Professional Documents

Culture Documents

Ratio Analysis: Net FA TA Cash Shareholder Funds

Uploaded by

ashwini_goyalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ratio Analysis: Net FA TA Cash Shareholder Funds

Uploaded by

ashwini_goyalCopyright:

Available Formats

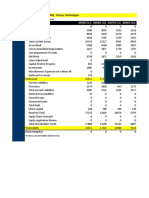

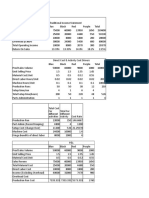

Net FA TA Cash Shareholder funds

55040 123517 5034 78248

46929 845780 118729 330471

398782 1120348 4953 664851

35242 142730 464 100826

22433 112166 1175 55999

16974 69373 444 26891

57320 532110 250770 420920

5288 8830 232 5635

799242 2228653 132186 1229674

77165 17945700 1325496 228438

Ratio Analysis

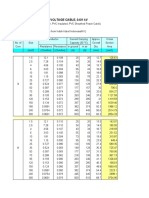

Net FA/TA % Net FA/TA %cash/total assets Debt Equity Ratio

0.45 44.56 4.08 0.00

0.06 5.55 14.04 0.08

0.36 35.59 0.44 0.16

0.25 24.69 0.33 0.09

0.20 20.00 1.05 0.05

0.24 24.47 0.64 1.00

0.11 10.77 47.13 0.01

0.60 59.89 2.63 0.03

0.36 35.86 5.93 0.19

0.00 0.43 7.39 8.02

Debt CA CL Inventories

350 68477 37463 11215

27332 798851 487495 97976

103654 721566 323624 11

9163 107488 29538 25112

2843 89733 53277 6696

26906 52399 12828 402

3030 474790 108160 111730

144 3542 2571 324

228438 1429411 770541 57044

1831309 17868535 935751 16227547

Inventory/Total capitalCurrent Ratio Industry classification

0.14 1.83 Pharma (Low FA and low debt)

0.27 1.64 Very Less FA and low debt ( Retailfood)

0.00 2.23 Automobile (Too Much Credit sales and purchase involved

as it is slow moving)

0.23 3.64 Oil and Gas (To counter high volitality of price,

higherinventory is maintained)

0.11 1.68 Hospitality ( least current ratio because all cash sales

involved)

0.01 4.08 Heavy engeneering (High FA and debt because it is too

much investment intensive industry)

0.26 4.39 IT (Cash rich industry with minimal debt)

0.06 1.38 Telecommunication (FA are properly spread across

because it requires good investment)

0.04 1.86 Cement Industry (It is a balance industry)

7.88 19.10 Banking ( current ratio too high because of too much

liquidity they havve to maintain and the money deposited

by customers is a liability for bank)

You might also like

- Site Capacity Refill Threshold Mean # of Customers/Day Mean Gallons/Customer STD Dev of Gallons RequestedDocument16 pagesSite Capacity Refill Threshold Mean # of Customers/Day Mean Gallons/Customer STD Dev of Gallons RequestedMuhammad Tayyab MadniNo ratings yet

- Avg - Total Asset: Ebit Interest Exp Income Before TaxDocument28 pagesAvg - Total Asset: Ebit Interest Exp Income Before TaxMd Nazmus SakibNo ratings yet

- GA Examples-Excel Templ - ConstrDocument756 pagesGA Examples-Excel Templ - ConstrIlham BadarrudinNo ratings yet

- Performance at A GlanceDocument7 pagesPerformance at A GlanceLima MustaryNo ratings yet

- Total: Rezultate Economico Financiare/haDocument25 pagesTotal: Rezultate Economico Financiare/haRodion SoareNo ratings yet

- AVIVADocument5 pagesAVIVAHAFIS JAVEDNo ratings yet

- 651 - Burst Pressure Versus Casing Wear Calculation DDDocument4 pages651 - Burst Pressure Versus Casing Wear Calculation DDQuality controllerNo ratings yet

- 1.walmart and Macy's Case StudyDocument4 pages1.walmart and Macy's Case StudyJyothi VenuNo ratings yet

- Tyler Standard Screen ScaleDocument2 pagesTyler Standard Screen Scaleikkii hiyoriNo ratings yet

- Case 8-Group 16Document14 pagesCase 8-Group 16reza041No ratings yet

- StabilitasDocument6 pagesStabilitasdwi arfaNo ratings yet

- ITC Key RatiosDocument1 pageITC Key RatiosHetNo ratings yet

- ATC Valuation - Solution Along With All The ExhibitsDocument20 pagesATC Valuation - Solution Along With All The ExhibitsAbiNo ratings yet

- Amount in Million Taka: Year Total Assets Current Assets Current Liabilities Reteined EarningsDocument4 pagesAmount in Million Taka: Year Total Assets Current Assets Current Liabilities Reteined Earningsযুবরাজ মহিউদ্দিনNo ratings yet

- GCMMF Balance Sheet 1994 To 2009Document37 pagesGCMMF Balance Sheet 1994 To 2009Tapankhamar100% (1)

- Weighted Average Cost of Capital (WACC) - 2017 Value Weight Required Rate of ReturnDocument4 pagesWeighted Average Cost of Capital (WACC) - 2017 Value Weight Required Rate of ReturnravinyseNo ratings yet

- Kimia FMIPA UI TOF MS ES+ data analysisDocument1 pageKimia FMIPA UI TOF MS ES+ data analysisWulanNo ratings yet

- PMK Ethyl Glycidate CAS 28578-16-7: Analysis Result TableDocument2 pagesPMK Ethyl Glycidate CAS 28578-16-7: Analysis Result TablenatNo ratings yet

- PMK Cas 28578-16-7Document2 pagesPMK Cas 28578-16-7natNo ratings yet

- ITC Key RatiosDocument1 pageITC Key RatiosTushar SoniNo ratings yet

- Parcial Final Alberto Osorio Murillo..Document5 pagesParcial Final Alberto Osorio Murillo..Fray RomeroNo ratings yet

- Balance Sheet (2009-2000) - Infosys Technologies: All Numbers Are in INR and in x10MDocument18 pagesBalance Sheet (2009-2000) - Infosys Technologies: All Numbers Are in INR and in x10MGirish RamachandraNo ratings yet

- BetasDocument1 pageBetaslu acoriNo ratings yet

- Du Pont FlexDocument12 pagesDu Pont Flexhayagreevan vNo ratings yet

- TCS financial analysis reveals strong growthDocument5 pagesTCS financial analysis reveals strong growthREVATHI NAIRNo ratings yet

- Analysis of Heavy Engineering Company: Presented By: Pragya JaiswalDocument20 pagesAnalysis of Heavy Engineering Company: Presented By: Pragya JaiswalpragyarahuljaiswalNo ratings yet

- Mesh To Micron Conversion Chart Ecologix SystemsDocument3 pagesMesh To Micron Conversion Chart Ecologix SystemsPitipong SunkhongNo ratings yet

- Your Holding Details - BAKK1484Document4 pagesYour Holding Details - BAKK1484pandyahitesh6351145099No ratings yet

- Asset Classsification 2005-10Document2 pagesAsset Classsification 2005-10Anoop MohantyNo ratings yet

- Act WorkDocument10 pagesAct WorkAsad Uz JamanNo ratings yet

- Itc Key RatioDocument1 pageItc Key RatioAbhishek AgarwalNo ratings yet

- Basic Fret CalculatorDocument2 pagesBasic Fret CalculatorBenjamin RivasNo ratings yet

- Payroll Period: Number of Working Days:: October 1-15, 2020 11Document3 pagesPayroll Period: Number of Working Days:: October 1-15, 2020 11Nikki OloanNo ratings yet

- Termo 9-12-21Document2 pagesTermo 9-12-21HolaNo ratings yet

- Ms (%) Ed (Kcal/Kg) PC (%) Proteina Animapd (%) FC (%) Ee (%)Document20 pagesMs (%) Ed (Kcal/Kg) PC (%) Proteina Animapd (%) FC (%) Ee (%)JUAN FERNANDO SEGURA CASTRONo ratings yet

- Nepal Stock Exchange Summary Report: Market Stats and Sector IndexDocument15 pagesNepal Stock Exchange Summary Report: Market Stats and Sector IndexJeevan ChaudharyNo ratings yet

- 403-General Phase Slowscan - Co - FDS - FASS - 1D - 1Document5 pages403-General Phase Slowscan - Co - FDS - FASS - 1D - 1KuthuraikaranNo ratings yet

- HUDCO Financial Performance Overview FY11-FY23Document68 pagesHUDCO Financial Performance Overview FY11-FY23shivam vermaNo ratings yet

- Sr. Name: Registration #: Hassan Abid Ilyas 36230 Muhammad Saad 36229 Kamran Shah 23662 Noman Ahmed 37554Document19 pagesSr. Name: Registration #: Hassan Abid Ilyas 36230 Muhammad Saad 36229 Kamran Shah 23662 Noman Ahmed 37554hasan abidNo ratings yet

- Codigo de Colores CableadoDocument8 pagesCodigo de Colores CableadoLed Alcalá100% (3)

- Latihan 2 - Kelompok 2Document20 pagesLatihan 2 - Kelompok 2InnabilaNo ratings yet

- Assignment 3 - 1180100739Document1 pageAssignment 3 - 1180100739mayuriNo ratings yet

- Tata Motors - Ratio AnalysisDocument6 pagesTata Motors - Ratio AnalysisAshvi AgrawalNo ratings yet

- Chinese FDI in African Countries 1990-2020Document45 pagesChinese FDI in African Countries 1990-2020fdwfwffNo ratings yet

- Essential equipment rental listDocument58 pagesEssential equipment rental listAlexandru DanțișNo ratings yet

- Fixed Acidity Volatile Acidity Citric Acid Residual Sugar Chlorides Count Mean STD Min 25% 50% 75% Max Free Sulfur DioxideDocument2 pagesFixed Acidity Volatile Acidity Citric Acid Residual Sugar Chlorides Count Mean STD Min 25% 50% 75% Max Free Sulfur DioxideOkky JayadiNo ratings yet

- Calculo de NominaDocument6 pagesCalculo de NominaingenierofavianNo ratings yet

- Ramco Cement BsDocument6 pagesRamco Cement BsBharathNo ratings yet

- Finance - Balance Sheet - Mahanagar Telephone Nigam Ltd (Rs in CrDocument26 pagesFinance - Balance Sheet - Mahanagar Telephone Nigam Ltd (Rs in CrDaman Deep Singh ArnejaNo ratings yet

- Nepal Stock Exchange Limited: Singhadurbar Plaza, Kathmandu, Nepal. Phone: 977-1-4250758,4250735, Fax: 977-1-4262538Document58 pagesNepal Stock Exchange Limited: Singhadurbar Plaza, Kathmandu, Nepal. Phone: 977-1-4250758,4250735, Fax: 977-1-4262538member2 mtriNo ratings yet

- Espectro Respuesta x=5Document75 pagesEspectro Respuesta x=5Anderson Torres FerrelNo ratings yet

- Esfuerzo y DefDocument2 pagesEsfuerzo y DefAle LunaNo ratings yet

- Undersize & Oversize Cumulative Analysis: Particle SizeDocument2 pagesUndersize & Oversize Cumulative Analysis: Particle SizeJohn NathanNo ratings yet

- Numerical integration of a system of differential equationsDocument366 pagesNumerical integration of a system of differential equationsDiana Sofia Serna PeñaNo ratings yet

- LOW VOLTAGE CABLE SPECIFICATIONS AND LOAD DATADocument9 pagesLOW VOLTAGE CABLE SPECIFICATIONS AND LOAD DATAef.sofyaNo ratings yet

- Catálogo de Componentes de RF y Microondas de Precisión - July 2022Document79 pagesCatálogo de Componentes de RF y Microondas de Precisión - July 2022Tecnico 01 MegacomNo ratings yet

- Ultima AsignacionDocument18 pagesUltima Asignacionjose franciscoNo ratings yet

- Wire Gauges - Current RatingsDocument1 pageWire Gauges - Current RatingsluixfoNo ratings yet

- Dimensions and Weights Per Metre ID-based On ISO 4200 SizesDocument2 pagesDimensions and Weights Per Metre ID-based On ISO 4200 SizesUrtzi LegorburuNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- Case 3 Classic PenDocument4 pagesCase 3 Classic Penashwini_goyalNo ratings yet

- Case 3 Classic PenDocument4 pagesCase 3 Classic Penashwini_goyalNo ratings yet

- Share of GDP over time for major countries from 0-1998 ADDocument1 pageShare of GDP over time for major countries from 0-1998 ADashwini_goyalNo ratings yet

- Operations Rose at 7.99%Document9 pagesOperations Rose at 7.99%ashwini_goyalNo ratings yet

- Significant PoliciesDocument6 pagesSignificant Policiesashwini_goyalNo ratings yet

- Excercise Ranking InvestmentsDocument7 pagesExcercise Ranking Investmentsashwini_goyalNo ratings yet

- Ranking InvestmentsDocument2 pagesRanking Investmentsashwini_goyalNo ratings yet

- BK Marketing MixDocument2 pagesBK Marketing Mixashwini_goyalNo ratings yet

- WDM Concepts & Components - FOC - Students - April 2011Document94 pagesWDM Concepts & Components - FOC - Students - April 2011ashwini_goyalNo ratings yet

- Segment Report PoliciesDocument1 pageSegment Report Policiesashwini_goyalNo ratings yet

- AAA AUTO Group EGM Draft MinutesDocument9 pagesAAA AUTO Group EGM Draft Minutessmart investorsNo ratings yet

- CAPE Accounting 1999Document6 pagesCAPE Accounting 1999Naomi HugginsNo ratings yet

- Autoparts India Pvt. LTD, Standalone. With An Aim To Learn How Wonjin Manage TheirDocument2 pagesAutoparts India Pvt. LTD, Standalone. With An Aim To Learn How Wonjin Manage TheirVimal MorkelNo ratings yet

- I003Document3 pagesI003concast_pankajNo ratings yet

- Capitol University: Cagayan de Oro CityDocument2 pagesCapitol University: Cagayan de Oro CityJase JbmNo ratings yet

- LESSON 1: Introduction To Financial Management: TargetDocument51 pagesLESSON 1: Introduction To Financial Management: Targetmardie dejanoNo ratings yet

- Tute 1, 2018 - Intro To Tax and Residency - SolutionDocument4 pagesTute 1, 2018 - Intro To Tax and Residency - SolutionerinNo ratings yet

- IFSC Project As Per Schedule - GIFT - LivemintDocument5 pagesIFSC Project As Per Schedule - GIFT - LivemintManish BokdiaNo ratings yet

- Project 3Document22 pagesProject 3Cole FunNo ratings yet

- The Baby Boomer BustDocument13 pagesThe Baby Boomer BustPeter MaverNo ratings yet

- Nego San BedaDocument24 pagesNego San Bedataktak69100% (3)

- Corpo Lecture NotesDocument40 pagesCorpo Lecture Notesgilberthufana446877100% (1)

- Investools Introduction To Trading Stocks SlidesDocument285 pagesInvestools Introduction To Trading Stocks SlidesChristopher HeathNo ratings yet

- Alternative Investment Funds: Meaning, Taxation, Regulations & ListDocument7 pagesAlternative Investment Funds: Meaning, Taxation, Regulations & Listsanket karwaNo ratings yet

- Corporate Loan OriginationDocument37 pagesCorporate Loan Originationk_adhikary67% (3)

- ABC - PFRS 3 Final Exam ReviewDocument17 pagesABC - PFRS 3 Final Exam ReviewCristel TannaganNo ratings yet

- NIL MidtermDocument28 pagesNIL MidtermAnonymous B0aR9GdNNo ratings yet

- NVIDIA Corp. $173.19 Rating: Neutral Neutral NeutralDocument3 pagesNVIDIA Corp. $173.19 Rating: Neutral Neutral Neutralphysicallen1791No ratings yet

- Answer KeyDocument6 pagesAnswer KeyClaide John OngNo ratings yet

- Marco Glisson April 15Document127 pagesMarco Glisson April 15glimmertwinsNo ratings yet

- PL Capital v. Orrstown Financial Services BoardDocument53 pagesPL Capital v. Orrstown Financial Services BoardPublic OpinionNo ratings yet

- Makati City Treasurer vs Mermac, Inc. local business tax case dismissedDocument2 pagesMakati City Treasurer vs Mermac, Inc. local business tax case dismissedAngelNo ratings yet

- Balance Sheet of Shakti PumpsDocument2 pagesBalance Sheet of Shakti PumpsAnonymous 3OudFL5xNo ratings yet

- Central Depository Company of PakistanDocument58 pagesCentral Depository Company of Pakistanmolvi001No ratings yet

- Midterm Exam Portfoliomanagement Fall 2019Document3 pagesMidterm Exam Portfoliomanagement Fall 2019eya feguiriNo ratings yet

- Articlesofincorporation PDFDocument13 pagesArticlesofincorporation PDFJowi SuNo ratings yet

- FundroomDocument6 pagesFundroomTalib KhanNo ratings yet

- Case Bausch & LombDocument4 pagesCase Bausch & LombMohan BishtNo ratings yet

- Bajaj Capital Wealthprenuer Internship InductionDocument15 pagesBajaj Capital Wealthprenuer Internship Inductionharshita khadayteNo ratings yet

- Essentials of Treasury Management - Working Capital Class Final OutlineDocument32 pagesEssentials of Treasury Management - Working Capital Class Final OutlinePablo VeraNo ratings yet