Professional Documents

Culture Documents

Jawaban TK 1 Managerial Accounting

Uploaded by

Arkan RunakoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jawaban TK 1 Managerial Accounting

Uploaded by

Arkan RunakoCopyright:

Available Formats

Tugas Kelompok ke-1

(Minggu 3 / Sesi 4)

Cost Behavior:analysis and use

Theory

1. What is committed fixed cost? And give 2 examples

Fixed Cost adalah cost yang selalu tetap dalam rentang yang relevan, penambahan

aktifitas dalam rentang yang relevan tidak akan menambah fixed cost. Fixed cost per

unit berubah-ubah dan secara total selalu tetap.

Atau bisa dikatakan, fixed cost ialah biaya yang jumlah totalnya akan tetap sama dan

tidak berubah sedikitpun walaupun jumlah barang yang diproduksi dan dijual

berubah-ubah dalam kapasitas normal.

Contoh : - Biaya sewa gedung

- Biaya premi asuransi

2. What is discretionary fixed cost? And give 2 examples

Disrectionary fixed cost merupakan biaya

(a) yang timbul dari keputusan penyediaan anggaran secara berkala (biasanya

tahunan) yang secara langsung mencerminkan kebijakan manajemen puncak

mengenai jumlah maksimum biaya yang diijinkan untuk dikeluarkan,

(b) yang tidak dapat menggambarkan hubungan yang optimum antara masukan

dengan keluaran (yang diukur dengan volume penjualan, jasa, atau produk).

Contoh : - biaya riset dan pengembangan

, - biaya iklan,

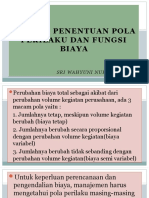

3. Mention 3 ways to separates mixed cost

3 metode yang digunakan secara luas untuk memisahkan mixed cost menjadi

komponen tetap dan variabel, yaitu :

1. Metode Tinggi Rendah

2. Metode Scatterplot

3. Metode Kuadrat Terkecil

4. What is major disadvantage of high low method?

High low method memiliki beberapa kelemahan.

ACCT6173 Managerial Accounting

a. Titik tinggi dan rendah sering sebagai apa yang disebut di luar garis. Mereka

mungkin mewakili hubungan biaya kegiatan yang tidak khas. Jika demikian,

formula biaya yang dihitung menggunakan dua titik ini tidak mewakili apa yang

biasanya terjadi.

b. Jika titik-titik ini bukan di luar garis, pasangan titik-titik lainnya jelas lebih

mewakili.

5. What is relevant range?

Relevant range adalah suatu kisaran tingkat aktifitas dimana asumsi relatif perilaku

biaya variabel dan biaya tetap dianggap valid.

CASES

1. Antz Industries has provided you with the following data for its materials storeroom:

Month Number of Shipments Storeroom Costs

January ....................................... 175 $3,000

February ..................................... 225 3,600

March ......................................... 275 4,300

April ........................................... 175 3,800

May ............................................ 200 2,700

June ............................................ 225 3,200

July ............................................. 300 4,250

August ........................................ 325 4,400

September .................................. 275 4,100

October ....................................... 200 3,150

November ................................... 150 2,650

December ................................... 175 2,750

Required:

Determine the cost behavior using the high-low method.

Jawab :

Number of Shipments Storeroom Costs

Level aktifitas tertinggi (Agustus) 325 4,400

Level aktifitas terendah(November) 150 2,650

ACCT6173 Managerial Accounting

Perbedaan 175 1,750

Variable cost = change in cost : Change in activity

Variable cost = 1750 / 175

= 10 per shipment

Fixed cost element = Total cost Variable cost

Fixed cost = 4400 (10 x 325)

= 1150

Cost Formula = Y = 1150 + 10X

2. The following data relating to units shipped and total shipping expense have been

assembled by Archer Company, a wholesaler of large ,custom-built air-conditioning

units for commercial building

Month Unit shipped Total Shipping Expense

January 3 $1.800

February 6 $2.300

March 4 $1.700

April 5 $2.000

May 7 $2.300

June 8 $2.700

July 2 $1.200

Required: using High Low Method,estimate cost formula for shipping expense

Jawab :

Number of Shipments Storeroom Costs

Level aktifitas tertinggi (June) 8 2.700

Level aktifitas terendah (July) 2 1.200

Perbedaan 6 1.500

Variable cost = change in cost : Change in activity

ACCT6173 Managerial Accounting

Variable cost = 1500 / 6

= 250 per shipment

Fixed cost element = Total cost Variable cost

Fixed cost = 2700 (250 x 8)

= 700

Cost Formula = Y = 700 + 250X

3. Here is the relation between production cost and the number of unit production form PT

ABC for month of August 2015 :

Volume Production Production Cost

Minimum 20.000 unit Rp. 1.200.000,-

Maximum 25.000 unit Rp. 2.000.000,-

Required: Calculate variable cost/unit

Jawab :

Minimum 20.000 unit Rp. 1.200.000,-

Maximum 25.000 unit Rp. 2.000.000,-

Perbedaan 5.000 unit Rp. 800.000,-

Variable/unit = Rp 800.000/5000 = Rp 160/unit

4. The following data relating to units shipped and total shipping expense have been

assembled by Three Lion Company, a wholesaler of large, customs-built air-

conditioning units for commercial buildings:

Units Shipped Shipping Expense

June . 6 $ 7,200

July . 12 9,200

August .. 8 6,800

September .... 10 8,000

ACCT6173 Managerial Accounting

October . 14 9,200

November .... 16 10,800

December .... 4 4,800

Required :

a. Using the high low method, estimate a cost formula for shipping expense (15%)

ANSWER

Unit Shipped Shipping Expense

High Activity Level (November) 16 $10.800

Low Activity Level (December) 4 $4.800

Change 12 $6.000

Variable Cost = Change in cost : Change in Activity

Variable Cost = 6.000 Shipping Expense : 12 Unit Shipped

Variable Cost = 500 per unit shipment

Fixed Cost = Total Cost Variable cost

= 10.800 (500 per unit shipment x 16 total shipping expense)

= 2.800

Cost Formula: Y = 2.800 + 500X

b. January in the next year, unit shipped 15 units. What is the shipping expense for

January (10%)

Answer:

X = 15 units

Y = 2.800 + 500 X

Y = 2.800 + 500 (15)

Y = 2.800 + 7.500

Y = 10.300

Shipping expense (January in the next year) for unit shipped 15 units = $10.300

ACCT6173 Managerial Accounting

You might also like

- Bab 2 Prilaku BiayaDocument10 pagesBab 2 Prilaku BiayaNurhalizaNo ratings yet

- PERILAKU BIAYA 1Document24 pagesPERILAKU BIAYA 1Zakaria Aji RavandhikaNo ratings yet

- Analisis BiayaDocument5 pagesAnalisis BiayaTHE FAZZ ALEXANDRIANo ratings yet

- 2 Perilaku BiayaDocument29 pages2 Perilaku BiayaAlfira NabilaNo ratings yet

- Analisis BiayaDocument12 pagesAnalisis BiayaAnisaul Hasanah100% (1)

- Tugas Kasus Perilaku BiayaDocument7 pagesTugas Kasus Perilaku Biayaimamfadilah24062003No ratings yet

- 1.02 - Perilaku Biaya Dan KasusDocument66 pages1.02 - Perilaku Biaya Dan KasusIndra NurcahyoNo ratings yet

- Metode Penentuan PolaDocument16 pagesMetode Penentuan PolaSri SulastriNo ratings yet

- 13 - RESUME ANGGARAN BIAYA VARIABEL - Zahra Imanuha (17200129)Document8 pages13 - RESUME ANGGARAN BIAYA VARIABEL - Zahra Imanuha (17200129)Zahra ImanuhaNo ratings yet

- Materi 3Document23 pagesMateri 3KnrhmaaNo ratings yet

- Tugas Akbi E3-1 E3-2 & Resume - Bintang Alvin Syaifullah - 041911233153Document6 pagesTugas Akbi E3-1 E3-2 & Resume - Bintang Alvin Syaifullah - 041911233153alNo ratings yet

- BIAYA MANUFAKTURDocument15 pagesBIAYA MANUFAKTURAekynla Aekin BrahmanaNo ratings yet

- Tugas Pertemuan 3 - Yudikna MahardikaDocument4 pagesTugas Pertemuan 3 - Yudikna MahardikayudiknamahardikaNo ratings yet

- Budgeting After Mied TestDocument52 pagesBudgeting After Mied TestTesa Lonika SidabalokNo ratings yet

- Anggaran VariabelDocument9 pagesAnggaran VariabelAnita SuryawatiNo ratings yet

- Tugas CHP 3 - AkMan - Kelompok 7Document12 pagesTugas CHP 3 - AkMan - Kelompok 7Cicilia CindyNo ratings yet

- Akuntansi Manajemen 3.14 - 3.16 Dianns 19011002 Manajemen ADocument8 pagesAkuntansi Manajemen 3.14 - 3.16 Dianns 19011002 Manajemen ADian Nur Sa'adah100% (1)

- BIAYA STANDAR DAN VARIABLE COSTINGDocument2 pagesBIAYA STANDAR DAN VARIABLE COSTINGJessika Dian PratiwiNo ratings yet

- Tugas2 BM 5 20002043pim5136mj6Document7 pagesTugas2 BM 5 20002043pim5136mj6Yandaa SeptaniaNo ratings yet

- Tugas 1 Ekma 4314Document3 pagesTugas 1 Ekma 4314novan pardiansyahNo ratings yet

- Bab 2 Perilaku BiayaDocument21 pagesBab 2 Perilaku BiayaIra Sofyana SimatupangNo ratings yet

- Akutansi ManajemenDocument18 pagesAkutansi ManajemenNisaNo ratings yet

- Rangkuman Akuntansi Minggu Ke 1Document11 pagesRangkuman Akuntansi Minggu Ke 1Nurfatwa SalamahNo ratings yet

- Bab 2 Perilaku BiayaDocument25 pagesBab 2 Perilaku BiayaRodiotul AzkiyaNo ratings yet

- Tugas Kelompok Akuntansi ManajemenDocument8 pagesTugas Kelompok Akuntansi Manajemengrace MarianaNo ratings yet

- BiayaPertemuan2Document12 pagesBiayaPertemuan2YanDian ChanelNo ratings yet

- Analisis Perilaku BiayaDocument24 pagesAnalisis Perilaku BiayaaruminawatiNo ratings yet

- MODUL AKUNTANSIDocument4 pagesMODUL AKUNTANSIMuhammad Ridwan100% (1)

- 16-Anggaran VariabelDocument27 pages16-Anggaran Variabelagus ariNo ratings yet

- PRILAKU BIAYADocument14 pagesPRILAKU BIAYAdidikNo ratings yet

- Akbi 3 COSTBEHAVIOURDocument42 pagesAkbi 3 COSTBEHAVIOURBriana SefayaNo ratings yet

- 1821 Acct6173 Txea TK1-W3-S4-R1 Team5Document5 pages1821 Acct6173 Txea TK1-W3-S4-R1 Team5Andita Kevira SambadaNo ratings yet

- Perilaku Biaya M3Document38 pagesPerilaku Biaya M3Rainafzrpti 20No ratings yet

- SMJ0263 - 02 - Perilaku BiayaDocument11 pagesSMJ0263 - 02 - Perilaku Biayatabah wiwitNo ratings yet

- Pengertian Anggaran VariabelDocument5 pagesPengertian Anggaran VariabelShofyan HarisNo ratings yet

- Biaya PemeliharaanDocument4 pagesBiaya PemeliharaanSyifa Fadya60% (5)

- Variabel BudgetDocument31 pagesVariabel BudgetMuharisa SyafelinaNo ratings yet

- ANALISIS PERILAKU BIAYADocument7 pagesANALISIS PERILAKU BIAYAfadhliNo ratings yet

- Akuntansi ManajemenDocument10 pagesAkuntansi ManajemenMaskurin Nur AzizahNo ratings yet

- 21-Soal Konsep Biaya Dan Klasifikasi Biaya (Haikal Abdullah Q) 2202311053Document5 pages21-Soal Konsep Biaya Dan Klasifikasi Biaya (Haikal Abdullah Q) 2202311053Haikal AbdullahNo ratings yet

- AkmenlanDocument11 pagesAkmenlanmolina priscillaNo ratings yet

- Pemisahan Biaya Semi VariabelDocument11 pagesPemisahan Biaya Semi VariabelLiana GNo ratings yet

- Analisis Perilaku Biaya-1Document23 pagesAnalisis Perilaku Biaya-1KhoironNo ratings yet

- AkuntasiDocument3 pagesAkuntasievan pramantaraNo ratings yet

- Perilaku Biaya AktivitasDocument26 pagesPerilaku Biaya AktivitasBaiq AuliaNo ratings yet

- Mti 10001899 061021103216Document33 pagesMti 10001899 061021103216juwita sonyaNo ratings yet

- Akutansi Manajemen High LowDocument7 pagesAkutansi Manajemen High LowIstikomahNo ratings yet

- Kasus 1 Perilaku BiayaDocument1 pageKasus 1 Perilaku BiayaDespa DikaNo ratings yet

- Tugas Akuntansi Manajemen 2Document26 pagesTugas Akuntansi Manajemen 2CitraNo ratings yet

- Perilaku BiayaDocument7 pagesPerilaku Biayasuriyani100% (1)

- Biaya PerilakuDocument7 pagesBiaya PerilakuPindi YulinarNo ratings yet

- Tugas 1 - Akuntansi Biaya - Bayu ErtantoDocument4 pagesTugas 1 - Akuntansi Biaya - Bayu ErtantoBayu ErtantoNo ratings yet

- Sesi 3 - Cost Acct - Perilaku BiayaDocument33 pagesSesi 3 - Cost Acct - Perilaku BiayashofiaalifahamidahNo ratings yet

- BAB II Cost BehaviourDocument8 pagesBAB II Cost BehaviourRahma WatiNo ratings yet

- Pert 3, Biaya Variabel Dan Tetap-1Document26 pagesPert 3, Biaya Variabel Dan Tetap-1Ranho JaelaniNo ratings yet

- OPTIMASI AKUNTANSIDocument5 pagesOPTIMASI AKUNTANSIAriefNo ratings yet

- Kos Linier dan Jenis-jenis KosDocument16 pagesKos Linier dan Jenis-jenis KosMuhammad Ramanda Fajhrul FirdausNo ratings yet

- 2 PerilakuDocument14 pages2 PerilakuswaxmoggNo ratings yet

- Ep 1 Sop Identifikasi Hambatan Budaya FixDocument1 pageEp 1 Sop Identifikasi Hambatan Budaya FixArkan RunakoNo ratings yet

- Ep 1 Sop Identifikasi Hambatan Budaya FixDocument3 pagesEp 1 Sop Identifikasi Hambatan Budaya FixArkan RunakoNo ratings yet

- Salinan Perbup Nomor 2 Tahun 2017 TTG Pedoman Penggunaan Dana Non Kapitasi Program Jaminan Kesehatan Nasional Pada Pusat Kesehatan MasyarakatDocument5 pagesSalinan Perbup Nomor 2 Tahun 2017 TTG Pedoman Penggunaan Dana Non Kapitasi Program Jaminan Kesehatan Nasional Pada Pusat Kesehatan MasyarakatArkan RunakoNo ratings yet

- JasaKesehatanDocument3 pagesJasaKesehatanriris67% (3)

- 8.2.3.6 Petunjuk Penyimpanan Obat Di RumahDocument2 pages8.2.3.6 Petunjuk Penyimpanan Obat Di RumahArkan RunakoNo ratings yet

- Ep 1 Sop Identifikasi Hambatan Budaya FixDocument2 pagesEp 1 Sop Identifikasi Hambatan Budaya FixArkan RunakoNo ratings yet

- Upt Puskesmas Jeruklegi Ii: Pemerintah Kabupaten Cilacap Dinas KesehatanDocument1 pageUpt Puskesmas Jeruklegi Ii: Pemerintah Kabupaten Cilacap Dinas KesehatanArkan RunakoNo ratings yet

- Ep 1 Sop Identifikasi Hambatan Budaya FixDocument3 pagesEp 1 Sop Identifikasi Hambatan Budaya FixArkan RunakoNo ratings yet

- MOU Dengan Tempat Rujukan Banyumas (NEW)Document2 pagesMOU Dengan Tempat Rujukan Banyumas (NEW)Arkan RunakoNo ratings yet

- Ep 1 Sop Identifikasi Hambatan Budaya FixDocument2 pagesEp 1 Sop Identifikasi Hambatan Budaya FixArkan RunakoNo ratings yet

- MOU Dengan Tempat Rujukan RSPC (NEW)Document2 pagesMOU Dengan Tempat Rujukan RSPC (NEW)Arkan RunakoNo ratings yet

- Sop Pembuatan LplpoDocument2 pagesSop Pembuatan LplpoAnnita K. Nisaa'No ratings yet

- Daftar Rumah Sakit Dan Laboratorium RujukanDocument3 pagesDaftar Rumah Sakit Dan Laboratorium RujukanArkan RunakoNo ratings yet

- Ep 1 Sop Identifikasi Hambatan Budaya FixDocument2 pagesEp 1 Sop Identifikasi Hambatan Budaya FixArkan RunakoNo ratings yet

- Ep 1 Sop Identifikasi Hambatan Budaya FixDocument2 pagesEp 1 Sop Identifikasi Hambatan Budaya FixArkan RunakoNo ratings yet

- Ep 1 Sop Identifikasi Hambatan Budaya FixDocument3 pagesEp 1 Sop Identifikasi Hambatan Budaya FixArkan RunakoNo ratings yet

- 8.2.4.4 Tindak Lanjut Efek Samping Obat Dan KTDDocument3 pages8.2.4.4 Tindak Lanjut Efek Samping Obat Dan KTDArkan RunakoNo ratings yet

- Ep 1 Sop Pengadaan Rapat Identifikasi Hambatan FixDocument3 pagesEp 1 Sop Pengadaan Rapat Identifikasi Hambatan FixArkan RunakoNo ratings yet

- 8.2.6.1 Penyediaan Obat-Obat Emergensi Di Unit PelayananDocument2 pages8.2.6.1 Penyediaan Obat-Obat Emergensi Di Unit PelayananArkan RunakoNo ratings yet

- 8.2.5.1 Identifikasi Dan Pelaporan Kesalahan Pemberian Obat Dan KNCDocument2 pages8.2.5.1 Identifikasi Dan Pelaporan Kesalahan Pemberian Obat Dan KNCArkan RunakoNo ratings yet

- 8.2.3.7 Penanganan Obat Kadaluwarsa Atau RusakDocument3 pages8.2.3.7 Penanganan Obat Kadaluwarsa Atau RusakArkan RunakoNo ratings yet

- 8.2.3.6 Petunjuk Penyimpanan Obat Di RumahDocument2 pages8.2.3.6 Petunjuk Penyimpanan Obat Di RumahArkan RunakoNo ratings yet

- 8.2.4.3 Pencatatan, Pemantauan, Pelaporan Efek Samping Obat, KTDDocument2 pages8.2.4.3 Pencatatan, Pemantauan, Pelaporan Efek Samping Obat, KTDArkan RunakoNo ratings yet

- 8.2.6.2 Penyimpanan Obat Emergensi Di Unit PelayananDocument2 pages8.2.6.2 Penyimpanan Obat Emergensi Di Unit PelayananArkan RunakoNo ratings yet

- 8.2.2.4 Pengelolaan ObatDocument2 pages8.2.2.4 Pengelolaan ObatArkan RunakoNo ratings yet

- MONITORING OBATDocument3 pagesMONITORING OBATArkan RunakoNo ratings yet

- 8.2.4.1 Pelaporan Efek Samping ObatDocument2 pages8.2.4.1 Pelaporan Efek Samping ObatArkan RunakoNo ratings yet

- 8.2.3.6 Petunjuk Penyimpanan Obat Di RumahDocument2 pages8.2.3.6 Petunjuk Penyimpanan Obat Di RumahArkan RunakoNo ratings yet

- 8.2.4.1 Pelaporan Efek Samping ObatDocument2 pages8.2.4.1 Pelaporan Efek Samping ObatArkan RunakoNo ratings yet

- 8.2.3.5 Pemberian Informasi Tentang Eso Atau Efek Yang Tidak DiharapkanDocument2 pages8.2.3.5 Pemberian Informasi Tentang Eso Atau Efek Yang Tidak DiharapkanArkan RunakoNo ratings yet

- Konsep-Konsep Biaya Dan Lingkungan EkonomiDocument27 pagesKonsep-Konsep Biaya Dan Lingkungan EkonomiHizda Novia Diegas Utamy0% (1)

- Jawaban TK 1 Managerial AccountingDocument5 pagesJawaban TK 1 Managerial AccountingArkan RunakoNo ratings yet

- Bab 7 The Cost of Quality and Accounting For Production Losses PDFDocument15 pagesBab 7 The Cost of Quality and Accounting For Production Losses PDFSandi SetiawanNo ratings yet

- Handout CH 04 IndDocument55 pagesHandout CH 04 IndHimakunta Stie PMNo ratings yet