Professional Documents

Culture Documents

Decision Making

Uploaded by

AashikkhanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Decision Making

Uploaded by

AashikkhanCopyright:

Available Formats

DECISION MAKING

OVERVIEW

Objective

To identify relevant costs and appropriate techniques for decision-making

and use them in various decision-making situations.

DECISION The decision-making cycle

MAKING Information requirements

Short run

Long run

RELEVANT CVP INVESTMENT

COSTS ANALYSIS APPRAISAL

Definition Contribution Techniques

Complications Breakeven chart ARR

P/V graph Payback

Calculations NPV

Assumptions IRR

SHORT RUN Multi-product Conclusion

DECISIONS

Discontinuance

Limiting factor

Further processing

Make or buy

Accept or reject

In identifying decision-making as a major topic the Examiner has specifically referred

to:

relevant cost analysis

limiting factors

DCF

allowing for uncertainty.

Accountancy Tuition Centre (Overseas Courses) Ltd 2002 0701

DECISION MAKING

1 DECISION MAKING

1.1 The decision making cycle

Identify objectives

Identify alternative

courses of action

Obtain information

about alternatives

Post Implementation

review/audit

Select one of the

alternatives

Implement the

decision

Compare actual

results

Accountancy Tuition Centre (Overseas Courses) Ltd 2002 0702

DECISION MAKING

1.2 Information requirements

Data requirements

Qualitative Quantitative

Effect on employees

Opinions of customers

Impact on local area eg Monetary Non-monetary

pollution

Political and economic factors

Costs Resources

eg possible change in tax rates

Revenues required

Possible reaction of

impact on

competitors

market share

A decision should not be made without careful consideration of qualitative factors.

1.3 Short-run decision making

Short term decision making assumes that decisions previously made concerning fixed

plant and equipment cannot be altered.

Such decisions should therefore make best use of existing resources. Relevant costs

must be considered.

1.4 Long-run decision making

In the long term new investment in plant and equipment may be considered.

Looking further into the future requires consideration of the time value of money.

Discounted cashflow techniques are therefore important for long-run decisions.

2 RELEVANT COSTS FOR DECISION MAKING

2.1 Definition

Relevant costs (and revenues) are those pertinent to a particular decision-making

situation.

They are:

future

avoidable

incremental

cash flows.

They many also be opportunity costs.

Accountancy Tuition Centre (Overseas Courses) Ltd 2002 0703

DECISION MAKING

Non-relevant costs include

sunk costs

committed costs

non-cashflows

allocated

apportioned

Overheads

absorbed

recharged

2.2 Complications

2.2.1 Materials

Materials needed

for project

In stock Not in stock

No alternative Alternative use Use current purchase

use price

Use scrap value Scarce Not scarce

Use material cost plus Use replacement

lost contribution from cost

alternative (opportunity

cost)

Accountancy Tuition Centre (Overseas Courses) Ltd 2002 0704

DECISION MAKING

2.2.2 Labour

Labour needed

for project

Already employed Hire new workers

No alternative Alternative work Use current wage

work rate

Saved redundancy No spare capacity Spare capacity

costs

Labour cost plus lost Any incremental wages

contribution eg overtime premium

3 SHORT-RUN DECISIONS

Discontinuance Limiting

(shutdown) factor

Decisions

Further processing Make or buy

Accept or reject an order

Accountancy Tuition Centre (Overseas Courses) Ltd 2002 0705

DECISION MAKING

3.1 Discontinuance decisions

That is, whether to eliminate (shutdown) part of the business.

3.1.1 Decision criteria

Compare loss in revenue to savings in avoidable costs.

3.1.2 Qualitative factors

Adverse publicity regarding redundancies.

Possible adverse reaction by investors – share price might fall.

Effect on morale in remaining segments of the business.

Lost synergy eg shared skills between divisions.

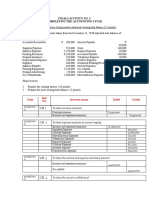

Example 1

Decentro Ltd is a divisionalised company. Divisional results are as follows.

Division Division Division

X Y Z

£ £ £

Sales 50,000 30,000 40,000

Variable costs (30,000) (18,000) (20,000)

Specific fixed costs (12,000) (10,000) (10,000)

Apportioned head-office costs (5,000) (4,000) (5,000)

–––––– –––––– ––––––

Profit/(loss) 3,000 (2,000) 5,000

–––––– –––––– ––––––

Required:

Determine whether or not Division Y should be closed.

Solution

Division Y

£

Sales

Variable costs

––––––

Gross contribution

Specific fixed costs

––––––

Contribution towards head office costs

––––––

It would appear that division Y should

Accountancy Tuition Centre (Overseas Courses) Ltd 2002 0706

DECISION MAKING

3.2 Limiting factor decision

A factor other than sales limits the level of activity at which the company can

operate.

3.2.1 Decision criteria

Maximise the contribution earned per unit of limiting factor.

Example 2

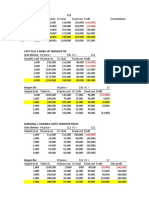

A company produces two products with the following cost and revenue data per unit.

A B

£ £

Selling price 20 10

Variable cost 8 6

Fixed cost 4 3

Budgeted units 2,000 3,000

There are only 7,000 machine hours available to produce both A and B. A requires 4

hours per unit and B requires 1 hour per unit.

Required:

Calculate the profit maximising product mix.

Solution

A B

£ £

SP/unit

Less VC/unit

–— –—

Contribution/unit

Hours/unit

–— –—

Contribution/Unit of limiting factor

–— –—

Ranking

Utilisation: Hours available Production plan

–—–— –—–—

–—–— –—–—

Accountancy Tuition Centre (Overseas Courses) Ltd 2002 0707

DECISION MAKING

Example 3

Required:

As per Example 2 but we are able to sub-contract the products for an additional

variable cost of £1 per unit for A and £0.50 per unit for B.

Solution

A B

£ £

Contribution foregone/unit purchased (increase in VC/unit)

Hours/unit

–— –—

Contribution forgone/unit of limiting factor

–— –—

Ranking for production

Production and sales plan

Hours available Production and sales plan

–—–—

–—–—

3.3 Further processing decision

Whether to sell at an intermediate point or to further process and sell at an enhanced

value.

3.3.1 Decision criteria

We compare incremental revenues of further processing with the incremental costs of

further processing.

Accountancy Tuition Centre (Overseas Courses) Ltd 2002 0708

DECISION MAKING

Example 4

Selling prices Conversion costs Conversion costs

(variable) (fixed)

C : £5/unit C → F £6/unit

D : £7/unit D → G £6/unit £10,000

E : £8/unit E → H £6/unit

F : £10/unit

G : £14/unit

H : £22/unit

Refining operation

F

C

Input Joint G

D

process

H

E

Budgeted units/demand

C/F 4,000

D/G 2,000

E/H 1,000

Required:

Determine which products should be further processed.

Solution

C/F D/G E/H Total

Incremental £ £ £ £

costs/revenues

Revenue/unit

Less VC/unit

–— –—– –—

Contribution/unit

–—

Budgeted units

–—–— –—–— –—–—

Total contribution

Less Fixed cost

–—–—

Change in profit

––––––

Conclusion:

Accountancy Tuition Centre (Overseas Courses) Ltd 2002 0709

DECISION MAKING

3.4 Make or buy decision

Whether to make a product in house or to purchase that product from an outside

supplier.

3.4.1 Decision criteria

Compare the marginal cost of making with the purchase cost of buying in.

Example 5

Product K is currently produced in house a £15/unit of which £6/kg is fixed. The cost

of purchasing this product from a contractor is £10/unit.

Required:

Determine whether the product should be made in-house.

Solution

Product K

£

Marginal cost of making

Marginal cost of buying in (purchase price)

–—–—

Decision

–—–—

3.5 Accept or reject an order

3.5.1 Decision criteria

Are the relevant costs of the decision less or greater than the suggested revenue? An

application of relevant cost analysis.

Example 6

A material P in stock, which is used on the product to be produced is already used as a

substitute for another material Q in common usage. Material Q can be purchased for

£4.00/kg and conversion costs required to P are £2.00/kg. Alternatively P could be

sold for scrap at £1.50/kg.

Required:

Determine the relevant cost of the 3 kg of P required for the product.

Accountancy Tuition Centre (Overseas Courses) Ltd 2002 0710

DECISION MAKING

Solution

Decision Analysis Revenue/unit

£

Either sell for scrap

Or substitute for material Q

–—–—

Choose to substitute as the next best alternative.

Relevant cost of 3 kg of material P

–—–—

Example 7

Skilled labour needed to fulfil the order would be specially recruited for £50,000.

Unskilled labour would be transferred from another department where it is paid

£30,000. Half is currently idle. The other half generates a contribution of £5,000.

Required:

Calculate the relevant labour cost of the order.

Solution

£

Skilled labour

Unskilled

Idle workers – no incremental cost

Working – labour cost + opportunity cost

––––––

Relevant cost

––––––

4 COST VOLUME PROFIT ANALYSIS (CVP)

4.1 Contribution

£

Revenue X

Variable production costs (X)

Variable non-production costs (X)

–––

Contribution X

–––

Accountancy Tuition Centre (Overseas Courses) Ltd 2002 0711

DECISION MAKING

4.2 Breakeven charts

Breakeven point occurs where: Total contribution = Total fixed costs.

£

Total

revenue

Total

costs

Fixed costs

Units

Breakeven

point

OR

£

Total

revenue

Total

costs

Total variable

costs

Units

Breakeven

point

Accountancy Tuition Centre (Overseas Courses) Ltd 2002 0712

DECISION MAKING

4.3 Profit/volume graphs

Profit

£

Total

profit

0 Units or revenue

–

Breakeven point

Fixed

costs

4.4 Calculations

Contribution per unit = Unit selling price – Unit variable costs

Profit = (Sales volume × Contribution per unit) – Fixed costs

Fixed costs

Breakeven sales volume =

Contribution per unit

Margin of safety = Actual or budgeted sales – Breakeven sales

Fixed costs + Target profit

Sales volume to achieve a target profit =

Contribution per unit

Contribution per unit

C/S ratio =

Selling price per unit

Fixed costs

Breakeven sales revenue =

C/S ratio

4.5 Assumptions

All costs can be split into fixed and variable.

Fixed costs are constant.

Variable cost per unit is constant.

Selling price per unit is constant.

Stock levels are constant (ie sales = production).

CVP analysis is therefore only useful within a limited range of activity.

Accountancy Tuition Centre (Overseas Courses) Ltd 2002 0713

DECISION MAKING

4.6 Multi-product

4.6.1 Assumption

CVP analysis can be extended to multi-product situations if a predetermined

sales mix is held to be constant.

4.6.2 Calculation

Calculate a weighted average contribution per unit to depict average

revenues and average costs for the given sales mix.

Use breakeven formulae as for single product analysis.

Number of units calculated will be in total therefore split in mix ratio to state

in terms of individual products.

Accountancy Tuition Centre (Overseas Courses) Ltd 2002 0714

DECISION MAKING

5 INVESTMENT APPRAISAL

5.1 Techniques

The methods learnt in Paper 3 and Paper 8 are also examinable in Paper 9.

Accounting rate of return (ARR) .

Payback period

Net present value (NPV)

Internal rate of return (IRR) .

5.2 Accounting rate of return

Average annual net profit

× 100

Initial investment

OR Average annual net profit

× 100

Average investment

Cost + scrap

Where average investment =

2

5.2.1 Advantages 5.2.2 Disadvantages

Easily calculated. Arbitrary target ARR.

Easily understood %. Ignores time value of money.

Similar to ROCE used by analysts Profits are subjective.

for company appraisal.

A % measure – does not show the

absolute gain to shareholders.

Use of ARR will not lead to investment decisions which maximise shareholder wealth.

5.3 Payback period

The time it takes for the cash inflows from a project to equal the cash outflows.

5.3.1 Advantages 5.3.2 Disadvantages

Easily calculated. Ignores cashflows after the payback

Easily understood. period.

Uses objective cashflows.

Maximises liquidity. Ignores time value of money.

Favours low risk projects.

Ignores project profitability.

Arbitrary target payback period.

Use of payback will not lead to maximisation of shareholder wealth.

Accountancy Tuition Centre (Overseas Courses) Ltd 2002 0715

DECISION MAKING

5.4 NPV

The present value of cash inflows less the present value of cash outflows.

5.4.1 Advantages 5.4.2 Disadvantages

Takes into account the time value Difficult to calculate.

of money.

Difficult to explain to non-

Uses objective cashflows. accountants.

An absolute measure of gain to

shareholders.

NPV shows the increase in shareholder wealth from undertaking a project.

Use of NPV will lead to maximisation of shareholder wealth.

5.5 IRR

The discount rate at which NPV = 0.

5.5.1 Advantages 5.5.2 Disadvantages

Takes into account the time value Difficult to calculate.

of money.

Some projects have multiple IRR’s.

Uses objective cashflows.

a % measure – does not show the

Easily understood %. absolute gain to shareholders.

Not reliable where projects are

mutually exclusive.

Use of IRR will not lead to investment decisions which maximise shareholder wealth.

5.6 Conclusion

NPV is the only reliable method of project appraisal.

It is superior to ARR, payback and IRR.

It is also superior to ROI and RI used by divisional managers for project appraisal.

Accountancy Tuition Centre (Overseas Courses) Ltd 2002 0716

DECISION MAKING

FOCUS

You should now be able to

discuss the decision making process and the information needed for decision

making

deal with various short-run decisions, identifying the relevant costs in each

scenario

use and discuss CVP analysis and investment appraisal methods .

Accountancy Tuition Centre (Overseas Courses) Ltd 2002 0717

DECISION MAKING

EXAMPLE SOLUTIONS

Solution 1 – Discontinuance

Division Y

£

Sales 30,000

Variable costs (18,000)

––––––

Gross contribution 12,000

Specific fixed costs (10,000)

––––––

Contribution towards head office costs 2,000

––––––

It would appear that division Y should remain open as it makes a positive contribution

towards head office costs.

This assumes that total head office costs will remain the same if division Y closes ie

they are unavoidable.

Solution 2 – Limiting factor

A B

£ £

SP/unit 20 10

Less VC/unit 8 6

–— –—

Contribution/unit 12 4

Hours/unit 4 1

–— –—

Contribution/Unit of limiting factor 3 4

–— –—

Ranking 2 1

Utilisation: Hours available Production plan

7,000 Product B

(3,000) @ 1 hr/unit 3,000 units

–—–— –—–—

4,000 Product A

(4,000) @ 4 hrs/unit 1,000 units

–—–— –—–—

Accountancy Tuition Centre (Overseas Courses) Ltd 2002 0718

DECISION MAKING

Solution 3 – Purchase alternative

A B

£ £

Contribution foregone/unit purchased (increase in VC/unit) 1.00 0.50

Hours/unit 4 1

–— –—

Contribution forgone/unit of limiting factor 0.25 0.50

–— –—

Ranking for production 2 1

Production and sales plan

Hours available Production and sales plan

7,000

Product B produced

(3,000) @ 1 hr/unit = 3,000 units

–—–—

(4,000) @ 4 hrs/unit Product A produced

–—–— = 1,000 units

Product A bought in (remainder)

1,000 units

Solution 4 – Further processing

C/F D/G E/H Total

Incremental £ £ £ £

costs/revenues

Revenue/unit 5 7 14

Less VC/unit (6) (6) (6)

–— –—– –—

Contribution/unit (1) 1 8

–—

Budgeted units Do not 2,000 1,000

further process –—–— –—–— –—–—

Total contribution 2,000 8,000 10,000

Less Fixed cost (10,000)

–—–—

0

––––––

Using quantitative data only the decision appears marginal.

Accountancy Tuition Centre (Overseas Courses) Ltd 2002 0719

DECISION MAKING

Solution 5 – Make or buy

Product K

£

Marginal cost of making (15 – 6) 9

Marginal cost of buying in (purchase price) 10

–—–—

Decision Make

–—–—

Solution 6 – Relevant cost analysis

Decision Analysis Revenue/unit

£

Either sell for scrap 1.50

Or substitute for material Q (4 – 2) = 2.00

–—–—

Choose to substitute as the next best alternative.

Relevant cost of 3 kg of material P = 3 × 2 = £6.00

–—–—

Solution 7 – Relevant labour cost

£

Skilled labour 50,000

Unskilled

Idle workers – no incremental cost Nil

Working – labour cost + opportunity cost (15,000 + 5,000) 20,000

––––––

Relevant cost 70,000

––––––

Accountancy Tuition Centre (Overseas Courses) Ltd 2002 0720

You might also like

- Lesson 3.A: Cultural Dimensions and Dilemmas (CH 5)Document38 pagesLesson 3.A: Cultural Dimensions and Dilemmas (CH 5)Leon WuNo ratings yet

- Organisation ChangeDocument15 pagesOrganisation ChangeAssignmentLab.com100% (1)

- Chapter 5 Foundations of PlanningDocument31 pagesChapter 5 Foundations of PlanningNiz Ismail0% (1)

- Managers As Decision MakersDocument20 pagesManagers As Decision MakersAdnan WalidadNo ratings yet

- Questionnaire & Form DesignDocument41 pagesQuestionnaire & Form DesignAjithreddy BasireddyNo ratings yet

- Models of Decision MakingDocument19 pagesModels of Decision MakingRohit DhawareNo ratings yet

- Monetary Policy and Monetary Policy InstrumentsDocument106 pagesMonetary Policy and Monetary Policy Instrumentsjhsobrun100% (1)

- Decision Making: Mrugaja AurangabadkarDocument17 pagesDecision Making: Mrugaja AurangabadkarMrugaja Gokhale AurangabadkarNo ratings yet

- Introduction To Manegerial EconomicsDocument13 pagesIntroduction To Manegerial Economicsarv2326No ratings yet

- Chapter 2 - Thinking Like An EconomistDocument3 pagesChapter 2 - Thinking Like An EconomistMaura AdeliaNo ratings yet

- 2.1 The Decision-Making Process: Figure 2.1: Steps in Decision Making and Problem SolvingDocument6 pages2.1 The Decision-Making Process: Figure 2.1: Steps in Decision Making and Problem SolvingDaniel Wong S. K.No ratings yet

- Management Basics PDFDocument14 pagesManagement Basics PDFanissaNo ratings yet

- Nature of The Factors Which Influence The Dividend Policy of A FirmDocument2 pagesNature of The Factors Which Influence The Dividend Policy of A FirmAbu Aalif Rayyan100% (2)

- Diminishing MusharakahDocument19 pagesDiminishing MusharakahKhalid WaheedNo ratings yet

- Lesson 10.A: Culture and International Marketing Management (CH 11)Document22 pagesLesson 10.A: Culture and International Marketing Management (CH 11)Leon WuNo ratings yet

- Case Example of The Creative Problem Solving Process Great Northern Bus CompanyDocument10 pagesCase Example of The Creative Problem Solving Process Great Northern Bus Companyraum123No ratings yet

- Case STUDY O.BDocument7 pagesCase STUDY O.BLucas0% (2)

- Theory X and Theory YDocument7 pagesTheory X and Theory YdanballaisNo ratings yet

- Environmental Appraisal: 2 Year MBA Group 3Document37 pagesEnvironmental Appraisal: 2 Year MBA Group 3Megha ThackerNo ratings yet

- Operating LeverageDocument2 pagesOperating LeveragePankaj2cNo ratings yet

- NPV CalculationDocument7 pagesNPV CalculationnasirulNo ratings yet

- Unit1 RM An IntroductionDocument21 pagesUnit1 RM An IntroductionRajendra ChaudharyNo ratings yet

- Strategic ManagementDocument9 pagesStrategic ManagementRubayet AbedinNo ratings yet

- Negotiating With International Customers, Partners and RegulatorsDocument29 pagesNegotiating With International Customers, Partners and RegulatorsPratik AgarwalNo ratings yet

- Priman StandardDocument29 pagesPriman StandardBonCedrickDorojaNo ratings yet

- Leadership in Turbulent TimesDocument6 pagesLeadership in Turbulent TimesSuresh DewanganNo ratings yet

- Economic Growth.f01Document16 pagesEconomic Growth.f01Dina ErtoleuNo ratings yet

- International Environment and Management Lecture 1Document32 pagesInternational Environment and Management Lecture 1Anant MauryaNo ratings yet

- Export financing and documentation overviewDocument9 pagesExport financing and documentation overviewKhushi KaulNo ratings yet

- Decision Making ModelsDocument10 pagesDecision Making ModelsSaurabh G100% (3)

- FlextimeDocument3 pagesFlextimerashid rahmanzadaNo ratings yet

- Business Economics AssignmentDocument7 pagesBusiness Economics AssignmentDEAN JASPERNo ratings yet

- BECSRDocument35 pagesBECSRProf. Bhaktabandhu Dash100% (1)

- Transformationa L Leaders: Jeffrey Perez Dba StudentDocument29 pagesTransformationa L Leaders: Jeffrey Perez Dba StudentFlorante De LeonNo ratings yet

- Business Strategy AssignmentDocument11 pagesBusiness Strategy AssignmentAssignment Helper0% (1)

- CCM Culture Change in Organizations Chap10Document21 pagesCCM Culture Change in Organizations Chap10Anastasia GeorginaNo ratings yet

- Chapter 16 Integrated Marketing Communications and International AdvertisingDocument15 pagesChapter 16 Integrated Marketing Communications and International AdvertisingTakeshi KetchumNo ratings yet

- Organisational Behaviour AssignmentDocument9 pagesOrganisational Behaviour AssignmentSabrish100% (1)

- Decision Making Process and StylesDocument54 pagesDecision Making Process and StylesJelan Alano100% (1)

- Introduction To Business - Session 1Document39 pagesIntroduction To Business - Session 1kid.hahn100% (1)

- International Business CGB - ModifiedDocument2 pagesInternational Business CGB - ModifiedAdugna GirmaNo ratings yet

- OB ExamDocument5 pagesOB ExamtarunNo ratings yet

- Quality Management SchemesDocument33 pagesQuality Management SchemesPrasanga PriyankaranNo ratings yet

- Strategic Management Mcom 4TH Sem PDFDocument14 pagesStrategic Management Mcom 4TH Sem PDFrrNo ratings yet

- Money and BankingDocument68 pagesMoney and BankingdivyaNo ratings yet

- Mastersheet MGMT 625Document158 pagesMastersheet MGMT 625Adee KhanNo ratings yet

- Theories of DevelopmentDocument35 pagesTheories of DevelopmentD Attitude Kid94% (18)

- Derivatives Summary Part 1Document2 pagesDerivatives Summary Part 1Katia IbrahimNo ratings yet

- International Business,: Governmental and Legal SystemsDocument30 pagesInternational Business,: Governmental and Legal SystemsHeba SamiNo ratings yet

- Project ManagementDocument14 pagesProject ManagementRay KiarieNo ratings yet

- Ethical Issues in Budget PreparationDocument26 pagesEthical Issues in Budget PreparationJoseph SimonNo ratings yet

- Principles of Management: Module 1: Introduction To ManagementDocument32 pagesPrinciples of Management: Module 1: Introduction To Managementnaman khan satnaNo ratings yet

- Case Analysis: Solving Business ProblemsDocument46 pagesCase Analysis: Solving Business ProblemsPatrick Anthony100% (1)

- l6 Political Economical and Other Factors Affecting MncsDocument18 pagesl6 Political Economical and Other Factors Affecting MncsShamalNo ratings yet

- Rational Decision Making ModelDocument4 pagesRational Decision Making Modeladitya_shinde_2No ratings yet

- Data PreparationDocument38 pagesData PreparationGarvit Dhingra100% (1)

- Guide To Case AnalysisDocument10 pagesGuide To Case AnalysisYuanxin MaNo ratings yet

- Module 12 - Relevant Costing and Short-Term Decision MakingDocument8 pagesModule 12 - Relevant Costing and Short-Term Decision MakingAndrea ValdezNo ratings yet

- Cost Benefit Analysis: Professional Development InstituteDocument28 pagesCost Benefit Analysis: Professional Development InstituteArdra SNo ratings yet

- App 2 - Variance InvestigationDocument24 pagesApp 2 - Variance InvestigationAashikkhan100% (2)

- ExPACCAP7 PDFDocument48 pagesExPACCAP7 PDFAashikkhanNo ratings yet

- June 2009 Ques XDocument8 pagesJune 2009 Ques XMei Mei ChanNo ratings yet

- FS11Document60 pagesFS11AashikkhanNo ratings yet

- ACCA学习网:Document4 pagesACCA学习网:AbdullahKhanAfridiNo ratings yet

- ACCA学习网:Document4 pagesACCA学习网:AbdullahKhanAfridiNo ratings yet

- ACCA学习网:Document4 pagesACCA学习网:AbdullahKhanAfridiNo ratings yet

- ACCA学习网:Document4 pagesACCA学习网:AbdullahKhanAfridiNo ratings yet

- ACCA学习网:Document4 pagesACCA学习网:AbdullahKhanAfridiNo ratings yet

- Managing People: Time Allowed 3 HoursDocument4 pagesManaging People: Time Allowed 3 HoursAbdullahKhanAfridiNo ratings yet

- ACCA学习网:Document4 pagesACCA学习网:AbdullahKhanAfridiNo ratings yet

- ACCA学习网:Document4 pagesACCA学习网:AbdullahKhanAfridiNo ratings yet

- ACCA学习网:Document4 pagesACCA学习网:AbdullahKhanAfridi100% (1)

- F1 Ans 04 06Document8 pagesF1 Ans 04 06AashikkhanNo ratings yet

- ACCA学习网:Document7 pagesACCA学习网:AbdullahKhanAfridiNo ratings yet

- ACCA学习网:Document4 pagesACCA学习网:AbdullahKhanAfridiNo ratings yet

- Managing People: Time Allowed 3 HoursDocument4 pagesManaging People: Time Allowed 3 HoursAbdullahKhanAfridiNo ratings yet

- ACCA学习网:Document7 pagesACCA学习网:AbdullahKhanAfridiNo ratings yet

- F1 Ans 05 12Document8 pagesF1 Ans 05 12AashikkhanNo ratings yet

- F1 Ans 02 06Document10 pagesF1 Ans 02 06AashikkhanNo ratings yet

- F1 Ans 04 12Document8 pagesF1 Ans 04 12AashikkhanNo ratings yet

- F1 Ans 03 12Document7 pagesF1 Ans 03 12AashikkhanNo ratings yet

- F1 Ans 05 06Document11 pagesF1 Ans 05 06AashikkhanNo ratings yet

- F1 Ans 03 06Document8 pagesF1 Ans 03 06AashikkhanNo ratings yet

- ACCA学习网:Document9 pagesACCA学习网:AbdullahKhanAfridiNo ratings yet

- F1 Ans 02 12Document10 pagesF1 Ans 02 12AashikkhanNo ratings yet

- BudgetingDocument22 pagesBudgetingAashikkhan50% (2)

- App 2 - Variance InvestigationDocument24 pagesApp 2 - Variance InvestigationAashikkhan100% (2)

- SVCL Application WB FundDocument16 pagesSVCL Application WB FundSurajPandeyNo ratings yet

- ULTIMATE Sample Paper 3Document22 pagesULTIMATE Sample Paper 3Vansh RanaNo ratings yet

- Chapter 18 Investment in AssociateDocument5 pagesChapter 18 Investment in AssociateEllen MaskariñoNo ratings yet

- FAR210 - Feb 2023 - SSDocument11 pagesFAR210 - Feb 2023 - SSfarisha aliahNo ratings yet

- Chapter 8 Implementing - Strategies - Marketing - FinanceDocument45 pagesChapter 8 Implementing - Strategies - Marketing - FinanceayuNo ratings yet

- CS as a Valuer and Emerging Valuation OpportunitiesDocument42 pagesCS as a Valuer and Emerging Valuation OpportunitiesGAURAVNo ratings yet

- Balance Sheet of Mahindra&Mahindra L.T.D: LiabilitiesDocument2 pagesBalance Sheet of Mahindra&Mahindra L.T.D: LiabilitiesDelectable Food DiariesNo ratings yet

- Fauji Fertilizer Company LimitedDocument16 pagesFauji Fertilizer Company Limitedkhan izharNo ratings yet

- Chap14 The Calculation & Interpretation of Accounting RatiosDocument6 pagesChap14 The Calculation & Interpretation of Accounting RatiosSaiful AliNo ratings yet

- Reporting and Analyzing Receivables: QuestionsDocument25 pagesReporting and Analyzing Receivables: QuestionsAstrid LimónNo ratings yet

- Financial Statement Analysis - Dabur India LTDDocument17 pagesFinancial Statement Analysis - Dabur India LTDVishranth Chandrashekar100% (1)

- Business Combination 4Document2 pagesBusiness Combination 4Jamie RamosNo ratings yet

- 1915103-Accounting For ManagementDocument22 pages1915103-Accounting For Managementmercy santhiyaguNo ratings yet

- Capital Alliance PLC Interim Financial StatementsDocument10 pagesCapital Alliance PLC Interim Financial Statementskasun witharanaNo ratings yet

- Simple Balance Sheet For Sole Proprietorship or PartnershipDocument2 pagesSimple Balance Sheet For Sole Proprietorship or PartnershipMary86% (7)

- Baltic Group Cost Analysis and Transfer Pricing StrategiesDocument4 pagesBaltic Group Cost Analysis and Transfer Pricing StrategiesSangtani PareshNo ratings yet

- Principles Underlying Asset Liability ManagementDocument12 pagesPrinciples Underlying Asset Liability Managementrconsonni2100% (1)

- Corporate valuation & financial modelling case studyDocument3 pagesCorporate valuation & financial modelling case studyRakshith PsNo ratings yet

- 2 Home, SA, Branch ProblemsDocument7 pages2 Home, SA, Branch ProblemsthatfuturecpaNo ratings yet

- Bank Cash Flow and Income Statement AnalysisDocument5 pagesBank Cash Flow and Income Statement AnalysisAldrin LiwanagNo ratings yet

- Accounting in Action 12eDocument65 pagesAccounting in Action 12eMd Shawfiqul Islam0% (1)

- MidtermsDocument9 pagesMidtermsRae SlaughterNo ratings yet

- Feir Alexa Mae C. Final Exam Financial Analysis and ReportingDocument7 pagesFeir Alexa Mae C. Final Exam Financial Analysis and ReportingEnalyn AldeNo ratings yet

- FIN081 - P2 - Q2 - Receivable Management - AnswersDocument7 pagesFIN081 - P2 - Q2 - Receivable Management - AnswersShane QuintoNo ratings yet

- Sol05 4eDocument74 pagesSol05 4eFathurNo ratings yet

- Nerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Document3 pagesNerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Mica Mae Correa100% (1)

- Wall Street Mastermind S Investment Banking Technical Interview Cheat SheetDocument2 pagesWall Street Mastermind S Investment Banking Technical Interview Cheat Sheetxandar198No ratings yet

- Financial Statement Analysis FrameworkDocument7 pagesFinancial Statement Analysis FrameworkmkhanmajlisNo ratings yet

- Segmented Reporting Investment Center Evaluation and Transfer PricingDocument42 pagesSegmented Reporting Investment Center Evaluation and Transfer PricingAyu Dian SetyaniNo ratings yet

- Module 7 Financial Statement AnalysisDocument20 pagesModule 7 Financial Statement AnalysisHailsey WinterNo ratings yet