Professional Documents

Culture Documents

Kapatiran NG Mga Naglilingkod Sa Pamahalaan NG Pilipinas VS TAN

Uploaded by

baijam0 ratings0% found this document useful (0 votes)

66 views3 pagesOriginal Title

Kapatiran ng mga Naglilingkod sa Pamahalaan ng Pilipinas VS TAN.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

66 views3 pagesKapatiran NG Mga Naglilingkod Sa Pamahalaan NG Pilipinas VS TAN

Uploaded by

baijamCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

Kapatiran ng mga Naglilingkod sa Pamahalaan ng second sale, but on every subsequent sale, as well.

EO

Pilipinas, Inc. vs. Tan [G.R. No. 81311 June 30, 1988] 273 merely increased the VAT on every sale to 10%,

unless zero-rated or exempt.

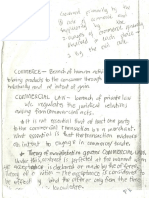

FACTS: These four (4) petitions seek to nullify Executive

Order No. 273 issued by the President of the Philippines, ISSUE: Whether or not EO 273 is unconstitutional.

and which amended certain sections of the National

Internal Revenue Code and adopted the value-added tax,

for being unconstitutional in that its enactment is not HELD: No. Petitioners have failed to show that EO 273

allegedly within the powers of the President; that the VAT was issued capriciously and whimsically or in an arbitrary

or despotic manner by reason of passion or personal

is oppressive, discriminatory, regressive, and violates the

due process and equal protection clauses and other hostility. It appears that a comprehensive study of the

provisions of the 1987 Constitution. VAT had been extensively discussed by this framers and

other government agencies involved in its

The VAT is a tax levied on a wide range of goods and implementation, even under the past administration. As

services. It is a tax on the value, added by every seller, the Solicitor General correctly sated. "The signing of E.O.

with aggregate gross annual sales of articles and/or 273 was merely the last stage in the exercise of her

services, exceeding P200,00.00, to his purchase of goods legislative powers. The legislative process started long

and services, unless exempt. VAT is computed at the rate before the signing when the data were gathered,

of 0% or 10% of the gross selling price of goods or gross proposals were weighed and the final wordings of the

measure were drafted, revised and finalized. Certainly, it

receipts realized from the sale of services.

cannot be said that the President made a jump, so to

speak, on the Congress, two days before it convened."

The VAT is said to have eliminated privilege taxes,

multiple rated sales tax on manufacturers and producers,

advance sales tax, and compensating tax on importations. Next, the petitioners claim that EO 273 is oppressive,

The framers of EO 273 that it is principally aimed to discriminatory, unjust and regressive.

rationalize the system of taxing goods and services;

simplify tax administration; and make the tax system The petitioners" assertions in this regard are not

more equitable, to enable the country to attain economic supported by facts and circumstances to warrant their

recovery. conclusions. They have failed to adequately show that the

VAT is oppressive, discriminatory or unjust. Petitioners

The VAT is not entirely new. It was already in force, in a merely rely upon newspaper articles which are actually

modified form, before EO 273 was issued. As pointed out hearsay and have evidentiary value. To justify the

by the Solicitor General, the Philippine sales tax system, nullification of a law, there must be a clear and

prior to the issuance of EO 273, was essentially a single unequivocal breach of the Constitution, not a doubtful

stage value added tax system computed under the "cost and argumentative implication.

subtraction method" or "cost deduction method" and

was imposed only on original sale, barter or exchange of As the Court sees it, EO 273 satisfies all the requirements

articles by manufacturers, producers, or importers. of a valid tax. It is uniform. A tax is considered uniform

Subsequent sales of such articles were not subject to when it operates with the same force and effect in every

sales tax. However, with the issuance of PD 1991 on 31 place where the subject may be found." The sales tax

October 1985, a 3% tax was imposed on a second sale, adopted in EO 273 is applied similarly on all goods and

which was reduced to 1.5% upon the issuance of PD 2006 services sold to the public, which are not exempt, at the

on 31 December 1985, to take effect 1 January 1986. constant rate of 0% or 10%.

Reduced sales taxes were imposed not only on the

The disputed sales tax is also equitable. It is imposed only Atty. Ernesto Salunat

on sales of goods or services by persons engage in

business with an aggregate gross annual sales exceeding o Partner of ASSA Law and Associates -

P200,000.00. Small corner sari-sari stores are Counsel of the Philippine Public School

consequently exempt from its application. Likewise Teachers Association (PPSTA)

exempt from the tax are sales of farm and marine o Retained Counsel of PPSTA Board

products, spared as they are from the incidence of the members (His brother Aurelio Salunat

VAT, are expected to be relatively lower and within the being part of the board)

reach of the general public.

Complainants filed an intra-corporate case

The Court likewise finds no merit in the contention of the against its members of the Board before the SEC

petitioner Integrated Customs Brokers Association of the and Ombudsman for unlawful spending and the

Philippines that EO 273, more particularly the new Sec. undervalued sale of real property of the PPSTA.

103 (r) of the National Internal Revenue Code, unduly Here, Atty. Salunat entered his appearance as

discriminates against customs brokers. counsel for the PPSTA Board members.

o Complainants contend conflict of interest

At any rate, the distinction of the customs brokers from and that he violate Rule 15.06 as he

the other professionals who are subject to occupation tax assured the board members that he will

under the Local Tax Code is based upon material win the case.

differences, in that the activities of customs brokers (like

those of stock, real estate and immigration brokers) Atty. Salunat responded by saying:

partake more of a business, rather than a profession and o He appeared as counsel for the PPSTA

were thus subjected to the percentage tax under Sec. 174

Board members in behalf of the ASSA

of the National Internal Revenue Code prior to its Law and Associates, and only filed a

amendment by EO 273. EO 273 abolished the percentage manifestation of extreme urgency

tax and replaced it with the VAT. where another lawyer handled the case.

HORNILLA v. SALUNAT o Complainant instigated, orchestrated and

indiscriminately filed the case against the

July 1, 2003

PPSTA board members.

Ynares-Santiago, J

o He denied ensuring the victory of the

board members as he only assured that

the truth will come out.

RULE 15.03 A lawyer shall not represent conflicting

interests except by written consent of all concerned o Atty. Ricafort guilty of gross violation of

given after a full disclosure of the facts. oath of office for filling trumped-up

charges against him.

Benedicto Hornilla and Federico Ricafort filed an

administrative complaint with the IBP on BAR Discipline Test of inconsistent interests:

against Ernest Hornilla for illegal and unethical practice

o whether or not in behalf of one client, it

and conflict of interest.

is the lawyers duty to fight for an issue

or claim, but it is his duty to oppose it for

the other client. In brief, if he argues for

FACTS:

one client, this argument will be opposed

by him when he argues for the other

client

o whether the acceptance of a new relation

will prevent an attorney from the full

discharge of his duty of undivided fidelity

and loyalty to his client or invite suspicion

of unfaithfulness or double dealing in the

performance thereof.

Derivative suit = corporation vs. stockholders

ISSUE:

Can a lawyer engaged by a corporation defend members

of the board of the same corporation in a derivative suit?

HELD: Guilty of representing conflicting interests.

admonished to observe a higher degree of fidelity in the

practice of his profession.

Conflict of interest because of dual

representation in all derivative actions.

The interest of the corporate client is paramount

and should not be influence by any interest of the

individual corporate officials = conflict of interest

WARNED that a repetition of similar acts will be dealt

with more severly.

You might also like

- DepEd Form 137-ADocument2 pagesDepEd Form 137-Akianmiguel84% (116)

- Sacay V DENRDocument2 pagesSacay V DENRJam ZaldivarNo ratings yet

- Taule CaseDocument9 pagesTaule CaseyzarvelascoNo ratings yet

- Perpetual Savings Bank V Fajardo by CastroDocument2 pagesPerpetual Savings Bank V Fajardo by CastroJoana CastroNo ratings yet

- Introduction To Law and Legal SystemsDocument41 pagesIntroduction To Law and Legal Systemsbaijam100% (1)

- Introduction To Law and Legal SystemsDocument41 pagesIntroduction To Law and Legal Systemsbaijam100% (1)

- U0001 720148211316536201482113165384Document6 pagesU0001 720148211316536201482113165384Parveen Dagar0% (1)

- Motion For Leave Demurrer) MelgarDocument11 pagesMotion For Leave Demurrer) MelgarRichard Conrad Foronda Salango100% (2)

- Erector Advertising Sign Group Inc vs. NLRCDocument2 pagesErector Advertising Sign Group Inc vs. NLRCEmmagine EyanaNo ratings yet

- Rabor Vs CSCDocument36 pagesRabor Vs CSCNiel S. DefensorNo ratings yet

- Lawyer Suspended for Abandoning Client CaseDocument6 pagesLawyer Suspended for Abandoning Client CaseGideon InesNo ratings yet

- Social JusticeDocument10 pagesSocial JusticeReno T. SunioNo ratings yet

- Dr. Phylis Rio v. Colegio de Sta. Rosa-Makati And/or Sr. Marilyn Gustilo G.R. No. 189629, August 06, 2014Document2 pagesDr. Phylis Rio v. Colegio de Sta. Rosa-Makati And/or Sr. Marilyn Gustilo G.R. No. 189629, August 06, 2014mrlouiemabalotNo ratings yet

- Some DigestDocument8 pagesSome DigestRed Sainz AbeloNo ratings yet

- Pimentel vs. Aguirre examines limits of presidential power over LGUsDocument2 pagesPimentel vs. Aguirre examines limits of presidential power over LGUsLIERANo ratings yet

- Affidavit ComplaintDocument2 pagesAffidavit ComplaintLouisPNo ratings yet

- Case Digest TAXDocument12 pagesCase Digest TAXCayle Andre E. NepomucenoNo ratings yet

- Petitioner Vs Vs Respondent: en BancDocument5 pagesPetitioner Vs Vs Respondent: en BancSeok Gyeong KangNo ratings yet

- Case 4 PRC V de GuzmanDocument2 pagesCase 4 PRC V de GuzmanChuck NorrisNo ratings yet

- COMELEC vs Toledo Age Limit DisputeDocument3 pagesCOMELEC vs Toledo Age Limit DisputeDyane Garcia-AbayaNo ratings yet

- 17.MARK-monserrat Vs CeronDocument2 pages17.MARK-monserrat Vs CeronbowbingNo ratings yet

- Lansang vs. Court of AppealsDocument2 pagesLansang vs. Court of AppealsKrisha PajarilloNo ratings yet

- Director of Lands Vs CA - 102858 - July 28, 1997 - JDocument5 pagesDirector of Lands Vs CA - 102858 - July 28, 1997 - JJacinth DelosSantos DelaCerna100% (1)

- Case 08 - Chavez v. NLRCDocument2 pagesCase 08 - Chavez v. NLRCbernadeth ranolaNo ratings yet

- 04 - Republic Vs RambuyongDocument2 pages04 - Republic Vs RambuyongRogelio Rubellano IIINo ratings yet

- ElecLaw - Romualdez-Marcos vs. Comelec, G.R. No. 119976 September 18, 1995Document2 pagesElecLaw - Romualdez-Marcos vs. Comelec, G.R. No. 119976 September 18, 1995Lu CasNo ratings yet

- Quasi-Judicial Function - Judicial Determination of Sufficiency of StandardsDocument2 pagesQuasi-Judicial Function - Judicial Determination of Sufficiency of StandardsCristelle Elaine ColleraNo ratings yet

- 112 Otis - Co. V Pennsylvania R. Co. (Tan)Document3 pages112 Otis - Co. V Pennsylvania R. Co. (Tan)AlexandraSoledadNo ratings yet

- Master Iron V NLRCDocument2 pagesMaster Iron V NLRCMigs GayaresNo ratings yet

- Deano Vs GodinezDocument3 pagesDeano Vs GodinezRepolyo Ket CabbageNo ratings yet

- NPC v. Henson, GR 129998, December 29, 1998Document2 pagesNPC v. Henson, GR 129998, December 29, 1998LeyardNo ratings yet

- SEC v. Universal Rightfield Property Holdings, Inc., G.R. No. 181381Document12 pagesSEC v. Universal Rightfield Property Holdings, Inc., G.R. No. 181381Rhenfacel Manlegro100% (1)

- Municipal Board Term LimitsDocument2 pagesMunicipal Board Term LimitsNikita DaceraNo ratings yet

- Issue:: Estribillo vs. Department of Agrarian Reform G.R. NO. 159674, JUNE 30, 2006Document3 pagesIssue:: Estribillo vs. Department of Agrarian Reform G.R. NO. 159674, JUNE 30, 2006Angelica Mojica LaroyaNo ratings yet

- Caloocan City vs CA - Mayor's Authority to File Cases on Behalf of the CityDocument2 pagesCaloocan City vs CA - Mayor's Authority to File Cases on Behalf of the CityPrincess AyomaNo ratings yet

- Feliciano v. GisonDocument5 pagesFeliciano v. GisonAlianna Arnica MambataoNo ratings yet

- Vallacar Transit V Jocelyn Catubig (Agas)Document3 pagesVallacar Transit V Jocelyn Catubig (Agas)Junsi AgasNo ratings yet

- Automatic Reversion Rule Does Not Apply in MPDC Position DisputeDocument2 pagesAutomatic Reversion Rule Does Not Apply in MPDC Position DisputeChelle BelenzoNo ratings yet

- Tancinco v. Ferrer-CallejaDocument8 pagesTancinco v. Ferrer-CallejaAlec VenturaNo ratings yet

- 75 PALE Bernardo v. RamosDocument2 pages75 PALE Bernardo v. RamosJoesil Dianne SempronNo ratings yet

- Case Digests in Labor RelationsDocument2 pagesCase Digests in Labor RelationsbarcelonnaNo ratings yet

- STAT CON - Insular Lumber Co V CADocument3 pagesSTAT CON - Insular Lumber Co V CAerosfreuyNo ratings yet

- MACTAN CEBU INTERNATIONAL AIRPORT AUTHORITY MCIAA Petitioner v. CITY OF LAPU LAPU AND ELENA T. PACALDO Respondents. G.R. No. 181756 June 15 2015 PDFDocument23 pagesMACTAN CEBU INTERNATIONAL AIRPORT AUTHORITY MCIAA Petitioner v. CITY OF LAPU LAPU AND ELENA T. PACALDO Respondents. G.R. No. 181756 June 15 2015 PDFTan Mark AndrewNo ratings yet

- (Digest) Cena v. CSCDocument3 pages(Digest) Cena v. CSCJechel TBNo ratings yet

- 7 NATU-VS-TORRES DigestDocument2 pages7 NATU-VS-TORRES DigestYvonne DolorosaNo ratings yet

- 19 (S-DP) Lucena Grand Terminal V Jac LinerDocument2 pages19 (S-DP) Lucena Grand Terminal V Jac LinerMayoree FlorencioNo ratings yet

- FBTC v. ChuaDocument14 pagesFBTC v. ChuaiptrinidadNo ratings yet

- COMELEC recall resolution upheldDocument5 pagesCOMELEC recall resolution upheldcedec_009No ratings yet

- General Welfare Clause Cases SummaryDocument8 pagesGeneral Welfare Clause Cases Summarycrystine jaye senadreNo ratings yet

- Feliciano & Gonzales vs. DND (Admin Law December 10)Document2 pagesFeliciano & Gonzales vs. DND (Admin Law December 10)Amiel Arrieta ArañezNo ratings yet

- 006 COSCOLLUELA Re in The Matter of Clarification of ExemptionDocument2 pages006 COSCOLLUELA Re in The Matter of Clarification of ExemptionKatrina CoscolluelaNo ratings yet

- Akbayan VS ComelecDocument17 pagesAkbayan VS ComelecMaria Celiña PerezNo ratings yet

- Ampatuan V Hon. DILG Sec Puno DigestDocument3 pagesAmpatuan V Hon. DILG Sec Puno DigestDonn LinNo ratings yet

- NUBE Vs Judge LazaroDocument3 pagesNUBE Vs Judge LazaroRichmond LucasNo ratings yet

- 11 DIGEST G R No 179597 IGLESIA FILIPINA INDEPENDIENTE Vs HEIRSDocument2 pages11 DIGEST G R No 179597 IGLESIA FILIPINA INDEPENDIENTE Vs HEIRSJonel L. SembranaNo ratings yet

- Mayor Vs MacaraigDocument2 pagesMayor Vs MacaraigCass ParkNo ratings yet

- CASE-Pangasinan Transportation Co. v. The Public Service CommissionDocument7 pagesCASE-Pangasinan Transportation Co. v. The Public Service CommissionJosh GatusNo ratings yet

- Government vs. Monte de PiedadDocument1 pageGovernment vs. Monte de Piedademmaniago08No ratings yet

- Civil Service Commission authority over appointmentsDocument5 pagesCivil Service Commission authority over appointmentsAlicia Jane NavarroNo ratings yet

- Philreca Vs DILGDocument1 pagePhilreca Vs DILGGilbertNo ratings yet

- COMELEC V. ESPAOLDocument2 pagesCOMELEC V. ESPAOLYPENo ratings yet

- Taxation 2 Vat Case DigestsDocument27 pagesTaxation 2 Vat Case DigestsErnest MancenidoNo ratings yet

- Kapatiran NG Mga Naglilingkod Sa Pamahalaan NG Pilipinas, Inc. vs. Tan G.R. No. 81311 June 30, 1988Document2 pagesKapatiran NG Mga Naglilingkod Sa Pamahalaan NG Pilipinas, Inc. vs. Tan G.R. No. 81311 June 30, 1988piptipaybNo ratings yet

- Kapatiran V TanDocument6 pagesKapatiran V TanClaudine Christine A. VicenteNo ratings yet

- Kapatiran vs. TanDocument2 pagesKapatiran vs. TanPatricia Denise Emilio-Del Pilar100% (1)

- AbstractDocument19 pagesAbstractbaijamNo ratings yet

- Lyceum Case of Secondary MeaningDocument1 pageLyceum Case of Secondary MeaningbaijamNo ratings yet

- Dhe A0037400Document19 pagesDhe A0037400baijamNo ratings yet

- Problem Solving in Early Mathematics TeachingDocument19 pagesProblem Solving in Early Mathematics TeachingbaijamNo ratings yet

- Commercial Law Reviewer - AteneoDocument47 pagesCommercial Law Reviewer - AteneoElmer PinoNo ratings yet

- Kho Vs CADocument1 pageKho Vs CARenz Owen DacasinNo ratings yet

- Converse Vs UniversalDocument13 pagesConverse Vs UniversalbaijamNo ratings yet

- AbstractDocument19 pagesAbstractbaijamNo ratings yet

- Del RoxsarioDocument8 pagesDel RoxsarioIrene QuimsonNo ratings yet

- Criminal Law Basics (40Document122 pagesCriminal Law Basics (40baijamNo ratings yet

- G.R. Nos. L-27425 & L-30505 - Converse Rubber Vs Jacinto RubberDocument8 pagesG.R. Nos. L-27425 & L-30505 - Converse Rubber Vs Jacinto RubberArmand Patiño AlforqueNo ratings yet

- Criminal Law Basics (40Document122 pagesCriminal Law Basics (40baijamNo ratings yet

- G.R. Nos. L-27425 & L-30505 - Converse Rubber Vs Jacinto RubberDocument8 pagesG.R. Nos. L-27425 & L-30505 - Converse Rubber Vs Jacinto RubberArmand Patiño AlforqueNo ratings yet

- Birkenstock v. Philippine Shoe ExpoDocument17 pagesBirkenstock v. Philippine Shoe ExpoPrincess Trisha Joy UyNo ratings yet

- Commercial Law Reviewer - AteneoDocument47 pagesCommercial Law Reviewer - AteneoElmer PinoNo ratings yet

- Introduction To Law and Legal SystemsDocument115 pagesIntroduction To Law and Legal SystemsbaijamNo ratings yet

- Criminal Law 2: Sample QuestionsDocument6 pagesCriminal Law 2: Sample QuestionsbaijamNo ratings yet

- Criminal LawDocument5 pagesCriminal LawbaijamNo ratings yet

- Posadas V Ombudsman (341 SCRA 388) : DigestsDocument2 pagesPosadas V Ombudsman (341 SCRA 388) : Digestsbaijam0% (1)

- How To Use This TextDocument10 pagesHow To Use This TextDaenerysNo ratings yet

- The Rules of ExponentsDocument4 pagesThe Rules of ExponentsbaijamNo ratings yet

- Notes 0001Document16 pagesNotes 0001baijamNo ratings yet

- LEGAL WRITING GUIDEDocument13 pagesLEGAL WRITING GUIDENaa'emah Abdul BasitNo ratings yet

- Basic Management Principles for PharmacistsDocument88 pagesBasic Management Principles for PharmacistsDaveP.100% (1)

- English GrammarDocument51 pagesEnglish Grammaralexdow100% (1)

- San Beda 2009 Commercial Law (Insurance)Document30 pagesSan Beda 2009 Commercial Law (Insurance)Claire RoxasNo ratings yet

- Balane's Wills Case DoctrinesDocument22 pagesBalane's Wills Case DoctrinesAnjo AlbaNo ratings yet

- Ateneo 2007 Commercial LawDocument124 pagesAteneo 2007 Commercial LawJingJing Romero100% (54)

- LASC Case SummaryDocument3 pagesLASC Case SummaryLuisa Elena HernandezNo ratings yet

- Analysis of Freedom of Trade and Commerce in India Under The Indian ConstitutionDocument19 pagesAnalysis of Freedom of Trade and Commerce in India Under The Indian ConstitutionHari DuttNo ratings yet

- Digest 25. Serrano de Agbayani vs. PNB, 38 SCRA 429Document1 pageDigest 25. Serrano de Agbayani vs. PNB, 38 SCRA 429Inez Monika Carreon PadaoNo ratings yet

- Teodoro M. Hernandez V The Honorable Commission On Audit FactsDocument2 pagesTeodoro M. Hernandez V The Honorable Commission On Audit FactsAngela Louise SabaoanNo ratings yet

- Catherine A. Brown 2017 - Non-Discrimination and Trade in Services - The Role of Tax TreatiesDocument287 pagesCatherine A. Brown 2017 - Non-Discrimination and Trade in Services - The Role of Tax Treatieshodienvietanh2015535016No ratings yet

- Bloomberg Businessweek USA - March 25 2024 Freemagazines TopDocument76 pagesBloomberg Businessweek USA - March 25 2024 Freemagazines Topkyc7c87qf7No ratings yet

- Safety Data Sheet: Zetpol 1020Document8 pagesSafety Data Sheet: Zetpol 1020henrychtNo ratings yet

- CHM580Document7 pagesCHM580Azreen AnisNo ratings yet

- Assigned Cases SpreadsheetDocument13 pagesAssigned Cases SpreadsheetJulius David UbaldeNo ratings yet

- 2019 Civil Service Exams Schedule (CSE-PPT) : Higit PaDocument12 pages2019 Civil Service Exams Schedule (CSE-PPT) : Higit PaJean LiaoNo ratings yet

- Sing To The Dawn 2Document4 pagesSing To The Dawn 2Nur Nabilah80% (5)

- Business Law Midterm ExamDocument6 pagesBusiness Law Midterm ExammoepoeNo ratings yet

- 5.17.18 FIRST STEP ActDocument28 pages5.17.18 FIRST STEP ActSenator Cory BookerNo ratings yet

- A Message To The Glorious ChurchDocument109 pagesA Message To The Glorious ChurchhungrynicetiesNo ratings yet

- GAISANO INC. v. INSURANCE CO. OF NORTH AMERICADocument2 pagesGAISANO INC. v. INSURANCE CO. OF NORTH AMERICADum DumNo ratings yet

- Case Digest: SUPAPO v. SPS. ROBERTO AND SUSAN DE JESUS PDFDocument4 pagesCase Digest: SUPAPO v. SPS. ROBERTO AND SUSAN DE JESUS PDFGerard LeeNo ratings yet

- Haryana GovtDocument1 pageHaryana GovtSudhanshu NautiyalNo ratings yet

- Accounting For Merchandising Operations Chapter 6 Test Questions PDFDocument31 pagesAccounting For Merchandising Operations Chapter 6 Test Questions PDFDe Torres JobelNo ratings yet

- Role of Jamaat Islami in Shaping Pakistan PoliticsDocument15 pagesRole of Jamaat Islami in Shaping Pakistan PoliticsEmranRanjhaNo ratings yet

- Ass. 15 - Gender and Development - Questionnaire - FTC 1.4 StudentsDocument5 pagesAss. 15 - Gender and Development - Questionnaire - FTC 1.4 StudentsKriza mae alvarezNo ratings yet

- Consent of Occupant FormDocument2 pagesConsent of Occupant FormMuhammad Aulia RahmanNo ratings yet

- NC LiabilitiesDocument12 pagesNC LiabilitiesErin LumogdangNo ratings yet

- InwaDocument3 pagesInwadfgrtg454gNo ratings yet

- 2007 Political Law - Atty AlobbaDocument4 pages2007 Political Law - Atty AlobbaMark PiadNo ratings yet

- Alcatel-Lucent Short Message Service CenterDocument3 pagesAlcatel-Lucent Short Message Service CenterLL ABNo ratings yet

- Depository ReceiptsDocument2 pagesDepository Receiptskurdiausha29No ratings yet

- Test BDocument5 pagesTest Bhjgdjf cvsfdNo ratings yet