Professional Documents

Culture Documents

Fuji Xerox Fact Sheet

Uploaded by

WXXI NewsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fuji Xerox Fact Sheet

Uploaded by

WXXI NewsCopyright:

Available Formats

Introducing the New Fuji Xerox

Xerox and Fuji Xerox to combine, creating a global leader in

innovative print technologies and intelligent work solutions

• Creates substantial value for Xerox employees, customers, • Accelerates path to revenue growth through global reach,

business partners and shareholders industry-leading scale and enhanced innovation capabilities

• Well-positioned to lead in growing business areas such as • Combined company will have enhanced financial flexibility

high-speed inkjet, industrial printing and workplace solutions, for future growth investments and capital returns

while leveraging Fujifilm's extensive technologies

Better Together – Xerox and Fuji Xerox

Combining to lead the evolution of the industry and unleash competitive strengths

2 0 1 7 REVEN UE 1,2 2017 REV EN U E 1 , 2

$ 10.3B $ 9.6B

#1 Worldwide Equipment #1 Market Share in Asia

Revenue Leader

#1 Share in Japan

• Iconic technology brand

• Strong market presence in

• Innovation DNA: Invented fast-growing geographies

xerography and pioneered

• World-class R&D, manufacturing

MPS

and sales platform

• Among the best operating

• Leading in Office Products /

margins in the industry

Office Printer market

• >75% recurring revenue

• ~40% of revenue from growing

market segments of Graphic

Communications and Solutions

& Services

New Fuji Xerox by the numbers

Broad Global

Scale

180+

COUNTRIES

#1

E Q U IP M E N T

~$120B

TO TAL AD D R E S SABL E

$18B+

IN RE V E N U E

R E VE N U E S HAR E O P P O RTU N ITY

World-Class

Innovation

~$1B

COMBINED R&D

6

IN N OVATIO N LABS

6,600+

E N GIN E E R S

11,470 PAT E N T S

Strong

Financial Profile

2020

RETURN TO

$1.7B+

TO TAL AN N UAL

2022

HIGH- TE E N S

$1.5B

F CF 3 BY 2 0 2 0

REVENUE G RO WTH CO S T SAVIN GS O P E R ATIN G M AR GIN

Assumes exchange rate of JPY114: US$1

1.

Reflects 2017 actual revenue for Xerox and calendar year 2017 estimated revenue for Fuji Xerox (includes inter-company revenues of ~$0.1B for Xerox and ~$1.6B for Fuji Xerox).

2.

Recurring revenue is equal to post sale revenue.

3.

Free cash flow defined as cash flow from operations minus CAPEX, including internal use software.

Additional Information and Where to Find It

This release may be deemed to be solicitation material in respect of the transactions with FUJIFILM Holdings Corporation (“Fujifilm) described herein (the

“Transactions”) and/or the matters to be considered at the Company’s 2018 Annual Meeting of Shareholders. In connection with the Transactions and the 2018

Annual Meeting, Xerox plans to file with the Securities and Exchange Commission (“SEC”) and furnish to Xerox’s shareholders one or more proxy statements and

other relevant documents. BEFORE MAKING ANY VOTING DECISION, XEROX’S SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT(S) IN

THEIR ENTIRETY WHEN THEY BECOME AVAILABLE AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE TRANSAC-

TIONS AND/OR THE COMPANY’S 2018 ANNUAL MEETING OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENTS BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTIONS AND/OR THE COMPANY’S 2018 ANNUAL MEETING AND THE PARTIES RELATED

THERETO. Xerox’s shareholders will be able to obtain a free copy of documents filed with the SEC at the SEC’s website at http://www.sec.gov. In addition, Xerox’s

shareholders may obtain a free copy of Xerox’s filings with the SEC from Xerox’s website at http://www.xerox.com under the heading “Investor Relations” and then

under the heading “SEC Filings.”

Participants in the Solicitation

The directors, executive officers and certain other members of management and employees of Xerox may be deemed “participants” in the solicitation of proxies

from shareholders of Xerox in favor of the Transactions or in connection with the matters to be considered at the Company’s 2018 Annual Meeting. Information

regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the shareholders of Xerox in connection with the

Transactions or the Company’s 2018 Annual Meeting will be set forth in the applicable proxy statement and other relevant documents to be filed with the SEC. You

can find information about Xerox’s executive officers and directors in Xerox’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017, Xerox’s and

such persons’ other filings with the SEC and in Xerox’s definitive proxy statement filed with the SEC on Schedule 14A.

Cautionary Statement Regarding Forward-Looking Statements

This release, and other written or oral statements made from time to time by management contain “forward-looking statements” as defined in the Private Securities

Litigation Reform Act of 1995. The words “anticipate”, “believe”, “estimate”, “expect”, “intend”, “will”, “should” and similar expressions, as they relate to us, are

intended to identify forward-looking statements. These statements reflect management’s current beliefs, assumptions and expectations and are subject to a number

of factors that may cause actual results to differ materially. Such factors include but are not limited to: our ability to address our business challenges in order to

reverse revenue declines, reduce costs and increase productivity so that we can invest in and grow our business; changes in economic and political conditions, trade

protection measures, licensing requirements and tax laws in the United States and in the foreign countries in which we do business; changes in foreign currency

exchange rates; our ability to successfully develop new products, technologies and service offerings and to protect our intellectual property rights; the risk that

multi-year contracts with governmental entities could be terminated prior to the end of the contract term and that civil or criminal penalties and administrative

sanctions could be imposed on us if we fail to comply with the terms of such contracts and applicable law; the risk that partners, subcontractors and software

vendors will not perform in a timely, quality manner; actions of competitors and our ability to promptly and effectively react to changing technologies and customer

expectations; our ability to obtain adequate pricing for our products and services and to maintain and improve cost efficiency of operations, including savings from

restructuring actions; the risk that individually identifiable information of customers, clients and employees could be inadvertently disclosed or disclosed as a result

of a breach of our security systems; reliance on third parties, including subcontractors, for manufacturing of products and provision of services; our ability to

manage changes in the printing environment and expand equipment placements; interest rates, cost of borrowing and access to credit markets; funding require-

ments associated with our employee pension and retiree health benefit plans; the risk that our operations and products may not comply with applicable worldwide

regulatory requirements, particularly environmental regulations and directives and anti-corruption laws; the outcome of litigation and regulatory proceedings to which

we may be a party; the risk that we do not realize all of the expected strategic and financial benefits from the separation and spin-off of our Business Process

Outsourcing business; the effects on our business resulting from actions of activist shareholders; and other factors that are set forth in the “Risk Factors” section, the

“Legal Proceedings” section, the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section and other sections of our

Quarterly Reports on Form 10-Q for the quarters ended March 31, 2017, June 30, 2017 and September 30, 2017 and our 2016 Annual Report on Form 10-K, as well

as our Current Reports on Form 8-K filed with the SEC. Furthermore, the actual results of the Transactions could vary materially as a result of a number of factors,

including, but not limited to: (i) the risk that the transactions may not be completed in a timely manner or at all, which may adversely affect Xerox’s business and the

price of Xerox’s common stock, (ii) the failure to satisfy the conditions to the consummation of the transactions, including the receipt of certain approvals from

Xerox’s shareholders and certain governmental and regulatory approvals, (iii) the parties may be unable to achieve expected synergies and operating efficiencies in

the transactions within the expected time frames or at all, (iv) the transactions may not result in the accretion to Xerox’s earnings or other benefits, (v) the occurrence

of any event, change or other circumstance that could give rise to the termination of the transaction agreements, (vi) the effect of the announcement or pendency of

the transactions on Xerox’s and/or Fujifilm business relationships, operating results, and business generally, risks related to the proposed transactions disrupting

Xerox’s current plans and operations and potential difficulties in Xerox’s employee retention as a result of the transactions, (vii) risks related to diverting manage-

ment's attention from Xerox’s ongoing business operations, (viii) the outcome of any legal proceedings that may be instituted against Xerox, its officers or directors

related to the transaction agreements or the transactions and (ix) the possibility that competing offers or acquisition proposals for Xerox will be made. Xerox assumes

no obligation to update any forward-looking statements as a result of new information or future events or developments, except as required by law.

Fuji Xerox Co., Ltd. (“Fuji Xerox”) is a joint venture between Xerox Corporation and Fujifilm in which Xerox holds a noncontrolling 25% equity interest and Fujifilm

holds the remaining equity interest. In April 2017, Fujifilm formed an independent investigation committee (“IIC”) to primarily conduct a review of the appropriateness

of the accounting practices at Fuji Xerox’s New Zealand subsidiary and at other subsidiaries. The IIC completed its review during the second quarter 2017 and

identified aggregate adjustments to Fuji Xerox’s financial statements of approximately JPY 40 billion (approximately $360 million) primarily related to misstatements

at Fuji Xerox’s New Zealand and Australian subsidiaries. We determined that our share of the total adjustments identified as part of the investigation was approxi-

mately $90 million and impacted our fiscal years 2009 through 2017. We concluded that we should revise our previously issued annual and interim consolidated

financial statements for 2014, 2015 and 2016 and the first quarter of 2017 the next time they are filed. Our review of this matter has been completed. However,

Fujifilm and Fuji Xerox continue to review Fujifilm’s oversight and governance of Fuji Xerox as well as Fuji Xerox’s oversight and governance over its businesses in

light of the findings of the IIC. At this time, we can provide no assurances relative to the outcome of any potential governmental investigations or any consequences

thereof that may happen as a result of this matter.

You might also like

- Andrew Cuomo Misdemeanor ComplaintDocument1 pageAndrew Cuomo Misdemeanor ComplaintNew York PostNo ratings yet

- Statement Provided by Foodlink UnitedDocument1 pageStatement Provided by Foodlink UnitedWXXI NewsNo ratings yet

- Mayor Warren Resignation LetterDocument2 pagesMayor Warren Resignation LetterWXXI NewsNo ratings yet

- Letter To AG James 4.13.21 (2305843009422915593)Document1 pageLetter To AG James 4.13.21 (2305843009422915593)News 8 WROCNo ratings yet

- MCH LetterDocument1 pageMCH LetterWXXI NewsNo ratings yet

- Mayor Warren Resignation LetterDocument2 pagesMayor Warren Resignation LetterWXXI NewsNo ratings yet

- Davis Polk Letter 8-5-21Document1 pageDavis Polk Letter 8-5-21WXXI NewsNo ratings yet

- Independent Investigator's Report To The Board of EthicsDocument7 pagesIndependent Investigator's Report To The Board of EthicsPatrick CrozierNo ratings yet

- 2021.7.22 Letter From Executive ChamberDocument2 pages2021.7.22 Letter From Executive ChamberWXXI NewsNo ratings yet

- Carbone LetterDocument1 pageCarbone LetterWXXI NewsNo ratings yet

- Flagler-Mitchell Docs Redacted (206292)Document55 pagesFlagler-Mitchell Docs Redacted (206292)News 8 WROCNo ratings yet

- Pittsford Schools Fourth Grade WorksheetDocument1 pagePittsford Schools Fourth Grade WorksheetWXXI NewsNo ratings yet

- GO 336 Duty To InterveneDocument2 pagesGO 336 Duty To InterveneNews 8 WROCNo ratings yet

- RASE Commission To Release Report, Give Recommendations On Combatting RacismDocument281 pagesRASE Commission To Release Report, Give Recommendations On Combatting RacismNews 8 WROCNo ratings yet

- Letter To AG James 4.13.21 (2305843009422915593)Document1 pageLetter To AG James 4.13.21 (2305843009422915593)News 8 WROCNo ratings yet

- Media Release - Rules of Engagement 012721Document1 pageMedia Release - Rules of Engagement 012721WXXI NewsNo ratings yet

- Hall V Warren 21 CV 6296 Filed ComplaintDocument96 pagesHall V Warren 21 CV 6296 Filed ComplaintNews 8 WROCNo ratings yet

- RASE Commission To Release Report, Give Recommendations On Combatting RacismDocument281 pagesRASE Commission To Release Report, Give Recommendations On Combatting RacismNews 8 WROCNo ratings yet

- Report On The Investigation Into The Death of Daniel PrudeDocument204 pagesReport On The Investigation Into The Death of Daniel PrudeNews 8 WROCNo ratings yet

- GO 341 ChokeholdsDocument2 pagesGO 341 ChokeholdsNews 8 WROCNo ratings yet

- Celli Final ReportDocument84 pagesCelli Final ReportNews10NBCNo ratings yet

- State/County School District Capital RegionDocument26 pagesState/County School District Capital RegionNewsChannel 9No ratings yet

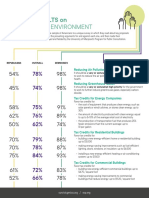

- National Survey Results-Energy and EnvironmentDocument2 pagesNational Survey Results-Energy and EnvironmentWXXI NewsNo ratings yet

- HEC Letter To LeadershipDocument4 pagesHEC Letter To LeadershipWXXI News100% (1)

- Survey Results-NY 25 Energy and EnvironmentDocument3 pagesSurvey Results-NY 25 Energy and EnvironmentWXXI NewsNo ratings yet

- Return To Work Guide For RCSD StaffDocument14 pagesReturn To Work Guide For RCSD StaffWXXI NewsNo ratings yet

- 01 1.PDF Daniels LawDocument26 pages01 1.PDF Daniels LawNews10NBCNo ratings yet

- Building Protocols For RCSD Remote LearningDocument1 pageBuilding Protocols For RCSD Remote LearningWXXI NewsNo ratings yet

- RCSD Parent Guide For Returning To SchoolDocument4 pagesRCSD Parent Guide For Returning To SchoolWXXI News100% (1)

- RTA Survey January 2021Document3 pagesRTA Survey January 2021WXXI NewsNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 26 27 16 Electrical Cabinets and EnclosuresDocument3 pages26 27 16 Electrical Cabinets and EnclosureskaichosanNo ratings yet

- StatProb11 Q4 Mod3 RegressionAnalysis v4Document21 pagesStatProb11 Q4 Mod3 RegressionAnalysis v4ALEX SARAOSOS100% (4)

- PM and Presidential Gov'ts Differ Due to Formal Powers and AppointmentDocument3 pagesPM and Presidential Gov'ts Differ Due to Formal Powers and AppointmentNikeyNo ratings yet

- Section 3 Evidence Act 1950Document3 pagesSection 3 Evidence Act 1950ayesyaNo ratings yet

- (OBIEE11g) Integrating Oracle Business Intelligence Applications With Oracle E-Business Suite - Oracle Bi SolutionsDocument11 pages(OBIEE11g) Integrating Oracle Business Intelligence Applications With Oracle E-Business Suite - Oracle Bi SolutionsVenkatesh Ramiya Krishna MoorthyNo ratings yet

- Module 2 - Introduction To A Web-AppDocument17 pagesModule 2 - Introduction To A Web-AppJASPER WESSLYNo ratings yet

- Design of Masonary Retaining Wall - SteppedDocument3 pagesDesign of Masonary Retaining Wall - Steppedmeenu100% (1)

- Marie Bjerede and Tzaddi Bondi 2012 - Learning Is Personal, Stories of Android Tablet Use in The 5th GradeDocument50 pagesMarie Bjerede and Tzaddi Bondi 2012 - Learning Is Personal, Stories of Android Tablet Use in The 5th Gradeluiz carvalhoNo ratings yet

- Solaris 10 Service - (Management Facility (SMF: Oz Melamed E&M Computing Nov 2007Document18 pagesSolaris 10 Service - (Management Facility (SMF: Oz Melamed E&M Computing Nov 2007Anonymous 4eoWsk3100% (3)

- Crusher RC Classic RC-II OM FN 23830 (En)Document128 pagesCrusher RC Classic RC-II OM FN 23830 (En)julio cesarNo ratings yet

- App Form BLIDocument8 pagesApp Form BLIPaulo LuizNo ratings yet

- Bigdata 2016 Hands On 2891109Document96 pagesBigdata 2016 Hands On 2891109cesmarscribdNo ratings yet

- Speech ExamplesDocument6 pagesSpeech Examplesjayz_mateo9762100% (1)

- Presentasi AkmenDocument18 pagesPresentasi AkmenAnonymous uNgaASNo ratings yet

- The Power Elite and The Secret Nazi PlanDocument80 pagesThe Power Elite and The Secret Nazi Planpfoxworth67% (3)

- Nonlinear Optimization: Benny YakirDocument38 pagesNonlinear Optimization: Benny YakirMahfuzulhoq ChowdhuryNo ratings yet

- Tough Turkish TBM Moves Through Fractured and Faulted Rock: Issue 1 + 2014Document8 pagesTough Turkish TBM Moves Through Fractured and Faulted Rock: Issue 1 + 2014sCoRPion_trNo ratings yet

- Case Study ExamplesDocument18 pagesCase Study ExamplesSujeet Singh BaghelNo ratings yet

- US20170335223A1Document18 pagesUS20170335223A1hugo vignoloNo ratings yet

- Royal Harare Golf Club: An Oasis of Excellence in The Midst of Political and Economic DevastationDocument24 pagesRoyal Harare Golf Club: An Oasis of Excellence in The Midst of Political and Economic DevastationCompleatGolferNo ratings yet

- Gram-Charlier para Aproximar DensidadesDocument10 pagesGram-Charlier para Aproximar DensidadesAlejandro LopezNo ratings yet

- m100 Stopswitch ManualDocument12 pagesm100 Stopswitch ManualPatrick TiongsonNo ratings yet

- Diploma Engineer Question Paper-1Document1 pageDiploma Engineer Question Paper-1Nahid RahmanNo ratings yet

- Concreting PlantsDocument9 pagesConcreting PlantsSabrina MustafaNo ratings yet

- Responsibility and Transfer Pricing Solving: Answer: PDocument3 pagesResponsibility and Transfer Pricing Solving: Answer: PPhielle MarilenNo ratings yet

- Assignment 2 Front SheetDocument17 pagesAssignment 2 Front SheetPhanh NguyễnNo ratings yet

- January 2023: Top 10 Cited Articles in Computer Science & Information TechnologyDocument32 pagesJanuary 2023: Top 10 Cited Articles in Computer Science & Information TechnologyAnonymous Gl4IRRjzNNo ratings yet

- 280Document6 pages280Alex CostaNo ratings yet

- 4563Document58 pages4563nikosNo ratings yet

- Trial Balance Entries ListingDocument3 pagesTrial Balance Entries ListingIza ValdezNo ratings yet