Professional Documents

Culture Documents

RBL Free Account

Uploaded by

DineshKumarPanda0 ratings0% found this document useful (0 votes)

189 views3 pagesNOne

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentNOne

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

189 views3 pagesRBL Free Account

Uploaded by

DineshKumarPandaNOne

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

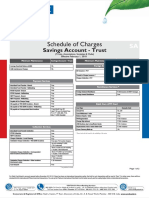

ABACUS DIGITAL SAVINGS ACCOUNT

Schedule of Benefits & Charges ABACUS DIGITAL SAVINGS ACCOUNT

Features Charges (in INR) applicable beyond free limits Abacus (OTP Based KYC) Abacus (In-person KYC)

DOORSTEP BANKING

Doorstep Cashiers Cheque / Demand Draft Delivery Rs. 25/visit Not Available *

Doorstep Courier Pick-Up / Delivery (Non-Cash) Rs. 25/visit Not Available *

Doorstep Cash Delivery (Rs. 1,000 to Rs. 2,00,000) Rs. 120/visit Not Available *

Doorstep Cash Pick-up (Rs. 1,000 to Rs. 2,00,000) Rs. 250/visit Not Available *

DEBIT CARD & ATM RELATED

Master Titanium Debit Card Rs. 150 p.a. Free Free

Master Platinum Debit Card Rs. 400 p.a. * *

RBL Bank's ATM Cash Withdrawal & Balance Enquiry Free Free Free

Other Bank's Domestic ATM - Cash Withdrawal Rs. 15/txn Free Free

Other Bank's Domestic ATM - Balance Enquiry Rs. 5/txn Free Free

Other Bank's International ATM - Cash Withdrawal Rs. 125/txn * *

Other Bank's International ATM - Balance Enquiry Rs. 25/txn * *

ATM/POS Decline Charges (Insufficient Funds) Rs. 20/txn * *

Replacement of Lost Card Rs. 50/instance * *

Replacement of Damaged Card Free Free Free

MISCELLANEOUS

Account Closure Charges (if closed within 6 months) # $ Rs. 500 * *

Cheque Deposited & Return (Financial Reason) Rs. 100/instance * *

Cheque Deposited & Return (Technical Reason) Rs. 50/instance * *

Cheque Issued & Return (Financial Reason) 1st Cheque Rs. 350; 2nd onwards Not Available *

Rs. 750 per instrument

Cheque Issued & Return (Technical Reason) Free Not Available Free

ABACUS DIGITAL SAVINGS ACCOUNT

Schedule of Benefits & Charges ABACUS DIGITAL SAVINGS ACCOUNT

Features Charges (in INR) applicable beyond free limits Abacus (OTP Based KYC) Abacus (In-person KYC)

ECS Return Rs. 350/instance Not Available *

Standing Instruction Failure/Amendment Rs. 50 *@ *

Balance Statement (Other than 31st March) Rs. 25 *@ *

Interest Statement (Duplicate Only) Rs. 25 *@ *

TDS Certificate (Duplicate Only) Rs. 25 *@ *

Paid Cheque Report / Signature Verification$ /

Photo Attestation$ / Copy of Old Cheque& Rs. 50 Not Available *

DD/BC Cancellation/Revalidation/Duplicate Issuance Rs. 50 Not Available *

Tax Payment Free Free @ Free

Stop Payment Individual or Range Rs. 50 Not Available *

Duplicate Pass Book$ / Statement Rs. 50 Not Available *

Bill Payment Online Free Free Free

SMS Alert (Optional Services) 25 paise per SMS or *@ *

Rs. 100 per month whichever is lower

COMMON GUIDELINES

- Indicates no free limits applicable and standard charges is applicable on transaction/services

*

@ - These transactions/services would be available only through Digital Channel. Post In-person verification is conducted and physical signature is updated in RBL Bank records these requests can be processed through our branches also

# - Account closure charges is waived off if account is closed within 14 days of account opening

$ - Following charges are waived for Senior Citizen customers Account Closure, Duplicate Passbook, Signature Verification and Photo Attestation

& - If copy of cheque is requested within a period of one year from the date of cheque / debit instruction, no charge will be levied

Others:

1. All charges are exclusive of taxes which would be levied as per prevailing rates as prescribed from time to time

2. Any RBI Mandated charge/regulations will supersede the published charges. For details please visit our website at www.rblbank.com or your nearest branch

3. All transactions/services, where a free limit is specified, usage beyond the free limit will be charged as per the standard charge of the respective services

4. Any purchase/sale of foreign exchange will attract Service Tax on the gross amount of currency exchanged as per Service Tax on Foreign Currency Conversion Charges (FCY)

5. The above charges are subject to revision with a prior intimation of 30 days to all account holders. Closure of account due to revision of charges will not be subject to account closure charges

6. Mandatory/Regulatory SMS Alerts will be offered free to all customers in the registered Mobile Number

7. Non Maintenance Charges are not applicable once the account becomes dormant

8. There will be a cross-currency mark-up charge of 3.5% on foreign currency transactions carried out on RBL Bank Debit Cards. The exchange rate used will be the VISA/Master Card wholesale rate prevailing at the time of transaction. Additional charges levied (if any) by other

bank on International ATM transactions will also be borne by the card holder

Customer Service: +91 22 61156300 to 99, 1800 123 8040, I Email us at:customercare@rblbank.com I Website: www.rblbank.com I SMS Banking: Type HELP & send to 9223366333 I Internet Banking: To register visit our website I Debit Card: Best in class features & benefits

ABACUS DIGITAL SAVINGS ACCOUNT

Schedule of Benefits & Charges ABACUS DIGITAL SAVINGS ACCOUNT

Features Charges (in INR) applicable beyond free limits Abacus (OTP Based KYC) Abacus (In-person KYC)

Monthly Average Balance Nil Nil

Non Maintenance Charge per month Nil Nil

PAYMENTS

Demand Draft at Branch Locations Rs. 50/instrument 1 Free p.m. @ 1 Free p.m.

Demand Draft at Non-Branch Locations Rs. 50/instrument 1 Free p.m. @ 1 Free p.m.

RTGS Outward through Branch Rs. 25/txn Not Available 1 Free p.m.

RTGS Outward through Digital Channels Free Not Available Free

NEFT Outward through Branch <=10K - Rs. 2.5/txn; >10K to 1L - Rs. 5/txn; Not Available 5 Free p.m.

>1L to 2L - Rs. 15/txn; >2L - Rs. 25/txn

NEFT Outward through Digital Channels Free Free Free

Fund Transfer (Within RBL Bank) Free Free @ Free

Payable At Par Cheque Book Rs. 2/leaf Not Available 1 Cheque Book free p.q. (20 leaves)

COLLECTIONS

Local Cheque Collection Free Free Free

Outstation Clearing - At RBL Locations Rs. 50/cheque * *

Outstation Clearing - At Non-RBL Locations Rs. 50/cheque * *

RTGS, NEFT, Inward Fund Transfers Free Free Free

CASH DEPOSITS/WITHDRAWALS

Cash Deposit at Home Branch Location Rs. 2/1000 Min Rs. 50/txn Not Available Free 1,00,000 p.m.

Cash Deposit at Non Home Branch Location Rs. 2/1000 Min Rs. 50/txn Not Available Free 1,00,000 p.m.

Cash Withdrawal at Home Branch Location Free Not Available Free

Cash Withdrawal at Non Home Branch Location Rs. 1/1000 Min Rs. 25/txn Not Available Free 1,00,000 p.m.

You might also like

- Schedule of Benefits & Charges Abacus Digital Savings AccountDocument3 pagesSchedule of Benefits & Charges Abacus Digital Savings AccountDeepak ThakurNo ratings yet

- Digital Savings Account Effective July 2021Document3 pagesDigital Savings Account Effective July 2021Nikhil KumarNo ratings yet

- Basic and Classic Savings Account Effective September 2020Document3 pagesBasic and Classic Savings Account Effective September 2020moviejunk97No ratings yet

- Iob Rupay Platnum CardDocument1 pageIob Rupay Platnum CardkrishNo ratings yet

- Super Shakti Savings AccountDocument2 pagesSuper Shakti Savings Accountrcosmic1980No ratings yet

- Schedule of Charges Effective January 1, 2020: Traders Current AccountDocument3 pagesSchedule of Charges Effective January 1, 2020: Traders Current Accountjpsmu09No ratings yet

- Demat ComparisonDocument2 pagesDemat ComparisonMohit ChhabraNo ratings yet

- HSBC Advance Tariff ScheduleDocument5 pagesHSBC Advance Tariff Scheduleshine1975No ratings yet

- Schedule of Charges Current AccountDocument8 pagesSchedule of Charges Current AccountAshif RejaNo ratings yet

- Documents Required For Title TransferDocument2 pagesDocuments Required For Title TransferChaitanya Chaitu CANo ratings yet

- Burgundy Fees and Charges 01042023Document7 pagesBurgundy Fees and Charges 01042023Nagaraj VukkadapuNo ratings yet

- Bundled Savings Account Monthly ChargesDocument2 pagesBundled Savings Account Monthly ChargesSweta MistryNo ratings yet

- Grace Period Granted - 1 Month As Per RBI Guidelines To Restore MABDocument2 pagesGrace Period Granted - 1 Month As Per RBI Guidelines To Restore MABprasanNo ratings yet

- SOB Indus ProgressDocument2 pagesSOB Indus ProgressAMit PrasadNo ratings yet

- Casil Soc 01 07 23Document2 pagesCasil Soc 01 07 23rishisiliveri95No ratings yet

- Service Charges - BoB - As On 6.11.17Document63 pagesService Charges - BoB - As On 6.11.17Praneta pandeyNo ratings yet

- Master Circular On Non Home Transactions Updated Till 31.10.2023Document19 pagesMaster Circular On Non Home Transactions Updated Till 31.10.2023kanoimalNo ratings yet

- Jubilee Plus Savings Account Features and ChargesDocument2 pagesJubilee Plus Savings Account Features and ChargesRuthvik TMNo ratings yet

- PIONEER Current Account SOB Eff 1st Dec 2022Document2 pagesPIONEER Current Account SOB Eff 1st Dec 2022Rajat AgarwalNo ratings yet

- Screenshot 2023-06-23 at 11.12.58 AMDocument13 pagesScreenshot 2023-06-23 at 11.12.58 AMR P CNo ratings yet

- Core Savings Account - IDBIDocument2 pagesCore Savings Account - IDBIprasanNo ratings yet

- Being MeDocument2 pagesBeing MeVarshaNo ratings yet

- Indus AdvantageDocument1 pageIndus Advantagesubhasish paulNo ratings yet

- Niyo SBM SOCDocument1 pageNiyo SBM SOCRobi RoboNo ratings yet

- Myworld Pricing 2021Document3 pagesMyworld Pricing 2021carinaNo ratings yet

- MCB Bank Key Fact Statement for Deposit ProductsDocument3 pagesMCB Bank Key Fact Statement for Deposit ProductsHassan AhmadNo ratings yet

- Being MeDocument2 pagesBeing Metharun venkatNo ratings yet

- "Being Me" Savings Account (January 01,2021) : Issuance Fee (Personalised Debit Card) Rs.150Document2 pages"Being Me" Savings Account (January 01,2021) : Issuance Fee (Personalised Debit Card) Rs.150Sweta MistryNo ratings yet

- Tariff Sheet For HDFC Bank Individual Demat AccountDocument1 pageTariff Sheet For HDFC Bank Individual Demat Accountnirvana8791No ratings yet

- Au Digital Savings Account - 31 - MarchDocument5 pagesAu Digital Savings Account - 31 - MarchZach KingNo ratings yet

- Super Savings Account: Common Service ChargesDocument2 pagesSuper Savings Account: Common Service ChargesSantosh ThakurNo ratings yet

- Schedule-Of-Charges SBM BankDocument14 pagesSchedule-Of-Charges SBM Bankmegha90909No ratings yet

- Schedule of Business Bank Account ChargesDocument2 pagesSchedule of Business Bank Account ChargesJella RamakrishnaNo ratings yet

- Service Charges and Fees For Current Account Advantage Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Advantage Effective July 01 2022rupak.album.03No ratings yet

- From Kotak WebsiteDocument20 pagesFrom Kotak WebsiteHimadri Shekhar VermaNo ratings yet

- Current Account For CSC - VLE W.E.F 1st September 2016: Monthly Average Balance NILDocument1 pageCurrent Account For CSC - VLE W.E.F 1st September 2016: Monthly Average Balance NILKulwinder Singh MayaanNo ratings yet

- Parameter Au Samriddhi Current AccountDocument2 pagesParameter Au Samriddhi Current Accounthiteshmohakar15No ratings yet

- Burgundy Fees and Charges As On 2019 09Document7 pagesBurgundy Fees and Charges As On 2019 09Shivanshu SinghNo ratings yet

- YES FIRST Programme Criteria and Benefits w.e.f. February 1, 2020Document2 pagesYES FIRST Programme Criteria and Benefits w.e.f. February 1, 2020Ayush JadhavNo ratings yet

- Iob Visa Gold CardDocument1 pageIob Visa Gold CardsanathNo ratings yet

- Titanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowDocument2 pagesTitanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowGaurav Singh RathoreNo ratings yet

- Burgundy Fees and Charges 14 08Document8 pagesBurgundy Fees and Charges 14 08ShipaNo ratings yet

- SoSC NR 08Document2 pagesSoSC NR 08dumbNo ratings yet

- SOC-Resident Savings Account Wef 1st Sep 2023Document34 pagesSOC-Resident Savings Account Wef 1st Sep 2023bbh90895No ratings yet

- Core Savings AccountDocument2 pagesCore Savings AccountVarshaNo ratings yet

- Schedule of Charges Edge Business 1st Feb 20 PDFDocument2 pagesSchedule of Charges Edge Business 1st Feb 20 PDFRavie S DhamaNo ratings yet

- In Mid Savings AccountDocument4 pagesIn Mid Savings Accountjb6c8h4rnmNo ratings yet

- Au Digital Savings AccountDocument5 pagesAu Digital Savings AccountQuaint ZoneNo ratings yet

- MCB Young Key Fact SheetDocument3 pagesMCB Young Key Fact SheetFahad MagsiNo ratings yet

- Issuance Fee (Personalised Debit Card) Rs.150/-: Grace Period Granted - 1 Month As Per RBI Guidelines To Restore MABDocument2 pagesIssuance Fee (Personalised Debit Card) Rs.150/-: Grace Period Granted - 1 Month As Per RBI Guidelines To Restore MABSäñtôsh Kûmãr PrâdhäñNo ratings yet

- Indus Infotech December292017Document1 pageIndus Infotech December292017Harssh S ShrivastavaNo ratings yet

- Basic Saving Account With Complete KYCDocument2 pagesBasic Saving Account With Complete KYCVarsha100% (1)

- Caart PDFDocument2 pagesCaart PDFvinodNo ratings yet

- SOC Indus Multiplier MaxDocument4 pagesSOC Indus Multiplier Maxmanoj baroka0% (1)

- NRI Savings Account Tariff StructureDocument4 pagesNRI Savings Account Tariff StructureRishiNo ratings yet

- Sosc Credit CardsDocument10 pagesSosc Credit Cardsvishakanksha01No ratings yet

- Institution Savings Account Exclusive PremiumDocument5 pagesInstitution Savings Account Exclusive Premiumjeffy yesudasNo ratings yet

- Changes in Upcoming Schedule of Charges (Jul-Dec-2022)Document1 pageChanges in Upcoming Schedule of Charges (Jul-Dec-2022)Nasir MuhmoodNo ratings yet

- Angel One ProfileDocument2 pagesAngel One ProfileAyush VermaNo ratings yet

- Accounting Note or SampleDocument2 pagesAccounting Note or Samplenilo bia100% (1)

- INDUE LIMITED - Current & Historical Company ExtractDocument28 pagesINDUE LIMITED - Current & Historical Company ExtractclarencegirlNo ratings yet

- Impact of human resource accounting on firm valueDocument6 pagesImpact of human resource accounting on firm valuePawar ComputerNo ratings yet

- Cambridge Master of Finance (MFin) 2013 BrochureDocument13 pagesCambridge Master of Finance (MFin) 2013 BrochureCambridgeJBSNo ratings yet

- Ily Abella Surveyors Income StatementDocument6 pagesIly Abella Surveyors Income StatementJoy Santos33% (3)

- QUARTER 2 GENMATH WEEK3 Lesson 26 4 Solving Problems Involving Simple and Compound InterestDocument3 pagesQUARTER 2 GENMATH WEEK3 Lesson 26 4 Solving Problems Involving Simple and Compound InterestLalaine Jhen Dela CruzNo ratings yet

- Shane and AssociatesDocument2 pagesShane and AssociatesCheryl MountainclearNo ratings yet

- Richard W. Ellson: February 2016: Ellson Consulting, LLC: Raleigh, NCDocument4 pagesRichard W. Ellson: February 2016: Ellson Consulting, LLC: Raleigh, NCNick HuronNo ratings yet

- A Project Report On Comparative Study inDocument82 pagesA Project Report On Comparative Study inBhawna Rajput100% (1)

- Concept of Income Tax ExplainedDocument27 pagesConcept of Income Tax Explainedsosexyme123No ratings yet

- Cindy MYOB 2Document1 pageCindy MYOB 2SMK NusantaraNo ratings yet

- Practice Test Mid Term 1Document9 pagesPractice Test Mid Term 1Bob ColtonNo ratings yet

- Case 10.1Document13 pagesCase 10.1Chin Figura100% (1)

- Original PDF Financial Management in The Sport Industry 2nd Edition PDFDocument41 pagesOriginal PDF Financial Management in The Sport Industry 2nd Edition PDFmathew.robertson818100% (34)

- HDFC Life Guaranteed Savings Plan - Brochure - RetailDocument8 pagesHDFC Life Guaranteed Savings Plan - Brochure - RetailVikram SinghNo ratings yet

- Mr. Mir Ashraf Ali ROLL NO: 2281-14-672-077: "Demat Account"Document103 pagesMr. Mir Ashraf Ali ROLL NO: 2281-14-672-077: "Demat Account"ahmedNo ratings yet

- L.3 (Indemnity & Guarantee, Bailment & Pledge)Document16 pagesL.3 (Indemnity & Guarantee, Bailment & Pledge)nomanashrafNo ratings yet

- Chapter 13 To 15Document13 pagesChapter 13 To 15Cherry Mae GecoNo ratings yet

- Mr. Radhakrishnan's business transactionsDocument11 pagesMr. Radhakrishnan's business transactionsPriyasNo ratings yet

- Summary of The Contents (#1 To 10) As BelowDocument22 pagesSummary of The Contents (#1 To 10) As BelowRajesh UjjaNo ratings yet

- TVOMDocument55 pagesTVOMSamson CottonNo ratings yet

- COMM 308 Course Outline - Summer 2 2021 - Section CADocument14 pagesCOMM 308 Course Outline - Summer 2 2021 - Section CAOlivia ZakemNo ratings yet

- Allied Banking Corp vs Lim Sio WanDocument12 pagesAllied Banking Corp vs Lim Sio WanKathleen MartinNo ratings yet

- Pricing Products and Services True/False QuestionsDocument49 pagesPricing Products and Services True/False QuestionsKimyongseongNo ratings yet

- Bank StatementDocument4 pagesBank Statementuriaswalliser.frnb1.04.4No ratings yet

- Republic Planters Bank Vs CADocument2 pagesRepublic Planters Bank Vs CAMohammad Yusof Mauna MacalandapNo ratings yet

- AR PresentationDocument32 pagesAR PresentationSaq IbNo ratings yet

- Unit I Introduction To Marketing FinanceDocument3 pagesUnit I Introduction To Marketing Financerajesh laddhaNo ratings yet

- Appellate Decision Bank of America v. Limato NJ A-4880-10T3Document14 pagesAppellate Decision Bank of America v. Limato NJ A-4880-10T3Adam Deutsch100% (2)

- Testbirds GmbH Credit Note for Rahul Rohera WorkDocument1 pageTestbirds GmbH Credit Note for Rahul Rohera WorkRahul RoheraNo ratings yet