Professional Documents

Culture Documents

Bio Metrics Technology

Uploaded by

Ahmed Cheikh SidiaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bio Metrics Technology

Uploaded by

Ahmed Cheikh SidiaCopyright:

Available Formats

CGAP IT Innovation Series

Biometrics Technology

Steve Whelan, with contributions from CGAP Staff and echange, LLC

Biometrics technology measures an individual’s How Does Biometrics

unique physical or behavioral characteristics, such Technology Work?

as fingerprints, facial characteristics, voice pat-

The general purpose of all biometric technologies

tern, and gait, to recognize and confirm identity.

is to capture and store information at an enroll-

Although the technology is still new, growing

ment stage to compare at a later verification

awareness of the importance of data security is

stage. In the capture process, software assigns

increasing adoption steadily. For some organiza-

values to a biometric image and stores these val-

tions, low-cost biometric solutions may be more

ues in a template that requires far less storage

convenient and secure than the passwords and

than the image itself.

personal identification numbers (PINs) that these

institutions currently use to restrict access to

During verification, when the client initiates a

financial data.

transaction, the system scans the client’s biomet-

ric (e.g., voice pattern, retinal image, fingerprint,

Who Should Consider etc.), matches this scan against the stored tem-

Biometrics Technology? plate, and approves or rejects it. It sends this

result to the business software to either proceed

Biometrics technology may be an option for any

with or halt the client’s transaction. A secure audit

organization that uses physical cards, documents,

trail is also recorded for each match attempt.

passwords, or identification numbers to secure

data stored in electronic format on a computer or

The False Rejection Rate measures how often an

Automated Teller Machine (ATM). Since biometric

authorized user’s biometric data is rejected by the

applications can be simple—off-the-shelf pack-

system; and the False Acceptance Rate measures

ages can be installed to restrict staff access to

how frequently an unauthorized person gains

systems or files—the technology is available to

access to secure resources. Manufacturers use

almost any computerized microfinance institution

these measures to monitor and determine the

(MFI). However, biometrics technology to secure

effectiveness (security and ease of use) of their

individual client transactions generally requires

systems.

additional implementation. With these biometric

applications, some portable client-held device,

The table below compares biometric technologies

such as a Smart Card, is also required to store

and suggests why fingerprint technology is

each client’s biometric template. (See the Smart

among the most commonly used applications.

Cards article of the CGAP IT Innovation Series.)

Consultative Group to Assist the Poor

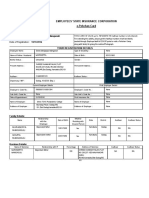

Table 1. Comparison of Biometrics

Hand

Characteristic Finger-prints Geometry Retina Iris Face Signature Voice

Ease of Use High High Low Medium Medium High High

Reasons Dryness, dirt, Hand injury, Glasses Poor lighting Lighting, Changing Noise,

for Errors age age age, signatures colds,

glasses, hair weather

Accuracy High High Very High Very High High High High

User Medium Medium Medium Medium Medium Medium High

Acceptance

Required High Medium High Very High Medium Medium Medium

Security Level

Long-term High Medium High High Medium Medium Medium

Stability

Source: Simon Liu and Mark Silverman, “A Practical Guide to Biometric Security Technology,” IT Professional (January/February 2001).

Requirements for Costs

Biometrics Technology The following are indicative costs of a biometric

• Reliable electrical power for card or biometric fingerprint system that verifies identity and pass-

readers es match/no-match results to other software (e.g,.

• Solid processes and adequate staff for manag- the transaction application). The costs below

ing card systems and enrolling clients assume the use of Smart Cards, since these sys-

• Software integration between cards, readers, tems furnish the greatest potential and flexibility

and central MIS for MFI applications.

• A Smart Card for each client costs US$ 6–$ 10

Benefits and Costs of per card.

Biometric Technology • Software programming routines to develop the

reader-MIS interface cost US$ 1,000–$ 1,900.

Benefits • A set-up or installation fee to deploy card read-

• Greater security—biometrics link a person to an ers will be charged.

action. • Basic fingerprint readers run US$ 60–$ 130, or

• Convenience—clients have no identification fingerprint/card readers are US$ 100–$ 240.

number or password to remember.

• Local verification—clients hold their identity Some smart card read-

information (e.g., on a Smart Card), so there is ers come with built-in

no need to verify identity via a central reposito- fingerprint capability to

ry or server. authenticate the bearer

• Verification is swift and does not require staff. of the actual card. This

• User identity is stored safely and is tamper-free. raises the price of the

reader but increases

Consultative Group to Assist the Poor

security and eliminates the need to integrate mul- enrollment lets clients access their accounts

tiple components. without remembering passwords or PINs. Once

PCs configured with card and fingerprint read-

ers were set up at Prodem FFP offices, clients

Microfinance Implementations were authenticated quickly, and transaction

Few microfinance institutions have opted for bio- times sped up. All of Prodem FFP’s 54 offices

metrics technology, but a case study in Bolivia are equipped with smart card and biometric

illustrates its potential. readers. By the end of 2003, over half will have

full ATM capabilities as well. In many cases,

customers will be able to conduct transactions

Prodem FFP (Bolivia) without waiting in line for tellers.

For Prodem FFP, a combination biometric finger-

print and Smart Cards was appealing for security, Prodem FFP CEO Eduardo Bazoberry considers

ease of use, and cost. With enrollment and reader biometrics with Smart Card to be an excellent tool

equipment supplied by Digital Persona, Prodem to deliver better financial services to Prodem’s

FFP tasked an in-house development team to clients. Although Prodem FFP offers only savings,

write software to integrate the biometric and card transfers, and loan disbursements through its bio-

software with its MIS. Prodem FFP’s configura- metrics and smart card system, it envisions using

tion uses separate fingerprint and smart card the system to offer additional products over time.

readers, and the MFI is now evaluating combina-

tion readers now that low-cost readers with com-

bined fingerprint and smart card technology have Lessons for Implementation

been developed.

Client experience

In general, the equipment has been reliable, Positive client experience is critical to successful

affordable, and easy to integrate. Used in conjunc- biometrics implementation. Prodem FFP com-

tion with a smart card system, Prodem FFP’s fin- bined fingerprint technology, Smart Cards, and

gerprint verification has reduced fraud, error, and ATMs to allow its customers to conduct transac-

repudiation of transactions. Although the MFI has tions themselves, without waiting in long lines for

not conducted a detailed cost-benefit analysis, it tellers. This reduces transaction times and elimi-

has identified a number of benefits. nates the need for clients to remember PINs or

passwords. The biometrics system must also be

• More staff availability. Customers have been user-friendly in the way it captures biometric infor-

satisfied with the speed with which Prodem mation. Of Prodem FFP’s 43,000 clients with

FFP’s biometrics system verifies client identi- smart cards, only two cardholders have been

ties. Retries due to false rejections have been unable to use the system due to the condition of

well within the range of acceptable perform- their fingerprints. In these cases, Prodem FFP

ance. By combining Smart Cards and biomet- resorted to traditional passbooks to record their

rics technology, Prodem FFP staff has not had transactions.

to deal with forgotten PIN numbers or unautho-

rized use of cards or accounts, so they have

more time to provide personal service and Phased implementation

advice to clients. Some MFIs should introduce simpler biometric

applications at first to test the pros and cons of a

• Better customer experience. A fingerprint biometric system without incurring great

template stored directly on the card during expense. For example, MFIs can easily install off-

Consultative Group to Assist the Poor

the-shelf software packages that include a reader To Learn More

on their computers to restrict staff access to par-

ticular systems or client files. Biometrics providers

The popularity of fingerprint identification technol-

Maintain system security ogy has helped drive down the cost of readers

and associated software components. Integrators

A biometrics system protects the privacy of the

can help speed the deployment of applications,

individual because identity templates are not cen-

but software packaged with readers is becoming

trally stored or communicated. In the system

more powerful and easier to use.

adopted by Prodem FFP, client templates exist

only on the card, so client identity cannot be

The main international suppliers of biometric fin-

manipulated, compromised, or misused. If the

gerprint readers include:

card is lost or stolen, the client must return to a

AuthenTec, http://www.authentec.com/

branch to take another thumb reading in order to

Digital Persona Inc.,

be issued a new card. It is a minimal administra-

http://www.digitalpersona.com

tive burden relative to the level of security gained.

SecuGen, http://www.secugen.com/

Identix, http://www.identix.com/

General guidance Gemplus, http://www.gemplus.com

Oberthur, http://www.oberthur.com

The unique challenges of implementing biometric

Schlumberger-SEMA, http://www.slm.com

systems are well documented by the UK

Biometrics Working Group.

CGAP has not reviewed their products nor does it

endorse them in any way.

• All security systems, biometric or otherwise,

require time, money, and energy to setup,

administer, and maintain properly. Organizations surveyed

• System throughput rates must be carefully

Prodem FFP, Eduardo Bazoberry,

addressed, for both enrollment and operational

ebazoberry@prodemffp.com.bo,

use.

591 2 214 7580

• Enrollment sessions and training for all users is

(almost) always required.

• Although studies show strong acceptance of Other resources

biometric technology, some users will object to

UK Biometrics Working Group,

it, so a policy must be developed for this.

http://www.cesg.gov.uk/site/ast/index.-

• The system integrator should be carefully cho-

cfm?menuSelected=4&displayPage=4

sen because hardware/software integration will

Biometrics Consortium,

be the hardest task. Biometric technologies are

http://www.biometrics.org

too complex to plug in and activate immediately.

World Resources Institute’s Digital Dividend

• System integration may require changes in

Project, www.digitaldividend.org

other pieces of hardware that cannot readily be

anticipated.

• It is important to use proven products and sta-

ble vendors.

• The implemented biometric system must be

more efficient than the alternatives or the use

of the biometric will be seen as a mistake.

Consultative Group to Assist the Poor

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- New Candidate Information Sheet-BUZZ WORKSDocument2 pagesNew Candidate Information Sheet-BUZZ WORKSsuhas pawar0% (2)

- Rajasthan State Road Transport E-TicketDocument1 pageRajasthan State Road Transport E-TicketRohit KumarNo ratings yet

- 099 - Request For Certificate of EmploymentDocument1 page099 - Request For Certificate of EmploymentJee AlmanzorNo ratings yet

- HONS CircularDocument3 pagesHONS CircularMubarokNo ratings yet

- Appointment Slip-1Document1 pageAppointment Slip-1adrijaamukherjee27No ratings yet

- Xxxx Xxxx 2844: नामांकन मांक/ Enrolment No.: XXXX/XXXXX/XXXXXDocument1 pageXxxx Xxxx 2844: नामांकन मांक/ Enrolment No.: XXXX/XXXXX/XXXXXJaypee AimNo ratings yet

- Aadhaar Update Form: Aadhaar Enrolment Is Free & VoluntaryDocument4 pagesAadhaar Update Form: Aadhaar Enrolment Is Free & VoluntaryRahulNo ratings yet

- MEA Online Appointment Receipt for Passport ReissueDocument3 pagesMEA Online Appointment Receipt for Passport Reissueakash agarwalNo ratings yet

- Format For SDF & EVLDocument1 pageFormat For SDF & EVLmdmuzahidansari8No ratings yet

- E-Mail:: RNI No. GUJGUJ/2013/59491Document17 pagesE-Mail:: RNI No. GUJGUJ/2013/59491nikita kankiyaNo ratings yet

- Gitex - Shopper - 2019 - 1 of 1 PDFDocument1 pageGitex - Shopper - 2019 - 1 of 1 PDFJishnu CheemenNo ratings yet

- 1 Tatkal Application Form DegreeDocument1 page1 Tatkal Application Form Degreerajat bajajNo ratings yet

- Maxgoogle XtreamiptvDocument23 pagesMaxgoogle XtreamiptvMounir YousfiNo ratings yet

- Updated KYCDocument3 pagesUpdated KYCSarvar PathanNo ratings yet

- SaleDocument1 pageSaleMegan HerreraNo ratings yet

- No Objection Certificate for Wife's EmploymentDocument1 pageNo Objection Certificate for Wife's EmploymentBlazeDream Technologies Pvt LtdNo ratings yet

- 23240CADEL224206Document1 page23240CADEL224206ojas khuranaNo ratings yet

- Motivation Letter For VisaDocument2 pagesMotivation Letter For VisaJelena Jokić0% (1)

- Kotak Mahindra Bank Signature Change FormDocument1 pageKotak Mahindra Bank Signature Change FormDr Monal YuwanatiNo ratings yet

- Litesh KUmar Prvovincial AppointmentDocument1 pageLitesh KUmar Prvovincial AppointmentPawan RawatNo ratings yet

- 2327 514 236 236 1 0 Administrator 6/21/1905 0:00Document4 pages2327 514 236 236 1 0 Administrator 6/21/1905 0:00Rian RamadanNo ratings yet

- Bell Winter Explorer - S104675 - Miss Andrea Alegie Fuentes - Arrival Airport Transfer ConfirmationDocument3 pagesBell Winter Explorer - S104675 - Miss Andrea Alegie Fuentes - Arrival Airport Transfer ConfirmationElsa Vargas MonterNo ratings yet

- General Request Letter For Police ClearanceDocument1 pageGeneral Request Letter For Police ClearanceMazh FathNo ratings yet

- Provisional Appointment For Driving Skill TestDocument1 pageProvisional Appointment For Driving Skill TestRahul Kumar SahuNo ratings yet

- Checklist Business VisaDocument1 pageChecklist Business VisaArmaine ParaisoNo ratings yet

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument2 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationTontadarya PolytechnicNo ratings yet

- Hacked Emails and Passwords ListDocument25 pagesHacked Emails and Passwords ListSanata BangunNo ratings yet

- Tenant Verification FormDocument2 pagesTenant Verification FormShivam PandeyNo ratings yet

- J&K e-Governance Agency Gate Passes for SDC WorkDocument110 pagesJ&K e-Governance Agency Gate Passes for SDC WorkMisba waniNo ratings yet

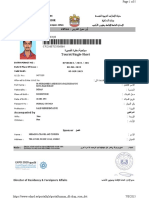

- ﺳ ﯿﺎ ﺣ ﯿ ﺔ / ﺳ ﻔ ﺮ ﺓ - ﻗ ﺼ ﯿ ﺮ ﺓ Tourist/Single-Short: Evisa - إّذ ن د ﺧ و ل ا ﻟﻛ ﺗ ر وﻧ ﻲDocument1 pageﺳ ﯿﺎ ﺣ ﯿ ﺔ / ﺳ ﻔ ﺮ ﺓ - ﻗ ﺼ ﯿ ﺮ ﺓ Tourist/Single-Short: Evisa - إّذ ن د ﺧ و ل ا ﻟﻛ ﺗ ر وﻧ ﻲshahid pkNo ratings yet