Professional Documents

Culture Documents

Case Digest: Pimentel Vs Aguirre

Uploaded by

Maria Anna M LegaspiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Digest: Pimentel Vs Aguirre

Uploaded by

Maria Anna M LegaspiCopyright:

Available Formats

PIMENTEL vs.

AQUIRRE

G.R. No. 132988

19 JULY 2000

FACTS:

Subject of this action is Administrative Order No. 372 (AO 372) requires local government

units (LGU) to reduce their expenditures by 25% of their authorized regular appropriations

for non-personal services (Sec. 1); and allows the LGUs to withhold a portion of their

internal revenue allotments.

Petitioner filed to the SC a petition for certiorari and prohibition, contending that the

President, in issuing the said AO, was in effect exercising the power of control over LGUs;

& that the directive to withhold a portion of their IRA is in contravention of Sec. 286 of the

LGC & Sec. 6, Art. X of the Constitution.

ISSUE: Whether Secs. 1 & 4 of AO 372 are valid exercises of the Presidents power of

general supervision over LGUs.

HELD: Sec. 1 YES; Sec. 4 NO

RATIO:

The Court held that Sec. 1 of AO 372, being merely an advisory is well within the powers of

the President. It is not a mandatory imposition, and such directive cannot be characterized

as an exercise of the power of control.

Local fiscal autonomy does not rule out any manner of national government intervention

by way of supervision, in order to ensure that local programs, fiscal and otherwise, are

consistent with national goals. The AO is intended only to advise all government agencies

and instrumentalities to undertake cost-reduction measures that will help maintain

economic stability in the country. It does not contain any sanction in case of

noncompliance.

The Local Government Code also allows the President to interfere in local fiscal matters,

provided that certain requisites are met:

o (1) an unmanaged public sector deficit of the national government;

o (2) consultations with the presiding officers of the Senate and the House of

Representatives and the presidents of the various local leagues;

o (3) the corresponding recommendation of the secretaries of the Department of

Finance, Interior and Local Government, and Budget and Management; and

o (4) any adjustment in the allotment shall in no case be less than 30% of the

collection of national internal revenue taxes of the third fiscal year preceding the

current one.

However, Sec. 4 of AO 372 cannot be upheld. A basic feature of local fiscal autonomy is

the automatic release of the shares of LGUs in the national internal revenue. This is

mandated by the Constitution and the Local Government Code. Section 4 which orders

the withholding of a portion of the LGUs IRA clearly contravenes the Constitution and the

law.

You might also like

- Pimentel v. Aguirre, Et Al.Document2 pagesPimentel v. Aguirre, Et Al.Noreenesse Santos100% (1)

- Villafuerte V Robredo DigestDocument2 pagesVillafuerte V Robredo DigestJose Ramon Ampil50% (2)

- Province of Batangas Vs RomuloDocument2 pagesProvince of Batangas Vs RomuloCelinka Chun100% (3)

- Pimentel vs. Aguirre Case DigestDocument2 pagesPimentel vs. Aguirre Case DigestArlene Q. Samante100% (1)

- Province of Batangas vs. Romulo Case DigestDocument1 pageProvince of Batangas vs. Romulo Case DigestPaola Camilon0% (1)

- CD Acord vs. ZamoraDocument2 pagesCD Acord vs. ZamoraJane Sudario100% (2)

- Ganzon Vs CADocument3 pagesGanzon Vs CAKeilah Arguelles100% (1)

- Province of Batangas v. RomuloDocument4 pagesProvince of Batangas v. RomuloNoreenesse Santos100% (1)

- Cawaling Vs COMELEC DigestDocument2 pagesCawaling Vs COMELEC DigestHaroun Pandapatan67% (3)

- COA Oversteps Authority in Disallowing LGU Health BenefitsDocument1 pageCOA Oversteps Authority in Disallowing LGU Health BenefitsL-Shy Kïm50% (2)

- SC Rules Secretary Can Suspend Mayors Under Supervisory PowerDocument2 pagesSC Rules Secretary Can Suspend Mayors Under Supervisory PowerGeanelleRicanorEsperon100% (5)

- Digest of Drilon v. Lim (G.R. No. 112497)Document2 pagesDigest of Drilon v. Lim (G.R. No. 112497)Rafael Pangilinan71% (7)

- Digest of Limbona v. Mangelin (G.R. No. 80391)Document3 pagesDigest of Limbona v. Mangelin (G.R. No. 80391)Rafael Pangilinan80% (5)

- Joson V TorresDocument2 pagesJoson V TorresMaureen Co50% (2)

- SC Rules on Local Officials' SuspensionDocument4 pagesSC Rules on Local Officials' SuspensionNOLLIE CALISING100% (1)

- Dadole vs. COA, G.R. No. 125350Document4 pagesDadole vs. COA, G.R. No. 125350Roward100% (1)

- Samson v. AguirreDocument2 pagesSamson v. AguirreNoreenesse SantosNo ratings yet

- Disomangcop Vs DPWH SecretaryDocument2 pagesDisomangcop Vs DPWH SecretaryKhryz Callëja86% (7)

- Pimentel Vs Ochoa DigestedDocument2 pagesPimentel Vs Ochoa DigestedRonnie Garcia Del Rosario100% (1)

- Hebron V ReyesDocument3 pagesHebron V ReyesTippy Dos Santos100% (2)

- Miranda V AguirreDocument2 pagesMiranda V AguirreFidela Maglaya100% (1)

- Marmeto v. COMELECDocument2 pagesMarmeto v. COMELECLucila Mangrobang0% (3)

- 19 Comelec Vs Conrado CruzDocument1 page19 Comelec Vs Conrado Cruzmayton30100% (2)

- Whether or Not The Reduction of Validity by The Court of Appeal Assailed Law Provide Is Proper? - YESDocument9 pagesWhether or Not The Reduction of Validity by The Court of Appeal Assailed Law Provide Is Proper? - YESjeliena-malazarte100% (1)

- Miranda vs. Aguirre DigestDocument2 pagesMiranda vs. Aguirre DigestAlfred BryanNo ratings yet

- Alvarez V Guingona DigestDocument4 pagesAlvarez V Guingona DigestJamiah Hulipas67% (3)

- Drilon Vs LimDocument2 pagesDrilon Vs LimJay Ronwaldo Talan JuliaNo ratings yet

- President's Power of Supervision Over LGUsDocument9 pagesPresident's Power of Supervision Over LGUsLan100% (1)

- Disomangcop v. DatumanongDocument3 pagesDisomangcop v. DatumanongGRNo ratings yet

- Datu Kida Vs SenateDocument3 pagesDatu Kida Vs SenateChikoy Anonuevo100% (1)

- Tan Vs PerenaDocument2 pagesTan Vs PerenaPio Guieb AguilarNo ratings yet

- Atienza v. Villarosa DigestDocument6 pagesAtienza v. Villarosa DigesttinctNo ratings yet

- Acord Vs Zamora Case DigestDocument5 pagesAcord Vs Zamora Case DigestJohn SolivenNo ratings yet

- Cawaling V COMELEC Digest Issue Pertaining Only To The GR AssignedDocument2 pagesCawaling V COMELEC Digest Issue Pertaining Only To The GR AssignedJamiah HulipasNo ratings yet

- Sangguniang Barangay of Don Mariano Marcos vs. MartinezDocument2 pagesSangguniang Barangay of Don Mariano Marcos vs. MartinezJudiel Pareja100% (1)

- Samson v. AguirreDocument2 pagesSamson v. AguirreCristelle Elaine Collera100% (3)

- RTC and MTC Judges AllowancesDocument2 pagesRTC and MTC Judges AllowancesPatrick James Tan0% (1)

- Navarro V Ermita PubCorp DigestDocument1 pageNavarro V Ermita PubCorp DigestErika Bianca Paras100% (2)

- Rimando v. Naguilian Emission Testing Center, Inc.Document1 pageRimando v. Naguilian Emission Testing Center, Inc.GR100% (1)

- Republic Vs Bayao. GR No 179492. DigestDocument5 pagesRepublic Vs Bayao. GR No 179492. DigestBianca Fenix100% (3)

- Digest - G.R. No. L-23825 Pelaez Vs Auditor General (Separation of Powers, Non-Delegability of Legislative Power, Completeness and Sufficient Standard Test)Document2 pagesDigest - G.R. No. L-23825 Pelaez Vs Auditor General (Separation of Powers, Non-Delegability of Legislative Power, Completeness and Sufficient Standard Test)Mark100% (3)

- Mandanas vs. Ochoa DigestDocument6 pagesMandanas vs. Ochoa DigestJamiah Hulipas100% (8)

- Umali v. ComelecDocument2 pagesUmali v. ComelecOwdylyn Lee75% (4)

- Corona v. SenateDocument2 pagesCorona v. SenateAnonymous 5MiN6I78I0100% (2)

- Cordillera Broad Coalition V COADocument2 pagesCordillera Broad Coalition V COANikablin BalderasNo ratings yet

- Dadole Vs COADocument1 pageDadole Vs COAMak FranciscoNo ratings yet

- Andaya Vs RTCDocument2 pagesAndaya Vs RTCejusdem generisNo ratings yet

- Cawaling V COMELEC Digest With Issue NG Kambal CaseDocument4 pagesCawaling V COMELEC Digest With Issue NG Kambal CaseJamiah Hulipas100% (3)

- Digest - Aguinaldo vs. SantosDocument1 pageDigest - Aguinaldo vs. SantosPaul Vincent Cunanan100% (2)

- Drilon V LimDocument1 pageDrilon V LimRMSNo ratings yet

- San Juan V Civil Service CommissionDocument3 pagesSan Juan V Civil Service CommissionMarefel AnoraNo ratings yet

- 092 Hebron v. ReyesDocument4 pages092 Hebron v. ReyesIris Gallardo100% (1)

- DAR vs. Sarangani DigestDocument2 pagesDAR vs. Sarangani DigestHaroun Pandapatan100% (2)

- Municipality of Jimenez vs. Baz, Jr.Document2 pagesMunicipality of Jimenez vs. Baz, Jr.Elyn Apiado100% (1)

- President's Power of Supervision vs Control Over Liga ng Barangay ElectionsDocument2 pagesPresident's Power of Supervision vs Control Over Liga ng Barangay ElectionsJaja Gk100% (2)

- Pimentel vs. Aguirre Upholds Presidential Power of General SupervisionDocument1 pagePimentel vs. Aguirre Upholds Presidential Power of General SupervisionRalph VelosoNo ratings yet

- Pimentel vs. Aquirre ruling on presidential power over LGUsDocument1 pagePimentel vs. Aquirre ruling on presidential power over LGUsnicole coNo ratings yet

- Pimentel Vs AguirreDocument3 pagesPimentel Vs AguirreKR ReborosoNo ratings yet

- 257 Pimentel V AguirreDocument2 pages257 Pimentel V AguirreJai HoNo ratings yet

- Panaguiton Digest Pimentelvs AguirreDocument2 pagesPanaguiton Digest Pimentelvs AguirrecpanaguitonNo ratings yet

- 162 Agabon vs. NLRCDocument149 pages162 Agabon vs. NLRCMaria Anna M LegaspiNo ratings yet

- Danube Dam CaseDocument81 pagesDanube Dam CaseVince Llamazares LupangoNo ratings yet

- WPP MKTG vs. GaleraDocument2 pagesWPP MKTG vs. GaleraMaria Anna M Legaspi100% (2)

- FULL Olympia International Vs CADocument14 pagesFULL Olympia International Vs CAMaria Anna M LegaspiNo ratings yet

- FULL Cabrera vs. TianoDocument7 pagesFULL Cabrera vs. TianoMaria Anna M LegaspiNo ratings yet

- Ang Yu Asuncion Vs CADocument16 pagesAng Yu Asuncion Vs CAJorace Tena LampaNo ratings yet

- FULL Tambunting, Jr. vs. Sumabat PDFDocument8 pagesFULL Tambunting, Jr. vs. Sumabat PDFMaria Anna M LegaspiNo ratings yet

- FULL Permanent Savings vs. VelardeDocument17 pagesFULL Permanent Savings vs. VelardeMaria Anna M LegaspiNo ratings yet

- FULL Republic vs. BañezDocument30 pagesFULL Republic vs. BañezMaria Anna M LegaspiNo ratings yet

- FULL Ramos vs. CondezDocument7 pagesFULL Ramos vs. CondezMaria Anna M LegaspiNo ratings yet

- FULL Philippine National Bank vs. OseteDocument8 pagesFULL Philippine National Bank vs. OseteMaria Anna M LegaspiNo ratings yet

- FULL Ledesma vs. CADocument8 pagesFULL Ledesma vs. CAMaria Anna M LegaspiNo ratings yet

- CDSJL vs. ROSA-MERISDocument1 pageCDSJL vs. ROSA-MERISMaria Anna M Legaspi0% (1)

- FULL Banaga vs. MajaduconDocument17 pagesFULL Banaga vs. MajaduconMaria Anna M LegaspiNo ratings yet

- FULL Camarines Sur IV Electric Cooperative, Inc. vs. AquinoDocument18 pagesFULL Camarines Sur IV Electric Cooperative, Inc. vs. AquinoMaria Anna M LegaspiNo ratings yet

- CASE DIGEST: Caballes vs. DARDocument2 pagesCASE DIGEST: Caballes vs. DARMaria Anna M Legaspi100% (4)

- Antonio v. MoralesDocument7 pagesAntonio v. MoralesAnonymous P5vqjUdmLyNo ratings yet

- CASE DIGEST SIOL v. ASUNCIONDocument2 pagesCASE DIGEST SIOL v. ASUNCIONMaria Anna M LegaspiNo ratings yet

- CASE DIGEST: Villaviza Vs PanganibanDocument1 pageCASE DIGEST: Villaviza Vs PanganibanMaria Anna M Legaspi100% (2)

- CASE DIGEST Luna Vs AlladoDocument1 pageCASE DIGEST Luna Vs AlladoMaria Anna M LegaspiNo ratings yet

- CASE DIGEST: Land Bank of The Philippines vs. BanalDocument2 pagesCASE DIGEST: Land Bank of The Philippines vs. BanalMaria Anna M LegaspiNo ratings yet

- Court Rules Lack of Correct Docket Fee Deprives Court of JurisdictionDocument1 pageCourt Rules Lack of Correct Docket Fee Deprives Court of JurisdictionMaria Anna M LegaspiNo ratings yet

- Case Digest - People vs. BaykerDocument1 pageCase Digest - People vs. BaykerMaria Anna M Legaspi100% (2)

- CASE DIGEST: Caballes vs. DARDocument2 pagesCASE DIGEST: Caballes vs. DARMaria Anna M Legaspi100% (4)

- Rules of Procedure For IP Rights CasesDocument20 pagesRules of Procedure For IP Rights CasesJay GarciaNo ratings yet

- Coca-Cola Liable for Illegal Dismissal of Route Helpers Despite Manpower AgenciesDocument2 pagesCoca-Cola Liable for Illegal Dismissal of Route Helpers Despite Manpower AgenciesMaria Anna M Legaspi100% (1)

- Case Digest: Yrasuegui Vs PalDocument1 pageCase Digest: Yrasuegui Vs PalMaria Anna M LegaspiNo ratings yet

- Case Digest: Assoc of Small Landowners vs. Sec. of Agrarian ReformDocument2 pagesCase Digest: Assoc of Small Landowners vs. Sec. of Agrarian ReformMaria Anna M Legaspi100% (3)

- 3rd Year - Agrarian Reform Syllabus 1st Sem 2017Document10 pages3rd Year - Agrarian Reform Syllabus 1st Sem 2017Maria Anna M LegaspiNo ratings yet

- Full Case - Peñaranda vs. Baganga Plywood CorporationDocument16 pagesFull Case - Peñaranda vs. Baganga Plywood CorporationMaria Anna M LegaspiNo ratings yet

- Part II - Audit Observations and RecommendationsDocument32 pagesPart II - Audit Observations and Recommendationssandra bolokNo ratings yet

- Reynaldo R. San Juan Vs CSC, DBM, Cecilia Almajose GR No. 92299, April 19, 1991Document3 pagesReynaldo R. San Juan Vs CSC, DBM, Cecilia Almajose GR No. 92299, April 19, 1991Joan PabloNo ratings yet

- Invitation Letter LYDCDocument12 pagesInvitation Letter LYDCRoi Constantine PontillasNo ratings yet

- Alvarez v. Guingona ruling on city statusDocument8 pagesAlvarez v. Guingona ruling on city statusJose IbarraNo ratings yet

- Establishment of Local Government in MalaysiaDocument8 pagesEstablishment of Local Government in MalaysiaIrsyad KhirNo ratings yet

- Municipality of Jimenez vs. BazDocument6 pagesMunicipality of Jimenez vs. BazAr Yan SebNo ratings yet

- Dad, Kab, Mag SK ResolutionDocument2 pagesDad, Kab, Mag SK ResolutionD M100% (1)

- Building Third Sector Capacity-Encouraging Surer Funding and Asset TransferDocument25 pagesBuilding Third Sector Capacity-Encouraging Surer Funding and Asset TransferImprovingSupportNo ratings yet

- GP Results 1995 517 PDFDocument235 pagesGP Results 1995 517 PDFPrakash RajNo ratings yet

- Class Observation Politics & GovernanceDocument3 pagesClass Observation Politics & GovernanceMichael CatalanNo ratings yet

- RA 10742 SK Reform ActDocument13 pagesRA 10742 SK Reform Actmemvi_7467% (3)

- Philippines Housing LawsDocument2 pagesPhilippines Housing LawsMykel King NobleNo ratings yet

- Integrating Civil Service Reform With Decentralisation: A Case StudyDocument20 pagesIntegrating Civil Service Reform With Decentralisation: A Case StudyShoaib MuneerNo ratings yet

- COMELEC upholds "ghost precinctDocument6 pagesCOMELEC upholds "ghost precinctMariaAyraCelinaBatacanNo ratings yet

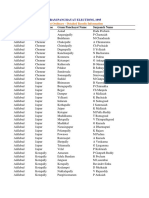

- Certified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsDocument3 pagesCertified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsSunStar Philippine NewsNo ratings yet

- Oriental Mindoro - MunDocument30 pagesOriental Mindoro - MunireneNo ratings yet

- Philippines Performance Measurement at The Local Level: Final ReportDocument189 pagesPhilippines Performance Measurement at The Local Level: Final ReportMudz LaubanNo ratings yet

- Guide to position classification, compensation and allowances in the Philippine governmentDocument14 pagesGuide to position classification, compensation and allowances in the Philippine governmentedwin6656No ratings yet

- Fourth Monthly Test Philippine Politics and Good Governance: Department of EducationDocument5 pagesFourth Monthly Test Philippine Politics and Good Governance: Department of EducationAdora AlvarezNo ratings yet

- Powers and Attributes of LGUs Based on Key SC RulingsDocument10 pagesPowers and Attributes of LGUs Based on Key SC RulingsspecialsectionNo ratings yet

- Handled by Atty. Elman Is Not Intended To Replace Your Books and Major References. God BlessDocument10 pagesHandled by Atty. Elman Is Not Intended To Replace Your Books and Major References. God BlessCharlotte GallegoNo ratings yet

- Federalism Text NotesDocument7 pagesFederalism Text NotesChandni JeswaniNo ratings yet

- SK Resolution 2023Document4 pagesSK Resolution 2023kabataansulong2023No ratings yet

- DLL Politics and GovernanceDocument25 pagesDLL Politics and GovernanceAding Sam75% (4)

- EstoniaDocument17 pagesEstoniaVasile Melnic100% (1)

- Localgovernmentads505 130123130757 Phpapp02Document7 pagesLocalgovernmentads505 130123130757 Phpapp02Salmah SolihinNo ratings yet

- PNP designates finance officersDocument31 pagesPNP designates finance officersSouthern Police50% (2)

- Tanzania - Feasibility Studies and Detailed Design of The Multinational Arusha-Holili - Taveta-Voi Road - RAP SummaryDocument103 pagesTanzania - Feasibility Studies and Detailed Design of The Multinational Arusha-Holili - Taveta-Voi Road - RAP SummaryKarim NazefNo ratings yet

- Case 1 Basco Vs PagcorDocument2 pagesCase 1 Basco Vs PagcorJairus Adrian VilbarNo ratings yet

- सुधारित यादी - नोडल अधिकारी - जल युक्त शिवार अभियानDocument30 pagesसुधारित यादी - नोडल अधिकारी - जल युक्त शिवार अभियानJoint Chief Officer, MB MHADANo ratings yet