Professional Documents

Culture Documents

Accounting System

Uploaded by

SebastianOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting System

Uploaded by

SebastianCopyright:

Available Formats

Unit 1- ACCOUNTING AND ITS FUNCTIONS

1. The Emerging Role of Accounting

Stewardship Accounting: In earlier times in history, wealthy people employed

‘stewards’ to manage their property. These stewards rendered an account of their

stewardship to their owners periodically.

Financial Accounting

Cost Accounting

Management Accounting

Social Responsibility Accounting: Social responsibility accounting widens the

scope of accounting by considering the social effects of business decisions, in addition

to the economic effects.

Human Resource Accounting: Human Resource Accounting is a branch of accounting

which seeks to report and emphasise the importance of human resources

(knowledgeable, trained, loyal and committed employees) in a company’s earning

process and total assets. In simple words, it involves accounting for investment in

people and their replacement costs, as well as accounting for the economic values of

people to an organisation.

Inflation Accounting:It aims at correcting the distortions in the reported results

causedby price level changes. Generally, rising prices during inflation have the

distorting influence of overstating the profit.

2. Accounting As An Information System

Accounting served as an information provider to the following users;

Shareholders and Investors: Since shareholders and other investors have

investedtheir wealth in a business enterprise, they are interested in knowing

periodically aboutthe profitability of the enterprise

Creditors: The main concern of the creditors is focused on the credit worthiness of

the firms and its ability to meet its financial obligations.

Employees: Greater emphasis is on industrial democracy through employee

participation in management decisions has important implications for the supply of

information to employees.

Government: The task of the Government in managing the industrial economy of the

country is facilitated if accounting information is presented, as far as possible, in a

uniform manner.

Management: Planning, organising, and controlling are all concerned with making

decisions which have their own specific information requirements.

Consumers and others.

3. Accounting Personnel

Internal Auditor:An Internal Auditor is an employee of an organisation. The internal

auditor is responsible for performing monitoring activities, and other services,

including designing and operating the system of internal control, auditing the data

reported to the directors of the company, and assisting external auditors.

Controller: or Chief Accountant.She/he is overall in-charge of all activities

comprising financial accounting, cost accounting, managementaccounting, tax

accounting, etc. She/he exercises authority both for accounting withinthe

organisation and for external reporting.

Treasurer: She/he is the custodian and manager of all the cash and near-cash

resources of the firm.

Finance Officer: Financing decision is concerned with determining the optimum

financing mix, or capital structure. It examines the various methods by which a firm

obtains short-term and long-term finances through various alternative sources.

Unit 2- ACCOUNTING CONCEPTS AND STANDARDS

1. The Accounting Framework

The American Institute of Certified Public Accountants (AICPA) and Generally Accepted

Accounting Principles (GAAP) encompass the conventions, rulesand procedures necessary to

define accepted accounting practice at a particular

2. Accounting Concepts

Business Entity Concept: In accounting we make a distinction between business and the

owner. An enterprise is an economic unit, separate and apart from the owner, or owners. As

such, transactions of the business and those of the owners should be accounted for, and

reported separately.

Money Measurement Concept:States that all transactions are to be recorded only

inmonetary terms and record only those transactions, which can be measured in

moneyterms. It ignores intangibles like employee loyalty and customer satisfaction, as

theycannot be expressed in money terms. It also assumes records on the basis of a stable

monetary unit.

Going concern concept refers to the expectation that the organisation will have an indefinite

life. This assumption has an important bearing on how the assets are to be valued.

Cost Concept states that an asset is to be recorded in books of accounts at a price for, or at a

cost incurred to acquire it.

Accrual concept says that an accountant should recognise incomes and expenses when they

have actually accrued, irrespective of whether cash is received or paid.

Conservatism concept forbids the inclusion of unrealised gains but advocates provision for

possible losses.

Materiality concept admonishes that events of relatively small importance need not be given

a detailed or theoretically correct treatment. They may be ignored for recording purpose.

Consistency concept envisages that accounting information should be prepared on a

consistent basis from period to period, and within periods there should be consistent

treatment of similar items.

Periodicity concept divides the life of a business into smaller time periods which are

generally one year, and the accountant is supposed to prepare necessary financial

statements for each time period.

3. The Changing Nature Of Generally Accepted Accounting Principles

Generally accepted accounting principles are usually developed by professional accounting

bodies like American Institute of Certified Public Accountants (AICPA) and Institute of

Chartered Accountants of India (ICAI). Since the environment, in which business operates,

undergoes constant changes as a result of changes in economic and financial policies of the

Government and changes in the structure of business, continued evaluation of the relevance

of generally accepted accounting principles is required.

4. Accounting Standards In India

With a view to harmonise varying accounting policies and practices currently in use in India,

the Institute of Chartered Accountants of India (ICAI) formed the Accounting Standards

Board (ASB). So far, twenty eight standards have been issued by ASB.

You might also like

- Accounting For EMBA Prepared by Ahmed SabbirDocument95 pagesAccounting For EMBA Prepared by Ahmed Sabbirsabbir ahmed100% (1)

- CHAPTER ONE PrinDocument15 pagesCHAPTER ONE Prinbelaybekele88No ratings yet

- Accounting and Business - Part IDocument38 pagesAccounting and Business - Part IJaymark LigcubanNo ratings yet

- Financial Accounting 1 document overviewDocument21 pagesFinancial Accounting 1 document overviewVignesh CNo ratings yet

- Chapter One: Accounting Practice and PrinciplesDocument16 pagesChapter One: Accounting Practice and PrinciplesTesfamlak MulatuNo ratings yet

- 11 Accountancy Theory - 2022-23 [EM]Document36 pages11 Accountancy Theory - 2022-23 [EM]kms195kds2007No ratings yet

- Introduction To Accounting Basic AccountingDocument16 pagesIntroduction To Accounting Basic AccountingNiña VelinaNo ratings yet

- Basic Accounting 1Document44 pagesBasic Accounting 122100629No ratings yet

- Accounting I ModuleDocument92 pagesAccounting I ModuleJay Githuku100% (1)

- Accounting 1: Fundamental ofDocument78 pagesAccounting 1: Fundamental ofLuisitoNo ratings yet

- UNIT-IV-Accounting TheoryDocument14 pagesUNIT-IV-Accounting TheoryNarayanapally DeepikaNo ratings yet

- 1 Session OneDocument6 pages1 Session OneHardik ShahNo ratings yet

- ACCO101Document37 pagesACCO101Belle AustriaNo ratings yet

- CH 1 Review of The Accounting Process OmDocument28 pagesCH 1 Review of The Accounting Process OmStephenray EstarejaNo ratings yet

- Financial Accounting Managers GuideDocument13 pagesFinancial Accounting Managers GuideMohit TripathiNo ratings yet

- Part 1 - Acc - 2016Document10 pagesPart 1 - Acc - 2016Sheikh Mass JahNo ratings yet

- Concept of Accounting: The Language of BusinessDocument13 pagesConcept of Accounting: The Language of BusinessSanthu bm97No ratings yet

- REVIEW OF THE ACCOUNTING PROCESS OM Chapter 1Document29 pagesREVIEW OF THE ACCOUNTING PROCESS OM Chapter 1shanNo ratings yet

- Chapter-1 Introduction To Accounting and BusinessDocument17 pagesChapter-1 Introduction To Accounting and BusinessTsegaye Belay100% (1)

- Unit-I: SVD & SGL College of Management and Technology: RajahmundryDocument38 pagesUnit-I: SVD & SGL College of Management and Technology: RajahmundryHappyPrinceNo ratings yet

- 413 Block1Document208 pages413 Block1Subramanyam Devarakonda100% (1)

- Unit 1 KMBN103Document16 pagesUnit 1 KMBN103Anuj YadavNo ratings yet

- Financial Accounting FrameworkDocument45 pagesFinancial Accounting Frameworkajit_satapathy1988No ratings yet

- Basic Accounting Crash Course on Assets & LiabilitiesDocument5 pagesBasic Accounting Crash Course on Assets & LiabilitiesCyra JimenezNo ratings yet

- Chapter 1: Session 1 Introduction To Financial AccountingDocument161 pagesChapter 1: Session 1 Introduction To Financial AccountingHarshini Akilandan100% (1)

- Accounting:: Information For Decision MakingDocument29 pagesAccounting:: Information For Decision MakingKhursheed Ahmad KhanNo ratings yet

- Accounting & Financial Management Mca 405ADocument22 pagesAccounting & Financial Management Mca 405ANaveen Kumar reddy ENo ratings yet

- Far ReviewerDocument16 pagesFar ReviewerAizle Trixia AlcarazNo ratings yet

- Shahjalal University of Science &technologyDocument12 pagesShahjalal University of Science &technologyপ্রজ্ঞা লাবনীNo ratings yet

- Accounting For Managers Chapter 1Document53 pagesAccounting For Managers Chapter 1Filomena AndjambaNo ratings yet

- Fundamentals of AccountingDocument39 pagesFundamentals of Accountingchaitra kiranNo ratings yet

- Accounting 1 Introduction Defines ObjectivesDocument8 pagesAccounting 1 Introduction Defines ObjectivesJamodvipulNo ratings yet

- Lecture Notes - Introduction To AccountingDocument21 pagesLecture Notes - Introduction To Accountinghua chen yuNo ratings yet

- Uses of Accounting Information and The Financial StatementsDocument15 pagesUses of Accounting Information and The Financial StatementsSweta KumariNo ratings yet

- Introduction To AccountingDocument6 pagesIntroduction To AccountingNicole_Gella_G_1555No ratings yet

- Introduction To AccountingDocument37 pagesIntroduction To AccountingRey ViloriaNo ratings yet

- GFA06 - Financial Analysis and Appraisal of ProjectsDocument48 pagesGFA06 - Financial Analysis and Appraisal of ProjectswossenNo ratings yet

- Week 1 AccDocument24 pagesWeek 1 AccLawrence MosizaNo ratings yet

- Accounting Theory Handout 1Document43 pagesAccounting Theory Handout 1Ockouri Barnes100% (3)

- What Is AccountingDocument4 pagesWhat Is AccountingJoann SuficienciaNo ratings yet

- Meaning of AccountingDocument50 pagesMeaning of AccountingAyushi KhareNo ratings yet

- MBA Accounting Theory Questions Amity Business SchoolDocument18 pagesMBA Accounting Theory Questions Amity Business SchoolkanikaNo ratings yet

- Accounting defined as economic info systemDocument11 pagesAccounting defined as economic info systemKyrzen NovillaNo ratings yet

- FAR-HandoutDocument7 pagesFAR-Handoutq47cn4rbdhNo ratings yet

- AE13A Introduction To AccountingDocument33 pagesAE13A Introduction To AccountingSherylLiquiganNo ratings yet

- Modules 1Document4 pagesModules 1JT GalNo ratings yet

- Assignment CH-1 Introduction To AccountingDocument7 pagesAssignment CH-1 Introduction To AccountingHarsh SachdevaNo ratings yet

- Introduction To Accounting Class 11 Notes Accountancy Chapter 1Document6 pagesIntroduction To Accounting Class 11 Notes Accountancy Chapter 1SSDLHO sevenseasNo ratings yet

- Accounting IntroductionDocument18 pagesAccounting Introductionአረጋዊ ሐይለማርያምNo ratings yet

- Why we need accounting: essential financial info for decisionsDocument32 pagesWhy we need accounting: essential financial info for decisionsDaniel LaurenteNo ratings yet

- ABM1compilation NotesDocument9 pagesABM1compilation NotesMa Geneva Metille BroñolaNo ratings yet

- Cfas Lesson 1Document5 pagesCfas Lesson 1Rosemalyn JoseNo ratings yet

- Fa&a All Unit (KMBN 103)Document41 pagesFa&a All Unit (KMBN 103)abdheshkumar7897No ratings yet

- Fundamental of Accounting: Chapter 1-2Document31 pagesFundamental of Accounting: Chapter 1-2Renshey Cordova MacasNo ratings yet

- Uniathena - Basic Accounting CourseDocument21 pagesUniathena - Basic Accounting CourseAdalia MahabirNo ratings yet

- AFM Short NotesDocument56 pagesAFM Short NotesthamiztNo ratings yet

- FinAcc Chapter 1Document8 pagesFinAcc Chapter 1IrmaNo ratings yet

- Fabm Reviewer 1Document9 pagesFabm Reviewer 1Ronaldo BulanNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Readings For CompensationDocument2 pagesReadings For CompensationSebastianNo ratings yet

- Detailed Design and Production Information For Main Hull Steel StructuresDocument4 pagesDetailed Design and Production Information For Main Hull Steel StructuresRoni VincentNo ratings yet

- Snipping Tool Print JobDocument1 pageSnipping Tool Print JobSebastianNo ratings yet

- TribonDocument3 pagesTribonSebastianNo ratings yet

- TribonDocument16 pagesTribonSebastian100% (2)

- TribonDocument3 pagesTribonSebastianNo ratings yet

- Snipping Tool Print Job PDFDocument1 pageSnipping Tool Print Job PDFSebastianNo ratings yet

- AVEVA Hull DetailedDocument4 pagesAVEVA Hull DetailedSebastianNo ratings yet

- AVEVA Initial DesignDocument4 pagesAVEVA Initial DesignPaulo Estevao100% (1)

- Tribon M3 Brochure PDFDocument32 pagesTribon M3 Brochure PDFVioleta SimionNo ratings yet

- AVEVA Hull Drafting 12.0: Business BenefitsDocument2 pagesAVEVA Hull Drafting 12.0: Business BenefitsSebastianNo ratings yet

- AVEVA Hull Structural PDFDocument4 pagesAVEVA Hull Structural PDFSebastianNo ratings yet

- Optimize ship design with NAPA naval architecture softwareDocument8 pagesOptimize ship design with NAPA naval architecture softwareSebastianNo ratings yet

- AVEVA Initial DesignDocument4 pagesAVEVA Initial DesignPaulo Estevao100% (1)

- AVEVA Hull DetailedDocument4 pagesAVEVA Hull DetailedSebastianNo ratings yet

- MCA (Revised) Term-End Examination December, 2015: Time: 3 Hours Maximum Marks: 100 (Weightage 75%)Document2 pagesMCA (Revised) Term-End Examination December, 2015: Time: 3 Hours Maximum Marks: 100 (Weightage 75%)SebastianNo ratings yet

- MCS 034june10Document2 pagesMCS 034june10rajeysh_shahNo ratings yet

- SIM Editor User Menu: 先按装 SET UP.在按装 PL-2303VISTADocument22 pagesSIM Editor User Menu: 先按装 SET UP.在按装 PL-2303VISTASebastianNo ratings yet

- MCS-035 Accounting and Financial Management CourseDocument3 pagesMCS-035 Accounting and Financial Management CourseSebastianNo ratings yet

- Software Engg June 2014Document2 pagesSoftware Engg June 2014SebastianNo ratings yet

- Mca 3 SyllabusDocument8 pagesMca 3 SyllabusSebastianNo ratings yet

- Software Engg Dec-12 PDFDocument2 pagesSoftware Engg Dec-12 PDFSebastianNo ratings yet

- SetupDocument12 pagesSetupSebastianNo ratings yet

- Mcsl-36 Lab SyllabusDocument1 pageMcsl-36 Lab SyllabusSebastianNo ratings yet

- Software Engg December 2014Document2 pagesSoftware Engg December 2014SebastianNo ratings yet

- Time: 3 Hours Maximum Marks: 100 (Vveightage 75%) Note: Question No. 1 Is Compulsory. Attempt Any Three Questions From The RestDocument2 pagesTime: 3 Hours Maximum Marks: 100 (Vveightage 75%) Note: Question No. 1 Is Compulsory. Attempt Any Three Questions From The RestSebastianNo ratings yet

- Software Engg June-11Document3 pagesSoftware Engg June-11SebastianNo ratings yet

- MCA Software Engineering Exam QuestionsDocument2 pagesMCA Software Engineering Exam QuestionsSebastianNo ratings yet

- Budget Implementation Bu ErwinDocument15 pagesBudget Implementation Bu Erwin-Green YusufNo ratings yet

- Acca Brochure - 2014 - Final PDFDocument8 pagesAcca Brochure - 2014 - Final PDFtipu1sultan_1No ratings yet

- Sitia Sparkle Co Purchases Its Raw Material From Africa Which Remains in Transit For Three WeeksDocument2 pagesSitia Sparkle Co Purchases Its Raw Material From Africa Which Remains in Transit For Three WeeksTashfeenNo ratings yet

- Tax Notes For Construction Industry in AlbaniaDocument117 pagesTax Notes For Construction Industry in AlbaniaEduart GjokutajNo ratings yet

- Index Internal Auditor 2004 - 2016Document222 pagesIndex Internal Auditor 2004 - 2016pembazak100% (1)

- Your Firm Has Been Engaged To Examine The Financial Statements PDFDocument3 pagesYour Firm Has Been Engaged To Examine The Financial Statements PDFHassan JanNo ratings yet

- Executive Summary: Highlights of Financial OperationsDocument12 pagesExecutive Summary: Highlights of Financial OperationsJaniceNo ratings yet

- Annual Report 2021 Final CompressedDocument281 pagesAnnual Report 2021 Final CompressedshahyanNo ratings yet

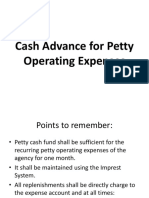

- Cash Advance For Petty Operating ExpensesDocument25 pagesCash Advance For Petty Operating ExpensesGuiller C. Magsumbol100% (2)

- 5 Taxpayer's RemediesDocument5 pages5 Taxpayer's RemediesYarah MNo ratings yet

- Oracle R12 P2P Interview Preparation - by Dinesh Kumar SDocument94 pagesOracle R12 P2P Interview Preparation - by Dinesh Kumar Sdineshcse86gmailcomNo ratings yet

- Bu Shivani Report 4Document31 pagesBu Shivani Report 4Shivani AgarwalNo ratings yet

- Karnataka Bank 5326520315Document101 pagesKarnataka Bank 5326520315eepNo ratings yet

- Full Download Ebook PDF Mcgraw Hills Taxation of Individuals and Business Entities 2020 Edition 11th Edition PDFDocument41 pagesFull Download Ebook PDF Mcgraw Hills Taxation of Individuals and Business Entities 2020 Edition 11th Edition PDFfrancis.buford145100% (33)

- The Adoption of ISA CanadaDocument27 pagesThe Adoption of ISA Canadamajestas777No ratings yet

- Tengku Mona Mia: Personal DetailsDocument5 pagesTengku Mona Mia: Personal Detailsdanang setiawanNo ratings yet

- E RFP LAPS EWSDocument84 pagesE RFP LAPS EWSCheturwedi IASNo ratings yet

- Core 1 - Journalize TransactionsDocument14 pagesCore 1 - Journalize TransactionsCharlote MarcellanoNo ratings yet

- Application For The Post of Director General Khyber Pakhtunkhwa Revenue Authority (Kpra)Document6 pagesApplication For The Post of Director General Khyber Pakhtunkhwa Revenue Authority (Kpra)Syed Muhammad Ijlal HussainNo ratings yet

- Protax 04Document10 pagesProtax 04aptureincNo ratings yet

- Muhammad Farooq Safdar: Core CompetenciesDocument2 pagesMuhammad Farooq Safdar: Core CompetenciesNasir AhmedNo ratings yet

- CC1 A212 - StudentDocument5 pagesCC1 A212 - StudentCarylChooNo ratings yet

- AUDITING PRINCIPLES Chap 6 and 7 SummaryDocument13 pagesAUDITING PRINCIPLES Chap 6 and 7 SummaryAlexius GucilatarNo ratings yet

- Reflection Paper Valuation FinalDocument7 pagesReflection Paper Valuation FinalMaureen CortezNo ratings yet

- Principles of Accounting V1Document6 pagesPrinciples of Accounting V1Umar AnsariNo ratings yet

- Stock Take - Audit ProgrammeDocument4 pagesStock Take - Audit ProgrammeYi Tong LiewNo ratings yet

- Circular-2019 E7Document69 pagesCircular-2019 E7Mohit SharmaNo ratings yet

- Chapter I: Introduction To Accounting What Is Accounting? Accountancy in The PhilippinesDocument3 pagesChapter I: Introduction To Accounting What Is Accounting? Accountancy in The PhilippinesLala LalaNo ratings yet

- IcaiDocument12 pagesIcaibasanisujithNo ratings yet

- Contemporary Auditing 11th Edition Knapp Solutions ManualDocument25 pagesContemporary Auditing 11th Edition Knapp Solutions ManualMichaelWilliamscnot100% (56)

![11 Accountancy Theory - 2022-23 [EM]](https://imgv2-1-f.scribdassets.com/img/document/720867815/149x198/2c342b8fe0/1712502586?v=1)