Professional Documents

Culture Documents

Earned Income Tax Credit Self Employed Ireland

Uploaded by

madmossyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Earned Income Tax Credit Self Employed Ireland

Uploaded by

madmossyCopyright:

Available Formats

Revenue Operational Manual 15.1.

44

[15.1.44] Earned Income Tax Credit

Section 472AB, Taxes Consolidation Act, 1997

Updated January 2017

1. Introduction of new Earned Income Tax Credit

Section 472AB Taxes Consolidation Act 1997 was inserted by Finance Act

2015 and applies for the tax years 2016 et seq. It provides for a maximum tax

credit of 950 (550 for 2016) (computed by reference to the standard rate of

income tax) in respect of an individuals earned income.

2. Earned Income

For the purposes of this Earned Income Tax Credit, the qualifying earned

income is earned income (as defined in section 3 Taxes Consolidation Act

1997) other than earned income that qualifies for relief under section 472

Taxes Consolidation Act 1997 (Employee (PAYE) Tax Credit).

Example 1 Non-proprietary director earning 50,000

As the earnings are taken into account for the purposes of the Employee

(PAYE) Tax Credit, they are not relevant for the Earned Income Tax Credit.

Example 2 Proprietary director earning 50,000

As the earnings are not taken into account for the purposes of the Employee

(PAYE) Tax Credit, they are relevant for the Earned Income Tax Credit.

3. Interaction with the Employee (PAYE) Tax Credit

Where an individual has earned income that qualifies for

(i) Employee (PAYE) Tax Credit, and

(ii) Earned Income Tax Credit,

the combined value of both Tax Credits cannot exceed 1,650.

Revenue Operational Manual 15.1.44

Example 3 Individual has PAYE pension of 6,000 and Case I income of

40,000

Employee (PAYE) Tax Credit

6,000 x 20% = 1,200*

Earned Income Tax Credit

40,000 x 20% = 8,000

Maximum Tax Credit = 950

However, the aggregate tax credits cannot exceed 1,650. Therefore

the amount of the Earned Income Tax Credit is

1,650 - 1,200* = 450

Example 4 - Individual has PAYE pension of 5,000 and Case I income of

2,000

Employee (PAYE) Tax Credit

5,000 x 20% = 1,000

Earned Income Tax Credit

2,000 x 20% = 400

As the aggregate of the tax credits is 1,400, there is no restriction.

4. Cases taxed under Joint Assessment

The Tax Credit is based on an individuals income. Where joint assessment

applies, a separate tax credit may be due in respect of each spouses individual

income.

Example 5 Assessable spouse has Case I income of 50,000 and non-

assessable spouse has Case II of 2,500

The assessable spouse is due 2 Earned Income Tax Credits, as follows

Own income maximum of 950, plus

Spouses income (2,500 x 20%) = 500.

Revenue Operational Manual 15.1.44

Example 6 Assessable spouse has Directors salary of 60,000 and non-

assessable spouse has a salary of 40,000 from the same company. Neither

are entitled to the Employee (PAYE) Tax Credit.

The assessable spouse is due 2 Earned Income Tax Credits, as follows

Own income maximum of 950, plus

Spouses income maximum of 950.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- PerfumeDocument21 pagesPerfumedeoremeghanNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Wild Atlantic Way IrelandDocument22 pagesWild Atlantic Way IrelandmadmossyNo ratings yet

- Cost Behavior: Analysis and UseDocument36 pagesCost Behavior: Analysis and Userachim04100% (1)

- BATA PAKISTAN LIMITED As An OrganisationDocument14 pagesBATA PAKISTAN LIMITED As An OrganisationTajammul HussainNo ratings yet

- Work Sample - M&A Private Equity Buyside AdvisingDocument20 pagesWork Sample - M&A Private Equity Buyside AdvisingsunnybrsraoNo ratings yet

- Assignment ON Case Analysis of Harnischfeger Corporation: Submitted To Submitted by Dr. Shikha Bhatia Shreya PGFB1144Document3 pagesAssignment ON Case Analysis of Harnischfeger Corporation: Submitted To Submitted by Dr. Shikha Bhatia Shreya PGFB1144simplyshreya99No ratings yet

- SLFI610-Project Appraisal & FinanceDocument2 pagesSLFI610-Project Appraisal & FinanceVivek GujralNo ratings yet

- Final Test Pre-IntermediateDocument5 pagesFinal Test Pre-Intermediatebulajica100% (5)

- Nishat Mill IbfDocument18 pagesNishat Mill IbfU100% (1)

- Difference Between Basel 1 2 and 3 - Basel 1 Vs 2 Vs 3Document8 pagesDifference Between Basel 1 2 and 3 - Basel 1 Vs 2 Vs 3Sonaal GuptaNo ratings yet

- Guidance on Completing Cytotoxic Drug Risk AssessmentsDocument4 pagesGuidance on Completing Cytotoxic Drug Risk AssessmentsmadmossyNo ratings yet

- Guidance On Completing A Biological Risk AssessmentDocument2 pagesGuidance On Completing A Biological Risk AssessmentmadmossyNo ratings yet

- Getting Ready To Go To The Test Centre. Explainer Guide For ChildrenDocument17 pagesGetting Ready To Go To The Test Centre. Explainer Guide For ChildrenmadmossyNo ratings yet

- Guidance To Support The Review and Updating of Laboratory Biological AgentsDocument14 pagesGuidance To Support The Review and Updating of Laboratory Biological AgentsmadmossyNo ratings yet

- National Health and Safety Risk AssessmentDocument4 pagesNational Health and Safety Risk AssessmentCarmen M AvinazarNo ratings yet

- Covid 19 Information Booklet PDFDocument16 pagesCovid 19 Information Booklet PDFajithathreyasNo ratings yet

- Sample Bleach Chemical Agents Risk AssessmentDocument4 pagesSample Bleach Chemical Agents Risk AssessmentmadmossyNo ratings yet

- Sample Formalin 10 Per Cent Chemical Agents Risk AssessmentDocument6 pagesSample Formalin 10 Per Cent Chemical Agents Risk AssessmentmadmossyNo ratings yet

- Form EU2 Explanatory LeafletDocument3 pagesForm EU2 Explanatory LeafletmadmossyNo ratings yet

- A Parent S Guide To Close Contacts in School PDFDocument3 pagesA Parent S Guide To Close Contacts in School PDFmadmossyNo ratings yet

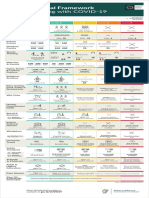

- National Framework - COVID-19Document1 pageNational Framework - COVID-19UndisclosedNo ratings yet

- Stay-Safe-at-Work-A2 Covid 19Document1 pageStay-Safe-at-Work-A2 Covid 19madmossyNo ratings yet

- Form EU1 Application Guide for Family MembersDocument3 pagesForm EU1 Application Guide for Family MembersmadmossyNo ratings yet

- SláinteCare Ireland 2019Document58 pagesSláinteCare Ireland 2019madmossyNo ratings yet

- 71477Document5 pages71477madmossyNo ratings yet

- Action Plan 2018: A Strategy For Ireland'S International Financial Services Sector 2015-2020Document51 pagesAction Plan 2018: A Strategy For Ireland'S International Financial Services Sector 2015-2020Ali PaquiraNo ratings yet

- Ireland's Public Finances Slowly Recovering After CrisisDocument4 pagesIreland's Public Finances Slowly Recovering After CrisismadmossyNo ratings yet

- The Socio-Economic Impact of Forestry in Co. LeitrimDocument149 pagesThe Socio-Economic Impact of Forestry in Co. Leitrimmadmossy100% (1)

- Irish Government Spending Review 2018 Sports Capital ProgrammeDocument30 pagesIrish Government Spending Review 2018 Sports Capital ProgrammemadmossyNo ratings yet

- Culturally Curious PDFDocument18 pagesCulturally Curious PDFmadmossyNo ratings yet

- Full Licence Application Guidance NotesDocument4 pagesFull Licence Application Guidance NotesmadmossyNo ratings yet

- 2018 Dublin One City One Book Programme FinalDocument2 pages2018 Dublin One City One Book Programme FinalmadmossyNo ratings yet

- SamphireIslandDocument1 pageSamphireIslandmadmossyNo ratings yet

- Movementplantsplantproductsinto EUfrom Third Countries 290115Document3 pagesMovementplantsplantproductsinto EUfrom Third Countries 290115madmossyNo ratings yet

- Rebuilding Ireland - Action PlanDocument115 pagesRebuilding Ireland - Action PlanmadmossyNo ratings yet

- EC Plant Passport GuideDocument8 pagesEC Plant Passport GuidemadmossyNo ratings yet

- Gastronomy of IrlelandDocument13 pagesGastronomy of IrlelandDreamsAvenue.comNo ratings yet

- Guide to Irish education systemDocument39 pagesGuide to Irish education systemmadmossyNo ratings yet

- The Tipperary: WWW - Discoverireland.ie/thetipperary10Document24 pagesThe Tipperary: WWW - Discoverireland.ie/thetipperary10madmossyNo ratings yet

- Chapter 5 (Audit)Document2 pagesChapter 5 (Audit)arnel gallarteNo ratings yet

- Director Client Customer Operations in Chicago IL Resume Jill MazurcoDocument2 pagesDirector Client Customer Operations in Chicago IL Resume Jill MazurcoJillMazurcoNo ratings yet

- China Soap Synthetic Detergent Market ReportDocument10 pagesChina Soap Synthetic Detergent Market ReportAllChinaReports.comNo ratings yet

- Swanand Co-Op. Housing Society LTDDocument2 pagesSwanand Co-Op. Housing Society LTDskumarsrNo ratings yet

- 1 IB Nature & ScopeDocument19 pages1 IB Nature & ScopePanav MohindraNo ratings yet

- IncotermsDocument1 pageIncotermssrinivas0% (1)

- Indian News Agencies at A GlanceDocument3 pagesIndian News Agencies at A GlanceNetijyata MahendruNo ratings yet

- Dissolution RegulationsDocument15 pagesDissolution Regulationsbhavk20No ratings yet

- Quiz - Act 07A: I. Theories: ProblemsDocument2 pagesQuiz - Act 07A: I. Theories: ProblemsShawn Organo0% (1)

- Lion Air ETicket (IIZKUK) - NataliaDocument2 pagesLion Air ETicket (IIZKUK) - NataliaNatalia LeeNo ratings yet

- Price/BV (X) 1.46 Ev/Ebitda (X) 6.76 0.81: Ratio 2016-17 2017-18 2018-19Document2 pagesPrice/BV (X) 1.46 Ev/Ebitda (X) 6.76 0.81: Ratio 2016-17 2017-18 2018-19Pratik ChourasiaNo ratings yet

- CapbudhintDocument3 pagesCapbudhintImran IdrisNo ratings yet

- White Rust Removal and PreventionDocument17 pagesWhite Rust Removal and PreventionSunny OoiNo ratings yet

- JFET and MOSFET quiz questionsDocument4 pagesJFET and MOSFET quiz questionsfGNo ratings yet

- Real Estate Mortgage-JebulanDocument2 pagesReal Estate Mortgage-JebulanLee-ai CarilloNo ratings yet

- Founders Pie Calculator FinalDocument3 pagesFounders Pie Calculator FinalAbbas AliNo ratings yet

- Macro CH 11Document48 pagesMacro CH 11maria37066100% (3)

- Tata Consultancy Services LimitedDocument4 pagesTata Consultancy Services LimitedPRITEENo ratings yet

- Bayfield Mud CompanyDocument3 pagesBayfield Mud CompanyMica VillaNo ratings yet

- BMW Case StudyDocument3 pagesBMW Case StudyPrerna GoelNo ratings yet

- Mr. WegapitiyaDocument10 pagesMr. WegapitiyaNisrin Ali67% (3)