressure Rated Tube: Frictional Head Loss ChartDocument1 pagePolyethylene (PE) SDR-Pressure Rated Tube: Frictional Head Loss CharthumphrangoNo ratings yet

- Common Stocks Across MF Schemes ReportDocument4 pagesCommon Stocks Across MF Schemes Reportbidar007No ratings yet

- Crank Gear Ratios and Percentages by TypeDocument1 pageCrank Gear Ratios and Percentages by Typebillythekid24No ratings yet

- Soil Deformation and Pressure ChangesDocument2 pagesSoil Deformation and Pressure ChangesfredyNo ratings yet

- India Market Update July 2019Document3 pagesIndia Market Update July 2019GNo ratings yet

- Trend yDocument2 pagesTrend yiwan dermawanNo ratings yet

- 010 - Rubber HoseDocument1 page010 - Rubber Hosehentai savemeNo ratings yet

- Market 8 Aug 2014 3.30 PMDocument2 pagesMarket 8 Aug 2014 3.30 PMasifNo ratings yet

- Perusahaan Tahun Roa - Y DPK - Z FDR - Z1 NPF - Z2Document3 pagesPerusahaan Tahun Roa - Y DPK - Z FDR - Z1 NPF - Z2Kapitayan JawiNo ratings yet

- Tabla de Perdidas de CargaDocument1 pageTabla de Perdidas de CargagnoquiNo ratings yet

- Data FaoziahDocument1 pageData FaoziahElisa ErlaniNo ratings yet

- Metodos de LicuacionDocument1 pageMetodos de LicuacionJesús MeraNo ratings yet

- Summer Project DataDocument22 pagesSummer Project Datayashaswisharma68No ratings yet

- Relacion Del Comité de Usuarios de Agua Ccochapata-Tupac Amaru-Canas Cód. de Parcela Areas (Ha)Document4 pagesRelacion Del Comité de Usuarios de Agua Ccochapata-Tupac Amaru-Canas Cód. de Parcela Areas (Ha)Mijail Candia ArmutoNo ratings yet

- No Desa/Kelurahan BB/TB Gizi Buruk Gizi Kurang Normal N % N % NDocument13 pagesNo Desa/Kelurahan BB/TB Gizi Buruk Gizi Kurang Normal N % N % NSyarifuddin 12No ratings yet

- Kimia Anorganik: Rekapitulasi Perbandingan Nilai Antar Waktu Data Hasil Pemantauan Kualitas Sungai Batang LembangDocument12 pagesKimia Anorganik: Rekapitulasi Perbandingan Nilai Antar Waktu Data Hasil Pemantauan Kualitas Sungai Batang LembangSusilawati SusiNo ratings yet

- Top Companies in India To Invest in StocksDocument4 pagesTop Companies in India To Invest in Stocksraju thakurNo ratings yet

- BetasDocument1 pageBetaslu acoriNo ratings yet

- Toshiba Fraud Case ExposedDocument23 pagesToshiba Fraud Case ExposedShashank Varma100% (1)

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)

- 2.trade To Territory, PPTDocument38 pages2.trade To Territory, PPTMamilla Babu100% (1)

- The Indian ConstitutionDocument15 pagesThe Indian ConstitutionMamilla BabuNo ratings yet

- Student Registration FormDocument1 pageStudent Registration FormMamilla BabuNo ratings yet

- VijayDocument6 pagesVijayMamilla BabuNo ratings yet

- 20160317110814!telugu SasanaluDocument110 pages20160317110814!telugu SasanaluMamilla BabuNo ratings yet

- Ratio AnalysisDocument46 pagesRatio AnalysisMamilla BabuNo ratings yet

- HR and MM ContentDocument1 pageHR and MM ContentMamilla BabuNo ratings yet

- VijayDocument6 pagesVijayMamilla BabuNo ratings yet

- Various HR LettersDocument9 pagesVarious HR LettersshivaachantiNo ratings yet

- SDLC Methodologies: Waterfall ModelDocument3 pagesSDLC Methodologies: Waterfall ModelMamilla BabuNo ratings yet

- Service Delivery ProcessDocument63 pagesService Delivery ProcessMamilla BabuNo ratings yet

- Project Profiles For MUDRADocument183 pagesProject Profiles For MUDRAManishGuptaNo ratings yet

- 76.fundamental Technical AnalysisDocument39 pages76.fundamental Technical AnalysisMamilla BabuNo ratings yet

- Waspas Paper Optest 2017Document9 pagesWaspas Paper Optest 2017Mamilla BabuNo ratings yet

- Distribution Agreement TemplateDocument27 pagesDistribution Agreement TemplateQiuyu ChenNo ratings yet

- Gap Close Tool 3 Emp SelectionDocument17 pagesGap Close Tool 3 Emp SelectionMamilla BabuNo ratings yet

- Acids and BasesDocument90 pagesAcids and BasesMamilla BabuNo ratings yet

- Pharmacy ActDocument6 pagesPharmacy ActMamilla BabuNo ratings yet

- Liquidity and ProfitabilityDocument63 pagesLiquidity and ProfitabilityMamilla Babu100% (1)

- Financial Performance Icici Life InsuranceDocument39 pagesFinancial Performance Icici Life InsuranceMamilla BabuNo ratings yet

- LasreDocument29 pagesLasreMamilla BabuNo ratings yet

- Economic Value AddedDocument34 pagesEconomic Value AddedMamilla BabuNo ratings yet

- Capital Structure and ProfitabilityDocument70 pagesCapital Structure and ProfitabilityMamilla BabuNo ratings yet

- Icici PrudentialDocument1 pageIcici PrudentialMamilla BabuNo ratings yet

- Sales and PromotionDocument61 pagesSales and PromotionMamilla BabuNo ratings yet

- Social Responsibilities of ManagementDocument3 pagesSocial Responsibilities of ManagementMamilla BabuNo ratings yet

- A Study On Employees Welfare Measures in Super Spinning MillsDocument4 pagesA Study On Employees Welfare Measures in Super Spinning MillsMamilla BabuNo ratings yet

- Pom PsdaDocument12 pagesPom PsdaShivani MalikNo ratings yet

- Sales and PromotionDocument61 pagesSales and PromotionMamilla BabuNo ratings yet

- Initial Outlay - Question 9Document4 pagesInitial Outlay - Question 9Hayati AhmadNo ratings yet

- Calm 20 - Test 2 Twenty-Something ProjectDocument3 pagesCalm 20 - Test 2 Twenty-Something Projectapi-350666556No ratings yet

- Mathematics Challenge Wiskunde-Uitdaging Umceli-Mngeni NgezibaloDocument7 pagesMathematics Challenge Wiskunde-Uitdaging Umceli-Mngeni NgezibaloJoseph VijuNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 759201740040819 Assessment Year: 2019-20Document6 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 759201740040819 Assessment Year: 2019-20mukesh singhNo ratings yet

- Study Note - 2Document1 pageStudy Note - 2s4sahithNo ratings yet

- Quotation Cum Proforma Invoice: Packaging and ForwardingDocument1 pageQuotation Cum Proforma Invoice: Packaging and ForwardingDHIRAJ ANAND SHINDENo ratings yet

- Payroll Activity SummaryDocument1 pagePayroll Activity SummaryChoo Li ZiNo ratings yet

- Payment of Bonus ActDocument8 pagesPayment of Bonus ActAndy Russell100% (1)

- My Payslip 31 MAR 23Document1 pageMy Payslip 31 MAR 23educatingmary226No ratings yet

- Reporting expenses under Clause 44 of Form 3CD Tax AuditDocument3 pagesReporting expenses under Clause 44 of Form 3CD Tax AuditOnil ShahNo ratings yet

- CPAR Tax On Estates and Trusts (Batch 90) - HandoutDocument10 pagesCPAR Tax On Estates and Trusts (Batch 90) - HandoutAljur SalamedaNo ratings yet

- F6 (VNM) - FXVN Ltd Foreign Exchange Gains and LossesDocument12 pagesF6 (VNM) - FXVN Ltd Foreign Exchange Gains and LossesHuyền NguyễnNo ratings yet

- ACCA P6 ATX UK All Technical ArticlesDocument47 pagesACCA P6 ATX UK All Technical ArticlesFahad HassanNo ratings yet

- VAT Concept MapDocument9 pagesVAT Concept MapMuadz HassanNo ratings yet

- Gran Turismo Mon 21 Aug 1815 TicketsDocument2 pagesGran Turismo Mon 21 Aug 1815 TicketsJohn John EstiponaNo ratings yet

- Module 33 Retained Earnings ProblemDocument1 pageModule 33 Retained Earnings ProblemThalia UyNo ratings yet

- Allegations Cancellation Notice For Aditya TelengDocument3 pagesAllegations Cancellation Notice For Aditya TelengAaditya TelangNo ratings yet

- Computation of Total Income Income From Salary (Chapter IV A) 260000Document1 pageComputation of Total Income Income From Salary (Chapter IV A) 260000jassi7nishadNo ratings yet

- Dayworks - January 2013Document2 pagesDayworks - January 2013swamydceNo ratings yet

- Ssm-Arry Urus SDN Bhd-Mar17Document6 pagesSsm-Arry Urus SDN Bhd-Mar17xidaNo ratings yet

- Philippines Excise Tax ReturnDocument2 pagesPhilippines Excise Tax ReturnCJ GranadaNo ratings yet

- Ta Claim Form NewDocument2 pagesTa Claim Form Newsumit kumarNo ratings yet

- Budget Booklet 2020 by Avinash GuptaDocument47 pagesBudget Booklet 2020 by Avinash GuptaSumit AnandNo ratings yet

- FINS5516 2019T1 Week10 Practice Questionv2 PDFDocument16 pagesFINS5516 2019T1 Week10 Practice Questionv2 PDFKelvin ChenNo ratings yet

- PhoneDocument2 pagesPhoneNandita HariharasudhanNo ratings yet

- Property Twins Cashflow Spreadsheet - v0.5Document7 pagesProperty Twins Cashflow Spreadsheet - v0.5Vivek HandaNo ratings yet

- Rocket Man Incorporated Provided The Following Financial Statement Information ForDocument1 pageRocket Man Incorporated Provided The Following Financial Statement Information ForTaimour HassanNo ratings yet

- How To Create Make Print Payroll Pay Check Payslip Stub w-2 w/2 w2 1099 Forms Self Employed CreditDocument7 pagesHow To Create Make Print Payroll Pay Check Payslip Stub w-2 w/2 w2 1099 Forms Self Employed Creditrealstubs50% (4)

- Quotation-Protection Relay Testing ServicesDocument2 pagesQuotation-Protection Relay Testing Servicesmep luckyoneNo ratings yet

- Why You Just Can't Withdraw A Bounce Back Loan From Company?Document2 pagesWhy You Just Can't Withdraw A Bounce Back Loan From Company?kainat fatimaNo ratings yet