Professional Documents

Culture Documents

Financial Accounting 1 (Bookkeeping) Finals - Exercise 4 Column Reports

Uploaded by

Lucille Gacutan Aramburo0 ratings0% found this document useful (0 votes)

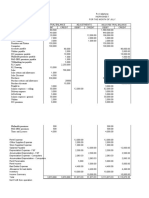

14 views1 pageThe document provides a trial balance and adjusted trial balance for Q Delivery Service for the year ended December 31, 2010. It lists accounts and their debit and credit balances. It directs the individual to prepare adjusting entries, income statements, balance sheets, capital statements, and closing entries based on the provided trial balance information. It also asks for a post-closing trial balance.

Original Description:

Q Delivery Service_Exercise 5

Original Title

Q Delivery Service_Exercise 5

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides a trial balance and adjusted trial balance for Q Delivery Service for the year ended December 31, 2010. It lists accounts and their debit and credit balances. It directs the individual to prepare adjusting entries, income statements, balance sheets, capital statements, and closing entries based on the provided trial balance information. It also asks for a post-closing trial balance.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views1 pageFinancial Accounting 1 (Bookkeeping) Finals - Exercise 4 Column Reports

Uploaded by

Lucille Gacutan AramburoThe document provides a trial balance and adjusted trial balance for Q Delivery Service for the year ended December 31, 2010. It lists accounts and their debit and credit balances. It directs the individual to prepare adjusting entries, income statements, balance sheets, capital statements, and closing entries based on the provided trial balance information. It also asks for a post-closing trial balance.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

FINANCIAL ACCOUNTING 1 (BOOKKEEPING)

FINALS – EXERCISE 4

Individual Activity

Direction:

Based on the given trial balance and adjusted trial balance, give the following:

1. Adjusting entries

2. Income Statement (column)

3. Balance Sheet (column)

4. Capital Statement (column)

5. Income Statement – Report Form

6. Balance Sheet – Report Form

7. Capital Statement – Report Form

8. Closing Entries

9. Post-closing Trial Balance

Q Delivery Service

Worksheet

December 31 2010

Trial Balance Adjusted Trial Balance

Accounts

Debit Credit Debit Credit

Cash 1,450,000 1,450,000

Accounts Receivable 760,000 760,000

Prepaid Rent 210,000

Prepaid Insurance 675,000 225,000

Office Supplies 225,000 50,000

Office Equipment 985,000 985,000

Accumulated depreciation, office equipment 235,000 320,000

Delivery equipment 8,560,000 8,560,000

Accumulated Depreciation, delivery equipment 2,000,000 3,420,000

Accounts payable 240,000 240,000

Office salaries payable 250,000

Truck driver’s wages payable 80,000

Unearned delivery fees 420,000 270,000

Q. Capital 8,655,000 8,655,000

Q, Drawing 3,510,000 3,510,000

Delivery fees earned 15,640,000 15,790,000

Office rent expense 660,000 760,000

Garage rent expense 660,000 770,000

Office salaries expense 3,650,000 3,900,000

Telephone expense 295,000 295,000

Office supplies used 175,000

Truck driver’s wages 4,230,000 4,310,000

Gas, oil, and repairs 1,320,000 1,320,000

Insurance expense 450,000

Depreciation, delivery equipment 1,420,000

Depreciation, office equipment 85,000

27,190,000 27,190,000 29,025,000 29,025,000

You might also like

- Lalala Express Delivery Service Quarterly Financial StatementsDocument2 pagesLalala Express Delivery Service Quarterly Financial StatementsRochelle ObadoNo ratings yet

- Rui Company FS FINALDocument20 pagesRui Company FS FINALNikkiNo ratings yet

- Fabm2 First Grading ReviewerDocument3 pagesFabm2 First Grading ReviewerjhomarNo ratings yet

- Dream Catcher Events Financial PlanDocument10 pagesDream Catcher Events Financial PlanPrince Jeffrey FernandoNo ratings yet

- WorksheetDocument4 pagesWorksheetHumaira NomanNo ratings yet

- Shin 094920Document11 pagesShin 094920Yuri KorterNo ratings yet

- 7 SynthesisDocument5 pages7 SynthesisCristine Jane Granaderos OppusNo ratings yet

- Nayan StoreDocument4 pagesNayan StoreBeatriz Cabrera100% (1)

- FDNACCT C35A Group Project Group 3Document21 pagesFDNACCT C35A Group Project Group 3cNo ratings yet

- The Accounting Cycle PHASE 1 - RECORDING AND CLASSIFYING PROCESS (During The Accounting Period)Document19 pagesThe Accounting Cycle PHASE 1 - RECORDING AND CLASSIFYING PROCESS (During The Accounting Period)Allondra DapengNo ratings yet

- #1-Illustrative ProblemDocument19 pages#1-Illustrative ProblemNisharie AbanNo ratings yet

- 10 Column WorksheetDocument5 pages10 Column Worksheetrommel legaspi100% (1)

- 10-Column Worksheet FormDocument1 page10-Column Worksheet Formobrie diazNo ratings yet

- Nubear FPDocument4 pagesNubear FPgwynethanne.dimayuga.acctNo ratings yet

- Work Sheet 3Document2 pagesWork Sheet 3Maryam AlamNo ratings yet

- Praktiswan Complete WorksheetDocument12 pagesPraktiswan Complete WorksheetMiranda, Aliana Jasmine M.No ratings yet

- Landing On YouDocument5 pagesLanding On YouCharsel LumileNo ratings yet

- Finals Activity No .2 Completing THE Accounting Cycle: Palad, Nica C. Mr. Alfred BautistaDocument6 pagesFinals Activity No .2 Completing THE Accounting Cycle: Palad, Nica C. Mr. Alfred BautistaMica Mae CorreaNo ratings yet

- KhemDocument2 pagesKhemMelonie GalarpeNo ratings yet

- 3rd-Long-QuizDocument1 page3rd-Long-QuizRonah SabanalNo ratings yet

- Toko Kenanga Neraca Percobaan / Work Sheet Per 31 Desember 2016 No Keterangan Neraca Saldo Penyesuaian Debet Kredit Debet KreditDocument4 pagesToko Kenanga Neraca Percobaan / Work Sheet Per 31 Desember 2016 No Keterangan Neraca Saldo Penyesuaian Debet Kredit Debet KreditWasiah R MaharyNo ratings yet

- Chapter 06 - AdjustmentsDocument26 pagesChapter 06 - AdjustmentsMkhonto Xulu100% (1)

- FABM 2 HANDOUTS 1st QRTRDocument17 pagesFABM 2 HANDOUTS 1st QRTRDanise PorrasNo ratings yet

- Performance Task #8 Preparation of Trial BalanceDocument2 pagesPerformance Task #8 Preparation of Trial BalancetineNo ratings yet

- Answer Key - Chapter 6 - ACCOUNTING1Document19 pagesAnswer Key - Chapter 6 - ACCOUNTING1IL MareNo ratings yet

- Act 110 Bonus Activity (Dimalawang)Document10 pagesAct 110 Bonus Activity (Dimalawang)Kilwa DyNo ratings yet

- Practice Problem SolutionDocument15 pagesPractice Problem SolutionTherese Noelle R. ARMADA100% (1)

- Lab Komputer Akuntansi KeuanganDocument8 pagesLab Komputer Akuntansi KeuanganlistianiNo ratings yet

- Math-11-ABM-FABM1-Q2-Week-2-for-studentsDocument12 pagesMath-11-ABM-FABM1-Q2-Week-2-for-studentsRich Allen Mier UyNo ratings yet

- Post-Closing Trial BalanceDocument8 pagesPost-Closing Trial BalanceNicole Andrea TuazonNo ratings yet

- Jimbo P. Manalastas BSA 1-1Document4 pagesJimbo P. Manalastas BSA 1-1Jimbo ManalastasNo ratings yet

- I - Identify The Following Accounts As A. Assets, Liabilities, Capital, Revenue, Expense, Other Income B. Debit or Credit C. Nominal or Real AccountDocument2 pagesI - Identify The Following Accounts As A. Assets, Liabilities, Capital, Revenue, Expense, Other Income B. Debit or Credit C. Nominal or Real AccountAries KeiffNo ratings yet

- Adjusted trial balance income statement balance sheet closing entries post closing trial balanceDocument1 pageAdjusted trial balance income statement balance sheet closing entries post closing trial balanceiya RasonableNo ratings yet

- FDNACCT - Group 1 Project - Eri Torsten HardwaresDocument24 pagesFDNACCT - Group 1 Project - Eri Torsten HardwaresLara Ysabelle CappsNo ratings yet

- Accounting Cycle ExampleDocument20 pagesAccounting Cycle ExampleAlJohara AlMadiNo ratings yet

- Latihan Soal 2_Lubis, Keysha SalsabillaDocument2 pagesLatihan Soal 2_Lubis, Keysha SalsabillaKeysha SalsabillaNo ratings yet

- Answer Key - Chapter 6 - ACCOUNTINGDocument92 pagesAnswer Key - Chapter 6 - ACCOUNTINGIL MareNo ratings yet

- FdnacctDocument20 pagesFdnacctvitobautistaNo ratings yet

- AnswersDocument24 pagesAnswersDeul ErNo ratings yet

- SW - Chapter 7Document8 pagesSW - Chapter 7andrie gardoseNo ratings yet

- WS MerchDocument5 pagesWS Merchjeonlei02No ratings yet

- J. P. Peralta Computer Clinic Worksheet For The Month Ended December 31, 2020Document2 pagesJ. P. Peralta Computer Clinic Worksheet For The Month Ended December 31, 2020Minjin lesner ManalansanNo ratings yet

- Initial Investment Fixed Cost (Monthly) Particulars Amount (RS.) Particulars Amount (RS.)Document6 pagesInitial Investment Fixed Cost (Monthly) Particulars Amount (RS.) Particulars Amount (RS.)Prince JoshiNo ratings yet

- Kevin ConsultantDocument13 pagesKevin ConsultantNaufal MohammadNo ratings yet

- Book 1Document6 pagesBook 1xbautista124No ratings yet

- Big Red Bicycle Master Budget FY 2011/2012 FY Q1 Q2 Q3 Q4Document3 pagesBig Red Bicycle Master Budget FY 2011/2012 FY Q1 Q2 Q3 Q4rida zulquarnainNo ratings yet

- Pas 7, Trial BalanceDocument2 pagesPas 7, Trial BalanceWesNo ratings yet

- Jupiter Store - Soln - Completing The Accounting CycleDocument10 pagesJupiter Store - Soln - Completing The Accounting CycleMariella Olympia PanuncialesNo ratings yet

- Financial Estimates and Budgets for New BusinessDocument8 pagesFinancial Estimates and Budgets for New Businessnur syafieraNo ratings yet

- UntitledDocument6 pagesUntitledJomar PenaNo ratings yet

- Accounting TestDocument4 pagesAccounting Testdinda ardiyaniNo ratings yet

- Lou Bernardo Company October 2021 Trial Balance and AdjustmentsDocument2 pagesLou Bernardo Company October 2021 Trial Balance and AdjustmentsJasfer Niño100% (1)

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Abigail Santos Boutique, Worksheet and Financial Statement For MerchandisingDocument9 pagesAbigail Santos Boutique, Worksheet and Financial Statement For MerchandisingFeiya LiuNo ratings yet

- BUSINESS PLAN - EntrepDocument7 pagesBUSINESS PLAN - EntrepimchangkyunNo ratings yet

- Income Statement - ProblemsDocument4 pagesIncome Statement - ProblemsKatlene JoyNo ratings yet

- DagohoyDocument6 pagesDagohoylinkin soyNo ratings yet

- Iaf Problem 2Document9 pagesIaf Problem 2Apple RoncalNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Wiley Practitioner's Guide to GAAS 2006: Covering all SASs, SSAEs, SSARSs, and InterpretationsFrom EverandWiley Practitioner's Guide to GAAS 2006: Covering all SASs, SSAEs, SSARSs, and InterpretationsRating: 2 out of 5 stars2/5 (2)

- Sally Go-Bangayan vs. Benjamin Bangayan, JRDocument3 pagesSally Go-Bangayan vs. Benjamin Bangayan, JRLucille Gacutan AramburoNo ratings yet

- Effect and Application of Laws Art 1-18Document29 pagesEffect and Application of Laws Art 1-18Lucille Gacutan AramburoNo ratings yet

- Cortez vs. CortezDocument3 pagesCortez vs. CortezLucille Gacutan AramburoNo ratings yet

- Manuel R. Bakunawa III vs. Nora Reyes BakunawaDocument2 pagesManuel R. Bakunawa III vs. Nora Reyes BakunawaLucille Gacutan AramburoNo ratings yet

- Case Digest 1-SubmittedDocument29 pagesCase Digest 1-SubmittedLucille Gacutan AramburoNo ratings yet

- Grace J. Garcia, A.K.A. Grace J. Garcia-Recio v. Rederick A. RecioDocument2 pagesGrace J. Garcia, A.K.A. Grace J. Garcia-Recio v. Rederick A. RecioLucille Gacutan AramburoNo ratings yet

- Soledad L. Lavadia v. Heirs of Juan Luces LunaDocument3 pagesSoledad L. Lavadia v. Heirs of Juan Luces LunaLucille Gacutan AramburoNo ratings yet

- Yolanda E. Garlet vs. Vencidor T. GarletDocument3 pagesYolanda E. Garlet vs. Vencidor T. GarletLucille Gacutan AramburoNo ratings yet

- Kazuhiro Hasegawa vs. Minuro NikamuraDocument2 pagesKazuhiro Hasegawa vs. Minuro NikamuraLucille Gacutan AramburoNo ratings yet

- Saudi Arabian Airlines Saudia and Brenda J. Betia, Petitioners, - Versus - Ma. Jopette M. Rebesencio, Montassah B. Sacar-Adiong, Rouen Ruth A. Cristobal and Loraine S. Schneider-CruzDocument3 pagesSaudi Arabian Airlines Saudia and Brenda J. Betia, Petitioners, - Versus - Ma. Jopette M. Rebesencio, Montassah B. Sacar-Adiong, Rouen Ruth A. Cristobal and Loraine S. Schneider-CruzLucille Gacutan AramburoNo ratings yet

- Ramonito O. Acaac vs. Melquiades D. Azcuna, Jr.Document2 pagesRamonito O. Acaac vs. Melquiades D. Azcuna, Jr.Lucille Gacutan AramburoNo ratings yet

- Case Digest 1-SubmittedDocument29 pagesCase Digest 1-SubmittedLucille Gacutan AramburoNo ratings yet

- Quiao vs. Quiao, Et. Al.Document2 pagesQuiao vs. Quiao, Et. Al.Lucille Gacutan AramburoNo ratings yet

- Millarosa vs. Carmel Development Inc.Document2 pagesMillarosa vs. Carmel Development Inc.Lucille Gacutan AramburoNo ratings yet

- Norma A Del Socorro Vs Ernst Johan Brinkman Van WilsemDocument2 pagesNorma A Del Socorro Vs Ernst Johan Brinkman Van WilsemLucille Gacutan AramburoNo ratings yet

- Nagkakaisang Maralita NG Sitio Masigasig Inc Vs Military Shrine Services - Philippine Veterans Affairs Office Department of National DefenseDocument1 pageNagkakaisang Maralita NG Sitio Masigasig Inc Vs Military Shrine Services - Philippine Veterans Affairs Office Department of National DefenseLucille Gacutan AramburoNo ratings yet

- Case Digest 2 - A-SubmittedDocument46 pagesCase Digest 2 - A-SubmittedLucille Gacutan Aramburo100% (1)

- Orion Savings Bank Vs Shigekane SuzukiDocument2 pagesOrion Savings Bank Vs Shigekane SuzukiLucille Gacutan AramburoNo ratings yet

- 6grade 9 November ME 2018-2019Document11 pages6grade 9 November ME 2018-2019Lucille Gacutan AramburoNo ratings yet

- Case Digest 1-SubmittedDocument29 pagesCase Digest 1-SubmittedLucille Gacutan AramburoNo ratings yet

- Case Digest 3 - 1-SubmittedDocument3 pagesCase Digest 3 - 1-SubmittedLucille Gacutan AramburoNo ratings yet

- Case Digest 3-SubmittedDocument49 pagesCase Digest 3-SubmittedLucille Gacutan AramburoNo ratings yet

- Case Digest 2 - B-SubmittedDocument42 pagesCase Digest 2 - B-SubmittedLucille Gacutan AramburoNo ratings yet

- 5grade 10 October QE 2018-2019Document21 pages5grade 10 October QE 2018-2019Lucille Gacutan AramburoNo ratings yet

- 4grade 10 September ME 2018-2019Document9 pages4grade 10 September ME 2018-2019Lucille Gacutan AramburoNo ratings yet

- 5grade 10 October QE 2018-2019Document21 pages5grade 10 October QE 2018-2019Lucille Gacutan AramburoNo ratings yet

- Victory Elijah Christian College MATH GRADE 10 AUGUST – FIRST QUARTER TESTTITLE Victory Elijah Christian College FILIPINO GRADE 10 AUGUST – FIRST QUARTER TESTDocument30 pagesVictory Elijah Christian College MATH GRADE 10 AUGUST – FIRST QUARTER TESTTITLE Victory Elijah Christian College FILIPINO GRADE 10 AUGUST – FIRST QUARTER TESTLucille Gacutan AramburoNo ratings yet

- 1grade 10 June ME 2018-2019Document6 pages1grade 10 June ME 2018-2019Lucille Gacutan AramburoNo ratings yet

- 2july Grade 10 TestDocument8 pages2july Grade 10 TestLucille Gacutan AramburoNo ratings yet

- Mobile AccessoriesDocument27 pagesMobile AccessoriesDiya BoppandaNo ratings yet

- Balakrishnan 2011Document67 pagesBalakrishnan 2011novie endi nugrohoNo ratings yet

- Jay Abraham - Billion Dollar Marketing Weekend - Singapore 2005Document3 pagesJay Abraham - Billion Dollar Marketing Weekend - Singapore 2005Josh HermanNo ratings yet

- Conceptual Framework First ProblemDocument12 pagesConceptual Framework First ProblemJohn JosephNo ratings yet

- Abhishek Alloys PVT LTDDocument18 pagesAbhishek Alloys PVT LTDRajeshKolekarNo ratings yet

- Equity AnalysisDocument17 pagesEquity AnalysisVarsha SukhramaniNo ratings yet

- ConclusionDocument5 pagesConclusionkalaswami0% (1)

- JHGJGJHDocument29 pagesJHGJGJHAKHIL MICHAELNo ratings yet

- Radha Sridhar - 2 - 2019-2020Document2 pagesRadha Sridhar - 2 - 2019-2020Radha SridharNo ratings yet

- 7115 w17 QP 12Document12 pages7115 w17 QP 12mrsundeepsNo ratings yet

- Poverty ArticleDocument10 pagesPoverty ArticleAbdullah UmerNo ratings yet

- Reaction PaperDocument5 pagesReaction PaperAgonee Riego33% (3)

- Note On Ground Water Fee in OrissaDocument7 pagesNote On Ground Water Fee in Orissaapu_biswasNo ratings yet

- MusharkaDocument33 pagesMusharkaDaniyal100% (1)

- Case 22 Victoria Chemicals A DONEDocument14 pagesCase 22 Victoria Chemicals A DONEJordan Green100% (5)

- Folding Clothes Made Easy with IFZAFOLDDocument15 pagesFolding Clothes Made Easy with IFZAFOLDAimi50% (2)

- Enager Industries3Document5 pagesEnager Industries3pratheek30100% (1)

- Chapter 18 - Financial Management Learning GoalsDocument25 pagesChapter 18 - Financial Management Learning GoalsRille LuNo ratings yet

- FINANCIAL ACCOUNTING I 2019 MinDocument6 pagesFINANCIAL ACCOUNTING I 2019 MinKedarNo ratings yet

- Fiscal Policy MeaningDocument47 pagesFiscal Policy MeaningKapil YadavNo ratings yet

- Working Capital ManagementDocument16 pagesWorking Capital ManagementjcshahNo ratings yet

- Box Truck Business PlanDocument28 pagesBox Truck Business PlanDee DawaneNo ratings yet

- Jindal GroupDocument8 pagesJindal Groupamit65inNo ratings yet

- The Nature of The Public SectorDocument14 pagesThe Nature of The Public Sectorhiwatari_sasuke100% (1)

- HFM Traning HITATHIDocument83 pagesHFM Traning HITATHIRakesh Jalla100% (1)

- Lesson Plan Income Taxation FINALDocument6 pagesLesson Plan Income Taxation FINALRandy Magbudhi100% (2)

- Sunflower App Business and Financial PlanDocument19 pagesSunflower App Business and Financial PlanshakepeersphNo ratings yet

- Income: According To Ordinary Concepts and Statutory Income. Income AccordingDocument194 pagesIncome: According To Ordinary Concepts and Statutory Income. Income AccordingHan Ny PhamNo ratings yet

- Farm DocumentDocument14 pagesFarm DocumentKatu2010No ratings yet

- RR No. 25-2020Document2 pagesRR No. 25-2020Kram Ynothna BulahanNo ratings yet