Professional Documents

Culture Documents

4 5 Project Analysis

Uploaded by

Arpan ChattopadhyayCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

4 5 Project Analysis

Uploaded by

Arpan ChattopadhyayCopyright:

Available Formats

Teaching notes Session 4 & 5

PROJECT ANALYSIS

Obtaining the financing needed to fund the cost of project requires satisfying

prospective long-term lenders about technical feasibility, marketing and creditworthiness.

Financiers also need to be satisfied about environment, ecological and social impact of the

project.

The process in banking parlance is known as pre-credit appraisal process. Pre-credit

appraisal is most critical part of lending process as through this process bank/lenders takes

decision to accept or reject a loan proposal. The terms and conditions on which the loan is

sanctioned are also decided through the appraisal process. The quality appraisal ultimately

determines quality of loan assets. The process of project analysis appraisal commonly

involves assessment of-

a) Managerial Analysis determines capacity and competence of the proponent to do

business. A lender must do proper due diligence through background check of the

proponent, his work experience, his qualification, his market report and his past

credit history so as to satisfy himself about honesty, integrity and business ability of

the applicant. In case of legal person like Limited Liability Company, he should

examine its charter to satisfy that it can engage itself in a particular line of

business; it has requisite powers to borrow and execute documents. Lender should

examine the adequacy and suitability of the management structure, quality of

management and management capability under stress, personnel policies including

succession planning, bargaining power with suppliers and financial strength. Since

majority of loan default occurs due to managerial inefficiency, it is essential that

managerial competence be assessed beyond doubt when a loan proposal is

appraised. A KYC norm for proper identification of the borrower is also completed

through this process.

b) Technical analysis involves assessment of availability of technology- latest or

proven to produce required quantity and quality of goods. It also involves assessing

availability of skilled manpower, availability of raw material, availability of

machinery, pollution or environment clearance required if any so that project can

be completed without time or cost overrun.

c) Market analysis is done through demand forecasting and stimulating demand

through product promotion and selling strategies. Market appraisal also involves

assessment of competitive advantage which unit enjoys, economic and social

trends which may have bearing on the demand of the product, who are the major

buyers, whether market demand is stable, seasonal or permanent, what substitutes

are already available in the market, what is extent of competition from abroad,

what are import restrictions, what product range and product mix is available,

what distribution set up is required for marketing the product, how government

policies are likely to impact the future of the industry, and whether raw material,

skilled labor, power etc. is available for uninterrupted product of the unit. Overall

[Type text] Page 1

Teaching notes Session 4 & 5

objective of market appraisal is to satisfy that industry outlook is promising, there is

no tariff or other barriers for growth and environmental and political factors are

favorable.

d) Social cost benefit analysis: Social problems arise largely due to conflicts between

economic development and natural resources. Economic losses and social costs

from environmental degradation often occur long after the economic benefits of

development have been realized. Most often, the development projects provide

economic benefits and better living environment, but they also affect local people

adversely. Social impact assessments help in understanding such impacts. In large

project social impact analysis is one of the critical assessment tool for accepting or

otherwise of project financing.

e) Environmental and ecological impact analysis: Like social impact analysis,

environmental and ecological impact analysis is also done to understand impact of

the project on environment and ecology of the country. Through impact analysis it

is also determined what project will have to do to restore or balance the ecology or

environment.

f) Financial analysis is determined by assessment of cost of project and Promoters

ability to raise requisites resources to meet the project cost. This also involves

analyzing financial health of the project by examining debt equity ratio, interest

coverage ratio, debt service coverage ratio and loan life coverage ratio. In large

projects cash flow is critically analyzed to ensure that project will be able to serve

its commitment. For the purpose of determining the viability of the project and

the ability of the borrower to service its loan and give a reasonable return on the

capital; estimates of cost of production, profitability, cash flow and projected

balance sheets are obtained from the borrower/s at least for the period of

repayment of debt. These are inter-related and are prepared on the basis of the

estimated cost of the project, sources of finance envisaged and various

assumptions regarding capacity utilization, availability of inputs and their price

trend, selling price of end product etc. The lender should critically look into the

important assumption capacity utilization, cost of raw material, estimates of wages

and salaries, estimates of administrative expenses, selling prices assumed and

provision made for depreciation and statutory taxes. Verification/scrutiny of

profitability is the core of qualitative appraisal of a project. The entrepreneurs are

very often tempted to present a rosy picture. A prudent and skillful lender should

not only critically verify the figures furnished by the project sponsor but he should

also satisfy himself with the basis of various assumptions on which sales and

profitability estimates have been arrived at. Assessment of financial requirement of

the borrower for acquiring fixed assets and for meeting working capital

requirement is final part of appraisal process. Terms and conditions of loan, interest

rate, margin, security- both primary and collateral, repayment terms, period of limit

and documents to be executed are all determined through this process.

[Type text] Page 2

Teaching notes Session 4 & 5

It may be noted that each project has got its own strength and weakness. Such

strength and weakness may further vary from project to project even in same industry.

Accordingly, for the purpose of financing a particular project assessment should be

based on evaluation of the strengths and weakness of the individual projects. The

inherent protective factors, competitive edge, level of technological up gradation,

operational efficiency, managerial capability, cash flow trend, liquidity, past trend of

servicing debts, government policies and status affecting the industry/ project need to

be critically examined.

[Type text] Page 3

You might also like

- Project Report of MaggiDocument78 pagesProject Report of Maggicooldilip199285% (143)

- Chapter 2Document17 pagesChapter 2Arpan ChattopadhyayNo ratings yet

- Chapter 2Document17 pagesChapter 2Arpan ChattopadhyayNo ratings yet

- Please Indicate The Age Group You Belong To:: 21-30 Years 31-40 Years 41-50 Years 51-60 Years 60 Years and AboveDocument2 pagesPlease Indicate The Age Group You Belong To:: 21-30 Years 31-40 Years 41-50 Years 51-60 Years 60 Years and AboveArpan ChattopadhyayNo ratings yet

- La Case StudyDocument1 pageLa Case StudyArpan ChattopadhyayNo ratings yet

- Chapter 2Document17 pagesChapter 2Arpan ChattopadhyayNo ratings yet

- La Case StudyDocument1 pageLa Case StudyArpan ChattopadhyayNo ratings yet

- La Case StudyDocument1 pageLa Case StudyArpan ChattopadhyayNo ratings yet

- La Case StudyDocument1 pageLa Case StudyArpan ChattopadhyayNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Financial Accounting A Managerial Perspective PDFDocument3 pagesFinancial Accounting A Managerial Perspective PDFVijay Phani Kumar10% (10)

- Module-1 SolutionsDocument6 pagesModule-1 SolutionsARYA GOWDANo ratings yet

- Cisco RV340, RV345, RV345P, and RV340W Dual WAN Security RouterDocument13 pagesCisco RV340, RV345, RV345P, and RV340W Dual WAN Security RouterluzivanmoraisNo ratings yet

- Mac16Cm, Mac16Cn Triacs: Silicon Bidirectional ThyristorsDocument6 pagesMac16Cm, Mac16Cn Triacs: Silicon Bidirectional Thyristorsmauricio zamoraNo ratings yet

- ESTATE TAX SUMMARYDocument35 pagesESTATE TAX SUMMARYRhea Mae Sa-onoyNo ratings yet

- Raymond ReddingtonDocument3 pagesRaymond Reddingtonapi-480760579No ratings yet

- Abu Bakr GumiDocument9 pagesAbu Bakr GumiajismandegarNo ratings yet

- Agenda Item 1.4: IPSAS-IFRS Alignment Dashboard OverviewDocument23 pagesAgenda Item 1.4: IPSAS-IFRS Alignment Dashboard OverviewHadera TesfayNo ratings yet

- Drying and Firing Shrinkages of Ceramic Whiteware Clays: Standard Test Method ForDocument2 pagesDrying and Firing Shrinkages of Ceramic Whiteware Clays: Standard Test Method ForEliKax!No ratings yet

- Shipper Information - Not Part of This B/L ContractDocument1 pageShipper Information - Not Part of This B/L ContractMelíssa AlvaradoNo ratings yet

- Unit 12 - MCQs BBN AnswersDocument50 pagesUnit 12 - MCQs BBN Answersايهاب العنبوسيNo ratings yet

- Company Auditor Appointment & RotationDocument14 pagesCompany Auditor Appointment & RotationSurendar SirviNo ratings yet

- United States Court of Appeals, Sixth CircuitDocument9 pagesUnited States Court of Appeals, Sixth CircuitScribd Government DocsNo ratings yet

- Legal Research Step by Step, 5th EditionDocument346 pagesLegal Research Step by Step, 5th Editionderin100% (2)

- TRE ASA (TRE ASA) - Value Investors Club Analysis of Norwegian Holding CompanyDocument9 pagesTRE ASA (TRE ASA) - Value Investors Club Analysis of Norwegian Holding CompanyLukas Savickas100% (1)

- (30.html) : Read and Listen To Sentences Using The WordDocument3 pages(30.html) : Read and Listen To Sentences Using The Wordshah_aditNo ratings yet

- Beat The TerrorDocument73 pagesBeat The TerrorKashvi KatewaNo ratings yet

- A-Academy Chapter (4)Document27 pagesA-Academy Chapter (4)alaamabood6No ratings yet

- Intermediate Directions: U. S. CitiesDocument2 pagesIntermediate Directions: U. S. CitiesNouvel Malin BashaNo ratings yet

- InventoriesDocument17 pagesInventoriesYash AggarwalNo ratings yet

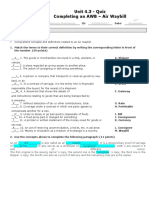

- 1DONE2. CX Quiz 4.3 - Air WaybillDocument1 page1DONE2. CX Quiz 4.3 - Air WaybillProving ThingsNo ratings yet

- Connectors and Linkers b1Document1 pageConnectors and Linkers b1Anonymous 0NhiHAD100% (1)

- Full Text Constitution Amendmenst and Concept of StateDocument221 pagesFull Text Constitution Amendmenst and Concept of StateMelissa NadresNo ratings yet

- Services Institute of Medical Sciences Merit List Session 2014-2015Document18 pagesServices Institute of Medical Sciences Merit List Session 2014-2015Shawn ParkerNo ratings yet

- Main Ethical Concerns of The Philippine Society in Relation To Business PDFDocument10 pagesMain Ethical Concerns of The Philippine Society in Relation To Business PDFGwyneth MalagaNo ratings yet

- Trinsey v. PelagroDocument12 pagesTrinsey v. Pelagrojason_schneider_16100% (3)

- Semester V and VI: University of MumbaiDocument52 pagesSemester V and VI: University of MumbaiMittal GohilNo ratings yet

- Curtis v. Loether, 415 U.S. 189 (1974)Document8 pagesCurtis v. Loether, 415 U.S. 189 (1974)Scribd Government DocsNo ratings yet

- SC Annual Report - LegalDocument52 pagesSC Annual Report - LegalelciNo ratings yet

- CG and Other StakeholdersDocument13 pagesCG and Other StakeholdersFrandy KarundengNo ratings yet